Abstract

This study investigates the relationship between local protectionism and performance of multinational corporation (MNC) subsidiaries in China. We integrate overarching theories (i.e., institutional theory and extended resource-based view) to investigate a model for identifying whether local protectionism at the subnational level is beneficial or detrimental for foreign subsidiary operations or functions as a double-edged sword. We also examine whether or not internal organizational capabilities and relational capital with government moderate the effects. On the basis of regression analyses, our empirical findings reveal that the positive or negative effects of subnational protectionism in China depend on performance types. Moreover, performance contribution is considerably moderated by various internal capabilities of MNC subsidiaries. Findings offer valuable and practical implications for MNCs intending to invest in emerging economies.

Similar content being viewed by others

1 Introduction

Theory of multinational corporations (MNCs) proposes that firms investing overseas need to possess firm-specific advantages (FSAs), particularly to combat the liabilities of foreignness (LOF) and outperform their local counterparts (Dunning, 1977; Wan et al., 2020). However, we note that an important but overlooked research domain is how FSAs and the environmental disadvantages (i.e., LOF) of MNCs interact with each other to shape their competitive environment and determine their performance. The reasons such a discussion remains in its infancy are the dynamic nature of the power of initial LOF and FSAs over time (Wan et al., 2020) and heterogeneity of institutional environments across subnational regions (Gardberg & Fombrun, 2006). That is, the impact of protectionism causing LOF to MNCs in host economies should be observed. However, note that there can be varying levels of protectionism at the subnational region level within a host country. Our literature review also reveals that extant studies on this issue have generally focused on the relationship between protectionist policies and corporate strategies, such as regional specialization (Bai et al., 2004), internationalization (Meyer & Thein, 2014), or foreign direct investment (FDI) decision-making (Luo et al., 2021).

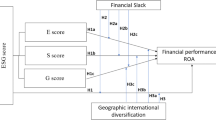

To address the preceding gaps, we initiate an inquiry with this exploratory research and investigate the following research questions: To what extent does the variance of subnational protectionism within a host market affect MNC subsidiaries’ performance? How may MNC subsidiaries successfully manage such an institutional idiosyncrasy (i.e., subnational protectionism) by developing firm competitive resources or capabilities in the market? This study primarily aims to investigate how subnational protectionism and firm-level competitive factors of MNC subsidiaries interactively explain their variation in financial and innovation performance in a large emerging market context. This investigation is conducted by integrating institutional theoryFootnote 1 and extended resource-based view (RBV)Footnote 2 (Isobe et al., 2008). Thus, our holistic research models provide a comprehensive perspective by highlighting the relationship between institutional environments and firm-specific capabilities in shaping foreign subsidiaries’ performance.Footnote 3 This study uses the preceding discussions as bases to contribute to the strategy and international business (IB) literature on protectionism and performance of foreign subsidiaries.

First, the existing literature has a propensity to either juxtapose institution- and foreign subsidiary-level factors within a host market (Lu et al., 2021) or investigate each influence separately. To address these research limitations, the current study attempts to explore how corporate internal competitive advantages affect the outcome of MNC subsidiaries in host economies under institutional disadvantages. Conventional RBV focuses mainly on the role of the possession of or control over resources as primary means to create value from strategic activities (Popli et al., 2017). Extended RBV emphasizes the importance of internal and external resources and capabilities, such as institution-mediated transactions and resource-leveraging relationship that link firms in external conditions, in helping them (i.e., firms) achieve sustainable competitive advantages and superior performance outcomes (Xiao et al., 2020). Therefore, we are convinced that this theoretical perspective offers an ideal theoretical framework to examine how MNC subsidiaries can successfully manage and leverage their competitive resources and capabilities corresponding to institutional context, eventually mitigating additional costs arising from their unfamiliarity with the foreign host market.

Second, economic downturns during global financial crises (e.g., in the 1930s and early 1980s) often promote industrial protectionism and increase discrimination policies against foreign firms, reaching wide consensus among scholars and practitioners (Balabanis et al., 2001; Evenett, 2019). Recently, the COVID-19 pandemic has sparked broad-based recourses to trade restrictions (Contractor, 2022). For this reason, protectionism, which functions as a barrier impeding international trade and FDI, is an important research area in IB. With a few exceptions, the existing empirical studies have been primarily conducted using cross-country data (e.g., Frattaroli, 2020; Keay, 2019; Yilmazkuday, 2022). However, large emerging markets, such as BRICS (i.e., Brazil, Russian Federation, India, China, and South Africa), impose significant variation in regional rules, regulations, and institutions (e.g., Meyer & Nguyen, 2005; Shi et al., 2012). Thus, these markets experience substantial differences in protectionism imposed by each local (provincial) government. Accordingly, the mere use of national-level data may have limits on establishing a precise situation. We presume that the lack of adequate data availability and appropriate research setting results in minimal empirical experiments. This study extends the extant research in the sense that the performance implications of protectionism are significant at the subnational level and are also shaped by the heterogeneous firm-specific internal capabilities of MNC subsidiaries. The presence of subnational protectionism alone may not necessarily drive down the outcome of MNC subsidiaries. Hence, other firm-level conditions should be considered to precisely address these contingencies or interaction effects (Nguyen et al., 2022).

Third, the extant studies have tended to investigate protectionism’s performance implications using a single performance measure, thereby oversimplifying the causal effects (e.g., Keay, 2019; Rammal et al., 2022). Undeniably, each performance measure has its own pros and cons. Therefore, plural performance assessments should be incorporated to reflect the fact and yield considerably robust results. On the basis of this idea, this paper’s additional contributions include employing a conventional financial performance measure and adopting an innovation performance measure. Given the unique and large sample associated with foreign subsidiaries operating in China, our empirical findings show that the degree of regional protectionism exerts a distinct effect on firm performance using different performance measures. This performance contribution of regional protectionism is moderated by various internal capabilities possessed by MNC subsidiaries.

2 Theoretical Background

Despite the excellent effort of IB researchers in synthesizing institutional theory and applying new institutional economies in IB research, they have generally explored the national-level role of institutions. Consequently, this research stream provides relatively minimal attention to subnational regions’ role in explaining the variation in performance of MNC subsidiaries. This situation represents a significant shortcoming in the literature, given that MNCs may operate in host markets (Meyer & Nguyen, 2005), with relatively heterogeneous local institutional conditions across different subnational regions in these markets (Elg & Ghauri, 2021). Institutions in many large emerging economies can differ significantly from those in developed economies and, more importantly, vary significantly across their subnational regions (Ma et al., 2013; Shi et al., 2012).

We argue that protectionism at the subnational region level may represent an important institutional instrument by subnational governments in emerging economies. This institutional logic may provide new insights into the role of institutions across subnational regions within a host economy in the MNC subsidiary context. In general, the central government adopts industrial policies to promote local entrepreneurs through subsidies and tariffs. These policies are expected to uniformly and negatively impact the competitive position of MNC subsidiaries by raising their goods or services costs. However, local governments at the subnational region level may have different incentives from the central government to protect their regional local market. In particular, subnational regions within large emerging economies, such as China and India, are likely to be heterogeneous in the process of market liberalization and openness (Ma et al., 2013; Shi et al., 2012).

By contrast, RBV argues that firms should possess internal strategic resources, which are inimitable, non-transferable, and non-substitutable, in creating and maintaining a sustained competitive advantage and in overcoming such institutional barriers (Barney, 1991). According to RBV, firms attain different levels of competitive advantages in the same market mainly because they own a dissimilar magnitude of resource reservoir (Martin et al., 2020), thereby illustrating performance variances among firms. Under this logic, Grahovac and Miller (2009) and Ghauri et al. (2021) indicate that firms’ ability to achieve competitive advantage directly impacts their organizational performance. Barney (1991) stresses that resources required to obtain sustained competitive advantage and improve performance include all assets, information, and knowledge because they help firms enhance their efficiency and effectiveness. Similarly, some authors relying on knowledge-based view (KBV) insights have clarified the importance of knowledge and decouple corporate capabilities (e.g., technological and marketing capabilities), particularly from resources through which they are deployed (Paul & Rosado-Serrano, 2019). That is, knowledge-based capabilities are crucial resources enabling firms to develop strong competitive edge, enabling them to win against competitors possibly safeguarded by protectionists’ pressures.

Xiao et al. (2020) argue the importance of firms’ possession of some extended resources, functioning as a vehicle to improve firm competitiveness, such as relational capital. They suggest that relational resources are a crucial part of intangible assets, as much as knowledge, and an invaluable element composing organizational capabilities, leading to enhanced corporate performance. However, the market’s local business environment is characterized by uncertainty in situations where MNC subsidiaries have appropriate knowledge-based capabilities and also establish a good relationship with the local government, which legislates a beggar-my-neighbor game (i.e., a protectionist policy). That is, when relational resources are built on mutual trust with local governments and regimes, MNC subsidiaries are likely to invest significant organizational resources to concentrate their businesses on these markets. This behavior pattern tends to logically add up to the enrichment of corporate performance (Ghauri et al., 2016). This elucidation is closely related to extended RBV, which is the most recently expanding theoretical discussion in the IB domain (Yang et al., 2018).

3 Hypotheses

3.1 Local Protectionism and MNC Subsidiary Performance

Protectionism can take different forms. For example, government officials may impose heavy tariffs on products produced by firms in overseas countries and directly prevent MNCs from producing overseas and investing in local markets. Thus, protectionism is often a form of political rent seeking. This form of rent seeking may decrease returns to innovation, interfere with fair competition between local and foreign firms, and aggravate MNC subsidiaries’ performance. Another possible concern is that protectionism at the subnational level is the product of successful lobbying activities by a particular set of local firms (Frattaroli, 2020). For example, top management of firms anticipating a decline in performance prefers more protection from foreign competition and, therefore, engages in lobbying effort.

Evidence of the preceding explanations can be found in several extant empiric studies. Frattaroli (2020) argues that protectionist interventions into MNC operations in local markets in the interest of national security obstruct follow-up FDI and victimize MNC shareholders. Keay (2019) similarly suggests that adoption of protectionist policy harms MNCs’ organizational performance in an unfamiliar environment and also disturbs local firms’ productivity improvements and learning potential. This situation indicates a strong, significant negative relationship between protectionism and national gross performance. Lenway et al. (1996) explain that protectionism is increasingly considered an integral part of government policy aimed at providing its support for fostering local infant industries. They further document that protectionism often triggers dual effects that simultaneously reduce the value of innovation in the protected industry and reward the poor performance of MNCs. Protectionism decreases incentives to innovate and surely hurts the performance of MNC subsidiaries.

Hypothesis 1

Local protectionism at the subnational/regional level within a host market negatively influences the performance of MNC subsidiaries.

3.2 Possession of Technological Capabilities

On the basis of KBV, outcome differences among firms are often caused by discrepancies in invaluable, rent-generating, and non-fungible resources or so-called capabilities (Paul & Rosado-Serrano, 2019). Among these various capabilities, MNCs possessing technological capabilities may be R&D-oriented, proactive to absorb new local technologies, and can transform current knowledge into sophisticated technologies (Park, 2010). The reason is that such a capability may include the capacity to improve the quality of products to satisfy local market needs (Wu et al., 2019), apply adequate technologies to commercial ends (Zhang et al., 2019), and develop and adopt new products and process technologies to fulfill future needs (Eisend et al., 2016; Poudel et al., 2019). Another archetypal attribute is that technologically oriented firms are anticipated to allocate many organizational resources to undertake R&D, focus considerably on increasing human capital (e.g., skilled labor), and establish a corporate culture that supports learning and creativity (Park & Ghauri, 2011). For these reasons, the technological capability of MNCs is considered a crucial strategic resource, enabling them to achieve competitive advantage and enhance their performance even in an unfamiliar environment.

In regions with high protectionism, local governments tend to erect various barriers or adopt formidable rules to protect local firms from foreign rivals in the market. MNC subsidiaries may find themselves in an increasingly disadvantageous position vis-a-via their local counterparts in such highly protectionist regions. Thus, MNC subsidiaries need to be armed with unique organizational weapons, in that their firm performance will generally depend on the development of their own competitive advantages. Technological capability, which is commonly defined as “the skills – technical, managerial, and institutional – that allow productive enterprises to utilize equipment and technical information efficiently” (Lall, 1993: 720), may represent such an important weapon that can be used to help MNC subsidiaries relative to their local counterparts become markedly creative (cf. Moorman & Slotegraaf, 1999). Moreover, technological capabilities play a central role in driving learning and innovative productivity (Park & Ghauri, 2011) and accelerating the development or commercialization of new products (Tsai, 2004). Taking the new-energy vehicle industry (NEV) as an example, the central government in a host country unveiled a national development plan for its NEV industry to support and accelerate its future development. However, local governments in some regions may choose to adopt various regional protectionist programs to support their local auto firms against outside competitors by purchasing vehicles from local companies or directly providing them with subsidies. In this situation, only MNC NEV makers with strong technological capabilities could surmount such a negative effect of strong local protectionism and subsequently achieve high innovative productivity and profitability. These arguments suggest that although protectionism may have a negative impact on firm performance, the possession of technological capabilities by MNC subsidiaries may function as a clue to overcoming handicaps triggered by regional protectionism. Therefore, we formulate the following hypothesis:

Hypothesis 2

The negative relationship between local protectionism and performance of MNC subsidiaries is positively moderated by the possession of technological capabilities.

3.3 Possession of Marketing Capabilities

The main question in IB pertains to the strategy used by MNCs to uphold and increase their competitive advantage. One of the factors that can strengthen competitive edge is having marketing capabilities (Ghauri et al., 2016; Martin et al., 2020). The notion of marketing capabilities is established through KBV. MNCs, adopting a knowledge-based strategy, invest in organizational resources and capabilities that can build favorable customer relationships, reinforce market positions, and satisfy local market needs. Thus, firms often attempt to understand the ways in which these capabilities provide a unique character through organizational processes. Accordingly, marketing capabilities are considered a primary contributing element differentiating corporate performance from other firms. The close relationship between marketing capabilities and firm performance is particularly plausible. Marketing capabilities involve an integrative process designed to apply the knowledge, skills, and collective assets of firms to market-related business essentials; hence, businesses are able to add value to their products and services, adapt to market conditions, maximize market opportunities, and meet competitive threats, thereby enhancing organizational performance (Park et al., 2009).

Previous studies have confirmed the association between marketing capabilities and competitive advantage or firm performance. Martin et al. (2020) find from an experiment exploring international new ventures that marketing capabilities are a basis of competitive advantage. Sharma et al. (2018) use data from 154 Vietnamese manufacturing exporters as bases to determine that the increase in marketing capabilities of these firms is a conduit leading to their enhanced performance. Sun et al. (2019) state that MNCs seek to gain global competitive advantage via strategic international expansion targeting long-term performance improvements, and that firms’ marketing capability is one of the most powerful aspects giving rise to market advantages. Sun et al. (2019) collect a huge amount of data from multiple sources and show that high marketing capability contributes to international expansion and yields better outcomes over an extended period, whereas a low level of such a capability does not result in positive consequences. The same results are also provided by other empirical studies, such as Eisend et al. (2016) and Martina et al. (2020). Park et al. (2009) indicate that marketing capabilities could make firms compete against local rivals, even if there is the latter’s cost differential advantage. Such cost differentials between MNCs and local firms can be induced, for example, by local protectionism. Moreover, the results of these empirical studies imply that MNCs’ possession of marketing capabilities may lessen the negative impact of protectionism and unfavorable business environment on performance.

Hypothesis 3

The negative relationship between local protectionism and performance of MNC subsidiaries is positively moderated by the possession of their marketing capabilities.

3.4 Degree of Government–Firm Relationship

Host governments’ protective policies installing barriers to block foreign investments and discriminate against foreign operations from local entrepreneurs are a huge challenge for MNC subsidiaries to boost their businesses in an overseas market. In the case where any discrepancy between anticipations and actual performance occurs, MNC subsidiaries better think about the emergence of public issues (i.e., relationship between MNC and various levels of government) (Mukherjee et al., 2018). Host government intervention, in terms of policy and regulations, changes the market environment for MNC subsidiaries in most countries (Cavusgil et al., 2020). Foreign firms gradually encounter operational difficulties in escalating their brand value among stakeholder groups, thereby increasingly influencing their performance and productivity (Ewing et al., 2010). From the perspective of MNC subsidiaries, the creation of a favorable atmosphere with central and local governments is significant in developing and sustaining organizational competitiveness in host countries (Lu et al., 2021). In many examples, relational links between MNC subsidiaries and the government function as sources of credibility within the wider community. relational links can also provide a competitive advantage for attracting customers, accumulating good quality of human capital, and expediting development approval processes (Ewing et al., 2010).

The Asian Development Bank (2003) explains that government policies toward a business-friendly environment and firms’ sociable connection with government officials often yield a positive impact on business growth performance. Long and Yang (2016) state that local governments have a propensity to exert strong control over the distribution of key economic resources, thereby motivating firms to cultivate reciprocal relations with the government to secure access to crucial resources. In addition, firms’ timely securement of the necessary resources based on friendly relationships with the government can lead to performance improvement. Banerjee and Venaik (2018) examine the impact of the association between the government and firms. They find that government–firm bargaining relationship is a critical determinant, significantly affecting firm performance. Ewing et al. (2010) similarly document that firms’ good relationship with the government helps “lubricate” business negotiations and increase commercial opportunities. They also identify that relationships between MNCs and local government are considerably vital strategic tools used by firms to maintain and raise their reputation. Josephson et al. (2019) argue that the government is a market regulator, serving as a market overseer and investigating the influences of public policies on corporate performance. Therefore, any negative effect triggered by protectionism may be reduced when MNC subsidiaries have a strong political connection with local governments.

Hypothesis 4

The negative relationship between local protectionism and performance of MNC subsidiaries is positively moderated by their degree of government–firm relationship.

4 Methods

4.1 Data and Sample

To test our hypotheses, we utilized data from a sample of MNC subsidiaries operating in the manufacturing sector of China. The reason is that the manufacturing sector has been the most prominent in absorbing FDI flows into China over the past decades. With the rapid economic development and increasing openness to attract FDI over the last several decades, China has become the world’s second largest annual FDI recipient after the US, and the largest annual FDI beneficiary among developing economies, accounting for over 20% of the total FDI flows to developing economies (UNCTAD 2020). China has remained one of the most attractive destinations for FDI globally despite severe pressure on current global FDI flows owing to the effects of the China–US trade tensions over the past few years and the current cascading effects of the COVID-19 pandemic. Thus, China represents an ideal setting to explore our central research question, which underlies a substantial portion of IB studies, of whether and how much host-market local protectionism matters in explaining the variation in the performance of MNCs’ foreign subsidiaries operating overseas.

Varying levels of protectionism exist across different subnational regions in China, supported by the preponderance of empirical evidence (e.g., Bai et al., 2004; Luo et al., 2021). Significant heterogeneity in the regional protectionism level in China enables us to expect a visible relationship between local protectionism and the performance of MNCs’ subsidiaries. China, as the world’s largest emerging economy, has been experiencing ongoing institutional transformation by incrementally enhancing market-oriented institutional reform and market liberalization over the past 40 years (Xiao et al., 2019). Variation in protectionism across subnational regions in China makes it a strong target for collecting the rich primary data necessary to test our hypotheses empirically.

We developed a unique longitudinal data set for empirical analysis by primarily drawing from the Annual Industrial Survey Database (2001–2007) of the Chinese NBS. This database provides the most comprehensive demographic and financial information on local and foreign-invested firms with independent legal status and accounting systems, the annual sales of which exceed 5 million yuan (approximately USD 658,000 based on the average exchange rate in 2007). In 2007, the database covered approximately 95% of the total manufacturing output in China and firms operating in approximately 40 two-digit industries. The NBS database has been generally accurate and internally consistent for empirical analyses and has been used by many previous strategic management and IB studies (e.g., Deng et al., 2018; Xiao & Park, 2018). We chose the panel data from 2001 to 2007 because the sample period has witnessed significant changes in FDI inflows and regional protectionism since China’s accession to the WTO in late 2001. Since China’s entry into WTO, FDI inflows into China have maintained a rapid growth, which increased from USD 46.88 billion in 2001 to USD 74.77 billion in 2007, up by an annual average of 8.2%. We chose 2007 as the ending year to avoid the confounding effects of the 2008 global financial crisis. After removing observations with missing data on key variables or unrealistic numbers possibly from data entry errors, we constructed a final unbalanced panel consisting of 158,387 firm-year observations, which included 64,898 MNC subsidiaries operating in the Chinese manufacturing sector. All financial figures are real annual figures deflated to the base year of 1990 to remove the effects of deflation or inflation from price changes over time.

4.2 Variables and Measurement

4.2.1 Dependent Variable

The emphasis of this exploratory research was examining how protectionism at the subnational regional level within the host country may explain the variation of MNC subsidiary performance. To better understand this connection, we chose to measure our dependent variable using two levels of performance, which can help us better determine performance outcomes because each performance measure has its own set of strengths and weaknesses (e.g., Hult et al., 2008). The first performance measure is return on assets (ROA), which is the most common financial performance measure, defined as net income divided by total assets (Xiao et al., 2019). Our second performance measure is innovation performance, defined as new product sales divided by total sales (Deng et al., 2018). We selected innovation performance because it reflects the use of ideas or creativity to enhance products, processes, and procedures that increase the significance and usefulness of manufacturing firms’ products (Choi et al., 2012).

4.2.2 Independent Variables

This study employs four primary independent variables: local protectionism, technological capability, marketing capability, and government–firm relationship. The regional market openness index, developed by the National Economic Research Institute (NERI) from 2001 to 2007, reflects the reduction of local protectionism in Mainland China’s 31 regions at the provincial level (Fan et al., 2011). Higher regional market openness reflects lower regional protectionism. In measuring the degree of local protectionism, we reverse coded this longitudinal regional market openness index by multiplying it by − 1, so that higher values reflected higher levels of local protectionism.

To measure technological capabilities, we used R&D investment, defined as the ratio of R&D expenses to total sales, which is the most used approach in the literature (e.g., Kotabe et al., 2002). By investing substantial resources in R&D, an MNC subsidiary can build its technological capability by investing substantial resources in R&D. Similar to Kotabe et al. (2002), we used marketing investments to measure firm marketing capabilities, which are defined as the ratio of advertising expenditures divided by total sales. A higher level of advertising investment as a percentage of an MNC subsidiary’s total sales reflects the firm’s substantial effort in building its marketing capability. We measured the degree of government–firm relationship using the different levels of government with which an MNC subsidiary is affiliated. In China, all firms, including local and foreign-invested firms, remain under the jurisdiction of various levels of government, which is called lishu in China, such as the central, provincial, city/prefecture, county, and other lower levels. We followed prior studies (Xiao et al., 2013) and used a continuous scale, ranging from 1 to 10, to reflect the different degrees of government–firm relationships.

4.2.3 Control Variables

We included several control variables: MNC subsidiaries’ entry mode choice, firm size, firm age, intangible asset ratio, financial leverage, fixed assets ratio, export intensity, and dummies for industry, region, and year. We included a dichotomous variable, wholly owned subsidiaries (code 1) from international joint ventures (coded 0). We measured firm size using the natural logarithm of a foreign subsidiary’s total assets to control the potential effects of differences in economies of scale. We measured firm age as the number of years since a foreign subsidiary’s establishment in China to determine the effect of organizational life cycle on firm performance. To control the importance of a foreign subsidiary’s intangible assets in shaping firm performance, we incorporated intangible assets ratio, defined as intangible assets divided by total assets, as a control in the model to predict firm performance. We measured financial leverage as the ratio of total debt to total assets. We also measured fixed assets ratio using the ratio of fixed assets to total assets to control the importance of a firm’s capital intensity in predicting its firm performance. We used export intensity, defined as export value divided by total sales, to determine the importance of exports in predicting firm performance. To control for any industry, region, or year effects, we included the two-digit industry, two-digit area, and year dummies in the models.

5 Analysis and Results

Given that we used a firm-level panel data set to test our hypotheses, the unit of analysis is at the foreign subsidiary level. This study’s focus is on between-subsidiary variation (i.e., differential effects of local protectionism between MNC subsidiaries) rather than within-subsidiary variation (i.e., changing effects of local protectionism in an MNC subsidiary over time). Given the objective of this study, we used random effects as our estimation because this estimation technique is more appropriate in this case. Moreover, the fixed-effects model does not allow the inclusion of variables that do not vary over time (Judge et al., 1985). Given that our moderating variable of the degree of government–firm relationship is constant for some firms and the industry and region dummies used to control for unobserved heterogeneity do not vary across time, using the fixed-effects approach is inappropriate. This approach requires variance in dependent and independent variables to ensure that these variables are distinguishable from the fixed effects. The same (i.e., random effects) estimation approach has been widely used in prior studies (e.g., Chung et al., 2010; Xiao et al., 2013). To minimize the possible endogeneity problem, we lagged all time variant independent variables and control variables in the estimations by one year.

Table 1 presents the descriptive statistics and correlations for the variables. Although the coefficients are below 0.37, we conducted variance inflation factor (VIF) tests. The average VIF value in models and all VIF values of the variables involved in the interaction effects are considerably below 2, suggesting no serious concern of multicollinearity. Nonetheless, we followed Aiken and West’s (1991) recommendation for testing interaction effects and mean-centered all variables used in creating the interaction terms before analysis to further minimize the potential for multicollinearity and increase the interpretability of interaction.

We present the results of the tests of our hypotheses in Tables 2 and 3. Table 2 shows our regression results using firm ROA. Table 3 provides the results of the same models using firm-level innovation performance. All regression models include the control and dummy variables to control for industry, year, and region effects; and the interaction terms are added sequentially. Model 1 in each table is the baseline model with the control variables only. Model 2 in each table tests Hypothesis 1 (i.e., main effect of regional protectionism on firm ROA or innovation performance). Models 3, 4, and 5 in each table test Hypotheses 2, 3, and 4, respectively. Model 6 in each table is the full model testing Hypotheses 1–4, with all variables included. The significance level of the Wald chi-squared statistics shown in each model in Tables 2 and 3 indicates that the explanatory variables explain a significant portion of the variation in the dependent variables (i.e., ROA or innovation). The significance of the explanatory variables’ coefficients indicates support for the hypotheses.

As shown in Model 2 of Table 2, the coefficient of the term representing the effect of regional protectionism is positive and significant for firm ROA (β = 0.008, p < 0.01). In terms of magnitude, the unstandardized coefficient of local protectionism was 0.008, suggesting that each local protectionism is related to a 0.008-point increase in ROA. Given that standard deviation of ROA was 0.305 (Table 1), the 0.008-point increase in ROA is equivalent to 0.026 standard deviations (i.e., 0.008/0.305). As local protectionism has a positive and statistically significant influence on ROA, Hypothesis 1 is not supported using the performance measure of ROA. One plausible explanation is that MNC subsidiaries may enjoy the benefits of efficiency in exploiting many additional observable and, more importantly, unobservable heterogeneous ownership advantages over their counterparts in the protected regional market, where market rules and interregional competition forces are not well-developed.

Moreover, similar local to firms, MNC subsidiaries that have already invested in a highly protectionist region may benefit from trade protection policies, such as tariff or nontariff trade barriers imposed in the region on imported products, enabling them to earn economic rent from protectionism. An additional alternative explanation for the positive effect of regional protectionism on ROA of MNC subsidiaries is that those subsidiaries investing in highly protectionist regions may become more profitable than those in less protectionist regions. The reason is that the strong local protectionism in a region may lead to decreased local competition, nourishing inefficiencies and making product market supply unable to meet demand. In this case of product supply/demand imbalances, MNC subsidiaries may achieve significant gains from the charging of a premium price and, consequently, become markedly profitable (measured by ROA). These unexpected benefits from local protectionism can be considered among the unique protectionism rents.

Hypotheses 2, 3, and 4 expect that MNC subsidiaries’ technological and marketing capabilities and their capability in developing a government–firm relationship can weaken the negative effect of protectionism on firm performance. As shown in Models 3 and 4 of Table 2, coefficients of the terms representing the interactions of regional protectionism with technological and marketing capabilities are statistically nonsignificant (technological capability: β = − 0.096, n.s.; marketing capability: β = − 0.143, n.s.). Accordingly, the role of technological or marketing capabilities in positively moderating the contribution of regional protectionism to firm performance is not supported using the performance measure of ROA. Although we find that the technological capabilities of an MNC subsidiary appear minimally important in influencing the contribution of regional protectionism to ROA of the subsidiary, the importance of developing technological knowledge in sufficiently compensating for their LOF and limiting competition for local firms should not be underestimated. A plausible explanation for the insignificant moderating effect of marketing capabilities is that investment and effort in developing marketing capabilities to analyze the market environment, predict changes in customer needs or preferences, and differentiate their products from competitors may become unnecessary when the market-oriented rules or systems are not effectively developed. In this regard, we expect that when investing in a region with greater institutional barriers, the marketing effort of MNC subsidiaries may simply become additional unnecessary costs. An additional alternative and markedly plausible explanation for the unexpected finding (i.e., moderating effect of technological or marketing capabilities) is that some managerial skills and organizational knowledge may be required for MNC subsidiaries to achieve better financial performance by efficiently utilizing their technological or marketing competencies.

As shown in Model 5 of Table 2, coefficient of the term representing the interaction of regional protectionism with the government–firm relationship is statistically significant but negative (β = − 0.001, p < 0.01). This finding reveals that the government–firm relationship can further strengthen the negative contribution of regional protectionism to firm ROA. In terms of magnitude, the result suggests that MNC subsidiaries with low-level government–firm relationship had a strongly positive relationship between local protectionism and ROA (β = 0.010). Meanwhile, firms with high-level government–firm relationship exhibited a weakly positive slope for this relationship (β = 0.006). Given that government–firm relationship negatively moderates the relationship between local protectionism and firm performance, Hypothesis 4 is unsupported using the performance measure of ROA. A plausible explanation is that forming a close institutional relationship with hierarchically ranked governments may become a burdensome institutional arrangement. Subsidiaries can be required to align their interests with those non-commercial interests driven by political and social objectives or pressures of the host-country governments they are affiliated with in the region, resulting in poor performance relative to the less or non-politically connected subsidiaries (Sun et al., 2010). Another alternatively plausible explanation for this finding is that MNC subsidiaries tied to lower-level governments may enjoy strong local protectionism imposed by the local governments to protect these subsidiaries from intense local market protection by means of creating various trade barriers, different special preferences in accessing key resources, and administrative policies. Such behaviors of local governments are possibly motivated because earnings of these subsidiaries are directly tied to low-level governments’ revenues.

To facilitate interpretation, we plotted the significant interaction effect of regional protectionism and government–firm relationship in Model 5 of Table 2 in Fig. 1. In this figure, regional protectionism and government–firm relationship take the values of one standard deviation below and above the mean, respectively. As shown in Fig. 1, the positive effect of regional protectionism on ROA of MNC subsidiaries is weaker when the subsidiaries are closely affiliated with higher-level government (i.e., under high-level governmental jurisdiction) than when they are affiliated with lower-level government (i.e., under low-level governmental jurisdiction). The findings shown in the full model (i.e., Model 6 of Table 2) with all variables included demonstrate that all effects are generally similar to previous models.

In Table 3, we test Hypothesis 1 to examine the contribution of regional protectionism to firm innovation. As shown in Model 2 of Table 3, the contribution of regional protectionism to firm innovation is negative and statistically significant (β = − 0.007, p < 0.01), which is consistent with our prediction. In terms of magnitude, the finding suggests that each local protectionism was related to a 0.007-point decrease in innovation performance. Given that the standard deviation of innovation performance was 0.216 (Table 1), the 0.007-point decrease in innovation performance is equivalent to 0.032 standard deviations (i.e., 0.007/0.216). Therefore, Hypothesis 1 is strongly supported by using the performance measure of firm innovation. In Models 3, 4, and 5 of Table 3, we tested Hypotheses 2, 3, and 4, respectively, regarding the effects of MNC subsidiaries’ technological capability, marketing capability, and government–firm relationship on the contribution of regional protectionism to firm innovation. In Model 3 of Table 3, coefficient of the interaction of regional protectionism with technological capability is positive and statistically significant (β = 0.211, p < 0.01). Thus, Hypothesis 2 is strongly supported using the performance measure of innovation. In terms of magnitude, the result suggests that MNC subsidiaries with high-level technological capability had a weak negative relationship between local protectionism and innovation performance (β = − 0.005). Meanwhile, firms with low-level technological capability exhibited a strong negative slope for this relationship (β = − 0.011).

To facilitate interpretation, we plotted the results of the significant interaction effect of regional protectionism and technological capability measured as R&D intensity in Model 3 of Table 3 in Fig. 2. In this figure, regional protectionism and technological capability take the values of one standard deviation below and above the mean, respectively. As shown in Fig. 2, the negative effect of regional protectionism on the innovation of MNC subsidiaries is weaker when the subsidiaries have a strong technological capability than when they have a weak technological capability.

In Model 4 of Table 3, coefficient of the interaction term of regional protectionism with marketing capability is statistically nonsignificant (β = − 0.036, n.s.). Again, we failed to find support for Hypothesis 3 using the performance measure of innovation. Moreover, maximizing their marketing resources or capabilities, such as reputational assets (e.g., brand image and name in the market) and relational resources (e.g., close ties with customers and business partners), and transferring them effectively to enhance product innovation performance may be difficult for MNC subsidiaries. Similar to the effect of technological capability, coefficient of the interaction of regional protectionism with the government–firm relationship in Model 5 of Table 3 is positive and statistically significant (β = 0.001, p < 0.01). This result provides strong support for Hypothesis 4 using the performance measure of innovation. In terms of magnitude, the result suggests that MNC subsidiaries with a high level of government–firm relationship had a weakly negative relationship between local protectionism and innovation performance (β = − 0.005). Meanwhile, firms with low-level government–firm relationship exhibited a strong negative slope for this relationship (β = − 0.009).

To facilitate interpretation, we plotted the results of the significant interaction effect of regional protectionism and government–firm relationship in Model 5 of Table 3 in Fig. 3. In this figure, regional protectionism and government–firm relationship take the values of one standard deviation below and above the mean. As shown in Fig. 3, the negative effect of regional protectionism on the innovation of MNC subsidiaries is weaker when foreign subsidiaries are closely affiliated with higher-level government (i.e., under high-level governmental jurisdiction) than when they are affiliated with lower-level government (i.e., under low-level governmental jurisdiction). The results of the full model (Model 6 in Table 3) with all variables included are generally consistent with the evidence of previous models.

For reference, we demonstrated the robustness of our findings by employing a series of robustness tests and also confirmed that the presence of an endogeneity issue is negligible through the Heckman two-stage procedure (Heckman, 1979; Xiao et al., 2013). The detailed results of these tests are available upon request.

6 Discussion and Conclusion

6.1 Theoretical and Practical Implications

Our study presents the following theoretical implications for scholars. First, this research finds that industry policy at the subnational level is not a monolithic structure. Thus, industry policy does not uniformly curb firm-level performance, but its impact is contingent on the use of different performance measures. These results challenge the conventional wisdom that protectionism tends to be constantly beneficial to domestic firms and detrimental to MNCs. These findings are aligned with the “local autonomy model” (Young, 2000). Local governments have a strong incentive to maximize the tax revenue by shielding firms and industries’ boundaries of their regime (Bai et al., 2004).

Second, we find that the impact of regional protectionism is negatively associated with MNC subsidiaries’ innovative performance. Initially, these findings also look counter-intuitive. However, previous literature has repeatedly suggested that government interference holds back firms’ innovative activities. Lenway et al. (1996) find that trade protectionism in the US steel industry reduces the returns to innovation and encourages innovative firms to exit. Espeli (1997) posits that protectionism in the Norwegian textile industry reduces management and workers’ responsibility for firms’ future and plays an effective barrier against innovative orientation. That is, our statistical results and the extant empirical studies show that regional protectionism in local markets functions as a hurdle inhibiting firms’ innovation, and it (i.e., protectionism) proves challenging for them to develop new products and subsequent relevant sales. Our findings suggest a distinct perspective on local protectionism’s role in shaping the performance of MNC subsidiaries using different performance measures. Regional protectionism plays a role in blocking new foreign entries into China, thereby creating serious market imperfections. That is, protectionism provides a chance for foreign firms already operating in the internal (i.e., local) market to maximize earnings through market imperfections.

Third, this research takes an in-depth look into firm-level moderators for the consequence of protectionism. According to institutional theory, the external policy environment provides the rules of the game or legitimacy for MNC subsidiaries in formal and informal ways, including enforcing their culture and granting trade licenses/permission. This study further extends the lens of institutional theory by highlighting the active role of firms’ strategic capabilities and provides new insight into how firms respond to the subnational environment by utilizing various firm resources. Thus, our study contributes a more fully formulated explanation for the factors of how MNC subsidiaries defend themselves from the hostile policies of host countries or even successfully leverage it. Most previous studies on this topic have investigated the direct relationship between protectionism and firm performance (e.g., Keay, 2019). Such measures mainly describe corruption at the national level and fail to capture firm-level reactions. Our study suggests that national or subnational institutions cannot homogeneously affect every foreign subsidiary within the same administrative regions, thereby advising researchers on how to incorporate institutional theory to minutely and precisely test the relevant topics.

On the practical side, our study provides a useful practical implication for MNC subsidiaries when adapting to the institutional environment imposed by local governments’ industry policies. Our results show how protectionism and firm-level capabilities jointly affect MNC subsidiaries’ performance. We explain how MNCs plan to enter a foreign market or already operating overseas, respond to institutional pressure in the host country, and adapt to the new environment. Firms planning to enter foreign markets should consider the protectionism level and their internal capabilities and adjust their strategies accordingly. For example, government–firm relationship may promote firms’ short-term financial performance (i.e., ROA) but possibly negatively affect their long-term competitiveness in that it mitigates firms’ effort to improve organizational efficiency and effectiveness, resulting in long-term deterioration. The idea corresponds with the extant literature on the role of political connection. Some scholars (e.g., Fan et al., 2007) argue that political connection leads to an inferior governance structure and is detrimental to firm performance. Managers of MNC subsidiaries may sort out their business priorities and use corporate strategies flexibly thereafter. For example, if MNC subsidiaries attempt to achieve immediate financial improvement, then building a new political connection can help achieve this goal. If MNC subsidiaries aim to escalate long-term performance, then subsidiary managers should carefully think of how to link the relationship to firm innovation rather than merely being satisfied with the enhancement of short-term financial performance. Our findings provide a practical guideline for MNCs to adjust to the host countries’ uncertain environments.

Second, a plausible explanation for the positive effect of regional protectionism on MNC subsidiaries’ profitability is that these subsidiaries that are already incumbent on the market and have high status market power may enjoy the limited competition generated by protectionism. Our findings suggest that protectionism at the subnational level in China does not discriminate MNC subsidiaries from local firms. Nevertheless, subsidiary managers should remember that local governments care more about potential contributors to their regional economic growth.

Third, our finding may suggest a practical implication for the decision on where to locate investment. The choice of location of FDI by MNC has long been the subject of intense scrutiny, given that numerous studies have examined the determinants of location choice of FDI (e.g., Nielsen et al., 2017). Our mixed impact of local protectionism on different MNC performance measurements may offer further implications for MNC managers. For example, MNCs with business domain related to information and communications technology and that need to pursue innovation or knowledge creation in the host market may need to locate in regions with minimal local protectionism. By contrast, MNC subsidiaries, which are based on traditional industries and need to pursue short-term financial performance as a top priority, may choose to enter areas where local protectionism is strong.

6.2 Limitations and Future Research Avenues

Despite this study’s important contributions, our research also has limitations. First, the measurement of protectionism is based on the degree of overall institutional constraints. Future studies may employ alternative measures for local protectionism at the national and region level, such as the more recent trade protectionist measures resorted by the US and the countermeasures taken by China against the US trade protectionism. Moreover, prospective studies may explore how and to what extent such protectionist policies and trade wars may, directly and indirectly, shape the performance of MNC subsidiaries. Second, our analyses are restricted to a host market, namely, China. The generalizability of our findings to other market contexts should be made with significant caution. Third, we are convinced that the subsidiary mandate that it plays within the MNC network may also likely shape the performance of MNC subsidiaries or the effect of institutional arrangements (e.g., regional protectionism) on their performance. However, data unavailability does not allow us to control for such possible effects. Thus, we are optimistic that future research can investigate how the different strategic choices (e.g., market-seeking, knowledge exploitation, or resource-scanning) of the subsidiary parent firms affect the performance of foreign subsidiaries. In particular, we investigate the importance of firm capabilities at the subsidiary level in explaining the contribution of regional protectionism to firm performance by assuming MNC subsidiaries to be relatively independent of their MNC headquarters and the MNC global network. However, as noted by prior studies (e.g., Cano-Kollmann et al., 2016), the unique relationship between MNC headquarters and foreign subsidiaries may cause the agency problem to emerge and makes MNC subsidiaries benefit more from the international knowledge connectivity to generate competitive capabilities needed for overcoming local protectionism effect in their innovation. We are optimistic that future research to investigate the underlying mechanisms through which MNC subsidiaries can enjoy their unique MNC-foreign subsidiary linkages or global knowledge connectivity to mitigate the local protectionism effect on their innovation. Lastly, performance measurement is at the heart of IB research (Hult et al., 2008). The current study finds that protectionism at the regional level tends to shape MNC subsidiaries’ performance distinctly for different performance measures. Although we particularly explore how subnational regional protectionism influences the innovation of foreign subsidiaries, the innovation itself may reflect different meanings for the subsidiaries according to the stages of industry life cycle. Thus, future research is encouraged to explore the potential effects of changes in life cycle stages and validate our results by exploring the protectionism effect using other performance measures.

Change history

18 December 2023

A Correction to this paper has been published: https://doi.org/10.1007/s11575-023-00526-0

Notes

Our institutional theory is likely to be associated with the institution-based view (Peng et al., 2009).

Extended RBV emphasizes tangible and intangible resources that can be the source of competitive advantage. (Xiao et al., 2020).

Extended firm resources (e.g., all different types of firm-specific resources, including social capital possessed by foreign subsidiaries) may play a pivotal role in overcoming unfavorable institutional environments. Accordingly, when we examine firm performance, we may need to simultaneously examine internal strategic resources and subnational institutional variations.

References

Aiken, L. S., & West, S. G. (1991). Multiple regression: Testing and interpreting interactions. Sage Publications.

Asian Development Bank. (2003). Asian Development Outlook 2003: Competitiveness in developing Asia. Asian Development Bank.

Bai, C. E., Du, Y., Tao, Z., & Tong, S. Y. (2004). Local protectionism and regional specialization: Evidence from China’s industries. Journal of International Economics, 63(2), 397–417.

Balabanis, G., Diamantopoulos, A., Mueller, R. D., & Melewar, T. C. (2001). The impact of nationalism, patriotism and internationalism on consumer ethnocentric tendencies. Journal of International Business Studies, 32(1), 157–175.

Banerjee, S., & Venaik, S. (2018). The effect of corporate political activity on MNC subsidiary legitimacy: An institutional perspective. Management International Review, 58(5), 813–844.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Cano-Kollmann, M., Cantwell, J., Hannigan, T. J., Mudambi, R., & Song, J. (2016). Knowledge connectivity: An agenda for innovation research in international business. Journal of International Business Studies, 47, 255–262.

Cavusgil, S. T., Deligonul, S., Ghauri, P. N., Bamiatzi, V., Park, B. I., & Mellahi, K. (2020). Risk in international business and its mitigation. Journal of World Business, 55(2), 101078.

Choi, S. B., Park, B. I., & Hong, P. (2012). Does ownership structure matter for firm technological innovation performance? The case of korean firms. Corporate Governance: An International Review, 20(3), 267–288.

Chung, C., Lee, S. H., & Beamish, P. (2010). Subsidiary expansion/contraction during times of economic crisis. Journal of International Business Studies, 41, 500–516.

Contractor, F. J. (2022). The world economy will need even more globalization in the post-pandemic 2021 decade. Journal of International Business Studies, 53, 156–171.

Deng, Z., Jean, R. J. B., & Sinkovics, R. R. (2018). Rapid expansion of international new ventures across institutional distance. Journal of International Business Studies, 49(8), 1010–1032.

Dunning, J. H. (1977). Trade, location of economic activity and the MNE: A search for an eclectic approach. In B. Ohlin, P. O. Hesselborn, & P. M. Wijkman (Eds.), The International Allocation of Economic Activity. Palgrave Macmillan. https://doi.org/10.1007/978-1-349-03196-2_38.

Eisend, M., Evanschitzky, H., & Calantone, R. J. (2016). The relative advantage of marketing over technological capabilities in influencing new product performance: The moderating role of country institutions. Journal of International Marketing, 4(1), 41–56.

Elg, U., & Ghauri, P. N. (2021). A global marketing logic: Local stakeholders’ influence in diverse emerging markets. International Marketing Review, 38(6), 1166–1188.

Espeli, H. (1997). Protectionism, lobbying and innovation. Perspectives on the development of the norwegian textile industry, especially since 1940. Scandinavian Economic History Review, 45(3), 257–275.

Evenett, S. J. (2019). Protectionism, state discrimination, and international business since the onset of the Global Financial Crisis. Journal of International Business Policy, 2(1), 9–36.

Ewing, M. T., Windisch, L., & Newton, F. J. (2010). Corporate reputation in the people’s Republic of China: A B2B perspective. Industrial Marketing Management, 39, 728–736.

Fan, J. P., Wong, T. J., & Zhang, T. (2007). Politically connected CEOs, corporate governance, and Post-IPO performance of China’s newly partially privatized firms. Journal of Financial Economics, 84(2), 330–357.

Fan, G., Wang, X. L., & Zhu, H. P. (2011). NERI INDEX of marketization of China’s provinces report. Economic Science Publishing House.

Frattaroli, M. (2020). Does protectionist anti-takeover legislation lead to managerial entrenchment? Journal of Financial Economics, 136, 106–136.

Gardberg, N. A., & Fombrun, C. (2006). Corporate citizenship: Creating intangible assets across institutional environments. Academy of Management Review, 31(2), 329–346.

Ghauri, P., Wang, F., Elg, U., & Rosendo-Ríos, V. (2016). Market driving strategies: Beyond localization. Journal of Business Research, 69(12), 5682–5693.

Ghauri, P., Strange, R., & Cooke, F. L. (2021). Research on international business: The new realities. International Business Review, 30(2), 101794.

Grahovac, J., & Miller, D. J. (2009). Competitive advantage and performance: The impact of value creation and costliness of imitation. Strategic Management Journal, 30(11), 1192–1212.

Heckman, J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–161.

Hult, G., Ketchen, D., Griffith, D., Chabowski, B. R., Hamman, M. K., Dykes, B. J., Pollitte, W. A., & Cavusgil, S. T. (2008). An assessment of the measurement of performance in international business research. Journal of International Business Studies, 39, 1064–1080.

Isobe, T., Makino, S., & Montgomery, D. B. (2008). Technological capabilities and firm performance: The case of small manufacturing firms in Japan. Asia Pacific Journal of Management, 25, 413–428.

Josephson, B. W., Lee, J. Y., Mariadoss, B. J., & Johnson, J. L. (2019). Uncle Sam rising: Performance implications of business-to-government relationships. Journal of Marketing, 83(1), 51–72.

Judge, G. G., Griffiths, W. E., Hill, R. C., & Lee, T. C. (1985). The theory and practice of econometrics. Wiley.

Keay, I. (2019). Protection for maturing industries: Evidence from canadian trade patterns and trade policy, 1870–1913. Canadian Journal of Economics, 52(4), 1464–1496.

Kotabe, M., Srinivasan, S., & Aulakh, P. (2002). Multinationality and firm performance: The moderating role of R&D and marketing capabilities. Journal of International Business Studies, 33, 79–97.

Lall, S. (1993). Understanding technology development. Development and Change, 24(4), 719–753.

Lenway, S., Morck, R., & Yeung, B. (1996). Rent seeking, protectionism and innovation in the american steel industry. The Economic Journal, 106, 410–421.

Long, C., & Yang, J. (2016). What explains chinese private entrepreneurs’ charitable behaviors? —A story of dynamic reciprocal relationship between firms and the government. China Economic Review, 40, 1–16.

Lu, J., Choi, S. J., Jiménez, A., & Bayraktar, S. (2021). Bribery in emerging economies: an integration of institutional and non-market position perspective. Asia Pacific Journal of Management, forthcoming.

Luo, H., Liu, X., Wu, A., & Zhong, X. (2021). Is it possible to escape? Local protectionism and outward foreign direct investment by chinese privately-owned enterprises. Asia Pacific Journal of Management, 38, 1499–1524.

Ma, X., Tong, T., & Fitza, M. (2013). How much does subnational region matter to foreign subsidiary performance? Evidence from Fortune Global 500 corporations’ investment in China. Journal of International Business Studies, 44, 66–87.

Martin, S. L., Javalgib, R. R. G., & Ciravegna, L. (2020). Marketing capabilities and international new venture performance: The mediation role of marketing communication and the moderation effect of technological turbulence. Journal of Business Research, 107, 25–37.

Meyer, K. E., & Nguyen, H. V. (2005). Foreign investment strategies and sub-national institutions in emerging markets: Evidence from Vietnam. Journal of Management Studies, 42(1), 63–93.

Meyer, K. E., & Thein, H. H. (2014). Business under adverse home country institutions: The case of international sanctions against Myanmar. Journal of World Business, 49(1), 156–171.

Moorman, C., & Slotegraaf, R. J. (1999). The contingency value of complementary capabilities in product development. Journal of Marketing Research, 36, 239–257.

Mukherjee, D., Makarius, E. E., & Stevens, C. E. (2018). Business group reputation and affiliates’ internationalization strategies. Journal of World Business, 53(2), 93–103.

Nguyen, H. T. T., Larimo, J., & Ghauri, P. (2022). Understanding foreign divestment: The impacts of economic and political friction. Journal of Business Research, 139, 675–691.

Nielsen, B. B., Asmussen, C. G., & Weatherall, C. D. (2017). The location choice of foreign direct investments: Empirical evidence and methodological challenges. Journal of World Business, 52(1), 62–82.

Park, B. I. (2010). What matters to managerial knowledge acquisition in international joint ventures? High knowledge acquirers versus low knowledge acquirers. Asia Pacific Journal of Management, 27, 55–79.

Park, B. I., & Ghauri, P. N. (2011). Key factors affecting acquisition of technological capabilities from foreign acquiring firms by small and medium sized local firms. Journal of World Business, 46, 116–125.

Park, B. I., Whitelock, J., & Giroud, A. (2009). Acquisition of marketing knowledge in small and medium-sized IJVs: The role of compatibility between parents. Management Decision, 47, 1340–1356.

Paul, J., & Rosado-Serrano, A. (2019). Gradual internationalization vs born-global/international new venture models: A review and research agenda. International Marketing Review, 36(6), 830–858.

Peng, M. W., Sun, S. L., Pinkham, B., & Ghen, H. (2009). The institution-based view as a third leg for a strategy tripod. Academy of Management Perspectives, 23(4), 63–81.

Popli, M., Ladkani, R. M., & Gaur, A. S. (2017). Business group affiliation and post-acquisition performance: An extended resource-based view. Journal of Business Research, 81, 21–30.

Poudel, K. P., Carter, R., & Lonial, S. (2019). The impact of entrepreneurial orientation, technological capability, and consumer attitude on firm performance: A multi-theory perspective. Journal of Small Business Management, 57(S2), 268–295.

Rammal, H. G., Rose, E. L., Ghauri, P. N., Jensen, P. D. Ø., Kipping, M., Petersen, B., & Scerri, M. (2022). Economic nationalism and internationalization of services: Review and research agenda. Journal of World Business, 57(3), 101314.

Sharma, R. R., Nguyen, T. K., & Crick, D. (2018). Exploitation strategy and performance of contract manufacturing exporters: The mediating roles of exploration strategy and marketing capability. Journal of International Management, 24, 271–283.

Shi, W. S., Sun, S. L., & Peng, M. W. (2012). Sub-national institutional contingencies, network positions, and IJV partner selection. Journal of Management Studies, 49(7), 1221–1245.

Sun, P., Mellahi, K., & Thun, E. (2010). The dynamic value of MNE political embeddedness: The case of the chinese automobile industry. Journal of International Business Studies, 41, 1161–1182.

Sun, W., Price, J., &d, & Ding, Y. (2019). The longitudinal effects of internationalization on firm performance: The moderating role of marketing capability. Journal of Business Research, 95, 326–337.

Tsai, K. H. (2004). The impact of technological capability on firm performance in Taiwan’s electronics industry. The Journal of High Technology Management Research, 15(2), 183–195.

UNCTAD (The United Nations Conference on Trade and Development). (2020). World investment report-international production beyond the pandemic. UNCATD.

Wan, F., Williamson, P., & Pandit, N. R. (2020). MNE liability of foreignness versus local firm-specific advantages: The case of the Chinese management software industry. International Business Review, 29(1), #101623.

Wu, J., Ma, Z., & Liu, Z. (2019). The moderated mediating effect of international diversification, technological capability, and market orientation on emerging market firms’ new product performance. Journal of Business Research, 99, 524–533.

Xiao, S. F., & Park, B. I. (2018). Bring institutions into FDI spillover research: Exploring the impact of ownership restructuring and institutional development in emerging economies. International Business Review, 27(1), 289–308.

Xiao, S. F., Jeong, I., Moon, J. J., Chung, C. C., & Chung, J. (2013). Internationalization and performance of firms in China: Moderating effects of governance structure and the degree of centralized control. Journal of International Management, 19(2), 118–137.

Xiao, S. F., Lew, Y. K., & Park, B. I. (2019). 2R-Based View’ on the internationalization of service MNEs from emerging economies: Evidence from China. Management International Review, 59, 643–673.

Xiao, S. F., Lew, Y. K., & Park, B. I. (2020). International new product development performance, entrepreneurial capability, and network in high-tech ventures. Journal of Business Research, 124, 38–46.

Yang, Z., Huang, Z., Wang, F., & Feng, C. (2018). The double-edged sword of networking: Complementary and substitutive effects of networking capability in China. Industrial Marketing Management, 68, 145–155.

Yilmazkuday, H. (2022). Protectionism, competitiveness and inequality: Cross-country evidence from soccer. Department of Economics, Florida International University, Working Paper 2208.

Young, A. (2000). The razor’s edge: Distortions and incremental reform in the people’s Republic of China. Quarterly Journal of Economics, 115(4), 1091–1135.

Zhang, F., Jiang, G., & Cantwell, J. A. (2019). Geographically dispersed technological capability building and MNC innovative performance: The role of intra-firm flows of newly absorbed knowledge. Journal of International Management, 25(3), 100669.

Funding

This work was supported by both Hankuk University of Foreign Studies and Sookmyung Women’s University Research Fund

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ghauri, P.N., Xiao, S.S., Park, B.I. et al. Protectionism and its Impact on MNC Subsidiaries’ Performance. Manag Int Rev 63, 731–757 (2023). https://doi.org/10.1007/s11575-023-00519-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-023-00519-z