Abstract

Artificial intelligence (AI) technologies have significantly attracted the attention of institutional investors over the last decade. However, previous literature has not deeply explored the characteristics of venture capital (VC) investments in AI ventures. In this study, we explore whether and to what extent investments in AI ventures differ from those in similar non-AI ventures, and whether they are moderated by venture-level, country-level, and investor-level factors. We test our hypotheses on a sample of 5235 investments in 2689 AI ventures and 9215 investments in 4373 non-AI ventures belonging to the Industry 4.0 domain, observed from 2000 to 2019. We find that the amount invested in AI ventures is significantly lower than non-AI ones: this negative relationship is, however, moderated by a venture’s development stage, VC investor’s experience and the AI development level of the country in which the invested venture operates.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Artificial intelligence (henceforth, AI) is a general term that refers to any technology able to perceive the surrounding environment and make decisions to maximize its probability of success while achieving a predetermined goal (Russell and Norvig 2020). AI technology is able to replicate human cognitive ability in problem-solving, decision-making, and learning activities (Bellman 1978), enabling perception, reasoning, and action (Winston 1992). AI includes several different research domains, which have among their core components machine learning, NLP (natural language processing), deep learning, predictive APIs (application programming interface), and image and speech recognition.

AI is increasingly perceived as an emerging technology that may be harnessed to address global concerns and that will produce deep transformations in society (such as bridging the educational gap, developing treatments for cancer and other diseases etc.) (Pwc 2017). Pwc forecasts, as a consequence of the diffusion of AI, an increase in global GDP by 14% by 2030, with an impact on production and consumption of 7% and 8%, respectively.

Because of its pervasiveness and dynamism, AI technology has the potential to become the dominant general-purpose technology of the coming era, due to its capacity to generate important spillovers that can propel new technological opportunities in several domains (Cockburn et al. 2018). Given the disruptive potential of AI technology on society, the academic literature has mostly focused on examining: (i) the consequences of its diffusion (Agrawal et al. 2019; Felten et al. 2021; Jacobides et al. 2021; Krakowski et al. 2023), both in terms of impact on productivity (Furman and Seamans 2018) and labor (Acemoglu and Restrepo 2018); (ii) its evolutionary dynamics, being a source of change in innovation processes (Cockburn et al. 2018) and of new innovative ideas (Krakowski et al. 2023).

However, the AI technology has also attracted the attention of institutional investors over the last decade. Venture capital’s (henceforth, VC) investments in AI ventures have grown dramatically in recent years, from about $3 billion in 2012, to $75 billion in 2020. AI ventures received more than 20% of all VC investments in 2020. US-based and Chinese ventures accounted for more than 80% of the value of VC investments in AI ventures, while Europe and UK accounted for 4% and 3%, respectively (OECD 2021). According to ForbesFootnote 1, the overall financing amount and the average round size for AI have increased consistently over the last decade. In 2010, the average early stage round for ventures focused on AI was around $5 million. In 2017, overall funding climbed by more than 200 times to $12 million for first-round early stage round. In 2021, despite a decline in transaction volume, AI ventures raised about $20 billion in investment. This is testified by the OECD which reports that: “The venture capitalist (VC) sector tends to forerun general investment trends, indicating the AI industry is maturing. As the AI industry matures, the median amount per investment is growing, there are more very large investments and proportionately fewer investment deals at early stages of financing” (OECD 2021). Given this evidence, the exploration of the key financing patterns that surround AI financing by VCs is certainly a worthy endeavor in the context of entrepreneurial finance.

This article contributes to the stream of literature on VC financing by providing novel quantitative evidence on the determinants of VC invested amounts, with a focus on the AI industry. While prior works have studied VC investments in general or in specific innovative fields such as fintech (Cumming and Schwienbacher 2018; Haddad and Hornuf 2019), they have fallen short in terms of providing insights into VC investments in AI. Thus, we know little about the extent to which AI ventures receive VC financing and how this works in concert with investor experience, country, or invested venture characteristics. The ultimate purpose of this research is to examine if AI ventures receive more or less funding by VCs than non-AI ventures belonging to the Industry 4.0 domain. An interesting and intertwined question is whether and to what extent this relationship is moderated by venture-level, country-level, and investor-level factors. Does a venture’s life stage mitigate the risks associated with an emerging and rapidly evolving technology and with the regulatory and competitive challenges of a new investment domain, by encouraging VC investment attitude towards AI? Does investor experience and specialization in AI matter? Are these patterns equally generalizable to countries characterized by a high development of the AI industry? These questions are timely and have both academic and practical relevance.

To our knowledge, understanding the investment patterns of VCs in the AI industry is still an unexplored dimension of operations in the VC market. This is surprising, given the novelty of this investment opportunity and the important impact that AI ventures could play on the innovation and growth of economies. Thus, our unique angle is to explore the landscape of VC investments in AI to see whether differentials in venture characteristics, investor experience, and country specialization in the field affect the financing patterns of AI ventures.

We tackle our research questions focusing primarily on the amount received by AI versus non-AI ventures (belonging to the Industry 4.0 domain) in VC deals between 2000 and 2019 worldwide. Results show that, in general, in a VC deal, AI ventures raise less capital than non-AI ventures. This is in line with the idea that the AI domain involves severe risks for VCs, ranging from regulatory and competitive challenges, ethical and privacy concerns, and a high uncertainty associated with a rapidly evolving technology. However, we find that the negative relationship between the amount of capital invested by VCs and the AI domain of the invested ventures is moderated by the evolution of the stage of life of the venture, by investors’ AI-specific and general previous experience and by the AI development level of the country in which the invested venture operates.

The remaining parts of the paper are organized as follows. Section 2 presents the theoretical background and our research hypotheses. Section 3 illustrates the methodology. Section 4 illustrates the results of the econometric analysis and some robustness checks. Finally, Section 5 concludes the paper.

2 Theoretical background

AI technologies and solutions are new methods to improve ventures’ process- and product-oriented productivity and R&D activities in downstream sectors (Babina et al. 2024) and serve as cornerstone of the Fourth Industrial Revolution, or Industry 4.0. AI is no longer perceived primarily as a business tool for increasing automation, but as an emerging technology that may be harnessed to address diverse global concerns, ranging from issues related to the development of new drugs and treatments to the reduction of the educational and gender gap. Indeed, recent literature has classified AI as a general-purpose technology (GPT), given its potential to affect a wide range of product and services (Babina et al. 2024; Cockburn et al. 2019; Iori et al. 2021; Martinelli et al. 2021), generating a large-scale economic impact. For example, Goldfarb et al. (2022), employing an approach that uses data from online job ads and postings, rank emerging technologies based on their likelihood to become general-purpose technology applications, and find AI-related technologies (e.g., machine learning, big data, data science) at relatively high-ranked positions.

Compared to all other technologies commonly grouped within the Industry 4.0 paradigm (such as IoT, big data, cloud computing, robotics), AI technologies differ in their scope and applications. The idiosyncratic nature of AI and other digital non-AI technologies in the Industry 4.0 domain can be observed in their intrinsic characteristics (e.g., life cycle stage, technological and industrial knowledge base, specific and enabling functions, general technology properties) (Bresnahan 2010; Frank et al. 2019) and also in their potential to enable radical transformations in firms’ production and business processes, including their ability to drive firms to adopt new environmentally sustainable practices (Montresor and Vezzani 2023). Montresor and Vezzani (2023) examine the extent to which the eco-innovation propensity of Italian firms is driven by the heterogeneous and complementary nature of Industry 4.0 technologies. In particular, the authors find that new eco-innovative production processes and models benefit most from investments in AI compared to other digital technologies.

Because of its distinctive GPT characteristics, which favor recombinant innovation and the capture of complex knowledge (Montresor and Vezzani 2023), the AI domain may be an attractive area for VC investment because of the significant technological benefits and learning opportunities that may be generated by AI ventures to the advantage of customers and/or incumbents in the market (Maula et al. 2013). However, the AI industry poses a number of possible risks for VCs compared to the non-AI 4.0 domain, which may counterbalance the rewards that are associated with the potential of AI to disrupt existing industries or create new markets. First, AI ventures are generally subject to stronger information asymmetries compared to ventures operating in other digital areas because AI is an emerging, complex, and rapidly evolving technology. Second, AI brings with it several regulatory and competitive challenges that should not be overlooked, and that do not impact the non-AI 4.0 industry as much. The rapid pace of AI developments is accompanied by severe competition and regulatory risks that could hinder AI ventures in achieving long-term success and VCs in reaping the benefits of their investments. Third, the unpredictability of unchecked technological developments that may lead to ethical and privacy concerns and the vulnerability of AI-systems to cyber-attacks could cause potential losses to investors. VCs factor the inherent risks associated with AI technological developments into their decision-making processes (Agrawal et al. 2015; Colombo et al. 2022), and are often induced to discount their offer price (Reuer et al. 2012), thus reducing the invested amount per deal. Taking these arguments together, we introduce our first hypothesis:

-

H1: The amount of capital invested in a VC deal is lower for invested ventures operating in the AI domain compared to non-AI Industry 4.0 ventures.

Investors may rely on direct information disclosures by entrepreneurs to reduce their information asymmetry and decide whether to invest in a venture. Entrepreneurs’ information disclosures also help in increasing the amount of capital raised in an external equity deal. For example, in private deals, a rigorous screening by investors in the pre-investment process makes the focal venture more attractive and more prone to receive higher capital injections in the future (Hoyos-Iruarrizaga et al. 2017). Alternatively, information asymmetries between ventures’ insiders and outsiders can be mitigated if the entrepreneurs show proof of the ventures’ track record (Officer et al. 2009). The longer the history of a venture is at the time of an external equity deal, the higher the probability for investors to find available information on that ventures’ business activities. Indeed, in previous works, scholars have used ventures’ age as a measure of the extent of ex ante information asymmetry about ventures’ activities and valuations (see Beatty 1989; Ritter 1991). Similarly, Diamond (1989) shows that older ventures present milder moral hazard problems and are rewarded by banks with lower interest rates compared to younger ventures, which still have no proof of good credit histories, regardless of their underlying quality.

Hence, we argue that the negative effect of AI ventures’ information asymmetry on the amount of capital invested by VCs should be more severe for younger ventures compared to older ones. Therefore, we introduce the following hypothesis:

-

H2: The negative relationship between the amount of capital invested by VCs and the AI domain of the invested ventures is positively moderated by the invested venture’s stage of life.

A correct evaluation of AI ventures is crucial to identify investment opportunities that can generate sustainable, long-term value for investors. VCs with more experience can be advantaged both in mitigating the risks associated with the AI technology and in providing a correct evaluation of how advancements of AI may affect the long-term growth prospects of their portfolio ventures.

VC investors collect crucial knowledge from previous investment experiences (see Dimov and Martin de Holan 2010; Gompers et al. 2009). These experiences contribute to improving VCs’ screening and scouting abilities, provide more robust due diligence and corporate governance processes, leading them to target higher-quality ventures to invest in (Sørensen 2007). The combination of technical expertise, market knowledge, and risk management experience makes VCs better in capitalizing the potential of investment opportunities, while minimizing the risks associated with a new and rapidly evolving technological sector. VCs’ expertise and track records also influence the amount that VCs can invest in target ventures. Indeed, more experienced VCs and/or VCs with a higher reputation, which is related to the collective perception by stakeholders of the VCs’ abilities coming from their track records and investment successes (Pollock et al. 2015), have better chances to raise more capital for new funds from limited partners compared to unexperienced and/or non-reputable VCs (Gompers 1996). Hence, we argue that the negative relationship between VC capital amount and investments in AI ventures should be less severe for experienced VCs compared to unexperienced ones. Therefore, we introduce the following hypothesis:

-

H3: The negative relationship between the amount of capital invested by VCs and the AI domain of the invested ventures is positively moderated by the investors’ previous experience.

Another important characteristic of VCs, which may impact the choice of ventures to invest in and the invested amount, is their specific knowledge of the sector they invest in. Investing in AI requires a comprehensive understanding of the underlying technology (OECD 2021)Footnote 2, of the true potential of AI ventures and of the competitive dynamics and regulatory challenges of the AI industry. Considering the pace at which AI technology is continuously developing (Tang et al. 2020), VCs need to adopt a proactive approach that combines a careful consideration of the AI industry landscape and competition dynamics with a focus on risk management, to correctly manage ethical, cyber, and regulatory risks. One of the biggest issues facing VCs investing in AI is, for example, the ability to evaluate the economic and financial viability of AI-related businesses. Valuations should be carefully done to separate ventures that have groundbreaking technology from others that are simply riding the AI hype wave and would not offer interesting rewards to investors. Investors’ AI-specific knowledge allows VCs to mitigate such valuation risks.

Given the rapid pace of AI development and the uncertainty associated with AI technologies, VCs with AI-specific knowledge and skills will have a deeper understanding of the competitive dynamics of the AI industry, of the specific technologies that underpin it, of the evolving regulatory landscape, as well as of potential ethical and cyber security risks. This will lead them to perceive the AI domain as more rewarding compared to AI-unexperienced VCs, consequently increasing invested amounts in AI ventures. Taking into consideration these arguments, we introduce the following hypothesis:

-

H4: The negative relationship between the amount of capital invested by VCs and the AI domain of the invested ventures is positively moderated by the investors’ previous AI-specific experience.

In several countries, the AI regulatory landscape and the AI ecosystem are still in their infancy and are subject to changes as technology develops. As technology advances, security, privacy, and ethical concerns call for greater regulation of AI and for more developed infrastructures, which can affect the growth prospects of AI ventures and the related investment trends. As for many types of investors in the market, VCs also do not operate in a vacuum but into a specific institutional embedding, made of formal and informal norms enforced in the country setting they operate. Moreover, VCs are tempted to follow the market during boom periods (Gompers and Lerner 1999; Nanda and Rhodes-Kropf 2013), with a consequent increase in the supply of VC in certain industries, which results in greater competition between investors and higher valuations for target ventures operating in these industries (Inderst and Müller 2004). We expect that VCs located in countries characterized by more vibrant AI activities will also be more prone to invest in ventures operating in the AI domain. In other words, we suggest that country-level characteristics may affect VC investments in AI firms. Hence, we introduce our last hypothesis:

-

H5: The negative relationship between the amount of capital invested by VCs and the AI domain of the invested ventures is positively moderated by the AI industry development degree of the country in which the venture operates.

3 Data and methods

3.1 Sample

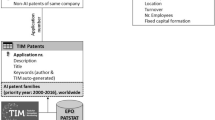

We obtained the data used in this paper from Crunchbase, a unique database that captures worldwide information about VC investments in high-technology ventures. For each portfolio venture, Crunchbase reports information on the date of each investment and on the investing VC firms. The database provides additional details on the ventures including the foundation year, the country of operation, a description of the industry in which the venture operates, the number of financing rounds received, the amount of money raised in each financing round and the type of funding received. The dataset also reports information on investors that can broadly be classified as individuals and financial organizations (e.g., VC and private equity firms). The present analysis is based on data that was obtained from Crunchbase in November 2019.

The initial dataset contains information on 437,747 deals related to 118,066 ventures. We proceeded through several steps in the selection of the sample. First, we restricted the analysis to ventures financed by VCs, thus excluding individual investors: we obtained 381,117 VC investments in 113,262 ventures. Then, we focused on ventures belonging to industries based on the application of the main digital technologies of the current wave, i.e., the ones collected under the Industry 4.0 domain. To classify Industry 4.0 ventures, we started from the category variable retrieved from CrunchBase, indicating a description of the venture’s industry. Moreover, we complemented the business description reported in CrunchBase with the description provided by Orbis by Bureau van Dijk database (for the ventures that we could find in Orbis, i.e., about 78% of our sample). We then looked into the ventures’ business descriptions for keywords belonging to the lists that Martinelli et al. (2021) used to identify the emergent patterns of development of the technologies within the Industry 4.0 paradigm, i.e., Internet of Things, big data, cloud, robotics, artificial intelligence, and additive manufacturing. We selected in this way 73,045 deals in 17,156 Industry 4.0 ventures, corresponding to the 19% of our sample of VC investments. In order to capture differences between AI ventures and non-AI ventures, a dummy variable d_venture_AI has been added in the database. To identify AI ventures, we also followed Martinelli et al. (2021). In particular, we defined a venture as belonging to the AI domain if in at least one of its business descriptions there was at least one of the keywords that Martinelli et al. (2021) used to identify the technological bases of AI. Deals in AI ventures are around the 38% of the total deals in Industry 4.0 ventures, accounting for 27,662 deals in 6575 AI ventures. Finally, we excluded observations for which we had missing data for the control variables used in our econometric model. The final sample consists of 7094 Industry 4.0 ventures, involved in 14,598 VC investments. Out of these investments, the 36% of the ventures belong to the AI domain, accounting for 5237 investments in 2691 ventures.

We then performed a matching procedure to identify, out of the Industry 4.0 non-AI ventures, a group of ventures that more closely resemble AI ones (i.e., the “treated” ventures) in terms of observable characteristics. AI ventures were matched through the coarsened exact matching (CEM) algorithm (Iacus et al. 2012) with the comparable non-AI ventures. CEM enforces a stronger control of the balancing of the matched sample because it matches directly on matching variables, rather than a combination of them (i.e., like the propensity score technique does). Moreover, for continuous variables, the balancing is not focused exclusively on the mean but on the entire variable distribution.

To run the matching, we used venture-year observations in which both AI ventures and non-AI ventures received their first VC investment. The set of pre-treatment matching variables of the CEM are the venture’ age classes (identified by the four quartiles of the age variable distribution), investment year, country dummies, and industry dummies. These industry dummies are based on NACE Rev. 2 core code classification. Specifically, Software is equal to 1 if the venture belongs to the software industry class (NACE Rev. 2 classification at four-digit equal to 5829, 5821, 6202, 6203, 6201, 6209, 6200, and 5820). Lifescience & Biotech is equal to 1 if the firm belongs to the life science or biotech industry (NACE Rev. 2 classification at four-digit equal to 7211, 8710, 7500, 8622, 9604, 8610, 4646, 4774, 9609, 2120, 8690, 2110, 4773, 8790, 3250, 2100, 8623, 8720, 2660, 8730, and 8621). High Tech Manufacturing is equal to 1 if the focal acquired venture belongs to a high-tech or medium-high-tech manufacturing industry, excluding software and biotech or life science, 0 otherwise, according to the Eurostat aggregation of manufacturing and services industries on the basis of their technology and knowledge intensity (based on the NACE Rev. 2 classification, see https://ec.europa.eu/eurostat/cache/metadata/Annexes/htec_esms_an3.pdf). Similarly, High Knowledge Intensive Service is equal to 1 for ventures operating in high-tech and knowledge-intensive service industries, excluding software and biotech or life science, 0 otherwise. Low Tech Manufacturing is equal to 1 if ventures are in a low-tech or medium-low-tech manufacturing industry, 0 otherwise. Low Knowledge Intensive Service is equal to 1 for ventures that operate in low-tech or low knowledge-intensive service industries, 0 otherwise. The baseline in the estimates is given by other industries.

The CEM creates strata along all these dimensions and then keeps only observations that fall in strata in which there are both AI and non-AI ventures. In other words, the CEM guarantees the overlap of control group ventures and the group of AI ventures along all these dimensions simultaneously. The CEM discards 1% of non-AI ventures, leaving us with 7062 ventures for which we observe 14,450 financing rounds (out of which 2689 are AI ventures, involved in 5235 financing rounds). Last, we built a panel database of AI and matched non-AI ventures, in which all ventures are observed yearly, between 2000 and 2019.

Table 1 reports the distribution of our samples (i.e., total sample and matched sample) in terms of foundation year, country of operation, industry (classified according to the same seven industry categories, see the following section for more details), and investment year.

Looking at the total sample, as we expected, 68.64% of ventures have been founded after 2011, coherently with the recent development of Industry 4.0 technologies. Almost 60% of the sample is composed by US ventures (58.69%), 19.12% are European ventures, almost 8% from UK while the remaining 14.40% is composed especially by Canadian (3.17% of the total sample), Israeli (2.6%), Chinese (1.94%), Singapore (0.97%), and Australian (0.64%) ventures. Regarding industries, 26.35% of the ventures operate in the software industry, 19.40% in the other high-tech knowledge intensive industries, and 8.40% in low-tech knowledge intensive industries. The remaining ventures belong to high-tech and low-tech manufacturing industries (5.71%), life science and biotech (2.36%) and other industries like construction, energy, and agriculture.

As to the investment year, 13.78% of financing rounds relate to investments made in the years before 2010, while the remaining investments are concentrated in the period from 2011 to 2019 (86.18%). This is driven by the fact that the Crunchbase coverage has increased over time.

To provide a more fine-grained classification of AI ventures, we assigned each of them to specific AI technological domains. To do this, we followed the classification of AI technological domains developed by the European Commission (EU)’s Joint Research Centre (Samoili et al. 2020). In order to provide a more detailed description of the distribution of our ventures according to the Industry 4.0 classification and the AI sub-domains, we report in Table 2 the composition of our sample. Regarding the Industry 4.0 classification, our sample is composed by AI ventures (38.08%), ventures operating within the Big Data domain (24.85%), Cloud Computing ventures (17.32%), Internet of Things ventures (10.22%), ventures in the Robotics industry (7.76%), and ventures doing 3D Printing (1.77%). Focusing on the AI ventures, we resorted to the EU classification, which includes the following macro-domains: Reasoning, Planning, Learning, Communication, Perception, Integration and Interaction, Services, Ethics and Philosophy. The 91.78% of the AI ventures in our sample belongs to the Services AI subdomain. This subdomain refers to technologies developed in the form of infrastructures, software, and platforms and provided as applications, which can be executed on demand and stored in the cloud (e.g., cognitive computing, ML frameworks, bots, and virtual assistants, etc.). The 7.14% belongs to the Ethics AI subdomain, referring to technologies aimed at advancing technological compliance with ethical principles and values such as users’ safety, security, and privacy. The remaining 1.08% of AI ventures is distributed homogeneously among the remaining categoriesFootnote 3.

4 Empirical analysis

4.1 Variables

Table 3 reports the description of the variables used in the empirical analysis. The dependent variable used in our baseline econometric model is deal_raised_amount, measured as the amount of financing in USD (in natural log) a venture received in the focal round. The main independent variable testing H1 is the dummy d_venture_AI. This dummy takes the value of 1 if the venture involved in the deal is in the AI domain, and 0 otherwise.

As to the venture-level variables, used to test H2, we included: (i) venture_age indicating the age of the venture in the year of the investment or (ii) venture stage of financing, with the dummy d_venture_late_stage, which takes the value of 1 if the venture is in growth or late stage at the time of investment, i.e., received the financing at least 3 years after its foundation, and 0 otherwiseFootnote 4.

As to the VC experience variables used to test H3, we considered a “general” investment experience given by the (natural logarithm of the) cumulated number of investments done by lead VC(s) up to the year before the focal investment year (VC_exp). In order to test H4, we measured a “specialized” experience in AI ventures given by the cumulated number of investments in AI ventures done by lead VC(s) up to the year before the focal investment year (VC_AI_exp). As a robustness check, in order to proxy for specialized experience, we also resorted to the percentage of AI investments on total investments done by lead VC(s) up to the year before the focal investment year (VC_AI_exp_perc) as to take into account a size effect that may influence our results. Finally, we also defined a dummy (d_high_VC_AI_exp) equal to 1 if the percentage of AI investments on total investments done by lead VC(s) up to the year before the focal investment year is higher than the median of the variable distribution in the sample.

As to the investor-level variables, we controlled for investors’ typology (disentangling through different dummies between Independent VCs, Bank-affiliated VCs, Corporate VCs, Governmental VCs and other types of investors, containing e.g. University affiliated VCs, angels, incubators and accelerators) and for the VC age of the lead investor in the round, using the variable VC_age measured as the average age in case of multiple lead VCs in the same deal. We also controlled for VC_count, a variable measured as the natural logarithm of the total number of VC investors participating in a focal investment. We included GDP per capita (country_gdppercapita) and GDP growth (gdpgrowth) in order to control for the wealth of a country. We also controlled for the ventures’ industry of operation, including the industry dummies.

Finally, in order to test H5, we measured the country’s orientation to the AI industry. In more detail, we resorted to a multi-item AI-development factor variable. This variable is computed considering two aspects for every dyad country-investment year: the percentage of funding amount in AI ventures over the total funding amount in the year before the investment, and the number of AI patents filed in the focal country in the year before the investment. These measures have been standardized by transforming them into z-scores and then normalizing the scores within each year on a 100-point scale, to make their scaling comparable. We then defined two dummies proxying the country orientation to the AI industry. In particular, d_AI_development is equal to 1 if the multi-item AI-development factor variable is higher than the median of the variable distribution in the sample. d_AI_development_high is equal to 1 if the multi-item AI-development factor is higher than the third quartile of the variable distribution in the sample. This second dummy has the aim of identifying the countries with the highest degree of development in AI technologies. Our econometric model also includes country, industry, and year fixed effects.

4.2 Descriptive statistics

Tables 4 and 5 report the correlation matrix and the descriptive statistics of the dependent, independent, and control variables. The correlations are generally low, so multi-collinearity is unlikely to be an issue. We also checked the Variance Inflation Factor (VIF) and found that all VIFs were well below the commonly agreed upon threshold of 5 (Belsey et al., 2005).Footnote 5

As to the descriptive statistics reported in Table 5, it is interesting to discuss some preliminary evidence based on the comparison between AI and non-AI ventures. According to our results, AI ventures raised a significantly lower amount of VC financing than non-AI VC-backed ventures, both in a focal round and over all the rounds received during their life, this providing a preliminary confirmation to our H1. The difference is significant in economic terms since the average amount raised in a financing round is 14.2 million USD in AI ventures versus 16.7 million € for non-AI ones.

AI ventures receive financing rounds coinvested by higher number of investors and are, on average, 1 year younger at the time of financing, in earlier stages of their lifecycle, and receive money from younger VCs. AI ventures also seem to be smaller than non-AI ones, although the difference of the means of total assets between AI and non-AI ventures is not significant (p = 0.1330). As to the typology of VC, AI ventures have a higher probability to be backed by governmental VCs (GVC) and higher probability to receive financing from other types of VCs (i.e., other than bank-affiliated VCs (BVCs) or corporate VCs (CVCs)) than non-AI ventures. In terms of expertise, AI ventures seem to be backed by more experienced VCs whatever the proxy used to measure investor experience.

As to the characteristics of the countries in which AI ventures are located, results indicate that these ventures operate in countries characterized by higher GDP growth and higher AI development level.

This preliminary evidence provided by univariate analysis will be tested and enriched in the multivariate analysis described in the following section (Section 4.3) Tables 6, 7, 8, 9, 10 and 11.

4.3 Results

The results of OLS estimates (with matched sample, robust standard errors and clustered observations) are illustrated in Tables 6, 8 and 10 (in Tables 7, 9 and 11 we report the marginal effects). In particular, in Table 6 we include venture’s characteristics to test H1 and H2, in Table 8 we include proxies of investor’s experience to test H3 and H4, while in Table 10 we include country-level controls for the degree of AI development to test H5.

Model 1 in Table 6 includes only controls as baseline. The higher the number of investors coinvesting in the focal round, the higher the amount invested, as suggested by the positive and statistically significant coefficient of VC_count. Moreover, we find that ventures invested by at least one BVC lead investor receive more funding compared to ventures invested by IVC investors (baseline). The same is valid for CVC lead investors, while the opposite occurs for ventures invested by GVCs or other types of investors. Older VCs seem to invest higher funding amounts as indicated by the positive and significant coefficient of VC_age: a one standard deviation increase in the age of the lead investor, corresponding to 15.35 years, results in a 51% increase in the funding amount. The other control variables are not significant at conventional confidence levels.

In Model 2, we add to the regression the dummy d_venture_AI, to test H1 predicting that the amount of capital invested in a VC deal is lower when the invested venture operates in the AI domain. The coefficient of the d_venture_AI variable is negative and significant (p < 0.01). More in details, according to our estimates, AI ventures obtain 25.1% less funding amount compared to non-AI ventures. This evidence supports the view that AI ventures are subject to more information asymmetry than non-AI ones, which results in a more limited capital invested per deal. This confirms our hypothesis H1.

To test our hypothesis H2, we turn our attention to the estimates displayed in Models 3 and 4 in which we resort to two different proxies of venture stage of life, i.e., age and stage of the invested venture. In particular, H2 predicts that the negative relationship between the amount of capital invested by VCs and the AI domain of the invested ventures is positively moderated by the invested venture’s stage of life. As to the direct effect of venture_age, in Model 3, we find that older ventures (i.e., ventures with a higher age at the time of the investment) enjoy significantly higher funding amounts. In particular, looking at the marginal effects, a one standard deviation increase of the venture age (corresponding to 3.77 years) results in an increase of the raised amount at the investment equal to about 112%. As to the interaction between d_venture_AI and venture_age, we find confirmation to H1, since the interaction coefficient is positive and significant (p < 0.01). Specifically, the (negative) average marginal effect of d_venture_AI is reduced when venture_age increases. Looking at the marginal effect (shown in Table 7), we find that AI ventures are associated with a 20.52% reduction in the raised amount compared to non-AI ones at venture_age equal to 1 (1st quartile of venture_age distribution). This reduction decreases to 14.48% at venture_age equal to 3 years (median of venture_age distribution). At venture_age equal to 5 years (3rd quartile of venture_age distribution), the difference between the raised amount of AI and non-AI ventures becomes not significant. These marginal effects are significantly different from each other at p < 0.05. Similarly, in Model 4 the interaction between d_venture_AI and the variable d_venture_late_stage has a positive and significant coefficient (p < 0.01), and the (negative) average marginal effect of d_venture_AI is reduced and becomes positive, although non-significant, when d_venture_late_stage is equal to 1 (from – 17.37% to 3.13%). These marginal effects are significantly different from each other at p < 0.01. Hence, H2 is confirmed.

To test our hypotheses H3 and H4, we refer to the models reported in Table 8. H3 and H4, respectively, predict that the negative relationship between the amount of capital invested in a VC deal and AI domain of the invested venture is positively moderated by the investors’ generic and AI-specific previous experience. In Model 5, we added the variable VC_exp, as a measure of the generic previous experience of lead investors, and its interaction with the dummy d_venture_AI. We find that the average marginal effect of VC_exp is positive and significant (p < 0.01). In other words, if VC_exp increases by 10%, the raised amount increases by about 0.4%. Interestingly, the interaction between d_venture_AI and the variable VC_exp has a positive and significant coefficient (p < 0.01). Looking at marginal effect (shown in Table 9), we found that AI ventures are associated to a 17.24% reduction in the raised amount compared to non-AI ones at VC_exp equal to 2.14 (corresponding to 8.49 investments, i.e., the 1st quartile of VC_exp distribution). This reduction decreases to 13.03% at VC_exp equal to 3.58 (corresponding to 35.87 investments as in the median of VC_exp). Finally, at VC_exp equal to 4.84 (125.21 investments, i.e., 3rd quartile of VC_exp distribution), AI ventures are associated to a 9.17% reduction in the raised amount compared to non-AI ones. These marginal effects are significantly different from each other at p < 0.05. Thus, these results confirm H3.

Similarly, in Model 6 we added to the regression the variable VC_AI_exp, as a measure of the previous experience of lead investors investing in other AI ventures, and its interaction with the dummy d_venture_AI. We see that the interaction between d_venture_AI and the variable VC_AI_exp has a positive and significant coefficient (p < 0.01). Moreover, Table 9 shows that AI ventures are associated to a 13.56% reduction in the raised amount compared to non-AI ones at VC_AI_exp equal to 0 (1st quartile of VC_AI_exp distribution). This reduction decreases to 11.29% at VC_AI_exp equal to 1 (95th percentile of VC_AI_exp distribution). Finally, at VC_AI_exp equal to 10 (99th percentile of VC_AI_exp distribution), the difference between the raised amount of AI and non-AI ventures becomes not significant. These marginal effects are significantly different from each other at p < 0.01.

Thus, H4 can also be confirmed. We checked the robustness of this result by substituting VC_AI_exp with the alternative measures for investors’ AI experience, namely VC_AI_exp_perc, i.e., the percentage of AI investments on total investments done by lead VC(s) up to the year before the focal investment year (Model 7), and the dummy d_high_VC_AI_exp, equal to 1 if the percentage of AI investments on total investments done by lead VC(s) up to the year before the focal investment year is higher than the median of the variable distribution in the sample (Model 8). Although our results are not confirmed by Model 7, they are consistent in Model 8. This can be due to the fact that VC_AI_exp_perc is highly skewed, with both median and third quartile equal to 0, hence the dummy is a more suitable functional form.

Finally, H5 predicted that the negative relationship between the amount of capital invested by VC and the AI domain of the invested ventures is positively moderated by the AI industry development in the country in which the ventures operate. To test this hypothesis, we included in Model 9 (Table 10) the dummy d_AI_development, indicating whether the country of the invested venture has high AI-development in the year before the deal, and its interaction with d_venture_AI. The average marginal effect of d_AI_development is positive but not significantly different from 0 (p = 0.100), meaning that country AI development per se is weakly related to higher raised amount in VC deals. The coefficient of the interaction term is positive but not significant (p = 0.261), therefore the (negative) marginal effect (shown in Table 11) of d_venture_AI is not significantly reduced when d_AI_development goes from 0 to 1. Looking at the most AI-oriented countries, captured by the dummy d_AI_development_high, results reported in Model 10 (Table 10) indicate that the average marginal effect of d_AI_development_high is positive but still not significantly different from 0 (p = 0.176). However, the coefficient of the interaction term is positive and significant (p < 0.05). Table 11 shows that the (negative) marginal effect of d_venture_AI is significantly reduced from – 20.19% to – 9.08% when d_AI_development goes from 0 to 1. These marginal effects are significantly different from each other at p < 0.05. This suggests that being located in a country with high AI development actually reduces (without deleting) the negative difference between amount raised by AI ventures compared to non-AI ones. This provides support to H5Footnote 6.

5 Conclusions

With this article, we contribute to the literature on VC financing by providing novel quantitative evidence on the determinants of VC invested amounts, with a focus on the AI industry. Indeed, we know little about the extent to which AI ventures receive VC financing and how this works in concert with investor experience, country or invested ventures’ characteristics. The purpose of the research was to examine if AI ventures receive more or less funding from VCs than non-AI ventures, and understand whether and to what extent this relationship is moderated by venture-level, country-level, and investor-level factors.

We found that in general, in a VC deal, AI ventures raise less capital than non-AI ventures. This evidence is in line with the idea that AI ventures are subject to more information asymmetries, regulatory risks, competitive challenges, and ethical/privacy concerns than non-AI ones, which results in a more limited capital invested per deal. However, we found that the negative relationship between the amount of capital invested by VCs and the AI domain of the invested ventures is moderated by the venture’s age and stage, and by investors’ AI-specific and general previous investment experience. On the one hand, information asymmetries between ventures’ insiders and outsiders can be mitigated if ventures’ age increases (Officer et al. 2009). Older invested ventures have a higher probability to disclose more information to external equity investors at the moment of a deal. As to investor-level characteristics, in general, experienced VCs are better in mitigating the risks associated with the AI technology and in providing a correct evaluation of potential ventures. Moreover, VCs that developed AI-specific track-records show better technical expertise, market knowledge, and risk management practices to evaluate how advancements of AI may affect the long-term growth prospects of their portfolio ventures. Finally, being located in a country with significantly high AI development reduces the negative difference between the amount raised by AI ventures compared to non-AI ones.

Nevertheless, our study has some limitations that suggest avenues for future research. We argue that AI ventures face greater information asymmetries, which can lead to an investor discount and subsequently reduce the investment per deal. However, some venture characteristics, such as intellectual property rights (e.g., patents), could impact the amount funding ventures receive. Controlling for the amount of intangible assets was not possible in this study but this is a promising research opportunity for future research.

The data suggest a number of practitioner implications. While a non-detrimental number of opportunities potentially open up for both entrepreneurs and investors in the AI domain, the presence of information asymmetries, regulatory and competitive challenges, and the risk connected with the unpredictability of technological developments pose some limits in the financing dynamics. From an investor’s point of view, our results offer insights into both firm- and fund-level characteristics that can lower financing frictions in a sector characterized by high technological uncertainty. VCs should be less concerned about investments in AI ventures when developing greater generic investment experience and specific AI industry know-how. Our results are also conducive to the idea that the potential opportunities for entrepreneurs are broad and the funding amounts higher if they enter into a relationship with specialized VCs. Entrepreneurs need to be aware that financing amounts might be lower than expected unless their ventures scale-up and fall into more mature stages of development. Although we suggest VC managers should consider more carefully the value that interacting with AI ventures may introduce, especially if they are in their later stages, we also caution AI entrepreneurs about selecting VC investors without considering their experience and specific knowledge in AI.

Our results also provide concrete implications for policy. As AI is unfolding as a technology, there is a pressing need for policymakers to develop initiatives that can enhance the development and application of AI technologies. However, policymakers should be aware that the introduction of policies that can alleviate frictions between investors and AI ventures could set the boundaries to generate more relevant funding opportunities for AI firms and enable the technological power of AI to unfold its potential. Public policies have in fact been documented to have the potential to spur VC activity in specific sectors that are crucial for the economic and technological development of an area. How could these policies play a role without creating new barriers for entrepreneurs and negatively affecting the development and spreading of AI? Which policies should be implemented to increase VCs’ interested in AI ventures? It would be interesting to examine the intersection between government programs, enforcement of regulations and VC activity in the AI sector. An additional promising domain for future research regards the examination of the evolution of VC financing in AI across different geographic areas: does it help to create greater investment opportunities when cross-border investments are considered? Which are the characteristics of the business environment (if any) that favor investors–investee relationships in this domain? The challenges ahead are significant, and the increasing number of resources devoted by VCs to AI indicates that this financing domain is a burgeoning area to explore and further evidence is warranted.

Data availability

The data that support the findings of this study are available from the corresponding author upon request.

Notes

Since our sample is not balanced according to the different AI categories, we cannot explore differences by disentangling among the different sub-domains. However, if we compare AI ventures belonging to the Services sub-domain (i.e., the most populated one) with AI ventures operating in the other subdomains, we find no statistical difference in terms of amount raised, VC experience (both general and AI-specific), venture age, venture stage, and number of VC investors participating in a focal round. The results of these tests, unreported in the paper for the sake of brevity, are available from the authors upon request.

Our results are robust to the use of alternative measures for the d_venture_late_stage (i.e., taking as threshold to distinguish early from late stage ventures respectively 2, 4, and 5 years after foundation, instead of 3 years).

The results of these tests are available from the authors upon request.

Finally, we run several robustness checks. First, we inserted among the controls the variable venture_size. Adding this variable reduced our dataset to 2205 observations out of our total sample of 14,450 observations. The variable venture_size is measured as the total assets of the invested venture in the year of the focal investment year for ventures founded in the same year in which they received their first VC round, or in the year after. Total assets data were obtained from the Orbis database managed by Bureau van Dijk. The results of these models, not reported in the text for the sake of brevity but available from the authors upon request, do not show significant differences with our main models. The lower significance of coefficients is due to the drastically reduced number of observations. Second, we replicated our estimates measuring venture size by resorting to two different proxies: (i) the total number of employees and (ii) the sales of the ventures. Both measures are considered in the year before the receipt of VC financing or in the year of investment for ventures financed at foundation. Similar to what happens with the inclusion of total assets, adding these two variables as controls significantly reduces our sample to 1902 and 1597 observations, respectively, for number of employees and sales. These estimates, confirming our results, are not shown in the test for the sake of brevity but are available from the authors upon request. Third, we ran our models focusing on first-round investments only (i.e., those in which a given venture receives financing for the first time) since follow-on investment decisions are qualitatively different from initial investment decisions (Podolny 2001). This filter reduced our dataset to 6840 first investments (38.2% of which obtained by 2618 AI ventures). Again, these estimates (not reported in the text for the sake of brevity but available from the authors upon request) confirm our results.

References

Acemoglu D, Restrepo P (2018) Artificial intelligence, automation and work (Working Paper No. 24196). National Bureau of Economic Research

Agrawal A, Cockburn I, Zhang L (2015) Deals not done: Sources of failure in the market for ideas. Strat Manag J 36:976–986

Agrawal A, Gans J, Goldfarb A (2019) The economics of artificial intelligence: An agenda. University of Chicago Press

Babina T, Fedyk A, He AX, Hodson J (2024) Artificial intelligence, firm growth, and product innovation. J Financ Econ 151:103745

Beatty RP (1989) Auditor reputation and the pricing of initial public offerings. Account Rev 64:693–709

Bellman R (1978) Artificial Intelligence: Can Computers Think? Boyd & Fraser Publishing Company

Bresnahan T (2010) General purpose technologies. In Handbook of the economics of innovation, Vol. 2, ed. Hall BH, Rosenberg N, 761–91. Amsterdam, the Netherlands: Elsevier

Cockburn IM, Henderson R, Stern S (2018) The impact of artificial intelligence on innovation (Working Paper No. 24449). National bureau of economic research

Cockburn I, Henderson R, Stern S (2019) The Impact of Artificial Intelligence on Innovation: An Exploratory Analysis, in: The Economics of Artificial Intelligence: An Agenda. University of Chicago Press

Colombo MG, Montanaro B, Vismara S (2022) What drives the valuation of entrepreneurial ventures? A map to navigate the literature and research directions. Small Business Economics, forthcoming.

Cumming DJ, Schwienbacher A (2018) Fintech Venture Capital. Corp Gov 26(5):374–89

Diamond DW (1989) Reputation acquisition in debt markets. J Polit Econ 97:28–862

Dimov D, Martin de Holan P (2010) Firm experience and market entry by venture capital firms. J Manag Stud 47:130–161

Felten E, Raj M, Seamans R (2021) Occupational, industry, and geographic exposure to artificial intelligence: A novel dataset and its potential uses. Strat Manag J 42(12):2195–2217

Frank AG, Dalenogare LS, Ayala NF (2019) Industry 4.0 technologies: Implementation patterns in manufacturing companies. Int J Prod Econ 210:15–26

Furman J, Seamans R (2018) Ai and the economy (Working Paper No. 24689). National Bureau of Economic Research

Goldfarb A, Taska B, Teodoridis F (2022) Could Machine Learning be a General Purpose Technology? A Comparison of Emerging Technologies Using Data from Online Job Postings. Working Paper Series

Gompers PA (1996) Grandstanding in the Venture Capital Industry. J Finan Econ 42:133–56

Gompers PA, Lerner J (1999) The venture capital cycle. MIT Press, Cambridge, MA

Gompers PA, Kovner A, Lerner J (2009) Specialization and Success: Evidence from Venture Capital. J Econ Manag Strat 18:817–844

Haddad C, Hornuf L (2019) The Emergence of the Global Fintech Market: Economic and Technological Determinants. Small Bus Econ 53:81–105

Hoyos-Iruarrizaga J, Fernández-Sainz A, Saiz-Santos M (2017) High Value-Added Business Angels at post-investment stages: Key predictors. Int Small Bus J: Res Entrepreneurship 35:94–968

Iacus SM, King G, Porro G (2012) Causal Inference Without Balance Checking: Coarsened Exact Matching. Polit Anal 20(1):1–24

Inderst R, Müller HM (2004) The effect of capital market characteristics on the value of start-up firms. J Finan Econ 72:319–356

Iori M, Martinelli A, Mina A (2021) The direction of technical change in AI and the trajectory effects of government funding. LEM Papers Series 2021/41, Laboratory of Economics and Management (LEM), Sant'Anna School of Advanced Studies, Pisa, Italy

Jacobides MG, Brusoni S, Candelon F (2021) The evolutionary dynamics of the artificial intelligence ecosystem. Strat Sci 6(4):412–435

Krakowski S, Luger J, Raisch S (2023) Artificial intelligence and the changing sources of competitive advantage. Strat Manag J 44(6):1425–1452

Martinelli A, Mina A, Moggi M (2021) The enabling technologies of industry 4.0: examining the seeds of the fourth industrial revolution. Indust Corp Change 30 (1):161-188

Maula MVJ, Keil T, Zahra SA (2013) Top Management’s Attention to Discontinuous Technological Change: Corporate Venture Capital as an Alert Mechanism. Organ Sci 24:926–947

Montresor S, Vezzani A (2023) Digital technologies and eco-innovation. Evidence of the twin transition from Italian firms. Indust Innov 30(7):766-800

Nanda R, Rhodes-Kropf M (2013) Investment cycles and startup innovation. J Finan Econ 110:403–418

OECD (2021) Venture capital investments in artificial intelligence report. OECD Digital Economy Papers

Officer MS, Poulsen AB, Stegemoller M (2009) Target-firm information asymmetry and acquirer returns. Rev Finan 13:467–493

Podolny JM (2001) Networks as the pipes and prisms of the market. Am J Sociol 107:33–60

Pollock TG, Lee PM, Jin K, Lashley K (2015) (Un)Tangled: Exploring the asymmetric coevolution of VC firm reputation and status. Administrat Sci Q 60:482–517

PWC (2017) Bot.Me: A revolutionary partnership. How AI is pushing man and machine closer together. Consumer Intelligence Series. https://www.pwc.com/it/it/publications/assets/docs/PwC_botme-booklet.pdf

Reuer JJ, Tong TW, Wu C (2012) A signaling theory of acquisition premiums: evidence from IPO targets. Acad Manag J 55:667–683

Ritter JR (1991) The long-run performance of initial public offerings. J Finan 46:3–27

Russell SJ, Norvig P (2020) Artificial Intelligence: A Modern Approach 4. Prentice Hall

Samoili S, Lopez Cobo M, Gomez Gutierrez E, De Prato G, Martinez-Plumed F, Delipetrev B (2020) AI WATCH. Defining Artificial Intelligence, EUR 30117 EN, Publications Office of the European Union, Luxembourg

Sørensen M (2007) How smart is smart money? A two-sided matching model of venture capital. J Finan 62:2725–2762

Tang X, Li X, Ding Y, Song M, Bu Y (2020) The pace of artificial intelligence innovations: Speed, talent, and trial-and-error. J Informetric 14:1–14

Winston PH (1992) Artificial Intelligence. Addison-Wesley Publishing Company, Reading

Acknowledgements

We acknowledge the financial support provided by the GRINS project, financed by PNRR (Piano Nazionale di Ripresa e Resilienza, Missione 4 (Infrastruttura e ricerca), Componente 2 (Dalla Ricerca all’Impresa), Investimento 1.3 (Partnership Estese), Tematica 9 (Sostenibilità economica e finanziaria di sistemi e territori)), and by the HumanTech Project, funded by the Italian Ministry of University and Research (MUR) for the period 2023–2027 under the ‘Departments of Excellence’ programme (L. 232/2016).

Funding

Open access funding provided by Politecnico di Torino within the CRUI-CARE Agreement. No funding applies

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethical conduct

This research does not involve human participants

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Montanaro, B., Croce, A. & Ughetto, E. Venture capital investments in artificial intelligence. J Evol Econ 34, 1–28 (2024). https://doi.org/10.1007/s00191-024-00857-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-024-00857-7