Abstract

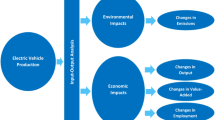

This paper inspects the effects of government subsidies on a supply chain that involves a supplier, a manufacturer, and consumers with electric vehicles (EVs). In practice, the government usually subsidizes different players (the supplier, the manufacturer, or consumers) in the supply chain using two subsidy schemes, namely the linear subsidy model (Model L) and the fixed subsidy model (Model F). We examine the equilibria of the EV supply chain that incorporates the influence from the government who is an external player in each subsidy model. To reach the target adoption of EVs, subsidizing the supplier / consumer presents the least costs to the government in Model L / Model F. We further compare all subsidizing policies in Model L / Model F to show that offering fixed subsidies to the consumer is the optimal subsidizing policy. We also conduct numerical experiments to show the robustness of the optimal subsidizing policy with varying demand uncertainty and target adoption. We extend the model to explore the effects of different subsidizing policies on consumer surplus and social welfare.

Similar content being viewed by others

Notes

References

Alizamir S, de Véricourt F and Sun P (2016). Efficient feed-in-tariff policies for renewable energy technologies. Operations Research 64(1):52–66.

Arifoglu K, Deo S and Iravani SMR (2012). Consumption externality and yield uncertainty in the influenza vaccine supply chain: Interventions in demand and supply sides. Management Science 58(6):1072–1091.

Cachon GP and Fisher M (2000). Supply chain inventory management and the value of shared information. Management Science 46(8):1032–1048.

Chang PL, Hsu CW and Cheng HL (2013). Building a photovoltaic marketing model based on feed-in tariffs and system installed cost. Journal of the Operational Research Society 64(9):1361–1373.

Chick SE, Mamani H and Simchi-Levi D (2008). Supply chain coordination and influenza vaccination. Operations Research 56(6):1493–1506.

Cohen MC, Lobel R and Perakis G (2015). The impact of demand uncertainty on consumer subsidies for green technology adoption. Management Science 62(5):1235–1258.

Crist P (2012). Electric vehicles revisited: Costs, subsidies and prospects. International Transport Forum Discussion Paper.

Diamond D (2009). The impact of government incentives for hybrid-electric vehicles: Evidence from US states. Energy Policy 37(3):972–983.

Eberle U and von Helmolt R (2010). Sustainable transportation based on electric vehicle concepts: A brief overview. Energy & Environmental Science 3(6):689–699.

Gallagher KS and Muehlegger E (2011). Giving green to get green? Incentives and consumer adoption of hybrid vehicle technology. Journal of Environmental Economics and Management 61(1):1–15.

Gunasekaran A, Irani Z and Papadopoulos T (2014). Modelling and analysis of sustainable operations management: Certain investigations for research and applications. Journal of the Operational Research Society 65(6):806–823.

Huang J, Leng M, Liang L and Liu J (2013). Promoting electric automobiles: Supply chain analysis under a government’s subsidy incentive scheme. IIE Transactions 45(8):826–844.

Kalish S and Lilien GL (1983). Optimal price subsidy policy for accelerating the diffusion of innovation. Marketing Science 2(4):407–420.

Krass D, Nedorezov T and Ovchinnikov A (2013). Environmental taxes and the choice of green technology. Production and Operations Management 22(5):1035–1055.

Lau AHL and Lau HS (2003). Effects of a demand-curve’s shape on the optimal solutions of a multi-echelon inventory/pricing model. European Journal of Operational Research 147(3):530–548.

Lieberman W (2004). The theory and practice of revenue management. Journal of Revenue & Pricing Management 3(4):384–386.

Lim MK, Mak H-Y and Rong Y (2014). Toward mass adoption of electric vehicles: Impact of the range and resale anxieties. Manufacturing & Service Operations Management 17(1):101–119.

Lobel R and Perakis G (2011). Consumer choice model for forecasting demand and designing incentives for solar technology. Available at SSRN 1748424.

Luo C, Leng M, Huang J and Liang L (2014). Supply chain analysis under a price-discount incentive scheme for electric vehicles. European Journal of Operational Research 235(1):329–333.

Mamani H, Adida E and Dey D (2012). Vaccine market coordination using subsidy. IIE Transactions on Healthcare Systems Engineering 2(1):78–96.

Paucar-Caceres A and Espinosa A (2011). Management science methodologies in environmental management and sustainability: Discourses and applications. Journal of the Operational Research Society 62(9):1601–1620.

Raz G and Ovchinnikov A (2015). Coordinating pricing and supply of public interest goods using government rebates and subsidies. IEEE Transactions on Engineering Management 62(1):65–79.

Taylor TA and Xiao W (2014). Subsidizing the distribution channel: Donor funding to improve the availability of malaria drugs. Management Science 60(10):2461–2477.

Van Benthem A, Gillingham K and Sweeney J (2008). Learning-by-doing and the optimal solar policy in California. The Energy Journal 29(3):131–151.

Zheng J, Mehndiratta S, Guo JY and Liu Z (2012). Strategic policies and demonstration program of electric vehicle in China. Transport Policy 19(1):17–25.

Acknowledgements

The authors are grateful to the editors and three anonymous referees for their valuable comments and suggestions. The authors acknowledge support from NSFC (71472049, 71271059, 71172039,71629001, 71531005).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

In the benchmark model, the manufacturer’s expected profit is \(\pi _M(p,q)=p {\mathbf{\mathsf{E}}}min[q, \epsilon ap^{-b}] - wq\). By setting \(z=\frac{q}{ap^{-b}}\), manufacturer’s problem turns to \(\pi _M(p,z)=ap^{-b} [p A(z) - wz]\), where \(A(z) = {\mathbf{\mathsf{E}}}min[z, \epsilon ] = \int _{L}^{z} f(x)x\hbox{d}x + \bar{F}(z)z\). \(\partial \pi _M(p,z)/\partial p= ap^{-b-1}\{bzw-(b-1)pA(z)\}\). For \(b>1\), optimal p is uniquely determined by z. \(\partial \pi _M(p,z)/\partial p=0\) implies \(p^*(z)=\frac{bwz}{(b-1)A(z)}\). Since \(p^*(z)\) is the unique maximizer of \({\mathbf{\mathsf{E}}}\pi _M(p, z)\), next we will show \(z_{0}\) optimizes \(\pi _M[p^*(z),z]\).

where we have used the fact that \(\frac{\partial \pi _M[p^*(z),z]}{\partial p}=0\) due to the optimality of \(p^*(z)\). Since \(b>1\), first-order condition requires the optimal \(z_{0}\) satisfies \(G(z_0)=0\). Now we should show such a \(z_{0}\) always exists and is uniquely determined. We can easily check that \(G(L)=L>0\) and \(G(H)=-(b-1)<0\). Since G(z) is continuous, we have \(G'(z)=\bar{F}(z)[1-\frac{zf(z)b}{\bar{F}(z)}]\). Increasing General Failure Rate means \(zf(z)/\bar{F}(z)\) is increasing, and then \(G'(z)\) is decreasing in z and G(z) is a concave function. This, in conjunction with \(G(L)>0\) and \(G(H)<0\), guarantees the uniqueness of \(z_{0} \in [L, H]\). Therefore, \(z_{0}\) is the unique solution of equation \((b-1)A(z)=bz\bar{F}(z)\).

Anticipating the manufacturer’s strategy, supplier chooses w to maximize her profit \(\pi _{S}=(w-c)q\), where \(q=z_{0}a{p^*}^{-b}\) and \(p^*=p^*(z_{0})\). It can be easily solved that \(w^*=bc/(b-1)\). Based on this, the equilibrium of the game has been solved. \(p^* = \frac{b^2 z_{0}c}{(b-1)^2 A(z_{0})}\), \(q^* = a z_{0}Tc^{-b}\), \(\pi_{S}^* = \frac{az_{0}T}{b-1} c^{1-b}\), \(\pi _{M}^{*} = \frac{abz_{0}T}{(b-1)^2} c^{1-b}\), \({ES^*} = aA(z_{0})Tc^{-b}\).

Proofs of Propositions 2 and 3 are similar to the proof of Proposition 1 and are omitted here.□

Proof of Proposition 4

With linear subsidy \(r_3\) offered to consumers, the manufacturer’s profit expected profit is

Then, we can see the problem is almost the same with the benchmark model. We omit the analysis and results here since it can be solved similarly. In addition, Proposition 2 and Proposition 3 can also be converted into the benchmark model and we can prove them similarly.□

Proof of Proposition 5 and Proposition 6

With the fixed subsidy s 2 to the manufacturer, his expected profit is

The only difference between this problem and the benchmark for the manufacturer is his unit cost. We can directly infer \(p^*=\frac{bz_{0}(w-s_2)}{(b-1)A(z_{0})}\) and \(q=az_{0}T(w-s_2)^{-b}\). Then, the supplier’s problem is

First-order condition requires \(w^{FM}=\frac{bc-s_2}{b-1}\). Then, \(w^{FM}-s_2=\frac{b(c-s_2)}{b-1}\) is the manufacturer’s actual unit cost, and \(p^{FM}=\frac{b^2 z_{0}(c-s_2)}{(b-1)^2 A(z_{0})}\).

When the fixed subsidy s 1 are offered to the supplier, her profit is \(\pi _{w}=(w-c+s_1)q\) as her unit cost turns into \(c-s_1\) from c. The manufacturer’s problem keeps the same. Then, we can directly infer from the benchmark that \(w^{FS}=\frac{b(c-s_1)}{b-1}\) and \(p^{FS}=\frac{b^2 z_{0}(c-s_1)}{(b-1)^2 A(z_{0})}\). Under these two policies, if unit subsidy is always s, we can see the manufacturer’s problem does not change since his cost and demand both keep the same under these two policies. Therefore, their equilibria are almost the same.□

Proof of Proposition 7

Under P FC , the manufacturer’s expected profit is

\(\partial \pi _M(p,z)/\partial p=a(p-s_3)^{-b-1}\{ bzw-A(z)s_3-(b-1)A(z)p\}\). Since \(p>c>s_3\), first-order condition requires \(p^*(z)=\frac{bzw-A(z)s_3}{(b-1)A(z)}\). Given z, \(p^*(z)\) is uniquely determined. Next we will find \(z^{FC}\) that optimizes \(\pi _M[p^*(z),z]\).

Since \(p>s_3\) and \(b>1\), first-order condition requires \(K(z)=0\). We can easily check that \(K(L)=L(w-s_3)>0\) and \(K(H)=-(b-1)w<0\). Since K(z) is continuous, optimality of \(z^{FC}\) requires \(K(z^{FC})=0\). Since \(A(z^{FC})\bar{F} (z^{FC})s_3>0\), this indicates \(G(z^{FC})=bz^{FC}\bar{F}(z^{FC})-(b-1)A(z^{FC})>0\). In the proofs of benchmark model, we have show G(z) is decreasing and concave in [L, H]. This, in conjunction with \(G(L)>0\), \(G(H)<0\) and \(G(z_{0})=0\), guarantees \(z^{FC}<z_0\). When \(bz/A(z)-(b-1)/\bar{F}(z)\) is unimodal, we can easily obtain the optimal \(z^{FC}\) is uniquely determined by w and \(z^{FC}\) increases as w increases but decreases as s 3 increases. Since \(p^{FC}=\frac{w}{\bar{F}(z^{FC})}\), we can easily get \(p^{FC}\) increases as w increases and decreases as s 3 increases.□

Proofs of Proposition 8 and Lemma 1

From Propositions 2, 3 and 4, we observed \(ES^{LC}=ES^{LM}=ES^{LS}\) when \(r_1=r_2=r_3\). Meanwhile, \(EX^{LC}=\frac{b}{b-1} EX^{LM}\) and \(EX^{LM}=\frac{b}{b-1} EX^{LS}\). With \(b>1\), we can easily obtain \(EX^{LC}>EX^{LM}>EX^{LS}\). Additionally, we can observe \((1-r) \pi _M^{LC} = \pi _M^{LM} = \pi _M^{LS}\) and \(\pi _{S}^{LC}=\pi _{S}^{LM}=\pi _{S}^{LS}/(1-r)\). Since \(r>0\), we obtain \( \pi _M^{LC} > \pi _M^{LM} = \pi _M^{LS}\) and \(\pi _{S}^{LC}=\pi _{S}^{LM}>\pi _{S}^{LS}\). We thus complete the proof of Lemma 1.□

Proofs of Propositions 9, 10 and 13 are straightforward and omitted here.

Proofs of Proposition 11

Suppose unit subsidy under P FC is s and unit subsidy under P FS is r, then \(EX^{FC}=\tau s\) and \(EX_{FS}=\frac{z_0}{A(z_0)}\tau r\). Thus, we just need to compare s and \(\frac{z_0}{A(z_0)} r\). By solving the chain’s problem while keeping the constraint in Eq. (11) tight, and denoting \(z^{FC}=z^*\), we have \(s=\left\{ \frac{bz^*}{A(z^*)}-\frac{b-1}{F(z^*)} \right\} c\) and \(\frac{z_0}{A(z_0)}r=\left\{ \frac{z_0}{A(z_0)}-(b-1)\root b \of {\frac{A(z_0)}{A(z^*)}} \left(\frac{1}{\bar{F}(z^*)}-\frac{z^*}{A(z^*)}\right) \right\} c = \left\{ \frac{z_0}{A(z_0)}+(b-1)\root b \of {\frac{A(z_0)}{A(z^*)}} \frac{z^*}{A(z^*)} - \root b \of {\frac{A(z_0)}{A(z^*)}} \frac{b-1}{\bar{F}(z^*)} \right\} c\). Since we can show \(z^*<z_0\), we have \( \root b \of {\frac{A(z_0)}{A(z^*)}}>1\). If \(b>\frac{z \bar{F}(z)}{\int _{L}^{z}xf(x)\hbox{d}x}\) for any \(z\in [L, z_0]\), we can conclude \(\frac{z}{A(z) \root b \of {A(z)}}\) increases in z within \([L, z_0]\), which indicates \(\frac{z_0}{z^*} \left[\frac{A(z^*)}{A(z_0)}\right]^{(1+1/b)}>1\). Then, \(\frac{z_0}{A(z_0)}=\frac{z_0}{A(z_0)} \root b \of {\frac{A(z_0)}{A(z^*)}} \root b \of {\frac{A(z^*)}{A(z_0)}} \frac{z^*}{A(z^*)} \frac{A(z^*)}{z^*} >\root b \of {\frac{A(z_0)}{A(z^*)}} \frac{z^*}{A(z^*)}\). Therefore, \(\frac{z_0 r}{A(z_0)c}>b \root b \of {\frac{A(z_0)}{A(z^*)}} \frac{z^*}{A(z^*)} - \root b \of {\frac{A(z_0)}{A(z^*)}} \frac{b-1}{\bar{F}(z^*)}= \root b \of {\frac{A(z_0)}{A(z^*)}} \left[\frac{bz^*}{A(z^*)}-\frac{b-1}{F(z^*)}\right]> \frac{bz^*}{A(z^*)}-\frac{b-1}{F(z^*)} =\frac{s}{c}\). Then, we have \(\frac{z_0}{A(z_0)}r>c\), \(EX^{FS}>EX^{FC}\), and \(P_{FC}\succ P_{FS}\). \(P_{FS}\succ P_{LC}\) is straightforward and we omit it.□

Proof of Proposition 12

The proofs of the equalities are straightforward and now we focus on the inequality. \(z_0>z^{FC}\) indicates \(\frac{z^{FC}}{A(z^{FC})}<\frac{z_0}{A(z_0)}\) because \(\frac{z}{A(z)}\) increases in z. Since \(ES^{FS}=A(z_0)a(p^{FS})^{-b}=A(z^{FC})a(p^{FC}-s^{FC})^{-b}=\tau \) and \(A(z_0)>A(z^{FC})\), we can easily get \(p^{FS}>p^{FC}-s^{FC}\). Meanwhile, \(\tau =\frac{A(z^{FC})}{z^{FC}} q^{FC}=\frac{A(z_0)}{z_0} q^{FS}=\frac{A(z_0)}{z_0} q^{FM}\) indicates \(q^{FC}<q^{FS}=q^{FM}\).□

Rights and permissions

About this article

Cite this article

Fu, J., Chen, X. & Hu, Q. Subsidizing strategies in a sustainable supply chain. J Oper Res Soc (2017). https://doi.org/10.1057/s41274-017-0199-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41274-017-0199-2