Abstract

A plethora of tools are used for investment decisions and performance measurement, including net present value, internal rate of return, profitability index, modified internal rate of return, average accounting rate of return. All these and other known metrics are generally considered non-equivalent and some of them are regarded as unreliable or even naïve. Building upon Magni (Eng Econ 55(2):150–180, 2010a, Eng Econ 58(2):73–111, 2013)’s average internal rate of return, we show that the notion of Chisini mean enables these tools to be used as rational decision criteria. Specifically, we focus on 11 metrics and show that, if properly used, they all provide equivalent accept–reject decisions and equivalent project rankings. Therefore, the intuitive notion of mean is the founding basis of investment decision criteria.

Similar content being viewed by others

Notes

It is worth noting that, while the NPV notion is gold standard for capital budgeting purposes, the NPV notion is of limited use (and hardly ever mentioned) in investment performance measurement, when ex post assessment is accomplished of a portfolio or a fund managers’ skill. In these cases, only relative measures of worth such as rates of return or excess returns are relevant.

See also Barry and Robison [2].

In the case of \(\mathbf {F}\), the MIRR-implied capital is \(c_t=c_{t-1}(1+MIRR)=c_0(1+MIRR)^t\) so the total capital is \(C^{M^{*}}=\left[ c_0\frac{1-q^n}{1-q}\right] \) where \(q=(1+MIRR)/(1+r)\).

See also Gray and Dewar [15] for an axiomatization of the time-weighted rate of return.

See also the average ROA in Magni [29].

Note that this class is analogous to the equivalence class implied by the SRR, where values are not discounted. Therefore, \(\bar{\jmath }(c_0)\) can be viewed as an SRR, where discounting takes no place.

MD is also used as an approximation of the so-called Time-Weighted Rate of Return by chain-linking a series of Modified Dietz returns [42, p. 92].

Note that \(\text {v}_0\) is the first term of the linear combination and its weight is 1.

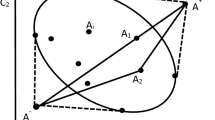

If \(C^{h-k}<0\), then one can consider the incremental project \(k-h\).

See Ben-Horin and Kroll [3] for a different incremental analysis for ranking projects and its relation to AIRR approach.

If \(C^j<0\), then \(\min _{1\le j\le m} \bar{\imath }^j\) replaces \(\max _{1\le j\le m} \bar{\imath }^j\).

It can be shown that both \(\bar{\imath }^j(K)\) and \(\bar{\pi }^j (K)\) can be framed as weighted means of period rates \(i_t^j (K)\) and \(\pi _t^j (K)\) that can be derived from the equivalence class [K]. However, the presented shortcut expressed by Eq. (35) is much more frugal from a computational point of view.

Lima e Silva et al. [21] apply the direct method to so-called pre-purchase financing pools, which are loans where the financed amount is the same for all the members of the pool. The authors supply a correct ranking of the various loans by choosing, as benchmark capital, the very amount distributed to borrowers.

It can be shown that, formally, \(\bar{\pi }^j (K)\) can also be viewed as the weighted mean of the excess return rates \(\pi _t^j\).

References

Athanasopoulos, P.J.: A note on the modified internal rate of return and investment criterion. Eng. Econ. 23(2), 131–133 (1977)

Barry, P.J., Robison, L.J.: Technical note: economic rates of return and investment analysis. Eng. Econ. 59(3), 231–256 (2014)

Ben-Horin M., Kroll Y.: A simple intuitive NPV-IRR consistent ranking. Q. J. Econ. Finance (2017). doi:10.1016/j.qref.2017.01.004

Berk, J., DeMarzo, P.: Corporate Finance. Global Edition, 3rd edn. Pearson, Harlow (2014)

Borgonovo, E., Gatti, S., Peccati, L.: What drives value creation in investment projects? An application of sensitivity analysis to project finance transactions. Eur. J. Oper. Res. 205(1), 227–236 (2010)

Brealey, R.A., Myers, S., Allen, F.: Principles of Corporate Finance. Global Edition. McGraw-Hill Irwin, Pennsylvania (2011)

Brounen, D., de Jong, A., Koedijk, K.: Corporate finance in Europe: confronting theory with practice. Financ. Manag. 33(4), 71–101 (2004)

Chisini, O.: Sul concetto di media on the concept of mean. Periodico di Matematiche 9(4), 106–116 (1929)

de Finetti, B.: Sul concetto di media on the concept of mean. Giornale dell’Istituto Italiano degli Attuari 2(3), 369–396 (1931)

Evans, D.A., Forbes, S.M.: Decision making and display methods: the case of prescription and practice in capital budgeting. Eng. Econ. 39(1), 87–92 (1993)

Fabozzi, F.J., Peterson, P.P.: Financial Management and Analysis, 2nd edn. Wiley, Hoboken (2003)

Fischer, B.R., Wermers, R.: Performance Evaluation and Attribution of Security Portolios. Academic Press, Waltham (2013)

Fisher, F.M., McGowan, J.J.: On the misuse of accounting rates of return to infer monopoly profits. Am. Econ. Rev. 73(1), 82–97 (1983)

Graham, J., Harvey, C.: The theory and practice of corporate finance: evidence from the field. J. Financ. Econ. 60(2–3), 187–243 (2001)

Gray, K.B., Dewar, R.B.K.: Axiomatic characterization of the time-weighted rate of return. Manag. Sci. 18(2), 32–35 (1971)

Graziani, R., Veronese, P.: How to compute a mean? The Chisini approach and its applications. Am. Stat. 63(1), 33–36 (2009)

Hazen, G.B.: A new perspective on multiple internal rates of return. Eng. Econ. 48(1), 31–51 (2003)

Herroelen, W.S., Van Dommelen, P., Demeulemeester, E.L.: Project network models with discounted cash flows a guided tour through recent developments. Eur. J. Oper. Res. 100(1), 97–121 (1997)

Kay, A.: Accountants, too, could be happy in the golden age: the accountants rate of profit and the internal rate of return. Oxf. Econ. Pap. 28(3), 447–460 (1976)

Kierulff, H.: MIRR: a better measure. Bus. Horizons 51(4), 321–329 (2008)

Lima e Silva J., Sobreiro V.A., Kimura H.: Pre-purchase financing pool: Revealing the IRR problem. Eng. Econ. (2017). doi:10.1080/0013791X.2017.1333662

Lin, A.Y.S.: The modified internal rate of return and investment criterion. Eng. Econ. 21(4), 237–247 (1976)

Lindblom, T., Sjögren, S.: Increasing goal congruence in project evaluation by introducing a strict market depreciation schedule. Int. J. Prod. Econ. 121(2), 519–532 (2009)

Magni C.A.: Accounting and economic measures: an integrated theory of capital budgeting. SSRN Working paper. http://ssrn.com/abstract=1498106 (2009)

Magni, C.A.: Average internal rate of return and investment decisions: a new perspective. Eng. Econ. 55(2), 150–180 (2010a)

Magni C.A.: Depreciation classes, return on investment and economic profitability. SSRN Working paper. http://ssrn.com/abstract=1718525 (2010b)

Magni, C.A.: Aggregate return on investment and investment decisions: a cash-flow perspective. Eng. Econ. 56(2), 181–182 (2011)

Magni, C.A.: The internal-rate-of-return approach and the AIRR paradigm: a refutation and a corroboration. Eng. Econ. 58(2), 73–111 (2013)

Magni, C.A.: Investment, financing and the role of ROA and WACC in value creation. Eur. J. Oper. Res. 244(3), 855–866 (2015)

Magni, C.A.: Capital depreciation and the underdetermination of rate of return: a unifying perspective. J. Math. Econ. 67, 54–79 (2016)

Mørch, O., Fagerholta, K., Pantuso, G., Rakkec, J.: Maximizing the rate of return on the capital employed in shipping capacity renewal. Omega 67, 42–53 (2017)

Park, C.: Fundamentals of Engineering Economics. International Edition. Pearson, Harlow (2013)

Pasqual, J., Padilla, E., Jadotte, E.: Technical note: equivalence of different profitability criteria with the net present value. Int. J. Prod. Econ. 142(1), 205–210 (2013)

Peasnell, K.V.: Some formal connections between economic values and yields and accounting numbers. J. Bus. Finance Account. 9(3), 361–381 (1982)

Rao, R.: Financial Management. MacMillan Publishing Company, Basingstoke (1992)

Remer, D.S., Nieto, A.P.: A compendium and comparison of 25 project evaluation techniques. Part 1: net present value and rate of return methods. Int. J. Prod. Econ. 42(1), 79–96 (1995a)

Remer, D.S., Nieto, A.P.: A compendium and comparison of 25 project evaluation techniques. Part 2: ratio, payback, and accounting methods. Int. J. Prod. Econ. 42(2), 101–129 (1995b)

Remer, D.S., Stokdyk, S.B., Van Driel, M.: Survey of project evaluation techniques currently used in industry. Int. J. Prod. Econ. 32(1), 103–115 (1993)

Robichek, A.A., Myers, S.C.: Optimal Financing Decisions. Prentice-Hall, Englewood Cliffs (1965)

Ross, S.A., Westerfield, R.W., Jordan, B.D.: Essentials of Corporate Finance, 7th edn. McGraw-Hill Irwin, New York (2011)

Sandahl, G., Sjögren, S.: Capital budgeting methods among Swedens largest groups of companies. The state of the art and a comparison with earlier studies. Int. J. Prod. Econ. 84(1), 51–69 (2003)

Spaulding, D.: The Handbook of Investment Performance: A User’s Guide, 2nd edn. TSG Publishing Inc, Somerset (2011)

Wiesemann, D., Kuhn, D., Rustem, B.: Maximizing the net present value of a project under uncertainty. Eur. J. Oper. Res. 202(2), 356–367 (2010)

Acknowledgements

The authors wish to thank an anonymous reviewer, who supplied invaluable remarks for revising the paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Chisini mean

The Chisini mean of n homogeneous values \(x_1,\ldots ,x_n\), with respect to the invariance requirement g, is the number (if it exists) \(\bar{x}\) such that \(g(\bar{x},\bar{x},\ldots ,\bar{x})=g(x_1,\ldots ,x_n)\), which is Eq. (3). The latter may have no solutions, so that the mean does not exist, or it may have several solutions and each one may be used as a mean. Indeed the solution exists and is unique if \(g(x,\ldots ,x)=q(x)\), with \(q(\cdot )\) continuous and strictly monotone. In this case, the mean is given by

Note that the Chisini mean is always consistent, in the sense that when all values \(x_1,\ldots ,x_n\) are equal to a, then \(\bar{x}=a\). Due to its general definition, it has no other specific properties. In particular it is not necessarily internal, i.e. included between the minimum and the maximum values of the observations, or associative. The latter property which, roughly speaking, states that a mean of n-data can be computed from the means of partial non overlapping subgroups of values, is however satisfied when the function q meets suitable conditions. This happens, for example, when the Chisini mean generates an arithmetic or a geometric mean as it occurs in our paper.

Appendix B: Proof of Proposition 4

Proof

Since, from (6), \(f_k=c_{k-1}(1+i_k)-c_k\), it follows that NPV is a function of the \(i_k\)’s and we can look for a mean of them which leaves NPV unchanged, for fixed \(c_k\)’s and \(v_{k,0}\)’s. Thus, considering the NPV as the invariance requirement (3), we have

where \(c_{-1}=0\). Simplifying the constant and solving for \(\bar{\imath }\), one gets

which is the project AIRR, i.e., the capital-weighted arithmetic mean given in (7).

Notice now that, from (36), NPV can also be written as

where the first term in the last equality is obtained using the expression of the \(v_{k,0}\)’s obtained by (10). Solving the invariance condition

we have

which is the market AIRR, i.e. the weighted arithmetic mean of forward rates found in (9).

Finally, letting \(\pi _t=i_t-r_t\) be the project’s excess return (rate) in period \([t-1,t]\), NPV can be written, from (38), as

Thus, the mean of the \(\pi _k\)’s that leaves unchanged NPV is:

and, using (37) and (39), \(\bar{\pi }=\bar{\imath }-\bar{r}.\)

From (40),

and thus, since \(\bar{\pi }\) is the Chisini mean that leaves unchanged NPV, Eq. (12) is proved. \(\square \)

Rights and permissions

About this article

Cite this article

Magni, C.A., Veronese, P. & Graziani, R. Chisini means and rational decision making: equivalence of investment criteria. Math Finan Econ 12, 193–217 (2018). https://doi.org/10.1007/s11579-017-0201-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-017-0201-4

Keywords

- Value creation

- Accept–reject decisions

- Project ranking

- Equivalence class

- Net present value

- Average internal rate of return