Abstract

This paper researches two volatility transmission phenomena that take place within (‘heat wave’) and between (‘meteor shower’) spot and futures markets of four precious metals—gold, silver, platinum and palladium. We create conditional volatilities by considering three types of Markov switching GARCH models in combination with three different distribution functions. Conditional volatilities are subsequently embedded in Markov switching mean model. We find that ‘heat wave’ effect is more intense than ‘meteor shower’ effect, and this applies for both spot and futures markets of all precious metals. The results indicate that ‘heat wave’ effect is more intense in high than in low volatility periods, and also this effect is stronger in futures markets than in spot markets. ‘Meteor shower’ effect is stronger in low volatility regime than in high volatility regime, which is particularly true for the futures markets. Rolling regression results are in line with switching parameters. In addition, we find that ‘meteor shower’ effect, from futures to spot market, is stronger when short-term futures are analysed vis-à-vis long-term futures.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

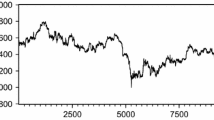

Over the past decades, there has been a remarkable increase in global demand for precious metals, particularly gold, which resulted in high price oscillation of these commodities. This happened because precious metals can be used for various purposes, inter alia, they could serve as monetary media and media of international exchange, they can be used in industry, for savings, personal investment, fashion or medical reasons (see Kirkulak-Uludag and Lkhamazhapov 2017; Ranganathan 2018). In addition, global financialization contributed significantly to liquidity of precious metals, since these assets are used in nowadays for portfolio diversification and as hedging instruments against inflation and currency risk. Generally speaking, there are two main groups of market participants that find an interest in precious metals. From the one hand, agents that use precious metals in further production processes are companies for most of the part, and they are interested in physical commodity procurement. On the other hand, non-commercial traders focus their attention on achieving positive returns from precious metals’ investments or use these assets for the purpose of portfolio diversification. These participants are often defined as speculators, and they operate primarily in future markets by taking long-positions. Taking into account that various factors affect precious metal in both spot and futures markets, it raises a general question about the nature of interdependence between spot and futures markets of precious metals. Figure 1 shows parallel dynamics of spot and futures prices (with the shortest maturity—1 month) of four precious metals. It is obvious that all metals report very heavy price oscillations, but also it can be noticed that futures prices are slightly above spot prices, for most of the time. This situation is described by the term contango, and it commonly appears for assets which have storage costs. Since futures do not require storage costs, they are more favourable, and thus, their prices are little bit higher than spot prices.

Mayer et al. (2017) argued that causality between spot and futures markets is attributable to several potential channels. Most importantly, spot and future prices are connected via the process of arbitrage, which involves simultaneous buying and selling of a commodity in different markets, in order to achieve a risk-free profit. The intensity and speed of this process is determined by interest rates, inventory costs, and the nature of storage itself. Referring to the theory of asymmetry of information within markets, future prices react faster to new information, which serves as a signal for spot markets. This happens due to the fact that futures markets show far less friction, comparing to spot markets, which means that transaction costs are lower in futures markets (see Cheng and Xiong 2014). In addition, Ruan et al. (2016) explained yet another link between spot and futures prices, which was originally defined by Working (1949). They asserted that most common way to price a futures contract is by using the non-arbitrage theory. According to this principle, the futures prices are determined by two factors—the current spot price and the cost of carrying the underlying goods from now until the delivery. This implies that the futures prices are equal to the spot prices in the future, which means that spot prices determine futures prices. However, according to Balcilar et al. (2015), a vast empirical evidence speaks otherwise, indicating that futures prices influence spot prices, and not vice-versa. Such results probably occur for two main reasons—transaction costs and asymmetric information for traders. As have been said, transaction costs are lower in the futures markets, while the price discovery happens earlier in the futures market than the spot market because of asymmetric information. In addition, Kaufmann and Ullman (2009) contended that spot-futures nexus could reveal which factors play a crucial role in price determination of precious metals. In particular, if volatility shocks spill over from spot to futures markets in stronger intensity, then market fundamentals are more important determinant of precious metals prices. Conversely, if price innovations are stronger from futures markets, than speculations have an upper hand in the price determination.

According to aforementioned, this paper tries to add to the literature by empirically examining two phenomena, popularly known as ‘heat wave’ and the ‘meteor shower’ effect that potentially exist within (between) spot and futures markets of four precious metals—gold, silver, platinum and palladium. According to typology of Engle et al. (1990), ‘heat wave’ appears when volatility shocks from one market impact the next day volatility within the same market, which is similar to a situation when a hot day in New York is likely to be followed by another hot day in New York, but not likely by a hot day in Tokyo. On the other hand, the ‘meteor shower’ effect suggests that volatility shocks spill over from one geographic region to another, i.e. between different markets, which is analogous to a ‘meteor shower’ phenomenon that occurs over many places. Investigating these phenomena between spot and futures markets make sense, even if short-term futures are considered, because spot and futures prices never match perfectly, i.e. their relations are described either by contango or backwardation (see Fig. 1).

In order to find reliable answers regarding the question about the magnitude of volatility transmission within (between) the markets, we use several sophisticated research methodologies. First, in the process of conditional volatilities creation, our initial assumption is that time-series of the selected spot and futures precious metals are subject to the presence of multiple structural breaks. This is a viable conjecture due to the fact that we cover relatively long time-span of more than 18 years, which is permeated with numerous phases of peaks and throughs, as shown in Fig. 1. This undesirable feature of time-series could produce biased estimates of conditional volatilities, as Drakos et al. (2010) contended. In these particular occasions, the sum of estimated GARCH coefficients is close to or even exceeds one, and Frommel (2010) asserted that this nuisance could cause a non-stationary volatility in a single-regime GARCH models, biased conclusions and poor risk predictions. With the purpose to address this issue, we construct conditional volatilities of the selected commodities by using several Markov switching GARCH (MS-GARCH) specifications, whereby we consider simple GARCH, TGARCH and EGARCH models in the Markov switching framework, also employing three different distribution functions—Normal, Student-t and GED. We apply this elaborate and time-consuming approach, because we want to recognize accurately intrinsic features of spot and futures markets, such as asymmetry in different regimes and time varying conditional skewness and kurtosis of the daily time-series. Therefore, for every considered market, we estimate nine models, with the goal to find an optimal one, from which we derive a biased-free regime-switching conditional volatility time-series.

Following the construction of the regime switching conditional volatilities, we intend to determine a bidirectional nonlinear relationship between spot and futures markets, making possible for variables to depend on the two independent state regimes in the mean process. In other words, we estimate eight parametric Markov switching models (four for spot and four for futures markets), in which every variable in spot market takes a position of dependent variable, while corresponding variable from futures market has an explanatory role, and vice-versa. An appealing characteristic of Markov switching model is that it can distinguish between different regimes endogenously. Numerous recent papers used the Markov switching model to investigate various economic phenomena (see Jouini 2018; Živkov et al. 2019; Stillwagon and Sullivan 2020). In order to provide more credibility to our regime-switching parameters, we also estimate a rolling regression model, which produces time-varying parameters and complements the regime-switching results.

At the end, we test the well-known Samuelson effect, which asserts that volatility declines with increasing maturity of futures. In that respect, we consider one-year maturity futures and rerun all aforementioned procedures that are applied for the analysis between spot and short-term futures markets. In this way, we can compare ‘heat wave’ and 'meteor shower' parameters and draw a conclusion whether the Samuelson effect exists in precious metals’ markets.

Based on our best knowledge, this paper contributes to the existing literature in several ways. First, unlike most papers that focused their attention on the return spillover effect, our subject of research is the second moment spillover effect that is far less investigated. Second, we explore the field of precious metals, which is vastly unresearched in the literature, comparing to various other financial assets, such as stocks, exchange rates, bonds and energy commodities. Third, we want to be accurate in the analysis as much as possible, which is accomplished by the usage of several sophisticated methodological approaches that make our results more reliable. Fourth, we complement our main findings by two additional analyses—rolling regression and the Samuelson effect testing, providing in this way a comprehensive conclusion on the researched topic.

Besides introduction, a broad framework of the paper is as follows: Section 2 presents brief literature review. Section 3 explains used methodologies. Section 4 introduces data set and statistical properties of created conditional volatilities. Section 5 provides and discusses regime-switching findings. Section 6 is reserved for two complementary analyses – rolling regression and the Samuelson hypothesis testing. The last section concludes.

2 Brief literature review and related studies

Although an intense debate about interaction between spot and futures markets was going on in recent decades, regarding various financial and commodity assets, very few papers focused their attention to precious metals markets. For instance, Balcilar et al. (2015) investigated the existence of dynamic causal relationships between the daily spot and futures prices of one, two, three and four months of West Texas Intermediate (WTI), using time-varying Granger causality approach. They reported very strong temporal characteristics between the spot and futures markets and asserted that the lead–lag relationships between the spot and futures oil prices have undergone significant changes over the years, but neither oil market dominates the other in the short-run. However, in the long-run, they found that the futures oil prices are weakly exogenous, meaning that the spot prices are those that adjust to the deviations from the long-run equilibrium. The study of Beckmann et al. (2014) analysed the relationship between the spot and futures prices of energy commodities, applying two different forms of nonlinearity—the exponential and the logistic forms. They concluded that price discovery function of futures prices can only be observed if previous volatility has been low, while little or no explanatory power is detected when volatility is high. They offered an explanation that high volatility reflects market turbulences which might be explained by price pressures resulting from speculation. In this case, the nexus between spot and futures prices results from investors who use energy products as an asset class and cause price movements to move away from fundamental values.

The study of Caporale et al. (2019) investigated spot and futures markets of WTI oil, trying to determine the process of price discovery between the markets, considering the cost-of-carry model. They concluded that futures markets play a more important role than spot markets, but their relative contributions turn out to be highly unstable. The paper of Demir et al. (2019) researched the interrelationship between the spot, futures, and forward cotton markets in China over a period of a major policy change—a temporary State reserve program for cotton that was established in 2011 and ended in 2014. They used vector autoregressive (VAR) methodology and reported that cotton futures market emerged as the primary source of price discovery in China cotton markets, i.e. cotton futures had mostly stable leading effect on cotton spot and forward markets during a period where policy interventions were particularly dramatic. Wu et al. (2018) researched the asymmetric price adjustment between spot and futures prices for corn and soybeans markets, utilizing threshold cointegration models. According to their findings, the local spot prices of corn and soybeans adjust to restore long‐run equilibrium, respective to futures market at the CME. They found that the corn spot price adjusts faster to futures price increases than futures price decreases. On the other hand, the soybean spot price adjusts faster to futures price decreases than futures price increases. Tse and Chan (2010) investigated the lead–lag interaction between the futures and spot markets of the S&P500, applying the threshold regression model on intraday data. They concluded that the lead effect of the futures market over the spot market is stronger when there is more market-wide information. On the other hand, their results indicated that the lead effect of the spot market is stronger in periods of directionless trading than in bullish and bearish periods. Beckmann and Czudaj (2013) applied nonlinear smooth transition models to analyse whether the forward spread is a leading indicator of future spot price movements in the cases of three industrial metals—aluminium, nickel, and zinc. They found that such price discovery function can be identified, in most cases, in periods of low volatility.

According to extant literature, the connection between spot and futures markets undoubtedly exists. However, very few papers researched spot-futures interlinks among precious metals, and to the best of our knowledge, the existing papers only considered gold, as widely traded precious metal, while other precious metals were disregarded. One such paper is Nicolau and Palomba (2015), who analysed the dynamic relationship between spot and futures prices in crude oil, natural gas and gold markets, employing a battery of recursive bivariate VAR models. They contended that spot and future prices are always cointegrated, but the dynamic interactions between spot and futures prices substantially depend on commodity market. In particular, they found that the Granger-causality generally operates in both directions for the crude oil, while a Granger non-causality of spot price on futures prices is found for natural gas. As for the gold market, they claimed that there is no possibility of a valid forecasting between spot and futures prices. Ruan et al. (2016) analysed the dynamic features of cross-correlations and exceedance correlations between COMEX gold spot and futures returns, using the detrended cross-correlation analysis. They found nonlinear cross-correlations between gold spot and futures markets due to the existence of transactions costs and asymmetric information. They asserted that some exogenous events may affect the cross-correlations and cause the asymmetry of the exceedance correlations between spot and futures returns. In that occasions, the price discovery may fail, and spot and futures prices may even deviate from one another in the short term. Jena et al. (2018) used wavelet methodologies and reported stronger interaction among the gold futures and spot market at different time scales. According to their findings, the degree of integration is very high at lower frequencies, i.e. four to six months, and weak in high frequencies such as one week. This indicates that in the short period of one week to one month, market specific or idiosyncratic factors are more important.

3 Used methodologies

3.1 Markov switching GARCH model

In order to produce biasfree conditional volatilities of the selected spot and futures precious metals, we use several specifications of the Markov switching GARCH model,Footnote 1 along with the three different distribution functions—normal, Student-t and generalized error distribution. In that sense, we consider simple GARCH specification in the Markov switching framework, but also EGARCH and TGARCH specifications, which can gauge possible asymmetries in different regimes. Various types of the MS-GARCH model are applied, because they can recognize structural breaks in variance endogenously, circumventing in such way its overestimation. Serial correlation is avoided by assuming an AR(1) process for the conditional mean of all examined assets, whereby residuals of the model can follow three aforementioned distributions—normal \(\varepsilon \sim N(0,{h}_{t})\), Student-t \(\varepsilon \sim St(0,{h}_{t},\nu )\) and generalized error distribution \(\varepsilon \sim GED(0,{h}_{t},k)\). Different regime switching GARCH specifications are presented in the following order—simple GARCH (Eq. 1), EGARCH (Eq. 2) and TGARCH (Eq. 3).

where \({h}_{t}\) is conditional volatility, \({\omega }_{1st}\) is a state dependent constant, whereas \({\omega }_{2st}\) and \({\omega }_{3st}\) measure ARCH and GARCH effect under regime \({S}_{t}\). \({\omega }_{4st}\) is the regime-switching coefficient that evaluates an asymmetric response of volatility to positive and negative shocks in EGARCH and TGARCH models. All models are estimated by the maximum likelihood methodology, which looks like as follows:

Albu et al. (2015) and Lukianenko et al. (2020) contended that regime switching models can switch some or all parameters of the model according to the Markov process, which is governed by a state variable (\({S}_{t}\)). The state variable (\({S}_{t}\)) evolves according to a first-order Markov chain, with transition probability. In all GARCH specifications, we assume two possible states – low volatility (state 1) and high volatility (state 2). The dynamics of this process is governed by the transition matrix P, and \({p}_{i}\) is the probability of switching from state 1 to state 2. Conditional on an information set \({\zeta }_{t-1}\), \({p}_{1t}=Pr({S}_{t}=1|{\zeta }_{t-1})\) is the probability that unobserved state variable \({S}_{t}\) is in regime 1. These probabilities are grouped together into the transition matrix according to the expression (5):

However, Cai (1994) and Hamilton and Susmel (1994) argued that the GARCH model in a regime switching context with state-dependent past conditional variances is unfeasible. This is the case because conditional variance depends not only on the observable information set \({\zeta }_{t-1}\) and on the current regime \({S}_{t}\), but also on all past states \({S}_{t-1}\), i.e. on the full history of the time series (\({y}_{t-1}, {y}_{t-2},\dots , {y}_{0}, {S}_{t}, {S}_{t-1},\dots , {S}_{1}\)). In this case, estimation becomes intractable because the number of possible paths of the process grows exponentially as \(t\) grows. Possible solution proposed Gray (1996), who offered a way to circumvent this problem. Taking into account symmetric GARCH model, conditional variance, according to him, should be generated as in Eq. (6), instead of being generated by Eq. (1).

where \({\tilde{h }}_{t-1}\) is expressed as:

where \({\Phi }_{i,t-1|t-2}\) is a probability vector whose \({i}^{th}\) element correspond to \(\mathbf{\rm P}({S}_{t-1}=i|\Theta ; {\zeta }_{t-2})\). In Eq. (7), \(K\) is a number of regimes, \({\zeta }_{t}\) is the information gathered from only the observations up to time \(t\), and \(\Theta\) is a vector of parameters in the model. A solution is that \({h}_{t}\) only depends on the history of the observations \({\zeta }_{t-1}\), and not on the history of the states, which yields much more tractable approach of estimating MS-GARCH model.

3.2 Regime switching process in the mean

In order to capture nonlinear ‘heat wave’ and ‘meteor shower’ effect between spot and futures markets of the selected assets, we employ the Markov regime-switching model in the mean. As in the GARCH regime-switching process, we also assume two states, but regime characteristics are diametrically opposite than in MS-GARCH model. In other words, when (\({S}_{t}\)) value is equal to 1, spot and futures markets are characterized by increased volatility, whereas when (\({S}_{t}\)) value is equal to 2, then the markets are in low volatility state. We also allow the variance of the error term to switch simultaneously between the states. Equation (8) tests ‘heat wave’ and ‘meteor shower’ hypotheses in the spot markets, while Eq. (9) evaluates the hypotheses for futures markets. Symbol \({h}_{t}\) denotes conditional variance calculated via the best fitting MS-GARCH model, also considering the three different distribution functions—\(N(0,{h}_{t})\), \(St(0,{h}_{t},\nu )\) and \(GED(0,{h}_{t},k)\).

Symbols \({\theta }_{st}\) and \({\eta }_{st}\) are the regime dependent constants in the two equations, whereas \({\alpha }_{st}\) and \({\beta }_{st}\) are the regime switching coefficients, which gauge nonlinear ‘heat wave’ and ‘meteor shower’, respectively, in both spot and futures markets. According to Eq. (8), Markov switching model can provide an information about how much weight volatility shocks from the previous day and from futures markets may assign to conditional volatility in spot market. The same applies in Eq. (9), but for the futures markets.

Switching between regimes in Eqs. (8) and (9) does not occur deterministically but with a certain degree of probability. Unobserved and discrete state variable \({S}_{t}\) depends serially on \({S}_{t}-1, {S}_{t}-2,\dots , {S}_{t}-r\), which is called the \({r}^{th}\) order Markov switching process that is governed by an expression (10):

Transition probabilities given in Eq. (10) determine the probability at each point in time in which a specific state occurs, rather than imposing particular dates a priori. In such way, the empirical data may indicate the nature and incidence of the regime changes.

4 Dataset and the construction of regime-dependent conditional volatilities

This paper includes daily closing prices of four precious metals—gold, silver, platinum and palladium. In the main research process, we couple short-term futures with monthly maturity and spot prices of the selected metals. For the Samuelson hypothesis testing, which is complementary analysis, we additionally consider long-term futures with 12 months maturity. All spot prices are collected from LBMA market (London Bullion Market Association) from www.lbma.org.uk website. As for futures prices, they are retrieved from www.stooq.com website, which stores futures prices from CBOT and NYMEX markets. In particular, gold and silver prices are from CBOT, while platinum and palladium prices are from NYMEX. For the main research, the sample covers relatively long time-period of 18.5 years, between January 2003 and June 2021, while for complementary research, we shorten the sample to little bit over three and a half years, from December 2017 to June 2021, due to unavailability of the data. This applies only for long-term futures of gold and silver, while for platinum and palladium calculations are not conducted, because for these metals only data of about half year exist, which is too short for reliable estimates.

Both short-term and long-term futures time-series are transformed into log-returns according to the expression \({r}_{i,t}=100\times \mathrm{log}\left({P}_{i,t}/{P}_{i,t-1}\right)\), where \({P}_{i}\) denotes the closing prices of the selected precious metals, while \(i\) stands for particular precious metal, and this is actually a roll over method. All spot and futures time-series of the precious metals are synchronized according to the existing observations. Table 1 comprises stylized facts of the spot and short-term futures time-series. It is obvious that all precious metals have positive daily average returns, whereby these returns are more left-asymmetric and fat-tailed, comparing to the Gaussian distribution. LB(Q) and LB(Q2) tests show that autocorrelation and heteroscedasticity are present in the empirical log-returns time series, which means that some form of ARMA-GARCH model might tackle these issues. Augmented Dickey-Fuller (ADF) unit root test indicates that all time-series are stationary and thus, suitable for GARCH estimation.

Our sample covers time-span of 18.5 years, and it is characterized by various turbulent global events, thus a viable assumption is that all daily time-series are ‘polluted’ with multiple structural breaks. This unwanted feature of time-series can reflect negatively on the accuracy of the estimated conditional volatilities in the GARCH process. Therefore, in the construction of conditional volatilities, we use the best fitting specification of several MS-GARCH models, whereas AIC values serve to determine which particular model is the best one. The MS-GARCH model is very useful in these circumstances, because it can recognize structural breaks endogenously. Table 2 contains calculated AIC values of nine models for every time-series, and it shows the heterogeneous results, which justifies our approach to consider a set of MS-GARCH models. In particular, we find that MS-GARCH model in combination with both Student t and GED distributions is optimal in four cases, while in the same number of times, MS-EGARCH model has an upper hand, also with Student t and GED distributions. MS-TGARCH model is not the best model for any of the selected time-series.

Table 3 presents the values of regime-switching probabilities in the optimal MS-GARCH models, which indicates what is the likelihood of staying in regime of low volatility (P11) and regime of high volatility (P22). According to Table 3, all four metals in spot market are dominantly characterized by low volatility regime. This is also the case for silver and platinum in futures markets. For palladium, high volatility regime has dominance in futures market, while for gold slight upper hand has low volatility regime in futures markets. Figure 2 shows how smooth probabilities evolve over time in spot market. Smooth probabilities in futures market can be obtained by request.

Following determination of the optimal MS-GARCH models, we construct regime-switching conditional volatilities of the precious metals in both spot and futures markets. Figure 3 indicates that dynamics of these volatilities is erratic, but also very similar between the two markets. This is expected, since spot and futures markets offer opportunities for risk-free price arbitrage, thus finding high discrepancy in prices and volatilities in these two markets is not a realistic scenario. However, according to Fig. 3, some tiny differences can be spotted, which gives us an assurance that transmission effects differentiate in magnitude, taking into account both directions of volatility transmissions.

5 Research results

This section presents the results of nonlinear ‘heat wave’ and ‘meteor shower’ effect between spot and futures markets of four precious metals, and Tables 4 and 5 contain the results. In particular, Table 4 reveals the findings regarding the spillover direction from futures to spot markets, whereas the results of the opposite effect are presented in Table 5. All \(\alpha\) parameters in the Tables measure the ‘heat wave’ phenomenon, while \(\beta\) coefficients indicate the magnitude of the ‘meteor shower’ effect. In addition, \({\alpha }_{1}\) and \({\beta }_{1}\) parameters measure the spillover effect in high volatility regime, while \({\alpha }_{2}\) and \({\beta }_{2}\) parameters gauge the size of the effects in low volatility regime. Panel B in both Tables suggests regime properties in both spot and futures markets. As can be seen, the regimes shift very fast between each other, i.e. both markets spend relatively short amount of time in each regime before switching to another regime. All error variances (\({\sigma }^{2})\) have negative sign in Tables 4 and 5, but since the variances are shown in quadratic form, they should be observed in absolute values. These indicators refer to the standard deviation of each regime, showing the level of the volatility in each state. It can be seen that in all eight cases, \({\sigma }^{2}\) is higher in high volatility regime, which is a sign that variabilities are more intense in high-volatility state, and that is expected.

5.1 ‘Heat wave’ findings

According to the results, all switching parameters are highly statistically significant, which speaks about the fact that intra-regional (‘heat wave’) and inter-regional (‘meteor shower’) volatility transmissions in spot and futures markets are a common phenomenon that happens on regular basis. More specifically, Tables 4 and 5 show that volatility spillover effect that occurs within a single market is more intense than volatility transmissions between two markets. This means that occurrences within one market play a more dominant role in shaping future developments of that market, than the case is with the external shocks that come from other places. In other words, ‘meteor shower’ spillover effects, although significant statistically and economically, have a secondary role in the construction of the volatility processes of one market. This assertion applies for both spot and futures markets of precious metals. The estimated results are well in line with the findings of Martinez and Tse (2008) who researched two theoretical phenomena (‘heat wave’ and ‘meteor shower’) using the Eurodollar, Euro/dollar exchange rates, and E-mini S&P 500 futures contracts electronically traded on the Chicago Mercantile Exchange (CME). These authors also reported stronger ‘heat wave’ volatility transmission effect, arguing that volatility of one market is mainly driven by its own volatility from the previous period.

By allowing transmission parameters to switch between the states of high and low volatility, we can gain an insight about nonlinear nature of intra- and inter-spillover effects in the markets. Regarding the ‘heat wave’ phenomenon in the spot markets, Table 4 shows that this effect is stronger in regime two, i.e. more tranquil periods. The strongest effect is recorded in gold market (0.914), while silver (0.877) and palladium (0.841) follow. Spot market serves for physical procurement of the metals that are used for various industrial, commercial and non-commercial purposes. According to various sources, such as Suh (in press) and bullionvault.com website, 10–15% of annual global demand for gold comes from industrial use, whereas the rest goes to jewellery and investments. On the other hand, silver finds its usage for number of purposes such as solder, batteries, LED chips, medicine, photography, semiconductors, touch screens, water purifications, and many other industrial uses, while platinum and palladium are used extensively for years in automotive industry for the production of catalytic converters. Therefore, owing to the fact that all precious metals are used extensively for numerous purposes, it can be expected that economic growth and other fundamental factors affect prices of these metals in spot markets, particularly in tranquil periods, which transfers consequently to volatilities within these spot markets. In crisis periods, economic activity falls off, which directly reflects on the physical demand of the metals, meaning that ‘heat wave’ effect also subsides in these periods.

As for futures markets, we find an opposite situation, in the sense that the ‘heat wave’ effect is stronger in turbulent times (first regime) in three out of four cases. This finding can be explained by the fact that participant in futures markets are mostly speculators and quick earning seekers. Frequently, these agents can be characterized as momentum traders, which mean that they react on a hint. Turbulent times especially provides opportunities for gaining high earnings, and these activities can boost highs and lows in futures markets and generate increased volatility. Therefore, this could be a probable reason why we find in gold, silver and palladium cases a more pronounced ‘heat wave’ effect in periods of turmoil than in relatively calm times. In particular, in the case of gold, we find that ‘heat wave’ effect is the highest (0.948), while in other three markets, it goes around 0.73. A viable explanation for such results can be linked with the fact that gold futures market is the most liquid one, while all other markets lag behind significantly (see Table 6). Therefore, owing to the fact that gold is the most commonly used commodity for speculation, diversification and hedging purposes, which is achieved via futures trading, speaks in favour that the ‘heat wave’ effect can be more pronounced in the case of gold than in the cases of other three precious metals.

5.2 ‘Meteor shower’ findings

This subsection presents and discusses the results of ‘meteor shower’ volatility spillover effect, i.e. between spot and futures markets, and \(\beta\) parameters are commented. Regime switching parameters in Tables 4 and 5 indicate that ‘meteor shower’ effect exists in both directions, from spot to futures and vice-versa. In particular, Tables 4 which contains spot results, shows that ‘meteor shower’ effect is stronger in high than in low volatility periods in all four cases. These findings can be explained by the fact that market participants are more sensitive in the periods of market uncertainty, and therefore prone to hasty and sometimes irrational actions as well as herding behaviour, which in total, increases ‘meteor shower’ volatilities (see e.g. Babecký et al. 2013). Also, the reason why high \(\beta\) parameters in high volatility regime are found can be due to the fact that spot markets are not so intense in trading activities as it is the case in futures markets. Because of that, price corrections in these markets happen in slow motion, which means that spillover shocks from other markets can be higher. As for lower \({\beta }_{2}\) parameters in spot markets, they suggest that ‘meteor shower’ effect is less powerful in the periods of market tranquillity. Contrary to crisis periods, in peaceful times, spot markets do not worry that some unpredictable situations might happen in futures markets, so \({\beta }_{2}\_s\) parameters are lower in all markets than \({\beta }_{1}\_s\) counterparts. According to our results, this effect is strongest in platinum spot market, with 0.227 value of spillover parameter, while silver and palladium spot markets follow with 0.112 and 0.068, respectively.

On the other hand, in futures markets (Table 5), ‘meteor shower’ effect is stronger in low volatility, i.e. market tranquillity in three out of four cases. In particular, \({\beta }_{2}\) parameters in Table 5 have value 0.363 for gold, 0.809 for silver and 0.632 for palladium, while in high volatility regime, these parameters are 0.017, 0.052 and 0.161 for gold, silver and palladium, respectively. The rationale for these somewhat peculiar results could be found in the paper of Mayer et al. (2017), who asserted that increased participation of non-commercial traders in one market generates further liquidity, which in turn reduces volatility and enables market forces to correct irrational prices. This explanation could be applied to our results, because we find notably smaller ‘meteor shower’ effect in futures markets in high volatility regime in three out of four cases. It is interesting to note that most liquid, gold market report the lowest \({\beta }_{1}\) parameter (0.017), while the second-best market in terms of liquidity, silver market, has the second-lowest \({\beta }_{1}\) parameter (0.052). In other words, due to the fact that number of traders in gold and silver futures markets is significantly higher than in platinum and palladium markets, and the number of trading transactions progressively increases in crisis periods, it can be assumed that these activities notably mitigate the effects of the external shocks when futures markets are under stress. Besides, the fact that situation between spot and futures prices are mainly contango, i.e. futures prices are higher than spot prices, may also contribute to the explanation why lower parameters are found in high volatility regime. In other words, higher futures prices allow them to absorb shocks from other market more effectively.

6 Complementary analyses

6.1 Rolling regression results

Estimated regime-switching parameters in Sect. 5 speak about the spillover effect in crisis and tranquil market conditions. However, these estimates show only an average value of the coefficients without indication what is their value across the sample. In order to be more informative, we additionally estimate two multivariate models, represented in Eqs. (8) and (9), with a rolling regression procedure. This type of technique can give us an insight whether results are driven by a particular sample period or not. In addition, we want to test the assertion of Magkonis and Tsouknidis (2017) who claimed that large and time-varying spillovers exists among the spot-futures volatilities. They researched petroleum-based commodities, and we want to check whether this type of relationship applies for precious metal as well. At the same time, this approach can serve as a robustness check for the estimated regime-switching parameters.

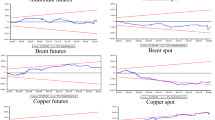

The idea to use rolling regression was borrowed from the recent papers of Hossain (2011), Xu et al. (2017) and Su et al. (2019). The size of the rolling window is set to two years, i.e. 504 daily observations, which is approximate number of working days in two years. In this process, we use generalized least square (GLS) approach for the rolling regression estimation, which is capable of correcting standard errors for autocorrelation and avoiding possible spurious regression. Besides, we apply the White method for heteroscedasticity, which was proposed by MacKinnon and White (1985). Figure 4 contains the plots that depict estimated rolling parameters. All rolling parameters in the plots are statistically significant at least at 10%, while statistically insignificant parameters are omitted.

Figure 4 shows that \(\alpha\) and \(\beta\) parameters oscillate greatly across the sample, which justifies the usage of this approach, and also it corroborates the assertion of Magkonis and Tsouknidis (2017) about the existence of large and time-varying volatility spillover effect between spot and futures markets. It is interesting to note that common pattern can be spotted in all plots in Fig. 4. In other words, we find that estimated rolling \(\alpha\) and \(\beta\) parameters are almost perfectly symmetrical, in a sense when ‘heat wave’ effect is strong, ‘meteor shower’ effect is weak and vice-versa. More specifically, when the period around global financial crisis and COVID19 crisis is observed, it can be seen that volatility transmissions within the markets are significantly stronger than volatility transmissions between the markets, which is the case in the most plots. It means that happenings from the previous day are significantly more important for investors in crisis periods, than the shocks that come from other market.

In addition, it can be seen that this phenomenon is stronger in futures markets, which is not surprising taking into account that in future markets dominantly operates speculators (between 97 and 98% of all participants in futures markets are speculators) who are very sensitive to increased volatility within the market and who adjust their actions swiftly. In particular, the level of ‘heat wave’ goes between 70 and 90% in all markets during global financial crisis, while the ‘meteor shower’ effect is well below this value and amounts between 10 and 30%.

As can be seen, the complementary rolling regression findings coincide with the regime-switching parameters in Tables 4 and 5, but not perfectly. In other words, the switching parameters suggest that ‘heat wave’ is stronger than the ‘meteor shower’ effect in both high and low volatility regimes in the most cases. However, rolling parameters speak otherwise, in a sense that the magnitude of rolling parameters shifts dramatically when diametrically opposite market conditions are under question. In particular, from 2010 and onwards, which is relatively tranquil period, it can be noticed in most cases that volatility impact changes substantially, meaning that external volatility shocks (‘meteor shower’ effect) become more important, while the impact from the previous day volatility (‘heat wave’) reduces significantly. These findings indicate that investors more vigilantly pay attention on the developments in the neighbouring markets than within the market in the periods of market calmness for the cases of gold, platinum and palladium. Generally speaking, rolling regression results supplement and give time-varying insight about the nexus, which regime-switching parameters cannot do. Therefore, rolling regression helps to better understand the complex spot-futures volatility transmission relations.

6.2 Testing the Samuelson hypothesis

Samuelson (1965) asserted that futures volatility increases as the expiration date approaches, which has become known as the Samuelson hypothesis or simply the maturity effect. According to Bessembinder et al. (1996) the difference between the behaviour of the prices of the first-nearby and deferred contracts is very important feature of commodity futures. Duong and Kalev (2008) contended that the oscillation of the former is large and erratic, while the latter is relatively stable, whereby the difference comes to the fore due to a decreasing pattern in the volatilities along the price curve as the Samuelson effect predicts. This phenomenon occurs because shock that affects the short-term price has an effect on the succeeding prices that decreases as the maturity increases. Jaeck and Lautier (2016) pointed out that when futures contract reaches its expiration date, it reacts more strongly to information shocks because of the ultimate convergence of the futures to the spot prices at maturity.

Our main research has only investigated a volatility spillover effect between spot prices and short-term futures prices. This subsection, on the other hand, tries to answer whether the maturity effect is present in precious metals’ markets. As have been said, for this purpose we additionally consider long-term (12 months) futures. Due to unavailability of relatively long data-span of all precious metals, the analysis is limited only to gold and silver commodities. The procedure conducted in this section is the same as in Sect. 5. Besides, we estimate the spillover effect only from futures to spot prices, in order to see is there any difference in the intensity of volatility transmission when futures of different maturity are at stake. Figure 5 jointly presents spot, short- and long-term futures of gold and silver, and the steepness of the term curve is obvious, particularly before an outbreak of COVID-19 pandemic. It can be noticed that the difference between long- and short-term futures prices shrinks significantly after an onset of the pandemic, which indicates to investors’ lack of confidence.

Table 7 shows the regime-switching parameters of ‘heat wave’ and the ‘meteor shower’ effects, estimated when short and long futures are considered.Footnote 2 The Samuelson effect suggests that short-term futures have higher volatility than long-term counterparts, which subsequently means that volatility transmission from short-term futures is also stronger. We find an evidence that confirms this assumption, which particularly applies for higher volatility regime (regime 1). In other words, in the cases of both gold and silver, we find that \({\upbeta }_{1\_\mathrm{F}}\) parameter is higher than \({\upbeta }_{1\_\mathrm{FL}}\) parameter, which coincides with the Samuelson hypothesis. These findings are in line with Lautier et al. (2019) claim, who asserted that on average, short-dated futures emit more information than do backdated contracts.

On the other hand, in calmer second regime, the hypothesis comes to the fore only in the case of silver, whereas for gold, we find that \({\upbeta }_{2\_\mathrm{FL}}>{\upbeta }_{2\_\mathrm{F}}\). This result is not unusual, because there are situations when the Samuelson principle might be violated. For instance, Fama and French (1988), asserted that the Samuelson effect might not occur at short-term horizons when inventories are high. They found these results for industrial metals. They argued that when the inventory is high, the spot and futures prices have the same variability. On the other hand, Anderson and Danthine (1983) offered another explanation for violation of the Samuelson theory, which is also in line with our results. They asserted that storage is not the most important explanatory factor for the behaviour of volatility, but production uncertainty and the way this uncertainty diffuses into the market. They claimed that futures prices are volatile in times when much uncertainty is resolved and are stable when little uncertainty is resolved. This could offer potential explanation why stronger spillover effect is found from long-term futures to spot prices in calm period in the case of gold.

7 Conclusion

This paper thoroughly investigates two volatility transmission phenomena that occur within (between) spot and futures markets of four precious metals—gold, silver, platinum and palladium. In particular, we gauge the volatility spillover effect within the market (‘heat wave’) and across the markets (‘meteor shower’). In the computation process, we put special emphasis on the accurateness of the created conditional volatilities, so we consider three different MS-GARCH specifications with three different distribution functions. The created optimal conditional volatilities are subsequently embedded in the Markov switching model, which can reveal a nonlinear nature of volatility spillovers between spot and futures markets. As for complementary analyses, we use the rolling regression methodology and test the Samuelson effect.

According to the estimated regime switching parameters, ‘heat wave’ spillover effect is more intense than volatility transmissions between the two markets, and this applies for both spot and futures markets of the precious metals. However, an intensity of this effect differs between high and low volatility regimes. In particular, in spot markets, this effect is stronger in calmer regime and weaker in turbulent regime. This is probably because spot markets serve for physical procurement of metals, and demand for these commodities is more intense in more tranquil and certain periods. On the other hand, in futures markets, ‘heat wave’ effect is more pronounced in turbulent regime, which can be explained by the nature of futures markets. In other words, participants in futures markets are mostly speculators, who have a primary goal to earn on price differences. Therefore, their activity intensifies in turbulent times, which contributes to more volatility transfers between consecutive days.

The situation reverses when’meteor shower’ effect is analysed. In other words, when volatility transmission is from futures to spot markets, then it is stronger in high volatility regime. Probable explanation could be due to the fact that spot market participants need to plan precious metals’ procurements for longer time. In that regard, if future developments are unpredictable, this would cause that every increased volatility in futures markets leads to higher volatility in spot markets, because futures markets gather and process information more quickly than spot markets. However, when ‘meteor shower’ effect is observed from spot to futures markets, then higher impact is detected in more tranquil regime. This happens because in peaceful times traders’ activity is smaller in futures markets, which means that futures price adjustments occur slower, and this also leaves more room for increased volatility transmission from other markets, which we detect in three out of four cases.

The results of estimated rolling regression give new insight about volatility transmission between spot and futures markets, because they are time-varying. In particular, during the periods around global financial crisis and COVID19 crisis, volatility transmissions within the markets are significantly stronger than volatility transmissions between the markets, which is the case for both spot and futures markets. This indicates that happenings from the previous day are significantly more important for market participants in crisis periods, than the shocks that come from other market. Situation reverses when calm periods are at stake.

In addition, by testing the Samuelson hypothesis, we find that ‘meteor shower’ effect from futures to spot market is stronger when short-term futures are analysed, comparing to long-term futures. This is the case for both gold and silver markets, and this particularly applies for more volatile regime.

We believe that the results from this paper can be useful for investors who perform in spot and futures markets of the precious metals. The results can help them to better understand what drives volatilities in these markets in various market conditions, and how to adjust their positions accordingly. In other words, using result from the paper, investors can better devise hedging strategies and better prepare themselves for incoming volatility shocks, taking into account both tranquil and crisis periods.

Notes

MS-GARCH model is estimated via’MSGARCH’ package in’R’ software.

Optimal models for spot, short- and long-term futures of gold are MS-TGARCH-GED, MS-GARCH-t and MS-EGARCH-t, respectively. For silver, optimal models are MS-GARCH-t, MS-GARCH-t and MS-EGARCH-t, respectively.

References

Albu LL, Lupu R, Calin AC (2015) A comparison of asymmetric volatilities across European stock markets and their impact on sentiment indices. Econom Comput Econom Cybernet Stud Res 49(3):5–19

Anderson RW, Danthine J-P (1983) The time pattern of hedging and the volatility of futures prices. Rev Econ Stud 50(2):249–266

Babecký J, Komárek L, Komárková Z (2013) Financial integration at times of financial instability. Finance a Úvěr-Czech J Econ Finance 63(1):25–45

Balcilar M, Gungor H, Hammoudeh S (2015) The time-varying causality between spot and futures crude oil prices: a regime switching approach. Int Rev Econ Financ 40:51–71

Beckmann J, Belke A, Czudaj R (2014) Regime-dependent adjustment in energy spot and futures markets. Econ Model 40:400–409

Beckmann J, Czudaj R (2013) The forward pricing function of industrial metal futures—Evidence from cointegration and smooth transition regression analysis. Int Rev Appl Econ 27(4):472–790

Bessembinder H, Coughenour, j.F., Seguin, P.J., Smoller, M.M. (1996) Is there a term structure of futures volatilities? Reevaluating the Samuelson Hypothesis. J Derivat 4(2):45–58

Cai J (1994) A Markov model of switching-regime ARCH. J Bus Econ Stat 12(3):309–316

Caporale GM, Ciferri D, Girardi A (2014) Time-varying spot and futures oil price dynamics. Scot J Polit Econ 61(1):78–97

Cheng I-H, Xiong W (2014) The financialization of commodity markets. Annu Rev Financ Econ 6:419–441

Demir M, Martell TF, Wang J (2019) The trilogy of China cotton markets: the lead–lag relationship among spot, forward, and futures markets. J Futur Mark 39(4):522–534

Drakos AA, Kouretas GP, Zarangas LP (2010) Forecasting financial volatility of the Athens stock exchange daily returns: an application of the asymmetric normal mixture GARCH model. Int J Financ Econ 15(4):331–350

Duong HN, Kalev PS (2008) The Samuelson hypothesis in futures markets: an analysis using intraday data. J Bank Finance 32:489–500

Engle RF, Ito T, Lin W-L (1990) Meteor showers or heat waves? Heteroskedastic inter-daily volatility in the foreign exchange market. Econometrica 58(3):525–542

Fama EF, French KR (1988) Business cycles and the behavior of metals prices. J Finance 43(5):1075–1093

Frommel M (2010) Volatility regimes in Central and Eastern European countries’ exchange rates. Finance a Úver-Czech J Econ Finance 60(1):2–21

Gray SF (1996) Modelling the conditional distribution of interest rates as a regime-switching process. J Financ Econ 42(1):27–62

Hamilton JD, Susmel R (1994) Autoregressive conditional heteroskedasticity and changes in regime. J Econom 64(1–2):307–333

Hossain AA (2011) In search of a stable narrow money-demand function for Indonesia, 1970–2007. Singap Econ Rev 56(1):61–77

Jaeck E, Lautier D (2016) Volatility in electricity derivative markets: the Samuelson effect revisited. Energy Econ 59:300–313

Kaufmann RK, Ullman B (2009) Oil prices, speculation, and fundamentals: interpreting causal relations among spot and futures prices. Energy Econ 31(4):550–558

Kirkulak-Uludag B, Lkhamazhapov Z (2017) Volatility dynamics of precious metals: evidence from Russia. Finance a Úver-Czech J Econ Finance 67(4):300–317

Lautier DH, Raynaud F, Robe MA (2019) Shock propagation across the futures term structure: evidence from crude oil prices. Energy Journal 40(3):125–153

Lukianenko I, Oliskevych M, Bazhenova O (2020) Regime switching modeling of unemployment rate in Eastern Europe. Ekonomicky Časopis 68(4):380–408

MacKinnon JG, White H (1985) Some heteroskedasticity consistent covariance matrix estimators with improved finite sample properties. J Econom 29(3):305–325

Magkonis G, Tsouknidis D (2017) Dynamic spillover effects across petroleum spot and futures volatilities, trading volume and open interest. Int Rev Financ Anal 52:104–118

Martinez V, Tse Y (2008) Intraday volatility in the bond, foreign exchange, and stock index futures markets. J Futur Mark 28(4):313–334

Mayer H, Rathgeber A, Wanner M (2017) Financialization of metal markets: Does futures trading influence spot prices and volatility? Resour Policy 53:300–316

Nicolau M, Palomba G (2015) Dynamic relationships between spot and futures prices. The case of energy and gold commodities. Resour Policy 45:130–143

Jena SK, Tiwari AK, Roubaud D (2018) Comovements of gold futures markets and the spot market: a wavelet analysis. Financ Res Lett 24:19–24

Jouini J (2018) Measuring the macroeconomic impacts of fiscal policy shocks in the Saudi Economy: A Markov switching approach. Roman J Econ Forecast 21(4):55–70

Ranganathan K (2018) Does global shapes of utility functions matter for investment decisions? Bull Econ Res 70(4):341–361

Ruan Q, Huang Y, Jiang W (2016) The exceedance and cross-correlations between the gold spot and futures markets. Physica A 463:139–151

Samuelson PA (1965) Proof that properly anticipated prices fluctuate randomly. Ind Manag Rev 6(2):41–49

Stillwagon J, Sullivan P (2020) Markov switching in exchange rate models: will more regimes help? Empir Econ 59:413–436

Su C-W, Wang K-H, Tao R, Lobont O-R (2019) Does the covered interest rate parity fit for China? Econ Res-Ekonomska Istraživanja 32(1):2009–2027

Suh DH (in press) Exploring the U.S. mining industry's demand system for production factors: implications for economic sustainability. Resources Policy. https://doi.org/10.1016/j.resourpol.2018.06.005

Tse Y-K, Chan W-C (2010) the lead–lag relation between the S&P500 spot and futures markets: an intraday-data analysis using a threshold regression model. Jpn Econ Rev 61(1):133–144

Working, (1949) The theory of price of storage. Am Econ Rev 39(6):1254–1262

Wu Z, Maynard A, Weersink A, Hailu G (2018) Asymmetric spot-futures price adjustments in grain markets. J Futur Mark 38(12):1549–1564

Xu Y, Liu Z, Jia Z, Su C-W (2017) Is time-variant information stickiness state-dependent? Port Econ J 16:169–187

Živkov D, Đurašković J, Manić S (2019) How do oil price changes affect inflation in Central and Eastern European countries? A wavelet-based Markov switching approach. Baltic J Econ 19(1):84–104

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Authors Dejan Živkov, Slavica Manić and Ivan Pavkov declare that have no conflict of interest.

Human and animals participants

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Živkov, D., Manić, S. & Pavkov, I. Nonlinear examination of the ‘Heat Wave’ and ‘Meteor Shower’ effects between spot and futures markets of the precious metals. Empir Econ 63, 1109–1134 (2022). https://doi.org/10.1007/s00181-021-02148-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-021-02148-7

Keywords

- Inter and intra volatility transmission effect

- Spot and futures markets

- Precious metals

- Markov switching models in mean and variance