Abstract

This paper revisits the question of interest rate pass-through from the federal funds rate to bank and open market rates from the years 1987 to 2015. We employ cointegration tests with improved testing power by using information in non-normal errors. Using this approach, we find evidence of cointegration between the federal funds rate and the prime rate, the federal funds rate and the 3-month financial commercial paper rate, but no evidence of cointegration between the federal funds rate and the 30-year conventional mortgage rate. Moreover, we estimate the degree of long-run pass-through for both the prime and commercial paper rates to be less than one. Our results confirm that there is not only significant co-movement between the federal funds rate and short-term borrowing rates, but also that interest rate pass-through, in the long run, is incomplete.

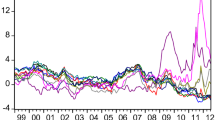

Note Figure plots the federal funds rate and other market rates from February 1987 to February 2015. The shaded lines are NBER recession dates

Similar content being viewed by others

Notes

The purpose of unconventional monetary policy was to reduce long-term private sector interest rates. (See Kuttner (2018)).

In general, one may consider VAR(p) representation; we suppress \(\Delta y_{t - 1}\), \(\Delta y_{t - 2}\),…, \(\Delta y_{t - p}\) for ease of exposition.

Also known as the cointegration regression (Engle and Granger 1987).

The simulation results of Lee et al. (2015) show that the RALS ECM test shows size distortions and the power of the RALS ADL and RALS EG2 tests tends to dominate that of the RALS EG test; therefore, we only consider the RALS ADL and RALS EG2 test in our experiment.

The exact critical values will be computed via interpolation using the nearest value of \(\rho^{2}\).

For the 3-month AA financial commercial paper rate, we use the series collected from January 1997 due to its availability.

Payne and Waters (2008) indicate that the transmission of monetary policy has changed since the early 1980s and throughout the 1990s as a result of the deregulation of the US banking system, the evolution of financial innovations and greater monetary policy transparency. To investigate the influence of these changes on the effectiveness of monetary policy, they set the starting period as 1987:02.

Data obtained from Rudebusch (2009).

On December 16, 2008, the Federal Open Market Committee established a target range for the federal funds rate of zero to a quarter percent.

See Pesavento (2004) for more details.

To describe the model, we use the prime rate (\(p_{t} )\) as a lending rate. The empirical tests have been implemented for all three lending rates.

Note that the testing regression of RALS EG2 can be obtained analogously. The only difference between the two tests is that the residual used to construct \(\hat{w}_{t}\) is computed from the residuals in (6).

The first-step regression of the RALS EG2 test is the same as that of the EG test. To save space, we do not report the same estimation results in Table 2.

For Eq. (11), the existence of cointegration between the two series confirms that the estimated \(\delta\) is not zero and there exists a nonzero value \(\lambda\) which implies the linear relationship of the two non-stationary variables is I(0). Accordingly, in cointegrated ADL testing regressions, the values of estimated coefficients are used to discuss economic issues, such as elasticity. For examples, see Fuinhas and Marques (2012) and Lee et al. (2018).

References

Aas K, Haff DH (2006) The generalized hyperbolic skew student’s t-distribution. J Financ Econom 4(2):275–309

Aristei D, Gallo M (2014) Interest rate pass-through in the Euro area during the financial crisis: a multivariate regime-switching approach. J Policy Model 36(2):273–295

Atesoglu HS (2003) Monetary transmission—federal funds rate and prime rate. J Post Keynes Econ 26(2):357–362

Banerjee A, Dolado J, Mestre R (1998) Error-correction mechanism tests for cointegration in a single-equation framework. J Time Ser Anal 19:297–308

Banerjee P, Arcabic V, Lee H (2017) Fourier ADL cointegration test to approximate smooth breaks with new evidence from crude oil market. Econ Model 67:114–124

Bauwens L, Laurent S (2005) A new class of multivariate skew densities with application to GARCH models. J Bus Econ Stat 23(3):346–354

Bohl MT, Siklos PL (2004) The bundesbank’s inflation policy and asymmetric behavior of the German term structure. Rev Int Econ 12:495–508

De Bondt G (2002) Retail bank interest pass-through: new evidence at the euro area level. European Central Bank Working Paper No. 136, Frankfurt, Germany

Enders W, Siklos PL (2001) Cointegration and threshold adjustment. J Bus Econ Stat 19(2):166–176

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55(2):251–276

Engle RF, Hendry DF, Richard J-F (1983) Exogeneity. Econometrica 51(2):277–304

Ericsson NR, MacKinnon JG (2002) Distributions of error correction tests for cointegration. Econom J 5(2):285–318

Freixas X, Rochet JC (1997) Microeconomics of banking. MIT Press, Cambridge

Fuinhas JA, Marques AC (2012) Energy consumption and economic growth nexus in Portugal, Italy, Greece, Spain and Turkey: an ARDL bounds test approach (1965–2009). Energy Econ 34(2):511–517

Gregory AW, Hansen BE (1996) Residual-based tests for cointegration in models with regime shifts. J Econom 70(1):99–126

Hansen B (1994) Autoregressive conditional density estimation. Int Econ Rev 35:705–730

Hansen B (1995) Rethinking the univariate approach to unit root testing: using covariates to increase power. Econom Theory 11:1148–1171

Holton S, d’Acri CR (2018) Interest rate pass-through since the euro area crisis. J Bank Financ 96:277–291

Horvath R, Kotlebova J, Sirnova M (2018) Interest rate pass-through in the euro area: financial fragmentation, balance sheet policies and negative rates. J Financ Stab 36:12–21

Hristov N, Hulsewig O, Wollmershauser T (2014) The interest rate pass-through in the Euro area during the global financial crisis. J Bank Financ 48:104–119

Im K, Schmidt P (2008) More efficient estimation under non-normality when higher moments do not depend on the regressors, using residual-augmented least squares. J Econom 144:219–233

Im K, Lee J, Tieslau MA (2014) More powerful unit root tests with non-normal errors. Festschrift in Honor of Peter Schmidt. Springer, New York, pp 315–342

Jones MC, Faddy MJ (2003) A skew extension of the t-distribution, with applications. J R Stat Soc Ser B 65(2):159–174

Kremers JJM, Ericsson NR, Dolado JJ (1992) The power of cointegration tests. Oxford Bull Econ Stat 54(3):325–348

Kuttner KN (2018) Outside the box: unconventional monetary policy in the great recession and beyond. J Econ Perspect 32(4):121–146

Kwapil C, Scharler J (2010) Interest rate pass-through, monetary policy rules and macroeconomic stability. J Int Money Financ 29(2):236–251

Lee H, Lee J (2015) More powerful Engle–Granger cointegration tests. J Stat Comput Simul 85(15):3154–3171

Lee H, Meng M, Lee J (2011) How do nonlinear unit root tests perform with non normal errors? Commun Stat Simul Comput 40(8):1182–1191

Lee H, Lee J, Im K (2015) More powerful cointegration tests with non-normal errors. Stud Nonlin Dyn Econom 19(4):397–413

Lee H, Oh D-Y, Meng M (2018) Stationarity and cointegration of health expenditure and GDP: in the presence of smooth structural shifts. Empir Econ. https://doi.org/10.1007/s00181-018-1561-1

Li J, Lee J (2010) ADL tests for threshold cointegration. J Time Ser Anal 31(4):241–254

Lothian JR, Taylor M (1996) Real exchange rate behavior: the recent float from the perspective of the past two centuries. J Polit Econ 104:488–510

Mark N (1990) Real exchange rates in the long-run: an empirical investigation. J Int Econ 28:115–136

Meng M, Payne JE, Lee J (2013) Convergence in per capita energy use among OECD countries. Energy Econ 36:536–545

Patton A (2004) On the out-of-sample importance of skewness and asymmetric dependence for asset allocation. J Financ Econom 2(1):130–168

Payne JE (2006) The response of the conventional mortgage rate to the federal funds rate: symmetric or asymmetric adjustment. Appl Financ Econ Lett 2:279–284

Payne JE (2007) Interest rate pass through and asymmetries in adjustable rate mortgages. Appl Financ Econ 17(17):1369–1376

Payne JE, Waters GA (2008) Interest rate pass through and asymmetric adjustment: evidence from the federal funds rate operating target period. Appl Econ 40(11):1355–1362

Pesavento E (2004) Analytical evolution of the power of the tests for the absence of cointegration. J Econom 122:349–384

Rudebusch GD (2009) The fed’s monetary policy response to the current crisis. FRBSF Economic Letter #2009-19

Venter JH, de Jongh PJ (2002) Risk estimation using the normal inverse gaussian distribution. J Risk 4(2):1–24

Williamson S (2015) The road to normal: new directions in monetary policy. Annual Report 2015, Federal Reserve Bank of St. Louis

Zivot E (2000) The power of single equation tests for cointegration when the cointegrating vector is prespecified. Econom Theory 16:407–439

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Oh, DY., Lee, H. & Boulware, K.D. A comment on interest rate pass-through: a non-normal approach. Empir Econ 59, 2017–2035 (2020). https://doi.org/10.1007/s00181-019-01696-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01696-3