Abstract

The relationship between political instability (PI) and economic development has been extensively debated in the social sciences, yielding contrasting empirical results. In this article, we synergise two novel techniques—synthetic control (SC) and matrix completion (MC)—to study the economic effects of PI events on the sub-Saharan African scene. Our identification strategies capture potential spatial and temporal heterogeneities of treatment effects. We show that PI inflicts statistically and economically significant collateral damage, albeit heterogeneous across economies and over time. Notably, the group average treatment effect on the treated (ATT) reveals output shrinkage of approximately 17–20 percentage points. Exploiting the temporal dimension of the two techniques, we find that although output loss persists into the long run, the bulk of the damage is wrecked in the short run. This finding particularly casts doubt on the full economic recovery hypothesis in the near aftermath of a PI episode. Furthermore, we unearth spatial heterogeneities of the effects where we show that the negative effects are disproportionately more pronounced for economies which experience protracted PI episodes. Lastly, our paper demonstrates that while both methods provide reliable counterfactuals, the MC estimator yields significantly better pre-treatment fit in our data than the SC framework.

Similar content being viewed by others

Availability of data and material

All data and materials leveraged in the analysis are publicly available, and all the sources to draw the data are disclosed in the manuscript.

Notes

We use the term SSA region broadly to encompass all economies wholly or partially located to the south of the Sahara desert–including Djibouti and Somalia, whose categorisation varies across different sources.

We relax this assumption in our empirical application.

In our analysis, as we document below, \(j = 1\) could be any of the nineteen SSA countries which experienced PI episodes during the 1980–2013 window, while the donor pool comprises of all other African countries that did not experience any PI episode during the entire study period (1965–2013).

Please see Liu et al. (2022) for a detailed formal discussion of the model specifications.

Our choice of a decade-long post-treatment window is also inspired by Abadie et al. (2015).

Similar inclusion criteria were used by Adhikari et al. (2018) in their study of reform waves using the SC framework.

Although Eritrea also meet our case selection criteria, the country is dropped due to data paucity.

This precludes Angola, Benin, Chad, Mauritius, Morocco, Mozambique, Nigeria, Uganda and Zimbabwe.

Alternatively, one is suggested to employ the Demeaned synthetic control (due to Ferman and Pinto 2021) in order to circumvent this challenge. Note that this paper does not pursue this route since our goal is to compare the prototype SC against its prototype MC counterpart.

See Abadie (2021) for a related discussion on data requirements in the practical application of SC frameworks.

Note that our results remain robust to the exclusion of exogenous matching covariates (see Sect. 5.2.3).

Please refer to Ben-Michael et al. (2022) for a formal contextual discussion of the SSC variant.

We also attempted this exercise using the interactive fixed effects counterfactual (IFEct) approach, whose results remain robust to those of the MC estimator. Nevertheless, the IFEct estimator is outperformed by the latter. Results for the IFEct estimations may be obtained from the authors upon a written request.

All MC estimates are based on unit-level bootstraps with 200 replications.

In fact, Hodler (2019) provides evidence of full economic recovery 17 years following the 1994 Rwandan genocide.

A subset of treated countries that share physical borders with members of the donor pool includes: Burundi, Burkina Faso, Central African Republic, Republic of Congo, Gambia, Mali and Rwanda.

We also report the results of this exercise for the SC framework in Fig. 16. Indeed, the SC results largely corroborate those obtained by the MC estimator.

These results can be accessed from the authors upon request.

We owe an anonymous referee for this observation.

References

Abadie A (2021) Using synthetic controls: feasibility, data requirements, and methodological aspects. J Econ Lit 59(2):391–425. https://doi.org/10.1257/jel.20191450

Abadie A, Gardeazabal J (2003) The economic costs of conflict: a case study of the Basque Country. Am Econ Rev 93(1):113–132. https://doi.org/10.1257/000282803321455188

Abadie A, Diamond A, Hainmueller J (2010) Synthetic control methods for comparative case studies: estimating the effect of California’s tobacco control program. J Am Stat Assoc 105(490):493–505. https://doi.org/10.1198/jasa.2009.ap08746

Abadie A, Diamond A, Hainmueller J (2015) Comparative politics and the synthetic control method. Am J Polit Sci 59(2):495–510. https://doi.org/10.1111/ajps.12116

Abadie A, L’hour J (2021) A penalized synthetic control estimator for disaggregated data. J Am Stat Assoc 116(536):1817–1834. https://doi.org/10.1080/01621459.2021.1971535

Abadie A, Vives-i-Bastida J (2023) Synthetic controls in action. Econom Soc Monogr (Forthcoming)

Adelman I, Morris C (1973) Economic growth and social equity in developing countries. Stanford University Press, Stanford

Adhikari B, Duval R, Hu B, Loungani P (2018) Can reform waves turn the tide? Some case studies using the synthetic control method. Open Econ Rev 29(4):879–910. https://doi.org/10.1007/s11079-018-9490-3

Aisen A, Veiga FJ (2013) How does political instability affect economic growth? Eur J Pol Econ 29:151–167. https://doi.org/10.1016/j.ejpoleco.2012.11.001

Alesina A, Özler S, Roubini N, Swagel P (1996) Political instability and economic growth. J Econ Growth 1(2):189–211. https://doi.org/10.1007/BF00138862

Athey S, Bayati M, Doudchenko N, Imbens G, Khosravi K (2021) Matrix completion methods for causal panel data models. J Am Stat Assoc 116(536):1716–1730. https://doi.org/10.1080/01621459.2021.1891924

Azariadis C, Drazen A (1990) Threshold externalities in economic development. Q J Econ 105(2):501–526. https://doi.org/10.2307/2937797

Bates RH, Epstein DL, Goldstone JA, Gurr TR, Harff B, Kahl CH, Knight K, Levy MA, Lustik M, Marshall MG et al (2003) Political instability task force report: Phase IV findings. Science Applications International Corporation, McLean

Benhabib J, Rustichini A (1996) Social conflict and growth. J Econ Growth 1(1):125–142. https://doi.org/10.1007/BF00163345

Ben-Michael E, Feller A, Rothstein J (2022) Synthetic controls with staggered adoption. J R Stat Soc Ser B Stat Methodol 84(2):351–381. https://doi.org/10.1111/rssb.12448

Bertin S, Ohana S, Strauss-Kahn V (2016) Revisiting the link between political and financial crises in Africa. J Afr Econ 25(3):323–366. https://doi.org/10.1093/jae/ejv025

Billmeier A, Nannicini T (2013) Assessing economic liberalization episodes: a synthetic control approach. Rev Econ and Stat 95(3):983–1001. https://doi.org/10.1162/REST_a_00324

Bircan Ç, Brück T, Vothknecht M (2017) Violent conflict and inequality. Oxf Dev Stud 45(2):125–144. https://doi.org/10.1080/13600818.2016.1213227

Blattman C, Miguel E (2010) Civil war. J Econ Lit 48(1):3–57. https://doi.org/10.1257/jel.48.1.3

Bluszcz J, Valente M (2022) The economic costs of hybrid wars: the case of Ukraine. Def Peace Econ 33(1):1–25. https://doi.org/10.1080/10242694.2020.1791616

Bove V, Elia L, Smith RP (2017) On the heterogeneous consequences of civil war. Oxf Econ Pap 69(3):550–568. https://doi.org/10.1093/oep/gpw050

Cattaneo MD, Feng Y, Titiunik R (2021) Prediction intervals for synthetic control methods. J Am Stat Assoc 116(536):1865–1880. https://doi.org/10.1080/01621459.2021.1979561

Cerra V, Saxena SC (2008) Growth dynamics: the myth of economic recovery. Am Econ Rev 98(1):439–57. https://doi.org/10.1257/aer.98.1.439

Clément MJA (2005) Postconflict economics in Sub-Saharan Africa, lessons from the Democratic Republic of the Congo. International Monetary Fund

Collier P (1999) On the economic consequences of civil war. Oxf Econ Pap 51(1):168–183. https://doi.org/10.1093/oep/51.1.168

Costalli S, Moretti L, Pischedda C (2017) The economic costs of civil war: synthetic counterfactual evidence and the effects of ethnic fractionalization. J Peace Res 54(1):80–98. https://doi.org/10.1177/0022343316675200

De Groot OJ, Bozzoli C, Alamir A, Brück T (2022) The global economic burden of violent conflict. J Peace Res 59(2):259–276. https://doi.org/10.1177/00223433211046823

De Haan J, Siermann CL (1996) Political instability, freedom, and economic growth: some further evidence. Econ Dev Cult Chang 44(2):339–350. https://doi.org/10.1086/452217

Devereux MB, Wen J-F (1998) Political instability, capital taxation, and growth. Eur Econ Rev 42(9):1635–1651. https://doi.org/10.1016/S0014-2921(97)00100-1

Farzanegan MR (2020) The economic cost of the Islamic revolution and war for Iran: synthetic counterfactual evidence. Def Peace Econ 33(2):1–21. https://doi.org/10.1080/10242694.2020.1825314

Ferman B, Pinto C (2021) Synthetic controls with imperfect pretreatment fit. Quant Econ 12(4):1197–1221. https://doi.org/10.3982/QE1596

Fosu AK (1992) Political instability and economic growth: evidence from Sub-Saharan Africa. Econ Dev Cult Chang 40(4):829–841. https://doi.org/10.1086/451979

Galiani S, Quistorff B (2017) The synth_runner package: utilities to automate synthetic control estimation using synth. Stand Genomic Sci 17(4):834–849

Gleditsch NP, Wallensteen P, Eriksson M, Sollenberg M, Strand H (2002) Armed conflict 1946–2001: a new dataset. J Peace Res 39(5):615–637. https://www.jstor.org/stable/1555346

Gobillon L, Magnac T (2016) Regional policy evaluation: interactive fixed effects and synthetic controls. Rev Econ Stat 98(3):535–551. https://doi.org/10.1162/REST_a_00537

Hodler R (2019) The economic effects of genocide: evidence from Rwanda. J Afr Econ 28(1):1–17. https://doi.org/10.1093/jae/ejy008

Jánossy F (1971) The end of the economic miracle: appearance and reality in economic development. Routledge

Jong-A-Pin R (2009) On the measurement of political instability and its impact on economic growth. Eur J Pol Econ 25(1):15–29. https://doi.org/10.1016/j.ejpoleco.2008.09.010

Kang S, Meernik J (2005) Civil war destruction and the prospects for economic growth. J Politics 67(1):88–109. https://doi.org/10.1111/j.1468-2508.2005.00309.x

Koubi V (2005) War and economic performance. J Peace Res 42(1):67–82. https://doi.org/10.1177/0022343305049667

Kugler J, Arbetman M (1989) Exploring the “phoenix factor’’ with the collective goods perspective. J Confl Resolut 33(1):84–112. https://doi.org/10.1177/0022002789033001004

Liu L, Wang Y, Xu Y (2022) A practical guide to counterfactual estimators for causal inference with time-series cross-sectional data. Am J Political Sci. https://doi.org/10.1111/ajps.12723

Marshall MG, Cole BR (2009) Global report 2009: conflict, governance, and state fragility. Center for Systemic Peace

Matta S, Bleaney M, Appleton S (2022) The economic impact of political instability and mass civil protest. Econ Pol 34(1):253–270. https://doi.org/10.1111/ecpo.12197

Mueller H (2013) The economic cost of conflict. Work. Pap., Int. Growth Cent., London

Murdoch JC, Sandler T (2002) Economic growth, civil wars, and spatial spillovers. J Confl Resolut 46(1):91–110. https://www.jstor.org/stable/3176241

Organski AF, Kugler J (1977) The costs of major wars: the phoenix factor. Am Pol Sci Rev 71(4):1347–1366. https://doi.org/10.2307/1961484

Pesaran MH, Smith RP (2016) Counterfactual analysis in macroeconometrics: an empirical investigation into the effects of quantitative easing. Res Econ 70(2):262–280. https://doi.org/10.1016/j.rie.2016.01.004

Polachek SW, Sevastianova D (2012) Does conflict disrupt growth? Evidence of the relationship between political instability and national economic performance. J Int Trade Econ Dev 21(3):361–388. https://doi.org/10.1080/09638191003749783

Rubin DB (1980) Randomization analysis of experimental data: the Fisher randomization test comment. J Am Stat Assoc 75(371):591–593. https://doi.org/10.2307/2287653

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94. https://doi.org/10.2307/1884513

Svensson J (1998) Investment, property rights and political instability: theory and evidence. Eur Econ Rev 42(7):1317–1341. https://doi.org/10.1016/S0014-2921(97)00081-0

Themnér L, Wallensteen P (2012) UCDP/PRIO Armed Conflict Dataset, v. 4-2012, 1946–2011, Uppsala Conflict Data Program. Peace Research Institute Oslo

Vonyó T (2008) Post-war reconstruction and the golden age of economic growth. Eur Rev Econ His 12(2):221–241. https://doi.org/10.1017/S1361491608002244

Wan S-K, Xie Y, Hsiao C (2018) Panel data approach vs synthetic control method. Econ Lett 164:121–123

Winkelried D, Urquizo C (2021) The economic effects of international administrations: the cases of Kosovo and East Timor. Econ Dev Cult Chang 69(2):869–901. https://doi.org/10.1086/703102

Acknowledgements

The authors are grateful to the Editor and the two anonymous referees for the constructive comments that substantially improved the paper. The authors are also indebted to Hung-Ju Chen, Diana Carillo, Dinarti Tarigan, Shu-Shiuan Lu, Ziyi Liu and participants at the 2022 Taiwan Economics Association Conference for helpful suggestions and discussions. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The authors declare that they have no conflict of interests.

Human and animal rights

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Donor pool weights for SC framework

This Appendix presents the weights of the control units used in the construction of the SC counterfactuals (Table 3).

Appendix B: Other robustness checks

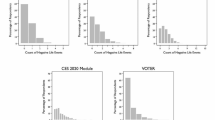

Dynamic treatment effect of PI: full donor pool vs leave-neighbours-out. Notes: The horizontal axis illustrates the number of years relative to the onset of the PI episode. For the MC estimator, the grey-shaded area represents the 90% confidence intervals obtained from the baseline estimates with full donor pool

SC Framework: dynamic treatment effects of PI episodes on GDP growth rate. Notes: The dashed line plots the GDP growth rate computed by recalibrating the SC framework on the log difference of GDP. The solid (dark) line depicts GDP growth rate computed by taking the year-on-year change of the baseline treatment effect. For the latter scenario, in each country, the observations start nine years before the onset of the PI episode since the growth rate in this case is computed post-SC estimation which was originally confined to 10 years pre-PI episode

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zonda, J.M., Lin, CC. & Chang, MJ. On the economic costs of political instabilities: a tale of sub-Saharan Africa. Empir Econ 66, 137–173 (2024). https://doi.org/10.1007/s00181-023-02452-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-023-02452-4

Keywords

- Political instability

- Economic recovery

- Economic growth

- Sub-Saharan Africa

- Matrix completion

- Synthetic control