Abstract

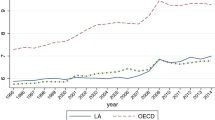

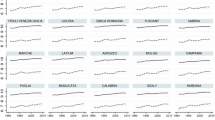

This paper studies stationarity and cointegration of healthcare expenditure (HE) and GDP for a sample of OECD countries. In particular, we employ newly developed unit root and cointegration tests which approximate an unknown number of smooth structural shifts in the low-frequency components of a Fourier expansion. The new unit root test indicates that HE and GDP are non-stationary. In the presence of a number of smooth shifts in the cointegration regression, our empirical results support the existence of stochastic comovement between HE and GDP in 14 out of 20 OECD countries. In addition, we examine the income elasticity of HE for the countries that we found cointegration relationship between HE and GDP. We found 13 out of 14 countries with income elasticity of HE higher than 1, which implies that health care is a luxury good.

Similar content being viewed by others

Notes

The long-run cointegration relationship between HE and GDP has been examined for states in the USA and groups of non-OECD countries in some recent research. See Wang and Rettenmaier (2007), Moscone and Tosetti (2010), and Baltagi et al. (2017). These recent studies investigate non-stationarity and cointegration based on panel-based tests while controlling for the cross-sectional dependence among panel units. These approaches provide rationales to understand the real-time situation that both HE and income among different states (or countries) could be affected by common shocks in economics.

See also the discussion in Jewell et al. (2003).

For example, the threshold cointegration test of Li and Lee (2010) extends the ADL test by including indicator functions reflecting a regime change.

Using the same data period allows us to avoid selecting an arbitrary time span and to compare previous findings to ours. Although an updated version of the Health Data File is available, it has not been considered in the literature due to lack of consistency in the long time series. For example, Carrion-i-Silvestre (2005) points out that the updated data set does not reflect reform in accounting systems for some countries and some years.

The exception is Japan; given that there is no information on its GDP until 1970, we used the period of 1971–1997.

Particularly, HE of Canada and USA and GDP of Germany and UK seem to be subject to several breaks.

We confirm that the differenced series are stationary.

We find the null hypothesis of unit root is significantly rejected in Germany (HE and GDP) and Iceland (GDP) at the 5% or higher level. Even though the test with cumulative frequencies tends to capture the remaining nonlinearities as well as the overall smooth shifts, as we observe Table 5 of Enders and Lee (2012a), it results in lower power as we select a higher value of q. By minimizing SSR, we find that the selected q of 5 for most of the series. In such case, we estimate 8 more parameters than we do in the test with a single frequency. We observe that the I(1) property of the same series, which we confirm based on the tests with a single frequency, is supported in other literature based on different methodology (Gertham and Lӧthgren 2000; Clemente et al. 2004; Carrion-i-Silvestre 2005).

The same number of maximum lags is recommended in Carrion-i-Silvestre (2005) based on the same data set.

That is, the long-run equilibrium relationship is specified by:

\( \ln {\text{HE}}_{t}^{i} = \mu_{1} + \mu_{2} t + \alpha \ln {\text{GDP}}_{t}^{i} + e_{t} .\)

See Pesavento (2004) for more details.

See also Fuinhas and Marques (2012).

The existence of cointegration between the two series confirms that the estimated \( \delta \) is not zero and there exists a nonzero value \( \lambda \) which results in the linear relationship of the two non-stationary variables to be I(0).

See also the discussion in Jewell et al. (2003).

References

Amsler C, Lee J (1995) An LM test for a unit root in the presence of a structural change. Econom Theor 11:359–368

Baltagi BH, Moscone F (2010) Health care expenditure and income in the OECD reconsidered: evidence from panel data. Econ Model 27:804–811

Baltagi BH, Lagravinese R, Moscone F, Tosetti E (2017) Health care expenditure and income: a global perspective. Health Econ 26:863–874

Banerjee A, Dolado J, Galbraith JW, Hendry DF (1993) Co-integration, error-correction, and the econometric analysis of non-stationary data. Oxford University Press, Oxford

Banerjee A, Dolado J, Mestre R (1998) Error-correction mechanism tests for cointegration in a single-equation framework. J Time Ser Anal 19:283–297

Banerjee P, Arčabić V, Lee H (2017) Fourier ADL cointegration test to approximate smooth breaks with new evidence from crude oil market. Econ Model 67:114–124

Becker R, Enders W, Hurn S (2004) A general test for time dependence in parameters. J Appl Econom 19:899–906

Blomqvist AG, Carter RAL (1997) Is health care really a luxury? J Health Econ 16:207–229

Campos J, Ericsson N, Hendry D (1996) Cointegration tests in the presence of structural breaks. J Econom 70(1):187–220

Carrion-i-Silvestre JL (2005) Health care expenditure and GDP: are they broken stationary? J Health Econ 24(5):839–854

Clemente J, Marcuello C, Montañés A, Pueyo F (2004) On the international stability of health care expenditure functions: are government and private functions similar? J Health Econ 23(3):589–613

Culyer AJ (1988) Health care expenditures in Canada: myth and reality; Past and future. Canadian Tax Foundation, Toronto

Cutler D (2002) Equality, efficiency, and market fundamentals: the dynamics of international medical care reform. J Econ Lit 40(3):881–906

Di Matteo L (2003) The income elasticity of health care spending: a comparison of parametric and nonparametric approaches. Eur J Health Econ 4:20–29

Di Matteo L, Di Matteo R (1998) Evidence on the determinants of canadian provincial government health expenditures: 1965–1991. J Health Econ 17:211–228

Enders W, Lee J (2012a) The flexible fourier form and Dickey–Fuller type unit root test. Econ Lett 117:196–199

Enders W, Lee J (2012b) A unit root test using a fourier series to approximate smooth breaks. Oxf B Econ Stat 74:574–599

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55(2):251–276

Fuchs V (1996) Economics, values, and health care reform. Am Econ Rev 86(1):1–24

Fuinhas JA, Marques AC (2012) Energy consumption and economic growth nexus in Portugal, Italy, Greece, Spain and Turkey: an ARDL bounds test approach (1965–2009). Energ Econ 34(2):511–517

Gallant AR (1981) On the bias in flexible functional forms and an essentially unbiased form: the flexible fourier form. J Econom 15:211–245

Gerdtham UG, Lӧthgren M (2000) On stationarity and cointegration of international health expenditure and GDP. J Health Econ 19:461–475

Getzen TE (2000) Health care is an individual necessity and a national luxury: applying multilevel decision models to the analysis of health care expenditures. J Health Econ 19:259–270

Gregory AW, Hansen BE (1996a) Residual-based tests for cointegration in models with regime shifts. J Econom 70(1):99–126

Gregory AW, Hansen BE (1996b) Tests for cointegration in models with regime and trend shifts. Oxf B Econ Stat 58:555–560

Grossman M (1972) On the concept of health capital and the demand for health. J Polit Econ 80:223–255

Hansen P, King A (1996) The determinants of health care expenditure: a cointegration approach. J Health Econ 15:127–137

Hitiris T, Posnett J (1992) The determinants and effects of health expenditure in developed countries. J Health Econ 11:173–181

Im KS, Lee J, Tieslau M (2005) Panel LM unit-root tests with level shifts. Oxf B Econ Stat 67:393–419

Jewell T, Lee J, Tieslau M, Strazicich MC (2003) Stationarity of heath expenditures and GDP: evidence from panel unit root tests with heterogeneous structural breaks. J Health Econ 22:313–323

Kapetanios G, Shin Y, Snell A (2003) Testing for a unit root in the nonlinear STAR framework. J Econometrics 112:359–379

Kleiman E (1974) The determinants of national outlay on health. The economics of health and medical care. International Economic Association Series. Palgrave Macmillan, London

Lee H, Lee J, Im KS (2015) More powerful cointegration tests with non-normal errors. Stud Nonlinear Dyn E 19(4):397–413

Leu RR (1986) The public-private mix and international health care cost. Public and private health services: Complementaries and conflicts. Basil Blackwell, Oxford

Leybourne S, Newbold P (2003) Spurious rejections by cointegration tests induced by structural breaks. Appl Econ 35:1117–1121

Leybourne S, Newbold P, Vougas D (1998) Unit roots and smooth transitions. J Time Ser Anal 19:83–97

Li J, Lee J (2010) ADL tests for threshold cointegration. J Time Ser Anal 31:241–254

McCoskey S, Kao C (1998) A residual-based test of the null of cointegration in panel data. Econom Rev 17:57–84

McCoskey S, Selden TM (1998) Health care expenditures and GDP: panel data unit root test results. J Health Econ 17:369–376

Moscone F, Tosetti E (2010) Health expenditure and income in the United States. Health Econ 19:1385–1403

Newhouse JP (1977) Medical care expenditure: a cross-national survey. J Hum Resour 12:115–125

Newhouse J (1992) Medical care costs: how much welfare loss? J Econ Perspect 6:3–21

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69:1519–1554

Perron P (1989) The great crash, the oil price shock and the unit root hypothesis. Econometrica 57:1361–1401

Perron P (2006) Dealing with structural breaks. Palgrave handbook of econometrics. Palgrave Macmillan, New York, pp 278–352

Pesavento E (2004) Analytical evolution of the power of the tests for the absence of cointegration. J Econometrics 122:348–349

Schmidt P, Phillips PCB (1992) LM tests for a unit root in the presence of deterministic trends. Oxford B Econ Stat 54:257–287

Shin Y (1994) A residual-based tests of the null of cointegration against the alternative of no cointegration. Econom Theor 10:91–115

Wang Z, Rettenmaier AJ (2007) A note on cointegration of health expenditures and income. Health Econ 16:559–578

Zivot E (2000) The power of single equation tests for cointegration when the cointegrating vector is prespecified. Econom Theory 16(3):407–439

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lee, H., Oh, DY. & Meng, M. Stationarity and cointegration of health care expenditure and GDP: evidence from tests with smooth structural shifts. Empir Econ 57, 631–652 (2019). https://doi.org/10.1007/s00181-018-1561-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1561-1