Abstract

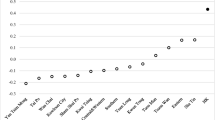

Frequently migration between Hong Kong (HK) and China can cause the real estate price standards of HK’s and China’s first-tier cities to resemble one another. This study adopts the real estate prices of HK and four major cities in China, namely Beijing, Shanghai, Shenzhen, and Guangzhou, from January 2001 to April 2019. The results reveal that for both long- and short-term returns, the HK real estate market is influenced by the Shanghai real estate market. The HK real estate market and the Shenzhen real estate market exhibit the most connectedness. This may be because of their geographic closeness; people are more likely to migrate between these two cities. The real estate market in Beijing exhibits the greatest informativeness. In the four cities, only the informativeness of Guangzhou City substantially lags behind that of HK. This study also discovers that in the relationship between those regional real estate markets, exchange rate and stock market returns are key factors. The connection between the housing markets of Beijing and Hong Kong is attributable to the foreign exchange market, whereas the connection between the housing markets of Hong Kong and other first-tier cities is attributable to the stock market. The change in exchange rate influences the volatility of Beijing’s real estate market. After this volatility is transmitted to HK, it influences the correlation between HK and Shanghai real estate markets as well as between HK and Shenzhen real estate markets.

Similar content being viewed by others

Notes

The duration of Cheng and Glascock’s (2005) research is from January 1993 to August 2004. Their samples come from the Morgan Stanley Capital International weekly stock market index given in US dollars. Innovation accounting analysis is adopted to observe variance of prediction error, and they discover that only a low percentage of Hong Kong index can be explained by the China index, at most 1.28%.

The study of Huo and Ahmed (2017) was from the period between July 2, 2014 and April 8, 2015. The samples come from the Shanghai Stock Exchange composite index and the Hong Kong Hang Seng Index every minute. The estimation results demonstrate that the stock index of the two places can be predicted by the lagging-period price of itself or the other. After the Shanghai–Hong Kong Stock Connect, Shanghai stock price exerts a significant spillover effect on Hong Kong stock price.

Zhang et al. (2016) point out that the economic structure in China was constantly improved and upgraded, and there have been some new developments in the country's real estate market.

Bodart and Reding (1999) found that that an increase in exchange rate volatility is accompanied by a decline in international correlations between bond and stock markets. Kim et al. (2006) found that real economic integration and the reduction in currency risk have generally had the desired effect of inter-financial market integration.

Figures 3 and 4 present dynamic spillover effects between variables estimated through rolling windows. The spillover index is estimated using variance decomposition based on a generalized VAR model, and thus the length of rolling-sample windows (i.e., the window size) must be determined in consideration of the number of variables and the degree of lag. Numerous variables or a high degree of lag indicates the necessity of a numerous periods (i.e., a large window size) in the estimation. Empirical studies choose their window size according to their sample requirements. For example, Diebold and Yilmaz (2013) determine the length of their rolling-sample windows to be 60 periods, whereas Tsai and Chiang (2019) use 40 periods as their window size. The present study, given the few variables included and to reveal variations in the correlations between different periods, uses a relatively concise model for estimation. This paper estimated total connectedness over 24-month rolling-sample windows.

References

Antonakakis N, Chatziantoniou I, Floros C, Gabauer D (2018) The dynamic connectedness of UK regional property returns. Urban Stud 55(14):3110–3134

Baklaci HF, Aydoğan B, Yelkenci Y (2020) Impact of stock market trading on currency market volatility spillovers. Res Int Bus Finance 52:101182

Bekiros S (2014) Nonlinear causality testing with stepwise multivariate filtering: evidence from stock and currency markets. N Am J Econ Finance 29:336–348

Bodart V, Reding P (1999) Exchange rate regime, volatility and international correlations on bond and stock markets. J Int Money Financ 18(1):133–151

Caporale GM, Hunter J, Ali FM (2014) On the linkages between stock prices and exchange rates: evidence from the banking crisis of 2007–2010. Int Rev Financ Anal 33:87–103

Cheng H, Glascock JL (2005) Dynamic linkages between the greater China economic area stock markets—Mainland China, Hong Kong, and Taiwan. Rev Quant Financ Acc 24(4):343–357

Deng Y, Girardin E, Joyeux R, Shi S (2017) Did bubbles migrate from the stock to the housing market in China between 2005 and 2010? Pac Econ Rev 22(3):276–292

Deng Y, Girardin E, Joyeux R (2018) Fundamentals and the volatility of real estate prices in China: a sequential modelling strategy. China Econ Rev 48:205–222

Diebold FX, Yilmaz K (2013) Measuring the dynamics of global business cycle connectedness. PIER Working Paper No. 13-070. https://ssrn.com/abstract=2369340

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66

Diebold FX, Yilmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Econom 182(1):119–134

Fan Q, Wang T (2017) The impact of Shanghai-Hong Kong Stock Connect policy on A-H share price premium. Financ Res Lett 21:222–227

Gerlach-Kristen P (2009) Business cycle and inflation synchronisation in Mainland China and Hong Kong. Int Rev Econ Financ 18(3):404–418

Gong Y, Hu J, Boelhouwer PJ (2016) Spatial interrelations of Chinese housing markets: spatial causality, convergence and diffusion. Reg Sci Urban Econ 59:103–117

Gupta R, Miller SM (2012) The time-series properties of house prices: a case study of the southern California market. J Real Estate Financ Econ 44(3):339–361

He Q, Qian Z, Fei Z, Chong TT-L (2019) Do speculative bubbles migrate in the Chinese stock market? Empir Econ 56:735–754

Ho K-Y, Shi Y, Zhang Z (2016) It takes two to tango: A regime-switching analysis of the correlation dynamics between the mainland Chinese and Hong Kong stock markets. Scott J Polit Econ 63(1):41–65

Huang J, Shen GQ (2017) Residential housing bubbles in Hong Kong: identification and explanation based on GSADF test and dynamic probit model. J Prop Res 34(2):108–128

Hui ECM, Ng I (2009) Price discovery of property markets in Shenzhen and Hong Kong. Constr Manag Econ 27(12):1175–1196

Hui ECM, Yu KH (2012) Assisted homeownership, investment and their roles in private property price dynamics in Hong Kong. Habitat Int 36:219–225

Hui ECM, Yue S (2006) Housing price bubbles in Hong Kong, Beijing and Shanghai: a comparative study. J Real Estate Financ Econ 33(4):299–327

Huo R, Ahmed AD (2017) Return and volatility spillovers effects: evaluating the impact of Shanghai-Hong Kong Stock Connect. Econ Model 61:260–272

Kim S-J, Moshirian F, Wu E (2006) Evolution of international stock and bond market integration: influence of the European Monetary Union. J Bank Finance 30(5):1507–1534

Koop G, Pesaran MH, Potter SM (1996) Impulse response analysis in nonlinear multivariate models. J Econom 74(1):119–147

Leung CKY, Tang ECH (2011) Comparing two financial crises the case of Hong Kong real estate markets. In: Bardhan A, Edelstein RH, Kroll CA (eds) Global housing markets: crises, policies, and institutions. Wiley, Hoboken, pp 377–398

Liow KH, Huang Y, Song J (2019) Relationship between the United States housing and stock markets: some evidence from wavelet analysis. N Am J Econ Finance 50:101033

Liu T-Y, Chang H-L, Su C-W, Jiang X-Z (2016) China’s housing bubble burst? Econ Transit 24(2):361–389

Miao H, Ramchander S, Simpson MW (2011) Return and volatility transmission in U.S. housing markets. Real Estate Econ 39(4):701–741

Monkkonen P, Wong K, Begley J (2012) Economic restructuring, urban growth, and short-term trading: the spatial dynamics of the Hong Kong housing market, 1992–2008. Reg Sci Urban Econ 42:396–406

Pan W (2019) Detecting bubbles in China’s regional housing markets. Empir Econ 56:1413–1432

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58(1):17–29

Phillips PCB, Yu J (2011) Dating the timeline of financial bubbles during the subprime crisis. Quant Econ 2(3):455–491

Shen Y-Y, Jiang Z-Q, Ma J-C, Wang G-J, Zhou W-X (2021) Sector connectedness in the Chinese stock markets. Empir Econ. https://doi.org/10.1007/s00181-021-02036-0

Tsai I-C, Chiang S-H (2019) Exuberance and spillovers in housing markets: evidence from first- and second-tier cities in China. Reg Sci Urban Econ 77:75–86

Xiao Q, Liu Y (2010) The residential market of Hong Kong: rational or irrational? Appl Econ 42(7):923–933

Yang X, Zhang Y, Li Q (2021) The role of price spillovers: what is different in China. Empir Econ 60:459–485

Yiu MS, Yu J, Jin L (2013) Detecting bubbles in Hong Kong residential property market. J Asian Econ 28:115–124

Zhang H, Li L, Chen T, Li V (2016) Where will China’s real estate market go under the economy’s new normal? Cities 55:42–48

Acknowledgements

I am immensely grateful to Professor Robert M. Kunst (Editor) and the anonymous referee for the constructive comments of this paper.

Funding

Funding from the Ministry of Science and Technology of Taiwan under Project No. MOST 110-2410-H-390-008-MY3 has enabled the continuation of this research and the dissemination of these results.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that she has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tsai, IC. The connectedness between Hong Kong and China real estate markets: spillover effect and information transmission. Empir Econ 63, 287–311 (2022). https://doi.org/10.1007/s00181-021-02143-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-021-02143-y

Keywords

- The HK real estate market

- The China real estate market

- Connectedness

- Spillover effect

- Information transmission