Abstract

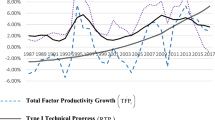

This paper proposes a latent variable approach to examine the induced innovation hypothesis originating from Hicks (The theory of wages, Macmillan, London, 1932). It allows a flexible decomposition of total factor productivity into Type I (exogenous) and Type II (induced) technical changes using a latent variable d as an argument in a variable cost function. By making extensive use of duality theory, we are able to estimate the Hicksian input demand functions, which are explicit in d but may lack a closed-form representation in terms of observable variables such as input prices and output level. The “unobservability” of d is solved by using a numerical inversion estimation method. We apply this methodology with an appropriate estimator to investigate the impact of induced innovation on China’s total factor productivity growth. Our findings indicate that the induced innovation hypothesis is strongly supported by the data and that induced innovation has a positive and profound effect on China’s productivity growth.

Similar content being viewed by others

Notes

Wei, Xie and Zhang (2017) estimated that the growth of TFP has been persistently negative and large since 2009.

In Fleisher et al. (2021), over-restrictive functional forms such as Cobb–Douglas and log forms were adopted to represent the production function of the final good and the cost function of generating d, respectively, in order to measure explicitly the impact of induced innovation.

The quadratic trend (t2) could be included to improve the flexibility of the model. Preliminary results however indicate the incorporation of t2 in GAi is not statistically significant based on the Wald test result.

The restrictions in Cases 1 to 3 will be tested by the standard Wald test.

Notice that the crude oil prices for years before 1998 are obtained from the 2016 Daqing Statistical Yearbook, which provided the benchmark price set by the Daqing oil field. From 1998 onward, the Chinese government relaxed price controls by implementing a market-oriented reform of petroleum products, so we use the producer price index of crude oil, obtained from the NBSC (2020), to extend the price series of crude oil to 1998 and beyond. In regard to the coal price prior to 1996, it is collected from China Prices Press (1998), whereas we use the Bohai-Rim Steam-Coal Price Index, provided by Wu et al. (2016) and Qinhuangdao Coal Network (2020), to extend the series to 1996 and beyond.

The Wald test was done with the help of the ANALYZ procedure in the TSP computer package.

It should be noted that the elasticity estimates reported here are not directly comparable with those obtained by Wong et al. (2022). In our model, we have two types of capital inputs, and output level rather than output price is treated as exogenous.

References

Acemoglu D (2010) When does labor scarcity encourage innovation? J Polit Econ 118(6):1037–1078

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Allen R (2009) The British industrial revolution in global perspective. Cambridge University Press, New York

Antle JM (1984) The structure of US agricultural technology, 1910–1978. Am J Agric Econ 66(4):414–421

Armanville I, Funk P (2003) Induced innovation: an empirical test. Appl Econ 35(15):1627–1647

Brandt L, Litwack J, Mileva E, Wang L, Zhang Y, Zhao L (2020) China’s productivity slowdown and future growth potential. Policy Research Working Paper No. 9298, World Bank, Washington, US

Binswanger HP (1974) The measurement of technical change biases with many factors of production. Am Econ Rev 66(6):964–967

Cao KH, Birchenall J (2013) Agricultural productivity, structural change, and economic growth in post-reform China. J Dev Econ 104:165–180

CEIC (2021) China premium database. https://insights.ceicdata.com/. Accessed 15 Dec 2021

Celikkol P, Stefanou S (1999) Measuring the impact of price-induced innovation on technological progress: application to the U.S. food processing and distribution sector. J Prod Anal 12(2):135–151

Chavas J-P (1984) The theory of mixed demand functions. Eur Econ Rev 24(3):321–344

Chen C, Lan Q, Gao M, Sun Y (2018) Green total factor productivity growth and its determinants in China’s industrial economy. Sustainability 10(4):1–25

China Prices Press (1998) Prices in China for 50 years (1949–1998). China Prices Press, Beijing (in Chinese)

Daqing Municipal Bureau of Statistics (2016) Daqing statistical yearbook 2016. China Statistics Press, Beijing (in Chinese)

Esposti R, Pierani P (2008) Price-induced technical progress in Italian agriculture. Rev Agric Environ Stud 89(4):5–28

Feenstra RC, Inklaar R, Timmer MP (2015) The next generation of the penn world table. Am Econ Rev 105(10):3150–3182

Fleisher B, McGuire WH, Wang X, Zhao MQ (2021) Induced innovation: evidence from China’s secondary industry. Appl Econ 53(52):6075–6093

Fuller W (1987) Measurement error models. Wiley, New York

Gao XM, Reynolds A (1994) A structural equation approach to measuring technological change: an application to southeastern US agriculture. J Prod Anal 5(2):123–139

General Administration of Customs of China (1993) China’s external trade indices monthly 1983–1992. China Customs Press, Beijing (in Chinese)

General Administration of Customs of China (2008) China’s External Trade Indices 1993–2004. China Customs Press, Beijing (in Chinese)

Habakkuk HJ (1962) American and British technology in the nineteenth century. Cambridge University Press, London

Hicks JR (1932) The theory of wages. Macmillan, London

Hong E, Sun L (2011) Foreign direct investment and total factor productivity in China: a spatial dynamic panel analysis. Oxf Bull Econ Stat 73(6):771–791

Hsieh C-T, Klenow PJ (2009) Misallocation and manufacturing TFP in China and India. Q J Econ 124(4):1403–1448

IMF (2019) Investment and capital stock dataset: 1960–2017, Version August-2019. Fiscal Affairs Department, International Monetary Fund. https://www.imf.org/external/np/fad/publicinvestment/data/data080219.xlsx. Accessed 15 Dec 2019

IMF (2021) IMF data—access to macroeconomic & financial data. International Monetary Fund. https://data.imf.org. Accessed 30 Dec 2021

Karagiannis G, Mergos G (2000) Total factor productivity growth and technical change in a profit function framework. J Prod Anal 14(1):31–51

Liu Q, Shumway CR (2006) Geographic aggregation and induced innovation in American agriculture. Appl Econ 38(6):671–682

McLaren K, Rossitter P, Powell A (2000) Using the cost function to generate Marshallian demand systems. Empir Econ 25:209–227

Moschini G, Moro D (1994) Autocorrelation specification in singular equation systems. Econ Lett 46(4):303–309

Morrison C, Schwartz A (1996) State infrastructure and productive performance. Am Econ Rev 86(5):1095–1111

National Bureau of Statistics of China (1997) The gross domestic product of China, 1952–1995. Northeast University of Finance and Economics Press, Liaoning

National Bureau of Statistics of China (2010) China compendium of statistics 1949–2008. China Statistics Press, Beijing (in Chinese)

National Bureau of Statistics of China (2019) National data. http://data.stats.gov.cn/easyquery.htm?cn=C01. Accessed 17 Jan 2019

National Bureau of Statistics of China (2020) 2020 China price statistical yearbook. China Statistics Press, Beijing (in Chinese)

Paris Q, Caputo M (1995) The Rhetoric of duality. J Agric Resour Econ 20(1):195–214

Peeters L, Surry Y (2000) Incorporating price-induced innovation in a symmetric generalised McFadden cost function with several outputs. J Prod Anal 14(1):53–70

Preckel P, Cranfield JAL, Hertel TW (2010) A Modified implicit directly additive demand system. Appl Econ 42(2):143–155

Qinhuangdao Coal Network (2020) The Bohai-Rim steam-coal price index. http://www.cqcoal.com/exp/exponent.jsp. Accessed 10 Dec 2020

Romer P (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Romer P (1990) Endogenous technological change. J Polit Econ 98(5):S71–S102

Satya P (2003) Effects of public infrastructure on cost structure and productivity in the private sector. Econ Rec 79(247):446–461

Shumway CR, Cowan BW, Lee D (2015) Testing the induced innovation hypothesis: accounting for innovation creation and innovation implementation incentives. AgBioforum 18(3):303–311

Stone R (1954) Linear expenditure systems and demand analysis: an application to the pattern of British demand. Econ J 64(255):511–527

Vijverberg W, Fu FC, Vijverberg CP (2011) Public infrastructure as a determinant of productive performance in China. J Prod Anal 36(1):91–111

Wei S-J, Xie Z, Zhang X (2017) From ‘Made in China’ to ‘Innovated in China’: necessity, prospect, and challenges. J Econ Perspect 31(1):49–70

Wong KKG, Park H (2007) The use of conditional cost functions to generate estimable mixed demand systems. Am J Agric Econ 89(2):273–286

Wong KKG, Fleisher BM, Zhao MQ, McGuire WH (2022) Technical progress and induced innovation in China: a variable profit function approach. J Prod Anal 57:177–191

World Bank (2021) World development indicators. https://data.worldbank.org/indicator. Accessed 30 Dec 2021

Wu Y (2000) Is China’s economic growth sustainable? A productivity analysis. China Econ Rev 11(3):278–296

Wu Y (2011) Total factor productivity growth in China: a review. J Chin Econ Bus Stud 9(2):111–126

Wu L, Qin R, Ren S (2016) An analysis of coal price trends in China. Coal Strategic Planning Research Institute and China Coal Research Institute, Report. https://chinadialogue-production.s3.amazonaws.com/uploads/content/file_en/9464/REPORT_ENG_An_Analysis_of_Coal_Price_Trends_in_China.pdf. Accessed 15 June 2021

Zhang H (2019) Non-neutral technology, firm heterogeneity, and labor demand. J Dev Econ 140:145–168

Zilibotti F (2017) Growing and slowing down like China. J Eur Econ Assoc 15(5):943–988

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Dr. Ka Kei Gary Wong declares that he has no conflict of interest. Dr. Min Qiang Zhao declares that he has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1 Derivation of Eq. (30)

Appendix 1 Derivation of Eq. (30)

Define the proportionate rate of growth of a variable v as \(\dot{v}\) and totally differentiating the variable cost function \(C\left[ {{\mathbf{w}}, \, {\mathbf{z}}, \, y{\text{, t, D}}^{c} \left( {{\mathbf{w}}, \, {\mathbf{z}}{, }y{\text{, t}}, \, c^{T} } \right)} \right]\) with respect to time, we obtain:

where \(S_{{Z_{i} }} = - \frac{\partial \log \left( C \right)}{{\partial \log \left( {z_{i} } \right)}}\), and \(E_{Cy}\) and \(\frac{{d\log \left( {D^{c} } \right)}}{dt}\) are defined in (21) and (31), respectively. Likewise, by taking the total derivative of the definition of the total variable cost (\(c = \sum\limits_{i^{\prime}} {w_{i^{\prime}}^{{}} x_{i^{\prime}} }\)) with respect to t, dividing through by c and then rearranging terms, it yields:

Equating Eqs. (33) and (34) after some algebraic manipulations gives:

Let \(C^{*} = \sum\limits_{i^{\prime} = 1}^{4} {\tfrac{\partial C}{{\partial w_{i^{\prime}} }}w_{i^{\prime}} } - \sum\limits_{j^{\prime} = 1}^{2} {\tfrac{\partial C}{{\partial z_{j^{\prime}} }}z_{j^{\prime}} }\) denote the total cost function of variable and fixed inputs (including public capital stock). Then, the total cost share functions of the variable input i and fixed input j are defined as \(S_{i}^{*} = \frac{{w_{i} X_{i} \left( {{\mathbf{w}}, \, {\mathbf{z}}, \, d,{\text{ y}}} \right)}}{{C^{*} }}\), and \(S_{{Z_{j} }}^{*} = \frac{{W_{{Z_{j} }} \left( {{\mathbf{w}}, \, {\mathbf{z}}, \, d,{\text{ y}}} \right) \cdot z_{j} }}{{C^{*} }}\), respectively. Dividing (35) by \(E_{Cy}\), we obtain:

\(\dot{y} - \sum\limits_{i^{\prime} = 1}^{{}} {\frac{{S_{i^{\prime} } }}{{E_{Cy} }}} \dot{x}_{i^{\prime} } - \sum\limits_{j} {\frac{{S_{{z_{j} }} }}{{E_{Cy} }}\dot{z}_{j} } = - \frac{\partial \log \left( C \right)}{{\partial t}}\frac{1}{{E_{Cy} }} - \frac{\partial \log \left( C \right)}{{\partial \log \left( d \right)}}\frac{{d\log \left( {D^{c} } \right)}}{dt}\frac{1}{{E_{Cy} }}.\)

It could be further rewritten as:

which is the expression in Eq. (30).

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wong, K.K.G., Zhao, M.Q. Induced innovation and its impact on productivity growth in China: a latent variable approach. Empir Econ 65, 371–399 (2023). https://doi.org/10.1007/s00181-022-02333-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-022-02333-2