Abstract

This paper investigates how family events interacting with entrepreneurs’ psychological affect and overconfidence impact new venture viability. We use panel data from the Australian Household, Income and Labor Dynamics survey, focusing on family event-induced psychological affect entrepreneurs experience as a predictor of new venture survival. Our accelerated failure time model shows that although negative family events interact with entrepreneur overconfidence to spur cautious behaviour, positive events interacting with overconfidence have the biggest impact (negative) on new ventures. The study enhances our understanding of the embeddedness of family in the entrepreneurial process and challenges past research by revealing how positive family events can have a greater negative impact on new venture survival than negative ones.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Founding entrepreneurs’ journeys are inextricably intertwined with their families because they are embedded in family settings (Aldrich & Cliff, 2003; Jennings & McDougald, 2007; Steier, 2007). Their families contribute financial support, physical help, or contacts with access to resources that can be mobilized and cross-subsidized (Carter, 2011). They also provide moral support (Hisrich, 1990; Øyhus, 2003) and behave as role models (Brockhaus, 1982; Shapero & Sokol, 1982). But it is gradually becoming clear that family structure, relationships, emotions, and goals can impact entrepreneurs’ psychological state and their decision-making, and in turn, business success (Combs et al., 2018; James et al., 2012; Jaskiewicz et al., 2017; Martinez & Aldrich, 2013; Powell et al., 2018), Unfortunately, little attention has been paid to the family (Jaskiewicz & Dyer, 2017), and for that matter, the idiosyncratic life circumstances each entrepreneur in the population may find himself or herself in when starting a business, and which can determine the success of the new venture (Shane & Venkataraman, 2000).

Changes within the family, events such as birth, marriage and death interrupt the family system and encroach on the entrepreneur (Cramton, 1993). They change the structure and alter roles played by family members; they modify their interactions (Jaskiewicz & Dyer, 2017). Family events have somewhat been alluded to in entrepreneurship research as positive or negative disruptions (Hisrich, 1990) that can lead to opportunity identification and new venture emergence (Aldrich & Cliff, 2003). Shapero and Sokol (1982) speculated that negative information is more likely to encourage individuals to create a new business than positive information, although, positive influences could also serve as a push toward entrepreneurship.

Further, the prevalence of overconfidence among founding entrepreneurs toward their new ventures (Busenitz & Barney, 1997; Camerer & Lovallo, 1999) begs consideration of the possibility that positive and negative family events have opposite effects on new ventures. Entrepreneurs’ overconfidence is a double-edged sword. It makes for their perseverance in the face of doubt as well as any obstacle encountered, but it also leads to overestimation of their ability to overcome adversity (Robinson & Marino, 2015).

We know very little about how, and if, family events might help or hinder the new venture, especially during its critical development stage vis-à-vis emergence. While Aldrich and Cliff (2003) built on the early work of others (De Rosenblatt et al., 1985), to establish a family embeddedness perspective on entrepreneurship, they focused largely on the emergence phase of new venture creation stage i.e., the emergence of new business opportunities and the emergence of new ventures.

The following three major research gaps exist. First, there is little research on the importance of families in the phase of venture development between start-up and exit. Second, there is a gap in our understanding of how aspects of family, such as changes in family composition, family members’ roles and relationships, and major family events, are linked to changes in venture development. Thirdly, the understanding of affect spin (which incorporates both positive and negative affect changes in response to major events) has been largely ignored in entrepreneurial research (Uy et al., 2017) and the venture development phase.

This paper focuses on the extent to which non-venture related family events (hereafter referred to as family events), and the positive or negative psychological affect associated with these events (family event-induced affect), impact the behaviour of entrepreneurs and their efforts in growing their new ventures. Entrepreneurial researchers have expressed keen interest in understanding the role of these family events on the critical development stage of the new venture (Cardon et al., 2012) namely, events concurrent with but which may not be straightforwardly related to the entrepreneurial process. In addition, we examined the interaction of overconfidence on family event-induced affect on the new venture creation process. We used panel data drawn from the Household, Income and Labor Dynamics (HILDA) survey in Australia, focusing on the non-venture related, family event-induced affect that entrepreneurs may experience as a predictor of their new venture survival – whether they exit or continue to survive. The survival or success of firms, especially new ventures, is contingent on their ability to constantly adjust to the dynamics and state of their environments (Ehsani & Osiyevskyy, 2023).

In our accelerated failure time model, we found that the impact of family event-induced affect was in the hypothesized direction – positive events have a positive influence and negative events have a negative influence on new venture survival. Interestingly, the strength of the relationship between family events and venture survival shows a consistent improvement in the level of significance, apart from financial hardship, which is not significant. This suggests that at least for affect arising from family events, affective influences on entrepreneurs’ behaviors and cognition do not operate separately, but rather are interdependent. Counterintuitively, although the interaction between negative family events and entrepreneur overconfidence does spur cautious behaviour to a small degree as anticipated, it is positive events interacting with overconfidence that make the biggest impact (negative) on the new venture.

The study contributes to the understanding of how entrepreneurs are embedded in their families and how the way that happens in their families influences them and their decision-making and subsequently the survival of their new ventures. This research makes three important contributions to the entrepreneurship literature. First, it sheds light on how family events outside of the venture can impinge on the entrepreneur’s affect and behaviors and significantly influence the venture creation process, as measured by firm survival. Second, our findings indicate that positive family events have a comparatively greater influence on new venture survival than negative ones. Third and more generally, while the focus of past research has been on marriage, divorce, and births (Aldrich & Cliff, 2003 etc.), our research has expanded family events to include other important events that have traditionally not been studied e.g., adoption of a new child, and death of spouse or child.

Theory and literature review

Family events-induced affect during new venture creation

The overarching theory in this study is based around the role of affect (i.e., emotions and moods) in the new venture creation process which has been widely recognized by both researchers and practitioners (Baron, 2008; Cardon et al., 2012). While most research on entrepreneurial affect focus on affect at the trait level (how entrepreneurs feel in general) or at the state level (how entrepreneurs feel at a certain point in time), our research builds on the concept of affect spin which examines how and why an entrepreneur’s affect changes or fluctuates at different points in time (Uy et al., 2017). Affect spin covers both positive and negative affect changes in response to affect-laden events and has been largely ignored in entrepreneurial research and this can result in insufficient or inaccurate forecasts of the affect’s impact on entrepreneurial outcomes (Uy et al., 2017). In particular, this study contributes to this by focusing on affect spin resulting from major family events during the venture creation process.

Family could mean a sense of belonging, wherein persons in a family are usually, though not always, linked by biological or marital relationships (Lodge et al., 2011) and share a history or future (McGoldrick & Carter, 2003). While families have a large and indisputable impact on human behaviour, management research is yet to fully incorporate many aspects of how families influence entrepreneurs, employees, managers, and their organizations (Jaskiewicz et al., 2017).

The major family events that this study is concerned with are special types of critical events. Elo et al. (2010) note that the research on change often focuses on critical events. To the extent that these events influence the mood and emotions of entrepreneurs, this study also adopts a similar focus in recognizing that a critical event is “an incident (that) must occur in a situation where the purpose or intent of the act seems fairly clear to the observer and where its consequences are sufficiently definite to leave little doubt concerning its effects” (Flanagan, 1954, p. 327). Family business researchers have been examining the impact of critical events in the family on the family business (Shi et al., 2019). For example, Graves and Thomas found that family firms adopted “born-again” global internationalization strategies because of critical events like intergenerational succession crises. In management research, studies in organizational behaviour have focused on the relationship between work and the current family while entrepreneurship research has focused on the family of origin (e.g., being raised in and part of an entrepreneurial family increases the likelihood for later entrepreneurial action) (Eagly, 1997; Laspita et al., 2012). However, like other aspects of family systems theory, these critical or major family events have been understudied in the context of entrepreneurship and new venture research (Jaskiewicz et al., 2017).

When family events, also sometimes called “stressors” (Hill, 1958) occur, they carry enough magnitude to systemically change the structure and function of the family system, as well as related needs, tasks, and demands on members, which would usually require individual adjustment on one or more fronts and relinquishments of at least some areas of familiarity (Kawai et al., 2023). Consequently, coping efforts aimed at restoring balance and normal functioning in daily family lives impose a psychological and physiological price on individuals, and which has both cognitive and behavioral components (McCubbin & Patterson, 1983).

Affect can automatically be triggered by various external stimuli, and in turn, spontaneously coordinates and activates alternative responses appropriate to the situation at hand (Cosmides & Tooby, 2000). What is compelling about the role of seemingly extraneous family events during new venture creation is that the induced affect can potentially influence entrepreneurs’ actions and confidence levels without their conscious scrutiny. Because feelings do not usually interrupt ongoing behaviour and call attention to themselves or their source (i.e., the family event), it is possible to examine their effects on other thoughts and behaviour (Isen, 1987). Family affairs are part of and may develop or emerge unexpectedly during the critical development stage of the new venture. Thus, discrete family events capture the heterogeneity in entrepreneurial families in terms of what individual entrepreneurs might be going through emotionally when coping with changes (or lack of) in the family system – good and bad stressors, which potentially determine whether the new venture survives or not.

In this paper, positive and negative family events are conjectured to induce corresponding low-level affect in entrepreneurs that turns on certain adaptive behaviors (Fredrickson, 2013), and regulates cognitive schemes (Forgas, 2014). Specifically, how positive and negative affect stimulates two key qualities of founding entrepreneurs’ behaviour and cognition – ability to act entrepreneurially and overconfidence in judgment is explored. In establishing the link between positive and negative family events and new venture survival, implicitly, affective influences on entrepreneurs’ propensities for entrepreneurial action and overconfidence are assumed to function separately and have distinct effects on the focal new venture (Baron, 2007).

Positive and negative family events-induced affect and entrepreneurial decision-making

Regardless of the specific origins of lucrative opportunities – “external enablers”, “new venture ideas” or “opportunity confidence” (Davidsson, 2015) - they require explicit entrepreneurial action or effort by entrepreneurs to create new ventures that will exploit these opportunities (Shane & Venkataraman, 2000). Affect can manifest in various aspects of entrepreneurs’ behaviour that may be critical for new venture creation without going through cognitive aspects (Baron, 2007), such as passion (Cardon et al., 2009), creativity (Baron et al., 2011), alertness to new information (Shepherd, 2009) and opportunity (Baron, 2006), and adaptive resilience (Duchek, 2018).

Fredrickson (1998) described such instances as “thought-action tendencies”, in which positive affect is suggested here to broaden the array of actions entrepreneurs can take that can help them build personal and other resources for the new venture. She hypothesized that if adverse situations engendered a narrowing of thought-action repertoires to allow for quick and decisive actions to be taken, then the reverse must also apply to benign situations, which engender a broadening of action selections (Fredrickson, 2001). Extrapolated to the family lives of entrepreneurs, it follows that joyful family events encourage play, creativity, empathy, and experimentation – entrepreneurial aspects of behaviour that can help entrepreneurs build up social capital, knowledge and skills base, financial equity, and other resources critical to the new venture. There is an induced spontaneity to help others as well as develop oneself (George & Brief, 1992) and undertake entrepreneurial tasks beyond what is immediately required for the new venture (Foo et al., 2009).

In contrast, similar to undergoing environmental jolts (Colombo et al., 2021), experiencing traumatic family events reduces such entrepreneurial reactions (Mithani et al., 2021). Displays of curiosity, willingness to try out new things, and urge to push limits – thought-action tendencies like these are automatically dialed down, or even turned off. Indeed, negative affect has been found to deleteriously impact entrepreneurs’ ability not only to evaluate opportunities but also to exploit them (Grichnik et al., 2010). In part, negative affect can predispose intransigent and uncooperative behaviors, which compromise entrepreneurs’ efforts to establish good relationships with various stakeholders who potentially provide an enduring source of help for the new venture.

Based on family systems theory (Jaskiewicz et al., 2017), new venture survival depends on something else beyond resources, strategy and competition: from within the entrepreneur’s family. Entrepreneurs are not alone in the venture creation process – the entire family is drawn along on the journey – and they are all involved in the feelings, emotions, and stresses that go along with the ups and downs of an entrepreneurial business, and vice versa (Hirshberg, 2012).

To summarize, a functional interpretation of family events is that they induce affect and influence entrepreneurs in a relatively straightforward way, separate from cognition. Entrepreneurs’ behaviors are adjusted according to the requirements of the induced affective state (Baron, 2007). Positive affect opens and predisposes such authentic, freestyle communication behaviors, whereas negative affect promotes a safer, restrictive way to wait and see before reciprocating (Forgas, 2008).

From the above discussion, we hypothesize that:

Hypothesis (H1a)

Positive family events are positively associated with new venture survival.

Hypothesis (H1b)

Negative family events are negatively associated with new venture survival.

Positive and negative family events-induced affect and overconfidence in entrepreneurs

Emotions affect cognition and in turn entrepreneurial decision-making. Affective influence on cognition is very likely to occur when judgment requires the use of heuristics or substantive processing to compute an outcome, especially when limited cognitive capacity is available to the individual (Forgas, 2008). Entrepreneurs tend to rely extensively (more than others) on the use of individual heuristics and beliefs as opposed to deliberating facts and arguing logic in their decision-making (Camerer & Lovallo, 1999; Puri & Robinson, 2007). They appear to be overconfident in their ideas, talents, and skills to be able to take the plunge (Baron, 2004; Baum & Locke, 2004; Cardon et al., 2009) and deal with the novel or poorly understood strategic contexts, time pressure, and scarce resources that comes with starting a new business (Alvarez and Busenitz, 2001; Baron, 1998).

Of interest to this research is the entrepreneur’s over-confidence as there has been much less research conducted on the link between overconfidence and entrepreneurial decision-making (Herz et al., 2014). Some limited examples include Galasso and Simcoe (2011) and Hirshleifer et al. (2012) who find that CEOs who are over-optimistic regarding the future performance of their company are more likely to pursue innovation, obtain more patents and patent citations, and are more likely to take their firms in a new technological direction. Using a student sample, Robinson and Marino (2015) found empirical evidence for the effects of overconfidence on venture creation decisions as mediated by risk perceptions. However, Chwolka and Raith (2023) argue that past empirical evidence is inconclusive and show that a more differentiated consideration reveals the effects of overconfidence on market entry to be ambiguous if not irrelevant.

However, just because overconfident entrepreneurs are better at exploiting opportunities does not mean they will succeed (Shane & Venkataraman, 2000). The tendency to exaggerate personal qualities and capabilities and underestimate the competition and difficulty of tasks (Wu & Knott, 2006) often leads entrepreneurs to make fatal errors in judgment and decision-making (Hayward et al., 2006; Hmieleski & Baron, 2009; Lowe & Ziedonis, 2006). In short, there is a negative association shown in research between entrepreneur overconfidence and new venture survival. To predict whether the effect of family events is aggravated or mitigated by the danger of entrepreneur overconfidence in the new venture creation process, we first discuss two ways affect serves a regulatory function infuses into cognition.

According to affect-as-information theory (Schwarz & Clore, 1983; Schwarz, 2003), affect tunes into an information processing style that helps a person determine whether a situation is good or bad basically (Clore & Huntsinger, 2007; Schwarz, 2012). Positive and negative affective states selectively recruit different cognitive strategies best suited to deal with an adaptive problem. Positive affect tunes individuals toward assimilation strategy or reliance on prior general knowledge and heuristics, and using deductive, top-down thinking that is more category-level and global in nature. Negative affect tunes individuals toward accommodation strategy or attention to new or situation-specific details and decision rules, and using inductive, bottom-up thinking that is more local in character (Forster and Dannenberg, 2010; Friedman & Forster, 2010; Gasper & Clore, 2002).

Alternatively, in affect priming (Bower, 1981; Isen et al., 1978), affect facilitates complex decision-making by automatically activating in our memory associated ideas and other materials that are affect congruent (Eich & Macauley, 2006). Originally, it was conceived that positive or negative affect simply biases cognitive interpretations one way or the other based on the good or bad memories evoked respectively. The greater the availability of mood-consistent associations, the more potent the influence of affect on the valence and quality of mental content. However, subsequent integrated theories argued that more than influencing what people think, memory priming may determine how people think (Forgas, 1995). If individuals had experienced positive affect, the memory retrieves and uses prior knowledge structures to interpret incoming information. If negative affect was experienced, it instead learns, encodes, and stores pertinent new information (Forster, 2012; Forgas, 2014).

These concepts indicate that when family events come about during the venture creation process, they potentially act on entrepreneurs’ overconfidence – spontaneously and automatically fine-tuning how opportunities versus risks are evaluated and decisions are made for the venture. Positive family events would induce a more global thinking style focusing on abstract, high-level features of the problem and picking the first acceptable alternative solution that comes to mind. This may prove useful for entrepreneurs to make necessary decisions quickly and efficiently under tight time and resource pressures (Baron, 2007). However, if entrepreneurs were overconfident, believing that their talents and skills alone were enough to compensate for any lack of information and overcome real difficulties in the venture creation process, positive family events only served to reinforce such error in judgment and decision-making. The net result is an increased vulnerability for making mistakes (e.g., accepting invalid information as true) that can cause serious harm to the new venture.

On the other hand, negative family events would promote a more local processing strategy focusing on specifics and details of the problem-solution (Baron, 2007), and it may enable them to make superior choices. Especially for overconfident entrepreneurs, negative family events may hold a great utility for their new ventures. In short, we propose the following set of testable hypotheses:

Hypothesis (H2a)

Entrepreneur overconfidence in decision-making negatively moderates the relationship between positive family events and new venture survival.

Hypothesis (H2b)

Entrepreneur overconfidence in decision-making positively moderates the association between negative family events and new venture survival.

Together, hypotheses 2a and 2b propose that entrepreneur overconfidence in decision-making has a moderating effect on new venture survival through family events. Accordingly, overconfidence in decision-making has a stronger negative influence on emotions (from positive family events or negative family events) on entrepreneurs, which in turn has further negative effects on new venture survival. These associations can be explained by family events-induced affect theory, family systems theory and affect-as-information theory discussed above.

Cumulative incidence of family events on new venture survival rate

While the type of family event matters (i.e. positive or negative), the quantity of family events also has an impact. Regardless the positive or negative nature of the family events, the greater the number of such events has a negative influence on new venture survival.

Building on family systems theory, family stress and coping theory notes that in addition to having to deal with the focal stressor event, entrepreneurs need to attend to the “pile-up of demands”, which is the cumulative impact of other stressors going on in their lives (McCubbin & Patterson, 1983). The ABC-X model that has dominated family stress theory since the end of World War II (Hill, 1949, 1958) characterizes the family system through its distinct variables, denoting inputs and outputs. Exogenous variables (A) encompass the particular stressor event, (B) the resources at the family’s disposal, and (C) perceptions of the event. The endogenous variable (X) in the ABC-X model gauges the extent to which the stressor event triggers a crisis, reaching a point where the family’s cohesion and functionality are compromised. Overall, these stressors will act negatively on individuals within the family.

Apart from the psychological effects of family events that have been explored earlier, there are potentially physical and psychosomatic effects at play that will have an impact on entrepreneurs. Stressful events have long been argued to cause the occurrence of illness (Mechanic, 1974) insofar there are interactions between the psychological and physical (Hinkle, 1968). The results support the notion of pile-up of demands, in that previous family events significantly influence the postcrisis strain.

Family stress and coping theory however focuses mainly on negative family events or crises, but positive family events can also have disruptive effects. Family events act as reference points that describe transitions in life (Miller, 2010) and family transitions (Dura & Kiecolt-Glaser, 1991; Jaskiewicz et al., 2017). These transitions require adaptations on their part. Adjustments take time and effort. Change could lead to depression as life events research has shown (Schneiderman et al., 2005). Family events such as spousal disputes are linked to one group of transitions and are the subject of a continuing stream of research. Financial situations - both positive (e.g. financial windfall) or negative (e.g. bankruptcy) - also feature as triggers for transitions (Miller, 2010).

Affect spin is one explanation for why an entrepreneur’s affect changes in response to different situations (Uy et al., 2017). According to affective events theory (Weiss & Cropanzano, 1996), work events trigger later emotional reactions. To examine how work events affect the fluctuation of daily emotional states (i.e., affect spin), Clark et al. (2018) studied how work events lead to subsequent emotional responses. They found that employees had a higher daily affect spin on days with mixed work events (i.e., days with both good and bad things happening at work) than on days with only good work events or no work events. In like manner, affect spin in terms of family events can encompass changes in both positive and negative affect in response to emotionally charged positive and negative events which can then have an impact on entrepreneurial outcomes.

Based on this, we hypothesize that:

Hypothesis (H3)

A higher incidence of family events is negatively associated with new venture survival.

Hypothesis 3 therefore proposes that irrespective of the nature (positive or negative) of family events, an increased frequency of such occurrences adversely affects the survival of new ventures.

Research model

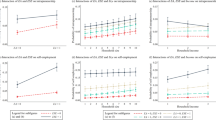

Figure 1 depicts the research model and hypotheses.

Methods

Data and sample

To test our hypotheses, we used panel data from the HILDA survey commissioned by the Australian government and administered by the Melbourne Institute of Applied Economic and Social Research at the University of Melbourne. This data set has been used by other researchers interested in examining the impact of negative family events like divorce on financial decisions (West, 2022). Also, the dataset has been used by other researchers interested in affect among entrepreneurs or self-employed individuals (e.g. Hessels et al. (2017) because it contains several novel characteristics which provide a robust empirical setting for our investigation, including information about what had occurred in the personal life of the entrepreneur, and by extension the family household, when developing the new venture, venture task conditions and initial resource endowments, as well as previous experience and demographic characteristics. The yearly survey, conducted since 2001, minimizes respondents’ recollection or retrospective rationality biases (Cassar & Craig, 2009).

The first wave in 2001 consisted of 7,682 households for a total of 19,914 individuals. In Wave 11 (2011), an additional 2,153 households (5,477 individuals) were added to the panel to compensate for attrition. In addition, there were changes added in the fifth wave (2005), when the HILDA survey included additional measures that were not measured before that, of which we used the dynamism measures. Also, items on the expectations of the ability of entrepreneurs to overcome initial disadvantages were inserted only in 2005. Given the major change in the data in 2011, and the additional measures from 2005 onwards, we have restricted the panel to 2005–2010.

Accordingly, we extracted entrepreneurs who started a new business in 2005 and observed when their businesses exited or continued to operate until 2010 (right censored). Consistent with prior studies, this means that our sample of new businesses was six years old or less, which represents the critical development stage of a venture (Chrisman et al., 2005; Robinson & McDougall, 2001; Zahra et al., 2002). We ensured that the respondents either were employees of other organizations or were not employed in the survey years before market entry. Unlike most entrepreneurship studies based on HILDA data that are focused on self-employment (Atalay et al., 2014), we selected entrepreneurs who reported themselves as “employers” as opposed to “own account workers” following the Australian Bureau of Statistics (ABS) definition. These entrepreneurs hired at least one employee. We excluded those who employed family members to avoid duplicity. The final sample consisted of 154 entrepreneurs with corresponding new businesses over 653 lagged yearly observations and across 19 different industries (two-digit ANZSIC codes).

New venture survival and statistical model

Survival is a fundamental and best measure of business performance during the critical development stage of the venture (Geroski et al., 2010; Shane & Delmar, 2004). Survival is defined as a firm, which regardless of other performance, remains being developed by the entrepreneur (Gordon & Davidsson, 2013). Each year after inception in 2005, we observed a new venture to have survived if the entrepreneur continued to report employment status as “employer”. Otherwise, a venture was treated as a case of exit due to failure (liquidated). Businesses that were reported as sold (eight firms) or had prematurely exited the panel survey (five firms) were considered right censored (i.e., not failures). In our sample, 88 of the new ventures (57%) were considered to have failed by 2010. The reasons for failure include a lack of profitability or insufficient turnover (Craig et al., 2007).

We recognize that while survival is a common measure of performance in many studies it has some drawbacks. Contrary to the common assumption that business success is measured by firm survival (Cooper et al., 1994; Haber & Reichel, 2005; Van de Ven et al., 1984), survival may not always mean success. Economic conditions may affect survivability. In research on new venture survival during economic downturns, Simón-Moya et al. (2016) found that survival is an inadequate indicator of success, especially in times of crisis. They found that new firms were more resilient in times of economic crisis than in times of economic growth. Additionally, they found that opportunity entrepreneurship had a higher survival rate than necessity entrepreneurship and that the characteristics of the most resilient firms changed depending on the economic situation. Similarly, focusing on necessity entrepreneurs and using the disadvantage theory of entrepreneurship, Boyd (2000) showed how survivalist entrepreneurship (individuals who start their own businesses out of necessity, as they have no other way to earn a living (Light & Rosenstein, 1995) emerged as a response to the massive joblessness that affected many Black women in urban areas of the north during the Great Depression.

Likewise, closure does not always mean failure. In a study of closures among new firms using U.S. Census Bureau data sources, Headd (2003) found that many businesses shut down even though they were doing well and that this challenged the validity of “business closure” as an indicator of business performance. Head surmised that it was hard to pinpoint the causes of genuine failures. For example, it appeared that a lot of owners had a deliberate plan to exit the business, either by closing it without much debt, selling it to someone else, or retiring from work. The study also found that innate factors like race and gender had little impact on the survival and success of the businesses at the time of closure.

To mitigate some of these concerns, we use more specialized techniques of survival analysis to test our theoretical arguments, so that we can accommodate right censoring in the data. To estimate the rate of firm failure as we test for Hypotheses 1 to 3, we consider the hazard rate, h(t), of a new venture as it progresses in time to be defined as the limiting probability that it fails in a given interval, between the period, t and t + Δt, assuming that the new venture is active at time t:

In specifying our statistical model, the most basic question to ask is whether there is any time dependence in the hazard rate of new ventures. If the hazard function is not constant (exponential), then there is duration dependence. Based on the initial honeymoon period and subsequent liability of adolescence thesis, the underlying hazard rate of new ventures is suggested to follow an inverted U-shaped curve (Bruderl and Schussler, 1990), with small businesses suggested to experience high death rates at around the first-year mark (Fichman and Levinthal, 1991). Therefore, to analyze our time until failure event data, we estimate a log-normal specification. The attractive feature of a log-normal model is that the time dependence of hazard is assumed to be non-monotonic – it increases and then decreases. Alternative models, such as Weibull and Gompertz’s, assume that hazard either only increases or decreases. Moreover, unlike non-parametric or Cox regression, our parametric approach allows standard maximum likelihood theory to be applied so that the likelihood of our data is maximized (efficient estimators). The log-normal specification is parameterized as an accelerated failure time or log-linear model. The dependent variable is Y = ln(tj), where tj is spell duration as defined in Eq. (1). Y is a linear function of a set of covariates Xj weighted by a vector of coefficients βx, an intercept term β0, and a term reflecting the nature of time dependence, µj as follows:

where µj \(\sim\) iid N(0, σ2). A positive βx indicates a delay in time to failure as a function of the covariate. Thus, given the same prior duration, new ventures with a higher value of the covariate would have a higher probability of continuing the following year. In our analysis, the covariate vector Xj contains the variables related to family events, entrepreneur overconfidence, and their interactions, as well as various measures of observed heterogeneity described below.

Family events

The HILDA measure consisted of 21 life events (Table 1; see also discussion by Wilkins et al., 2011). To assess the overall negative impact that entrepreneurs may experience in their family lives outside of the new venture, we counted the number of such events encountered each year. It is easy to see that these events are oriented toward the family in one way or another and have potential implications for the focal entrepreneur. To be sure, in our sample, we did not observe any reported occurrence of particular events that would necessarily incapacitate entrepreneurs from the venture creation process or that are personally inapplicable – changed jobs or retired, being detained in jail, fired or promoted at work, and seriously injured or ill. Further, to measure the differential effects of positive and negative family-induced affect on entrepreneurs, we used the Social Readjustment Rating Scale (Hobson et al., 1998; Holmes & Rahe, 1967; Miller & Rahe, 1997) to select corresponding positive and negative family events that have the highest stress impacts that would most likely trigger adaptive behaviours and influence cognition. Moreover, over the multi-year horizon of the survey, four of these family events stand out as being difficult to predict well in advance or unexpected, and therefore, their effect on the survival of the new ventures can be more clinically isolated. They are: the birth or adoption of a new child and death of a spouse or child (the former is predictable within months but not over several years), financial windfall (which includes lottery winnings among other irregular sources of income: the sum of inheritances, bequests, redundancy and severance payments, resident and non-resident parental transfers, payments from other non-household members) and bankruptcy (entrepreneurs might not have started their new ventures had they foreseen their financial difficulty). In addition, we also chose marital reconciliation and separation given the key roles that the spouse plays in entrepreneurship, especially in terms of emotional support (Steier, 2007). The occurrence of any of these six major family events in each yearly spell was coded as 1, and 0 otherwise. Collectively, the pairs of family events represent common, yet unfortunate and catastrophic events that can happen in entrepreneurial households during venture creation, and which would exact a hidden (psychological) price on the success of the business (Bruder, 2013).

The questions on major improvement and worsening in finances in the HILDA survey were about the household rather than business. Windfalls due to inheritance would boost entrepreneurs’ sense of opportunity so that where the home front is provided for financially, there is a greater ability to focus on the venture. On the flip side, it would likely accentuate the cognitive bias of overconfident entrepreneurs to commit resources unduly and excessively to focal opportunities, which will increase the likelihood that their ventures will fail. When the entrepreneur faces the threat of financial bankruptcy, the negative valence causes myopic behaviors that are not beneficial to the venture, but at the same time, also alleviates entrepreneur overconfidence, thereby improving new venture performance.

In each case, the net effect of two opposing forces – behaviour versus cognitive bias (overconfidence) on new venture survival depends on the relative strength of each. Table 2 summarizes the hypothesized impact of family events on new venture survival.

Entrepreneur overconfidence

Survey respondents were asked whether they expected their businesses to grow. Our measure of overconfidence is consistent with the methods used in previous studies (Li & Tang, 2010; Simon & Shrader, 2012). Overconfident entrepreneurs are those who overestimate the likelihood that their ventures will grow insofar as they can guarantee such success and draws from Kahneman & Tversky (1995) idea of “optimistic overconfidence”. We recognize that in colloquial terms, there may not be much difference between overconfidence and overoptimism. However, in line with previous research (Cervellati et al. ,2013), we have treated both constructs as different. We have followed researchers like Herz et al. (2014) who note that people exhibit two distinct forms of overconfidence. Firstly, they tend to be over-optimistic about their abilities (Svenson, 1981; Alicke et al., 1995). Secondly, they often overestimate their precision, i.e., they are judgmentally overconfident (Russo & Schoemaker, 1992). In this sense, optimism or over-optimism is a form of overconfidence.

Out of our sample of entrepreneurs (n = 154) who started a new business in 2005, only 46 of these businesses were observed to have grown in net asset or equity value by 2010. Assuming our sample represented the underlying population, which was held to be the case by the HILDA administrators, the probability that a new venture grows is p = 48/154 = 31%, with a 95%-confidence interval of 31% ± 1.96 x [p(1-p)/n]0.5 = 31% ± 7.3%. Therefore, the expectation (at 50% probability) that a new venture would grow would be evidence of overconfidence for these entrepreneurs (and 84 entrepreneurs did so in 2005). In this definitionFootnote 1, we identified those entrepreneurs who expected their new ventures to grow (which itself was significantly more optimistic than the realistic expectation of them not surviving) but experienced new venture failure or decline to be overconfident (a 1 − 0 dichotomous variable). Among the 84 entrepreneurs who exhibited overconfidence, only 26 of them (or 31%) saw their new ventures grow by 2010, attesting to its detrimental effects.

Perhaps overconfidence is more prevalent among entrepreneurs (Arabsheibani et al., 2000; Busenitz & Barney, 1997; Cooper et al., 1988; Puri & Robinson, 2007) because these individuals operate under conditions of high uncertainty when dealing with novel or poorly understood strategic contexts, time pressure, and scarce resources (Alvarez and Busenitz, 2001). In our sample, more than half were statistically defined as overconfident. The greater the uncertainty, the more we exhibit this bias. Hence, all entrepreneurs will exhibit overconfidence because of the high uncertainty and unpredictability of entrepreneurship. This led us to further develop an instrumental variable for overconfidence (Table 3).

Potential sources of heterogeneity

Controlling for sources of heterogeneity is important not only for methodological reasons but also because it refines our test of the family life transition explanation of new venture survival. We structured our analysis of factors that generate heterogeneity among entrepreneurs drawing from past research in entrepreneurship. For instance, on the key issue of entrepreneur overconfidence, if lasting through the nascent years or critical development stage of the venture is indeed due to the valence of family events encountered, then overconfident entrepreneurs who face complex and fast-changing venture task conditions should potentially benefit when negative events occur in their lives (see Hayward et al., 2006; Hmieleski & Baron, 2009). In the same vein, would those with greater start-up experience cognitively be less susceptible to the affective influence of positive family events (see Cassar, 2014)? What about younger versus older entrepreneurs (see Forbes, 2005)?

At the entrepreneur level, we controlled for variables, that could explain new venture survival, including venture task complexity and dynamism, marital status, age, personality traits, sex, education, and start-up experience (Lee & Lee, 2015). Marital status is measured based on 5 choices: Single, Married, Widowed, Divorced or Separated. Age is measured as a continuous variable. Sex is measured as a categorical variable with Female = 1, Male = 0. While the HILDA dataset does have a more granular measurement of ‘highest education achieved’. We follow Hessels et al. (2017) in measuring education as a categorical variable based on the highest level of education attained with University graduate or post-secondary and above qualifications = 1; Non-university graduate = 0. Hessels et al. cite Smith (2001) in justifying among demographic factors, those educated to degree level or equivalent performed differently. Furthermore, the graduate / non-graduate measure has also been adopted in other relevant entrepreneurship research (e.g. Mason et al., 2011; Storey, 2016; Thompson et al., 2010) and research using the HILDA dataset (e.g. Curry et al., 2019; Perales, 2017) and it is expected that individuals with higher education will respond differently as compared to those who do not have higher education.

Following Nikolaev et al. (2020), personality traits are measured using the Big Five personality inventory test with 5 measures (lowest = 1 to highest = 7): Extroversion; Agreeableness; Conscientiousness; Emotional stability; Openness to experience. Venture characteristics are measured with Task complexity and difficulty measured by a 7-point scale (lowest = 1 to highest = 7) and Task dynamism requiring taking initiative measured by a 7-point scale (least = 1 to most = 7). HILDA Survey respondents completed a module of 12 items which assessed various characteristics of their work. Previous factor analysis and structural equation modelling of these items identified three theoretically meaningful factors: demands and complexity; control; and security. Following Leach et al. (2011), we controlled for the factors reflecting demands or dynamism and complexity (four items such as “My job is complex and difficult” and “My job requires me to take initiative”, higher scores reflect greater demands and complexity).

At the new venture level, we controlled for the size and resource endowment of the businesses. Descriptive statistics and correlations for the variables used in our series of analyses are shown in Tables 4 and 5a and b respectively. Variance inflation factors for the covariates are less than 2 and the condition number is 13.06, which do not indicate multicollinearity.

Results

Table 6 reports the maximum likelihood estimates for our analysis of new venture survival. Because our failure time model is parameterized as a log linear function, we report coefficients as rescaled values of one-tenth of the estimated coefficients for easier interpretation. A positive estimated coefficient means that the covariate in question improves survival by delaying the time to failure, whereas a negative coefficient worsens survival by accelerating the time to failure. Model 1 is the baseline model, which incorporates only the control variables, excluding entrepreneur overconfidence. Not surprisingly, new ventures that are bigger and have greater resource endowments survive better. Entrepreneur age is suggested to have a curvilinear relationship with new venture survival (Shane, 2003), but here, it is either not significant or has a negative association with survival. This could be because the average age of entrepreneurs in the sample is 44 years old.

Next, Models 2 and 4 introduce the main effects of our key family events covariates. At this stage, the individual effects of the birth of a new child (p = 0.087) and financial windfall (p < 0.001) on survival rate are positive and significant, although the former is only marginal. Further, in the event of the death of a spouse or child (p = 0.044), the effect is negative and significant. The reason probably is that the birth of a new child demands much more resources and time than financial windfall despite both being positive events.

However, in our two-way interaction models, the strength of the relationship between family events and new venture survival shows a consistent improvement in the level of significance, apart from financial hardship, which is not significant. This may suggest that at least for affect arising from family events, affective influences on entrepreneurs’ behaviours and cognition do not operate separately, but rather are interdependent. Models 5 and 6 each contain the covariates pertaining only to positive and negative family events respectively to separate their effects. For positive events, there is strong support for Hypothesis 1a. Birth, marital reconciliation, and windfall are positively and significantly associated with new venture survival (p < 0.001). For negative events, in support of Hypothesis 1b, death (p = 0.016) and marital separation (p = 0.004) are negatively and significantly related to survival. The implications of our findings are straightforward. For illustrative purposes, holding everything else constant, if entrepreneurs received a windfall, the survival rate of the focal new venture improves by exp(0.244) = 1.3 times or said differently, the time to business failure slows down by about 28%. In contrast, when a spouse or child dies, the effect on entrepreneurs’ behaviour attributed to induced negative affect causes the rate of new venture failure to accelerate by 1/exp(-0.0501) = 5%.

Model 3 and subsequent models show that notwithstanding family events with positive or negative valence, the number of incidences of family events in entrepreneurs’ lives is negatively and significantly associated with new venture survival (p < 0.001). Whilst this finding corroborates our expectation in Hypothesis 3, the deleterious physiological impact on entrepreneurs is indicated to be relatively small. We estimate that for every additional family event an entrepreneur encounters, the rate at which the new venture fails increases by only 1/exp(-0.0136) = 1%. In our study, on average, an entrepreneur experienced one or at most two family events each year during venture creation. The maximum number observed is seven, for two overconfident entrepreneurs. Comparing the values of the coefficients, we would say their businesses probably failed because of overconfidence and related family event-induced affect, and not a higher incidence of family events that they had to contend with. This revelation from our analysis reinforces the theoretical direction of this paper, in which we have emphasized the psychological rather than biological effect of family events on entrepreneurs.

Continuing with Models 5 to 7, the interaction terms between each event and overconfidence show whether the negative effect of overconfidence on new venture survival changes when entrepreneurs encounter positive and negative family events. For a start, in agreement with the literature and in support of Hypothesis 2a, entrepreneur overconfidence is consistently shown to be negative and significant (p < 0.05). Positive family events amplify the negative effect of overconfidence on survival with the interaction terms for birth (p = 0.001) and reconciliation events (p < 0.001) are negative and significant. To describe this moderation effect using reconciliation with a spouse in Model 7, all other things being equal, the failure rate of the new venture is 1/exp[-(0.0553*0.3257)-(0.6708*0.3257)] = 27% faster. On the other hand, the positive and significant interaction between separation and overconfidence (p < 0.001) can be interpreted as evidence for the proposition that the negative effect of overconfidence alleviates the negative family events on new venture survival in Hypothesis 2b. For example, overconfidence reduces the impact of marital separation, such that the survival time of the new venture improves by exp[(0.2228*0.3257)- (0.0553*0.3257)] = 6%. The moderation effect of overconfidence on death as well as both windfall and bankruptcy events are not significant.

Overall, we find empirical support for Hypotheses 1 to 3. A chi-square difference test shows that our saturated two-way interaction term model (Model 7) significantly improves model fit (p < 0.001) relative to the main effects only model (Model 4). As a robustness check, we also modelled the failure time data by specifying an alternate log-logistic baseline hazard function, which returned results that are qualitatively the same. Even then, our log-normal model represents the most efficient model. An important issue left to be addressed is the net effect of positive versus negative family events on the new venture creation process. Using birth of a new child in Model 7 as an example, the overall effect of a positive family event, taking into account the moderation effect of overconfidence, on the focal new venture is an increase in time to failure by 1-{exp[0.1319-0.0129-(0.0553*0.3257) + 0.0694-(0.4151*0.3257)]/exp[0.1319-(0.0553*0.3257)]}=30%. On the other hand, the net effect of a negative family event (e.g., marital separation) increases the survival time of the new venture by {exp[0.1319-0.0129-(0.0553*0.3257)-0.0312+ (0.2228*0.3257)] /exp[0.1319-(0.0553*0.3257)]}-1 = 3%.

Figure 2a and b provide graphical illustrations of these effects. The effect of family events on new venture survival largely comes from affective influence on entrepreneurs’ overconfidence rather than their predisposition toward entrepreneurial action, which is substantially much smaller. This tells us that during the new venture creation process, overconfidence among entrepreneurs is more likely to boost the upbeat affect from a positive family event and lead to them overestimating their ability to overcome odds and the competition, thereby affecting their new ventures negatively. In contrast, overconfidence among entrepreneurs may be tempered in the situation of negative family events and have more beneficial effects on their new ventures– tempering destructive overconfident tendencies and encouraging deductive reasoning. Consequently, opposite to previous research, entrepreneurs’ experience of positive family events during new venture creation may be disadvantageous to the business due to overconfidence effects. Further, at least for family events in the context of entrepreneurship, it may be inferred that the effect of positive events is greater than that of negative events. This is counterintuitive based on extant literature, which has mostly emphasized negative affect.

Discussion

Significance of this study

This research makes three important contributions to the entrepreneurship literature. First, it sheds light on how family events outside of the trappings of the new venture can significantly influence the venture creation process, as measured by firm survival. To the best of our knowledge, this empirical study is the first of its kind as unlike previous studies of entrepreneurs using the HILDA survey data (Nikolaev & Wood (2018), this study did not focus on self-employed individuals but rather on those that employed at least one or more employees. Guided by psychological affect theory, this study demonstrates that like other aspects of family that can affect business decisions (Schell et al., 2022), family events have differential effects on founding entrepreneurs’ outward behaviours as well as cognitive biases, which impact the focal new ventures. Positive family events stimulate entrepreneurial actions that facilitate venture creation, but at the same time entrepreneurial overconfidence can amplify detrimental effects on the new venture. Conversely, negative family events suppress entrepreneurial actions, yet the negative influences of entrepreneurial overconfidence can be reduced for the new venture. In addition, a higher incidence of family events in the entrepreneurial household – regardless of positive or negative events - is not conducive to starting a new business.

Second, the findings indicate that positive family events have a comparatively greater influence on new venture survival than negative ones. This is surprising as the expectation is for negative events to have a greater impact as the distress and hardship that accompanies the entrepreneurial process are commonly heard (Doern & Goss, 2014; Markman et al., 2002). However it is positive events that elicit the stronger effect here with entrepreneurs and their new ventures, consistent with a recent meta-analysis (Fodor & Pintea, 2017). Moreover, the stronger impact of positive events is harmful to the new venture, and it is largely attributed to affective influence of overconfidence rather than to behaviours prompted by the events. Implicitly, this study addressed the unanswered question about the role of affect among entrepreneurs who exhibit high levels of cognitive bias and take excessive risks (Foo, 2011, p. 385). This research suggests that family-induced positive affect interacts with overconfidence to increase adverse risk-taking, whereas negative affect, to a lesser extent, reduces this effect. That entrepreneurial overconfidence has a potentially greater influence on positive family events is not inconsistent, and in fact, underpins the view that a stronger mobilization-minimization effect stems from negative events (Taylor, 1991). One’s emotional defenses are naturally designed to work hard to reduce negative affect emanating from the source (negative family event) so that its impact on other outcomes (new venture survival) is weakened. Similarly, Dewall and Baumeister (2007) demonstrated in a series of experiments that individuals have a “psychological immune system” that is attuned to minimise the impact of negative events by searching for happy thoughts. This implies that when positive events occur, the agreeable affect produced is more likely to be better received, or “stay under the radar” (persist) and allowed to operate.

Third, while the focus of past research has been on marriage, divorce, and births (Aldrich & Cliff, 2003), this research has expanded family events to include other important events which have traditionally not been studied much e.g., adoption of a new child, death of spouse or child, and marital reconciliation. This study finds that these also have a complex relationship to the survival of new ventures. This suggests that the effect that negative and positive family events on entrepreneurs and their new ventures are more nuanced than existing research suggests, and further studies will need to be conducted to understand them in greater detail.

Fourth, this study investigates the non-significant findings for the effects of death, financial windfall and bankruptcy, which can be explained as exceptions to the generalizations we posited earlier. Family events give rise to affect which may in some instances not be influenced by cognition and action and may even have an inconsistent, mood-incongruent influence (Forgas & George, 2001). Perhaps the idea of death (one’s own or loved one’s) is so threatening as to evoke psychological defenses designed to prevent the terror from becoming conscious (Pyszczynski et al., 1999). People exhibit little or no emotional response when confronted with death because they non-consciously search for emotionally pleasant, positive information to block the conscious mind from being paralyzed by the terror of death (Dewall & Baumeister, 2007). This would especially apply to the overconfident type of entrepreneurs; they believe that they will experience positive outcomes in almost any situation (Hmieleski & Baron, 2009). Beyond these effects discussed earlier under Hypothesis 1b, it is likely that overconfident entrepreneurs would perfunctorily shift focus to attend to the other pressing task of growing the new business, to get over the loss and restore equilibrium in their lives (Archer, 1999; Stroebe & Schut, 1999).

Finally, procedurally, separate analyses of positive and negative family events in Models 5 and 6 should show the same statistically significant correlations with new venture survival as in the saturated Model 7, and they did. However, conceptually, could this result imply that positive and negative affect may not actually mix, as previously advanced (Bledow et al., 2013; Frese & Gielnik, 2014).

Limitations and further research

There are, of course, possible alternative explanations for the results that are beyond the scope of this study. Some of these are alluded to in the discussion but require further research, such as the influence of venture performance on family stress, norms, attitudes and values, rather than the other way around (Aldrich & Cliff, 2003), as we have suggested. An affective state is a temporary state and often has no long-lasting effect, but the development and the survival of new ventures need perseverance and long-term efforts. In addition, heuristic decision-making could be more effective than rational decision-making for new ventures facing high uncertainty and other dependent variables might be more relevant like strategic decision-making, innovation, and risk-taking. While these explanations cannot be ruled out entirely, the paper included mechanisms to control for these aspects and further research is needed to explore these issues further.

While the data is longitudinal, one significant limitation is that it does not capture much of the process element. While our study used lagged yearly observations across different industries as lagged dependent variables, and some psychological affect is found to be associated with new venture survival, it is by no means evidence of cause and effect. In addition, there may be reversed causality effects. While experimental research may be difficult in overcoming some of these limitations, reinforcing the HILDA survey-based research with experience sampling methodology (ESM) can help address some of these critical issues whereby participants provide reports of their thoughts, feelings, and behaviours at multiple times across situations as they happen in the new venture creation process (Uy et al., 2010, 2017). Our research made some compromises in terms of measures e.g. we used similar control variables to those used by Hessels et al. (2017). Future research should consider better exploiting the richness of the HILDA dataset by considering other control variables and/or using the measures without transforming them.

Conclusion

This research enhances our understanding of how demands and stressors from the family domain can interfere with the venture creation process. It responds to the call for novel research approaches that are empirical, to advance the development of a field of research dedicated to entrepreneurial decision-making and behaviour, by bridging different streams of research. It examines in greater detail the role of emotions in entrepreneurial decision-making, and the influence of overconfidence and family events, on cognitive aspects of entrepreneurship.

In particular, it has three theoretical contributions. First, it contributes to research addressing the importance of families in the stages of new venture development between start-up and exit, which has been relatively limited (Jaskiewicz et al., 2017). It highlights how family events can impinge on the emotions and moods of the entrepreneur and significantly influence the venture creation process, as measured by firm survival. Second, it adds to our understanding of how aspects of the family (e.g., changes in family composition and family members’ roles and relationships and major family events) are linked to changes in venture development. We find that positive family events have a comparatively greater influence on new venture survival than negative ones. Third, while entrepreneurial affect research has focused on affect at the trait level or in the state level, our research builds on the concept of affect spin which examines how and why an entrepreneur’s affect changes at different points in time, an aspect that has been largely ignored in entrepreneurial research (Uy et al., 2017). While the focus of past research has been on marriage, divorce, and births (Aldrich & Cliff, 2003 etc.), our study has expanded family events to include other important events which have traditionally not been studied e.g., the adoption of a new child, death of spouse or child, and marital reconciliation and how this can result in affect spin.

The study also has practical implications for end users like entrepreneurs and policy makers. In light of this and in line with the theme of this year’s conference of “Bringing the Manager Back in Management”, there is room for including the role of emotional well-being, family events and family support systems in the entrepreneurship training programs that are provided (Wiklund et al. 2019).

In summary, our study is an initial attempt to empirically test how family events can significantly influence hardiness and new venture survival among entrepreneurs. Our findings underscore why the complex and multidimensional relationship between family and business must be emphasized in future entrepreneurship research, as suggested also by other scholars (Combs et al., 2018; Jaskiewicz et al., 2017; Powell et al., 2018). In particular, they display the relatively greater impact of positive vis-à-vis negative family events (via positive affect exacerbating entrepreneurs’ overconfidence) in determining the failure of new ventures.

Notes

We note that the statistical definition used to measure “overconfidence” here, strictly, refers to the concept of overoptimism (Parker, 2009, p. 125).

References

Aldrich, H. E., & Cliff, J. E. (2003). The pervasive effects of family on entrepreneurship: Toward a family embeddedness perspective. Journal of Business Venturing, 18, 573–596.

Alicke, M. D., Klotz, M. L., Breitenbecher, D. L., Yurak, T. J., & Vredenburg, D. S. (1995). Personal contact, individuation, and the better-than-average effect. Journal of Personality and Social Psychology, 68(5), 804–825.

Alvarez, S. A., & Busenitz, L. W. (2001). The entrepreneurship of resource-based theory. Journal of Management, 27, 755–775.

Arabsheibani, G., de Meza, D., Maloney, R., & Pearson, B. (2000). And a vision appeared unto them of a great profit: Evidence of self-deception among the self-employed. Economic Letters, 67, 35–41.

Archer, J. (1999). The nature of grief: The evolution and psychology of reactions to loss. Routledge.

Atalay, K., Kim, W-Y., & Whelan, S. (2014). The decline of the self-employment rate in Australia. Australian Economic Review, 47(4), 472–489.

Baron, R. A. (1998). Cognitive mechanisms in entrepreneurship: Why and when entrepreneurs think differently than other people. Journal of Business Venturing, 13, 275–294.

Baron, R. A. (2004). The cognitive perspective: A valuable tool for answering entrepreneurship’s basic why questions. Journal of Business Venturing, 19, 221–239.

Baron, R. A. (2006). Opportunity recognition as pattern recognition. How entrepreneurs connect the dots to identify new business opportunities. Academy of Management Perspectives, 20(1), 104–119.

Baron, R. A. (2007). Behavioral and cognitive factors in entrepreneurship: Entrepreneurs as the active element in new venture creation. Strategic Entrepreneurship Journal, 1, 167–182.

Baron, R. A. (2008). The role of affect in the entrepreneurial process. Academy of Management Review, 33(2), 328–340.

Baron, R. A., Tang, J., & Hmieleski, K. M. (2011). The downside of being ‘up’: Entrepreneurs’ dispositional positive affect and firm performance. Strategic Entrepreneurship Journal, 5, 101–119.

Baum, J. R., & Locke, E. A. (2004). The relationship of entrepreneurial traits, skill, and motivation to subsequent venture growth. Journal of Applied Psychology, 89(4), 587–598.

Bledow, R., Rosing, K., & Frese, M. (2013). A dynamic perspective on affect and creativity. Academy of Management Journal, 56(2), 432–450.

Bower, G. H. (1981). Mood and memory. American Psychologist, 36(2), 129–148.

Boyd, R. L. (2000). Race, Labor Market Disadvantage, and Survivalist Entrepreneurship: Black women in the Urban North during the Great Depression. Sociological Forum, 15(4), 647–670.

Bruder, J. (2013). The psychological price of entrepreneurship. Inc. Magazine. September. Retrieved from: https://www.inc.com/magazine/201309/jessica-bruder/psychological-price-of-entrepreneurship.html.

Bruderl, J., & Schussler, R. (1990). Organizational mortality: The liability of newness and adolescence. Administrative Science Quarterly, 35(3), 530–537.

Busenitz, L. W., & Barney, J. B. (1997). Differences between entrepreneurs and managers in large organizations: Biases and heuristics in strategic decision-making. Journal of Business Venturing, 12, 9–30.

Camerer, C., & Lovallo, D. (1999). Overconfidence and excess entry: An experimental approach. American Economic Review, 89(1), 306–318.

Cardon, M., Wincent, J., Singh, J., & Drnovsek, M. (2009). The nature and experience of entrepreneurial passion. Academy of Management Review, 34(3), 511–532.

Cardon, M., Foo, M-D., Shepherd, D., & Wiklund, J. (2012). Exploring the heart: Entrepreneurial emotion is a hot topic. Entrepreneurship Theory and Practice, 36(1), 1–10.

Carter, S. (2011). The rewards of entrepreneurship: Exploring the incomes, wealth, and economic well-being of entrepreneurial households. Entrepreneurship Theory and Practice, 35(1), 39–55.

Cassar, G. (2014). Industry and startup experience on entrepreneur forecast performance in new firms. Journal of Business Venturing, 29(1), 137–151.

Cassar, G., & Craig, J. (2009). An investigation of hindsight bias in nascent venture activity. Journal of Business Venturing, 24(2), 149–164.

Cervellati, E., Pattitoni, P., Savioli, M., & Yazdipour, R. (2013). Entrepreneurial under-diversification: Over optimism and overconfidence: Working Paper Series 09–13, The Rimini Centre for Economic Analysis.

Chrisman, J. J., McMullan, E., & Hall, J. (2005). The influence of guided preparation on the long-term performance of new ventures. Journal of Business Venturing, 20(6), 769–791.

Chwolka, A., & Raith, M. G. (2023). Overconfidence as a driver of entrepreneurial market entry decisions: A critical appraisal. Review of Managerial Science, 17(3), 985–1016.

Clark, M. A., Robertson, M. M., & Carter, N. T. (2018). You spin me right round: A within-person examination of Affect Spin and Voluntary Work Behavior. Journal of Management, 44(8), 3176–3199.

Clore, G. L., & Huntsinger, J. R. (2007). How emotions inform judgment and regulate thought. Trends in Cognitive Sciences, 11(9), 393–399.

Colombo, M. G., Piva, E., Quas, A., & Rossi-Lamastra, C. (2021). Dynamic capabilities and high-tech entrepreneurial ventures’ performance in the aftermath of an environmental jolt. Long Range Planning, 54(3), 102026.

Combs, J., Jaskiewicz, P., Shanine, K., & Balkin, D. (2018). Making sense of HR in family firms: Antecedents, moderators, and outcomes. Human Resource Management Review, 28, 1–4.

Cooper, A., Woo, C., & Dunkelberg, W. (1988). Entrepreneurs’ perceived chances of success. Journal of Business Venturing, 3(2), 97–108.

Cooper, A. C., Gimeno-Gascon, F. J., & Woo, C. Y. (1994). Initial human and Financial Capital as predictors of New Venture performance. Journal of Business Venturing (Vol, 9, 371.

Cosmides, L., & Tooby, J. (2000). Evolutionary psychology and the emotions. In Lewis, M., Haviland-Jones, J.M. (Eds.), Handbook of Emotions, 91–115. New York, Guilford.

Craig, J., Schaper, M., & Dibrell, C. (2007). Life in small business in Australia: Evidence from the HILDA Survey. Mimeo.

Cramton, C. (1993). Is rugged Individualism the Whole Story? Public and Private accounts of a firm’s Founding. Family Business Review, 6(3), 233–261.

Curry, M., Mooi-Reci, I., & Wooden, M. (2019). Parental joblessness and the moderating role of a university degree on the school-to-work transition in Australia and the United States. Social Science Research, 81, 61–76.

Davidsson, P. (2015). Entrepreneurial opportunities and the entrepreneurship nexus: A re-conceptualization. Journal of Business Venturing, 30, 674–695.

Dewall, C., & Baumeister, R. (2007). From terror to joy. Automatic tuning to positive affective information following mortality salience. Psychological Science, 18(11), 984–990.

De Rosenblatt, P., Mik, L., Anderson, R., & Johnson, P. (1985). The family in business: Understanding and dealing with the challenges entrepreneurial families face. Jossey-Bass.

Doern, R., & Goss, D. (2014). The role of negative emotions in the social processes of entrepreneurship: Power rituals and shame-related appeasement behaviors. Entrepreneurship Theory and Practice, 31, 496–519.

Duchek, S. (2018). Entrepreneurial resilience: A biographical analysis of successful entrepreneurs. International Entrepreneurship and Management Journal, 14(2), 429–455.

Dura, J. R., & Kiecolt-Glaser, I. K. (1991). Family transitions, stress and health. In P. A. Cowan, & P. A. Hetherington, E.M. (Eds.), Family transitions (pp. 59–76). Lawrence Erlbaum.

Eagly, A. H. (1997). Sex differences in social behavior: Comparing social role theory and evolutionary psychology. American Psychologist, 52, 1380–1383.

Ehsani, M., & Osiyevskyy, O. (2023). Firm failure and the exploration/exploitation dilemma: The role of firm life cycle. Long Range Planning: 102307.

Eich, E., & Macauley, D. (2006). Cognitive and clinical perspectives on mood-dependent memory. In J. P. Forgas (Ed.), Affect in Social thinking and Behavior (pp. 105–123). NY, Psych Press.

Elo, M. N., Halinen, A., & Törnroos, J. Å. (2010). Process research in business networks—An event-based method for qualitative analysis. 26th IMP conference.

Flanagan, J. C. (1954). The critical incident technique. Psychological Bulletin, 51(4), 327–358.

Fodor, O. C., & Pintea, S. (2017). The emotional side of entrepreneurship: A meta-analysis of the relation between positive and negative affect and entrepreneurial performance. Frontiers in Psychology, 8, 1–16.

Foo, M. (2011). Emotions and entrepreneurial opportunity evaluation. Entrepreneurship Theory and Practice, 35(2), 375–393.

Foo, M., Uy, M., & Baron, R. (2009). How do feelings influence effort? An empirical study of entrepreneurs’ affect and venture effort. Journal of Applied Psychology, 94(4), 1086–1094.

Forbes, D. P. (2005). Are entrepreneurs more overconfident than others? Journal of Business Venturing, 20(5), 623–640.

Forgas, J. P. (1995). Mood and judgment. The affect infusion model (AIM). Psychological Bulletin, 117(1), 39–66.

Forgas, J. P. (2008). Affect and cognition. Perspectives on Psychological Science, 3(2), 94–101.

Forgas, J. P. (2014). On the regulatory functions of mood: Affective influences on memory, judgments and behavior. In J. P. Forgas, & E. Harmon-Jones (Eds.), Motivation and its regulation: The control within (pp. 169–192). Psychology.

Forgas, J. P., & George, J. M. (2001). Affective influences on judgments and behaviour in organizations. An information processing perspective. Organizational Behavior and Human Decision Processes, 86, 3–34.

Forster, J. (2012). GLOMOsys: The how and why of global and local processing. Current Directions in Psychological Science, 21(1), 15–19.

Forster, J., & Dannenberg, L. (2010). GLOMO: A systems account of global versus local processing. Psychological Inquiry, 21, 175–197.

Fredrickson, B. L. (1998). What good are positive emotions? Review of General Psychology, 2(3), 300–319.

Fredrickson, B. L. (2001). The role of positive emotions in positive psychology: The broaden-and-build theory of positive emotions. American Psychologist, 56(3), 218–226.

Fredrickson, B. L. (2013). Positive emotions broaden and build. Advances in Experimental Social Psychology, 47, 1–53.

Frese, M., & Gielnik, M. M. (2014). The psychology of entrepreneurship. Annual Review of Organizational Psychology and Organizational Behavior, 1, 413–438.

Friedman, R. S., & Forster, J. (2010). Implicit affective cues and attentional tuning: An integrative review. Psychological Bulletin, 136(5), 875–893.

Galasso, A., & Simcoe, T. S. (2011). CEO Overconfidence and Innovation. Management Science, 57(8), 1469–1484.

Gasper, K., & Clore, G. L. (2002). Attending to the big picture: Mood and global versus local processing of visual information. Psychological Science, 13(1), 34–40.

George, J. M., & Brief, A. P. (1992). Feeling good-doing good: A conceptual analysis of the mood at work-organizational spontaneity relationship. Psychological Bulletin, 112(2), 310–329.

Geroski, P. A., Mata, J., & Portugal, P. (2010). Founding conditions and the survival of new firms. Strategic Management Journal, 31(5), 510–529.

Gordon, S. R., & Davidsson, P. (2013). Identifying important success factors in new venture creation. Business Creation in Australia No. 8, Australian Centre for Entrepreneurship Research.

Grichnik, D., Smeja, A., & Welpe, I. (2010). The importance of being emotional: How do emotions affect entrepreneurial opportunity evaluation and exploitation? Journal of Economic Behavior & Organization, 76, 15–29.

Haber, S., & Reichel, A. (2005). Identifying performance measures of Small ventures-the case of the Tourism Industry. Journal of Small Business Management, 43(3), 257–286.

Hayward, M. L. A., Shepherd, D. A., & Griffin, D. (2006). A hubris theory of entrepreneurship. Management Science, 52(2), 160–172.

Headd, B. (2003). Redefining business success: Distinguishing between Closure and failure. Small Business Economics, 21(1), 51–61.

Herz, H., Schunk, D., & Zehnder, C. (2014). How do judgmental overconfidence and overoptimism shape innovative activity? Games and Economic Behavior, 83, 1–23.

Hessels, J., Rietveld, C. A., & van der Zwan, P. (2017). Self-employment and work-related stress: The mediating role of job control and job demand. J of Bus Venturing, 32(2), 178–196.

Hill, R. (1949). Families under stress: Adjustment to the crises of war separation and return. Harper.

Hill, R. (1958). Generic features of families under stress. Social Casework, 39, 139–150.

Hinkle, L. E. Jr. (1968). Occupation, education and coronary heart disease. Science, 161, 238–246.

Hirshberg, M. C. (2012). For Better or for work: A survival guide for entrepreneurs and families. Greenleaf Book.

Hirshleifer, D., Low, A., & Teoh, S. H. (2012). Are overconfident CEOs better innovators? The Journal of Finance, 67(4), 1457–1498.

Hisrich, R. (1990). Entrepreneurship/intrapreneurship. American Psychologist, 45(2), 209–222.

Hmieleski, K. M., & Baron, R. A. (2009). Entrepreneurs’ optimism and new venture performance: A social cognitive perspective. Academy of Management Journal, 3, 473–488.

Hobson, C. J., Kamen, J., Szostek, J., Nethercut, C. M., Tiedmann, J. W., & Wojnarowicz, S. (1998). Stress life events: A revision and update of the social readjustment rating scale. International Journal of Stress Management, 5(1), 1–23.

Holmes, T. H., & Rahe, R. H. (1967). The social readjustment rating scale. Journal of Psychosomatic Research, 11, 213–218.

Isen, A. M. (1987). Positive affect, cognitive processes, and social behavior. Advances in Experimental Social Psychology, 20, 203–253.

Isen, A., Shalker, T., Clark, M., & Karp, L. (1978). Affect, accessibility of material in memory, and behavior: A cognitive loop? Journal of Personality and Social Psychology, 36(1), 1–12.