Abstract

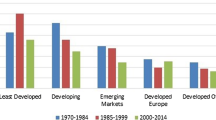

Studies show that the relationship between openness and output volatility is theoretically ambiguous, but most of these studies provide an empirical estimation for this relationship. This paper investigates the impact of trade openness on output volatility, and how this impact may be affected by the country’s level of development. We use a panel dataset for 33 countries for the years of 1980 through 2009. A standard deviation of quarterly real GDP over a 5-year span is used as the dependent variable. Controlling for the country and period-specific effects, the main results are as follows: trade openness increases the output volatility. And, the output volatility of countries with a higher level of development is less affected by trade openness.

Similar content being viewed by others

Notes

See UNDP 2014 Human Development Report.

\(\hbox {Log}(\hbox {RGDP}_{ it})=\hbox {Log}(\frac{\hbox {GDP}_{ it}}{\hbox {CPI}_{ it}})\), where \(\hbox {CPI}_{it}\) is the Consumer Price Index for country \(i\) in time \(t\).

Total PPP Converted GDP, G-K method, at current prices (in millions $).

Since \(t\) represents a period of 5 years and the openness is given by annual data, first, we take the logs of openness, and then, we calculate the average of logs over 5 years, that is, the average of the logs, not the log of the averages.

Note that the interaction term here is a continuous variable.

References

Bekaert G, Harvey C, Lundblad C (2006) Growth volatility and financial liberalization. J Int Money Finance 25(3):370–403

Calderón C, Schmidt-Hebbel K (2008) Openness and growth volatility. Working Paper No. 483, Central Bank of Chile

Giovanni J, Levchenko A (2009) Trade openness and volatility. Rev Econ Stat 91(3):558–585

Karras G (2006) Trade openness, economic size, and macroeconomic volatility: theory and empirical evidence. J Econ Integr 21(2):254–272

Smith LV, Galesi A (2011) GVAR Toolbox 1.1. http://www.cfap.jbs.cam.ac.uk/research/gvartoolbox

Yanikkaya H (2003) Trade openness and economic growth: a cross-country empirical investigation. J Dev Econ 72(1):57–89

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Abubaker, R. The asymmetric impact of trade openness on output volatility. Empir Econ 49, 881–887 (2015). https://doi.org/10.1007/s00181-014-0899-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-014-0899-2