Abstract

This paper examines how integration affects Foreign Direct Investment location in relation to a newly internalised border. It focuses on the fifth European Union enlargement that integrated the Central and Eastern European Countries. Using a spatial autoregressive model, 35,103 FDI location decisions are analysed for Europe at a NUTS-2 regional level over 1997–2010. It finds no distance effect in FDI location prior to enlargement, but after this time FDI is 37% higher in the CEEC regions that are contiguous with the newly internalised border. This is not explained by a national border effect that occurs throughout the union, nor by a drop in FDI in the border regions of the old Member States, but rather it is consistent with improved market access from the removal of the border checks. Along the internalised border it amounts to an extra 60 FDI projects and 13,600 gross jobs per annum, which is up to 2000 investments in the long-run. The results have implications for economic development and cohesion of the enlarged union.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic integration alters the sub-national distribution of activity (Midelfart-Knarvik et al. 2000; Behrens et al. 2007), but it also affects the peripheral status of border regions, making them a potential focal point for development (Niebuhr and Stiller 2004; Hanson 1998). The effect of borders on trade is extensively studied, both at regional and national levels (Capello et al. 2018), and it is shown that borders have a negative effect on international trade related to tariffs and country-level factors, such as institutions, networks or culture (Helliwell 1998). However, despite its strong association with trade (Cieślik 2005), little is known about how borders affect Foreign Direct Investment (FDI) location, particularly in the case of a major European integration event (Beugelsdijk and Mudambi 2013).Footnote 1 Indeed, from the perspective of theory there are opposing forces, and therefore uncertainty, since while a border lessens demand and strengthens the domestic agglomeration effect, it also makes a country’s interior regions less attractive to industry as a shelter from foreign competition (Brülhart et al. 2004).

This paper examines empirically how FDI locates in relation to the newly internalised border that followed the fifth European Union (EU) enlargement under which ten Central and Eastern European countries (CEECs) acceded to the union. The enlargement was perhaps the most complete attempt at a large-scale economic integration and it is associated with a strong increase in FDI (Basile et al. 2008). It abolished border checks that led to shorter waiting time and lower administration costs (Hornok 2008), reducing the CEEC trade costs with the existing fifteen Member States (the’EU15’) by up to 20 per cent (Edwards 2008). The paper evaluates the effect of geographical distance on FDI location in the CEECs in relation to the border with the EU15—the ‘West-East border’—comparing it at a regional level both before and after EU enlargement. Several possible explanations for the West-East border effect are considered, including that it is just a ‘national border effect’ between neighbouring countries or that it is caused by ‘boundary-hopping’ by investors over short distances from the EU15. Finally, we consider if the evidence is consistent with a market access explanation.

To examine a West-East border effect on FDI location after the fifth EU enlargement, a spatial autoregressive model is regressed that has temporal and spatially lagged dependent variables to allow for agglomeration and feedback between regions (Belotti et al. 2017). It is estimated using maximum likelihood, with data for 35,103 cross-border location decisions in the CEECs and EU15 (i.e., ‘EU25’), covering the years before and after EU enlargement. Both distance (road distance) and contiguity (first-, second- and third-order) of the CEECs to the West-East border are analysed. Since the border terms are time invariant, which makes the inclusion of region fixed effects problematic, a large number of variables are included for the investment motive in each of the CEECs and EU15. FDI is measured by the log number of projects in a region for each year, but the regional share of EU25 project is also considered to allow for variations in aggregate EU25 FDI over time. Alternative estimation methods are also considered, such as system-GMM (Kukenova and Monteiro 2009).

The paper finds that there is a statistically significant border effect in the CEECs after enlargement such that a 16.4% increase in distance to the West-East border reduces FDI in a region by 1% in the short-run (14.6% if the indirect effect from other regions is included). This is coincident with the removal of the border checks, whereas before enlargement there is no such effect, possibly because FDI located in the capital cities and served national markets. Notwithstanding this, the border effect is spatially constrained, such that FDI location is 37% higher after enlargement in the CEEC regions that are first-order contiguous with the newly internalised border. Along the entire West-East border this is an extra 60 projects and 13,600 gross jobs per annum in the short-run, which is up to 2000 investments in the long-run. It is not explained by competing explanations, but rather it is consistent with market access, being greatest for that part of the West-East border closest to the main EU market. The results have implications for the economic development and cohesion of the enlarged union.

The next section describes the fifth EU enlargement and considers the border effect, drawing on the literature. Section 3 sets out the approach, data and variables, and Sect. 4 analyses the West-East border effect empirically in terms of distance and contiguity. Section 5 considers possible explanations for the results and finally Sect. 6 concludes.

2 EU enlargement and the ‘West–East (WE) border effect’

Negotiations for the fifth EU enlargement commenced in 1998, leading to the membership of eight CEECs in May 2004—the Visegrád countries (of Hungary, Poland, Czechia and Slovakia), Slovenia and three Baltic States—followed by Bulgaria and Romania in January 2007.Footnote 2 The opening-up of the CEEC borders at enlargement removed the border checks on trade with the EU15, lowering the administration costs and waiting time (Hornok 2008), but leading to lower trade costs (Edwards 2008). This did not involve substantial tariff reductions, as these occurred under the earlier Association Agreements (see Baldwin et al. 1997). Further, other integration measures did not change sharply at this time, as regulations and product standards were little changed and just two CEECs had adopted the Euro currency by 2010.

A theoretical foundation for a sub-national border effect in economic activity is given by the 2-country, 3-region New Economic Geography model of Brülhart et al. (2004). In this model, the interior and border regions of the domestic country differ in access to the foreign market, leading to opposing effects from a trade liberalisation between the countries: foreign demand weakens the domestic agglomeration force and attracts industry to the border; but it also weakens the domestic dispersion force and makes the border regions less attractive as a shelter from foreign competition. Brülhart et al. (2004) do not consider FDI and they focus on the EU15, but through simulation they find that enlargement is likely to attract industry to the interior region as it has a large share of domestic industry, although they also find that the larger is the foreign market, the stronger is the pull towards the border region.

In the case of the CEECs, enlargement is likely to dramatically erode their domestic agglomeration force since the EU15 account for 90 per cent of EU25 GDP, and the implication of the Brülhart et al. model is that industry will be drawn towards its border with the EU15. Of course, FDI could just locate in the EU15 (or not arise at all from within the EU15), but the advantage of the CEECs is their relatively low production costs (Krugman and Venables 1990; Niebuhr and Stiller 2004; Jones et al., 2020).Footnote 3This suggests that the CEEC border regions will serve as an export-platform for the main EU market, but from within the internal market of the enlarged union (Ekholm et al. 2007; Jones et al. 2018). Since FDI located in the CEECs in the lead-up to enlargement (Pusterla and Resmini 2007) a similar phenomenon could exist beforehand, but it is unlikely to be pronounced as the border checks applied.

Other motives for FDI location in the regions are related to a ‘national border effect’, and indeed location in a foreign country close to the border with its origin country has been a recent focus for research (Schäffler et al. 2017). A country border location might facilitate a supply-chain relationship with the parent company or it might be that proximity to the parent enables better communication, coordination or control. It is an alternative explanation for the West-East border effect, implying that it is no different to that which operates at the national level within the union. If the nature of proximity reflects a supply-chain relationship then the free movement of goods is relevant, but otherwise it is the movement of people. A further possibility is that the West-East border effect is a diversion of investment, but over relatively short distances from the border regions of the EU15, i.e., ‘boundary-hopping’. It is not a market access explanation since the investors are rent-seeking to exploit cheaper locations nearby. It will lead to a loss of FDI in the EU15 borders, but involves no net gain to the EU25.

2.1 The West–East border and distances

Existing research on FDI location in the EU border regions offers little evidence for a West-East border effect, since it either does not consider this border or it is for some other indicator of activity. In the former case, it is really about the ‘national border effect’, including regions that border an investor’s country of origin, such as Italian provinces (Mariotti and Piscitello 1995), German states (Spies 2010) or Czech regions (Schäffler et al. 2017). FDI location is also considered for regions that border a host country, including Germany (Buch et al. 2003) and Poland (Cieślik 2005). Some of this evidence is indicative of a West-East border effect, as Hecht (2017) finds a distance effect for German FDI in the Czechia, while Cieślik finds a border effect for FDI in Poland, but only for regions that are contiguous with Germany.Footnote 4

Otherwise, the evidence is for some other indicator and possibly before enlargement. For four transition countries, Resmini (2007) finds that distance to the West-East border has a negative effect on employment, and Crozet and Soubeyran (2004) find that market access affects population growth in Romania. Brakman et al. (2012) examine European integration events since 1973 and they find that population increases on both sides of a border, although Redding and Sturm (2008) find adverse effects for Germany from the old ‘Iron Curtain’. As regards the build-up of investment at the border, a similar phenomenon has been commented upon in relation to an earlier Southern EU enlargement of the 1980s (Krugman and Venables 1990) and for the Mexican-U.S. border following trade liberalisation (Hanson 1998).

There are three parts of the West-East border in the CEECs with the EU15, as shown in Appendix Fig. 1a. These are: the westernmost border with Germany, Austria and Italy (referred to as the ‘GAI-border’); the northern border of Estonia with Finland (‘FIN-border’); and the southern border of Bulgaria with Greece (‘GRK-border’). The GAI-border is closest to the main EU15 market, and apart from the earlier German reunification, it follows the path of the old ‘Iron Curtain’. The FIN-border has sea links across the Gulf of Finland and it is a prime route for Estonian exports. The GRK-border arises from the accession of Bulgaria in 2007. Combined, and for brevity, we sometimes refer to these as the ‘WE-border’.

There are 260 NUTS-2 level regions in the EU25, of which 54 are in the CEECs. It is virtually identical to their share of the number of FDI investment projects, at 19.6%, where these data are described below. Each Baltic State is a single NUTS-2 region, but otherwise the number of regions in the CEECs varies from two for Slovenia to 16 regions for Poland. On average, the CEECs get 9.1 investments per region per annum over 1997–2010, compared to 9.8 for the EU15, but varying from 4.2 projects for Slovenia to 15.6 for the Baltic States. Table 1 shows that after enlargement the mean number of projects per region increases from 7.00 to 11.73 for the CEECs, which is similar for the EU15 (from 7.98 to 11.60). The mean number of projects increases in every CEEC after enlargement, but it is greatest for the Baltic States, Romania and Slovakia. Since these countries are generally not contiguous to the WE-border, then this does not offer support for a WE-border effect in FDI location.

To capture the distance to the WE-border the shortest road distance is used. Roads are the preferred method for the transport of goods in the EU, and indeed the Baltic States are the only CEECs where rail freight exceeds half of their trade, but declining since 2000 (Eurostat 2011). Sea transport is much less important for internal trade, and no leading European port is within the CEECs (the busiest container port, Gdańsk, is close to near the GAI-border). The minimum road distances to the GAI-, FIN- and GRK-borders are given in Table 1, based on the main city of each CEEC region, as in Eurostat (2010). It is calculated as a mean for each country, where geographically it divides the CEECs into three groups: the Visegrád countries and Slovenia (close to the GAI-border), the Baltic States (near the FIN-border) and the 2007 entrants (GRK-border). Table 1 shows the first group receives the greatest number of FDI projects, but that projects per region is greater for the Baltic States. Of the 2007 entrants, Romania is closer to the GAI-border, receiving about twice the number of projects as Bulgaria.

The other WE-border measure is contiguity (Beugelsdijk and Mudambi 2013), which is for the first-, second- and third-order contiguity of regions to this border using common edges (Anselin 1988). Of the CEECs, only Latvia, Lithuania and Romania are not adjacent to the WE-border, but each has second- or third-order contiguous regions. Of the EU15, only five have any contiguous regions (Austria, Finland, Germany, Greece and Italy). The regions are mapped in Appendix Fig. 1a, b for the CEECs and EU15, respectively. The mean minimum road distance of each order of contiguous region to each part of the WE-border is reported in Table 1. This is for the CEECs only, as the discontinuous nature of the EU15 means it does not always make sense for these countries.Table 1 does not offer prima facie support for a border effect in the CEECs as third-order regions have a greater number of FDI projects per region than the second-order regions, but the former include Prague and it is known that FDI agglomerates in capital cities (Resmini 2007). Likewise, the second-order contiguous regions in the EU15 include Berlin and Vienna (see Appendix Fig. 1b).

3 The methodology and data

The border effect in FDI location is examined using a spatial autoregressive (SAR) model:

where FDIrt is the number of FDI projects that locate in region r at year t, with r denoting all EU25 regions and t indexing years before and after enlargement. The number of FDI projects is logged, such that normality is not rejected in log-form.Footnote 5 Agglomeration economies give rise to persistence in FDI location (see Jones 2018, for a review), so that a lagged dependent variable is included in the right-hand side of (1), while to capture regional interactions in FDI a spatially lagged dependent term is included, where W is the weights matrix (LeSage 2014). A spatial lag of the temporal lag is heavily insignificant and so not included in (1).

For each CEEC, BEr is a variable for border regions and EUrt is a dummy variable for all years of its EU membership, where accession occurred in 2004 or 2007. Of interest is the coefficient on the interaction term, γ3, which reveals if there is a WE-border effect after EU enlargement. In the reduced form it is evaluated as exp γ3 − 1, as either the short- or long-run marginal effect. The error structure of Eq. (1) includes time fixed effects \({\theta }_{t}\) and a random error term urt, but we do not include region fixed effects since the border term is time invariant, either before and after enlargement (see below for further discussion of this point). Rather, a set of control variables Zr(t-1) is included that allow for regional differences to capture the location motives. These differ between the CEECs and EU15 (Jones et al. 2020), but they also include terms that are related to the accession process and to other border effects, as described below.

Equation (1) is estimated across the 260 NUTS-2 EU25 regions with annual data over 1997–2010. The spatial weight W matrix is row-standardised and constructed for first-order contiguity, which is like the reach of the border effect (see below). The BEr border term is measured using distance to the WE-border, but contiguity is used to examine its spatial extent. The SAR model corrects for the temporal and spatially-lagged dependent variables, and it is implemented using a bias-corrected quasi-maximum likelihood approach that adjusts the initial maximum likelihood estimates (Yu et al. 2008). System-Generalised Method of Moments (GMM) is recommended if there exist endogenous variables in addition to this (Kukenova and Monteiro 2009), but this is not the case. It also does not offer good instrumentation of the contemporaneous spatial lag term. Similar estimates are obtained if FDIrt is measured by the regional share of EU25 projects in each year to capture variations in aggregate investment over time, but in this case the spatial lag term is insignificant.

3.1 FDI data and distance measurement

The FDI data are sourced from the European Investment Monitor (EIM) commercial dataset. This is maintained by Ernst and Young, and it gives details of 35,103 foreign-owned projects locating in the EU25 over 1997–2010, covering periods before and after EU enlargement.Footnote 6 Ernst and Young (2012) claim to monitor 20,000 outlets and to contact most firms to validate data. The correlation with UNCTAD FDI data by country and year is 0.86, notwithstanding definitional differences, so that the data are believed to be representative.Footnote 7 An investment is included if it is cross-border and adds to the firm’s operating capacity, such as the provision of gross new jobs. However, it does not include disinvestments, nor for practical purposes does it include mergers and acquisitions. These data are presented in Table 1 above.Footnote 8 Elsewhere, Duboz et al. (2019) use the EIM data to study service FDI in Europe, also at the NUTS-2 level.

The EIM gives project details, such as the activity, source country and the number of associated jobs, but the investment expenditure is known for only about a third of projects, so that we focus on the number of projects. The data do not link projects and the large number of observations makes this task prohibitive, so that FDI is not examined at the multinational enterprise level. The EIM makes a distinction between greenfield and brownfield FDI, that can be used as proxies for horizontal and vertical FDI (Franco et al. 2010). Greenfield FDI involves a wholly new site, but brownfield FDI is mainly an expansion at an existing site in the same primary function, perhaps leading to economies of scale (Jones et al. 2020). About three-quarters of projects are greenfield FDI, 60% are manufacturing FDI and a half originate from the EU15, but just 1.4% of FDI projects originate from the CEECs.

The distance between a region and the WE-border is measured in kilometers as the shortest road distance using Google Maps. This includes roads that go through non-EU countries, such as from Bulgaria to Hungary through Serbia, but for which there is tariff-free transit.Footnote 9 It is these distances that are given in Table 1. Distance is logged in the regressions, so that the coefficient is an elasticity that gives a proportionately greater absolute effect at the WE-border.Footnote 10 The Euclidean distance is considered as an alternative, which is based on an Online Distance Calculator, but curved to just avoid crossing the Baltic Sea (such as from Riga in Latvia to the WE-border). The regions that are contiguous to WE-border are shown in Appendix Fig. 1a, b. The EUrt dummy captures EU enlargement, which for each CEEC is unity in each year from the date of membership onwards, but it is not lagged since membership was pre-announced. We also examine the build-up of FDI in the EU15 at the WE-border, in which case the EUrt dummy is measured for all years after 2004, which is when most CEECs acceded.

3.2 Regional, accession and border controls

The control variables Zr(t-1) in (1) include three broad sets of terms, for which details are given in Appendix Table 1 (the border terms are described below). The first set of controls allow for differences in the characteristics of regions, which is important as we are unable to include region fixed effects. These include many of the factors that drive FDI location, but by necessity, some are measured at the country level (Appendix Table 1). They are known to differ in their importance between the CEECs and EU15 (Jones et al. 2020).

The second set of controls relate to the accession process, and as well as picking-up accession events that may have encouraged FDI location, they capture the fall-off in FDI that immediately followed EU enlargement (see Jones et al. 2018). These include a dummy for the European Council commitment to liberalisation that improved investor confidence in the CEECs during the negotiations, plus dummies for one, two and three-years after membership to capture the spike in FDI in the CEECs at EU membership. Again, they are not lagged, and they are in addition to the EUrt dummy for enlargement.

The third set of controls include three border dummies for specific effects: (i) regions with a national capital city, of which three are in WE-border regions; (ii) regions contiguous with the former Soviet Union (including regions in Romania, Hungary, Slovakia and Poland, as well as the Baltic States) that may have had an adverse effect on integration (Pusterla and Resmini, 2007); and (iii) regions in both Hungary and Romania that are contiguous with the border between these countries, but for the years 2004–06 only. The 2004 enlargement made the 2007 accession more likely, and given that these countries share a common border, then during this period FDI may locate in western Romania in preference to eastern Hungary.

A further border dummy is used to investigate a ‘national border effect’ as a possible explanation for the WE-border effect. It is measured by first-order contiguity of the internal borders of the enlarged union to capture the free-movement of goods. The Schengen Area, which permits the passport-free movement of people, is also considered to capture the greater opportunity for in-person communication, coordination or control of plants across countries. These regions are shown in Appendix Fig. 2 and they are similar in coverage.

4 The results

The baseline results for the SAR model are presented in the first column of Appendix Table 2. It is estimated by maximum likelihood, implemented through the xsmle command in Stata (Belotti et al. 2017). The regressions omit the border term BEr and border control terms in Zr(t-1) presented below, but they include the accession and regional controls. For comparison, the results are given for the share of FDI projects relative to the EU25 in each year, while the rest of Appendix Table 2 regresses Eq. (1) using system-GMM or least squares dummy variable (LSDV). Focusing on the results in the first column of this table, it shows that the lagged dependent variable and the spatial lag are strongly significant, and that stationarity is satisfied (Kukenova and Monteiro 2009). The first of these indicates persistence in location, and the latter shows indirect effects from contemporaneous location in contiguous regions.

The SAR baseline results in Appendix Table 2 reveal that EU enlargement positively affects FDI location in the CEECs, but that its effect is smaller a few years later, suggesting a spike in investment at membership, while an EU commitment to enlarge is insignificant. The regional controls generally have the correct sign (Appendix Table 1), although they are often insignificant. They show that market size and an educated population are important location factors in the EU25, but that a favourable exchange rate, Euro membership and low corporate tax rate are also important in the CEECs. The wage rate is wrongly signed since it possibly signals the availability of skilled manufacturing labour. Different factors apply in the EU15, including physical infrastructure, Structural Funds (which are regions where FDI location is financially supported) and industrial specialism (i.e., lack of diversification). The negatively signed growth rate term in the EU15 picks-up smaller, but less attractive economies.

The results from regressing Eq. (1) for the EU25 FDI shares yield a very similar pattern of estimates for the regional controls in Appendix Table 2. However, the estimate of the spatial lag is insignificant, as its effect is weakened by weighting the observations in each year by the aggregate number of projects, although strengthening the EU enlargement effect. Since there are a large number of regions it gives almost identical results to the logit model.Footnote 11 The system-GMM estimation of Blundell and Bond (2000) yields weaker estimates of these controls, but it may fail to instrument the spatial lag term, which now has a larger estimate.Footnote 12 Appendix Table 2 presents the LSDV results, but this gives a downwards-biased estimate of the lagged dependent variable (Hsiao 2014), which is now smaller. The estimates of the regional controls are sharper (e.g., wage rate is negative and growth rate is positive), but the spatial lag is implausibly large and the enlargement term is insignificant. The FDI count data were also regressed using a Poisson model, but it gives similar results to the LSDV.

4.1 Distance measure

The results including the BEr border term are presented in Table 2, where this is measured by the logarithm of the road distance to the WE-border. Column I regresses Eq. (1) directly and it reveals that the distance effect in the CEECs is insignificant across all years. There is also no significant difference in this after EU enlargement. However, since FDI may to a limited extent have built-up in the WE-border regions prior to enlargement in response to the Association Agreements then it is likely to dilute the increased effect after enlargement. Given this, Column II estimates the border effect in spline form before and after enlargement, and in absolute terms it shows there is a significant effect for all years after enlargement. As it is a structural equation it is not possible to evaluate the estimated coefficient, but short- and long-run marginal effects are presented below based on the reduced form. The estimates of the regional controls in Zr(t-1) are like Appendix Table 2, and the accession terms (not shown) reveal FDI peaked at EU enlargement, although under an LR test the distance effect does not diminish across the years after enlargement (χ2(6) = 10.41; p value = 0.108).

If region fixed effects are added to Column II of Table 2, the border estimates before and after EU enlargement are 0.035 and -0.043, i.e., BEr × (1 − EUrt) and BEr × EUrt, but no standard error is reported for the latter by Stata. This is also the case if regional controls in Zr(t-1) are omitted, in which case the latter estimate is close to zero, while in our explorations Stata did not report the standard error for one or other interaction term. It is possibly because EUrt is a dummy variable, so that for any given region the interaction terms are time invariant both before and after EU enlargement, perhaps suggesting an identification issue.

The distance term is estimated for each CEEC after enlargement in Column III of Table 2. If the distance effect is uniform a similar estimate would be expected for each country, whereas it varies significantly across the CEECs (χ2(9) = 25.01; p value = 0.003). Indeed, inspection of the estimates suggests that the border effect is spatially constrained, since it is significant for the CEECs that are adjacent to the component parts of this border, i.e., Visegrád countries and 2007 entrants, while for the Baltic States there is a diminishing effect with distance from the FIN-border, although the estimates are insignificant. The attractiveness of the three parts of the WE-border is explored in Column IV, which shows that there is a diminishing distance effect after enlargement with respect to the GAI- and FIN-borders. In the latter case it is also the case before EU enlargement, while the GRK-border estimate is positive, but insignificant. The elasticity for the FIN-border suggests a stronger distance effect, but for the GAI-border it is similar to the WE-border in Column II, reflecting its relative importance. It is examined in Column V, that re-estimates the distance term for the GAI-border only, yielding qualitatively similar estimates to Column III for the WE-border as a whole.

4.2 Contiguity measure

The possibility that the WE-border effect is spatially constrained is explored in Table 3 by considering the contiguity of the CEEC regions to this border, focusing on different orders of contiguity. Again, there is no significantly greater border effect after enlargement, so that the BE estimates are presented in spline form and hence in absolute terms. Column VI shows that the BE terms are insignificant for each order of contiguity, except for the first-order term that is significant after enlargement. As the other contiguity terms are insignificant, it shows that the WE-border effect is spatially constrained, consistent with the evidence in Column III of Table 2. As before, it does not vary across years (χ2(6) = 6.52; p value = 0.367).

The border control Z terms in Column VI indicate that the capital city term is insignificant, so that its effect is not systematic across the CEECs, which is also the case for the regions that are adjacent to the former Soviet Union. Leading-up to the 2007 accession, the estimates show that FDI located in the Romanian border regions in preference to the Hungarian border. Column VII omits the border controls altogether, and the WE-border estimates are smaller in magnitude, but similar in pattern. Column VIII explores the contiguity effects for component parts of the WE-border, but again it offers support for the importance of the GAI-border after enlargement. Other effects are apparent, including positive effects at the FIN-border before and after enlargement, and some negative effects at the GRK-border.

5 Explanations for the West–East border effect

Possible reasons for the WE-border effect in FDI location in the CEECs were advanced above, and these are now explored, focusing on the results for contiguity.

5.1 National border effect

To explore whether the WE-border effect is just a national border effect that occurs across all EU regions, Column VI of Table 3 is re-estimated, but with additional terms for the national border. The first two columns of Table 4 include those for the EU internal borders to capture the free movement of goods, as in Appendix Fig. 2a, and the other columns include them for the Schengen Area to capture the free movement of people, as in Appendix Fig. 2b. If the national border term is included as a single term over time, Column IX shows that it is insignificant, which is also the case if it is allowed to vary after enlargement to capture the removal of the border checks (not shown). Variations in the national border term across the CEECs after enlargement is explored in Column X, but while it is significant for Slovakia, Slovenia, Latvia and Lithuania, Appendix Fig. 2a shows that these border regions cover each country, so that these significant ‘border terms’ are in fact just country effects.

Column XI re-estimates Column X using the Schengen Area to construct the national border terms, and the estimate for the Czechia is now significant, but this is also not a border effect. As Appendix Fig. 2a shows, these border regions cover the whole country except for the Prague region, which is equidistant to the WE-border to the north, west and south, and so an attractive location for FDI. The negative coefficient on this term therefore just picks-up the greater number of investments in the Prague region. It is not captured by the capital city term, which is insignificant. Given all this, Column XII allows the national border effect to vary with enlargement across the CEECs as a whole, but including a dummy for Czechia. This is the preferred regression, but while there is a positive national border effect after enlargement, it is insignificant. The first-order contiguity WE-border effect in the CEECs is significant, and similar in magnitude to Table 3, so it is not a national effect.

5.2 Boundary-hopping

A second possibility is that the WE-border effect in the CEECs is simply a diversion in FDI over short distances that would otherwise have located in the WE-border regions of the EU15, so that there is no net increase for the enlarged union as a whole. This is explored in Table 5 by re-estimating Eq. (1) with the BEr border term measured for the EU15 using contiguity, and as shown in Appendix Fig. 1b. The EUrt term is measured for years 2004 onwards, which is when most countries acceded.

Column XIII shows that none of the contiguity terms in the EU15 is significant, either before or after enlargement. This is also the case in Column XIV if the national border terms are included, except the third-order contiguity term after enlargement achieves significance at the 10% level. Further explorations (not shown) reveal a similar pattern for the GAI-border, and for each of the German, Austrian and Italian parts of this, so that it does not seem to arise from the comparative under-development of eastern Germany. Indeed, Column XV omits all of the controls other than the capital city term and there is a similar pattern, again suggesting that it is not explained by the intrinsic characteristics of the EU15 border regions.

To explore the unattractiveness of the EU15 border regions over time, Column XVI omits the lagged dependent variable, and it now shows that the first-order contiguity term of the EU15 is negative and significant, which is also the case if the national border terms are included in Column XVII. The explanation for this differs over time, as whereas the old ‘Iron Curtain’ was impermeable to trade before enlargement and made the EU15 border regions unattractive to FDI location (Barjak and Heimpold 1999; Topaloglou et al. 2005), this cannot explain the estimate after enlargement as the border controls were removed. Rather, the negative EU15 border effect after enlargement is likely to reflect ‘boundary-hopping’ by investors, due to the availability of low-cost locations nearby in the CEECs and the absence of border controls. This is not captured elsewhere in Table 5 as it is masked by the unattractiveness of the EU15 border regions before enlargement and by the inclusion of the lagged dependent variable.

The short-run estimates of FDI location for the regions that are first-order contiguous with the WE-border are opposite and broadly equal for the EU15 and CEECs, and this supports boundary-hopping.Footnote 13 However, it does not account wholly for the increase in FDI location in the CEEC border regions since on average the latter receive about three-times the number of investment projects as the EU15 border regions, while in job terms it is more than six-times greater.Footnote 14 Of course, these are gross effects, and it could be that the investors in the EU15 border regions divest after enlargement by closing plants or shedding jobs. However, given that the EU15 border regions were unattractive to FDI prior to enlargement, it is highly unlikely to account for the increase in FDI in the CEEC border regions after enlargement.

5.3 Market access and the short- and long-run effects

These results indicate that the WE-border effect in the CEECs is in addition to an EU-wide national border effect and that boundary-hopping from the EU15 border regions does not explain the increase in FDI location in the CEEC border regions after enlargement. Since the CEEC border regions offer good access to the main European market after enlargement and provide a lower cost base, then the most plausible explanation is market access. Several features support this. First, the WE-border effect is strongest for the GAI-border that is closest to the main European market. Second, the border effect occurs after the removal of the border checks on trade at EU enlargement that improved market access, and not before. Third, the effect is spatially constrained to the regions that are first-order contiguous with the border, suggesting that it is closeness to the main EU market that matters.

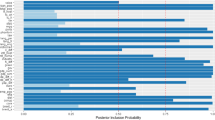

As regards the strength of the border effect, Table 6 presents the short-run and long-run effects for the dynamic SAR specification (Montmartin and Herrera 2015; Belotti et al. 2017), both for the direct effect and indirect effect that arises as a spatial spillover from other regions (Golgher and Voss 2016).Footnote 15 These are presented for the distance measure and first-order contiguity for the CEECs relative to the WE-border. It is for all FDI location, but for comparison Appendix Table 3 presents the estimates for FDI from the EU25 only.

Focusing on the first column of Table 6, the first row reproduces the coefficient from Column II of Table 2 for the distance term, while the other rows estimate marginal effects. These are elasticities so that the short-run direct estimate of -0.063 implies a 16.4% increase in distance of a CEEC region to the WE-border (e.g., from 100 to 116.4 km or from 1000 to 1164 km) reduces the number of FDI projects by 1% after EU enlargement. Together with the estimate of the EU term in Eq. (1) it suggests that FDI location increased across the CEECs after enlargement.Footnote 16 Including the indirect effect, the short-run estimate of − 0.071 implies a smaller elasticity of 14.6%, so that the distance effect is stronger. In the long-run, the direct and total distance effects are much stronger, at just 3.8% and 2.2%.

These elasticities suggest that the effect is concentrated around the WE-border, and indeed this is what the contiguity estimates indicate. The short-and long-run direct and indirect estimates for these are presented in the second part of Table 6, based on Column XII of Table 4. If evaluated they indicate short-run direct and total effects of 32% and 37%, but that the respective long-run effects are very large, at 277% and 1,209%. At the mean values for the first-order contiguous regions, these suggest 60 projects and 13,600 gross jobs per annum in the short-run, which in the long-run is up to 2000 projects and half a million gross jobs. Of course, this takes no account of displacement effects, including pecuniary external effects as prices are bid-up, while as we have seen FDI location peaks at EU membership.

The other columns of Table 6 explore the marginal effects for manufacturing FDI and greenfield FDI, and these offer more support for the importance of market access. In the case of manufacturing, these account for about half of the total number of investments. However, while the distance estimates are similar, the short-run contiguity effects are stronger, at 42% for the direct effect (32% for all FDI) and 50% for the total effect (37%). Since the number of investments is smaller for brownfield FDI and zeros become an issue, Eq. (1) is also regressed for greenfield FDI. In this case, the short-run contiguity effects are much weaker, but this offers further support for market access as it implies stronger effects for brownfield FDI, for which scale economies from a larger market size are important. For FDI originating from the EU25 (mainly the EU15), the estimates in Appendix Table 3 are larger in magnitude and this suggests that it tends to locate more in the CEEC border regions, but this is possibly because these investors are more likely to boundary-hop.

6 Conclusions

This paper examines the existence of a border effect in FDI location at the newly-internalised border that followed the fifth European Union enlargement of the mid-2000s. This integrated the CEECs, and by removing the border checks it lowered the trade costs with the incumbent EU15 Member States. It finds that there is a significant distance effect for FDI location in the CEECs after enlargement in relation the border with the EU15 (the ‘West-East border’), but that no such effect exists prior to this time. Evaluated, it implies that a 16.4% increase in distance to the border causes a 1% reduction in a CEEC region’s share of investments in the short-run, which is 14.6% once the indirect effect of spatial spillovers is allowed for. Notwithstanding this, the results point to the importance of regions that are first-order contiguous to the West-East border, with FDI location in the CEEC border regions 37% higher after EU enlargement than is expected based on their regional characteristics and compared to other regions. Along the entire West-East border this is an extra 60 investments and 13,600 gross jobs per annum. While FDI peaks at enlargement, there is no significant diminution in the border effect up to six years after enlargement, and in the long-run this is up to 2000 extra investments.

The spatially constrained nature of the West-East border effect in the CEEC regions that are contiguous with the EU15 supports a market access explanation. Indeed, the border effect is strongest for the part of the border that is closest to the main European market, while it is apparent after enlargement when the border controls are removed, and not before. It is also greater for manufacturing FDI that involves the movement of goods, and for brownfield FDI that involves additions to plant scale to reflect a larger market size. The paper finds that alternative explanations do not fully account for the border effect, including that it is a border effect that occurs across all national borders or that it arises from boundary-hopping from the EU15 border regions, although FDI in these regions may be affected after enlargement.

The implication of the paper is that the CEEC border regions are an export-platform for the main European market, so that there is an implicit border effect in FDI location within the enlarged union. A similar phenomenon has been noted in respect of the earlier Southern EU enlargement of the mid-1980s, and market access has been used to account for a build-up of employment at the Mexican-U.S. border following trade liberalisation. The existence of a border effect within the enlarged union is perhaps surprising given that the internal market is underpinned by the ‘four freedoms’ of the free movement goods, capital, services and people, since the enlargement removed the border checks. However, FDI location is likely to reflect the lower production costs of the CEECs relative to the EU15, making them an attractive location. This suggests that the border effect will exist for as long as there are disparities in economic development between the CEECs and EU15, and while FDI will help develop the CEECs, the results suggest that the benefits will be confined to the border regions. This has implications for European cohesion, which is both between the CEECs and EU15 and within the CEECs. Indeed, as the CEEC border regions develop as a result of FDI location, then it is plausible that the implicit internal border identified by this paper will move further eastwards.

Notes

The ‘border-effect puzzle’ was first identified by McCallum (1995), who found a substantial ‘home-bias’ in the trade between Canadian provinces compared to cross-border trade with U.S. states of a similar size and distance. Similar effects are found for the OECD (Wei 1996), U.S. states (Wolf 2000) and the EU (Head and Mayer 2000).

Cyprus and Malta joined the EU as part of this enlargement, but received little productive foreign investment and are not included, while Croatia joined in a sixth EU enlargement that took place in 2013.

For the number of projects, the mean and standard deviation are 10.7 and 19.2, but skewness and kurtosis are 7.3 and 81.4. In log-form, the latter are 0.3 and 2.5, for which normality is not rejected at the 1% level.

Attempts to update the data were unsuccessful, with Ernst and Young unwilling to release further data.

UNCTAD data are net FDI and it includes special purpose tax entities that are important for some countries. The EIM excludes portfolio investment and license agreements, as well as retail, leisure facilities, hotels, real estate and not-for-profit organizations. Joint ventures are included, but mainly between EU15 countries.

The EIM reports FDI at the NUTS-3 level, but it is not practical to analyze location at this level as on average there are 2 projects per region and a large number of zeros. The number of projects in each region is increased by unity to deal with zeros. NUTS-2 regions are defined by historical, administrative and natural boundaries (Eurostat 2010), and Internet search and other information were used to identify these locations in some cases. Inner and Outer London are combined, and islands and overseas territories are not included.

‘Union goods’ are verified by proof of EU status, and the Transports Internationaux Routiers (TIR) allows for the movement of ‘non-union goods’ in secure or approved vehicles / containers under a TIR carnet.

Rearranging the elasticity (d FDI/FDI)/(d distance/distance) = gives (d FDI/d distance) = (FDI/distance), so that for given and FDI the gradient d FDI/d distance is inversely related to distance.

Let p be the FDI share, the inverse of the logistic function p = 1/(1 + (1/exp z)) is ln (p / (1 − p)) = z, where z is the right-hand side of Eq. (1). Since p = nrt / nt, where nrt is the number of projects in region r at time t, by substitution ln (nrt / (nt − nrt)) = z, which for large r is virtually identical to (1), i.e., ln (nrt/nt) = z.

It is notwithstanding that the validity of the instruments is not rejected using the standard Hansen J test (Davidson and Zinde-Walsh 2017). The Hansen test is weakened by a large number of instruments, but the rule-of-thumb is that the instrument count should not exceed the number of units (Roodman 2009), which is large. The extra instruments of system-GMM over difference-GMM is also not rejected using a Difference Hansen test of the over-identifying restrictions (Bouayad-Agha and Védrine 2010). Serial correlation is tested to see if the lagged levels are mis-specified instruments, but the diagnostics reveal second-order serial correlation in the system GMM, so that the instruments are lagged a further year and tested up to AR(3).

Given that these approximate the short-run direct marginal effects, the reduction of FDI location in the EU15 border regions is 38% (= exp -0.478 − 1), but in the CEEC borders it is an increase of 32% (= exp 0.275 − 1).

That is (0.32% effect x 10 projects per region x 224 jobs per project) / (0.38% x 3.5 x 80) = 6.7.

Formally, in the short-run, and ignoring the dynamic term, the marginal effect for the k border region variable is calculated by the matrix ([I − ρW]−1 γk I), where given that each of the direct and indirect effects differ across regions the direct effect is calculated as the mean of the diagonal elements of the matrix and the indirect effect as the mean row sum of the off-diagonal elements (Elhorst 2014). For the long-run effect, and again referring to Eq. (1), this is calculated using the matrix ([(1—β) I—ρW]−1 γk I) (see Belotti et al. 2017).

FDI location increases by 0.509 - 0.063 ln distance in Column II of Table 2. This is positive up to a distance of 3,227 km from the WE-border, which covers all the CEEC regions.

References

Anselin L (1988) Spatial econometrics: methods and models. Springer, Dordrecht

Baldwin RE, Francois JF, Portes R (1997) EU enlargement: small costs for the West, Big gains for the East. Econ Policy 12(April):125–176

Barjak F and Heimpold G (1999), Development problems and policies at the German border with Poland: Regional Aspects of Trade and Investment. Discussion Paper No. 101, Institute for Economic Research, Halle.

Basile R, Castellani D, Zanfei A (2008) Location choices of multinational firms in Europe: the role of EU cohesion policy. J Int Econ 74(2):328–340

Behrens K, Gaigne C, Ottaviano GIP, Thisse J-F (2007) Countries, Regions and trade: on the welfare impacts of economic integration. Eur Econ Rev 51(5):1277–301

Belotti F, Hughes G, Mortari AP (2017) Spatial panel-data models using stata. The Stata J 17(1):139–180

Beugelsdijk S, Mudambi R (2013) MNEs as border-crossing multi-location enterprises: the role of discontinuities in geographic space. J Int Bus Stud 44(5):413–426

Blundell R, Bond S (2000) GMM estimation with persistent panel data: an application to production functions. Econom Rev 19(3):321–340

Bouayad-Agha S, Védrine L (2010) Estimation strategies for a spatial dynamic panel using GMM: a new approach to the convergence issue of European regions. Spat Econ Anal 5(2):205–227

Brakman S, Garretsen H, van Marrewijk C, Oumer A (2012) The border population effects of EU integration. J Reg Sci 52(1):40–59

Brülhart M, Crozet M, Koenig P (2004) Enlargement and the EU periphery: the impact of changing market potential. The World Econ 27(6):853–875

Buch C, Kleinert J and Toubal F (2003) Determinants of German FDI: New Evidence from Micro-Data’, Economic Research Centre of the Deutsche Bank Discussion Paper 09 / 03, Deutsche Bundesbank, Frankfurt.

Capello R, Caragliu A, Fratesi U (2018) Measuring border effects in European cross-border regions. Reg Stud 52(7):986–996

Cieślik A (2005) Regional characteristics and the location of foreign firms within Poland. Appl Econ 37(8):863–874

Crozet M, Soubeyran PK (2004) EU Enlargement and the internal geography of countries. J Comp Econ 32(2):265–279

Davidson R, Zinde-Walsh V (2017) Advances in specification testing. Can J Econ 50(5):1595–1631

Duboz M-L, Kroichvili N, Le Gallo J (2019) What Matters most for FDI attraction in services: country or region performance? An empirical analysis of EU for 1997–2012. Ann Reg Sci 63:601–638

Edwards H (2008) Implicit trade costs and European single market enlargement. Appl Econ 40(20):2601–2613

Ekholm K, Forslid R, Markusen JR (2007) Export-platform foreign direct investment. J Eur Econ Assoc 5(4):776–795

Elhorst JP (2014) Spatial econometrics: from cross-sectional data to spatial panels. Springer, London

Ernst and Young (2012), European Investment Monitor, Ernst and Young, London

Eurostat (2010), European Regional and Urban Statistics Reference Guide, Technical Report, Office for Official Publications of the European Communities, Luxembourg.

Eurostat (2011) Europe in Figures: Eurostat Yearbook 2011, Technical Report, Office for Official Publications of the European Communities, Luxembourg.

Franco C, Rentocchini F, Marzetti GV (2010) Why do firms invest abroad? An analysis of the motives underlying foreign direct investments. The Icfai Univ J Int Bus Law 9(1–2):42–65

Golgher AB, Voss PR (2016) ‘How to interpret the coefficients of spatial models: spillovers direct and indirect effects. Spat Demogr 4:175–205

Hanson GH (1998) Regional adjustment to trade liberalization. Reg Sci Urban Econ 28(4):419–444. https://www.sciencedirect.com/science/article/abs/pii/S0166046298000064

Head K, Mayer T (2004) Market potential and the location of Japanese investment in the European union. Rev Econ Stat 86(4):959–72

Head K, Mayer T (2000) Non-Europe: the magnitude and causes of market fragmentation in the EU. Rev World Econ 136(2):284–314

Hecht V (2017) Location choice of German multinationals in the Czech Republic. Econ Transit 25(4):593–623

Helliwell JF (1998) How much do national borders matter? The Brookings Institution, Washington

Hornok C (2008) Trade without borders: trade effect of EU accession by Central and Eastern European Countries. Forum for Research in Empirical International Trade, Working Paper No. 30.

Hsiao C (2014) Analysis of panel data. Cambridge University Press, New York

Jones J (2018) Agglomeration economies and the location of foreign direct investment: a meta-analysis. J Reg Sci 57:731–757

Jones J, Serwicka I, Wren C (2018) Economic integration, border costs and FDI location: evidence from the fifth European union enlargement. Int Rev Econ Financ 54:193–205

Jones J, Serwicka I, Wren C (2020) Motives for foreign direct investment location in Europe and EU enlargement. Environ Plan A: Econ Space 52(8):1681–1699

Krugman P, Venables AJ (1990) Integration and the competitiveness of peripheral industry. In: Bliss C, Braga De Macedo J (eds) Unity with Diversity in the European Economy: The Community’s Southern Frontier. Cambridge University Press, Cambridge

Kukenova M, Monteiro JA (2009) Spatial Dynamic Panel Model and System GMM: A Monte Carlo Investigation. MPRA Paper No. 14319, University of Lausanne. https://econpapers.repec.org/paper/pramprapa/13405.htm

LeSage J (2014) What regional scientists need to know about spatial econometrics. Rev Reg Stud 44(1):13–32

Mariotti S, Piscitello L (1995) Information costs and location of FDIs within the host country: empirical evidence from Italy. J Int Bus Stud 26(4):815–841

McCallum J (1995) National borders matter: Canada-U.S. regional trade patterns. Am Econ Rev 85(3):615–623

Midelfart-Knarvik KH, Overman H, Redding S and Venables AJ (2000) The Location of European Industry. Economic Paper No. 142, DG Economic and Financial Affairs, European Commission, Brussels.

Montmartin B, Herrera M (2015) Internal and external effects of R&D subsidies and fiscal incentives: empirical evidence using spatial dynamic panel models. Res Policy 44(5):1065–1079

Niebuhr A, Stiller S (2004) Integration effects in border regions: a survey of economic theory and empirical studies. Rev Reg Res 24(1):3–21

Pusterla F, Resmini L (2007) Where do foreign firms locate in transition countries? An empirical investigation. Ann Reg Sci 41(4):835–856

Redding SJ, Sturm DM (2008) The costs of remoteness: evidence from German division and reunification. Am Econ Rev 98(5):1766–1797

Resmini L (2007) Regional patterns of industry location in transition countries: does economic integration with the European union matter? Reg Stud 41(6):747–764

Roodman D (2009) A note on the theme of too many instruments. Oxford Bull Econ Stat 71(1):135–158

Schäffler J, Hecht V, Moritz M (2017) Regional determinants of German FDI in the Czech Republic: new evidence on the role of border regions. Reg Stud 51(9):1399–1411

Spies J (2010) Network and border effects: Where do foreign multinationals locate in Germany? Reg Sci Urban Econ 40(1):20–32

Topaloglou L, Kallioras D, Manetos P, Petrakos G (2005) A border regions typology in the enlarged European Union. J Borderl Stud 20(2):67–89

Wei SJ (1996) Intra-national versus international trade: How stubborn are nations in global integration?’, NBER Working Paper 5531, National Bureau of Economic Research, Cambridge, Massachusetts.

Wolf HC (2000) Intranational home bias in trade. Rev Econ Stat 82(4):555–563

Yu J, de Jong R, Lee LF (2008) Quasi-maximum likelihood estimators for spatial dynamic panel data with fixed effects when both n and T are large. J Econom 146:118–134

Acknowledgements

The authors are grateful for support from the ESRC Spatial Economics Research Centre, the Peter and Norah Lomas graduate scholarship programme at Newcastle, and Ernst and Young for the FDI data. Thanks also go to the constructive comments of an anonymous referee, to Matthew Freeman, Simona Iammarino and the participants at a Regional Science Association conference, British and Irish section, Harrogate, UK, 2017. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Serwicka, I.E., Jones, J. & Wren, C. Economic integration and FDI location: Is there a border effect within the enlarged EU?. Ann Reg Sci 72, 85–106 (2024). https://doi.org/10.1007/s00168-022-01190-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-022-01190-2