Abstract

This paper develops a hybrid model with an agent-based financial accelerator framework embedded in a standard new Keynesian economy. It explores the interactions between the financial accelerator and the credit market, focusing on the effects of bankruptcy. The paper replicates credit-market relationships, modeling various credit crunch scenarios. It uncovers endogenous fluctuations and “animal spirits” in entrepreneurs’ expectations, driving investment and production decisions. Notably, higher pro-cyclical leverage can have destabilizing effects in the presence of small shocks, increasing entrepreneurs’ bankruptcies. The results suggest that monetary policy’s effectiveness in stabilizing fluctuations depends on factors such as heterogeneity, bounded rationality, and heuristic updating mechanisms. Moderate monetary policies perform better in terms of economic growth with moderate-to-low volatility, while aggressive policies on inflation assist bounded rational agents in reducing errors in investment decisions and default rates, fostering a more stable macroeconomic environment. Increasing forecasting options introduces diversification among entrepreneurs, reducing volatility and stabilizing investments. More options mitigate investment fluctuations, acting as a counterbalance to prevailing market sentiments. Over time, individuals weakly adhering to trends or adopting contrarian approaches come to dominate the population of entrepreneurs, enhancing the overall stability of investment decisions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The financial crisis of 2007 highlighted the significant role of credit relationships and expectations in a complex system like the modern economy (Akerlof and Shiller 2009). The crisis also made more clear at least two phenomena. First, access to credit is limited: borrowers do not always have access to credit and have to pay some costs on external funds. Since borrowers are subject to the risk of default, banks usually apply a credit spread in their credit policy. This cost is modulated according to the lenders’ net worth or collateral and is due to the risk-taking activity of entrepreneurs. Second, as most financial crises reveal, financial agents, both professional financial intermediaries and borrowers, make mistakes in their forecasts and investment decisions.

Following the hybrid methodology developed by Assenza and Delli Gatti (2013, 2019), this paper presents an agent-based financial accelerator nested in an economy populated by households, capital producers, retailers, and public authorities modeled according to the standard new Keynesian approach. The paper analyzes the relationships between financial accelerator and credit market focusing on the effects of bankruptcy in the credit market. Consequently, heterogeneity and bounded rationality are introduced only for banks and firms, while the other economic entities are described as representative agents. Abandoning the one-to-one relationship between representative agents in the credit market, the paper introduces heterogeneity in the financial conditions of agents (i.e., lenders and borrowers) by allowing for actual bankruptcies and studying their effects on macroeconomic dynamics.

The hybrid model proposed is able to reproduce some stylized macroeconomic and microeconomic facts and to answer the following questions: (a) what is the role of endogenous animal spirits on macroeconomic stability (i.e., on business fluctuations)? (b) is the effectiveness of monetary policy influenced by market sentiment? (c) does a higher level of heterogeneity in heuristics have an impact on macroeconomic stability?

This paper replicates the credit-market relationship producing various credit crunch scenarios, i.e., scenarios in which banks shrink the supply of credit to financially fragile investors, also modeling the number of entrepreneurs who do not invest and leave the business. The model predicts endogenous fluctuations and animal spirits, i.e., waves of optimism and pessimism in entrepreneurs’ expectations that drive the investment and production decisions (Keynes 1936). We find that higher pro-cyclical leverage can have destabilizing effects in the presence of small shocks, i.e., it can increase entrepreneurs’ bankruptcies. In fact, waves of optimism can produce excessive borrowing decisions due to positive expectations of investment returns. When this happens, the number of entrepreneurs who are unable to meet their debt obligations increases. As a result, banks collect non-performing loans that worsen their financial condition and increase the average interest rate on loans negatively affecting the stability of the system.

The results of the model suggest that the effectiveness of monetary policy in stabilizing fluctuations depends interestingly on heterogeneity, bounded rationality, and heuristic updating mechanism. Moderate monetary policies seem to perform better in terms of economic growth with middle-to-low level of volatility. A more aggressive monetary policy in fighting inflation helps bounded rational agents to reduce their errors in investment decisions and their default rates, resulting in a more stable macroeconomic environment with intermediate growth rates. Conversely, a monetary policy that responds strongly to output growth may produce lower economic growth and a higher risk-free interest rate. This may mislead entrepreneurs into making optimal investment decisions leading to fewer investing agents.

Finally, the complexity of the system was increased by enhancing the number of forecasting rules for entrepreneurs. The results show that the system experiences lower output growth and investment associated with a lower level of volatility. Increasing the options in the forecasting rules has a twofold, non-linear effect: it increases uncertainty in investment and lending decisions (a destabilizing impact), and it reduces spikes in the dynamics of total investments and aggregate output (a stabilizing impact). The shift from a dichotomous heuristic choice to a decision-making mechanism with multiple heuristics directly affects the investment choice of the individual entrepreneur, as by definition each entrepreneur can choose from a larger set of expectation rules. In an environment of limited information, if the number of heuristics is high, the probability of making mistakes in forecasts and investment decisions increases, leading to more defaults (destabilizing impact). However, a higher number of heuristics allows the population of entrepreneurs to diversify among them, reducing volatility (stabilizing impact). The increase in available options seems to alleviate investment fluctuations by spreading entrepreneurs across a wider range of heuristics. This, in effect, serves as a stabilizing force against the trends where most investors tend to simply follow the prevailing market sentiments, thereby reinforcing them. Furthermore, over the long run, individuals who either weakly follow the trends or take contrarian approaches come to dominate the population of entrepreneurs, contributing to the overall stability of investment choices.

The paper is structured as follows: Section 2 reviews the existing literature on financial accelerator and credit rationing; Section 3 presents the model; Section 4 proposes some simulation results; and Section 5 presents concluding remarks.

2 Literature review

Credit is essential for economic activity and the relationship between lender and borrower plays a crucial role in the business cycle. In the last decades, a large amount literature has studied financial frictions by constructing dynamic general equilibrium models with credit market imperfections and introducing information asymmetry, collateral constraints, costly status checks and agency costs.Footnote 1 In their seminal work, Bernanke et al. (1999) develop a financial accelerator embedded in the link between the external finance premium (the difference between the cost of external and internal funds) and the borrower’s net worth, which operates as a positive feedback mechanism that amplifies macroeconomic fluctuations. Subsequently, financial acceleration mechanisms have been implemented in new Keynesian DSGE models (e.g., Smets and Wouters 2007). Gertler and Karadi (2011) extend the financial accelerator framework to analyze the effects of unconventional monetary policy. The authors allow the central bank to act as a financial intermediary, exploring the effects of expanding central bank credit intermediation to combat financial crises. Christiano et al. (2010) calibrate the financial accelerator framework to European and US data, finding that financial shocks are responsible for a substantial portion of economic fluctuations. The authors find that banks’ decisions on the size of their balance sheets – how much credit they create – are always critical to the behaviour of the economy. Merola (2015) estimates the impact of financial frictions on the US business cycle, providing evidence of the role of the financial acceleration mechanism in propagating economic fluctuations.

However, even though these macroeconomic models introduce the probability of default, actual bankruptcies never occur, and the authors ignore their effects on aggregate output by assuming that banks are always able to fully diversify risk. Indeed, according to the representative agent hypothesis, if an actual bankruptcy does occur, the entire corporate sector collapses.Footnote 2Moreover, the representative agent hypothesis in the credit market makes impossible to distinguish between financially fragile and financially sound agents and simplifies market interactions in exchanges between a representative lender and a representative borrower. This aggregate view of the financial market prevents analyses of the complex credit relationships between heterogeneous borrowers and lenders that characterize the modern financial economy.

The recent agent-based literature overcomes this problem by developing complex and evolving credit networks characterized by credit relationships that link the financial soundness of borrowers, the external finance premium, and endogenous macroeconomic dynamics. For example, Delli Gatti et al. (2005) show that in a model with financial frictions, firms’ investments are influenced by individual net worth. In Delli Gatti et al. (2010), the authors develop an agent-based financial accelerator in which the presence of a credit network can produce an avalanche of firm failures, whereby even a small shock can generate a large crisis. The transmission channel acts through bankruptcies, which deteriorate the financial conditions of banks, leading to higher interest rates in the credit market. In line with Greenwald and Stiglitz (1993), a vicious circle is thus triggered: worsening credit market conditions increase the probability of corporate bankruptcy, more non-performing loans will further weaken the banking sector by increasing bank failures and thus further worsening conditions in the credit market. Assenza et al. (2015) extend the macroeconomic agent model developed by Delli Gatti et al. (2011) by introducing capital and credit markets. The model highlights the crucial role of credit in business fluctuations, as there is a relationship between firms’ leverage and macroeconomic dynamics. When firms reach a high level of debt, banks have an incentive to restrict credit. Credit rationing leads to reduced investment and thus to a recession, characterized by a lower level of firms debt than during the expansion phase. Dosi et al. (2017) extend the agent-based model developed by Dosi et al. (2010, 2013, 2015), which incorporated Schumpeterian innovation dynamics and Keynesian demand-driven dynamics with a credit market. The model shows the emergence of a ’Minskian’ financial evolution: in good times, firms increase investment and leverage, weakening their financial soundness, resulting in higher bankruptcy rates and recession. Cincotti et al. (2010) develop a macro agent-based model with credit rationing and financially fragile firms and simulate the macroeconomic implications of firms’ dividend policy in the EURACE model. In this model, the authors confirm the evidence that firms’ leverage can be considered a proxy for the probability of default. In Raberto et al. (2012), the authors extend the analysis by focusing on endogenous boom–bust credit cycles and their interaction with the business cycle. The results confirm that the accumulation of corporate debt can foster economic growth in the short run, but excessive leverage can cause waves of bankruptcies, credit rationing, and recessions in the long run. Finding comparable results, Riccetti et al. (2013; 2016; 2021) incrementally extend the agent-based financial accelerator analysis by introducing a leverage accelerator component, the role of dividend distribution on financial instability and macroeconomic dynamics, and the borrower’s ability to access different sources of credit (i.e., a credit network). In these models, firms have long-run leverage targets and adjust their demand for credit accordingly. This theory implies that a growing firm will increase its leverage with pro-cyclical and destabilizing effects on the system, creating the basis for the next crisis with relevant implications for monetary policy. Furthermore, Delli Gatti and Desiderio (2015) and Giri et al. (2019)study how credit supply and financial instability are affected by different monetary policy rules, while Popoyan et al. (2017, 2020) extend the analysis by considering alternative macroprudential regulations.

Starting from the aforementioned literature, Assenza and Delli Gatti (2013, 2019) develop a hybrid macroeconomic agent-based model merging an agent-based financial accelerator in a macroeconomic model of the Greenwald–Stiglitz type. Hence, this approach embodies a macroeconomic thinking in a multi-agent context, which allows to decompose macroeconomic shocks disentangling a first round effect, purely macroeconomic, and a second round effect which depends on the heterogeneous characteristics of the agents. This hybrid approach has the advantage to give important insights on the role of agent heterogeneity in macroeconomic fluctuations without the need to model a complete agent-based framework, focusing instead only on a subset of sectors of interest. Following the same spirit, Reissl (2022) develop a hybrid agent-based stock flow consistent model to examine the effects of variations in banks’ expectations formation and to conduct policy experiments addressing the relationship between prudential regulation policy and monetary policy.

This paper contributes to research on the hybrid macroeconomic agent-based model by developing a new financial accelerator that operates as a positive feedback mechanism amplifying fluctuations in the system. In this paper, we analyze the direct and indirect effects of bank failures on banks’ balance sheets, showing how changes in a lender’s net worth can amplify and propagate fluctuations in the whole system (van der Hoog and David 2017). More precisely, the financial accelerator proposed in this work incorporates a firm-specific interest rate premium for financially fragile firms, a bank-specific component inversely dependent on their financial strength, and a credit reputation premium (CRP) for insolvent entrepreneurs. The credit reputation premium is an innovation in the existing literature and allows us to introduce a mechanism whereby the bank can stop lending to an insolvent entrepreneur. The CRP can make the expected net return on the investments financed by the loans negative, prompting the borrower to seek cheaper credit from other banks. Moreover, the CRP produces effects comparable with the lender participation constraint explained by Bernanke et al. (1999).

In our framework, delinquencies endogenously influence lenders’ behavior by affecting the share of failed agents exiting the market, introducing real consequences on the lender–borrower relationship, i.e., credit rationing. Hence, the model explicitly addresses the two types of credit rationing described by Kirschenmann (2016): (i) the cases where some borrowers may not have access to loans despite having profitable investment projects and are indistinguishable from the borrowers receiving the loans (Stiglitz and Weiss 1981; ii) the cases where all borrowers have access to credit but demand a larger loan amount than they receive from the bank (Jaffee and Russell 1976).

Furthermore, the paper extends the recent agent-based literature by introducing evolutionary selection among adaptive expectations rules (Hommes 2013). Usually, agents have heterogeneous expectations and update them according to a naive adaptive rule. In this analysis, agents can behave according to several simple rules of thumb and switch from one to the other based on their performance (Hommes 2011). This approach allows us to introduce animal spirits and waves into investment and borrowing decisions driven by market sentiment (i.e., entrepreneurs’ expectations) that further amplify business cycles as in De Grauwe (2012) and Bazzana (2020).

3 The model

The economy is populated by entrepreneurs, banks, households, capital goods producers, retailers, and the public sector (the central bank and the government) that implements monetary and fiscal policies. Agents interact in four markets: the credit market, the labor market, the capital goods market, and the consumer goods market. Entrepreneurs own companies (one entrepreneur per company), supply labor, and consume their wealth in the event of insolvency. In the opposite case, entrepreneurs invest all their wealth in productive activity, as in Bernanke et al. (1999). At the beginning of each period, the entrepreneur has a net worth; with this net worth, entrepreneurs purchase physical capital from the producers of capital goods, financing the difference with non-collateralized loans from banks. Entrepreneurs produce wholesale output by combining physical capital and labor under perfect competition. The retail sector buys the wholesale production from entrepreneurs and resells the goods to households under monopolistic competition. Households work, consume, and save over an infinite time horizon.

We now present the sequence of events and the agent-based specification of the financial accelerator (Sections 3.1 and 3.2). Then, in Section 3.3, we describe the microfoundations and the macroeconomic framework of the economy.

3.1 Sequence of the events

During each period (t), agents interact according to the following sequence of events:

-

Entrepreneurs define their demand for loans (based on their net worth and return on capital expectations),

-

Banks calculate the external finance cost for each possible borrower;

-

Entrepreneurs access to the credit supply from the bank with the lowest interest rate on loans and positive available funds;

-

Entrepreneurs purchase the factors of production (capital and labor) and produce, sell their output to retailers, and pay wages to workers;

-

Entrepreneurs calculate their individual return on investment;

-

If the individual return on investment is higher than the external finance cost, the entrepreneur is solvent and repays the outstanding loan. If not, the entrepreneur goes bankrupt;

-

Banks collect their profits by accounting for non-performing loans;

-

Entrepreneurs update their net worth and their expectations on capital return.

-

If the expected capital return is lower than the risk-free interest rate, the entrepreneur consumes her wealth and does not invest in the following period.

At the end of each period, aggregate variables (e.g., GDP, investment, inflation, risk-free interest rate) are updated.

3.2 Microfoundation

The main actors involved in the agent-based financial accelerator are entrepreneurs and banks. We assume a credit market populated by J heterogeneous entrepreneurs and B heterogeneous banks. The banks set the lending rates and the total amount of credit available. Entrepreneurs satisfy their credit demand at the lowest external finance premium. The net worth accumulated by entrepreneurs plays an important role in the credit relationship because it influences the cost of external finance.

3.2.1 Banks

In each period t, banks supply credit to the entrepreneurs. The j-th entrepreneur uses external loans (\(B_{j,t}\)) and available net worth \((N_{j,t-1})\) to purchases capital goods \((K_{j,t})\) as follows:

where \(Q_{t-1}\) is the price paid per unit of capital in term of numeraire goods.

By assumption, capital is homogeneous. Consequently, financial constraints apply to the entire capital of the firm and not only to investments.

External loans are extended by banks that face an opportunity cost equal to the gross risk-free rate, \(R_{t-1}=1+r_{t-1}\). Considering that entrepreneurs are risk neutral and households are risk averse, the entrepreneur absorbs all the risk. In order to motivate a non-trivial financial structure, we assume a “costly state verification” framework where lenders pay an auditing or monitoring cost to observe the realization of the entrepreneurial return (Townsend 1979). This monitoring cost can be interpreted as a bankruptcy cost.

Given the entrepreneur’s choices of \(K_{j,t}\), \(B_{j,t}\) and given the risk-free interest rate \(R_{t-1}\), loans are extended by banks. The interest rates on loans (\(Z_{b,j,t}\)) charged by the b-th bank are such that:

with \(\rho \) positive and uniform across firms and banks. According to Eq. 2, the interest rate charged on the \(j-th\) borrower consists of four components: (i) the policy rate defined by the central bank; (ii) a bank-specific component related to lender’s financial soundness, which is inversely proportional to the bank’s net worth (\(\varrho ^{b}=\frac{1}{N_{b,t-1}}\)); (iii) a firm-specific risk premium, which is a function of the borrower’s leverage; (iv) a credit reputation cost, a premium that banks charge to borrowers who have defaulted in the last period and which depends on the non-performing loans (\(\chi _{b,j,t-1}\)).

Equation 2 is in line with the external finance cost hypothesized by Bernanke et al. (1999) but adds some important features. As in the financial accelerator of De Grauwe and Macchiarelli (2015), Delli Gatti and Desiderio (2015), Riccetti et al. (2013) or Bazzana (2020), the firm-specific loan interest rate is a mark-up on the risk-free interest rate and depends positively on the financial fragility of the firm. Moreover, this setting explicitly introduces the finance soundness of banks into the definition of their lending policy, as in Bargigli et al. (2014). Consequently, the financial soundness of the bank plays a role in the credit policy decision, as banks with greater financial strength will be able to extend credit on more favorable terms (Delli Gatti et al. 2010; Altunbas et al. 2016). The last term represents a penalty that entrepreneurs insolvent in the previous period have to pay in order to maintain the credit channel with their lender. In most of the literature on financial accelerators,Footnote 3 the bank takes no strategic action against a failed borrower and the insolvent entrepreneur continues to have access to credit. In contrast, according to Eq. 2, the new financial contract is designed to take into account the possibility for the bank to change its credit policy towards insolvent borrowers. By charging an additional premium to entrepreneurs who have defaulted on their obligations, the bank implicitly signals a preference to extend credit to borrowers who fulfil their obligations. The bank has a memory of the defaulting borrowers in the previous period and uses this information as a signal to the entrepreneurs, modifying their credit market participation constraint. In this framework, the bank is not directly subject to a participation constraint (as in Bernanke et al. 1999), but through the cost of credit reputation it implicitly decreases the probability that a defaulting borrower will apply for credit, i.e., it increases credit rationing (Canales and Nanda 2012). Therefore, this premium alters the amount of funds available, increasing the cost of credit. Finally, as in Assenza and Delli Gatti (2019), the firm-specific cost of external credit introduces feedback between macro and micro dynamics, as changes in monetary policies propagate on the individual cost of credit through the risk-free interest rate.

The return of invested capital is subject to aggregate and idiosyncratic risks. The individual (firm-specific) return on capital is \(\omega _{j,t}R_{t}^{k}\), where \(R_{t}^{k}\) is the average gross return (uniform across firms) and \(\omega _{j}\) is the idiosyncratic shock, a stochastic variable i.i.d. across time and firms with uniform distribution on a non-negative support with \(E(\omega _{j,t})=1\).

According to the firm-specific shock, the loan return will be:

where \(\mu <1\) is the monitoring cost paid by the bank to observe the actual performance realized by the defaulting entrepreneur. In Eq. 3, the first line represents the case where the entrepreneur fulfils his debt contract. Therefore, the lender gets \(Z_{b,j,t}B_{j,t}\) and the borrower earns the difference between the return on investment and the cost of debt. Conversely, according to the second line, the borrower cannot fulfil his debt contract and defaults. In this case, the banks’ balance sheet is negatively affected by non-performing loans. According to Eq. 3, if the entrepreneur cannot fulfil the contract, the bank will suffer positive losses:

Since the loans are not collateralized, the firm bankruptcy will immediately cause a reduction in the bank’s wealth. As Eq. 2 shows, the bank will change its credit policy towards the bankrupt entrepreneur by adding a premium to the interest rate of the loan. It should be noted that this is completely absent in the classical framework of the financial accelerator because the bank perfectly diversifies its risk among entrepreneurs and takes no action against insolvent entrepreneurs.Footnote 4 In contrast, this agent-based specification introduces an additional cost of external funds into the financial contract for insolvent entrepreneurs that affects their investment and lending decisions. By introducing the default penalty, the bank implicitly reduces the expected net return on investment of the insolvent entrepreneurs in the previous period, affecting the probability that they will borrow, as will be shown in Section 3.2.2.

In line with the micro-prudential requirements implemented by Basel III framework, each bank b is subject to the compliance with requirements defining the maximum level of credit supplied (\(B_{b,t}^{\max }\)) and the maximum exposure to a single borrower (\(B_{b,j,t}^{\max }\)):

where \(N_{b,t-1}\) represents the bank’s total wealth, \(\gamma ^{b}\in (0,1)\) represents the risk-weighted minimum capital adequacy ratio, and \(\kappa ^{b}>0\) is the maximum exposure parameter (see Ciola et al. 2023).

Assuming that n is the total number of borrowers of bank b, the total credit actually supplied is \(\sum _{j=1}^{n}B_{j,t}\), which may be lower than \(B_{b,t}^{\max }\). In this case, the bank retains the remaining funds available at the central bank. In the opposite case, credit is rationed, and it is assumed that bank prioritizes lending to entrepreneurs with higher net worth. This rule of thumb can be justified by two reasons: first, higher net worth is seen by banks as a proxy of past success of firm; second, higher net worth represents higher return for lenders in the event of defaults, ceteris paribus.

The evolution of the bank’s net profits can be described by the following law of motion:

where\(\underset{j=1}{\overset{n}{\sum }}V_{b,j,t}\) is the sum of return on entrepreneurs’ loans from the previous period (both for fulfilling and insolvent borrowers), \(R_{t-1}D_{b,t}\) represents the payment on deposits, and \(I_{b,t}\) is the residual excess liquidity which is held in the central bank.Footnote 5

Consequently, the equity of the \(b-th\) bank evolves as follows:

The bank goes bankrupt if the net worth at the end of the period becomes negative (\(N_{b,t}<0\)). In this case, the bankrupt bank will be replaced by a new bank with a net worth randomly distributed around the average of the sector (\(\pm 15\%\)). Therefore, the firms’ bankruptcies affect the frequency of the credit crunch, reducing the net worth of banks and thus the maximum level of available credit.

3.2.2 Entrepreneurs

Entrepreneurs are the owners of firms (it is assumed that there is one entrepreneur per firm). Entrepreneurs differ in their economic endowment and expectations. At the beginning of each period, each entrepreneur formulates his or her expectations on his or her capital return and the level of inflation. It should be noted that the model assumes expectations of two reference variables: the inflation rate and the real return on capital, i.e., in the decision-making process entrepreneurs consider their own return on capital, \(\omega _{t}^{j}R_{t}^{k}\), and not the general return on capital of the whole economy \(R_{t}^{k}\).

The optimization problem of the j-th entrepreneur is defined as follows:

The demand of external funds obtained by solving the maximization problem is:

By definition, the expected return is firm-specific, whereas the mark-up on the risk-free interest rate in Eq. 10 is bank-specific, depending on its financial soundness and its credit policy parameter, i.e., its lending propensity. Therefore, even if two enterprises have the same net worth, they may borrow a different amount depending on their expectations and the lending bank. The entrepreneur visits banks, compares their interest rates on his credit application and borrows from the bank with the lowest interest rate. At the end of the period, the borrower’s return is equal to the difference between the return on investment and the cost of debt, which depends mainly on three factors: the idiosyncratic shock, the lending bank and the way the entrepreneur forms his expectations.

From the maximization problem, a relationship can be established between capital expenditure, net worth, and entrepreneur expectations. The relationship between capital and net worth can be expressed as an increasing function of the premium on external funds, so the optimal level of debt can be rewritten as:

If the expectations of net capital return are not positive (i.e., the numerator of Eq. 10),Footnote 6 the entrepreneur’s credit demand is equal to zero, hence:

When he does not apply for credit (i.e., the expected net return on capital is negative), the entrepreneur faces a new participation constraint that only concerns the relationship between the expected return on investment and the risk-free interest rate:

From Eq. 13, the entrepreneur invests his capital using internal finance only if his expectations of return on capital are:

Since for the entrepreneur the risk-free interest rate is given, his investment choice depends on the expected return on capital. If Eq. 14 is not verified, the entrepreneur does not invest in risky assets but in deposits and consumes a share of his total wealth at the end of the period. Therefore, the ratio defined by Eq. 14 can be seen as an exit threshold. If this ratio is less than 1, the entrepreneur exits the market, while in the opposite case he self-finances his firm.

Based on possible investment and financing decisions, the entrepreneur’s income evolves as follows:

where the first line of Eq. 15 represents the income of a solvent entrepreneur. The term in brackets in the first line represents the net investment return, i.e., the difference between the investment return and the external finance cost (which is fully redistributed as dividend to the entrepreneur), while \(W^{e}\) is the entrepreneur’s wage. The second line represents the income of a bankrupt entrepreneur. If the borrower is unable to honor the debt contract, the bank claims the entrepreneur’s return on investment and the entrepreneur only receives the wage. The third line shows the evolution of non-investing entrepreneurs. Since the participation constraint does not apply for these agents, they invest in the risk-free asset (i.e., deposits). Therefore their income depends on the wage and the return on the risk-free investment.

As shown, expectations play a crucial role in investment decisions. In line with the behavioral economic literature,Footnote 7 entrepreneurs form their expectations according to the following heuristics:

where x is the reference variable (inflation and return on capital) and \(w_{x}\) represents a trend extrapolation coefficient.

These heuristics introduce backward-looking components into the system dynamics. Equation 16 represents naive expectations. This rule prescribes that entrepreneurs form their expectations of future variable level using the last observed level. This means that, using the words of Keynes (1936), “it is sensible for producers to base their expectations on the assumption that the most recently realized results will continue”. Equation 17 represents the chartist rules. Following this heuristic, the entrepreneurs base their actions on past movements of variables. These rules find empirical confirmation both in analyses of the trading rules of financial markets and in laboratory experiments.Footnote 8 If the trend coefficient is positive (\(w_{x}>0)\), the heuristic describes trend-following behaviors, whereas in the opposite case (\(w_{x}<0\)), it represents contrarian expectations. In accordance with empirical evidence,Footnote 9 trend-following entrepreneurs behave according to the same heuristic in forecasting inflation and return on capital, but they adopt different weights for the trend parameters.

The selection of the heuristics depends on the investment performance (i.e., fitness measure) of the different forecasting rules. This fitness measure is the average return on investment (ROI) of the agents using the same rule of thumb. Supposing H forecasting rules and Jentrepreneurs, the evolutionary performance measure can be expressed as:

where \(J_{h,t}\) is the number of entrepreneurs adopting the h-th heuristic in period t and the term in the bracket is the ROI of the j-th entrepreneur. Agents endogenously update their strategy among the heuristics according to the performance measure as follows:

According to Eq. 19, the entrepreneur of type h will switch to another rule if his own return on investment is lower than his type’s ROI, since this return is lower than the average return of the other rule.Footnote 10 In line with the literature on adaptive learning (e.g., Hommes 2013), the higher the fitness measure of the h-th forecasting rule, the more entrepreneurs switch to this strategy. Furthermore, we introduce into the evolution of the heuristic fraction of expectations a positive predisposition to one prediction rule over another. In other words, there is a stickiness in the mechanism in line with the status-quo effect described by Kahneman et al. (1991).

To summarize, this specification of the financial accelerator is able to endogenize both the fraction of entrepreneurs who do not receive loans (as a consequence of defining the interest rate on loans) and the share of them who exit the market (based on the entrepreneur’s participation constraint). To curb the problem that after several periods the population of entrepreneurs may shrink significantly, different types of mechanisms can be defined. In this version of the model, we assume that there is no idle period for bankrupt entrepreneurs. In other words, an insolvent entrepreneur who exits the market in period t can access credit in the following period. By adopting this mechanism, we are able to keep the number of firms in the market constant as in Gertler and Kiyotaki (2010) and Dosi et al. (2013).

3.2.3 Households

In this framework, households work, consume, and invest their savings in financial assets that pay the risk-free interest rate. These households are simple Keynesian consumers (Assenza and Delli Gatti 2019). In each period, they consume a fraction of their total wealth, i.e., labor income, and financial wealth (Riccetti et al. 2015; Caiani et al. 2016). The residual is invested in deposits at the bank. More precisely:

where \(a_{1}\) represents the propensity to consume, \(0<a_{1}<1\). Thus, in line with Godley and Lavoie (2007), workers consume with fixed propensity (\(a_{1}\)) from their disposable income.

3.2.4 Retailers

The retailers buy wholesale goods from entrepreneurs and sells the final goods on the market. Assuming that the relative price of wholesale goods is \(\frac{1}{X_{t}}\), where \(X_{t}=\frac{P_{t}}{P_{t}^{w}}\) is the gross markup of retail goods over wholesale goods (Bernanke et al. 1999).

In the retail sector, firms operate in a monopolistically competitive environment where each firm adjusts its prices with a constant probability in each period (Calvo 1983; Yun 1996). This price-setting structure has often been adopted in macroeconomic applications to introduce price stickiness (e.g., see Clarida et al. 2000). In this sector, the n-th retailer sells the quantity of output \(Y_{n,t}\) at the nominal price \(P_{n,t}\). The total final goods and their price are thus the combination of the sales of the individual retailer:

with \(\epsilon >1\).

In each period the retailer is faced with a demand curve:

where \(P_{t}=\left[ \int _{0}^{1}P_{n,t}^{(1-\epsilon )}dn\right] ^{1/(1-\epsilon )}\).

To introduce price stickiness, in each period a share of firms faces the probability \(\left( 1-\theta \right) \) of being able to re-optimize their price. The n-th retailer sets its price to maximize its expected discounted profits:

where \(P_{t}^{*}\) is the price set by the retailers who are able to re-optimize, \(Y_{n,t}^{*}\) is the consequent demand given this price, \(\theta ^{k}\) is the probability that the price is fixed for k periods and \(P_{t}^{w}\) is the nominal price of wholesale goods.

Since the share \(\theta \) of retailers is not able to re-optimize in period t, the evolution of the price will be:

By combining Eqs. 24 and 25, the following Phillips curve can be obtained:

where the slope coefficient of inflation (\(\kappa _{\pi }\)) is decreasing in the probability of the individual price remains unchanged between periods and \(\kappa _{y}\) is the discount factor. In line with De Grauwe (2012) and Bazzana (2020), both \(\kappa _\pi \) and \(\kappa _y\) are greater than zero. In Eq. 26, actual inflation depends positively on both inflation expectations and the output gap. The output gap is defined as the deviation of the actual output from an expected level. This level can be interpreted as the level of potential output in the absence of bankruptcies.

3.2.5 Central bank

The central bank adjusts the policy rate (\(R_{t}\)) according to the following non-linear instrumental Taylor rule:

where \(\pi ^{T}\) represents the inflation target, \(R^{n}\) is the natural interest rate, \(\widehat{Y_{t}}\) represents the logarithmic change in output, \(\phi _{\pi }>0\) is the inflation reaction parameter and \(\phi _{y}\ge 0\) is the output gap coefficient, e.g., in Salle et al. (2013). According to Eq. 27, the central bank reacts to both the deviation of inflation from the target level and the level of activity. The Taylor rule defined in Eq. 27 allows us to investigate the impact of different monetary policies on system dynamics.

3.3 Aggregate variables and macroeconomic equilibrium

So far, we have described the behaviour of agents. In this subsection, individual choices will be aggregated to describe the macroeconomic dynamics.

Capital purchased by entrepreneurs is combined with labor to produce wholesale output according to a standard Cobb–Douglas production function:

where \(Y_{t}\) represents aggregate production, \(K_{t}\) and \(L_{t}\) are purchased capital and hired labor, respectively, and \(A_{t}\) is total factor productivity. The total amount of purchased capital in the economy is the sum of capital invested by both borrowing and self-financing entrepreneurs. Capital is supplied by a decentralized market in which capital firms act by clearing the market and adjusting the capital price \(Q_{t}\) as follows:

where the term in brackets represents the percentage change in purchased capital between two periods and \(\varphi (\cdot )\) is the coefficient of price elasticity of capital related to this change. According to Eq. 29, the price of capital evolves according to the dynamics of the demand for capital. This definition leads to a link between asset price variability and entrepreneurs’ net worth, in line with Bernanke et al. (1999) and Kiyotaki and Moore (1997).

At the end of the period, entrepreneurs sell their output to retailers and the undepreciated capital. The gross market return for holding one unit of capital between two periods will be:

According to Eq. 30, the return on capital is the sum of the value of the marginal productivity of capital (\(\frac{\alpha Y_{t}}{X_{t}K_{t}Q_{t-1}}\)) and the capital gain of undepreciated capital. The latter depends on the change in its price \(\left( \frac{(1-\delta )Q_{t}}{Q_{t-1}}\right) \).

In addition to capital, the production function requires labor. An inelastic labor supply by households and entrepreneurs in a full-employment economy is assumed.Footnote 11 The real wages for the two categories are:

where \(\left( 1-\alpha \right) \Omega \) represents the labor share of households and \(\left( 1-\alpha \right) \left( 1-\Omega \right) \) is the labor share of entrepreneurs.

Finally, the aggregate demand curve can be written as:

where \(C_{t}\) is households consumption, \(I_{t}\) is total investments and \(C_{t}^{e}\) defines the aggregate consumption of entrepreneurs who do not invest.Footnote 12 In line with Assenza and Delli Gatti (2019), government spending is exogenous and equal to a certain level of G.Footnote 13

4 Simulations

This section shows simulation results to illustrate how bankruptcies affect business cycle dynamics. Section 4.1 presents simulation results with a scenario that considers idiosyncratic shocks to the return on capital. These simulations allow for market competition between two types of entrepreneurs: naive and trend-following agents. In line with Popoyan et al. (2017), and recognizing that macroeconomic stability depends on both market sentiment and the reaction to monetary authority shocks, Section 4.2 analyses a framework that applies alternative Taylor rules with the aim of finding some monetary policy implications. To conclude, Section 4.3 performs some robustness checks on the role of expectations rules and credit policy on system dynamics by extending the range of the trend coefficient in the chartist rule, the number of heuristics and the agents.

In the model, the agent’s behavior is based on adaptive heuristics and their updating. This can lead to non-linearities in the dynamics and thus the model does not allow for analytical, closed-form solutions. For this reason, simulations were run with a Monte Carlo process repeated 100 times over a time period of 800 quarters in which each series differs from the others due to the firm-specific stochastic idiosyncratic shock. The following simulation results refer to the average of the simulations over a period of 750 quarters, as we decided to discard the first 50 periods to avoid dependence on initial conditions.Footnote 14

In line with Dosi et al. (2010), the parameters values are calibrated in a kind of “benchmark” setup for which the model is empirically validated.Footnote 15 The economy is populated by 120 entrepreneurs (i.e., firms) and four banks. In the chartist rule, the trend extrapolation coefficient for inflation and return on capital are 0.1 and 0.3, respectively, describing weak trend following expectations.Footnote 16 In line with Bernanke et al. (1999), the quarterly discount factor \(\beta \) is 0.98, the capital share \(\alpha \) is 0.45, the household labor share \(\left( 1-\alpha \right) \Omega \) is 0.5415 and the depreciation rate for capital \(\delta \) is 0.025. In line with Iacoviello and Neri (2010), the marginal propensity to consume \((a_{1})\) is equal to 0.6. Moreover, although there is no consensus in the literature,Footnote 17 the value of capital price elasticity to changes in invested capital \(\varphi (\cdot )\) is 0.01.

For the financial sector, the investment shock has a homogeneous distribution with \(E(\omega )=1\) and it can reduce or increase the firm specific return on capital by \(15\%\). According to Basel regulation, the capital requirement for lending is equal to 0.08, while the bank’s maximum exposure to an individual borrower is equal to 0.25. The last selected parameters concern the monetary policy rule: the inflation target is 2%, the natural interest rate (\(R^{n}\)) is 1.02%, and both coefficients \(\phi _{\pi }\) and \(\phi _{y}\)are equal to 1.

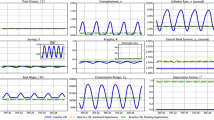

4.1 Endogenous fluctuations and other stylized facts

In this section, we investigate whether the model is able to replicate some stylized macroeconomic and microeconomic facts (Dosi et al. 2006, 2010, 2013, 2015). Table 1 shows the main empirical regularities replicated by the model. Figure 1 shows the evolution of output (left panel), total investment (middle panel), and consumption (right panel) in the baseline scenario populated only by naive entrepreneurs and weak trend followers (Scenario A). Analyzing the results of Scenario A, a positive growth is observed for all variables with persistent fluctuations. Looking at the long run, the simulation results show a stable evolution of the system accompanied by low average growth rates of output and capital, 0.020% and 0.037%, respectively. The dynamics of investment and production are intricately linked to the wealth accumulation process of entrepreneurs. In each time period, entrepreneurs invest their entire net worth, along with loans acquired from banks. Successful entrepreneurs, who avoid default, reap dividends at the period’s conclusion, reflecting their net return on investment. Consequently, for solvent entrepreneurs, this process yields a progressive growth in their net worth over time, thereby fostering a constructive trend in overall investment and production. This trend is partially offset by the losses of entrepreneurs who go into default.

However, looking at the short-term evolution, business cycles are characterized by booms and busts (Dosi et al. 2017; Stiglitz 2014) and the GDP growth rate exhibits a non-normal distribution with fat tails (see Fig. 7 in Appendix C). Since the theoretical framework does not include any long-term technological progress, we explore the cyclical behavior of the time series by filtering them through the Hodrick–Prescott filter \((\lambda =1600)\). Figure 2 shows that investment fluctuations are more volatile than output, while aggregate consumption exhibits a less volatile evolution (Stock and Watson 1999; Napoletano et al. 2006; Dosi et al. 2017).Footnote 18Moreover, as Table 2 shows, the model reproduces the empirical co-movement between output, investment and consumption (Stock and Watson 1999; Napoletano et al. 2006). These dynamics are the result of the key ingredients of the model, namely the heterogeneity of the expectations rule and the effect of bankruptcy on credit policy. By endogenizing investment decisions and banks’ credit policy, the model records a perturbation around the long-run evolution of the variables. This can be explained by entrepreneurs’ errors in the formation of expectations and thus in their investment decisions. These suboptimal decisions increase the amount of non-performing loans and bankruptcies, influencing the evolution of invested capital and, consequently, the evolution of output.

Moving to the evolution of the core variables of the agent-based specification, Fig. 3 illustrates the time series of the difference in the average performance between the rules of thumb (upper-left panel),Footnote 19 the number of entrepreneurs who do not invest and leave the market (upper-right panel), the number of naive agents (bottom-left panel), and total amount of non-performing loans (bottom-right panel)

The first panel illustrates that there is no heuristic that always performs better, but there is a sinuous evolution of the difference between investment returns. The positive spikes in the graph show that naive agents perform better on average than the chartists and vice versa. This evolution only partially drives the switching mechanism. In fact, this difference would completely drive the switching mechanism if there were no status quo effect in the updating mechanism. On the contrary, the model exhibits a stickiness in the heuristic choice. This stickiness explains the imperfect correspondence between the two dynamics in the left-hand boxes of Fig. 3. Analyzing the autocorrelation of the performance difference (Fig. 8 in Appendix C), the variable exhibits a negative autocorrelation in the first quarter that may be due to the nature of the two heuristics. For example, neglecting the default problem and assuming that there is a positive difference in performance, the naive behavior achieves a higher return, leading to an increase in the share of the heuristic. Given the implicit pro-trend nature of heuristics,Footnote 20 in the following period the trend following behavior will perform better because, on average, it takes better advantage of the positive trend. However, the pro-trend behavior of the chartists leads them to overestimate the dynamics of the investment return after two quarters (\(t+2\)) and to achieve a lower performance than the naive entrepreneurs.

The upper right-hand panel shows an oscillating dynamic around the average number of non-investing entrepreneurs (i.e. \(37.20\%\)). Despite the low volatility of the idiosyncratic shock, it is interesting to note that the number of non-investing entrepreneurs is not trivial. According to the nature of heuristics, waves of optimism based on past performance increase entrepreneurs’ demand for external funds (i.e. debt), showing a pro-cyclical dynamic in line with empirical evidence (Lown and Morgan 2006; Leary 2009; Kahle and Stulz 2013). As reported by Riccetti et al. (2013), due to the deteriorating leverage ratio of firms, small shocks have greater destabilizing effects on entrepreneurs’ financial strength, increasing their default. Indeed, Table 8 in Appendix C shows a positive cross-correlation between net worth and indebtedness. Entrepreneurs who have had positive performance in the previous period, thereby experiencing increases in their wealth, will increase their loan demand in the subsequent period, given the nature of expectations. However, this will lead to a weakening of financial stability and, consequently, losses following shocks (see the cross-correlation between indebtedness and losses, Table 8 in Appendix C). This explains the turbulent trend in total investment and output in Fig. 1. In fact, when insolvent entrepreneurs exit the market, they do not invest, adversely affecting their capital purchase and total output.

In line with empirical findings (Foos et al. 2010; Mendoza and Terrones 2012), we observe a positive correlation between entrepreneurs’ debt and non-performing loans, which negatively affect banks’ balance sheets (see Table 7 in Appendix C). In fact, when entrepreneurs go into default, the bank registers some bad debts.

Time series of the difference in performance measure (upper-left panel), number of non-investing agents (upper-right panel), number of naive agents (bottom-left panel), and amount of losses in the banking sector (bottom-right panel). Blue solid line: average level; grey shadow area: standard deviation

Investors default also negatively affects the total amount of invested capital and production. However, the effect on capital is partially mitigated by two opposing forces: self-financed entrepreneurs; and the consumption channel for those entrepreneurs who do not invest because they have a negative sentiment about future market dynamics.

As far as stylized microeconomic facts are concerned, the basic model is able to reproduce the size distribution of firms, which presents a right-hand skew, and the distribution of their growth rate, which presents fat tails (Fig. 4) (Bottazzi and Secchi 2006), the countercyclical evolution of firms’ defaults (see the correlation structure between output and losses in Table 7 in Appendix C) (Jaimovich and Floetotto 2008) and the lumpy fashion of firms’ investment (Table 8 in Appendix C) (Doms and Dunne 1998; Winberry 2021).

4.2 Monetary policy evaluation

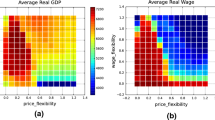

In this section, we perform some simulations using different Taylor rules with the aim of finding some monetary policy implications, i.e., whether more aggressive monetary policies are more effective in stabilizing a complex dynamic system with bounded rationality (for comparable analyses see Branch et al. 2009 or Anufriev et al. 2013). If the inflation reaction parameter and output gap coefficients are higher, monetary policy will be defined as more aggressive. Here, our analysis examines a theoretical problem: the effects of policies that do not conform to the Taylor principle expanding the range of values of the monetary policy parameters (\(\phi _{\pi }\) and \(\phi _{y}\)) in search of some general insights. The new analysis considers five possible parametrizations: Scenario A (\(\phi _{\pi }=1\), \(\phi _{y}=1\)), Scenario B (\(\phi _{\pi }=0.5\), \(\phi _{y}=1\)), Scenario C (\(\phi _{\pi }=2\),\(\phi _{y}=1\)), Scenario D (\(\phi _{\pi }=1\),\(\phi _{y}=0.5\)), and Scenario E (\(\phi _{\pi }=1\),\(\phi _{y}=2\)).

Table 3 shows the average and standard deviation of the main variables for the four scenarios. Comparing the trends in Fig. 5 between monetary policies with a relatively strong responsiveness to inflation (\(\phi _{\pi }=1\)), it can be seen that they have similar dynamics and final levels for all variables. The monetary policy applied in Scenario D appears to achieve the highest levels of investment and output growth while exhibiting intermediate levels of volatility fluctuations, in contrast to Scenario A and Scenario E. This is the case even though it is characterized by a low responsiveness to the output gap. Scenario D has lower average interest rates leading both to a lower level of self-financed investment and to fewer non-investing agents. The external financing premium strongly depends on the risk-free interest rate: if it is lower, the demand for credit will be higher, positively influencing the aggregate investment and the firms’ leverage (greater than 2.06% compared to scenario A). Furthermore, a low risk-free interest rate reduces the chances that the return on investment will be lower than the interest rate on loans and thus leads to a lower probability of default for entrepreneurs. The monetary policy of scenario E is characterized by a stronger responsiveness to output dynamics than Scenario A leading to lower rate of output growth (-0.004%) and comparable level of inflation. Despite the lower volatility in the variables, this combination of results has a negative impact on the average risk-free interest rate. As a result, Scenario E has a higher share of entrepreneurs who do not invest (+3.91%) and a lower level of credit demand, which undermine the dynamics of investment and output.

When comparing the monetary policy with the same responsiveness to output, Scenario B (\(\phi _{\pi }<1\)) has the lowest average growth rates of investment and production, about 1.3 times lower than the baseline scenario. On the contrary, in Scenario C (\(\phi _{\pi }>1\)), the economic system exhibits remarkably low levels of volatility. This stability within the system, combined with a reduced central bank interest rate, accounts for the relatively low number of non-investing agents and, consequently, the higher total investment as observed in Scenario C. Indeed, a low risk-free interest rate has a favorable impact on the cost of external financing, leading to increased firm leverage (more than 4.12% compared to the baseline scenario), thereby enabling greater investment.

In conclusion, in a system characterized by backward-looking components in the dynamics, aggressive monetary policies (C and E) seem to reduce animal spirits by creating a more stable macroeconomic environment, albeit at the expense of lowering the economic growth rate. In a system of this nature, with heterogeneous and bounded-rational agents, the monetary policy that appears to yield the best results is a moderate one (D), which responds assertively to inflation but does not overly pursue the goal of minimizing output variation.

4.3 Stabilization analysis with higher degree of heterogeneity

In this section, we run simulations by modifying some key parameters of the model to check the robustness of the results. First, we analyze the role of chartist entrepreneurs in the fluctuations of the system. In these simulations, we consider four heuristic parametrizations: Scenario A is the baseline scenario with naive and weak chartist entrepreneurs (WTF), Scenario E considers a population in which all entrepreneurs are naive, Scenario G assumes a competition between naive entrepreneurs and strong trend followers (STF), i.e., with a higher trend coefficient (\(w_{stf}=0.7\)), while in Scenario H we study the opposite scenario: competition between naive and contrarian entrepreneurs (\(w_{con}=-0.3\)).

As Table 4 shows, Scenario G has the highest average investment and output growth, but also the highest volatility. These dynamics can be explained by the pro-trend nature of the rule. According to this heuristic, agents expect a strong adjustment in the direction of the latest change in investment returns. This generates deeper waves of optimism/pessimism in investment decisions, intensity of the over-borrowing problem and probability of default, and volatility in the system. The pro-trend nature of this heuristic increases the expected return of entrepreneurs, inducing them to increase leverage (+18.25% compared to scenario A), positively affecting interest rates on loans. As a consequence of this higher external cost of funds, the probability that agents will be unable to meet their debt obligations will increase, causing them to default. Thus, in Scenario G, the number of entrepreneurs who do not invest and exit the market depends on the number of trend-following agents (shows the positive correlation equal to 0.128). During expansionary phases of the business cycle, the presence of strong trend followers in the population of entrepreneurs increases the probability of over-indebtedness and default decisions. On the other hand, STF agents will record more self-financed investments when they do not have access to the credit market. During downturns, the strong trend adjustment of investment return expectations decreases the demand for credit and thus the frequency of defaults, but also reduces the number of entrepreneurs who self-finance their investments.

From Table 4, it can be seen that by moving from stronger trend-following to contrarian behavior, the problem of over-borrowing is strongly reduced. Scenario H registers a reduction of 30.52% in the firms’ average leverage contrarian entrepreneurs expect an inverse adjustment of the return on investment, flattening the fluctuations of the system. The counter-cyclical essence of the heuristic reduces the demand for external financing, lowering the average leverage of firms, but increases the number of entrepreneurs who self-finance their investments. This phenomenon is demonstrated by the fact that the number of the contrarian in the population and the number of non-investing entrepreneurs are negatively correlated (-0.116). This second result can mainly be explained by a lower risk-free interest rate compared to scenario A (-0.48%), which leads to less binding participation thresholds.

In conclusion, it seems that by reducing the trend following coefficient (i.e., moving from scenario G to the others),Footnote 21 the economy experiences lower but more sustainable growth rates. It is lower because weak trend chartist/naive entrepreneurs have lower return expectations which negatively affect the level of debt and thus total investment and output. However, the reduction in the number of bankrupt entrepreneurs exiting the market positively affects the volatility of the investments.

Having described the effects of the trend coefficient on system dynamics, let us analyze the effects of a less conservative credit policy on the evolution of the system. More precisely, we consider scenarios with naive and weak chartist entrepreneurs, i.e., as in scenario A of the previous analyses, assuming that banks extend loans at lower prices.Footnote 22 By reducing the mark-up on the firm’s leverage ratio (\(\rho =1\)), we observe a higher average growth for both output (+0.014%) and total investment (+0.016%), with more volatility in the system than in Scenario A. On the one hand, the higher level of total investment can be explained by the lower premium for external financing. By reducing the cost of borrowing, more entrepreneurs will borrow capital from banks and ask for more loans. This larger amount of credit will positively influence the capital purchased, i.e., the total investment. On the other hand, by increasing the number of borrowers and the amount of their debt, the share of entrepreneurs leaving the market after the idiosyncratic shock will increase (+3.46%). Indeed, by reducing the cost of external funds, a less conservative credit policy can lead to a wave of over-indebtedness that increases the number of unfulfilled credit obligations and thus the number of defaults, increasing the volatility of the system. Ceteris paribus, a more conservative credit policy of the banking sector (\(\rho =3\)) leads the economic system to the opposite state, i.e., less credit extension which negatively affects total investment, leading to more stable but lower average output growth.

Time series of non-investing entrepreneurs and heuristics dynamics. Upper panerl: solid blue line: average level; grey shadow area: standard deviation. Lower panel: solid blue line: naive agents; dashed line: weak chartists and naive agents; crossed line: naive agents and chartists (weak and strong). The contrarians are represented by the distance between the crossed line and the total number of entrepreneurs

Finally, we analyze a more complex framework increasing the number of forecasting rules, i.e., we consider all the previous heuristics together: naive, contrarian, weak and strong chartist. The results of the simulations are in line with the dynamics of the previous scenarios. More precisely, this scenario shows comparable but lower slightly level of both production and total investment (-0.0001% and -0.0004%), with lower levels of volatility of investment. This result can be explained by the greater number of available strategies and the way they influence investment and borrowing decisions. Indeed, whereas in previous cases entrepreneurs were faced with a dichotomous choice between two alternative heuristics leading to deeper fluctuations, in this scenario they can choose between four forecasting rules. The expansion of available choices appears to mitigate investment fluctuations since it disperses the population of entrepreneurs across a greater number of heuristics. This, in turn, acts as a counterbalance to the dynamics in which the majority of investors simply follow prevailing trends, further strengthening them.

Moreover, looking at the dynamics of the heuristic shares (lower panel of Fig. 6), we find two main results. Firstly, a stable evolution can be observed. This dynamic can be explained by the status quo effect introduced by Eq. 16, which dominates the willingness of entrepreneurs to change heuristics. According to this stickiness, even if the agent heuristic has the lowest return on investment, the individual entrepreneur does not change if his return on investment is higher than that of his own type. Secondly, we can observe that in the long term, weak trend followers and contrarians dominate the population of entrepreneurs, representing the absolute majority. It is interesting to note that contrarians follow a heuristic opposite to that of weak trend followers, but with equal strength. Hence, it seems that intermediate heuristics are capable of outperforming those at the extremes.

5 Final remarks

In this paper, we have developed a hybrid agent-based macroeconomic model, characterized by a financial accelerator with heterogeneous agents that introduces an appropriate role for bankruptcies in credit relationships. By linking the external finance premium with entrepreneurs’ wealth and explicitly considering firms default, the model is able to amplify and propagate exogenous shocks in the system. Contrary to the standard literature on financial accelerators, borrower defaults play an explicit role in credit relationships in this framework.

On the one hand, the bankruptcies of entrepreneurs have direct effects on the credit relationship affecting the banks’ wealth. Indeed, suffering losses due to non-performing loans, banks may decide to reduce the supply of credit to defaulting entrepreneurs. On the other hand, banks with impaired financial conditions amplify and propagate the fluctuations to the whole system by increasing the interest rate on loans and reducing the total amount of credit. These new impaired credit conditions may further increase the number of failures in subsequent periods, affecting the stability of the system. We are therefore able to generate some important micro and macro stylized facts in many financial and economic series.

After identifying an appropriate role for bankruptcies in the financial accelerator framework and endogenously modelling the number of non-investing entrepreneurs, we explore the interactions of the financial accelerator with different monetary policies in search of general insights into their stabilizing effectiveness. The results suggest that monetary policies more aggressive on inflation reduce system volatility but is not able to achieve the highest economic growth rate. Indeed, this type of policy decreases the misleading signals at the origin of errors in investment and borrowing decisions, reducing the number of failures and thus resulting in a more stable macroeconomic environment. Moreover, the effectiveness of monetary policy is influenced by “market sentiment”, i.e., investors’ expectations about the future dynamics of the system.

As far as future extensions are concerned, our aim is twofold. On the one hand, it would be interesting to increase the complexity of the credit market by introducing a real interbank lending market by including banks that compete with each other or a more sophisticated banking sector, e.g., divided into several branches (wholesale and retail for deposits and loans), considering a “network-based financial accelerator” . Indeed, it can be assumed that, due to competition, external finance costs are lower and that this may generate waves of optimism with higher debt levels and a higher leverage ratio for investors. This deterioration in the financial soundness of firms can negatively affect the stability of the entire system because an unexpected credit crunch with increasing costs of external funds can produce avalanches of investors’ bankruptcies. On the other hand, we would like to further extend the macroeconomic environment by considering the consumer credit market, the transmission mechanism and the (re)distribution effects of macroeconomic shocks. In this future extension, banks will extend secured credit to both firms and consumers, where loans are secured by durable goods, e.g., houses and capital, exploring more complex business cycle dynamics.

Data Availability

The data that support the findings of this study are available from the corresponding author upon request.

Notes

See Kirman (1992) for an exhaustive analysis of the criticisms on the representative agent hypothesis.

With perfect diversification of the risk, the cost of loan under the optimal contract is determined by the requirement that the bank receives an expected return equal to the opportunity cost of its funds. Since in this case the loan risk is perfectly diversifiable, the relevant opportunity cost to the intermediary is the risk-free rate.

In this version of the model, we assume that these deposits receive a positive interest rate equal to the risk-free interest rate, and that there is no interbank market.

A negative numerator does not mean that the entrepreneur will not invest. There is still the possibility of self-financed investment as shown by Eq. 13.

See Frankel and Froot (1990) respectively.

See for example Assenza et al. (2013).

These assumptions are functional to the aim of the paper: to investigate the bankruptcy effects on the credit market leaving aside the feedbacks on real economy.

Following Bernanke et al. (1999), the consumption of non-investing entrepreneur is \(C_{j,t}^{e}=a_{1}\left[ W_{t}^{e}L_{j,t}+R_{t-1}N_{j,t-1}\right] .\)

Since the focus of the paper is on monetary policy and not fiscal policy effectiveness, we assume a stable government consumption for the sake of simplicity.

On the initial condition dependence and the complex dynamics in heterogeneous models see Hommes (2013).

In the robustness check section, we extend the range of the trend coefficient on capital return allowing for stronger trend following behavior (\(w_{stf}=0.7\)) and contrarian expectations (\(w_{con}=-0.3\)). These values for the trend extrapolation coefficient are in line with Anufriev et al. (2019).

See for example King and Wolman (1996).

The standard deviations of output, investment, and consumption are 20.92, 17.66, and 12.20, respectively.

This is defined as the difference between the naive average performance minus the trend-following one, \(U_{N,t}-U_{TF,t}\).

Notice that the naive heuristic is equal to the trend-following rule when the weight of the trend is null, \(w_{nai}=0\).

Notice that the relationship in absolute terms of the trend extrapolation coefficients among the heuristics is as follows \(w_{stf}>w_{wtf}=w_{con}>w_{nai}\) .

In this robustness analysis, we explore a range of the credit policy parameter on the firm’s leverage, \(\rho =(1;2;3)\).

References

Akerlof GJ, Shiller RJ (2009) Animal Spirits: How Human Psychology Drives the Economy, and Why it Matters for Global Capitalism. Princeton University Press, Princeton

Altunbas Y, Di Tommaso C, Thornton J (2016) Is there a financial accelerator in European banking? Fin Res Lett 17:218–221

Anufriev M, Assenza T, Hommes C, Massaro D (2013) Interest rate rules and macroeconomic stability under heterogeneous expectations. Macroecon Dyn 17(8):1574–1604. https://doi.org/10.1017/S1365100512000223

Anufrievs M, Hommes C, Makarewicz T (2019) Simple forecasting heuristics that make us smart: evidence from different market experiments. J Eur Econ Assoc 17(5):1538–1584

Assenza T, Delli Gatti D (2013) E pluribus unum: macroeconomic modelling for multi-agent economies. J Eur Econ Assoc 37:1659–1682. https://doi.org/10.1016/j.jedc.2013.04.010

Assenza T, Delli Gatti D (2019) The financial transmission of shocks in a simple hybrid macroeconomic agent based model. J Evol Econ 29:265–297. https://doi.org/10.1007/s00191-018-0559-3

Assenza T, Heemeijer P, Hommes C, Massaro D (2013) Individual expectations and aggregate macro behavior. Tinbergen Institute Discussion Paper 13-016/II

Assenza T, Delli Gatti D, Grazzini J (2015) Emergent dynamics of a macroeconomic agent based model with capital and credit. J Econ Dyn Control 50:5–28

Bargigli L, Gallegati M, Riccetti L, Russo A (2014) Network analysis and calibration of the “leveraged network-based financial accelerator’’. J Econ Behav Organ 99:109–125

Bazzana D (2020) Heterogeneous expectations and endogenous fluctuations in the financial accelerator framework. Macroecon Dyn 24(2):327–359

Bernanke B, Gertler M (1989) Agency costs, net worth and business fluctuations. Am Econ Rev 79(1):14–31

Bernanke B, Gertler M (1990) Financial fragility and economic performance. Q J Econ 105(1):87–114

Bernanke B, Gertler M, Gilchrist S (1999) The financial accelerator in a quantitative business cycle framework. In: Taylor JB, Woodford M (eds) Handbook of Macroeconomics, vol 1 of Handbook of Macroeconomics, chapter 21, 1341-1393. Amsterdam: Elsevier, North Holland

Bottazzi G, Secchi A (2006) Explaining the distribution of firm growth rates. Rand J Econ 37(2):235–256

Branch WA, Carlson J, Evans GW, McGough B (2009) Monetary policy, endogenous inattention and volatility trade-off. Econ J 119(534):123–157. https://doi.org/10.1111/j.1468-0297.2008.02222.x

Caiani A, Godin A, Caverzasi E, Gallegati M, Kinsella S, Stiglitz JE (2016) Agent based-stock flow consistent macroeconomics: towards a benchmark model. J Econ Dyn Control 69:375–408

Calvo GA (1983) Staggered prices in a utility-maximizing framework. J Monet Econ 12(3):383–398

Canales R, Nanda R (2012) A darker side to decentralized banks: market power and credit rationing in SME lending. J Financ Econ 105(2):353–366

Christiano L, Motto R, Rostagno M (2010) Financial factors in economic fluctuations. Working Paper Series 1192, European Central Bank, May 2010

Cincotti S, Raberto M, Teglio A (2010) Credit money and macroeconomic instability in the agent-based model and simulator Eurace. Economics: The Open-Access, Open-Assessment E-Journal 26(4):1–32

Ciola E, Turco E, Gurgone A, Bazzana D, Vergalli S, Menoncin F (2023) Enter the MATRIX model: a multi-agent model for transition risks with application to energy shocks. J Econ Dyn Control 146:104589

Clarida R, Galí J, Gertler M (2000) Monetary policy rules and macroeconomic stability: evidence and theory. Q J Econ 115(1):147–180

Curdia V, Woodford M (2010) Credit spreads and monetary policy. J Money Credit Bank 42(1):3–35

De Grauwe P (2012) Lectures on Behavioral Macroeconomics. Princeton University Press, Princeton

De Grauwe P, Macchiarelli C (2015) Animal spirits and credit cycles. J Econ Dyn Control 59:95–117. https://doi.org/10.1016/j.jedc.2015.07.003

Delli Gatti D, Desiderio S (2015) Monetary policy experiments in an agent-based model with financial frictions. J Econ Interact Coord 10:265–286. https://doi.org/10.1007/s11403-014-0123-7

Delli Gatti D, Di Guilmi C, Gaffeo E, Giulioni G, Gallegati M, Palestrini A (2005) A new approach to business fluctuations: heterogeneous interacting agents scaling laws and financial fragility. J Econ Behav Organ 56:489–512. https://doi.org/10.1016/j.jebo.2003.10.012

Delli Gatti D, Gallegati M, Greenwald B, Russo A, Stiglitz J (2010) The financial accelerator in an evolving credit network. J Econ Dyn Control 205(2):459–468. https://doi.org/10.1016/j.jedc.2010.06.019

Delli Gatti D, Gallegati M, Cirillo P, Desiderio S, Gaffeo E (2011) Macroeconomics from the bottom-up. Springer, Italy

Doms M, Dunne T (1998) Capital adjustment patterns in manufacturing plants. Rev Econ Dyn 1(2):409–429

Dosi G (2007) Statistical regularities in the evolution of industries. a guide through some evidence and challenges for the theory. In: Malerba F, Brusoni S (eds) Perspectives on innovation. Cambridge University Press, Cambridge MA

Dosi G, Fagiolo G, Roventini MA (2006) An evolutionary model of endogenous business cycles. Comput Econ 27(1):3–34

Dosi G, Fagiolo G, Roventini MA (2010) Schumpeter meeting Keynes, a policy-friendly model of endogenous growth and business cycles. J Econ Dyn Control 34:1748–1767

Dosi G, Fagiolo G, Napoletano M, Roventini A (2013) Income distribution, credit and fiscal policies in an agent-based Keynesian model. J Econ Dyn Control 37(8):1598–1625. https://doi.org/10.1016/j.jedc.2012.11.008

Dosi G, Fagiolo G, Napoletano M, Roventini A, Treibich T (2015) Fiscal and monetary policies in complex evolving economies. J Econ Dyn Control 52:166–189. https://doi.org/10.1016/j.jedc.2014.11.014

Dosi G, Napoletano G, Roventini A, Treibich T (2017) Micro and macro policies in the Keynes+Schumpeter evolutionary model. J Evol Econ 27(63):90

Fagiolo G, Napoletano M, Roventini A (2008) Are output growth-rate distributions fat-tailed? Some evidence from OECD countries. J Appl Econ 23:639–669

Foos D, Norden L, Weber M (2010) Loan growth and riskiness of banks. J Bank Finance 34(12):2929–2940

Frankel J, Froot K (1987) Short-term and long-term expectations of the yen/dollar exchange reate: evidence from survey data. J Jpn Int Econ 1:249–274

Frankel J, Froot K (1987) Using survey data to test standard propositions regarding exchange rate expectations. Am Econ Rev 77:133–153

Frankel J, Froot K (1990) Chartist, fundamentalist and trading in the foreign exchange market. Am Econ Rev 80:181–185

Gerlach-Kristen P (2003) Interest rate reaction functions and the Taylor rule in the euro area. Available at SSRN 457526

Gertler M, Karadi P (2011) A model of unconventional monetary policy. J Monet Econ 58(1):17–34. https://doi.org/10.1016/j.jmoneco.2010.10.004

Gertler M, Kiyotaki N (2010). Financial intermediation and credit policy in business cycle analysis. In: Handbook of monetary economics, vol 3, pp 547-599. Elsevier

Giri F, Riccetti L, Russo A, Gallegati M (2019) Monetary policy and large crises in a financial accelerator agent-based model. J Econ Behav Organ 157:42–58. https://doi.org/10.1016/j.jebo.2018.04.007

Godley W, Lavoie M (2007) Monetary Economics: An Integrated Approach to Credit, Money. Palgrave Macmillan, Income Production and Wealth

Greenwald B, Stiglitz J (1993) Financial market imperfections and business cycles. Q J Econ 108(1):77–114. https://doi.org/10.2307/2118496

Hommes C (2011) The heterogeneous expectations hypothesis: some evidence from the lab. J Econ Dyn Control 35(1):1–24. https://doi.org/10.1016/j.jedc.2010.10.003

Hommes C (2013) Behavioral Rationality and Heterogeneous Expectations in Complex Economic Systems. Cambridge University Press, Cambridge

Hommes C, Zhu M (2014) Behavioral learning equilibria. J EconTheory 150(C):778–814. https://doi.org/10.1016/j.jet.2013.09.002

Iacoviello M, Neri S (2010) Housing Market Spillover: evidence from an estimated DSGE model. Am Econ J Macroecon 2(2):125–164