Abstract

This paper examines the performance of Markov switching models of the exchange rate using a data-driven approach to determine the number of regimes rather than simply assuming two states. The analysis is conducted for the British pound, Canadian dollar, and Japanese yen exchange rates against the US dollar over the last 30 years with alternative specifications including a simple segmented trends model and Markov switching autoregressive models with monetary fundamentals. A noteworthy finding is that the number of regimes that minimizes mean square forecast errors tends to correspond to the number of regimes selected by Bayesian information criteria (but not Markov-switching-specific information criteria). For the monetary models, the number of regimes that minimizes forecast errors also tends to correspond to the most parsimonious model with well-behaved residuals. Although allowing for more regimes yields forecasting improvement over single- or two-regime models, the Markov switching model is still unable to outperform a random walk. This suggests that exchange rate models need to allow for novel, as opposed to repetitive or predetermined, structural change.

Similar content being viewed by others

Notes

The year-over-year percentage change is calculated as \(\Delta e_{t}=\frac{ e_{t}-e_{(t-12)}}{e_{(t-12)}}\).

See earlier working paper versions of this article for the constant variance results. We also examined models with switching GARCH; however, they tend to experience convergence failures at fairly low levels of regimes and lags. For results on the percentage of convergence failures in our models with switching variance, see appendix tables 22 and 23 of Electronic Supplementary Material. See Cavicchioli (2014a) for work on MS VAR(CH) models.

The coefficients and transition probabilities are estimated using Oxmetrics’s regime switching class of models for PcGive with switching variance.

There are of course other possibilities about how the model may be misspecified, including the need to include fundamentals and their lags, which will be explored in the following section.

Analysis of the recursively calculated information criteria yields the same result that the ranking of the models is not dependent on the end date of the sample.

See also Cavicchioli (2014b) which extends this approach.

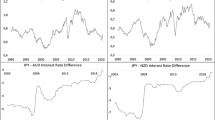

Data sources: the exchange rate and interest rate data are end-of-month data provided by Thomson Reuters. The M3 and production data are monthly series from the St. Louis Federal Reserve Economic Data (FRED).

The results for the Canadian dollar and yen display similar patterns to the pound and are reported in “Appendix.”

The CAD/USD and JPY/USD results are reported in the appendix tables 15 and 18 of Electronic Supplementary Material.

The results for the CAD/USD and JPY/USD are similar and reported in “Appendix.”

It is worth providing some caution, however, that the interpretability of the results may be suspect given the poor out-of-sample fit found in the following section.

References

Akaike H (1973) Information theory as an extension of the maximum likelihood principle. In: Petrov N, Csaki F (eds) Second international symposium on information theory. Akademiai Kiado, Budapest, pp 1–21

Bacchetta P, van Wincoop E (2004) A scapegoat model of exchange-rate fluctuations. Am Econ Rev 94(2):114–118

Balcilar M, Hammoudeh S, Asaba N-AF (2018) A regime-dependent assessment of the information transmission dynamics between oil prices, precious metal prices and exchange rates. Int Rev Econ Finance 40:42–89

Basher SA, Haug AA, Sadorsky P (2016) The impact of oil shocks on exchange rates: a Markov-switching approach. Energy Econ 54:11–23

Beckmann J, Czudaj R (2013) Oil prices and effective dollar exchange rates. Int Rev Econ Finance 27:621–636

Beckmann J, Belke A, Kühl M (2011) The Dollar-Euro exchange rate and macroeconomic fundamentals: a time-varying coefficients approach. Rev World Econ 147(1):11–40

Caporale GM, Menla Ali F, Spagnolo F, Spagnolo N (2017) International portfolio flows and exchange rate volatility in emerging Asian markets. J Int Money Finance 76:1–15

Casarin R, Sartore D, Tronzano M (2018) A Bayesian Markov-switching correlation model for contagion analysis on exchange rate markets. J Bus Econ Stat 36(1):101–114

Cavicchioli M (2014a) Analysis of the likelihood function for Markov-switching VAR(CH) models. J Time Ser Anal 35(6):624–639

Cavicchioli M (2014b) Determining the number of regimes in Markov-switching VAR and VMA models. J Time Ser Anal 35(2):173–186

Cheung Y-W, Chinn M (2001) Currency traders and exchange rate dynamics: a survey of the US market. J Int Money Finance 20:439–471

Cheung Y-W, Erlandsson UG (2005) Exchange rates and Markov switching dynamics. J Bus Econ Stat 23(2):314–320

Cheung Y-W, Chinn MD, Pascual AG (2005) Empirical exchange rate models of the nineties: are any fit to survive? J Money Finance 24:1150–1175

De Grauwe P, Grimaldi M (2006) Exchange rate puzzles: a tale of switching attractors. Eur Econ Rev 50(1):1–33

De Grauwe P, Vansteenkiste I (2007) Exchange rates and fundamentals: a non-linear relationship? Tech Rep 1:37–54

Dielbold FX, Mariano RS (1995) Comparing predictive accuracy. J Bus Econ Stat 13:253–263

Engel C (1994) Can the Markov switching model forecast exchange rates? J Int Econ 36:689–713

Engel C, Hamilton JD (1990) Long swings in the exchange rate: are they in the data and do markets know it? Am Econ Rev 80:689–713

Engel C, Mark NC, West KD (2008) Exchange rate models are not as bad as you think. In: NBER macroeconomics annual 2007, vol 36, no 1. University of Chicago Press, pp 151–165

Francq C, Zakoïa JM (2001) Stationarity of multivariate Markov-switching ARMA models. J Econ 102(2):339–364

Frankel JA (1979) On the mark: a theory of floating exchange rates based on real interest differentials. Am Econ Rev 69(4):610–622

Frankel JA, Froot KA (1990) Chartists, fundamentalists and trading in the foreign exchange market. Am Econ Rev 80(2):181–185

Frankel JA, Rose AK (1995) A panel project on purchasing power parity: mean reversion within and between countries. In: NBER working papers 5006. National Bureau of Economic Research

Frömmel M, MacDonald R, Menkhoff L (2005) Markov switching regimes in a monetary exchange rate model. Econ Model 22:485–502

Frydman R, Goldberg MD (2007) Imperfect knowledge economics: exchange rates and risk. Princeton University Press, Princeton

Frydman R, Goldberg MD (2011) Beyond mechanical markets. Princeton University Press, Princeton

Frydman R, Stillwagon JR (2018) Fundamental factors and extrapolation in stock-market expectations: The central role of structural change. J Econ Behav Organ 148(12):189–198

Goldberg MD, Frydman R (1996) Imperfect knowledge and behaviour in the foreign exchange market. Econ J 106(473):869–893

Goldberg MD, Frydman R (2001) Macroeconomic fundamentals and the DM/$ exchange rate: temporal instability and the monetary model. Int J Finance Econ 6(4):421–435

Greenwood R, Shleifer A (2014) Expectations of returns and expected returns. Rev Financ Stud 27(3):714–746

Hamilton JD (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57:357–384

Hamilton JD (2016) Macroeconomic regimes and regime shifts. In: Taylor J, Uhlig H (eds) Handbook of macroeconomics, vol 2. University of Chicago, Chicago

Johansen S, Juselius K, Frydman R, Goldberg MD (2010) Testing hypotheses in an I(2) model with piecewise linear trends An analysis of long persistent swings in the Dmk/\({\$}\) rate. J Econ 158(1):117–129

Juselius K, Stillwagon JR (2018) Are outcomes driving expectations or the other way around? An I(2) CVAR with interest rate expectations in the Dollar/Pound market. J Int Money Finance 83(60):93–105

Kilian L, Taylor MP (2003) Why is it so difficult to beat the random walk forecast of exchange rates? J Int Econ 60(1):85–107

Krolzig H-M, Hendry DF (2001) Computer automation of general-to-specific model selection procedures. J Econ Dyn Control 25(6):831–866

Marsh IW (2000) High-frequency Markov switching models in the foreign exchange market. J Forecast 19(2):123–134

Meese R, Rogoff KD (1983) Empirical exchange rate models of the seventies: do they fit out of sample. J Int Econ 14(2):3–24

Psaradakis Z, Spagnolo N (2006) Joint determination of the state dimension and autoregressive order for models with in Markov regime switching. J Time Ser Anal 27(5):753–766

Rossi B (2006) Are exchange rates really random walks? Some evidence robust to parameter instability. Macroecon Dyn 10(3):554–579

Sarno L, Valente G (2009) Exchange rates and fundamentals: footloose or evolving relationship. J Eur Econ Assoc 7(4):789–830

Schwarz G (1978) Estimating the dimension of a model. Ann Stat 6:461–464

Smith A, Naik PA, Tsai C-L (2006) Markov-switching model selection using Kullback-Leibler divergence. J Econ 134:553–557

Soros G (2008) The crash of 2008 and what it means: The new paradigm for financial markets. PublicAffairs

Stillwagon JR (2018) Are risk premia related to real exchange rate swings? Evidence from I(2) CVARs with survey expectations. Macroecon Dyn 22(2):255–278

Wolff CCP (1987) Time-varying parameters and the out-of-sample forecasting performance of structural exchange rate models. J Bus Econ Stat 5(1):87–97

Zhang J, Stine RA (2001) Autocovariance structure of Markov regime switching models and model selection. J Time Ser Anal 22(1):107–124

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

This research was funded by the Institute for New Economic Thinking (INET), Grant Number #INO16-00012.

Conflict of interest

The authors declare that they have no conflict of interest to report.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix: out-of-sample testing procedure

Appendix: out-of-sample testing procedure

This study evaluates the out-of-sample fit of the model following the tradition of Meese and Rogoff (1983). This method compares the predictive accuracy of the structural economic model to that of a simple random walk, using mean square error. In the tradition of Meese and Rogoff, this is a prediction exercise rather than forecasting because the actual values of the future X’s (regressors) are used to generate the out-of-sample predictions as opposed to requiring these to be forecasted as well.

Predictions are made by estimating the model up to time t, which generates initial coefficient estimates for the model. These estimates are combined with the actual values of the X’s at time \(t+k\), where k is the forecast horizon. Predictions are generated for the 1-month horizon. Then t is moved forward by one period and the model is re-estimated and new predictions are generated.

The random walk predictions are generated very simply. It assumes that the best prediction of the exchange rate for any point in the future is given by today’s exchange rate. In terms of this out-of-sample exercise, this implies that the random walk prediction made at time t for \(t+k\) is given by \(s_t\), for \(\hbox {k} = 1\).

From these predictions, forecast error statistics are calculated for both the economic model and the random walk model. In this paper, we evaluate the predicative ability of the model using mean square error statistic (MSE). Statistical significance of the difference between the MSE of the economic model and that of the random walk is estimated using the Diebold–Mariano 1995 test statistic.

Rights and permissions

About this article

Cite this article

Stillwagon, J., Sullivan, P. Markov switching in exchange rate models: will more regimes help?. Empir Econ 59, 413–436 (2020). https://doi.org/10.1007/s00181-019-01623-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01623-6