Abstract

Intertemporal choices play a fundamental role in the lives of individuals, and the Discounted Utility model is the essential framework for describing decision makers’ attitudes in front of alternatives structured over multiple periods. The classical formulation of the model assumes constant preferences over time, i.e., it assumes that individuals’ choices are consistent. Empirical evidence, however, shows that individuals’ preferences do not respond to this assumption, generating temporally inconsistent decisions. This paper addresses the problem of temporal inconsistency in order to interpret and describe anomalous choices, i.e., not rationalizable from a theoretical point of view, through the cognitive distortions of the decision-maker. Indeed, even if we assume that the investor is a rational subject, behavioral finance suggests that an anomaly is part of the human being and must be recognized as a systematic condition of the decision-making process. Exploiting the relationship between the rate of impatience and temporal preference, this work aims to demonstrate that the degree of decrease in impatience quantifies the weight of emotional drives in the anomalies of intertemporal choices. An experimental approach based on constructing the hyperbolic factor for each individual in different contexts is presented to test our results. The variability in the collected data highlights that individuals’ behavior is very different, suggesting the need to project strategies in personalized finance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The numerous real actions which seem little anchored to the canons of rationality have created a discrepancy between the theoretical-normative, rational context and the effective actions of investors (Rubaltelli, 2016). The Discounted Utility model, proposed by Samuelson (1937), assumes that individuals’ choices do not change over time (Cruz Rambaud et al. 2018a). This study analyzes, from a psychological perspective, the situations in which these choices are inconsistent. Indeed, inconsistency in intertemporal choices refers to the inconsistency of the decision-making process between the short and long term. Specifically, the former appears when an individual changes her attitude towards the choice and, thus, there is a change associated with haste and, consequently, with impatience. Therefore, the anomalies derived from the Discounted Utility model will be related to emotional factors through a description involving impatience and its degree of decrease.

To clarify the characteristics of the above phenomenon, Prelec (2004) has proved the equivalence between a decreasing impatience in time and the selection of non-optimal results from any temporal point of view. Based on this approach, this research compares the preferences exhibited by an investor adjusted to hyperbolic discounting with others who follow exponential discounting, by describing the central anomalies of the Discounted Utility model in terms of impatience. This study shows that delay effect, for which “as the waiting time increases, discount rates tend to be higher in short intervals than in longer ones” (Ventre and Ventre 2012; Cruz Rambaud and Muñoz Torrecillas 2016), is determined by a discount function which decreases non constantly, indicating a steep trend depending on the interval in which the evaluation periods reside. The interval effect, which suggests the situation in which shorter intervals bring more significant discounts per unit time (Read 2004; Read and Roelofsma 2003), is studied as a direct expression of whether preferences are affected by the subjective perception of time. The relationship between the interval effect and delay effect, inspired by Cruz Rambaud and Ortiz Fernández (2021), is also analyzed. Regarding the magnitude effect, which indicates the phenomenon whereby smaller amounts are discounted at a higher rate (Benzion et al. 1989; Holcomb and Nelson 1989; Cruz Rambaud et al. 2018b and 2018c), this paper proves that the increase of the considered amounts also increases individual’s propensity to wait. The latter attitude could be psychologically explained because small amounts are associated with immediate consumption whilst more significant results are linked to future investment. To study the sign effect, which stresses that the discount rate for gains is much higher than the discount rate for losses (Loewenstein and Thaler 1989), we will follow two roads. The first approach is based on the aversion to losses for which the disutility of negative amounts is greater than the utility perceived by a gain of the same entity. The second approach is based on the prospect theory. The psychological aspects of loss aversion are encapsulated in a coefficient \(\epsilon > 1\), representing the penalty related to negative versus positive outcomes. In this case, we will prove that the sign effect can be justified if the cardinal utility function, used to calculate the intertemporal utility function of a prospectus, is replaced by the utility function proposed by the prospectus theory (see Sect. 4.5).

Finally, the construction and analysis of the experimental part are presented empirically, confirming our hypotheses. This study suggests that, since the decrease in impatience can be seen as reflecting the irrationality underlying preference reversal and thus as the origin of inconsistent choices, this experimental approach can be adopted to study behavioral biases of individuals.

This paper is structured as follows. A brief description of the Discounted Utility model is presented in Sect. 2, followed by a more formal definition of preferences defined as inconsistent. In Sect. 3, the concept of impatience is introduced with a brief description of the various tools which are useful to calculate its degree. Specifically, in its fourth paragraph, impatience is analyzed in the context of exponential discounting and is presented in terms of consistent choices. In Sect. 4, we compare consistent and inconsistent preferences through the variation of the degree of impatience. In this regard, the following anomalies have been analyzed: the delay effect, the interval effect, the magnitude effect, and the sign effect. Section 5 presents an empirical experiment to detect the presence of the former effects in contexts of intertemporal choice. Finally, Sect. 6 discusses the obtained results, and Sect. 7 summarizes and concludes.

2 The discounted utility model and the discount rate

The term “intertemporal choice” is related to decisions whose consequences are distributed over time. The intertemporal dimension of this type of choice is that, once a set of goods has been fixed, the decision-maker must express a preference for results placed at different points in time. The individual behaviors do not always fall in the context of the economic perspective where a person is assumed to be represented by a single discount rate, specifically the image of her attitude towards the future. Analogous inconsistencies are met at a societal level.

The Discounted Utility (DU) model for measuring the utility of an intertemporal prospectus, described by Samuelson (1937, 1952), provides that decision-makers shall add up the values associated with each alternative by considering the utility of the individual goods as if they were received immediately, multiplied by the discounted rate which is one of the main elements of the model because it reduces the utility associated with the present, based on the distance between the decision and the retraction of the considered result. In this way, let us consider the following example.

Example 1

Let us assume investing today on a figure of $50 with a rate of return \(r>0\). After one year, the value of the amount is \(50+50r\). Therefore, if in a year we wanted to perceive $50, we should invest an amount equal to \(50/(1+r)\).

By applying the reasoning of Example 1 to a good \(\alpha\), whose outcomes, at specific times t and \(t+1\), are \(\alpha _t\) and \(\alpha _{t+1}\), respectively, its utility would result in:

where \(\rho\) is the intertemporal discount rate which gives the information on how the individual estimates the outcome of \(\alpha\) in the period \(t+1\). By generalizing the former reasoning to n periods, one has:

where \(\delta :=1/(1+\rho )\) is called the discount factor.

The expressions displayed in Table 1 (Read 2004) are among the most used discount functions depending on a parameter k, say \(F_k\), with specification of their corresponding rates \(\delta _k\) and discount factors \(f_k\).

Observe that, in all cases, the discount function is decreasing over time. However, the discount rate corresponding to the exponential model is constant for all future periods whilst, in all hyperbolic models, the discount rate is variable. These various formulations lead to different qualitative and quantitative conclusions in the prediction of behavior. In general, the descriptive power of the hyperbolic discounting for individual preferences is greater (Green and Myerson 1997).

A preference is temporally consistent only when using exponential discount where the discount rate is constant and the discount factor decreases steadily in the sense that, given two future instants \(t + m\) and \(t + n\), with \(m < n\), the discount factor only depends on the difference \(m - n\) and not on the values t and s.

Empirically, it has been shown that people tend to apply a drastic discount on short periods and a milder discount on more extended periods (hyperbolic discount). The consequence of this mechanism is that preferences are inconsistent, i.e., they vary over time so that yesterday’s perfect plans are not as optimal today. For this reason, in recent years, the hyperbolic discount has been established as the default option for describing the behavior of hyperbolic agents.

3 Impatience and inconsistency

3.1 Definition of impatience: some results

Definition 1

A discount function in one variable is a map

such that

where:

-

\(F(0)=1\),

-

\(F(t) >0\), for every t, and

-

F(t) is strictly decreasing.

Therefore, the discount function represents the value at 0 of a $1 reward available at instant t (Cruz Rambaud and González Fernández 2019).

Definition 2

Let F(t) be a discount function in one variable. The impatience associated to F(t) in a generic interval \([t_1,t_2 ]\) (\(t_1 < t_2\)) is defined as:

Consequently, the patience associated to F(t) in the interval \([t_1,t_2 ]\) (\(t_1 < t_2\)) is defined as:

Theorem 1

Let be \(F_1(t)\) and \(F_2(t)\) two discount functions. The following three conditions are equivalent:

-

(i)

The ratio \(\frac{F_2(t)}{ F_1 (t)}\) is increasing.

-

(ii)

The impatience represented by \(F_1(t)\) is greater than the impatience represented by \(F_2(t)\), for every \(t_1\) and \(t_2\) such that \(t_1< t_2\).

-

(iii)

If \(F_1(t)\) and \(F_2(t)\) are differentiable, for every t, \(\delta _1(t) >\delta _2 (t)\), where

$$\begin{aligned} \delta _i(t) = - \left. \frac{\mathrm {d} \ln F_i(z)}{\mathrm {d}z} \right| _{z=t}; \ i = 1, 2. \end{aligned}$$

Theorem 1(iii) justifies that \(\delta (t)\) can be considered as an instantaneous measure of impatience, i.e., it is not necessary to indicate the discounting interval (observe that this criterion coincides with that displayed in (ii)). In the following, we will consider a flow of values \((x_0,t_0;x_1,t_1;\dots ;x_n,t_n) \in (X \times T)^{n+1}\), where \(X = {\mathbb {R}}^m\) is the set of amount streams and \(T = {\mathbb {R}}^+\) is the set of points of time. In addition, point \(t = 0\) indicates “today” and, if the intertemporal prospectus is accepted by the decision-maker, it means that she will receive the amount \(x_k\) at time \(t_k\) and an outcome \(0 \in X\) at times \(t_i \ne t_k\). We will assume that:

-

For every x and \(y \in X\), then \(x \succeq y\) if, and only if, \((x,0) \succeq (y,0)\).

-

There is \(x_0 \in X\) such that \(x_0 \succ 0\).

-

\(\succeq\) is a weak order relation.

-

Preferences are continuous with respect to the product topology on \(X \times T\), i.e., for every pair (x, t), the sets \(\{(u,s) \in X \times T : (u,s) \preceq (x,t)\}\) and \(\{(u,s) \in X \times T : (u ,s) \succeq (x,t)\}\) are closed. This hypothesis is equivalent to require that the transition from one preference to another one is gradual, i.e., for every (x, t), (y, s) and (z, r) in \(X \times T\), such that \((y,s) \succ (x,t)\) and \((z,r) \prec (x,t)\), there exist \(u \in X\) and \(v \in X\) for which the indifference relations \((u,r) \sim (x,t) \sim (v,s)\) hold. In particular, for every x, y and z in X and every s and t in T, such that \((y,s) \succ (x,t)\) and \((z,s) \prec (x,t)\), there exists \(w \in X\) for which the indifference \((w,s) \sim (x,t)\) holds

-

Preferences are monotonic, i.e., if \(x \succeq y\) then \((x,t) \succeq (y,t)\), for every \(t \in T\).

-

Preferences are impatient in the sense that, for every \(s < t\), if \(x \succ 0\), one has \((x,s) \succ (x,t)\) and, for every \(x \prec 0\), then \((x,s) \prec (x,t)\) holds.

-

Preferences are represented by the Discounted Utility model in the following way:

$$\begin{aligned} \sum _t U(x_t) F(t), \end{aligned}$$where U is a utility function and F is a discount function.

3.2 The decrease in impatience: a measure of its degree

Definition 3

The preference \(\succeq\) exhibits decreasing impatience (DI) (resp. strictly decreasing impatience) if, for every \(\sigma > 0\) and \(0< x < y\), \((x,s) \sim (y,t)\) implies \((x,s+\sigma ) \preceq (y,t+\sigma )\) (resp. \((x,s+\sigma ) \prec (y,t+\sigma )\)).

Definition 4

The preference \(\succeq\) exhibits a decreasing impatience greater than \(\succeq ^{*}\) if, for every interval \(0 \le s < t\), \(\rho > 0\), \(\sigma > 0\) and, for every amount \(0< x < y\) and \(0< \alpha < \beta\) such that \((x,s) \sim (y,t)\), \((x,s+\sigma ) \sim (y,t+\rho +\sigma )\) and \((\alpha ,s) \sim ^{*} (\beta ,t)\) imply \((\alpha ,s+\sigma ) \succeq ^{*} (\beta ,t+\rho +\sigma )\).

Prelec (2004) experienced an equivalence between the selection of dominated results, i.e., not optimal from any time point of view and the decrease in the degree of impatience. In this sense, the decrease in impatience would be reflecting the irrationality underlying preference reversal. In addition, the degree of decrease in impatience indicates the “gap” between the concept of temporal preference and the concept of impatience.

The following result shows that the difference between the impatience rate and the time preference rate gives us information about how far we are moving away from stationarity throughout time.

Theorem 2

(Prelec 2004) Let \(\succeq\) and \(\succeq ^{*}\) be two preference relations represented by U, F, \(U^{*}\) and \(F^{*}\), where F and \(F^{*}\) are differentiable at least twice. Let g(t) and \(g^{*}(t)\) be their respective impatience functions defined as \(g(t) := \frac{F^{\prime }(t)}{F^{\prime }(0)}\) and \(g^{*}(t) := \frac{(F^{*})^{\prime }(t)}{(F^{*})^{\prime }(0)}\). The following statements are equivalent:

-

(i)

\(\succeq\) shows more DI than \(\succeq ^{*}\).

-

(ii)

The difference between the impatience rate, defined as the ratio \(g^{\prime }(t)\) to g(t), and the time preference rate is greater for function F than \(F^{*}\):

$$\begin{aligned} \left( -\frac{g^{\prime }(t)}{g(t)}\right) - \left( -\frac{F^{\prime }(t)}{F(t)}\right) \ge \left( -\frac{(g^{*})^{\prime }(t)}{g^{*}(t)}\right) -\left( -\frac{(F^{*})^{\prime }(t)}{F^{*}(t)}\right) . \end{aligned}$$

The key idea of Prelec’s result is that the instantaneous discount rate of a preference exhibiting more decreasing impatience must have a smaller derivative. In general, for every discount function F exhibiting decreasing impatience, one has:

As \(\delta (t) > 0\), this justifies that \(- \frac{g^{\prime }(t)}{g(t)} - \delta (t)\) can be considered as a measure of decreasing impatience (see Theorem 3).

The importance of the degree of DI has led many researchers to look for a measure which could be calculated with simplicity. Rohde (2010) proposed a tool which does not need knowledge of the discount function and does not assume any information about the utility. In effect, consider the indifference relations (called a pair of indifference) \((x,s) \sim (y,t)\) and \((x,s+\sigma ) \sim (y,t+\tau )\), with \(s < t\), \(x < y\), \(\sigma > 0\) and \(\tau > 0\).

Definition 5

The hyperbolic factor is defined as the following rate:

A pair of indifference can be constructed by following the following steps (Rohde 2010):

-

(I)

Fix \(y \ne 0\) and fix s, t and \(\tau\), with \(s<t\) and \(\tau > 0\).

-

(II)

Find x such that \((x,s) \sim (y,t)\).

-

(III)

Find \(\sigma\) such that \((x,s+\sigma ) \sim (y,t+\tau )\).

3.3 Relative impatience

Rohde (2009) has introduced different types of decreasing impatience:

-

1.

Starting from two rewards with different amounts and availability instants.

-

2.

Starting from two rewards with the same amount, available at different times:

-

(a)

But compensating with a common time interval.

-

(b)

But compensating with a common payment.

-

(a)

The first case allows the possibility that both dated rewards, (x, s) and (y, t) (\(0< x < y\)), are indifferent, giving rise to Definition 3. On the contrary, case 2(a) does not allow the indifference between (x, s) and (x, t) (\(0 \le s < t\)), unless the first amount x is anticipated and the second x is delayed the same period of time:

for every \(\tau > 0\) such that \(\tau \le s\). In this case, we will say that the preference \(\preceq\) satisfies spread seeking. Finally, case 2(b) also does not allow the indifference between both rewards unless they are compensated by adding another amount available at time 0. This situation gives rise to definitions 6 and 7.

Definition 6

The preference \(\succeq\) exhibits relative impatience if

with \(s<t\) and \(y \succ 0\).

The term “relative” indicates the dependence between the delay considered and the payment made in advance.

Definition 7

The preference \(\succeq\) exhibits decreasing relative impatience (DRI) if every indifference relation \((x,0;y,s) \sim (z,0;y,t)\) implies \((x,0;y,s+\sigma ) \preceq (z,0;y,t+\sigma )\).

In this case, one has:

and

from where:

By dividing both sides of the former inequality by h and letting \(h \rightarrow 0\), \(-F^{\prime }(s) \ge -F^{\prime }(t)\), whereby \(-F^{\prime }\) is decreasing.

By comparing definitions 3 and 7, we can immediately observe that, for both concepts, a time difference becomes less significant the further away it is from the present. However, the difference between two concepts is clarified by the following result:

Theorem 3

(Rohde 2009) For every t, one has:

where

and

In the following subsection, we will restrict our analysis to exponential discounting.

3.4 Impatience and exponential discount

Theorem 4

(Rohde 2009) The preference \(\succeq\) is represented by the exponential discount \(F(t) = \exp \{-kt\}\), with \(k>0\), if, and only if, the degree of decrease in relative impatience is constant and equal to k.

Thus, in case of an exponential discount function, as \(DI(t)=0\), Theorem 3 results in \(DRI(t) = \delta (t) = k\). Therefore, for decisions to be temporally consistent, the degree of impatience must remain constant over time, whilst the relative impatience must decrease over time constantly.

Theorem 5

Let A and B be two agents exhibiting exponential discount functions, \(F_A\) and \(F_B\), with respective discount rates \(\delta _A\) and \(\delta _B\). The following four conditions are equivalent:

-

(i)

If x and y are two arbitrary amounts such that \(x<y\), available respectively at times s and t (\(s<t\)), then \((x,s) \sim _A (y,t)\) implies \((x,s) \succ _B (y,t)\).

-

(ii)

Agent A is more patient than agent B.

-

(iii)

The area under the graph of function \(F_A(t)\) is greater than the area under the graph of \(F_B(t)\).

-

(iv)

The degree of decrease in the relative impatience of agent A is less than the degree of decrease in the relative impatience of agent B.

Proof

(i) \(\Rightarrow\) (ii). By hypothesis, \(\frac{F_A(s)}{F_A(t)} < \frac{F_B(s)}{F_B(t)}\), that is, \(\frac{F_A(t)}{F_B(t)} > \frac{F_A(s)}{F_B(s)}\). We can therefore apply Theorem 1, for which the increase of \(\frac{F_A(t)}{F_B(t)}\) is a condition equivalent to state that the impatience represented by \(F_B(t)\) is greater than that represented by \(F_A(t)\). So, A is more patient than B.

(ii) \(\Rightarrow\) (iii). By hypothesis, \(\delta _A < \delta _B\). In this case,

(iii) \(\Rightarrow\) (iv). This proof of this implication is immediate because, in this case, \(\delta _A < \delta _B\), and \(DRI(A) = \delta _A\) and \(DRI(B) = \delta _B\).

(iv) \(\Rightarrow\) (i). By hypothesis, \(\delta _A < \delta _B\). Consider two amounts x and y such that x is available at time s and y is available at time t, with \(s<t\). Assume that agent A exhibits the indifference \((x,s) \sim _A (y,t)\). In these conditions, one has:

This inequality implies \((x,s) \succ _B (y,t)\). \(\square\)

Thus, the information related to the area under the graph of the discount function is linked to the degree of decrease in the relative impatience of the agent.

3.5 Decrease in impatience and misperception of time

The expression proposed by Prelec (2004) to calculate the degree of decrease in impatience is equivalent to the speed with which the discount rate varies:

This equality determines a game between impatience and subjective perception of time. Delfino (2011), deepening this topic, observed that an increase in the temporal sensitivity gives rise to a decrease in the discount rate variation. We can then conclude, in terms of misperception of time, that:

-

\(DI(t) \ge 0\) if the objective and subjective times are bound by a reverse relationship.

-

\(DI(t) \le 0\) if the objective and subjective times are proportional.

Therefore, the discount rate can identify the decrease in impatience but cannot measure its degree and this means that distinct objects remain.

4 The decreasing impatience in anomalies

As the DI property determines significant effects on the selection of dominated results and decision persistence, the degree of impatience will be the protagonist of our study. In the light of the former observation, some anomalies of the Discounted Utility model will be analyzed by comparing the behavior of an agent A (exponential discount) and another agent B (hyperbolic discount).

4.1 Delay effect

The delay effect consists in a reversal of preferences due to the increase in the deferral interval. For example, suppose that initially agent B is indifferent between receiving a certain amount x at time s and a greater amount y at time t but, postponing both receptions by a constant period h, if the delay effect holds, this agent will prefer y at \(t+h\) over x at time \(s+h\):

However, as far as agent A is concerned, since the exponential discount provides that alternatives are always perceived in the same way (Thaler and Shefrin 1981), one has:

By applying the definition of the Discounted Utility model, one has:

and

This means that agent B’s discount factor decreases non-constantly by indicating a steep trend based on the interval in which the evaluation periods reside.

Theorem 6

If condition (1) holds, then the rate of variation of the discount function \(F_B\) is decreasing.

Proof

To analyze the rate of decrease of the discount function \(F_B\), just note that, starting from the former inequalities, we have:

Taking natural logarithms:

and re-ordering and dividing by h:

Letting \(h \rightarrow 0\):

Thus, \(\delta _B(s) > \delta _B(t)\), which indicates that the rate of variation of \(F_B\) decreases over time differently from that of agent A which instead is constant. \(\square\)

Until now, we have always assumed that, for every x and y in X, and for every s and t in T, \((x,s) \sim _A (y,t)\) implies \((x,s) \prec _B (y,t)\). In the following theorem, we are going to assume that the former hypothesis has some exemptions.

Theorem 7

Assume that agent A exhibits constant time preference \(\delta _A\) and agent B decreasing time preference \(\delta _B(t)\). If there exist \(x_0\) and \(y_0\) in X, and \(s_0\) and \(t_0\) in T such that \((x_0,s_0) \sim _A (y_0,t_0)\) and \((x_0,s_0) \sim _B (y_0,t_0)\), then:

-

There is \(\tau\) such that, for every \(t \in [0,\tau )\), agent B is more impatient than agent A and, for every \(t \in (\tau ,\infty )\), agent B is more patient than agent A.

-

There is \(T<\tau\) such that, for every \(t \in [T,\tau ]\), agent A exhibits less impatience, but greater relative impatience, than agent B.

Proof

As \((x_0,s_0) \sim _A (y_0,t_0)\) and \((x_0,s_0) \sim _B (y_0,t_0)\), then:

from where:

Consequently, as \(\delta _B(t)\) is decreasing, there is \(\tau\) (\(s< \tau < t\)) such that \(\delta _B(\tau ) = \delta _A\). Moreover,

-

For every t such that \(0 \le t < \tau\), \(\delta _B(\tau ) \ge \delta _A\).

-

For every t such that \(t \ge \tau\), \(\delta _B(\tau ) < \delta _A\).

So, for every \(t \in [0,\tau )\), agent B is more impatient than agent A and, for every \(t \in (\tau ,\infty )\), agent B is more patient than agent A. Obviously, \(F_A(\tau ) > F_B(\tau )\). As \(\delta _A = \delta _B(\tau )\), there is T (\(0< T < \tau\)) such that, for every \(T< t < \tau\), \(-F_A^{\prime }(t) > -F_B^{\prime }(t)\). So, for every t such that \(T< t < \tau\), agent A exhibits less impatience, but greater relative impatience, than agent B. \(\square\)

Consequently, for choices close enough to the present moment, agent B will be more inclined to accept smaller and immediate amounts. In effect, let x and y be two amounts such that \((x,0) \sim _A (y,t)\), where \(s< t < \tau\). Then (see the proof of Theorem 7) \(\delta _B > \delta _A\), which implies \((x,0) \succ _B (y,t)\).

By translating the choice into the future, agent B’s impatience will diminish to such an extent that the preference falls on the higher and less immediate results. In effect, let x and y be two amounts such that \((x,h) \sim _A (y,t+h)\), where \(h > \tau\). Then \(\delta _B < \delta _A\), which implies \((x,h) \prec _B (y,t+h)\).

4.2 Interval effect

The interval effect is a direct expression of the fact that preferences are conditioned by the subjective perception of time. In fact, Zauberman et al. (2009), by studying through a series of experiments the relationship between the time at which a prospectus is assessed and the review of the result, have shown that people perceive time differently from reality and, therefore, that their choices at a given time do not depend on the actual duration of the interval but on how it is perceived by the agent.

In effect, consider the following indifference relationships, where \(d_2 - d_1 = d_3 - d_2\):

-

I1: \((x_1,d_1) \sim (x_2,d_2)\) and \((x_2,d_2) \sim (x_3,d_3)\).

-

I2: \((x_1,d_1) \sim (X_3,d_3)\).

For Agent A (who exhibits exponential discounting), one has:

from where:

However, from an experimental perspective (Agent B), given that the interval \([d_1,d_3]\) is larger than \([d_1,d_2]\) and \([d_2,d_3]\), the inequality \(U(X_3) < U(x_3)\) holds. Thus,

from where:

Taking \(d_3 = d_1+h\), subtracting 1 in the two sides of the former inequality and letting \(h \rightarrow 0\), one has:

The latest inequality is compatible with the following three possibilities:

-

1.

\(\delta _B(t)\) is constant.

-

2.

\(\delta _B(t)\) is increasing.

-

3.

\(\delta _B(t)\) is decreasing.

Let us analyze the three cases separately.

Case 1. If \(\delta _B(t)\) is constant, then Agent B exhibits exponential discount and, as indicated in Sect. 3.4, agent A is more impatient than agent B. This explains why agent A requires a higher reward to be compensated for waiting from \(d_1\) to \(d_3\).

Case 2. If \(\delta _B(t)\) is increasing, one has:

which implies

and then

Last inequality indicates that \(DRI_B(t) < \delta _B(t)\), which is equivalent to \(DI_B(t) < 0\), which confirms the assumption that \(\delta _B\) is increasing.

Case 3. If \(\delta _B(t)\) is decreasing, analogously to case 2, it can be shown that \(DRI_B(t) > \delta _B(t)\), i.e., \(DI_B(t) > 0\).

An alternative analysis of this phenomenon could be carried out by considering Agent B’s perception of the interval \([d_1,d_3]\). The latter, in fact, is perceived differently from the actual duration equivalent to 2 times \([d_1,d_2]\) and, with respect to which, it will be larger depending on the distance from the present, the length of the interval itself and the sign of the DI(t). Nyberg et al. (2010) claim that men spend most of their time thinking about the past or imagining the future: the term “time of mental travel” refers to the activity in which such thoughts concern the self. So, preferences are conditioned not only by one’s ability to imagine but also by the will to make the efforts necessary to realize the mental representation.

From inequality \(U(x_1) F_B(d_1) < U(x_3) F_B(d_3)\), we know that there is an instant \(D_3\) for which \(U(x_1) F_B(d_1) = U(x_3) F_B(D_3)\), from which \(F_B(D_3) < F_B(d_3)\), and so \(D_3 > d_3\). Then:

The relationship between \(D_3\) and \(d_3\) indicates how the agent perceives time intervals. Therefore,

-

If agent B shows increasing impatience, she imagines the moment farther than it is, a perception which increases with \(d_1\) and \(d_2 - d_1\). By projecting herself at the moment in question, her impatience is such that she accepts a smaller amount than that she actually would like to receive. The larger the interval is, the greater the impatience and the more dilated the perception of the interval will be.

-

If agent B shows decreasing impatience, then the situation is the opposite to the previous one, in the sense that the perception of the interval \([d_1,d_2]\) will be more dilated for intervals closer to the present (\(d_1\)).

4.3 Relationship between the delay and interval effects

In Sects. 4.1 and 4.2, we have verified that the variation in impatience is the key to read how the expectation is perceived. This is due to two factors:

-

the variation of the period between the decision and the reception of the result, and

-

the variation of the intervals which separate the involved amounts.

In effect, by considering an agent with hyperbolic discount and so decreasing impatience, the two anomalies would be as follows:

-

The discount rate is reduced as the deferral period increases.

-

The discount rate is reduced as the interval length increases.

From this point of view, it is therefore possible to retract the phenomenon of the delay effect as a particular case of the interval effect. Setting \(d_1 = 0\) means that the increase in the range \(d_2 - d_1\) coincides with an increase of the period. The aim of the following paragraphs is to interpret the preferences not in terms of delay but according to the length of the considered intervals, with \(d_2 - d_1 = d_3 - d_2 = h\). In effect, assume that \((x,0) \sim _B (y,h)\). There is an agent A (with exponential discount function) such that \((x,0) \sim _A (y,h)\).

As h increases, the slope of the discount function decreases and the tendency of the agent to wait for the larger and later amounts is amplified. In effect, from preferences \((x,0) \sim _A (y,h)\) and \((x,0 ) \sim _B (y,h)\), one has \(F_A(h) = F_B(h)\). By assuming that \(F_B\) varies with a decreasing speed with respect to \(F_A\) then \(F_A(2h) < F_B(2h)\). Therefore:

So, from the indifference \((x,h) \sim _A (y,2h)\), one has:

This inequality is equivalent to saying that:

4.4 Magnitude effect

The magnitude effect concerns the change in the discount rate according to the size of amounts. Many studies, such as Andersen and Harrison (2013), demonstrate that, for smaller amounts, the discount rate has a trend steeper than the corresponding to larger amounts, highlighting the need to formulate a model which considers the amount of money.

However, the first reading of the phenomenon follows from observing that the agent is willing to wait longer in order to obtain a more significant result, as is the case of the delay effect. From this point of view, the two anomalies are not so different but, whilst the impatience of the delay effect depends on time and its perception, for the magnitude effect the impatience depends on the monetary value and the subjective perception that the agent has of it. Therefore, to exclude a model which explicitly considers the involved amounts, it would be sufficient to consider that the perceived utility and the patience are closely related. A psychological explanation, provided by Loewenstein and Thaler (1989), is that small sums are associated with immediate consumption whilst larger amounts are linked to an idea of future investment. From this point of view, delays in small amounts lead to a greater variation in the discount function. In effect, consider the following preferences, with \(s<t\), \(x<y\), \(X<Y\) and \(\frac{U(y)}{U(x)} = \frac{U(Y)}{U(X)}\):

and

We can immediately observe that, by increasing the amounts, the time interval that agent B is willing to wait to receive the highest amount also increases, showing a patience greater than that she would exhibit in the case of less important sums.

Let us demonstrate that the degree of decrease in impatience depends not only on how much longer we are willing to wait but also on the difference of amounts. In particular, the agent B’s impatience associated to the period [s, t] (\(s<t\)) for X and Y is less than that of agent A:

from which

and so

Observe that, since agent A’s impatience is constant, from \((x,s) \sim _A (y,t)\) and \((x,s) \sim _B (y,t)\), it follows that the degree of \(DI_B(t)\) increases as the initial amount increases. In fact, for agent A, a change in results does not involve a change in value (\(F_A(s) - F_A(t)\)), under the condition \(\frac{U(y)}{U(x)} = \frac{U(Y)}{U(X)}\), suggesting that it is only the degree of decrease in impatience that is sensitive to the absolute difference in results. Loewenstein and Thaler (1989) already observed that the consumer is influenced by this factor: the perception between €10 today and €15 tomorrow is different from the perception between €100 today and €150 tomorrow. The difference between the sums of the second case is felt more.

Theorem 8

Let x and y, with \(x<y\), and X and Y, with \(x<X<Y\), such that \(\frac{U(y)}{U(x)} = \frac{U(Y)}{U(X)}\). If \((x,s) \sim _B (y,t)\), then \((X,s) \prec _B (Y,t)\) if, and only if, \(U(y)-U(x) < U(Y)-U(X)\).

Proof

In effect, by taking \(s=0\), if \((x,s) \sim _B (y,t)\) then \(F_B(t) = \frac{U(x)}{U(y)}\).

Necessity. As \((X,s) \prec _B (Y,t)\), one has \(F_B(t) > \frac{U(X)}{U(Y)}\), from which:

and

By multiplying the last inequality by U(Y) and taking into account that \(\frac{U(Y)}{U(y)} > 1\), it follows \(U(y)-U(x)<U(Y)-U(X)\).

Sufficiency. Assume that \(Y-X > y-x\). As \([1-F_B(t)]X > [1-F_B(t)]x\), by combining both inequalities, one has:

from where \(Y > XF_B(t)\) and so \((X,s) \prec _B (Y,t)\). \(\square\)

Moreover, by considering the most significant sums, the preferences \((X,s) \sim _A (Y,t)\) and \((X,s) \prec _B (Y,t)\) are equivalent to saying that agent A is more impatient than agent B by Theorem 1, because \(\frac{F_B(s)}{F_B(t)} < \frac{U(X)}{U(Y)} = \frac{F_A(s)}{F_A(t)}\) implies \(\frac{F_B(t)}{F_A(t)} > \frac{F_B(s)}{F_A(s)}\) and so the ratio \(\frac{F_B(t)}{F_A(t)}\) is increasing.

4.5 Gain-loss asymmetry

Gain-loss asymmetry, also known as sign effect, means that people tend to anticipate losses more than earnings of the same magnitude. In that case, instead of comparing agents A and B, we will compare agent B discount functions in losses (\(F^-\)) and gains (\(F^+\)) situations trying to characterize their differences. By observing that the delay of an amount implies a greater risk due to the uncertain nature of the future, it is understood that, taking into account the impatience, an agent will prefer to obtain a profit as soon as possible and to delay losses as much as possible. However, experimental evidence shows us exactly the opposite (Yates and Watts 1975).

From a psychological point of view, this phenomenon is justified by considering that waiting for a loss generates a negative utility. In this sense, therefore, anticipating a negative result means stopping to worry about it. Loewenstein and Thaler (1989) observed in this connection that individuals suffer from a loss aversion for which the disutility of negative amounts is greater than the utility perceived by a gain of the same magnitude. In order to formalize this situation, consider \(0<x<y\) and \(s<t\). In this case, by focusing the sign effect on the discount functions \(F^{+}\) and \(F^{-}\):

By calculating the impatience in the interval [s, t], taking into account both preferences, one has:

Therefore, the individual will be less patient when it comes to losses and so, taking \(t=s+h\), one has:

Letting \(h \rightarrow 0\):

and so

A second approach which can be used to analyze the gain-loss asymmetry is the well-known prospectus theory, developed by Tversky and Kahneman (1992). From the point of view of this behavioral theory, the value assigned to a result x is based on the change from a reference point according to the following function:

The psychological aspects of loss aversion are enclosed in the coefficient \(\epsilon > 1\) which represents the penalty related to negative compared to positive resultsFootnote 1. Numerous studies have estimated the value of \(\epsilon\) and the founders of the theory have proved that \(\epsilon = 2.25\) (Tversky and Kahneman 1992). So, in terms of losses, the perceived difference is more than double the actual difference. Therefore, for the sign effect to occur, impatience must depend on the difference in the utility functions of involved results.

Theorem 9

If the utility of a result is calculated as V(x), where \(\epsilon > 1\) (according to the prospectus theory) and U is concave (\(U^{\prime \prime } < 0\)), then, for every \(0< x < y\) and \(s < t\), \((x,s) \sim (y,t)\) implies \((-x,s) \succ (-y,t)\).

Proof

In effect, for every \(0< x < y\) and \(s < t\), \((x,s) \sim (y,t)\) implies \(\frac{F(t)}{F(s)} = \frac{U(x)}{U(y)}\). In this case, one has:

Therefore, \(\frac{V(-x)}{V(-y)} < \frac{F(t)}{F(s)}\) and then \(V(-x) F(s) > V(-y) F(t)\), which means \((-x,s) \succ (-y,t)\). \(\square\)

Another approach could be given by the following theorem.

Theorem 10

If the utility of a result is calculated as (observe that this utility function satisfies loss aversion provided that \(|x |> 1\)):

where \(\epsilon > 1\) (according to the prospectus theory) and \(0< \alpha < \beta\), then, for every \(0< x < y\) and \(s < t\), \((x,s) \sim (y,t)\) implies \((-x,s) \succ (-y,t)\).

Proof

In this case, one has:

Therefore, \(\frac{V(-x)}{V(-y)} < \frac{F(t)}{F(s)}\) and then \((-x,s) \succ (-y,t)\). \(\square\)

5 Experimental phases

In this Section, we are going to check whether the observations previously made have an experimental value. Specifically, through the hyperbolic factor, we are going to focus on the variation of the degree of impatience in order to understand that:

-

The greatest variation occurs for shorter intervals close to the present.

-

The greatest variation occurs for less important outcomes.

-

The variation according to the sign of the result.

5.1 Design of a questionnaire for the calculation of the hyperbolic factor

The idea underlying to this subsection is to construct pairs of indifference, as indicated in steps (I)-(III) at the end of Sect. 3.2, in order to use the hyperbolic factor as a measure of the variation of the degree of impatience. As we are mainly interested in understanding the extent of the variation, it will sometimes be considered only the module of the obtained result. The first question, built with the purpose of studying the delay effect, results in the pair of indifference \((x,s) \sim (y,t)\) and \((x,s+\sigma ) \sim (y,t+\tau )\), by remembering that the exponential discount predicts the condition \(\sigma = \tau\).

As specified in step (I), fix \(s=0\), \(t=6\), \(\tau =12\), and y = €500. To derive the value of the x, respondents were asked:

Obtained the first indifference \((x,s) \sim (y,t)\), step (III) was simulated as follows:

In this way, all the parameters necessary for the calculation of the hyperbolic factor have been identified. Then:

Leaving unchanged s, t and \(\tau\), we changed the initial outcome by lowering it to a total of €50. In fact, although the hyperbolic factor is independent of y (Rohde 2010), we believe that \(\sigma\) can be affected by this variable:

Leaving the sum of €50 and \(s=0\), the values of t and \(\tau\) have been changed in the third question in order to study how the hyperbolic factor varies when intertemporal prospectuses involve periods closer to the present:

Finally, to study how the impatience varies based on the sign associated with the utility of amounts, respondents answered the following question:

5.2 Sample analyzed

The test was administered to a sample of 52 people aged between 18 and 65, 48.08% of whom were women. During the phase concerned with the collection of the data necessary for the calculation of the hyperbolic factor, the interviewed individuals were constantly urged to communicate their preferences as soon as possible. In fact, due to the low complexity of the proposed intertemporal perspectives and the impossibility of simulating the effect of the passage of time in a single interview, the tension generated by the haste in answers was necessary to obtain a considerable manifestation of behavioral distortions, indispensable for analysis. We point out that individuals were interviewed in a telematic mode.

5.3 Analysis of results

Let us start by comparing the hyperbolic factors H(0, 6, 500, 12) and H(0, 6, 50, 12). We expect values to be generally higher in the second case on the basis that the discount function has a steeper trend for less significant amounts. In fact, recalling that a psychological explanation for the phenomenon is to associate the smaller outcome with impending consumption, we expect that they have a greater hyperbolic factor. The purpose is then to study how the hyperbolic factor varies as the considered values change, analyzing whether, for values with equal ratio, the difference between them plays or not a significant role.

The reference value for the study is the median. Remember that the median is a position index which divides the distribution into two equal parts and it is therefore recommended when the data have a high variability: the minimum and maximum values shown in Table 2 justify its choice.

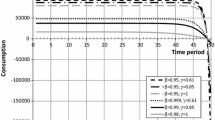

Observe that the distribution of the minimum value remains unchanged when less important amounts are considered and, in the same case, the distribution of the maximum value doubles. The median of the hyperbolic factors for the sum of €50 is about 6 times greater than that related to the amount of €500, in line with our forecasts. The following graphs point out how the distribution varies according to the figures considered: observe that, whilst for H(0, 6, 500, 6) there are multiple peaks, for H(0, 6, 50, 6) the graph is more homogeneous with only a peak at the maximum value (Figs. 1, 2).

In order to investigate the influence of the difference between the considered amounts, the ratio \(\frac{H(50)}{H(500)}\) of those respondents who presented the condition \(\frac{500}{x_{500}} = \frac{50}{x_{50}}\) was analyzed. The sample with this condition is 28.85% of the total of which:

-

46.67% showed no change in the value of the hyperbolic factor (57.7% were men);

-

13.34% showed a steeper discount for larger amounts (100% women); and

-

40% showed a steeper discount for smaller amounts (of which 66.67% were women).

It would be interesting to understand, from a behavioral point of view, the trait which characterizes 46.67% of the sample which is not prone to such behavior. In addition, women are more sensitive to this phenomenon.

Let us now draw attention to the comparison between H(0, 6, 50, 12) and H(0, 1, 50, 1) for which we expect the discount to be steeper for the shorter time frame (Table 3).

Observe that the hyperbolic factor for the shortest prospectus has a maximum value of almost a half of the maximum value for larger elevations, whilst distributions remain mostly unchanged. It follows that:

-

Who serves hyperbolically applies most of the decrease in impatience in the first period from “today” to “2 months”.

-

The rate at which the discount function decreases, also decreases over time.

-

As the length of the interval increases, the discount decreases (see Sect. 3.3).

Recall that this study has been divided into three cases: constant, increasing, and decreasing discount rate. Tables 4 and 5 allow us to consider the case of a decreasing rate over time. In fact, most of the sample has a positive term for the numerator, indicating a decreasing impatience over time: \(t = 1\) and \(\tau = 1\).

Now, let us compare the values H(0, 6, 500, 12) and \(H(0,6,-500,12)\). In this way, we expect higher values in the second case, due to the negative utility of the outcome. Changing the sign of the fixed amounts, most respondents presented a variation in the hyperbolic factor, as shown in Fig. 3.

Thus, only by changing the sign, 78.85% presented a different value of the hyperbolic factor of which only 41.48% showed a higher figure for negative amounts. While expecting the opposite, it must be borne in the way that, in a payment situation, the impatience of the debtor and the individual who is going to receive the debt is added up by lowering the degree of decrease in total impatience. Nevertheless, by explicitly comparing the values H(0, 6, 500, 12) and \(H(0,6,-500,12)\), we note that the discount function for negative amounts is much steeper: the percentage of distribution of the maximum value has almost doubled compared to the case of positive utilities, and the median has a higher value (see Table 6).

Figure 4 shows that the distribution in the case of negative amounts is more homogeneous.

6 Discussion

The aim of the paper has been to contribute to the discrepancy between the normative theoretical framework of intertemporal choices and the actual actions of individuals. Therefore, this study starts from the analysis of the fundamental, theoretical elements of the Discounted Utility model, i.e., an essential reference to the study of intertemporal choices because it provides a description of the investor’s behaviour when making a choice structured over several periods. The discount function has the task of reducing the present utility according to the time distance between the decision and the receipt of the outcome, and is decreasing in time. In fact, since the future is uncertain, outcomes acquire different values depending on whether the receipt is imminent. The psychological factors underlying this mechanism are encapsulated in the discount rate, whose value quantifies how the individual perceives the indeterminacy of the future. The second key element of the model is the investor’s impatience, whose value is related to the rate at which the discount function decreases. Classical formulations of the model predict a constant decrease in the assumed discount function of a linear or exponential nature. This condition is equivalent to requiring, by definition, constant impatience. Empirical and behavioural evidence has prompted researchers to introduce discount functions of a hyperbolic nature to explain the phenomenon of time inconsistency, i.e., the decision-maker varies his preferences over time. This attitude is not acceptable from a theoretical point of view since, in line with a rational investor profile, preferences should always be consistent over time.

Prelec (2004), analyzing the decision-making processes with the aim of understanding the characteristics underlying the temporal inconsistency, has proved an equivalence between the selection of results which are not optimal from any temporal point of view and a decreasing impatience over time. From Prelec’s studies, it is possible to conclude that the speed with which impatience decreases quantifies the difference between preferring sooner or later outcomes. What has been said also determines a relationship between objective and subjective time in the sense that not only the indeterminacy of the future is perceived individually but also the time intervals have their own extension. By collecting all this information, in our study, we have described the anomalies of the Discounted Utility model through the degree of decrease in impatience in relation to the behavioral anomalies of the investor. By the term anomalies, we mean those attitudes which cannot be rationalized from a theoretical point of view and lead, in terms of intertemporal choice, to inconsistency. Our analysis has provided not only a method to be able to quantify the relationship between the lack of decision-making persistence and the psychological mechanisms of the individual, but it has allowed us to experience that the inconsistency is precisely the inconsistency due to the decision-making process in relation to choices affecting the individual short or long term. This inconsistency is linked to the impatience of the individual and is therefore the direct consequence of the emotional impulses of the decision-maker. To experiment with what has been tried, a test was implemented to collect the elements useful for calculating the decrease in impatience through the hyperbolic factor, in different decision-making contexts.

Our experiment allowed us to prove that the inconsistency, linked to emotional drives, translates from a financial point of view into impatience, and impatience leads in turn to financial anomalies. In fact, during the experimental phase, the candidates were urged to respond quickly to provoke haste and agitation, essential for perceiving the anomalies.

The approach adopted in this paper is original and can pave the way for personalized behavioral finance. Indeed, quantifying the psychological factors that guide our choices with the degree of decrease in impatience can indicate a specific measure of the cognitive distortions underlying the decision-making process. The latter statement is equivalent to affirming that the interpretation and correction of existing models can actually be achieved only by taking into account the reasons behind the discrepancy between theory and empirical evidence, analyzing, in particular, the extent to which these factors have weight in the decision-making persistence.

7 Conclusion

Our study provides an important application in the field of behavioral finance. This discipline, describing the investor’s attitude within the market, has made it possible to understand that the attitudes considered anomalous are due to systematic cognitive processes. Assuming that individuals are by nature far from perfect rationality allows us to understand why choices often worsen the individual state. In this regard, Thaler and Sunstein (2008) introduced the concept of nudge: if a behavior is caused by a distortion of the decision-making process, then the same distortion can be pushed towards a better option, by integrating the skills in the behavioral field with the analysis of the decision-making context.

To maximize the effectiveness of this technique, it is necessary to consider that each investor has his own personality. A possible development of this study could be made by considering the relationship between the decrease in the degree of impatience and the temperament of decision-makers. Indeed, since the decrease in impatience reflects the inconsistency of decision-making underlying the phenomenon of temporal inconsistency, it would be of interest to analyze to what extent cognitive distortions, peculiar to the temperament of the individual, interact with the domain of intertemporal choices.

In this regard, we observe that the multiple differences between the personality of individuals suggest the impossibility of building a strategy which can give the same well-being to everyone. The analysis of the degree of decrease in impatience is the first step to realize the parameters of the investor because it allows us to relate the emotional impulses with the decision-making process. We can therefore think of creating homogeneous classes of investors, which instead represent a heterogeneous category, defined through the cognitive boundaries that unite them. The individual analysis of the response to the stimulus of nudge can be studied in the same way as the relationship existing between a body and the movement that follows it. In fact, even the investor, like all bodies, is endowed with inertia which represents the tendency to preserve one’s state, thus resulting in an obstacle to the implementation of optimal financial planning. Only, by following this path, do we believe it is possible to improve individual choices and the attitude towards the decisions made.

We observe that our idea can be extended to non-financial fields, as the nudge theory which is also applicable in the social field. The irrational degeneration of the behaviors described through the degree of decrease in impatience can lead to mechanisms which are deleterious for the individual.

However, there are two limitations of this approach to be considered. The first limit is of a computational nature since, in order to consider all the determining factors, the response to the nudge would require many variables. To overcome this limit, it is therefore necessary to identify the essential factors which are not excessively specific. For example, gender, temperament, and age could be considered, neglecting marital status, geographic location, and family status. Although the latter still have a weight in the decision-making process, they could be neglected in order not to get lost in an endless number of subclasses of the various cognitive boundaries. The second limit is instead of a moral nature and it is about freedom of choice. The authors of the theory speak of “libertarian paternalism” to indicate the maintenance of individual freedom of choice in a context in which the architects of choices direct the subjects. In this regard, we should therefore question the boundary between “gentle push” and persuasion.

However, the power of nudging is indisputable, but we cannot actually call it a totally new approach. In fact, the limited rationality of individuals has long been exploited to the detriment of individuals themselves by large companies which, through advertising, condition choices and preferences without damaging our freedom. The innovation of nudging, however, lies in the fact that behavioral distortions are seen as strengths, not weaknesses, for the realization of effective strategies. Thus, decision theory, nudge theory and intertemporal choice theory can together provide a method with great social impact.

Finally, as shown by our results, the study of intertemporal choices, through the analysis of impatience, must be immersed in models which consider the many factors affecting the agent: only through the interpretation of all the mechanisms, we can reach a faithful description of reality.

Notes

Observe that this condition is less restrictive than that presented by Al-Nowaihi et al. (2008).

References

Al-Nowaihi, A., Bradley, I., Dhami, S.: A note on the utility function under prospect theory. Econ. Lett. 99(2), 337–339 (2008)

Andersen, S., Harrison, G.W., Lau, M.I., Rutström, E.E.: Eliciting risk and time preferences. Econometrica 76(3), 583–618 (2008)

Benzion, U., Rapaport, A., Yagil, J.: Discount rates inferred from decisions: An experimental study. Manag. Sci. 35, 270–284 (1989)

Cruz Rambaud, S., González Fernández, I.: A measure of inconsistencies in intertemporal choice. PloS ONE 14(10), e0224242 (2019)

Cruz Rambaud, S., González Fernández, I., Ventre, V.: Modeling the inconsistency in intertemporal choice: the generalized Weibull discount function and its extension. Ann. Finance 14, 415–426 (2018)

Cruz Rambaud, S., Muñoz Torrecillas, M.J.: Measuring impatience in intertemporal choice. PLoS One 11(2), e0149256 (2016)

Cruz Rambaud, S., Ortiz Fernández, P.: Are delay and interval effects the same anomaly in the context of intertemporal choice in finance? Symmetry 13, 41 (2021)

Cruz Rambaud, S., Parra Oller, I.M., Valls Martínez, M.C.: The amount-based deformation of the \(q\)-exponential discount function: a joint analysis of delay and magnitude effects. Phys. A Statist. Mech. Appl. 508, 788–796 (2018)

Cruz Rambaud, S., Sánchez Pérez, A.M.: The magnitude and “peanuts” effects: Searching implications. Front. Appl. Math. Statist. 4, 670–678 (2018)

Delfino, A.: Perceive time and discount value. A critical analysis of time discount models. Int. J. Intell. Syst. 23(3), 505–542 (2011)

Green, L., Myerson, J.: Rate of temporal discount decreases with amount of reward. Memory Cogn. 95, 715–723 (1997)

Harvey, C.M.: The reasonableness of non-constant discounting. J. Public Econ. 53(1), 31–51 (1994)

Holcomb, J., Nelson, P.: An experimental investigation of individual time preference. Unpublished Manuscript. University of Texas (1989)

Kahneman, D., Tversky, A.: Prospect theory: an analysis of decision under risk. Econometrica 47(2), 263–229 (1979)

Kirby, K.N., Guastello, B.: Making choices in anticipation of similar future choices can increase self-control. J. Exp. Psychol. Appl. 7(2), 154 (2001)

Loewenstein, G., Prelec, D.: Anomalies in intertemporal choice: Evidence and an interpretation. Q. J. Econ. CVII, 575–597 (1992)

Loewenstein, G., Thaler, R.H.: Anomalies: intertemporal choice. J. Econ. Perspect. 3(4), 181–193 (1989)

Mazur, J.E.: Tests of an equivalence rule for fixed and variable delays. J. Exp. Psychol. Animal Behav. Process. 10, 426–436 (1984)

Nyberg, L., Kim, A.S., Habib, R., Levine, B., Tulving, E.: Consciousness of subjective time in the brain. Proc. Nat. Acad. Sci. 107(51), 22356–22359 (2010)

Paglieri, F., Castelfranchi, C.: Decidere il futuro: Scelta intertemporale e teoria degli scopi. Giornale Italiano di Psicologia 35(4), 743–776 (2008)

Prelec, D.: Decreasing impatience: a criterion for non stationary time preference in hyperbolic discounting. Scandinavian J. Econ. 106(3), 511–532 (2004)

Read, D.: Intertemporal choice. In D.J. Koehler & N. Harvey (Eds.), Blackwell Handbook of Judgment and Decision Making. Blackwell Publishing. pp. 424–443 (2004)

Read, D., Roelofsma, P.: Subadditive versus hyperbolic discounting: a comparison of choice and matching. Org. Behav. Human Dec. Process. 91, 140–153 (2003)

Rohde, K.I.M.: Decreasing relative impatience. J. Econ. Psychol. 30(6), 831–839 (2009)

Rohde, K.I.M.: The hyperbolic factor: a measure of time inconsistency. J. Risk Uncertainty 41(2), 125–140 (2010)

Rohde, K.I.M.: Measuring decreasing and increasing impatience. Manag. Sci. 65(4), 1700–1716 (2019)

Rosati, A., Stevens, J., Hare, B., Hauser, M.: The evolutionary origins of human patience: temporal preferences in chimpanzees, bonobos, and human adults. Current Biol. 17, 1663–1668 (2007)

Rubaltelli, E.: Psicologia dei mercati finanziari: Distorsioni cognitive, percezione del rischio e comportamenti collettivi. Giornale Italiano di Psicologia 33(1), 57–82 (2006)

Samuelson, P.: A note on measurement of utility. Rev. Econ. Stud. 4, 155–161 (1937)

Samuelson, P.: Probability, utility, and the independence axiom. Econometrica 20(4), 670–678 (1952)

Thaler, R.H., Shefrin, H.M.: An economic theory of self-control. J. Polit. Econ. 89(2), 392–406 (1981)

Thaler, R., Sunstein, C.R.: Nudge: Improving decisions about health, wealth, and happiness. Feltrinelli Editore (2014)

Tversky, A., Kahneman, D.: Advances in prospect theory: cumulative representation of uncertainty. J. Risk Uncertainty 5(4), 297–323 (1992)

Ventre, A.G.S., Ventre, V.: The intertemporal choice behaviour: classical and alternative delay discounting models and control techniques. Atti della Accademia Peloritana dei Pericolanti-Classe di Scienze Fisiche, Matematiche e Naturali, 90(S1) (2012)

Yates, J.F., Watts, R.A.: Preferences for deferred losses. Org. Behav. Human Performance 13, 294–306 (1975)

Zauberman, G., Kim, B.K., Malkoc, S.A., Bettman, J.R.: Discounting time and time discounting: subjective time perception and intertemporal preferences. J. Market. Res. 46, 543–556 (2009)

Acknowledgements

Mediterranean Research Center of Economy and Sustainable Development (CIMEDES), University of Almería (Spain).

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ventre, V., Cruz Rambaud, S., Martino, R. et al. An analysis of intertemporal inconsistency through the hyperbolic factor. Qual Quant 57, 819–846 (2023). https://doi.org/10.1007/s11135-022-01352-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-022-01352-6