Abstract

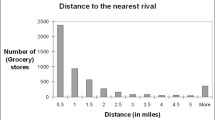

This paper examines the importance of geographical differentiation in store location decisions of firms in the retail discount industry. Using a novel data set that includes the store locations and accompanying market conditions for all stores belonging to the Wal-Mart, Kmart, and Target chains, we study the factors that influence the entry and location decisions of these firms. The model involves an incomplete information game between the three players where each firm has private information about its own profitability. A key feature of our modeling approach is that it permits asymmetries across firms in the impact of exogenous market characteristics and competitive interaction effects. Variations in the exogenous firm specific characteristics, such as the distances from the market to firms’ headquarters and the nearest distribution centers, serve as exclusion restrictions and provide the source for model identification. Parameter estimates of the payoff functions are used to predict the equilibrium market structure under a variety of market conditions that provide insights into the competitive landscape of the industry. Results show that all firms exert a strong negative impact on competitors when they are in close proximity, but the effect decreases with distance to rivals suggesting strong returns to spatial differentiation in this industry. Target stores fare well under competition except when these competitors are in close proximity. Wal-Mart’s supercenter format is found to be the most formidable player as it substantially impacts competitors even at a large distance. We also find significant asymmetries across players in their response to market conditions and competition interactions.

Similar content being viewed by others

Notes

Kyle (2006) makes similar arguments in the context of entry in pharmaceutical drugs.

In principle, the unobserved market characteristics can impact firms differently. In the empirical application we allowed for this possibility by estimating an additional model which allows for the unobserved market factor to vary across firms and found no substantial differences in results.

As discussed below in the context of format choices, it is also possible for the parameters to be contingent on the actions taken by firms.

The marketwide random component is ignored as it does not provide any additional insight into the importance of asymmetric effects.

The scenarios and parameter values are partly motivated by our empirical results.

For a detailed background on these firms, interested readers are referred to Zhu et al. (2008) and three recent books on each firm: The Wal-Mart Decade: How a New Generation of Leaders Turned Sam Walton’s Legacy into the World’s #1 Company (Robert Slater) Portfolio Hardcover (2003); On Target: How the World’s Hottest Retailer Hit a Bullseye ( Laura Rowley) Wiley (2003); Kmart’s Ten Deadly Sins: How Incompetence Tainted an American Icon, (Marcia Layton Turner) John Wiley & Sons (July 18, 2003).

For very large urban counties (for example LA county), we use the first three digits of the tract number to create sub-markets. The complete census tract ID is defined as follows: SS-CCC-TTTTTT, where the first two digits “SS” represents State FIPS code, the next three digits “CCC” represents County FIPS Code, and the last six digits “TTTTTT” is the census tract number. This definition defines a market as the tracts within a county with the same first three digits in their tract numbers and all six digit codes as locations.

We assume that firms are located at the centroid of the location, i.e., census tract. We calculate the distance between locations using the Haversine Formula. Based on latitude-longitude coordinate data, the distance between two points, a and b, is given by

$$ d_{a,b}\!=\!2R\arcsin\left[\!\min\left\{\! \left( \left( \sin\left( 0.5\left( lat_{b}\!-\!lat_{a}\right) \right) \right) ^{2}\!+\!\cos\left( lat_{a}\right) \cos\left( lat_{b}\right) \left( \sin\left( 0.5\left( lon_{b} \!-\!lon_{a}\right) \right) \right) ^{2}\right) ^{0.5},1\!\right\} \!\right] $$where R = 3961 miles denotes the radius of the earth.

One problem of the likelihood approach is that there might be multiple equilibria in the incomplete information game. Although we solved for the fixed point by using different starting values, uniqueness of the solution is not guaranteed. However, as long as the strength of competition effect is moderate, the equilibrium can be solved uniquely. We show analytical and simulation results in the Appendix.

A concern in our modeling framework is potential cannibalization across markets since each market is treated independently. This is less likely to be an issue in the non-MSA markets where the distance between the adjacent stores is quite large. Note however that the travel time in MSA markets is likely to larger potentially mitigating cannibalization. Jia (2008) makes contribution to the literature by incorporating the “spill over” effects across market within a firm. However the implicit assumption in her approach is the externality between two close-by stores within the same chain is positive.

According to an independent study by McKinsey & Co., Wal-Mart’s efficiency gains were the source of 25% of the entire U.S. economy’s productivity improvement from 1995 to 1999. “Can Wal-Mart get any bigger” Time Magazine (Vol. 161, issue 2, 2003).

References

Aguirregabiria, V., & Mira, P. (2004). Sequential estimation of dynamic discrete games. Working Paper, Boston University.

Aradillas-Lopez, A. (2005). Semiparametric estimation of a simultaneous game with incomplete information. Working Paper, Berkeley.

Bajari P., Benkard, L., & Levin, J. (2005a). Estimating dynamic models of imperfect competition. Working Paper, Duke.

Bajari, P., Hong, H., Krainer, J., & Nekipelov, D. (2005b). Estimating static models of strategic interactions. Working Paper, University of Michigan.

Bayer, P., & Timmins, C. (2004). On the equilibrium properties of locational sorting models. Working Paper, Yale University.

Berry, S. T. (1992). Estimation of a model of entry in the airline industry. Econometrica, 60(4), 889–917.

Bresnahan, T. F., & Reiss, P. C. (1987). Do entry conditions vary across markets. Brookings Papers on Economic Activity, 1987(3), 833–881.

Bresnahan, T. F., & Reiss, P. C. (1990). Entry in monopoly markets. Review of Economic Studies, 57(4), 531–553.

Bresnahan, T. F., & Reiss, P. C. (1991a). Entry and competition in concentrated markets. Journal of Political Economy, 99(5), 977–1009.

Bresnahan, T. F., & Reiss, P. C. (1991b). Empirical-models of discrete games. Journal of Econometrics, 48(1–2), 57–81.

Heckman, J. (1978). Dummy endogenous variables in a simultaneous equation system. Econometrica, Econometric Society, 46(4), 931–959.

Jia, P. (2008). What happens when wal-mart comes to town: An empirical analysis of the discount industry. Econometrica (in press).

Kyle, M. K. (2006). The role of firm characteristics in pharmaceutical product launches. RAND Journal of Economics, 37, 602–618.

Mazzeo, M. J. (2002a). Product choice and oligopoly market structure. Rand Journal of Economics, 33(2), 221–242.

Mazzeo, M. J. (2002b). Competitive outcomes in product-differentiated oligopoly. Review of Economics and Statistics, 84(4), 716–728.

Nishida, M. (2008). Estimating a model of strategic store network choice. Working Paper, University of Chicago.

Orhun, Y. (2005). Spatial differentiation in the supermarket industry. Working Paper, Berkeley.

Pakes, A., Ostrovsky, M., & Berry, S. (2004). Simple estimators for the parameters of discrete dynamic games with entry/exit examples. Working Paper, Harvard University.

Seim, K. (2001). Spatial differentiation and market structure: The video retail industry. Yale University Dissertation.

Seim, K. (2006). An empirical model of firm entry with endogenous product-type choices. Rand Journal of Economics, 37, 619–642.

Zhu, T., Singh, V., & Manusazk, M. (2008). Market structure and competition in the retail discount industry. Journal of Marketing Research (in press).

Author information

Authors and Affiliations

Corresponding author

Additional information

The paper is based on Ting Zhu’s thesis at Carnegie Mellon University.

Appendix: Equilibrium properties of incomplete information games

Appendix: Equilibrium properties of incomplete information games

A well-known problem with multi-agent discrete games is that they have non-existence of pure strategy equilibria and multiple equilibria in which certain values of the underlying latent payoffs could simultaneously be consistent with more than one equilibrium outcome. For existence, researchers generally assume that the data is generated by a pure strategy equilibrium and that the model satisfies restrictions sufficient to guarantee the existence of at least one such equilibrium. In the current application, since Eq. (6) is a continuous mapping from a probability space to itself, the existence of a solution of (6) can be proved from Brouwer’s Fixed Point Theorem. However, the uniqueness of such a solution is not guaranteed. The game will have multiple equilibria if, for given parameter θ, more than one value of P satisfies (6) in which case the likelihood function is not well defined. Aradillas-Lopez (2005) discusses the sufficient conditions for the uniqueness of equilibrium of incomplete information game and points out that the conditions for existence of a well-defined likelihood function are generally weaker in incomplete information game than in the complete information version of the game.

Heckman (1978) studies the general class of simultaneous equation qualitative response models and shows that if the distribution of the unobservables is continuous with unbounded support, a necessary and sufficient condition for the model to have a unique equilibrium for any values of exogenous variables is that the model is recursive. Though useful in some applications, this condition implies setting some strategic interactions parameters (which are of main interest) to zero. Instead, researchers have generally adopted one of the two approaches to deal with multiple equilibria problem. First, models sometimes yield a prediction for some outcome that is unique across all equilibria. For instance, Bresnahan and Reiss (1990, 1991a, b) and Berry (1992) ignore the identities of the players that enter a market and only consider the total number of entrants, an outcome for which their models yield a unique prediction. Alternatively, some papers impose additional structure on the model that guarantees equilibrium uniqueness. For example, Zhu et al. (2008) consider sequential move games that yields additional conditions for an outcome to be a subgame perfect Nash equilibrium.

In this Appendix, we study the equilibrium properties for the model proposed in Section 2. We begin with a proof on the sufficient conditions of uniqueness for the two player–two action game and then rely on simulation techniques for a more complex game, i.e., when the action space or the number of players becomes larger.

Consider a simple 2×2 game with two players and two possible actions: in or out. Firm i’s payoff of entry is

where p − i is the entry probability of i’s competitor, and ε i is the private information held by firm i and is type 1 extreme value distributed. Similar to the discussion on Eq. (7), the BNE is obtained by solving the following two simultaneous equations:

and

Define \(f=\left(\begin{array} [c]{c}f_{1}\\ f_{2}\end{array} \right)\), where

then taking the derivates of f 1 with respect to p 2 yields

and similarly

Hence the Jacobian matrix f ′ is

From the Gale-Nikaido Theorem: Suppose f: ℝn→ℝn is continuously differentiable function, and define Ω as the rectangle \(\Omega=\left\{ x\in\mathbb{R}^{n},a\leq x\leq b\right\},\) where a and b are given vectors in ℝn. Then f is one-to-one in Ω if for all x ∈ Ω, Jacobian matrix \(f^{\prime }\left( x\right)\) has only strictly positive principal minors. The sufficient condition that (1) has unique solution for \(\left( p_{1},p_{2}\right) \) is

or equivalently,

Hence as long as the interaction term of the competition intensity δ 1 δ 2 is below 16, the uniqueness of the Bayesian Nash equilibrium is ensured in this 2×2 game.

The message from the simple example above is that as long as the strength of strategic interaction is within a certain range, equilibrium is unique. As the game becomes more complex, i.e., the action space or the number of players gets larger, the matrix algebra becomes cumbersome. We rely on simulation technique to investigate the uniqueness property of incomplete information games. In the simulation, We are interested in how the equilibrium uniqueness property is related to \(\left(1\right)\) the variation of market characteristics across locations (choice alternatives), \(\left(2\right)\) the heterogeneity across players, and \(\left(3\right)\) the magnitude of competition effect. This simulation exercise is motivated by Bayer and Timmins (2004). We assume

-

There are two locations in the market, location 1 and location 2.

-

There are two players A and B who decide whether to enter the market or not and which location to choose.

-

The competition between players at the same location is stronger than the competition between players from different locations.

Players’ payoff functions are assumed to be:

where \(\delta_{lk}^{i}\) denotes the how firm i’s payoff at location l is affected by its competitor’s entry of location k and \(\delta_{ll}^{i} \geq\delta_{ll^{\prime}}^{i}\), where l ′ ≠ l. ε il are iid type one extreme value distributed.

We normalize x 1 = 1, β A = 1, and change x 2 from 1 to 10 and β B from 1 to 2. The ratio x 2/x 1 captures the variation of market conditions across locations. The larger the ratio, the more different the two locations are. Similarly, the ratio β B /β A represents the level of firm heterogeneity. Given the same market conditions, firms’ profitability will be different due to their preferences of those market factors. Given x 1, x 2, β 1, β 2 and \(\delta_{lk}^{i}\), the fixed points of the probability vector \(\left( P_{1A},P_{2A,}P_{1B,}P_{2B}\right)\) are solved from different starting values: \(\left( 0\text{ }0\text{ }0\text{ }0\right) ^{\prime}\), \(\left( 0\text{ }0\text{ }1\text{ }0\right) ^{\prime}\), \(\left( 0\text{ }0\text{ }0\text{ }1\right) ^{\prime}\), \(\left( 1\text{ }0\text{ }0\text{ }0\right) ^{\prime}\), \(\left( 1\text{ }0\text{ }1\text{ }0\right) ^{\prime}\), \(\left( 1\text{ }0\text{ }0\text{ }1\right) ^{\prime}\), \(\left( 0\text{ }1\text{ }0\text{ }0\right) ^{\prime}\), \(\left( 0\text{ }1\text{ }1\text{ }0\right) ^{\prime}\), \(\left( 0\text{ }1\text{ }0\text{ }1\right) ^{\prime}\). The discussion on why one should choose those points as starting points to test equilibrium multiplicity can be found in Bayer and Timmins (2004). As we change \(\delta_{11}^{A}\) from 0 to 100, and find \(\bar{\delta}_{ll}^{i}\), such that as \(\delta_{ll}^{i}>\bar{\delta}_{ll}^{i}\), we start to observe multiple fixed points for a particular combination of x 1, x 2, β 1, β 2. In Figs. 4 and 5 we plot how \(\bar{\delta }_{ll}^{i}\) changes as x 2/x 1 and β 2/β 1 changes under two scenarios:

-

Case 1:

Symmetric competition , \(\delta_{lk}^{A}=\delta_{lk}^{B}\), \(\delta_{ll^{\prime}}^{i}=\frac{1}{2}\delta_{ll}^{i}\)

-

Case 2:

Asymmetric competition: \(\delta_{lk}^{A}=2\delta_{ik}^{B}\), \(\delta_{ll^{\prime}}^{i}=\frac{1}{2}\delta_{ll}^{i}\)

In the first case, firms are symmetric in terms of competition, while in the second scenario Player B is stronger than player A in the sense that it exerts stronger negative impact on its competitor. The competition intensity is weaker if two players choose different locations. Comparing the plot for case 2 and that for case 1, we can find that the threshold for case 2 is larger. The reason is that the uniqueness conditions are determined by the interaction terms of the competition intensity. Hence the range for the competition intensity of \(\bar{\delta}_{11}^{1}\) is larger if \(\delta_{lk} ^{A}>\delta_{lk}^{B}\).

The results from simulation can be summarized as follows. First, as long as the strength of competition effect is moderate, there is a unique equilibrium in the incomplete information game. Second, there exists a threshold \(\bar{\delta}_{lk}^{A}\) such that when \(\delta_{lk}^{A}>\bar{\delta}_{lk}^{A} \), one starts to observe multiple equilibrium given the location characteristics and firms’ preference of those market characteristics. We find that as the variation of market characteristics increases, the threshold \(\bar{\delta}_{lk}^{A}\) increases. Put another way, the multiple equilibria is less likely to be observed when there is larger variation across locations. This finding is consistent with Seim (2001). Finally, as the asymmetry between players increases both in terms of their preference to market conditions \(\left( \beta_{B}/\beta_{A}\right)\) and the asymmetric of competition effect, the threshold \(\bar{\delta}_{lk}^{A}\) becomes higher.

Rights and permissions

About this article

Cite this article

Zhu, T., Singh, V. Spatial competition with endogenous location choices: An application to discount retailing. Quant Mark Econ 7, 1–35 (2009). https://doi.org/10.1007/s11129-008-9048-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-008-9048-6