Abstract

“Hard discounters” are retail formats that set retail food prices even lower than existing discount formats, such as Walmart and Target. Offering limited assortments and focusing on store-brands, these formats promise to change the competitive landscape of food retailing. In this paper, we study the effect of entry of one hard-discount format on markups earned by existing retail stores, focusing on several important grocery markets across the Eastern U.S. Focusing on establishment-level profitability, we estimate store-level markups using the production-side approach of De Loecker and Warzynski (Am Econ Rev 102(6):2437–2471). We find that hard-discounter entry reduced markups for incumbment retailers by 7.3% relative to markups in non-entry markets. These results indicate that the net effect of hard-discounter entry reduces the overall level of store profitability—despite the somewhat higher sales realized by incumbent retailers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Hard-discounters—which are generally defined as retailers that offer limited assortments, high-quality private label brands, and prices that are often 40–60% lower than current “discount” retailers, are an emerging format in the US market (Vroegrijk et al., 2013, 2016; Progressive Grocer, 2019). In fact, two hard discounters, Aldi and Schwarz Group (parent of Lidl)—together accounted for over \(\$100.0\) billion in sales in 2017, and each had nearly three times the compound annual growth rate between 2012–2017 as any other store in the global top-10 (Steenkamp, 2018). Although Aldi has been in the US market for over 20 years, the hard-discount concept has only recently emerged as a clear competitive threat to existing food retailers.

Despite the potentially transformational nature of the hard-discount business model, there is very little empirical research of their impact on existing retailers. In this paper, we provide empirical estimates of the effect of hard-discounter entry on incumbent retailer markups and store profitability.

Estimating the impact of hard-discounter entry on retail markups is not just a matter of curiosity. In recent decades, there have been a number of entry “waves” from retailing formats that seek to capitalize on the relatively large sales volumes that are associated with selling food. For example, in the 1990s, Walmart expanded from its base in Bentonville, Arkansas, to occupy nearly every market in the U.S., and many markets overseas. The impact of Walmart entry has been dramatic, and well-documented (Singh et al., 2006; Basker & Noel, 2009; Zhu & Singh, 2009; Ailawadi et al., 2010; Courtemanche & Carden, 2011; Holmes, 2011; Huang et al., 2012; Iacovone et al., 2015; Arcidiacono et al., 2016; Atkin et al., 2018).

In the 2000s, existing retailers consolidated in the face of Walmart entry, and club stores became the latest competitive threat (Courtemanche & Carden, 2014; Bauner & Wang, 2019). In the 2010s, online shopping emerged, but did not become a force for change in the grocery industry until Amazon acquired Whole Foods in 2017 (Turner, 2017), and the Covid-19 pandemic of 2020 accelerated the move online by some 10 years relative to existing trends (Progressive Grocer, 2020). Currently, European hard-discounters are entering many key markets in the US, and hope to succeed by providing essential items at prices that are even lower than those of Walmart or club stores (Jackson, 2020).

Understanding the effect of entry on incumbent retailers, therefore, is critical both for retail practice, and for developing fundamental knowledge with regard to the forces that shape U.S. retailing.

Researchers generally examine the effect of entry with the use of traditional, demand-side methods, combined with counterfactual simulations. However, estimating the effects of entry using store- and firm-level markup data is arguably more relevant, as the average food retailer carries thousands of products (FMI, 2021). Moreover, consumers often do not recall individual item prices (Dickson & Sawyer, 1990; Loy et al., 2020), but instead basket-level prices (Bell & Lattin, 1998), or firm-level product aggregations (Blonigen & Pierce, 2016). Markups are of central concern to retailers because of their implications for profitability, and to policymakers due to their consequences for price-setting conduct and industry competition. For these reasons, we examine the effect of hard-discounters’ entry into several important U.S. grocery markets with the use of a store-wide, markup-based approach.

We are not the first to consider the competitive effects of hard-discounter entry, and the nature of competitor responses. For example, Vroegrijk et al. (2013) argue that hard-discounters may have a “complementary” effect on existing retailers, as consumers tend to seek out the lowest-cost source for price-sensitive items, while seeking out traditional retailers for categories in which variety and quality may be more important. In a study most similar to ours, Cleeren et al. (2010) examine the inter- and intra-format effects of entry between hard discounters and supermarkets in Germany. Focusing on firm-level outcomes, they find a significant threshold effect for the impact of hard-discounter entry on supermarket profits.

In terms of incumbent responses, Lourenço and Gijsbrechts (2013) suggest that the optimal response by incumbent retailers to hard-discounters’ attempts to take away market share in the national brand market is to introduce only category-leaders, and at prices that reflect favorable value-for-money relative to their traditional-supermarket competitors. Similarly, Vroegrijk et al. (2016) examine whether introducing low-price private labels may be an effective way for supermarkets to beat hard-discounters at their own game, yet these authors find only limited success; while Hökelekli et al. (2017) suggest that price-competition through standard private labels may be the best of a set of ineffective defensive strategies.

While these studies provide valuable insight as to the reasons why hard-discounters may co-exist with traditional retailers in the same markets, these studies do not quantify the ultimate effect that hard-discounter entry is likely to have on incumbent markups, and the studies focus on empirical evidence from only a limited number of product categories.

Beyond the specific example of hard-discounter entry, and the evident importance of firm-level profit, surprisingly little is known about retailing markups in general. Conventional wisdom holds that the retailing sector is very competitive (Beresteanu et al., 2010; Ellickson, 2016), with net margins averaging 2.0% according to industry “stylized facts” (Campbell, 2020). However, estimating markups at the store level is a difficult empirical problem. The typical approach to estimating market power in retailing relies on demand-side methods (Berry et al., 1995; Nevo, 2001; Chintagunta, 2002), wherein the researcher estimates a large matrix of own- and cross-price demand elasticities, which condition the retailers’ ability to achieve an equilibrium price under some assumed form of an oligopolistic pricing game.

However, more recently, others recognize that if the goal is to estimate firm-level markups, then starting from a highly disaggregate set of products is not necessarily the most efficient way to begin, and tends to be very restrictive as well. De Loecker (2011a, 2011b); De Loecker and Warzynski (2012), Traina (2018), and many others, approach the problem of markup estimation instead from the production side: They apply the insight of Hall (1988) that markups can be estimated from a simple condition on the output elasticity of a variable input, and input-expenditure shares of that input. While most applications are in trade (De Loecker, 2007; Klette, 1999) and macroeconomic markup estimation (De Loecker et al., 2020; Traina, 2018), this approach is also useful in uncovering markup patterns among food retailers.

We provide new evidence on the relative competitiveness of food retailing, and examine the specific case of how market-entry by a discount-retail chain affects markups of incumbent retailers, by estimating store-level markups from a production-side perspective.

Our conceptual approach is well-understood: extending the growth model of Solow (1957) and Hall (1988) shows that “[U]nder competition and constant returns, the observed share of labor is an exact measure of the elasticity of the production function...”consequently, any departure between these two measures—if we assume constant returns to scale—is interpreted as a measure of imperfect competition (p. 923). De Loecker (2007), De Loecker (2011a) and De Loecker (2011b), and De Loecker and Warzynski (2012) develop the econometric details of how this conceptual model can be used to test for departures from competition in firm-level data, but the underlying logic is the same: with only limited firm-level production data, we can infer market power from changes in observed levels of output, and the employment of a variable input, if we assume no adjustment costs. This approach is particularly well-suited to estimating market power in a retailing context because it makes no assumptions with regard to the nature of demand relationships among individual products that are typical of other empirical studies in this literature (Berry et al., 1995; Nevo, 2001). This approach also “scales” well, so that it is able to recover markup estimates—even when the firms involved sell thousands of items, across a wide range of potentially-unrelated categories (Gelper et al., 2016). In this sense, the production-side approach avoids the curse of dimensionality that is common to all methods of estimating multi-product seller markups.

We develop a variation on the production-side markup estimation approach that was developed by De Loecker (2011a, 2011b) and De Loecker and Warzynski (2012), and apply our approach to store-level, food-retailer data. While the production approach to markup estimation is typically applied to Census of Manufacturers (CoM) data in the US (Foster et al., 2008; Asker et al., 2014; De Loecker et al., 2020), the equivalent data—from the Census of Retail Trade (CRT)—are insufficient for our purposes (Foster et al., 2006). Because the retailing industry tends to be more concentrated in local areas, the public CRT data are available only on an aggregated basis for reasons of confidentiality, and the establishment-level micro data do not contain the physical input measures we require.Footnote 1

Therefore, we use the TDLinx establishment-level data set from Nielsen, Inc. TDLinx is a census-type data set that aims to describe the locations and fundamental operating characteristics of all food retail locations in the U.S. (Cho et al., 2019). With these data, we are able to conduct our analysis at the firm level, and to explain company-wide markups that vary with changes in the firm’s competitive environment with the use of physical measures of key input quantities, and dollar-sales output values.Footnote 2 We address issues that remain with our store-level data below in the description of our identification strategy; but our production-side approach remains far less data-intensive than the equivalent demand-side approach for the same objectives.

We find that there are two effects on incumbent retailers that are due to the entry of a hard-discounter that remain after accounting for the endogeneity of both entry and shocks to labor productivity: First, sales increase for retailers in the proximity of the entering retailer by approximately 2.0% (within 3 or 5 km), which we interpret as a positive traffic-effect (from outside this proximate area) that is due to the limited assortment that is offered by the entering retailer and/or lower retail prices as a result of more intense competition. In this regard, our findings are consistent with Vroegrijk et al. (2013, p. 609), who find that “...losses to HDs are not necessarily most severe for incumbents in close proximity”Ċonsumers are attracted to the hard-discounter as they search for lower prices on either staple items, or items that are unique to the retailer, but then finish their shopping at other, local stores when they cannot find the range of items they are looking for at the hard discounter.

Second, markups are lower (by roughly 7.0%) for incumbent retailers as they reduce prices to compete with the entering retailer, or lose sales on previously high-margin sales that have been taken by the entering hard-discounter. Regardless of the specific mechanism, store-level markups are lower for stores in the proximity off an entering hard-discounter.

Aggregating the positive effect on store-sales, and the negative effect on markups, we find that the net effect on incumbent retailers is unambiguously negative. In general, therefore, we find that there is a net negative effect on incumbent performance due to hard-discounter entry, even without allowing for the potential dynamic effects that would be associated with potential non-price competitive effects of rivals: e.g., additional variety, low-price services, enhanced private-label strategy, or online delivery options.

We examine the potential response to hard-discounter entry from incumbent retailers through a series of counterfactual simulations. Retailers have been successfully improving productivity through the adoption of labor-saving technologies such as barcodes and barcode scanners (Basker, 2012), automated self-checkout systems (Litfin & Wolfram, 2006), digital price tags (Inman & Nikolova, 2017), or automated warehouses, robotic in-store fulfillment, and autonomous floor cleaning robots (Begley et al., 2019). Each of these advances can be interpreted in our context as labor-productivity enhancing investments that may help incumbent retailers compete with hard discounters on a cost basis.

Alternatively, retailers can adopt demand-side strategies by making enhancements to private-label offerings to attract market share from hard-discount retailers, as in Vroegrijk et al. (2016) or Hökelekli et al. (2017). We examine one example of each of these strategies, and show that a productivity-enhancing investment is able to raise store-level profit by 9.3% in competition with a hard discounter—relative to a do-nothing scenario—while an output-improving investment of the same magnitude may increase profit by 13.5%. Therefore, our hypothetical scenarios suggest that managers would be well advised to consider not competing directly against an entering hard-discounter, but by making the most of the market opportunities that are provided by the discounter, and exploiting the part of the market that is not well served by the hard-discount format, in general.

Our empirical model, and our findings, contribute to the methodological literature on estimating markups in food retailing, the substantive literature on the profit-effects of retailer entry, and the managerial literature on retailers’ response to new-format entry.

In terms of our methodological contribution: We are the first to apply a store-level, production-side approach to estimating market power in the food-retailing sector—and specifically to address the problem of how market entry affects the market power of existing firms. There are a number of reasons why a store-level approach is valuable in estimating the effect of entry: First, and most important, retailers sell thousands of items—items that can be either complements or substitutes in demand. While others examine the implications of complementarity among retail products for store-level market power (Thomassen et al., 2017; Richards et al., 2018), their analyses are necessarily restricted to a limited set of products in the store, and do not attempt to study the profitability of the store in general. On the other hand, our production-side approach, by definition, at least implicitly takes into account the firm-level profit implications of a wide variety of product-level interactions.

Second, our approach is sufficiently flexible to account for heterogeneous effects among the retailers in our sample: The retailers in our sample range from very small, limited-assortment retailers (approximately 3000 stock-keeping units, or SKUs) to large club stores and supercenters (upwards of 50,000 SKUs). A demand-side approach, which is dependent upon consistently estimating interactions among all possible products, cannot possibly yield comparable estimates across stores that differ in assortment to this extent.

Third, when the unit of observation is the establishment itself, there is a wider range of variables that can serve as instruments for endogenous labor input and entry decisions. Entry-endogeneity is a clear barrier to identification in any study of this type (Cleeren et al., 2010), so having access to suitable instruments is both important, and necessary.

Fourth, in the entry literature we are first to apply a production-side markup estimation approach to estimate the effect of entry on incumbent retailer profit-performance. Our approach is appropriate for this purpose as retailers are more likely to use firm-level measures of profitability to evaluate either the feasibility of entering a new market, or the extent of competitive harm that is inflicted by an entering rival. In the empirical model, we disaggregate the effects of entry into aggregate, store-level impacts on both sales and markups. Our simulation model shows that the net effect of entry—after accounting for higher sales due to positive traffic-effects in the local market and negative effects on markups due to price competition—reduces the overall level of store profitability.

Finally, our findings provide valuable information to retail managers who seek to stave off the worst impacts of hard-discounter entry. While intuition may suggest that incumbent retailers can survive by doing what hard-discounters do—but better—our findings show that total store sales are actually higher in proximity to hard discounter entrants. Therefore, increasing variety and providing high-quality store brands may be a more appropriate response. This result is reminiscent of Arcidiacono et al. (2016), who show why mimicking Walmart in the 2000s was likely a bad idea as the retailers who were different from Walmart survived, while direct competitors did not. Our findings in this regard align with Vroegrijk et al. (2013), who find that consumers are likely to “trade up and trade down” across retail formats due to hard-discounter entry, taking advantage of low prices in price-sensitive categories by hard discounters, while buying more price-sensitive items from high-variety traditional retailers. Our ultimate conclusions are the same as theirs: Hard discounter entry need not mean the end of retailers with store formats that appeal to other consumer segments.

This paper is structured as follows: in the next section, we describe a conceptual model of retail markups that is based on the markup-estimation framework of Hall (1988) and De Loecker and Warzynski (2012), and motivate our primary hypotheses. In the third section, we describe our data and identification strategy, while we derive an empirical model that is able to recover markups of the form that is required in our conceptual model in Sect. 4. We present and interpret our empirical findings in Sect. 5, and interpret our results in terms of the implications for retailer performance, and likely response strategies. We conclude and describe the limitations of our research in the Sect. 6.

2 Conceptual Framework and Theoretical Expectations

In this section, we frame our theoretical expectations with regard to the effect of hard-discounter entry based on the existing literature on retail-format entry, explain our core hypotheses, and provide a theoretically-consistent framework for testing each hypothesis in an empirical production context.

2.1 Hypothesis Development

The entry of a hard-discounter into a local market may affect incumbent retailers directly by reducing their market shares, and indirectly by influencing their pricing and operating strategies:

Hypothesis 1: Incumbent retailers reduce prices in response to hard-discounter entry. Because hard-discounters’ prices are significantly lower than those of conventional retailers, incumbent retailers may reduce prices in response to hard-discounter entry. By offering lower prices, incumbent retailers can continue attracting customers even after a hard-discounter entry, just as retailers responded to Walmart entry in the 1990s and 2000s (Basker, 2005; Hausman & Leibtag, 2007; Basker & Noel, 2009). Because hard-discounters offer a Walmart-like price effect, it is possible that hard-discounter entry leads to lower prices at incumbent retailers.

Hypothesis 2: Store-level sales for neighboring incumbent retailers rise upon entry of a hard-discounter. Hard-discounters carry limited assortments of grocery products, most of which are private labels. Therefore, consumers may visit both hard-discount stores and traditional supermarket stores to fill their shopping baskets. Previous research finds that consumers purchase price-sensitive products at hard-discount stores, and shop at incumbent retailers for categories in which variety and quality may be more important (Vroegrijk et al., 2013). If this is the case, geographically-proximate, incumbent retailers may choose to compete in non-price store attributes such as product variety, service quality, and high-quality fruits and vegetables in order to attract customers who shop at nearby hard-discounters for price-based reasons. Further, the size of the entire market may expand as geographies with entering hard discounters draw customers from outside the previous market boundaries (Ellickson et al., 2020). Therefore, we expect higher customer traffic and sales volume at incumbent retailers that are located near to entering hard discounters.

Hypothesis 3: Margins at rival retailers fall upon entry of a hard-discounter. Incumbent retailer sales may increase with hard-discounter entry, but higher sales do not necessarily increase profits or retail markups as a key performance metric for retail managers. For example, the empirical literature on Walmart entry shows that existing retailers’ markups fall due to Walmart’s generally negative impact on retail prices (Basker, 2005; Hausman & Leibtag, 2007; Basker & Noel, 2009)—without a correspondingly larger negative effect on wholesale prices (Huang et al., 2012). Due to the limited—and private-label-dominated—assortment of hard-discount stores, we expect the wholesale impacts of hard-discounter entry to be minimal. Whether incumbent markups fall, therefore, depends largely on whether they choose to meet hard-discounter prices, or raise service quality in order to build pricing power. Based on the Walmart experience, therefore, we expect to observe competitive pressures forcing equilibrium prices, and markups, down throughout the market.

2.2 Conceptual Model of Retail Markups

We adopt a store-level, markup-estimation approach to testing the hypotheses developed above (Hall, 1988; De Loecker, 2007; De Loecker & Warzynski, 2012). We believe that this approach is appropriate for the problem at hand, as estimating the structure of demand for the thousands of products that are sold by a typical food retailer is simply intractable (Villas-Boas, 2007). Moreover, our approach is particularly appropriate for estimating retail markups as retailers are concerned with firm-level and not product-level profits (Bliss, 1988). Whereas a focus on elasticities draws attention to product-level profits, it ignores the fact that products are purchased by the shopping-basket, often containing dozens of products, and retailers tend to stock and sell thousands of items during a relevant time period. Rather than concern ourselves with how demand interactions affect pricing power, we are more interested in how store-pricing in general manifests in store-level markups.

The production-function approach that was developed by Hall (1988) relies on the fact that the elasticity of output with respect to a variable input will equal that input’s expenditure share of revenue (or, its cost-share) in a competitive equilibrium. Any deviation from this result—if we assume constant returns to scale—is interpreted as evidence of the exercise of market power (or, at least, of prices that are above marginal cost). This approach is not only powerful but convenient, as it means that we need to estimate only the output-elasticity of a variable input at the establishment level. Both the availability of highly-granular, firm-level production-side data for grocery retailers, and advances in the econometric estimation of production functions (Olley & Pakes, 1996; Levinsohn & Petrin, 2003; Ackerberg et al., 2015), mean that this approach is appropriate for the type of problem that we present here, and is both tractable and empirically feasible.

The intuition of our approach is straightforward: beginning from the production technology that is described by Hall (1988), the firm-level markup is the difference in the growth of output that cannot be explained by the rise in input use (weighted by each input’s share in total expenses), and Hicks-neutral productivity growth, which implies that the ratio of inputs to output is constant. We interpret that if a firm is able to derive value from what cannot be explained, then it must be due to the exercise of market power. Thus, market power is in essence a latent construct: pricing power that is left over after everything else has been accounted for.

Formally, the growth in output is written as:

where \(\Delta q_{it}\) is firm i’s output (measured as sales revenue) growth in year t; \(\mu\) is the markup term (expresses as the ratio of price to marginal cost); \(\alpha\) is input k’s cost-share of revenue; \(\Delta x_{k}\) is the growth in the value of input k in year t; and \(\omega\) is a productivity shock (all lower-case letters refer to logarithms). As a practical matter, estimating this function directly is not possible, due to the clear correlation between contemporaneous productivity shocks and input employment; but recent advances in the econometric estimation of production functions provide a feasible solution to this problem. Namely, De Loecker (2007, 2011a, 2011b) and De Loecker and Warzynski (2012) describe a tractable solution that requires few restrictions on the production technology, and a general specification that is amenable to estimation with commonly available production data.

Conceptually, the assumptions that are necessary for this approach are minimal: there is at least one variable production input; the variable input does not have adjustment costs (which would make it quasi-fixed); and the firm minimizes the cost of production. If these assumptions are valid, then the output elasticity with respect to the variable input, conditional on fixed-input values, can be written as:

for firm i in time period t, where \(\phi _{it}\) is the output elasticity of the variable input; \(x_{it}\) is the variable input amount; \(w_{it}\) is the price of the variable input; \(q_{it}\) is the output value; and \(\lambda _{it}\) is the cost-minimizing value of the Lagrange multiplier. In this application, the Lagrange multiplier is interpreted as the marginal cost of production at a given level of output.

If the markup is given by the ratio of the output price to marginal cost, or \(\mu _{it}=p_{it}/\lambda _{it},\) then we can substitute for \(\lambda _{it}\) in the previous expression to arrive at an expression for the markup in terms of the output elasticity of the variable input, and its expenditure share:

where \(s_{it}\) is the variable input’s expenditure share in firm i’s total revenue. This expression implies that the markup is equal to the input’s output elasticity relative to its expenditure-share. Importantly, this expression suggests the minimal requirements for estimating the degree of departure from perfect competition: an estimate of the output elasticity for one variable input, and that input’s expenditure share to total revenue.

We are rarely interested, however, in simply recovering markups without some explanation for how they vary: over time, across firms, or both. For example, De Loecker (2007) examines how a firm’s export status influences markups, while Blonigen and Pierce (2016) use a similar approach to estimate the impact of mergers and acquisitions (M &A), using data from a large number of firms in a variety of industries. In our application, we are interested in how markups for incumbent food retailers are affected by the entry of a “hard discounter,” or a rival that is focused on selling a range of consumer products at the lowest-possible prices. With a production-approach to estimating markups, we allow the output-elasticity value in Eq. (3) to vary with a range of entry-definitions, and test our core hypotheses with regard to how we expect markups to respond.

3 Data and Identification Strategy

3.1 Data Description

Our core data set consists of TDLinx establishment-level data from Nielsen, Inc. As we noted above, TDLinx is a census-type data set that describes the locations and fundamental operating characteristics of food retail locations in the U.S. We use annual measures of output, labor input, a measure of capital (store size, in square feet), and a measure of technology investment (number of checkouts) for supermarket retailers in the relevant geographic markets over the 2014–2019 time period. Because the hard discounter format began a rapid penetration of the US market in 2017, our data covers the time period prior to entry, as well as after entry occurred.

Importantly, TDLinx contains the exact name and location of each store in the U.S., so it provides a census of all stores that were possibly affected by the discounter’s entry. Our geographic markets include all states with at least one of the discounter’s stores across our sample period, but we define the extent of competitive pressure within each market more precisely, as we will explain below.

TDLinx is also valuable for our purposes because it includes a wide range of attribute measures for each store—attributes that are likely to explain differences in store sales that cannot otherwise be attributed to labor efficiency, location, capital investment, or our other core variables.

Despite the fact that TDLinx contains all of the data that we need to accomplish our objectives—a measure of output, and measures of both variable and fixed inputs, over a panel of individual store-locations—TDLinx is not without limitations for our purposes: For instance, TDLinx measures only store-level dollar sales, and not physical quantity. Although a physical measure of quantity is likely ill-defined when the retailer sells products of varying qualities and descriptions over hundreds of categories, it nonetheless means that our primary variable of interest is measured in terms of dollars, and not the more usual measure of physical output.

In the international trade literature, authors commonly use revenue as a proxy for physical output as the latter is rarely available in the data (De Loecker, 2007, 2011a, b). The standard procedure is to deflate revenue by a common price index in order to arrive at a measure of physical output that is likely to approximate actual volume sales. De Loecker (2011a, 2011b) argues that this is problematic for estimating production-function parameters if the difference between the price index and actual firm prices is correlated with input demand.

In our case, we avoid this problem as we rely on the finding by DellaVigna and Gentzkow (2019) that food retailers tend to follow constant-pricing strategies across all of their stores. If this is the case, and the unit of observation is the individual store, then applying a common price index does not create the same econometric issues as in other applications. Therefore, we deflate store-level sales-output using a producer-price index (PPI) from the Bureau of Labor Statistics (US Bureau of Labor Statistics) for food retailers.

Second, TDLinx tends to capture larger retail food stores. As Cho et al. (2019) explain, TDLinx tends to use an industry-standard definition of a supermarket: more than \(\$2.0\) million in annual sales. Although they include smaller stores (\(\$1.0\)–\(\$2.0\) million) in their data under a different classification (the “Superette Subchannel”), their reporting may not capture smaller stores as accurately as alternative business-location data sets (e.g., the National Establishment Time Series, NETS, data set). However, for our purposes the error that is caused by excluding smaller stores is not likely to be significant, as our interest lies mainly in estimating the impact of entry on mainline grocery outlets.

Third, TDLinx does not gather exact labor-input values for each store, each year, but instead estimates the number of full-time equivalent (FTE) employees.Footnote 3 For this reason, the TDLinx data cannot be interpreted as a panel data set akin to the Census of Retail Trade, but rather a repeated cross-section of observations on the same store over time. In our empirical application, we are careful to not rely on time-series variation in any of our key estimation variables, but rather exploit the cross-sectional differences in entry, and output values, to identify the impact of entry (Ellickson & Grieco, 2013).

Despite these potential shortcomings, we believe that the TDLinx data remains the best alternative for examining store-level markups with the use of the production-side approach of De Loecker and Warzynski (2012).

We summarize the key variables that enter our empirical model in Table 1. From this table, it is clear that there is a substantial degree of variation in output and labor input among stores, so the key parameters of interest should be identified. In terms of our entry-estimation objective, the data in this table also show considerable variation in both the distance between each store and an entering hard-discounter, and the likelihood of being proximate to an entering store. Therefore, we are confident that we have the fundamental conditions in place to identify statistically the effect of hard-discounter entry on store performance.

Prior to estimating our structural model of store markups, we first examine the data for patterns in entry, and store output. We begin by examining the geographic dispersion of store openings. Figures 1, 2 and 3 show that there were only a few stores (10) open in 2017, scattered among Virginia, North Carolina, and South Carolina. By June of 2018, there were 54 stores, with additional locations in Delaware, Georgia, and New Jersey, and by June of 2019, there were 67 stores, including additional stores in Pennsylvania, Maryland, and New York.

In each state, we define a competitive market area around each store, and determine which other stores in our data are likely to fall into the competitive area of each entering hard-discounter. From the literature on store-location (Ellickson & Grieco, 2013), we define stores within a circle with a radius of 3 miles (5 km) as direct competitors to the enter hard-discounter, and consider these stores as treated. All other stores under the same banners, but outside of the competitive market region are defined as control stores.Footnote 4 Given the relatively small size of the hard discounters, we expect that a 3-mile competitive region is likely to be a conservative estimate of their sphere of influence.

Next, we split the data into “entry markets” and “non-entry markets,” where markets are defined by county, and examine the data for any differences in store-level output, before and after entry, using simple summary statistics. In Table 2, we see that sales in entry markets are substantially higher than in non-entry markets ($311.3 thousand per week versus $234.2 thousand per week). However, this summary statistic does not control for the clear endogeneity of market entry, so it may be the case that the hard discounter is simply attracted to more lucrative markets.

Further, this simple approach does not account for the efficiency of the labor input that drives markups in the De Loecker and Warzynski (2012) framework. We calculate a crude measure of labor efficiency, therefore, and report this value in Table 2: sales dollars per employee is a common managerial measure of labor efficiency in food retailing. According to this measure as well, entry markets appear to be characterized by not only higher-selling stores, but also stores that are more efficient.

Regardless, the difference in the entry and non-entry values in Table 2 suggest that hard-discounter entry has a dramatic effect on store performance. But, conclusive evidence is required for all potential confounding values—with respect to entry and to labor endogeneity.

3.2 Identification Strategy: Retail Entry

We identify the effect of entry on store-level markups by exploiting the quasi-natural experiment that was created by the staged entry of our target hard-discounter: The 67 stores in our sample did not enter each market at exactly the same time, so our data describe a sequence of entry-experiments: across time, and also across markets.Footnote 5 Because retail food markets tend to be relatively small, as most consumers prefer to travel short distances and are loyal to stores that are geographically proximate (Briesch et al., 2009), it is reasonable to assume that the entry of a particular store in each market exerts a competitive influence only on stores in that market. Entry into each market, however, is likely to be endogenous to the expected profitability of the market (Cleeren et al., 2010). We address this clear issue of identification with the use of a set of instruments through a control-function estimation framework.

First, we include a set of state-level fixed effects that account for unobserved factors that may be correlated with the decision to enter; this is an approach that was implemented by Klette (1999), who used fixed effects to capture differences in levels of productivity due to variations in labor quality. Fixed effects are effective instruments as they essentially absorb any local conditions that are unobserved to the econometrician, and yet likely to be important to the discounter’s decision to enter at that particular location. Thus, by including fixed effects, we allow cross-sectional differences in productivity to be correlated with output and all factor inputs (Klette, 1999).

Second, we include annually observed attributes of each local market (at the census-tract level) from the American Community Survey (ACS, US Bureau of Census). ACS data are useful in this regard as demographic and socioeconomic measures such as per capita income, average household size, local unemployment, and residential rental rates are likely to be highly correlated with purchasing-power measures that are considered by retailers in their decision to enter a market, and yet are mean-independent of the productivity of each individual store. Further, ACS provides exogenous variation at a level of geographic granularity that both helps identify the entry-effect in which we are interested, and differentiates local markets over time and space.

Third, and perhaps most important, we use commercial real estate data (CRE, CoStar, Inc.) for each entry location. Our CRE data—defined as commercial real estate sales prices per square foot—represent an ideal instrument for the decision to enter as these data reflect market-level real estate demand for the specific location that is targeted (or not) by the entering store. Because we use annual market-level real estate data for a 3-mile radius around the store, our real estate sales prices are exogenous to the specific case of the retailer, and are likely to capture a general level of demand for the location in question. Retail lots that are used by grocery stores, moreover, are generally fungible across any retail purpose, so CRE prices are independent of the output of a specific type of retailer.

In our empirical application, we examine the effect of using each of these instruments on the robustness of our empirical results, and determine their validity through first-stage instrumental variable regressions. In a first-stage instrumental-variables regression of the decision to enter on this set of instruments—estimated as a linear probability model (see below)—we find an F-statistic of 225.4, so our instrument is not weak according to the threshold (F = 10.0) defined by Stock and Yogo (2005). We report the complete results of these estimates in Table 3; in general, we are confident that our identification strategy supports our core hypotheses, and the robustness of our empirical findings.

Given that entry is a discrete variable, there is some debate over the exact form of the control-variable model for the entry variable. While the traditional approach would apply a Heckman-correction type of model with a suitable instrument, this approach is subject to bias in the second stage if the first-stage probit model is mis-specified.

However, Wooldridge (2015) argues that—in models such as this that are linear in the variables with a discrete endogenous explanatory variable (EEV)—it is preferred to estimate either a first-stage probit equation, or a linear probability model, and use the generalized residuals as control functions in the second-stage, structural model. When EEVs enter in non-linear ways, as in our second-stage model, a control function method is preferred because “...for general nonlinearities, inserting fitted values for EEVs is generally inconsistent, even under strong assumptions (p. 429).” Therefore, we adopt a control function approach with the generalized residuals from a first-stage, linear-probability model equation for the decision to enter regressed on state fixed effects, socioeconomic variables, and commercial real-estate prices.

3.3 Identification Strategy: Labor

As the literature on production-function estimation that we cited above clearly explains, the amount of labor that is employed is also endogenous to any unobserved productivity shock at the store level. In our static analog of the Ackerberg et al. (2015) approach, we instrument for the endogenous labor input in the second-stage of the estimation procedure with the use of a variable that is likely to be highly correlated with the amount of store-level employment, but is mean-independent of store output. According to first principles, firms minimize cost by choosing the level of input employment up to the point where the marginal value product is equal to the market wage. If labor markets are competitive, the market wage should, therefore, be correlated with the level of employment, but not necessarily related to the output level.

Therefore, we use market-level wages (we define each labor market at the county level) from the Quarterly Census of Employment and Wages (QCEW, USBLS, 2020b) for workers in retail grocery trade on a quarterly basis, and average over all quarters to arrive at an annual estimate of the average weekly wage. For the labor input, our instrumental-variables regression of labor employment on the average weekly wage and a constant produces an F-statistic of 391.5, so again our instrument cannot be described as weak.

In the next section, we describe how these instruments help identify markups and entry-effects with the use of production-type data at the individual-store level.

4 Empirical Approach

We examine the problem of hard-discounter entry from both a “naive” non-structural perspective and from a structural perspective: we first examine the data with the use of relatively simple, non-structural models (that ignore the likely endogeneity of entry and employment) to determine whether there are any patterns in the data that are consistent with our expectations with regard to the potential competitive effects of hard-discounter entry on both the sales volumes and the prices (via mark-ups) of nearby incumbent retailers.

We then estimate structural production functions that account for entry and for the well-understood endogeneity of variable inputs (Olley & Pakes, 1996; Levinsohn & Petrin, 2003; Ackerberg et al., 2015) using the approach that was developed for repeated-cross sectional data by Lowrey et al. (2021). We use this approach to test the effect of entry and of labor productivity on sales volumes, and markups, more formally. We then use the estimates from this model to conduct a set of counterfactual simulations that compare sale volumes and markups with and without hard-discounter entry. We interpret the results from these simulations as the likely impact of entry on incumbent retailers in our sample markets,Footnote 6

4.1 Overview of Empirical Approach

In our first set of models, we examine price and volume data for any summary-level evidence of hard-discounter entry. These non-structural models are not intended to be conclusive, but merely to examine the data in a way that is relatively free from modeling constraints in order to determine whether there are any patterns that are evident in the data. While the findings from these models may be suggestive, they are not definitive tests of our core hypotheses with regard to entry.

Our structural tests, on the other hand, address the endogeneity of input-choice and entry with the use of recently developed methods of markup estimation from the empirical trade and industrial organization literatures (De Loecker & Warzynski, 2012; De Loecker & Scott, 2016).

In a food-retail setting, we argue that a production-side approach to estimating the extent of market power is preferred over the traditional, demand-side approach to margin estimation [(Villas-Boas, 2007), for example] for several reasons: First, the accuracy and consistency of markups that are estimated from a demand-side approach depend on the relevance of the demand model that is brought to the task. Although it is well understood that random utility models that are applied to store level data are able to handle multi-product, high-dimension problems that would otherwise overwhelm a traditional demand-system approach (Nevo, 2001), they are not particularly well-suited to the scale of the demand problem that is presented by modern food retailers, where retailers typically stock and sell 40,000–50,000 products in the same store, and consumers select items from among hundreds of product categories. While others address the dimensionality problem that is inherent in retail demand analysis with the use of nested models of category-and-store choice (Bell & Lattin, 1998; Richards et al., 2018), they are still able to address the problem only in an indirect way: They reduce the scale of the problem by ignoring most of it.

Second, retail demand estimation is also problematic because consumers’ consideration sets are unobserved, and endogenous (Mehta et al., 2003; Koulayev, 2014; De los Santos & Koulayev, 2017): traditional demand-side analysis assumes that consumers shop only from a limited set of products in any category that form the products that they would reasonably consider buying. In actuality, however, the set of products from which each consumer chooses is endogenous to their preferences, experience, and the particular shopping environment, and analysts cannot measure (directly) the constituents of each shopper’s consideration set. Koulayev (2014) shows that the resulting estimation bias can be substantial.

Third, margin estimates that derived from demand-elasticity estimates are conditional on a specific solution concept that describes the game that is played among oligopolistic retailers. While the literature appears to have settled on Bertrand–Nash rivalry as a reasonable and robust way of thinking about how retailers interact, studies that adopt a “conduct parameter” approach typically show substantial deviations from the maintained form of the pricing game (Richards et al., 2018).Footnote 7 In contrast, the production approach to estimating markups makes no prior assumption as to the nature of the game that is played among competing firms, and provides consistent estimates regardless of how retailers compete (De Loecker, 2011b).

Fourth, by definition, market entry presents unique problems for demand-side analyses that are avoided by focusing only on store-level production. Specifically, if we seek to model the structure of rivalry among competing retailers with the use of changes in demand, and the set of retailers changes from one period to the next, then it is a difficult task to disentangle the effects of changes in product-level interaction that is introduced by a new competitor from changes in the game itself. By focusing only on the indirect effect of entry on each store’s input-productivity, we obviate the need to take demand-reallocation into account.

Our point is that when we are interested in store-level outcomes, a production approach has many appealing features relative to a more traditional demand-side approach. Nevertheless, in our empirical model below, we describe how we need to modify, and thus depart from, the approach that was developed by De Loecker and Warzynski (2012) to suit our particular needs.

4.2 Empirical Model

Researchers typically use panel data to estimate markups with the use of the production-side approach of De Loecker (2011a, 2011b) and De Loecker and Warzynski (2012). Nothing in the underlying theory requires panel data per se, but identifying the necessary productivity parameters generally requires methods that were developed specifically for application to panel data: The methods that were developed by Olley and Pakes (1996), Levinsohn and Petrin (2003), and more recently by Ackerberg et al. (2015) all assume that productivity shocks, which are correlated with endogenous input levels, follow Markov processes. In the absence of panel data, researchers must therefore estimate input-productivity parameters with the use of cross-sectional data, as in our application, where the unobserved shocks to productivity occur over firms, and not over time. Therefore, the ACF approach is appropriate for data that describe variation in output only across firms, at the same point in time. Thus, our empirical specification of retail markups adopts the same conceptual framework to identifying production parameters as does Ackerberg et al. (2015); but we depart from their approach, practically, due to the particular application to food retail and our firm-level data, which are repeated cross-sections (which were described in detail in Sect. 3).

Our approach requires a consistent estimate of the output-elasticity with respect to one variable input. In our case, the variable input of interest is labor—due both to its importance to food retailers and to its central role in empirical models of production more generally. Because most other retailing inputs either have a fixed relationship to output (e.g., materials, or inventory) or are subject to substantial adjustment costs (e.g., capital, in the form of the size of the store, or the technology used in the store), labor is an ideal input for our purposes. It is well-understood, however, that labor employment is endogenous, as shocks that affect output are also likely to affect the firm’s employment decisions (Olley & Pakes, 1996; Levinsohn & Petrin, 2003; Wooldridge, 2009).

Our two-step procedure, therefore, addresses the fundamental endogeneity of labor-input, and the endogeneity of the discounter’s decision to enter each particular market. We first invert the demand for an input other than the variable input of interest, and use a non-parametric approach to obtain a vector of expected production amounts that hold for any arbitrary parameterization of the production surface. We then use the fitted values from this expression to remove any observed shocks to productivity, and then use a control function approach to account for the endogeneity of labor and the discrete decision to enter. It is in this second step that we necessarily depart from Ackerberg et al. (2015) as our data are not dynamic, as required by their Markov-productivity assumption.

4.2.1 Stage One: Estimating Retail Output

Our first-stage production function is a parametric model of output and two state, or quasi-fixed, input variables. In the Olley and Pakes (1996) and Levinsohn and Petrin (2003) framework, the demand for one state variable serves as a proxy variable for the unobserved shock to productivity. In using this approach, we assume that productivity depends on factors besides the variable input, and that values of these other factors are not determined at the same time as the employment decisions for the variable inputs are made.

For our purposes, we assume a relatively simple functional form for the production function (Cobb-Douglas), in which output (\(y_{it}\)) for store i in period t is a function of the amount of labor (\(l_{it}\)) and two quasi-fixed variables (e.g., the size of store i, \(k_{1it}\), and the number of checkouts, \(k_{2it})\), so the production technology is given byFootnote 8:

where: each output and input value (except for 0,2 dummy variables) are expressed in logs; \(y_{it}\) is defined as revenue at the store level, normalized by a retail price index; labor \(l_{it}\) is measured as the number of employees (full-time equivalent, FTE) in store i in year t; both \(k_{1i}\) and \(k_{2i}\) are time-invariant proxies for different forms of capital investment; \(\textbf{z}_{it}\) is a vector of exogenous explanatory variables that are likely to be associated with inter-store differences in productivity; the variable \(\omega _{it}\) is a Hicks-neutral productivity measure that cannot be observed by the analyst, and is assumed to be correlated with \(l_{it}\); and \(\eta _{it}\) is an i.i.d. error, which is assumed to be uncorrelated both over firms and over time periods.Footnote 9

With this approach, we require a variable that proxies the unobserved shock to productivity, and another that serves as a state variable. We define \(k_{1i}\) as the size of the store (in square feet), and \(k_{2i}\) as the number of checkouts, which we interpret as a measure of the amount of investment in service technology that is deployed in the store. Although both measures could plausibly serve in either role, we define \(k_{1i}\) as the proxy variable, as store size is more likely to reflect inter-store variation in productivity than any measure of technology usage, and \(k_{2i}\) as the state variable. In our data, we also have indicators of whether the store sells gas or liquor. We use these discrete measures on gas and liquor sales as elements of the store-attribute (\(\textbf{z}\)) vector in the production-function above in order to capture the effect of observed store-heterogeneity on output, and labor productivity.

Our measures of store location allow us to test the impact of an entering hard-discounter on store productivity. We capture this effect in two ways: first, we calculate the distance between each store in our sample, and each hard-discounter.Footnote 10 We then use this measure to find the closest hard discounter, and define a continuous variable—COMP—as a continuous measure of the minimum distance between each store and the closest hard discounter. Second, we use this distance calculation to express competitive pressure as a binary variable: We determine whether there is an outlet of the hard-discounter within 10, 5, or 3 km (OPEN10, OPEN5, and OPEN3).Footnote 11

Our hypothesis suggests that an entering hard discounter is likely to cause a reduction in incumbent-store markups, which requires that we interact our competitive-pressure variables with the labor input in order to test the effect of entry on the marginal productivity of labor. We also include these competitive effects as intercept-shifting variables as entry is also likely to have a direct effect on store sales, and not just the efficiency of a variable input. Because these measures are likely to be highly collinear, we estimate different versions of the model, with each of these variables entering the model separately. We report our findings as to the differences in outcomes across these models in the Results section below.

Our static version of the Ackerberg et al. (2015) approach retains their core assumptions: (i) the unobservable is a scalar; and (ii) the proxy variable increases monotonically in the productivity shock.Footnote 12 Monotonicity is necessary so that we can write the unobserved shock to productivity as an arbitrary function of the state and proxy variables (\(k_{1i}\) and \(k_{2i}\)) and the vector of store attributes. With these assumptions, therefore, we write the demand for retail floor space as:

where each element of the vector \(\textbf{z}_{it}\) are potentially endogenous. The unobserved productivity shock for i at time t is therefore written in terms of the inverse-demand for \(k_{1i}\), or:

where \(g(\cdot )\) serves as an index of the productivity of firm i.

In order to express the output of firm i in terms of only observable and random factors, we then follow the first-stage of the Ackerberg et al. (2015) procedure by substituting this expression for the productivity shock back into the production function to arrive at:

Our first-stage model consists of a non-parametric specification of output as an arbitrary function of proxy, capital and labor inputs: \(\psi (l_{it},k_{1i},k_{2i},\textbf{z}_{it}).\)

There is some disagreement on the nature of this specification in the literature. While Olley and Pakes (1996) and Levinsohn and Petrin (2003) argue that the marginal product of labor is identified in (7), Ackerberg et al. (2015) maintain instead that the labor parameter is not identified as the amount of labor input is a simple, deterministic function of the other arguments of the production function. We follow Ackerberg et al. (2015) in this regard, as it is not necessary to use any estimates from the first-stage model.

Our non-parametric approach consists of a locally-weighted regression model with arguments that consist of non-linear and interaction terms that are calculated from the values of labor, capital, and proxy variables in the original production model (Levinsohn & Petrin, 2003). With this non-parametric model we obtain expected output values—\(\hat{\psi }\)—for any values of the parameters in (7)—\(\mathbf {\beta }\)—and use these estimates to generate a control function—\(CF_{it}\)—from the residuals of the locally-weighted regression model.

4.2.2 Stage Two: Estimating Retail Productivity

Our departure from Ackerberg et al. (2015) occurs in the second-stage estimation model: Whereas their underlying assumption maintains that the unobserved productivity shock follows a Markov process, we do not have the type of panel data that would allow us to exploit a similar assumption. In their case, the Markov assumption means that the productivity shock can be expressed as a stochastic function of lagged-values of productivity and an error term.

More generally, despite the number of applications of this model in the literature, we argue that most production data sets are likely not suitable for this task, so most researchers are in a similar position as us.

Instead, we assume that the productivity shocks represent idiosyncratic, store-level differences between stores in the same market. At the store level, differences in productivity between stores—most notably between stores in the same chain—are likely to reflect differences in management style, employee training, or local demand conditions that reflect deviations from average-store productivity: The most important shock to productivity is one that causes stores to differ from each other, and not from past versions of the same store. In a mathematical sense, cross-sectional differences in productivity are reflected in the control function that is estimated in the first-stage model—\(CF_{i}\)—so the process that underlies shocks to productivity for firm i is given by:

where \(\overline{\omega }\) reflects industry-mean productivity.

In the second-stage model, therefore, we first subtract the \(CF_{it}\) value from output, and express the difference as a linear (in logs) function of the the explanatory variables: capital, labor, store attributes, and a new error term that reflects differences in productivity between store i and the market-average:

In this model, however, labor is expected to be correlated with \(\xi _{it},\) so we estimate the second-stage model with the use of an instrumental variables approach. Further, in our model, recall that there are also terms that reflect discounter-entry in the \(\textbf{z}\) store-attribute vector. Regardless of how these distance measures are calculated, each is endogenous to the discounter’s decision to enter the market. Therefore, we include control functions for both the labor input and the decision to enter. As we described above, the primary instrument for the labor input consists of market-level wages for grocery store workers in the same county as the store in question. From first principles, we know that wages are expected to be correlated with each store’s demand for labor if managers minimize cost, but are mean-independent of store-level output.Footnote 13 We also include a set of store, year, and state fixed effects as instruments.

Entry, however, presents a more difficult identification problem. An ideal instrument would represent a measure of market-level demand for space, and hence represent the general attractiveness of a particular location, and yet remain independent of any individual store’s sales. For this purpose, therefore, we obtained ZIP-code level annual commercial real estate rental rates for retail locations. Commercial real estate prices are exogenous to the performance of any single firm, and still reflect the demand for each location for retail purposes. As we report below, this instrument performs well in first-stage regressions on the discounter’s decisions to enter each particular market. By adopting this control-function approach, we obtain consistent estimates of the output-elasticity of labor, the rest of the production-function parameters, and the implied markups from the De Loecker and Warzynski (2012) approach.

Others in this literature estimate production functions that are more deeply parameterized than the Cobb-Douglas, for the simple purpose of obtaining labor-elasticity estimates that vary over observations in the data set. Without further modification, a Cobb-Douglas production function implies an average value of the marginal product of labor (labor-elasticity) that is expected to represent all of the firms in the data.

However, this assumption is unsatisfactory as there is likely to be considerable heterogeneity remaining in the data—even after accounting for the idiosyncratic productivity shocks above. Further, there are more parsimonious ways of estimating models like this that still allow for parameters to vary over cross-sectional observations in the data—without sacrificing degrees of freedom, or imposing additional structure on the model.

Therefore, we account for unobserved heterogeneity in the data, and allow the marginal productivity of labor to vary across stores, by estimating a random-parameter version of the second-stage production function model that was introduced above. Each of the key production parameters is assumed to be normally distributed, with parameter-heterogeneity also dependent upon the entry variables described above. In this way, both the mean output levels for each store—and their markups—vary with the discounter’s entry activity. We use this approach to test our core hypotheses: that store output, and markups, are both likely to be affected by the entry of a hard-discounter.Footnote 14

4.2.3 Stage Three: Counterfactual Simulations

We conduct two counterfactual simulations in order to examine the potential effectiveness of responses by managers of traditional retailers to hard-discounter entry. We consider two types of responses: one on the demand side, store-traffic expansion following Briesch et al. (2009); and the second on the cost-side, akin to the insights by Basker (2012) on productivity improvements in general retailing.

For the first simulation, we consider the possibility of a strategy that has been shown to attract customers successfully: a retailer’s high-quality, private-label line. While Hökelekli et al. (2017) examine private-label strategies that are designed to defend market share (and profit) from hard-discounter incursion, they could not find a strategy among them—premium, economy, or standard tiers—that was actually successful. Moreover, their findings are based on counterfactual simulations of a demand-based model in which they add and remove private-label lines from a single category; but it is not plausible that adding or removing a product line from a single category will change the number of customers that choose one store over another.

Although a distinguishing feature of hard-discounters is their selection of private-label products, we consider a strategy that is instead designed to play to a hard-discounter’s weakness: their small assortment, and the proven value of large assortments in attracting customers (Briesch et al., 2009). While our model does not directly include the attractive power of assortments, we simulate the impact of a hypothetical assortment increase by incrementing store traffic with the use of magnitudes that are consistent with the existing empirical literature. We do so in steps, from 1% to 10%, and measure the change in store profit that are implied from the structural markup model.

In the second simulation, we consider productivity-enhancing responses such as the technology-adoption examples in Basker (2012). Although the specific example in Basker (2012, electronic scanning technology) is not likely to be repeated in the same way, the size of the productivity gains (mean productivity gain = 4.5%) that she describes are again both relevant and likely to describe real-world responses that traditional retailers would consider. Therefore, in this case, we use the existing productivity parameters, and simulate a range of productivity enhancements again from 1 to 10% in increments of 1%. For each gain in productivity, we calculate the implied change in store profit, taking into account the interaction effect between labor productivity and hard-discounter entry in the structural model. We report the results of both simulations in the next section.

5 Results

In this section, we first present results from a non-structural procedure for estimating store output (measured as annual store sales revenue), and then the structural estimates of our markup-and-entry model of store output.

Our non-structural estimates control for state, chain, and year fixed effects, as well as the full set of production inputs and store-attribute values. These findings are in Table 4. We estimate several versions of the model in order to examine the sensitivity of the core model parameters—the labor elasticity of output—to changing the set of covariates. We estimate: a basic model with only fixed effects and production inputs (Model 1); a model that includes store attributes (defined as whether the store sells gas or liquor, Model 2); a model that adds the distance from an entering hard-discounter as an output-shifting variable (Model 3); one that allows entry to affect output and the labor-elasticity (Model 4); and a model that defines entry as a discrete variable that takes a value of 1 if a hard-discounter enters within 5 km (Model 5).

From the results in this table, we see that the core output-elasticity estimates are relatively stable across the different specifications, and that the implied returns to scale (the sum of the elasticities) is not statistically different from 1.0.Footnote 15 Further, these reduced-form results show that output is greater for stores that sell both gas and liquor, all else constant, so there are clear opportunities for cross-selling services or alternative products in food retailing.

Most important for our objectives, however, Model 3 shows that sales appear to be significantly lower for stores that are nearer to an entering discounter than otherwise. But, controlling for the dual effects of entry on store output and labor efficiency (Model 4), the results in this table show that the main effect of entry on output is felt through the efficiency of labor, and not directly on gross output per se: In the presence of entry each worker generates less dollar sales than in the absence of entry—which we interpret as implying that average prices are lower across the store as management meets the new competitive pressure from the entering hard discounter. In Model 4, however, the direct effect of entry on store sales is not statistically significant, while it is in Model 5.

We interpret the positive effect of entry on store sales—controlling for the effect on labor productivity—as meaning that the entering hard-discounter drives incremental traffic to the area around the store, but forces prices down in equilibrium. Customers from outside the area who travel to the hard discounter for its low prices may not be able to find at the hard discounter the products that they want in every category, however—in particular national brands (Hökelekli et al., 2017)—so they shop at the nearest full-service supermarket in order to top off their baskets.

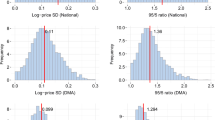

While the non-structural model results are suggestive of deeper patterns in the data, they are likely to be biased for the reasons cited above. After controlling for the endogeneity of entry and of labor inputs, we obtain structural estimates of labor-productivity on a store-level basis, and use these estimates to infer values for the markup over marginal cost. These estimates are in Table 5. In this table, we again report estimates from models that consider various definitions of entry: the distance to an entering hard discounter (Model 1); a binary indicator of a discounter within 3 km (Model 2); 5 km (Model 3); and 10 km (Model 4). According to the goodness-of-fit statistics reported in this table, it appears that Model 4 provides the best fit to the data among the “binary” models, although each fit the data slightly worse than the continuous definition in Model 1.

Because of the similarity in fit, and the magnitudes of the estimated parameters, we rely on the parameters from Model 4, simply due to the fact that we regard the binary definition of entry as the most consistent with how entry likely impacts retailers’ decisions in practice: the retailers are not likely to be affected by a discounter outside of what they regard as their market area, but will respond to what they perceive as a direct competitor.

Relative to the non-structural estimates in Table 4, we see that controlling for both labor and entry endogeneity leads to somewhat larger estimates for the output-elasticity with respect to labor. According to the theoretical model of markup determination (Hall, 1988), this implies higher markups after controlling for endogeneity. In Model 4, the results also show a negative marginal value of selling liquor, all else constant. Although liquor is notoriously a high-volume, high-margin category, it may be the case that retailers have to employ additional labor to manage the category, so controlling for labor-endogeneity removes any economic benefits to selling liquor.

Most important, however, the entry effects from Table 4 are confirmed for this structural model: We find a similar pattern of entry effects on incumbent retailers: Store output rises for stores that are near an entering hard-discounter—by an average of 1.9%, when we use the data in Table 1—but margins fall. Relative to the non-structural evidence, our structural model shows an attenuated store-output effect, but an accentuated impact on labor-efficiency. As in the previous table, we interpret this result as implying that entering discounters increase customers for surrounding stores that provide more variety; but the hard discounters increase pricing pressure on nearby retailers, which reduces the latter’s store-level markups.Footnote 16

Our estimates imply non-trivial changes in profitability for stores that are exposed to hard-discounter competition. In our preferred model (Model 4), the difference in markups that is implied by these estimates represents a 7.2% reduction in the price–cost margin. While this may seem to be a small impact, retail food net margins, which also take into account fixed costs of operation, tend to be roughly 2% (Campbell, 2020). A 7% reduction in the amount of margin available to pay fixed costs, therefore, can be substantial.

For example, suppose that a 2% margin results from a 50 pound bundle of groceries that sell for \(\$2.00\) per pound, with a cost-of-goods-sold of \(\$1.00\) per pound, and a fixed cost of \(\$48.00\) for the store. Net profit is \(\$2.00\) on sales of \(\$100.00\). If the price–cost markup falls from \(\$1.00\) to \(\$0.93\) per pound, then this 2% net margin becomes a loss of 1.5%. Over the longer term, bankruptcy ensues—despite the total sales effect that is implied by our model.

The simulation exercise provides important managerial insights into the type of defensive strategies that are likely to be successful (or not). Our first experiment, which uses a hypothetical expansion of sales volume (which could follow from a change in store-assortments among traditional retailers as a means of attracting additional customers) is successful in generating additional profit throughout the full range of the simulated store-preference parameter (Table 6). However, this effect shows clear diminishing marginal returns as the maringal gains disappear after a 10% increase in store-demand.

In the second experiment—an increase in the productivity of store labor—we find that the initial gains are maximized through a 3% gain in productivity, but the interaction with discounter-entry dominates after that point. Because markups are diminished by hard-discounter entry, and depend critically on labor productivity in our theoretical framework, higher productivity increases store profit through the direct effect, but reduces store profit due to the entry interaction. Intuitively, if a retailer becomes too profitable due to labor-related innovations, a hard-discounter will interpret this profitability as a market opportunity, enter, and reverse any gains in profit that were available.

Our findings are important for understanding both the broader, economic impacts of hard-discounter entry, and potential managerial responses: First, although we do not calculate the implied welfare effects on competing firms and consumers that buy from these retailers, it is clear from our results that producer surplus is likely to fall due to lower markups, but consumer surplus will rise for the same reason. To the extent that incumbent retailers may also reduce their SKU count in order to compete with hard discounters, consumers may also experience a reduction in welfare from a loss of variety. In general, however, lower prices tend to be net positive for consumers.

Second, retail managers need to be aware of the potential consequences due to the entry of paradigm-changing retailers—such as hard discounters—and draft responses that are least likely to be self-destructive. For instance, Arcidiacono et al. (2016) describe the impact on local markets due to Walmart’s entry into retail markets throughout the 1990s and 2000s. While the common perception was that “main street” would suffer most, it was instead the direct competitors to Walmart—the supermarkets that competed most directly with Walmart’s primary line of business—that suffered. In fact, retailers that were sufficiently differentiated from Walmart were less affected, if at all.

Our findings make a similar case: Responding by reducing prices and SKUs in order to match the hard discounters’ business models will likely end in failure; but differentiating by emphasizing variety, quality, and sharply differentiated store brands (Hökelekli et al., 2017) is more likely to be successful.

6 Conclusions and Implications

In this paper, we examine the impact of hard-discounter entry on incumbent retailer markups. Because retailers tend to sell thousands of items, we argue that the traditional demand-side approach to entry is intractable for a problem such this; consequently, we adopt the production-side markup-estimation approach of De Loecker and Warzynski (2012) for this purpose. Although this approach has been used extensively to estimate the effect of trade status on manufacturing margins (De Loecker, 2007) or corporate markups in general (De Loecker et al., 2020), we are the first to use this approach to examine retail-store performance.

We find that, averaged over all incumbent retailers and markets, markups fall by over 7.0% in response to hard-discounter entry, although total store sales rise by nearly 2.0%. There are two mechanisms that explain these effects: first, competitive pressure from entering hard discounters causes retail prices, and hence markups, to fall; and, second, customers who are newly attracted to a geographic area to shop at the hard discounter also shop in nearby stores in order to fill their baskets with items that are not available at the hard-discounter. This finding is remarkably consistent with those of others who document this same inter-store complementarity effect with the use of entirely different methods and data (Vroegrijk et al., 2013). Moderately higher sales, however, are likely irrelevant if the lower markup causes already-low-margin retailers to sell at a long-run loss.

Our empirical model has both macroeconomic and managerial significance: If the spread of hard discounters leads to lower retail prices for food, then consumers will almost certainly benefit in terms of total welfare. However, if hard-discounter entry leads to the exit of grocery stores in nearby markets—which were perhaps already marginally suited to traditional grocery retailers—then the “food desert” problem may be accentuated in these markets (Allcott et al., 2019).