Abstract

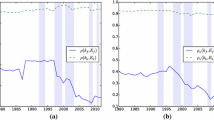

We present an agent-based model to study firm–bank credit market interactions in different phases of the business cycle. The business cycle is exogenously set, and it can give rise to various scenarios. Compared to other models in this literature strand, we improve the mechanism according to which the dividends are distributed, including the possibility of stock repurchase by firms. In addition, we locate firms and banks over a space and firms may ask credit to many banks, resulting in a complex spatial network. The model reproduces a long list of stylized facts and their dynamic evolution as described by the cross-correlations among model variables. The model allows us to test the effectiveness of rules designed by the current financial regulation, such as the Basel III countercyclical capital buffer. We find that the effectiveness of this rule changes in different business cycle environments and this should be considered by policy makers.

Similar content being viewed by others

Notes

This research stream comes from previous attempts to develop models with heterogeneous agents which interact through decentralized mechanisms, as for instance in Russo et al. (2007).

The typical mode of interaction in mainstream macropapers is instead indirect interaction, mediated by the price system.

This is a simplifying assumption that we make in order to keep the banking system as simple as possible, in absence of both the interbank market and the advances from the central bank to commercial banks. This is just an approximation of a fully decentralized banking system. Anyway, we do not think that a more detailed description of liquidity management in the banking sector could modify model dynamics significantly.

Compared to Delli Gatti et al. (2010) and Riccetti et al. (2013a), we do not assume the presence of decreasing returns to scale, that is the “financially constrained output function” where \(K_{i,t}^\beta \) with \(0<\beta <1\). Even if the model can be calibrated also (with a parameter \(0<\beta <1\)), in this case we are implicitly assuming constant returns to scale because the economic theory and many empirical studies suggest that firms often present (at least till a large level of size and complexity) increasing or constant returns to scale. Moreover, in this way, we avoid the presence of a further parameter.

According to the dynamic trade-off theory, firms have long-run leverage targets, but they do not immediately reach them; rather they adjust toward them during some periods. In our model, firms try to reach the target immediately, even if they could miss it because banks do not supply the required credit with a consequent leverage below the target, or because net worth is below its target and leverage goes above the target as explained in Eqs. , 5 and . For a review on the dynamic trade-off theory, see for instance Flannery and Rangan (2006), Frank and Goyal (2008, 2015), and Riccetti et al. (2013a).

The stocks repurchase mechanism is here equivalent to an extraordinary dividend. Moreover, dividends paid by the firms to the households are then not explicitly modeled as a component of the aggregate demand, which is exogenously set.

This credit rationing mechanism is never applied in our simulations. In practice, firms never reach a leverage equal to 4.

We decide to use twice the median net worth of the firms, because the median is usually smaller than the mean and firms are usually smaller than banks. In this way we reach two effects: on the one hand, new entrants are small new banks; on the other hand, new banks have enough money to provide credit to firms, thus avoiding the phenomena of “empty” banks that have to be merged in the following period. Moreover, we want to stress that the number of bank defaults is small, and that we find similar results when, as a robustness check, we perform simulations halving the net worth of new banks (that is, a net worth equal to the median net worth of the survived firms).

We also set a rule as a backstop against a huge disruption of the capital of the banking system. If \(\text{ LossB}_{t} > 0.5 \sum A_{z,t}\), the losses are very large for the banking system (above the 50% of the overall net worth of the banking system) and the Government covers them in order to prevent a systemic crisis. In practice, in all the performed simulations, the Government is never required to intervene, given the low number of bank defaults and the consequent small loss for the banking system compared to its total net worth (less than 5%).

The intervention of a Resolution Fund is up to a maximum of 5% of total liabilities, subordinated to the condition that at least 8% of total liabilities have already been subject to bail-in mechanisms.

Tutino et al. (2017), observing the Italian empirical evidence during the financial and sovereign crises, that is in 2009–2011–2012, show that “while larger intermediaries and commercial banks registered a contraction of the loans to customers, smaller banks, cooperative intermediaries and popular banks continued to perform positively in terms of lending to customers.” Given that small banks extend credits of relatively small amount, this feature could confirm our guess.

For the empirical evidence on this and other stylized facts on bank-firm credit networks, see Bottazzi et al. (2020).

However, this result is based on few simulations and it should be confirmed by a larger Monte Carlo experiment. We replicate the experiment with \(b=0.7\), that is we perform again 10 Monte Carlo simulations for each value of the parameter \(\text{ parCCB }\) from 0 to 20 (with step 2). In this case, the economy works better, with a higher mean growth and a lower growth volatility, because it is easy to recover from a crisis. Consequently, the presence of the CCB is irrelevant: in 5 out of 11 \(\text{ parCCB }\) cases, including the case of no CCB (\(\text{ parCCB }=0\)), the average volatility computed on the 10 simulations is 1.04, and in the other 6 cases it is included between 1.02 and 1.03, that is smaller but with a difference which is not statistically significant. The CCB is irrelevant probably also because the range of variation is smaller compared to the cases of \(b=0.8\) and \(b=0.9\), indeed, even when \(\text{ parCCB }=20\), the average (on the 10 simulations) maximum value of the CCB is 1.78 and the average minimum is 0.56 (quite far from the theoretical maximum and minimum of 2.5 and 0). The fact that the CCB is irrelevant confirms the result found with \(b=0.8\), when the presence of the CCB was on average neither beneficial nor detrimental. However, the fact that in this scenario we observe a better performance of the economy impedes the analysis on the “bad” simulations, given that in this case there are no “bad” simulations.

In our model, this mechanism is represented by the interest rate that changes following firms’ default probability, but it could be further extended including the possible behavior of restricting the amount of lent credit. Moreover, in our model, banks fix the interest rate observing the bad debt ratio of the previous period, that is a backward-looking statistics, while the banks’ choice to extend or not credit should be forward-looking. If the choice of the banks to extend credit could be useful for CCB functioning, it could also be the cause of an unsuccessful functioning: banks could be allowed to lend, but they do not want to do it.

References

Alessandrini P, Presbitero AF, Zazzaro A (2009) Banks, distances and firms, financing constraints. Rev. Finance 13(2):261–307

Allen F, Gale D (2000) Financial contagion. J Polit Econ 108(1):1–33

Bargigli L, Gallegati M, Riccetti L, Russo A (2014) Network analysis and calibration of the leveraged network-based financial accelerator. J Econ Behav Organ 99(2):109–125

Bargigli L, Riccetti L, Russo A, Gallegati M (2019) Network calibration and metamodeling of a financial accelerator agent based model. J Econ Interact Cordin. https://doi.org/10.1007/s11403-018-0217-8

Bernanke B, Gertler M (1989) Agency costs, net worth and business fluctuations. Am Econ Rev 79:14–31

Bernanke B, Gertler M (1990) Financial fragility and economic performance. Quart J Econ 105:87–114

Bernanke B, Gertler M (1995) Inside the black box: the credit channel of monetary transmission. J Econ Perspect 9(4):27–48

Bernanke B, Gertler M, Gilchrist S (1999) The financial accelerator in a quantitative business cycle framework. In: Taylor J, Woodford M (eds) Handbook of macroeconomics, vol 1. North Holland, Amsterdam, pp 1341–1393

Bottazzi G, De Sanctis A, Vanni F (2020) Non-performing loans and systemic risk in financial networks. SSRN No. 3539741. https://doi.org/10.2139/ssrn.3539741

Breevort KP, Hannan TH (2006) Commercial lending and distance: evidence from community reinvestment act data. J Money Credit Bank 38(8):1991–2012

Caccioli F, Shrestha M, Moore C, Doyne Farmer J (2014) Stability analysis of financial contagion due to overlapping portfolios. J Bank Finance 46:233–245

Caiani A, Godin A, Caverzasi E, Gallegati M, Kinsella S, Stiglitz JE (2016) Agent based-stock flow consistent macroeconomics: towards a benchmark model. J Econ Dyn Control 69(C):375–408

Cincotti S, Raberto M, Teglio A (2010) Credit money and macroeconomic instability in the agent-based model and simulator Eurace. Econ Open Access Open Assess E J 4:1–32

Cincotti S, Raberto M, Teglio A (2012) Macroprudential Policies in an Agent-Based Artificial Economy. Revue de l’OFCE 5:205–234

Da Silva MA, Lima GT (2017) Combining monetary policy and financial regulation: an agent-based modeling approach. J Econ Interact Coord. https://doi.org/10.1007/s11403-017-0209-0

Delli Gatti D, Gallegati M, Greenwald B, Russo A, Stiglitz JE (2006) Business fluctuations in a credit-network economy. Physica A 370(1):68–74

Delli Gatti D, Gallegati M, Greenwald B, Russo A, Stiglitz JE (2010) The financial accelerator in an evolving credit network. J Econ Dyn Control 34(9):1627–1650

Dosi G, Fagiolo G, Roventini A (2010) Schumpeter meeting Keynes: a policy-friendly model of endogenous growth and business cycles. J Econ Dyn Control 34(9):1748–1767

Fama E, French K (2001) Disappearing dividends: changing firm characteristics or lower propensity to pay? J Financ Econ 60(1):3–43

Flannery MJ, Rangan KP (2006) Partial adjustment toward target capital structures. J Financ Econ 79(3):469–506

Frank MZ, Goyal VK (2008) Tradeoff and pecking order theories of debt. In: Eckbo E (ed) The handbook of empirical corporate finance, chapter 12, vol 2. Elsevier, Amsterdam, pp 135–202

Frank MZ, Goyal VK (2015) The profits-leverage puzzle revisited. Rev Finance 19(4):1415–1453

Greenwald B, Stiglitz JE (1993) Financial market imperfections and business cycles. Quart J Econ 108:77–114

Krug S, Lengnick M, Wohltmann HW (2015) The impact of Basel III on financial (in)stability: an agent-based credit network approach. Quant Finance 15(12)

Lazonick W (2013) Lazonick W (2013) robots don’t destroy jobs; rapacious corporate executives do, Huffington Post Blog, http://www.huffingtonpost.com/william-lazonick/robots-dont-destroy-jobs-_b_2396465.html Accessed 04 Mar 2013

Lux T (2016) A model of the topology of the bank-firm credit network and its role as channel of contagion. J Econ Dyn Control 66:36–53

Neuberger D, Rissi R (2012) Macroprudential banking regulation: does one size fit all? University of Rostock, Institute of Economics, Thuenen-Series of Applied Economic Theory

Popoyan L, Napoletano M, Roventini A (2017) Taming macroeconomic instability: monetary and macro-prudential policy interactions in an agent-based model. J Econ Behav Organ 134:117–140

Riccetti L, Russo A, Gallegati M (2013) Leveraged network-based financial accelerator. J Econ Dyn Control 37(8):1626–1640

Riccetti L, Russo A, Gallegati M (2013b) Unemployment benefits and financial factors in an agent based macroeconomic model. Econ Open Access Open Assess J 7:2013–42

Riccetti L, Russo A, Gallegati M (2015) An agent-based decentralized matching macroeconomic model. J Econ Interact Coord 10(2):305–332

Riccetti L, Russo A, Gallegati M (2016) Stock market dynamics, leveraged network-based financial accelerator and monetary policy. Int Rev Econ Finance 43:509–524

Riccetti L, Russo A, Gallegati M (2018) Financial regulation and endogenous macroeconomic crisis. Macroecon Dyn 22(4):896–930

Russo A, Catalano M, Gaffeo E, Gallegati M, Napoletano M (2007) Industrial dynamics, fiscal policy and R&D: evidence from a computational experiment. J Econ Behav Organ 64(3–4):426–447

Skinner DJ (2008) The evolving relation between earnings, dividends, and stock repurchases. J Financ Econ 87:582–609

Stiglitz JE (2011) Rethinking macroeconomics: what failed, and how to repair it. J Eur Econ Assoc 9(4):591–645

Tesfatsion L, Judd KL (2006) Handbook of computational economics: agent-based computational economics, vol II. Elsevier, New York

Tutino F, Colasimone C, Brugnoni GC, Riccetti L (2017) The determinants of lending to customers: evidence from Italy between 2008 and 2012. In: Bilgin MH, Danis H, Demir E, Can U (eds) Empirical studies on economics of innovation, public economics and management. Springer, Switzerland, pp 57–102

Acknowledgements

We are grateful for helpful comments and suggestions to participants in the “MINSKY AT 100—Revisiting Financial Instability” conference, at Università Cattolica del Sacro Cuore, Milan, December 16–17 2019.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Riccetti, L., Russo, A. & Gallegati, M. Firm–bank credit network, business cycle and macroprudential policy. J Econ Interact Coord 17, 475–499 (2022). https://doi.org/10.1007/s11403-021-00317-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-021-00317-6