Abstract

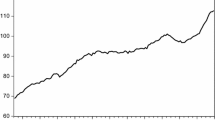

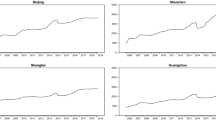

This study investigates whether there was a housing price bubble in Beijing and Shanghai in 2003. The existence of a bubble can be interpreted from (abnormal) interactions between housing prices and market fundamentals. This paper introduces an enhanced framework, with the combination of standard econometric methodologies: i.e., Granger causality tests and generalized impulse response analysis, and the reduced form of housing price determinants. A test case in Hong Kong, between 1990 and 2003, is included to test the reliability of our methods because Hong Kong has experienced the formation and bursting of a huge housing bubble around the year 1997. It is found that the pattern and magnitude of the estimated bubbles conform quite well to the discrepancies between the actual and predicted prices. Also, the findings suggest that there appeared a bubble in Shanghai in 2003, accounting for 22% of the housing price. By contrast, Beijing had no sign of a bubble in the same year. The bubble phenomenon, of course, should be taken with cautions. Nonetheless this study has laid the groundwork for further investigations in abnormal housing price phenomena in Mainland China.

Similar content being viewed by others

References

Busetti, F. R. (2000). Metaheuristic approach to realistic portfolio optimization. Master of Science dissertation, University of South Africa, Pretoria, South Africa.

Case, K. E., & Shiller, R. J. (1990). Forecasting prices and excess returns in the housing market. AREUEA Journal, 18(3), 253–273.

Engle, R. F., & Granger, C. W. J. (1987). Cointegration and error correction representation, estimation, and testing. Econometrica, 55, 251–276.

Granger, C. W. J. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica, 37, 424–438.

Finmatrica, Inc. (2001). Application of a modern statistical forecasting technique to the discipline of demand and supply planning. Atlanta: Finmatrica Inc.

Flood, R., & Hodrick, R. (1990). On testing for speculative bubbles. Journal of Economic Perspectives, 4(2), 85–101.

Henry, O. P. (1995). Data sources for measuring house price changes. Journal of Housing Research, 6(3), 377–387.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration: With application to the demand for money. Oxford Bulletin of Economics and Statistics, 52(2), 169–210.

Kim, K. H., & Lee, H. S. (2000). Real estate price bubble and price forecasts in Korea. Proceedings of 5th AsRES Conference in Beijing.

Kim, K. H., & Suh, S. H. (1993). Speculation and price bubbles in the Korean and Japanese real estate markets. Journal of Real Estate Finance and Economics, 6(1), 73–87.

Noguchi, Y. (1994). Land prices and house prices in Japan. In Y. Noguchi & J. Poterba (Eds.), Housing markets in the United States and Japan (pp. 11–28). Cambridge, MA: NBER.

Peng, R., & Hudson-Wilson, S. (2002). Testing real estate price bubbles: An application to Tokyo office market. Proceedings of 7th AsRES Conference in Seoul.

Pesaran, H. H., & Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Economics Letters, 58(1), 17–29.

Quigley, J. M. (1999). Real estate prices and economic cycles. International Real Estate Review, 2(1), 1–20.

Statistics South Africa (2004). Wholesale trade sales, July 2004. Statistical Release P6141.2. Pretoria: Statistics South Africa.

Stiglitz, J. E. (1990). Symposium on bubbles. Journal of Economic Perspectives, 4(2), 13–18.

Yang, C., & Lu, Y. J. (2003). Research on price bubbles in Beijing housing market. China Civil Engineering Journal, 36(9), 76–82.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hui, E.C.M., Yue, S. Housing Price Bubbles in Hong Kong, Beijing and Shanghai: A Comparative Study. J Real Estate Finan Econ 33, 299–327 (2006). https://doi.org/10.1007/s11146-006-0335-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-006-0335-2