Abstract

In recent years, China has introduced a series of trade and financial liberalization policies and taken a crucial step towards the internationalization of RMB. These new developments bring about one question: how has openness affected the RMB real exchange rate volatility? Our empirical results reveal that in the long term, both trade and financial openness reduce exchange rate volatility; in the short term, the effect of financial openness varies across the three financial sub-accounts. Financial development can magnify (mitigate) the impact of trade openness on volatility in the short (long) term, but its role in affecting the impact of financial openness depends on the financial sub-account involved. Economic policy uncertainty (EPU) weakens the impact of openness on exchange rate volatility. In addition, financial openness absorbs more external shocks than trade openness. Foreign exchange reserves, while offsetting financial crisis shocks, cannot adequately absorb current account balance shocks.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the late 1970s, China decided to set opening-up as its national policy. In the following decades, China achieved a few milestones in improving its trade openness: establishing free trade zones; entering the World Trade Organization (WTO); and strengthening regional economic cooperations, especially through the Belt and Road Initiative and the Regional Comprehensive Economic Partnership (RCEP).Footnote 1 Gradually, China has become one of the most important trading partners of major economies, including the US, Japan, and the European Union. At the same time, China attempted to improve its foreign direct investment (FDI) openness by adopting the “Bringing In and Going Out” strategy. In the early period of the opening-up reform (1978–1990), due to China’s lack of capital and technology, “Bringing In” was the emphasis. At that time, China was tasked with attracting FDI and adopting cutting-edge management techniques from developed economies. As China accumulated more capital and made notable technological progress, the “Going Out” strategy prevails. Accordingly, China’s Outward Direct Investment (ODI) has increased dramatically, and its size surpassed that of the FDI in 2015 for the first time (Zhu 2018).

Recently, China has enhanced its portfolio investment openness by launching the Shanghai/Shenzhen–Hong Kong Connect Programs for equity, bond, and financial derivatives. The three programs–launched in 2014/2016, 2017 and 2022, respectively–enable international capital to tap the opportunities in the Mainland capital market.Footnote 2 Besides, in September 2021, the Guangdong–Hong Kong–Macau Greater Bay Area launched the Cross-boundary Wealth Management Connect Scheme (Cross-boundary WMC), allowing residents in the Greater Bay Area to purchase wealth management products issued by banks within the same area.

In 2021, the Chinese government reiterated in the Outline of the 14th Five-Year Plan that the country will “enforce a high level of opening-up”.Footnote 3 This policy goal was re-emphasized in the report of the 20th Communist Party Congress held in October 2022. Such a proclamation implies that China will keep its door open to the outside world.

As the opening-up process advances, China’s sovereign currency–renminbi or RMB–will play a pivotal role in international trade, investment, and financing activities. RMB exchange rates, backed up by a country with a population of 1.4 billion and robust GDP growth, will continue to exert a significant impact on the monetary stability of the Asia-Pacific region (Chow 2021).

However, the opening-up policy is a double-edged sword for the RMB exchange rate. On the one hand, a higher degree of openness would increase market efficiency, thereby rendering the RMB exchange rate more responsive to new information from foreign markets. Whenever there is a currency mispricing, trade and investment activities in the open market will correct that, thus stabilizing the exchange rate in the long term. On the other hand, openness may expose China’s currency market to sentiments and speculations, therefore causing larger fluctuations in the exchange rate.

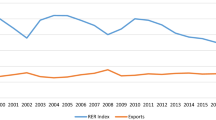

Figure 1 shows that (i) the RMB exchange rate underwent a transformation from a conventional regime–a fixed peg to the US dollar–to a managed floating regime in July 2005. Since 2006, the RMB exchange volatility has risen sharply. This pattern is consistent with Bleaney and Francisco (2010), who assert that a more flexible exchange rate regime would widen the band of real exchange rate fluctuations. (ii) Trade openness and financial openness follow similar trends, beginning with a sharp increase from 2002 to 2003, followed by a dip in 2008 due to the global financial crisis. Since then, the openness has picked up, but the overall trend is down. (iii) It is evident that there is an inverse relationship between volatility and openness during the period of 2004–2012. After 2012, volatility and openness show a concurrent declining trend and the relationship between the two becomes less unambiguous.

Time-series plot of exchange rate volatility and openness. Volatility = fixed window standard deviation of differenced log real effective exchange rate, Trade Openness = ratio of imports and exports to GDP, Financial Openness = ratio of stock of total liabilities to GDP. Sources: Bank for International Settlements (BIS), China Stock Market & Accounting Research (CSMAR) and the State Administration of Foreign Exchange (SAFE) of China

Although many studies have examined the impact of external openness on exchange rate volatility, few have focused on the Chinese context. Moreover, research remains sparse in revealing which factors drive the relationship between openness and exchange rate volatility. Against this backdrop, this paper first analyzes the impact of market openness on RMB exchange rate volatility. Here, we discuss three components of financial openness: FDI openness, portfolio investment openness, and other financial openness. Next, we investigate the roles that financial development (measured by financial penetration and market efficiency), economic policy uncertainty (EPU), and foreign exchange reserves have played in the relationship between openness and exchange rate volatility.

In terms of econometric methodology, previous studies use cross-section or panel regression to obtain an overall estimate over a multi-country sample. The regression approach, unable to adequately capture the diverse institutional and historical characteristics of different countries, may lead to inconsistent estimates and problematic economic policy implications. At least for China, we cannot ignore the impact of policies on currency pricing. Since the country’s capital market is not yet fully opened, China’s monetary authorities retain their influence on RMB pricing, as evinced by nontrivial increases in exchange rate movement around the RMB reforms in the past decade. At the same time, China has ranked among countries with the largest foreign exchange reserves and trade surpluses, and any external shocks to this unique, outward-looking economic structure may be exceptional.

Given China’s evolving openness and the ever-changing external economic environment, we expect time-varying interactions between openness, financial development, EPU, and foreign exchange reserves. To model the dynamics between these variables, we use the Autoregressive Distributed Lag (ARDL) model first proposed by Pesaran et al. (2001). This model enables us to examine both the short- and long-term relationships between variables of interest and their speed of adjustment to the long-term equilibrium, thereby helping us better observe the changing impact of economic variables on real exchange rate volatility. In addition, the ARDL model is well suited for a small sample and has been widely used in macroeconomic time series analysis.

Using ARDL models, we obtain the following results. After controlling for foreign exchange reserves, trade openness exhibits a direct, negative impact on exchange rate volatility in both the long and short term. On the contrary, a higher degree of financial openness tends to reduce volatility in the long term, and the short-term impact varies across sub-accounts. EPU and foreign exchange reserves are positively associated with exchange rate fluctuations in both the short and long term. Financial penetration increases volatility in the long term but has ambiguous effects in the short term. Besides, changes in market efficiency do not cause statistically significant responses in volatility. In terms of indirect effects, financial penetration, market efficiency, and EPU play different roles in the impact of sub-account openness on exchange rate volatility.

Overall, the contributions of our study are as follows. First, we measure the degree of financial development from two dimensions, i.e., financial penetration and market efficiency, and find that the two have different effects on RMB exchange rate volatility. Second, we investigate both direct and indirect effects of financial development, EPU, and foreign exchange reserves on exchange rate volatility under open conditions, thus providing a more realistic description of the interaction of various policies and shocks as a country’s economy grows. We discuss whether these factors can absorb the impact of external shocks on exchange rate volatility. Third, our empirical results on market opening-up and exchange rate regime reform provide policy recommendations for the monetary authorities in China. While our study focuses only on China, the empirical findings may offer insights into exchange rate policies for other emerging economies whose capital markets are partially open.

The rest of the paper proceeds as follows. Section 2 discusses the theoretical underpinnings based on the literature. Our data and empirical strategy are described in Section 3. Section 4 reports the preliminary test results and the estimates based on the ARDL model, while Section 5 documents our further analysis. Lastly, some concluding remarks are presented in Section 6.

2 Theoretical Underpinnings

This section reviews the literature on the effects of openness, financial development, economic policy uncertainty (EPU), foreign exchange reserves and other factors on exchange rate volatility and their transmission mechanisms.

2.1 Openness and Exchange Rate Volatility

Most studies find that a higher degree of trade openness is associated with lower exchange rate volatility (Bleaney and Francisco 2010; Curran and Velic 2019). There are three explanations for this negative relationship. First, following a macroeconomic shock (e.g., a halt in capital flows), an economy with a higher degree of trade openness can absorb the shock via adjustments of the current account balance, which helps the economy revert to the equilibrium more quickly (Romelli et al. 2018). In fact, Bleaney (2008) equates the sustainability of the current account balance to the stability of the real exchange rate. Under extreme market conditions, economies with a higher degree of trade openness are less prone to a currency crisis, thus are less likely to experience excessive exchange rate volatility (Cavallo and Frankel 2008). Second, a higher degree of trade openness–captured by a large quantity of tradables–accelerates exchange rate pass-through (i.e., price responsiveness to exchange rate changes). When unanticipated monetary and real shocks hit the economy, the relative price of domestic goods will adjust to offset the impact of the shocks. Even if the pass-through is incomplete in the short term, such adjustments will help ease the aggregate price rigidity in the domestic market, thereby reducing the exchange rate volatility (Hau 2002). Lastly, trade openness can stimulate economic growth (Sakyi et al. 2015). When the economy performs well, monetary authorities tend to reduce foreign exchange interventions, which also results in smaller exchange rate volatility (Krol 2014).

A few studies, however, conclude that a higher degree of trade openness does not necessarily correspond to lower exchange rate fluctuations. For example, Calderón and Kubota (2018) find that while manufacturing trade helps reduce real effective exchange rate (REER) fluctuations, non-manufacturing trade may lead to higher REER fluctuations. Interestingly, the mitigating effect of trade openness may not exist in some countries. For example, using data from South Africa, Mpofu (2021) reveals that trade openness, although cannot affect REER volatility in the long run, reduces volatility if it interacts with a flexible exchange rate regime. In the short run, trade openness exacerbates volatility as it brings about gold price volatility, which is transmitted to the exchange rate.

Likewise, whether financial openness exacerbates or mitigates exchange rate fluctuations remain uncertain. Using time-series and panel data for eight emerging Asian countries from 1980 to 2011, Al-Abri and Baghestani (2015) show that greater foreign liabilities do reduce REER volatility for most countries, including China. Several studies suggest that credit constraints are responsible for the negative relationship between the two. The more bilateral external debt a country maintains, the more credit constrained it is. In turn, credit constraints mitigate bilateral exchange rate volatility by reducing the impact of external shocks on the debtor country (Devereux and Lane 2003). Employing the PVAR model on a dataset of 40 selected developed and developing countries over the period of 1998–2016, Keefe (2021) finds that a liberalized capital account can absorb the impact of shocks from the international money market and mitigates the pressure from global credit conditions on foreign exchange rates. In other words, the more liberalized a country’s capital account is, the less the pressure global shocks would impose on the foreign exchange rates. Besides, Keefe and Saha (2022) show financial openness–proxied by the KOF globalization index–can partially absorb the impact of domestic shocks, such as shocks to inflation, interest rate differentials, and government debt. Their threshold model regressions reveal that in less open economies, macro variables elicit larger responses in the real exchange rates; in highly open economies, such responses are negligible, if not nonexistent.

On the contrary, Caporale et al. (2014, 2017) show that financial openness has a significant positive effect on real exchange rate volatility, even in Asian countries with fixed exchange rate regimes. Moreover, using data on short-term external debt from Korean companies and stock trading by international investors, Sung et al. (2014) also find a positive effect of financial market opening on exchange rate volatility. The positive effect is transmitted through four possible channels: credit instability, sectoral shock, risk and uncertainty spillover, and market liquidity. First, financial openness leads to unstable credit supply (Eslamloueyan and Fatemifar 2021),Footnote 4 which causes volatile corporate output, thereby spreading instability across the economy (Giovanni and Levchenko 2009; Meller 2013), which eventually results in an increase in exchange rate volatility. Second, financial openness drives firms towards specialization in pursuit of efficiency thus exposing them to sectoral shocks. Since specialized firms cannot mitigate industry-specific shocks through diversification, the exchange rate volatility would be higher in an economy that has higher financial openness (Al-Abri and Baghestani 2015). Third, financial openness tends to invite international risks and uncertainty, thereby exacerbating exchange rate volatility (Donadelli and Paradiso 2014). Last, financial openness increases liquidity in financial markets (Lee and Chou 2018), and a higher degree of liquidity appears to associate with higher exchange rate volatility (Sensoy and Serdengeçti 2019).

2.2 Financial Development and Exchange Rate Volatility

Some evidence shows that financial development has significant impact on exchange rate volatility. Nevertheless, it remains indeterminate whether this factor increases or decrease exchange rate volatility. The indeterminacy lies in that financial development exerts two different effects, direct and indirect, which merit more explanation.

In terms of direct effects, there is often a positive relationship between financial development and exchange rate volatility. A more developed financial market means the effectiveness of capital controls will be compromised (Berdiev et al. 2012). According to the monetary trilemma, if a country allows for free capital flows but is reluctant to forego its monetary policy independence, the country can only choose a floating exchange rate system. This is true for many advanced financial markets. Using annual data of 102 economies from 1974 to 2005, Lin and Ye (2011) demonstrate that countries with a high degree of financial development prefer a floating exchange rate regime. In these countries, there is a positive relationship between financial development and exchange rate volatility. In contrast, countries with less developed financial markets prefer fixed exchange rate regimes and will reap the benefits of low volatility by maintaining its exchange rate within a narrow band (Aghion et al. 2009).

As for indirect impact, the effect of financial development on exchange rate volatility seems to be negative. For instance, Li et al. (2016) and Zhu (2019) emphasize that financial development significantly reduces the impact of external liabilities on bilateral exchange rate risk. Al-Abri and Baghestani (2015) suggest that financial development encourages more FDI activities, which in turn, back up the domestic currency and help mitigate exchange rate volatility. Aizenman and Riera-Crichton (2008) argue that in developing countries, financial development and international reserves complement each other to offset the impact of terms-of-trade shocks on exchange rate volatility.

2.3 Economic Policy Uncertainty (EPU) and Exchange Rate Volatility

Krol (2014), using a dataset of 9 countries in the Euro area, provides evidence that EPU widens exchange rate volatility more than general economic uncertainty (proxied by VIX).Footnote 5 Since then, a growing body of studies have explored the impact of EPU on exchange rate volatility. For example, Zhou et al. (2020) and Yang et al. (2023) employ GARCH-MIDAS models and reveal that the China–US relative EPU tends to increase the long-term volatility of the onshore and offshore RMB exchange rates. Balcilar et al. (2016) argue that if domestic uncertainty exceeds foreign uncertainty, domestic agents will then invest in assets denominated in foreign currencies, thus causing the domestic currency to depreciate. This process will adversely affect the returns and enlarge the volatility of the domestic currency.

2.4 Foreign Exchange Reserves and Exchange Rate Volatility

A country’s foreign exchange reserves influence the choice of monetary policies, such as the scope and extent of foreign exchange interventions, which in turn, have a feedback effect on exchange rate movements (Akdogan 2020). Despite nontrivial holding costs, emerging market countries prefer to maintain a high level of reserves. Aizenman and Sun (2012) suggest that the fear of a decline in reserves is greater than the “fear of floating” in emerging market countries.

There are two motives behind accumulating foreign exchange reserves: the precautionary motive–preventing shocks and reducing volatility, and the mercantilist motive–eliminating price increases and stimulating economic growth. Both motives imply that reserves may cause changes in exchange rate volatility. However, most extant studies focus on the relationship between reserves and exchange rate movements (i.e., appreciation or depreciation) rather than the relationship between reserves and exchange rate volatility.Footnote 6

Studies have confirmed that reserves have a mitigating effect on exchange rate volatility, but the statistical significance depends on the exchange rate regime. Kohli (2015) analyzes the relationship between reserves and rupee volatility in India from 2004 to 2014 and finds that after 2010, reserves have the effect of reducing exchange rate volatility, but the effect was negligible or significantly positive before 2010. In this regard, he explains that prior to 2010, India adopted a managed floating exchange rate regime and reserves were a by-product of capital account surplus rather than a means for the authorities to stabilize the exchange rate. Using data from 28 emerging market economies from 1996 to 2002, Hviding et al. (2004) reach a similar conclusion: a higher level of reserves will eventually reduce real exchange rate volatility, but this effect does not exist at the beginning. Moreover, they argue that reserves affect volatility, not through actual foreign exchange intervention, but through signaling.

2.5 Other Factors that Drive RMB Exchange Rate Volatility

This study also considers how RMB exchange rate regime reforms affect the exchange rate volatility. Since 2000, the RMB exchange rate regime has undergone several rounds of reforms, two of which are particularly important.Footnote 7 (i) In July 2005, China’s central bank–People’s Bank of China (PBoC)–announced that the RMB exchange rate would no longer be fully pegged to the US dollar but would instead be determined by a basket of currencies. (ii) In August 2015, PBoC announced a new Central Parity Rate (CPR) pricing mechanism for RMB exchange rate against the US dollar. By establishing a more flexible exchange rate regime, this reform brought RMB closer to liberalization but at the same time, caused sharp short-term fluctuations in the exchange rate.

In addition to the exchange rate reforms, the 2008–09 global financial crisis and the COVID-19 epidemic also affect the RMB exchange rate volatility. Our exploration of the two events allows us to understand not only the impact of exogenous shocks, but also to observe whether openness, financial development, and foreign reserves can absorb the impact of these exogenous shocks on exchange rate volatility.

3 Data and Empirical Strategy

3.1 Dependent Variable: Real Exchange Rate Volatility

Given data availability, our sample spans the period from 2000Q1 to 2021Q4; see Table 8 in the Appendix for details. In the rest of this section, we will explain the selection and construction of the key variables.

Following Calderón and Kubota (2018), we define the real exchange rate volatility as:

where qt is the log real effective exchange rate (REER) in month t,Footnote 8 and n is the number of periods. When τ = 3, Eq. (1) generates the quarterly REER volatility, calculated from the 3-month differenced REER. For the sake of robustness, we use both a fixed window and a rolling window to compute quarterly real exchange rate volatility.

3.2 Explanatory Variables of Interest

3.2.1 Trade and Financial Openness

Trade openness is defined as the ratio of total trade (i.e., imports plus exports) to GDP, denoted as TRAOP. For financial openness, we follow Lane and Milesi-Ferretti (2018) and use the ratio of foreign liabilities (i.e., the stock of external debt) to GDP. We use foreign liabilities instead of external assets and liabilities as the numerator because the former can better reflect capital inflows driven by domestic economic factors, thus enabling foreign liabilities to GDP better capture the actual level of financial openness of a country (Al-Abri and Baghestani 2015).

Next, we aim to locate which aspect of financial openness drives the relationship between financial openness and real exchange rate volatility. To do so, we examine the standard classification of the Balance of Payments Statistics Manual 6 and break total financial openness (FINOP) into three categories: FDI openness (FDIOP), defined as the stock of FDI liabilities divided by GDP; portfolio openness (PORTOP), calculated as the stock of portfolio investment liabilities; and other financial openness (OTHOP),Footnote 9 calculated as other investment liabilities divided by GDP.Footnote 10

As discussed earlier, the impact of openness on real exchange rate volatility is ambiguous. So, it is difficult to decide ex ante the direction of the impact of each category of financial openness on real exchange rate volatility.

3.2.2 Financial Development

We measure financial development from two aspects: financial penetration and market efficiency. The former is measured by private sector credit as a share of GDP.Footnote 11 While financial penetration is widely used in the literature, it only provides a partial picture of the financial market. In China, bank-led financial intermediaries contribute about 70% of capital flows, leaving the rest 30% unexplained by measures of financial penetration. Market efficiency, which captures the matureness of the financial markets, can supplement financial penetration in explaining capital flows. Following Tran and Leirvik (2019), we calculate a proxy for market efficiency called the Adjusted Market Inefficiency Magnitude (AMIM) index. The larger the AMIM is, the less efficient the capital market, and vice versa. Therefore, we use the reverse of AMIM to denote market efficiency. Like the case with openness, the effect of market efficiency on exchange rate volatility is not clear ex ante.

3.2.3 Economic Policy Uncertainty (EPU)

We examine the impact of EPU on RMB exchange rate volatility using the ratio of China EPU to US EPU. For China, we use the EPU index developed by Huang and Luk (2020) as the proxy for its economic policy uncertainty. Compared with the EPU index built by Baker et al. (2016) and Davis et al. (2019), the Chinese EPU constructed by Huang and Luk (2020) is calculated from a wider selection of new sources, thus incorporating a wider coverage of information on uncertainty.Footnote 12 For the US, we choose the EPU index constructed by Baker et al. (2016). We expect that greater uncertainty leads to higher real exchange rate volatility.

3.2.4 Foreign Exchange Reserves

Finally, we take into account the impact of foreign exchange reserves on the RMB exchange rate volatility. In terms of the direct impact, intuitively, high reserves can smooth out exchange rate fluctuations through signaling (Hviding et al. 2004). However, the negative relationship between the reserves and exchange rate volatility is not absolute: it may depend on the motivations to accumulate reserves. In terms of the indirect impact, higher reserves tend to cushion the impact of external shocks to real exchange rates (Aizenman et al. 2012), which means that reserves have an indirect, mitigating effect on exchange rate volatility.

3.3 Control Variables

Based on the literature, for example, Calderón and Kubota (2018), and Mpofu (2021), we control for two categories of factors that may affect real exchange rate volatility: volatility shocks and exogenous shocks.

3.3.1 Volatility Shocks

The first category of controls is comprised of two types of volatility shocks: (i) domestic shocks, captured by real output volatility; and (ii) external shocks, measured by current account balance volatility and terms-of-trade volatility. Since output and current account balance are quarterly data, we measure the corresponding volatility shocks using two-quarter moving standard deviation. Meanwhile, the terms-of-trade balance–based on net barter–is available at monthly frequency, which allows us to measure the terms-of-trade volatility by 3-month moving standard deviation.

Theoretically, volatility shocks should be positively correlated with real exchange rate volatility. In addition, evidence shows that financial openness can offset the impact of nominal shocks on exchange rate volatility (Boubakri et al. 2019). Therefore, we conjecture that the impact of terms-of-trade shocks on exchange rate volatility become smaller after financial openness is accounted for.

3.3.2 Exogenous Shocks

The second category of controls is exogenous shocks, proxied by categorical and dummy variables that mark institutional changes or unexpected events. One such variable captures shifts in the exchange rate regime. To capture the time-varying intensity of this institutional factor, we use a categorical variable, ERR, which takes 0 before 2005Q2, 1 from 2005Q3 to 2015Q2, and 2 from 2015Q3 to 2021Q4. The second exogenous shock is the global financial crisis (GFC). Based on changes in China’s real output, we set GFC to 1 during 2007Q3–2009Q2 and 0 for other periods. The third shock is the COVID-19 pandemic (COV), which takes 1 during 2020Q1, 2020Q3, and 2021Q1, and 0 otherwise. The value of COV is derived from the Sino-US growth rate difference: when the difference is less than 0, COV is set to 1; when the difference is larger than 0, COV is set to 0.

3.4 Model Specification: The ARDL Approach

3.4.1 The ARDL Model

To identify the effects of openness, financial development, EPU, and reserves on real exchange rate volatility, we choose the Auto-Regressive Distributed Lag (ARDL) model. The ARDL model, first proposed by Pesaran et al. (2001), incorporates both long- and short-term information, where the former is captured by an error correction term, the same as in the error correction model (ECM). Despite this similarity, ARDL differs from traditional error correction models in two ways: first, ARDL allows the regressors to be purely I(0), purely I(1), or fractionally integrated; second, it allows the independent variables to have different lag orders, which mitigates problems related to serial correlations and endogeneity (Pesaran and Shin 1999). In other words, even if the sample size is small and/or the explained variables are endogenous, we can still obtain reliable estimates and inferences with the ARDL approach.

Denote p as the lag order for the dependent variable, and qj as the lag order for the j-th independent variable, the general form of ARDL(p, q1, …, qk) is:

where \({\alpha }_{0}\) is the constant, \({\alpha }_{1}\) represents the coefficient of the linear trend, and \({\mu }_{t}\) is the residual term, often assumed to be a white noise process.

What we care about is the long- and short-term relationship between the variables. Accordingly, Eq. (2) can be rewritten in a conditional error correction form:

where \({\psi }_{yi}\) measures the short-term responses of \({y}_{t}\), the dependent variable, to its lagged value,\({y}_{t-i}\);\({{\varvec{\psi}}}_{xj}\) and \({\varvec{\omega}}\) measure the short-term responses of the lagged and contemporaneous independent variables; \(\pi\) captures the speed-of-adjustment towards the long-term equilibrium; and \({\varvec{\theta}}\) is the long-term coefficients. Equation (3) corresponds to Case 1 in Pesaran et al. (2001), i.e., the “no intercept and no trend” specification.

3.4.2 The ARDL Bounds Test

The ARDL bounds test helps us determine whether there exists a cointegration relationship between the dependent variable and the independent variables. According to Pesaran et al. (2001) and Kripfganz and Schneider (2020), the bounds test is carried out in two steps. First, we test the null hypothesis \({H}_{0}:\pi =0\) and \({\sum }_{j=1}^{q}{{\varvec{\beta}}}_{j}=0\) versus the alternative hypothesis \({H}_{1}:\pi \ne 0\) or \({\sum }_{j=1}^{q}{{\varvec{\beta}}}_{j}\ne 0\). This multivariate test is based on an F-statistic. Second, if H0 is rejected, we test the hypothesis \({H}_{0}:\pi = 0\) versus \({H}_{1}\): \(\pi \ne 0\). This test is based on a \(t\)-statistic. However, if \({H}_{0}\) is rejected, we employ a \(z\)-test (or Wald test) to test whether the elements of \({\varvec{\theta}}\) are individually (or jointly) statistically significantly different from zero. If we reject the null hypothesis of \(\pi =0\) or the null that \({\varvec{\theta}}\) is zero in the second step, we can conclude that there exists a long-term relationship.

3.5 Empirical Strategy

Our empirical analysis is divided into three parts. First, before estimating the ARDL models, we calculate the descriptive statistics and conduct a few tests for stationarity and cointegration. Second, we build a baseline model that contains two types of variables: a proxy for openness and a set of control variables that include three volatility shocks and three exogenous shocks. Third, on top of the baseline model, we construct an extended model to examine the direct and indirect effects of openness. The indirect effects are captured by the interaction terms of openness and financial development, EPU, and reserves. To ensure that the coefficients of the interaction term is interpretable, we standardize the interaction term before doing the estimation. If the coefficient of the interaction term is greater than zero, we conclude that a higher degree of financial development, EPU, or reserves would amplify the impact of openness on real exchange rate volatility and vice versa.

4 Empirical Analysis

4.1 Preliminary Analysis Footnote 13

4.1.1 Summary Statistics

Compared with the fixed window volatility (volf), the mean and standard deviation of the rolling window volatility (volr) are smaller, which is consistent with the fact that the rolling window measure smooths out the fluctuations to a larger extent by introducing weak serial correlations. The degree of trade openness (TRAOP) is higher than the degree of total financial openness (FINOP). In terms of financial accounts, FDI account (FDIOP) has the highest value, other investment openness (OTHOP) comes second, and the portfolio investment openness (PORTOP) has the lowest value. For the shocks, the size of external shocks–captured by current account balance volatility (CAV) and terms-of-trade volatility (TOTV)–is significantly lower than that of the domestic shocks (RGV). The standard derivation of real growth volatility (RGV) is the highest among all variables. The median, the 25th percentile (P25), and 75th percentile (P75) of RGV show that real growth shocks follow a left-skewed distribution, and the extreme values in RGV can be largely attributed to the COVID-19 pandemic.

4.1.2 Stationarity and Bounds Tests

The F-statistic in the cointegration test turns invalid if a variable appears to be I(2). To ensure the validity our cointegration test, we use the Augmented Dickey-Fuller (ADF) test and the Phillips-Perron (PP) test to detect the existence of unit roots. The testing results indicate that four variables–TRAOP, FINPEN, RES, and RGV–have a unit root but become stationary after first difference. The rest of the variables do not have unit roots.

Since the variables of our interest have mixed orders of integration, we use the ARDL bounds test to check whether there is a long-term relationship among them. The bounds test for cointegration suggests that all models reject the null hypothesis of “no cointegration” at the 1% significance level.

4.2 Impact of External and Domestic Shocks on Real Exchange Rate Volatility

4.2.1 Model Specification

The baseline model selects a small set of control variables to explain the real exchange rate volatility in the long and short term. In order to explore the impact of positive and negative growth rate shocks on volatility, we split real growth volatility (RGV) into two parts: great growth rate shock, the part that is greater than the average growth rate, denoted by RGVg; and small growth rate shock, the part of growth rate shock that is less than the average, denoted by RGVs. We insert RGVg and RGVs into the model one at a time. Moreover, to check the robustness of our results, we estimate the model twice, first based on the fixed-window volatility (volf) and then based on the rolling-window volatility (volr).

Panel C of Table 1 presents the results of various diagnostic tests, including the Durbin-Watson test and the Breusch-Godfrey LM test for autocorrelation; Breusch-Pagan test, Harrison-McCabe test, and Goldfeld-Quandt test for heteroscedasticity; the Shapiro–Wilk test for normality; Ramsey regression specification error test (RESET) for omitted variables; and the cumulative sum (CUSUM) tests for parameter stability. These tests unanimously fail to reject the null hypotheses of no serial correlation, constant variance, normal distribution, no omitted variables, and no structural break at 10% significance level.

Recall that π is the coefficient of the error correction term, which captures the speed of adjustment to the long-term equilibrium. In all models, π’s are less than one and significantly negative at 1% level, meaning that there exists a long-term relationship between the control variables and real exchange rate volatility. Compared with columns (4) to (6), π’s in columns (1) to (3) exhibit a faster speed of adjustment. Meanwhile, models in columns (2) and (5), which contain large growth rate shock (RGVg), show faster rates of adjustment to the long-term equilibrium than models in columns (1), (3), (4) and (6), which contain the total growth rate shock (RGV) or the small growth rate shock (RGVs). This means that the larger the real growth shock is, the speedier exchange rate fluctuations would move towards equilibrium.

4.2.2 Long-term Effects

Panel A of Table 1 presents the long-term effect of shocks on real exchange rate volatility, i.e., the coefficient of \({\varvec{\theta}}\) in Eq. (3). As we could see, current account balance shocks (\(CAV\)) and terms-of-trade shocks (\(TOTV\)) increase the exchange rate volatility (\(vo{l}_{f}\) and \(vo{l}_{r}\)), whereas real growth shocks (\(RGV\)) reduce the volatility. Here, two points are worth noting. First, the negative relationship between real growth shocks and real exchange rate volatility seems counterintuitive. To explore this issue, we estimate the effects of great real growth shocks (\(RG{V}_{g}\)) and small real growth shocks (\(RG{V}_{s}\)) on real exchange rate volatility, respectively. As expected, the impact of growth shocks on exchange rate volatility is asymmetric: \(RG{V}_{g}\) has a significant negative impact, while \(RG{V}_{s}\) does not. This result suggests that China, a country with relatively tight capital control and exchange rate management, is more hawkish when facing large real growth shocks. The finding that aggressive interventions will result in more stable exchange rates is confirmed by columns (2) and (5), where the adjustment speed (\(\pi\)) is faster than the other columns.

Second, overall, the impact of external shocks (\(CAV\) and \(TOTV\)) on exchange rate volatility is greater than the impact of domestic shocks (\(RGV\)). This result runs counter to Caporale et al. (2014), who find that exchange rate fluctuations in developing countries, including China, are affected mainly by domestic shocks rather than by external shocks. The most likely reason why our results deviate from theirs is that Caporale et al. (2014) focus on the period from 1979 to 2004. At that time, many countries had low openness due to trade barriers, and thus, their exchange rates were not responsive to external shocks.

4.2.3 Short-term Effects

Panel B shows the short-term relationships between the shocks and real exchange rate volatility, i.e., \({\varvec{\omega}}\) and \({{\varvec{\psi}}}_{xj}\) in Eq. (3). Our findings on the short-term effects are as follows. First, the coefficients of the small real growth shocks (\(RG{V}_{s}\)) are statistically insignificant in the short term, which is in line with the results in the long term. On the contrary, large real growth shocks (\(RG{V}_{g}\)) has a significant impact on exchange rate volatility in the short term. Second, both current account balance shocks (CAV) and terms-of-trade shocks (TOTV) increase exchange rate volatility in the current period but smooth the volatility in the next period or after two periods. Third, the global financial crisis (GFC) significantly increases exchange rate volatility, while China’s exchange rate regime (ERR) and the COVID-19 pandemic (COV) have no significant effect in the short term. This finding reminds us that even for an emerging economy whose capital market is not fully opened, the global crisis can have a huge impact on exchange rate fluctuations.

4.3 Impact of Openness on Real Exchange Rate Volatility

4.3.1 Model Specification

What impact will market openness have on exchange rate volatility? To shed some light on this issue, we incorporate a series of proxies to openness into the extended ARDL models, including trade openness (TRAOP), total financial openness (FINOP), FDI openness (FDIOP), portfolio investment openness (PORTOP), and other investment openness (OTHOP).

The π’s, which capture the speed of adjustment to the long-term equilibrium, remain negative and statistically significant at 1% level in all five specifications. Of all the specifications, column (4) exhibits the fastest adjustment speed. This finding is consistent with our intuition that portfolio investment is relatively more liquid, and higher liquidity is associated with faster mean-reversion in the real exchange rate. The Adj \({R}_{2}\)’s show that the extended models have slightly higher explanatory power than the baseline model, except for the model in column (1).

4.3.2 Long-term Effects

Panel A of Table 2 shows the long-term effects of openness, from which we can draw three findings. First, trade openness (TRAOP) has no significant impact on the real exchange rate volatility in the long term. However, regardless of the type of financial account (FINOP, FDIOP, PORTOP, and OTHOP) examined, greater openness is associated with smaller exchange rate volatility. Second, in terms of scale, the impact of portfolio investment openness (PORTOP) on volatility appears to be smaller than other measures of financial openness. A reasonable explanation is that China’s portfolio investment market has the lowest degree of openness among all the financial market segments. Third, coefficients of current account balance shocks (CAV) and terms-of-trade shocks (TOTV) are all smaller than those in Table 1 without openness, indicating that openness does absorb shocks to real exchange rate. In addition, the coefficients of external shocks (CAV and TOTV) in column (2) to (4) are smaller than those in column (1). This is consistent with Keefe (2021), who emphasizes that the opening-up of financial markets attenuates the impact of global shocks to the currency market. Interestingly, terms-of-trade shocks (TOTV) lose their significance in column (5). This finding may be attributed to that the impact of other investment openness (OTHOP) on real exchange rate is much greater than that of the terms-of-trade shocks, such that the inclusion of other investment openness crowds out the explanatory power of terms-of-trade shocks.

Last, the coefficients of the same shocks have different magnitudes in different specifications. In column (1) with trade openness, terms-of-trade shocks–nominal shocks–have greater coefficients than the current account balance shocks–real shocks. In contrast, in column (2) with financial openness, current account balance shocks are marginally significant. This is consistent with our intuition that the real (nominal) shocks are more closely linked to the trade (financial) market. Therefore, when the trade (financial) openness increases, the currency market absorbs more of the impact from real (nominal) shocks, thus appearing to be more affected by nominal (real) shocks.

4.3.3 Short-term Effects

Panel B shows the short-term effects. As we can see, FDI openness (\(\Delta FDIOP\)) lowers the contemporaneous volatility, while other investment openness (\(\Delta OTHOP\)) raises the volatility with a two-quarter lag. In terms of the absolute magnitude, the short-term impact of FDI openness (\(\Delta FDIOP\)) is smaller than its long-term impact. This finding suggests that the impact of \(\Delta FDIOP\) on exchange rate fluctuations gradually increases. Meanwhile, the short-term impact of \(\Delta OTHOP\) is greater than its long-term impact in the absolute magnitude, but the impact reverses in sign, changing from positive in the short-term to negative in the long term. On the other hand, the opening-up of the financial and portfolio investment markets (\(\Delta FINOP\) and \(\Delta PORTOP\)) fail to have a significant impact on real exchange rate volatility in the short term. This suggests that in the short term, the opening of different financial accounts has heterogeneous impacts on exchange rate volatility.

For the three shocks, the short- and long-term coefficients are positive and much larger than those of openness. Similar to the impact of openness, the impact of shocks on exchange rate fluctuations increases progressively in the long term. As for the event-related categorical and dummy variables, only the global financial crisis (\(GFC\)) shows a significant impact on volatility. It is worth noting that in column (5), the short-term coefficient of \(GFC\) is greatly reduced compared with the rest columns, suggesting that other investment markets (OTHOP) have absorbed some of the impact of the global financial crisis on exchange rate volatility.

5 Further Analysis

As discussed in the previous section, trade openness does not show a statistically significant effect on exchange rate volatility. This seems to be counterintuitive and clashes with the literature. Meanwhile, the opening-up of different financial accounts has shown significant effects, yet the size and direction of the impact depends on certain economic and market conditions. The lack of a clear pattern of these effects is worthy of further investigation.

Based on the literature review in Section 2, we speculate that financial penetration, market efficiency, economic policy uncertainty (EPU), and foreign exchange reserves influence the impact of openness on exchange rate fluctuations. To this end, we proceed to examine the direct and indirect effects of the four factors on real exchange rate volatility. Furthermore, we employ Granger causality tests to scrutinize the directional relationship between openness and the four factors. To do so, we construct a three-variable VAR model involving openness, one of the factors, and the real exchange rate volatility.Footnote 14 The results are reported in Tables 3 through 7.

5.1 Impact of Trade Openness and Various Factors on Real Exchange Rate Volatility

5.1.1 Model Specification

Table 3 presents the effects of openness, the four factors, and shocks to exchange rate volatility. Compared with column (1) of Table 2, π’s in all columns of Table 3 are much greater, meaning that financial penetration (FINPEN), market efficiency (EFF), economic policy uncertainty (EPU), and foreign exchange reserves (RES) all help to accelerate the impounding of short-term volatility innovation into the long-term equilibrium. In addition, the Adj \({R}^{2}\)’s in column (1) to (5) of Table 3 are all greater than the Adj \({R}^{2}\) in column (1) of Table 2 (0.4263), indicating that the explanatory power of all models has been improved after considering the four factors.

5.1.2 Long-term Effects

First, column (1) of Table 3 shows that trade openness (TRAOP) has an insignificant effect on exchange rate volatility. Financial penetration (FINPEN) exhibits a positive significant effect, which is supported by the findings of Lin and Ye (2011) and Berdiev et al. (2012). The two studies believe that economies in the maturing stage of financial development often adopt a floating exchange rate regime. The indirect effect of financial penetration (\(TRAOP\times FINPEN\)), however, is not statistically significant in the Chinese context. On the other hand, results of the Granger causality test show that TRAOP does not Granger-cause \(vo{l}_{f}\), but FINPEN does Granger-cause \(vo{l}_{f}\). Meanwhile, there is evidence of Granger causality fromTRAOP to FINPEN at 5% significance level. This result implies that our ARDL estimation is robust to different model specifications; that is, we consistently find no impact of trade openness on volatility, despite that the effect of financial penetration does depend on trade openness.

Second, column (2) of Table 3 shows that the coefficient of EFF is not statistically significant. In contrast to FINPEN, market efficiency does not show any direct impact on exchange rate volatility (\(vo{l}_{f}\)). the Granger causality test yields the same result: EFF does not Granger-cause \(vo{l}_{f}\). However, the interaction term of trade openness and market efficiency (\(TRAOP\times EFF\)) has a significant, negative impact on volatility, which indicates that market efficiency exerts an indirect influence. To sum up, the capital flow from financial institutions–dominated by banks–has a direct impact on exchange rate fluctuations, while money flows from the capital market has an indirect impact.

Third, column (3) in Table 3 indicates that higher economic policy uncertainty (EPU) is associated with higher volatility. Meanwhile, the result of Granger causality test reports that the coefficient of EPU is statistically significant, suggesting that EPU provides important information about future real exchange rate volatility. However, the coefficient of \(TRAOP\times EPU\) shows that EPU does not impact volatility through trade openness. In other words, a higher degree of trade openness does not alter the impact of EPU on volatility.

Fourth, in column (4) of Table 3, the coefficient of TRAOP is significantly negative at 1% level, meaning that a higher degree of trade openness leads to lower real exchange rate volatility. In addition, the coefficient of RES is significant but that of \(TRAOP\times RES\) is not, indicating that foreign exchange reserves (RES) has a direct impact on real exchange rate volatility, but not an indirect impact. The Granger causality test reveals the same results: there is no Granger causality from TRAOP to \(vo{l}_{f}\) but from RES to \(vo{l}_{f}\).

Two issues are worth discussing. First, why does the model in column (4) estimate that trade openness has a significant impact on exchange rate volatility, while the other three models do not? We believe that trade openness contains information on reserves. After joining the WTO in 2001–an important step in trade liberalization–China has been running a trade surplus, which helps the country accumulate high foreign reserves. After controlling for foreign exchange reserves, trade openness reveals a significant negative effect on exchange rate volatility (column (4)). In contrast, when foreign exchange reserves are not controlled for, the positive effect of reserves on volatility partially offsets the negative effect of trade openness, making the coefficient of trade openness (TRAOP) statistically insignificant.

Second, accumulating foreign exchange reserves is often seen as an effective strategy to stabilize exchange rate fluctuations, but our results show the opposite.Footnote 15 In this regard, we propose three possible explanations. The first explanation lies in a reverse causal relationship between foreign exchange reserves and exchange rate volatility. As Kohli (2015) points out, reserve accumulation is a by-product of trade surplus under managed exchange rate regimes out of the mercantilist motive; it is not the result of exchange rate stabilization out of the precautionary motive. The second explanation is that foreign exchange intervention increases the fluctuation of reserves, therefore enlarging exchange rate volatility (Ramachandran and Srinivasan 2007). In order to test this hypothesis, we follow Lu et al. (2022) and construct an indicator to proxy foreign exchange intervention.Footnote 16 Over the period from 2000M01 to 2021M12, the Spearman correlation between foreign exchange intervention and real exchange rate volatility is 0.3 and significant at 1% level. This result suggests that greater foreign exchange intervention corresponds to higher volatility. The third explanation is that higher foreign exchange reserves give the monetary authorities and other market participants more confidence to release the price pressure to the currency market. This mentality is especially relevant in emerging market countries, where people generally harbor a “fear of floating”. If a country has difficulty establishing credibility in the currency market and adopts a managed exchange rate regime, it must hold a higher level of reserves to maintain its exchange rate regime (Cheung and Ito 2009). During the past three decades, China has loosened its restrictions on the RMB exchange rate, gradually moving away from a fixed exchange rate and gearing towards a more liberal exchange rate system. This liberalization policy is supported by its expanding foreign exchange reserves. As a result, there is a positive relationship between exchange rate volatility and reserves.

Last, compared with Panel A in Table 2, almost all coefficients of shocks (RGV, CAV, and TOTV) in Panel A of Table 3 are smaller. This finding suggests that the four factors–financial penetration, market efficiency, EPU and reserves–can absorb the impact of shocks on exchange rate volatility.

5.1.3 Short-term Effects

Panel B of Table 3 shows the short-term effects, which exhibit richer dynamics than the long-term effects. For example, real growth shocks are negative first but turn positive later; terms-of-trade shocks reveal the opposite: it is positive in the beginning but becomes negative afterwards.

For other variables, the signs of their coefficients remain unchanged. As shown in Panel B of column (1) in Table 3, the coefficients of financial penetration and its interaction with trade openness are both significantly positive. That is, financial penetration can affect real exchange rate volatility in the short term both directly and indirectly. Economic policy uncertainty (EPU) also has a significant positive impact on exchange rate volatility in the short term. On the contrary, in column (2), the coefficient of the interaction of trade openness and market efficiency loses its statistical significance. Column (4) indicates that trade openness has a stabilizing effect on the real exchange rate, whereas higher reverses cause greater exchange rate volatility. Moreover, global financial crisis stays significantly positive in all four models, and the coefficients fall slightly compared with column (1) of Panel B in Table 2.

It is also worth noting that the sign of ERR is negative in column (4), implying that a more flexible exchange rate regime helps stabilize real exchange rate volatility. This result seems counterintuitive at first glance. But upon a second look, China provides a good example to illustrate the benefits of market-oriented exchange rate reforms. Such reforms have helped mitigate pricing distortions (Kang et al. 2016) by cutting down real exchange rate volatility due to wild speculations.

5.2 Impact of Financial Openness and Various Factors on Real Exchange Rate Volatility

5.2.1 Model Specification

What is the effect of financial openness on exchange rate volatility? The results are presented in Tables 4 through 7. Specifically, Table 4 shows the impact of total financial openness (\(FINOP\)), while Tables 5 to 7 report the impact of three disaggregate measures of financial openness, i.e., FDI openness (\(FDIOP\)), portfolio investment openness (\(PORTOP\)), and other investment openness (\(OTHOP\)), respectively.

The values of \(\pi\) in columns (2) and (3) of Table 4 reveal that when \(EFF\) and \(EPU\) are present, the financial markets have faster speed of adjustment to equilibrium than trade markets. In other words, capital market efficiency and economic policy uncertainty facilitate short-term innovations to impound into the financial market, leading the latter to move more swiftly towards the long-term equilibrium. By contrast, financial penetration (\(FINPEN\)) and reserves (\(RES\)) promote the trade market to respond to short-term innovations and adjust to the long-term equilibrium. Except for column (1), the Adj \({R}^{2}\)’s in Table 4 reveal that financial market openness has a higher explanatory power than trade market openness. Again, all models pass the diagnostic tests.

5.2.2 Long-term Effects

Panel A of Table 4 reports the long-term effect of total financial openness (\(FINOP\)). The coefficients of \(FINOP\) in columns (2) and (4) are negative, which is consistent with the estimation in Panel A of Table 2, meaning that total financial openness can stabilize the exchange rate. The Granger causality tests generate the same result: \(FINOP\) does not Granger-cause \(vo{l}_{f}\) in models (1) and (3), but it does Granger-cause \(vo{l}_{f}\) in models (2) and (4).

Although financial openness (\(FINOP\)) and financial penetration (\(FINPEN\)) in column (1) are statistically insignificant, a closer look reveals that the current account balance shocks and terms-of-trade shocks in column (1) are smaller than that in column (2) of Panel A in Table 2. This finding suggests that financial penetration partially absorbs the impact of external shocks. That is, higher financial development helps mitigate the impact of external shocks on exchange rate volatility. This view is confirmed by column (2), where we include market efficiency (\(EFF\)) into the model.

Among the four factors, only foreign exchange reserves (\(RES\)) have a significant positive effect on exchange rate volatility, indicating that the accumulation of foreign exchange reserves exacerbates exchange rate volatility. In terms of magnitude, the coefficient of \(FINOP\) in column (4) of Panel A in Table 4 is the same as column (2) of Panel A in Table 2, meaning that the contribution of financial openness to exchange rate volatility is independent of foreign exchange reserves. Meanwhile, all interaction terms involving financial openness and foreign exchange reserves in Tables 4 through 7 are insignificant, indicating that reserves do not play a role in the impact of financial openness on exchange rate volatility. In addition, the model involving \(RES\) has higher explanatory power and the fastest speed of adjustment to the long-term equilibrium. These findings suggest that foreign exchange reserves are important in smoothing out RMB real exchange rate fluctuations.

Granger causality tests also provide some clues to the relationship between total financial openness and other four factors. In particular, financial openness does not Granger-cause financial penetration, capital market efficiency, or reserves; nevertheless, but it does Granger-cause \(EPU\). This result indicates that China’s financial market opening-up, while inviting economic policy uncertainty, has no bearing with financial development or foreign exchange reserves.

Tables 5 to 7 show the impact of the opening-up of three financial sub-accounts. Since the sub-accounts have different characteristics, it is not surprising that their estimation results differ from that in Table 4 where the three are aggregated.

Our findings from Tables 5 to 7 can be summarized as follows. First, Panel A of Tables 5 and 7 shows that the coefficients of \(FINPEN\) in column (1) are significantly positive, indicating that financial penetration increases exchange rate volatility, as in the case of the trade market (column (1) of Panel A of Table 3). In Panel A of Table 6, however, \(FINPEN\) and \(PORTOP\) lose their significance after we account for portfolio investment openness (\(PORTOP\)). A possible interpretation is that financial portfolio investment openness has opposing direct and indirect impacts on exchange rate volatility. On the one hand, more external investment shows an endorsement of RMB, which has a stabilizing effect on the exchange volatility; on the other hand, portfolio investment may invite more speculations in the context of high financial penetration, thus destabilizing the currency market.

Second, in column (2) of Panel A in Table 7, \(EFF\)–another variable that proxies the degree of financial development–when multiplied by other financial openness (\(OTHOP\)), becomes statistically significant. However, \(EFF\) is not significant when multiplied by FDI openness (Table 5) or portfolio investment openness (Table 6). This could be attributed to the fact that China’s capital markets have not yet been fully opened to cross-border capital flows.

Third, unlike the results for total financial openness, the coefficient of \(EPU\) exhibits significance in models involving openness measured by two financial sub-accounts. In Table 6, the coefficient of \(EPU\times PORTOP\) is significantly negative; in Table 7, the coefficient of \(EPU\) is significantly positive. Both results are aligned with our expectations: economic policy uncertainty not only exacerbates exchange rate fluctuations but also weakens the mitigating role of portfolio investment on exchange rate volatility.

Fourth, the coefficients of foreign exchange reserves (\(RES\)) are consistently positive, regardless of which sub-account of financial openness is included in the model. This observation is consistent with Tables 3 and 4, suggesting the robustness of our results that foreign exchange reserves increase exchange rate volatility.

Last, in Panel A of Table 6, conditioning on portfolio investment openness (\(PORTOP\)), the positive coefficients of current account balance volatility (\(CAV\)) and terms-of-trade volatility (\(TOTV\)) become smaller, indicating that portfolio market opening-up can effectively buffer the impact of external shocks on exchange rate volatility.

In summary, financial market opening-up reduces exchange rate volatility, whereas higher financial penetration, economic policy uncertainty, and foreign exchange reserves correspond to larger volatility. In terms of the magnitude of the direct impact, the effect of foreign exchange reserves is generally the strongest, followed by economic policy uncertainty and financial penetration, and finally, financial market openness. Moreover, the effect of reserves seems to be independent of financial openness; in other words, foreign exchange reserves play a key role in exchange rate volatility, regardless of the degree of financial openness. With regard to the indirect impact, EPU reduces the mitigating effect of portfolio investment openness on volatility, while market efficiency increases the negative impact of other investment opening-up on volatility. And the former effect is larger than the latter.

5.2.3 Short-term Effects

Panel B of Tables 5 to 7 reports the short-term effects. The effects of financial openness on exchange rate volatility are mixed: total financial openness (\(FINOP\)) increases the volatility, FDI openness (\(FDIOP\)) decreases it, portfolio openness (\(PORTOP\)) has no effect, and other financial openness (\(OTHOP\)) increases the volatility before mitigating it shortly after. We speculate that the short-term impact is mainly driven by different market signals communicated through the capital flows in different markets. For example, the purpose of FDI is to gain control of a local business and maintain a long-term relationship with the host market. Besides financing, FDI investors may also provide support to the target enterprises in terms of technology, talent acquisition, research and development (R&D), managerial knacks, and marketing. Furthermore, these investors may trade with each other, exchanging know-how and financial sources. Overall, FDI investors have more incentives to promote the host country’s economic growth, which in turn, fuels an optimistic expectation that helps reduce exchange rate volatility. Apparently, the long-term orientation of FDI differs from the goals of portfolio investment and other investments, which are more geared towards short-term gains. In fact, other financial openness contains speculative components that may build on information asymmetry, a divergence of investors’ opinions, and microstructure noise, all of which cause exchange rate volatility in the short term.

Second, financial penetration has an ambiguous effect on exchange rate volatility. After controlling for other investment openness (\(\Delta OTHOP\)), higher financial penetration (\(\Delta FINPEN\)) causes an increase in exchange rate volatility in the short term; conversely, after controlling for FDI openness (\(\Delta FDIOP\)), financial penetration has a negative effect on exchange rate volatility. In models that involve total financial openness (\(\Delta FINOP\)) and portfolio investment openness (\(\Delta PORTOP\)), financial penetration is not statistically significant.

Third, the coefficients of market efficiency (\(\Delta EFF\)) are always insignificant. Nevertheless, the coefficient of the interaction of portfolio investment openness and economic policy uncertainty (\(\Delta PORTOP \times EPU\)) is significantly negative, as shown in column (3) of Panel B in Table 6. This finding indicates that \(EPU\) could weaken the impact of \(PORTOP\) on exchange rate volatility in the short term, despite that \(PORTOP\) itself does not exert any significant direct impact. In addition, foreign exchange reserves (\(\Delta RES\)) have a direct and positive impact on exchange rate volatility, and the size of the short-term coefficient is close to that of the long-term.

Fourth, in columns (1) and (2) of Panel B in Table 4, the coefficients of the global financial crisis (\(GFC\)) dummy are significantly positive in all regressions, reflecting that \(GFC\) shocks do exacerbate exchange rate volatility. In terms of magnitude, the coefficient of \(GFC\) in column (4) is the smallest, indicating that foreign exchange reserves can offset the impact of external shocks under extreme market conditions, at least partially. This finding confirms the observation of Fratzscher (2009), who argues that during a financial crisis, countries with higher foreign exchange reserves enjoy smaller currency depreciations. However, from Tables 4 to 7, the coefficients of current account balance shocks (\(CAV\)) are larger in all regressions involving foreign reserves (\(RES\)). This finding, which holds both in the long and short term, suggests that China struggles to use its foreign exchange reserves to absorb trade (or real) shocks.

5.3 Sensitivity Analysis

To further prove the robustness of our conclusions, we use rolling window \(vo{l}_{r}\) instead of fixed window \(vo{l}_{f}\) as a proxy variable for exchange rate volatility and re-estimate our ARDL models. The results remain largely consistent with Sects. 4 and 5. Due to space limit, the results of the sensitivity analysis are not shown here, but are available upon request from the authors.

6 Concluding Remarks

This paper investigates how openness affects the real exchange rate volatility in China from 2000Q1 to 2021Q4. We break down openness into trade and financial openness. For financial openness, according to the balance of payments account, we further divide it into four categories: total financial openness, FDI openness, portfolio investment openness, and other investment openness. Using ARDL models, our estimates reveal that trade openness reduces exchange rate volatility after controlling for foreign exchange reserves; higher financial openness tends to be associated with lower exchange rate volatility in the long term, but the short-term impact is different and depends on the sub-account. In the short term, a higher degree of FDI openness reduces real exchange rate volatility; portfolio investment openness have insignificant effect; and other financial openness have ambiguous impacts. We attribute this to the fact that FDI opening-up sends a strong signal of future economic growth, thus reducing exchange rate volatility.

Given that openness has limited power to explain the RMB real exchange volatility, we attempt to examine whether financial development, economic policy uncertainty (EPU), and foreign exchange reserves play a role. In a relatively innovative way, we measure financial development from two dimensions: financial penetration, proxied by the total credit extended to the private non-financial sector divided by GDP, captures the quantity dimension; and market efficiency, proxied by the reverse of Adjusted Market Inefficiency Magnitude (\(INEFF\)) index based on Tran and Leirvik (2019), captures the price dimension.

Our further analyses yield several findings as follows. First, a higher degree of financial penetration is associated with larger exchange rate volatility in the long term. On the other hand, market efficiency does not have any significant effect on exchange rate volatility. This is related to the structure of China’s financial markets. In China, financial institutions, dominated by banks, take the lion’s share of capital flows, while capital markets are responsible for only a very small share. Our result suggests that, at the current stage, China’s capital market–at its immature stage with a low level of development–can hardly affect exchange rate fluctuations.

Second, EPU increases exchange rate volatility in both the long and short term. Our speculation on this observation is that uncertainty leads to heterogeneous investor beliefs about asset prices, and those who under- and/or over-value the assets tend to trade more. Such trading increases speculations in the currency market, thus increasing exchange rate volatility.

Third, greater reserves lead to greater volatility. This finding seems to be counterintuitive. In this regard, we propose three possible explanations: (i) There is a reverse relationship between reserves and volatility, where high reserves are mainly driven by the mercantilist motive and have little bearing with exchange rate stability. (ii) High reserves are most likely to be associated with frequent foreign exchange interventions, which cause increased exchange rate volatility. (iii) Higher foreign exchange reserves enhance the confidence of monetary authorities and other market participants, who are more comfortable in releasing price pressure on the exchange rate. The price pressure translates into more aggregative intervention and trading in the foreign exchange market, which leads to increased volatility.

Fourth, results of the extended models with interaction terms show that the impact of trade openness relies on the degree of financial development, measured by financial penetration and market efficiency. Two components of financial openness–portfolio investment openness and other investment openness–are affected by market efficiency and EPU. The insight is that the China’s monetary authorities, while increasing market openness, need to facilitate the development of domestic financial markets and reduce the indecisiveness of policy decisions.

Last but not least, this study also yields findings related to economic shocks and major events. (i) In terms of the impact of external shocks, financial openness plays a larger role than trade openness in absorbing external shocks; foreign exchange reserves can absorb the 2008–09 global financial crisis shocks but not much of the current account balance shocks. (ii) Real growth shocks–a type of domestic shocks–have a trivial impact on exchange rate volatility. Nevertheless, current account balance shocks and terms-of-trade shocks–both are external shocks–have a significant positive impact on volatility. (iii) China’s market-oriented exchange rate reforms have reduced RMB real exchange rate volatility; the financial crisis has exacerbated the volatility; and the COVID-19 pandemic has no effect on real exchange rate fluctuations.

Data Availability

The data for this study is available upon request from the corresponding author.

Notes

The first free trade zone was established in Shanghai in 2013. In the same year, Chinese President Xi Jinping unveiled the Belt and Road Initiative, which aims to strengthen international cooperation between and promote the economic development of the participating countries. On January 1, 2022, the Regional Comprehensive Economic Partnership (RCEP) officially came into force. As of March 2022, 15 Asia-Pacific countries have joined RCEP, including ten ASEAN countries and five non-ASEAN countries: China, Japan, South Korea, Australia and New Zealand. As the world’s largest free trade agreement area, RCEP is conducive to building a multilateral trading system, improving the business environment for regional trade and investment, and promoting trade and investment liberalization.

On July 4, 2022, the interest rate swap market connect scheme was launched, which aims to promote the interaction between the financial derivatives markets in Mainland and Hong Kong.

The full name is Outline of the 14th Five-Year Plan (2021–2025) for National Economic and Social Development and Vision 2035. The Outline, consisting of 19 chapters and 65 sections, elaborates on the key points and goals of China’s economic and social development. Chapter 4 of the Outline points out the necessity of expediting “the establishment of a complete demand system,” veering away from the export-oriented model, and shifting to a new “dual circulation development paradigm”. Chapter 12 of the Outline proposes to build a new economic system with a high-level openness and to promote economic development through the Belt and Road Initiative.

Many emerging markets have dollarized their liabilities, and therefore, any unexpected changes in relative prices would threaten financial stability.

For instance, Choi and Taylor (2022) find that international reserves held by the public sector is associated with depreciation.

Following Klau and Fung (2006), the BIS REER is calculated as the double-weighted geometric average of a basket of bilateral exchange rates. Specifically, to capture the impact of the relative exchange rate changes between two economies, the weights consist of three components: import competition, direct export competition, and third-market export competition. The weights are time-varying because they are calculated as the 3-year moving average. Readers interested in the composition of China’s REER can refer to the seminal work of Dai and Xu (2013) and Gao et al. (2022).

Total financial openness includes an additional dimension: derivatives openness. However, we ignore this dimension in our study for the following reason: while the stock of financial derivatives in China becomes non-zero after 2015Q1, the value remains very small.

In China, the main components of other investment liabilities include currency and deposits, loans, and trade credit. More specifically, currency and deposits comprise the external debt owed by banks. Loans mainly capture the external debt owed by companies, whose financing costs are affected by exchange rate fluctuations against the US dollar. Trade credit is the direct credit between importers and exporters, which differs from notes financing or import/export credit provided by banks.

De Gregorio and Guidotti (1995) emphasize that monetary aggregates are poor measures of financial development. Therefore, we dispend with the commonly used M2/GDP to measure the degree of financial development.

Specifically, the EPU index developed by Baker et al. (2016) is based on two authoritative newspapers in Mainland China: Renmin Daily and Guangming Daily. In contrast, Huang and Luk (2020) use ten Mainland newspapers: Beijing Youth Daily, Guangzhou Daily, Jiefang Daily, People’s Daily Overseas Edition, Shanghai Morning Post, Southern Metropolis Daily, The Beijing News, Today Evening Post, Wen Hui Daily, and Yangcheng Evening News.

Due to space limitations, the results of our preliminary analysis are not shown in the paper but are available upon request from the authors.

Due to space limitations, we do not present the results of Granger causality tests, but these results are available upon request from the authors.

Our measure for foreign exchange reserve (RES) is calculated by the log ratio of foreign exchange reserves to GDP. In our robust check, we use the growth rate of the log ratio, and our results are largely unchanged.

Foreign exchange intervention is measured as the ratio of monthly changes in funds outstanding for foreign exchange (FOFFE) to broad money, i.e., \(\Delta FOFF{E}_{t}/M{2}_{t}\). The data are downloaded from the websites of the National Bureau of Statistics of China (NBSC) and the Federal Reserve Economic Data (FRED).

References

Aghion P, Bacchetta P, Ranciere R, Rogoff K (2009) Exchange rate volatility and productivity growth: The role of financial development. J Monet Econ 56(4):494–513

Aizenman J, Riera-Crichton D (2008) Real exchange rate and international reserves in an era of growing financial and trade integration. Rev Econ Stat 90(4):812–815

Aizenman J, Sun Y (2012) The financial crisis and sizable international reserves depletion: From “fear of floating” to the “fear of losing international reserves”? Int Rev Econ Finance 24(1):250–269

Aizenman J, Edwards S, Riera-Crichton D (2012) Adjustment patterns to commodity terms of trade shocks: the role of exchange rate and international reserves policies. J Int Money Finance 31(8):1990–2016

Akdogan IU (2020) Understanding the dynamics of foreign reserve management: The central bank intervention policy and the exchange rate fundamentals. Int Econ 161:41–55

Al-Abri A, Baghestani H (2015) Foreign investment and real exchange rate volatility in emerging Asian countries. J Asian Econ 37:34–47

Baker SR, Bloom N, Davis SJ (2013) Measuring economic policy uncertainty. Chicago Booth Research Paper No. 13–02

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636

Balcilar M, Gupta R, Kyei C, Wohar ME (2016) Does economic policy uncertainty predict exchange rate returns and volatility? Evidence from a nonparametric causality-in-quantiles test. Open Econ Rev 27:229–250

Berdiev AN, Kim Y, Chang CP (2012) The political economy of exchange rate regimes in developed and developing countries. Eur J Polit Econ 28(1):38–53

Bin Z (2018) Towards a floating RMB exchange rate regime. China Economic J 11(1):53–60

Bleaney M (2008) Openness and real exchange rate volatility: in search of an explanation. Open Econ Rev 19:135–146

Bleaney M, Francisco M (2010) What makes currencies volatile? An empirical investigation. Open Econ Rev 21:731–750

Boubakri S, Guillaumin C, Silanine A (2019) Non-linear relationship between real commodity price volatility and real effective exchange rate: The case of commodity-exporting countries. J Macroecon 60:212–228

Calderón C, Kubota M (2018) Does higher openness cause more real exchange rate volatility? J Int Econ 110:176–204