Abstract

It is known that the US economy has grown faster during Democrat presidencies, but the Democrat-Republican presidential GDP growth gap cannot be attributed fully to policy differences, nor did Democrat presidents happen to benefit systematically from more favorable external shocks. The question why thus remains open. We postulate that, if the effect is real, a Democratic Party performance advantage should be present with respect to measures of political control other than just the presidency. We investigate partisan control of US state governments and show that national GDP grew faster when more states had Democrat governors and Democrat-majority state legislatures: a one-standard-deviation increase in the share of governorships controlled by the Democratic Party (unified Democrat state governments) is associated with a 0.57-percentage-point (0.77-percentage-point) increase in the real US national GDP growth rate. The effect appears to occur on top of the presidential D-R growth gap, suggesting that the Democrat growth advantage may be a more generalized phenomenon. To investigate whether the effects are explained by state-level policy differences, we adopt an encompassing measure of a state’s policy priorities—state policy liberalism (in the modern, popular sense rather than the classical sense). Nevertheless, our findings are not explained by state policy liberalism. That result echoes the puzzle at the national level that key national policy differences cannot account for the presidential growth gap.

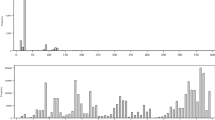

Source: David Leip’s Atlas of US Presidential Elections, Klarner (2013a), state agency websites

Similar content being viewed by others

Notes

For example, interest rates were expected to be higher and the dollar expected to be stronger under a George W. Bush presidency than under John Kerry (Snowberg et al., 2007a, b). The election of Joe Biden increased growth expectations of international experts by 0.98 percentage points for the year 2021 (Boumans et al., 2021).

The weighted and unweighted measures are similar: the correlation coefficients between the weighted and unweighted Democrat share of governorships, state legislatures, and unified state governments all are about 0.92. The results are similar when we weight by state income (gross state product is not available over the full sample period).

We do not include the share of Republican governors. Because only a handful of independent governors served over our sample period, their effect is almost exactly one minus the share of Democrat governors.

The baseline D-R growth gap for our sample is 176 basis points, not 179 as found by BW, because we consider the 1950:I-2015:I period rather than 1949:II-2013:I. Some early observations are lost owing to the lags entered into the VAR model of BW. Missing observations also affect BW when they consider the Baa-Aaa bond rating spread and Baker et al.’s (2016) uncertainty index, for which VAR models also are estimated A few shocks like the Hamilton shock are available slightly earlier (1949:II) because they are not constructed by BW using the VAR. We also extended the data set through to 2015:I for most of our models, although the inferences are very similar if we end the sample at the same time as BW.

Because of the small number of states when looking at subsets of the 50 states, we report heteroscedasticity robust standard errors as well.

We also investigate the correlation between state government partisanship and real personal income per capita growth conditional on other variables. Many previous studies dealt with correlates of state government partisanship and real personal income per capita growth. Those correlates include, for example, tax policies (e.g., Gale et al., 2015; Pickering and Rockey, 2013; Reed, 2006, 2008, 2009), public expenditure (Pickering and Rockey, 2013), federal transfers (Carlino et al., 2021), economic freedom (e.g., Bjørnskov, 2017; Bjørnskov and Potrafke, 2013; Compton et al., 2011; Gu et al., 2017; Hall et al., 2019), and public employment (Higgins et al., 2009). We have included some of those correlates and others that we also expect to be relevant (e.g., population growth, total energy production, urbanization). All such data are, however, not available for the full 1949–2016 period. In any event, the results suggest that partisan control of state governments remains correlated with income per capita growth when we control for those variables.

For example, liberal economic policies include a progressive tax system and more environmental protections, while liberal social policies include more social welfare benefits and fewer restrictions on abortion.

Furthermore, incorporating state policy liberalism into the VAR framework of BW, as discussed in the “Appendix”, does not change inferences substantially. That is, the explained portions of the DR gap in Tables 3 and 4 are similar when state policy liberalism is entered as an additional explanatory variable.

References

Acemoglu, D. (1995). Reward structures and the allocation of talent. European Economic Review, 39, 17–33.

Alesina, A. (1987). Macroeconomic policy in a two-party system as a repeated game. Quarterly Journal of Economics, 102, 651–678.

Alesina, A., Roubini, N., & Cohen, G. D. (1997). Political cycles and the macroeconomy. MIT Press.

Alesina, A., & Sachs, J. (1988). Political parties and the business cycle in the United States, 1948–1984. Journal of Money, Credit and Banking, 20, 63–82.

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. Quarterly Journal of Economics, 131(4), 1593–1636.

Bartels, L. M. (2008). Unequal democracy. Princeton University Press.

Belke, A. (1996). Politische Konjunkturzyklen in Theorie und Empirie: Eine kritische Analyse der Zeitreihendynamik in Partisan-Ansätzen. Mohr.

Bjørnskov, C. (2005). Does political ideology affect economic growth? Public Choice, 123, 133–146.

Bjørnskov, C. (2017). Growth, inequality, and economic freedom: Evidence from the US states. Contemporary Economic Policy, 35, 518–531.

Bjørnskov, C., & Potrafke, N. (2013). The size and scope of government in the US states: Does party ideology matter? International Tax and Public Finance, 20, 687–714.

Blinder, A. S., & Watson, M. W. (2016). Presidents and the US economy: An econometric exploration. American Economic Review, 106, 1015–1045.

Boumans, D., Gründler, K., Potrafke, N., & Ruthardt, F. (2021). The global economic impact of politicians: Evidence from an international survey RCT. CESifo Working Paper No. 8833.

Carlino, D., Drautzburg, T., Inman, B., & Zarra, N. (2021). Partisanship and fiscal policy in economic unions: Evidence from U.S. states. NBER Working Paper No. 28425.

Caughey, D., & Warshaw, C. (2016). The Dynamics of State Policy Liberalism, 1936–2014. American Journal of Political Science, 60, 899–913.

Chang, C.-P., Kim, Y., & Ying, Y.-H. (2009). Economics and politics in the United States: A state-level investigation. Journal of Economic Policy Reform, 12, 343–354.

Chappell, H. W., Jr., & Keech, W. R. (1986). Party differences in macroeconomic policies and outcomes. American Economic Review, 76, 71–74.

Coates, D., Heckelman, J. C., & Wilson, B. (2011). Special-interest groups and growth. Public Choice, 147, 439–457.

Compton, R. A., Giedeman, D. C., & Hoover, G. (2011). Panel evidence on economic freedom and growth in the United States. European Journal of Political Economy, 27, 423–435.

Falk, N., & Shelton, C. A. (2018). Fleeing a lame duck: Policy uncertainty and manufactory investment in U.S. states. American Economic Journal: Economic Policy, 10, 135–152.

Gale, W. G., Krupkin, A., & Rueben, K. S. (2015). The relationship between taxes and growth at the state level: New evidence. National Tax Journal, 68, 919–942.

Gentzkow, M., Shapiro, J. M., & Taddy, M. (2016). Measuring polarization in high-dimensional data: Method and application to congressional speech. Econometrica, 87, 1307–1340.

Gerber, A. S., & Huber, G. A. (2009). Partisanship and economic behaviour: Do partisan differences in economic forecasts predict real economic behavior? American Political Science Review, 103, 407–426.

Glaeser, E., Kallal, H. D., & Shleifer, A. (1992). Growth in cities. Journal of Political Economy, 100, 1126–1152.

Grier, K. B. (2008). US Presidential elections and real GDP growth, 1961–2004. Public Choice, 135, 337–352.

Gu, J., Compton, R. A., Giedeman, D. C., & Hoover, G. (2017). A note on economic freedom and political ideology. Applied Economics Letters, 24, 928–931.

Hall, J. C., Lacombe, D. J., & Shaughnessy, T. M. (2019). Economic freedom and income levels across US states: A spatial panel data analysis. Contemporary Economic Policy, 37, 40–49.

Hamilton, J. (2003). What is an oil shock? Journal of Econometrics, 113, 363–398.

Haynes, S. E., & Stone, J. A. (1990). Political models of the business cycle should be revived. Economic Inquiry, 28, 442–465.

Hibbs, D. A., Jr. (1977). Political parties and macroeconomic policy. American Political Science Review, 71, 1467–1487.

Hibbs, D. A., Jr. (1986). Political parties and macroeconomic policies and outcomes in the United States. American Economic Review, 76, 66–70.

Hibbs, D. A., Jr. (1987). The American political economy: Macroeconomics and electoral politics. Harvard University Press.

Hibbs, D. A., Jr. (2000). Bread and peace voting in US presidential elections. Public Choice, 104, 149–180.

Hibbs, D. A., Jr. (2008). Implications of the ‘bread and peace’ model for the 2008 US presidential election. Public Choice, 137, 1–10.

Higgins, M. J., Young, A. T., & Levy, D. (2009). Federal, state, and local governments: Evaluating their separate roles in US growth. Public Choice, 139, 493–507.

Higgs, R. (1987). Crisis and Leviathan: Critical Episodes in the Growth of American Government. Oxford University Press.

Jens, C. E. (2017). Political uncertainty and investment: Causal evidence from U.S. gubernatorial elections. Journal of Financial Economics, 124, 563–579.

Julio, B., & Yook, Y. (2012). Political uncertainty and corporate investment cycles. Journal of Finance, 67, 45–83.

Kane, T. (2017). Presidents and the US economy: comment. Working Paper, Hoover Institution, Stanford.

Klarner, C. E. (2013a). Governors Dataset, http://hdl.handle.net/1902.1/20408 IQSS Dataverse Network [Distributor] V1 [Version].

Klarner, Carl, (2013b), State Partisan Balance Data, 1937–2011, http://hdl.handle.net/1902.1/20403 IQSS Dataverse Network [Distributor] V1 [Version]

McCarty, N., Poole, K. T., & Rosenthal, H. (2006). Polarized America: The dance of ideology and unequal riches. MIT Press.

Oates, W. (1999). An essay on fiscal federalism. Journal of Economic Literature, 37, 1120–1142.

Olson, M. (1982). The rise and decline of nations: Economic growth, stagflation, and social rigidities. Yale University.

Pastor, L., & Veronesi, P. (2020). Political cycles and stock returns. Journal of Political Economy, 128, 4011–4045.

Pickering, A. C., & Rockey, J. (2013). Ideology and the size of US state government. Public Choice, 156, 443–465.

Potrafke, N. (2017). Partisan politics: Empirical evidence from OECD panel studies. Journal of Comparative Economics, 45, 712–750.

Potrafke, N. (2018). Government ideology and economic policy-making in the United States—A survey. Public Choice, 174, 145–207.

Ramey, V. (2011). Identifying government spending shocks: It’s all in the timing. Quarterly Journal of Economics, 126, 1–50.

Reed, R. W. (2008). The robust relationship between taxes and US state income growth. National Tax Journal, 61, 57–80.

Reed, R. W. (2009). The determinants of US state economic growth: A less extreme bounds analysis. Economic Inquiry, 47, 685–700.

Reed, W. R. (2006). Democrats, republicans, and taxes: Evidence that political parties matter. Journal of Public Economics, 90, 725–750.

Rodden, J. (2002). The dilemma of fiscal federalism: Grants and fiscal performance around the world. American Journal of Political Science, 46, 670–687.

Schmidt, M. G. (1996). When parties matter: A review of the possibilities and limits of partisan influence on public policy. European Journal of Political Research, 30, 155–186.

Snowberg, E., Wolfers, J., & Zitzewitz, E. (2007a). Partisan impacts on the economy: Evidence from prediction markets and close elections. Quarterly Journal of Economics, 122, 807–829.

Snowberg, E., Wolfers, J., & Zitzewitz, E. (2007b). Party influence in Congress and the economy. Quarterly Journal of Political Science, 2, 277–286.

Acknowledgements

We thank Warren Anderson, Jakob de Haan, James Hamilton, Gary Jacobson, Tim Kane, David Levy, Paolo Roberti, Nicolas Schreiner, William F. Shughart II, Michaela Slotwinski, Heinrich Ursprung, Kaspar Wüthrich, and the participants of the Silvaplana Workshop on Political Economy 2017, the CESifo Area Conference Public Sector Economics 2018, the Political Economy of Democracy and Dictatorship Conference 2019, the European Public Choice Society 2019, the Canadian Public Economics Group 2019, and seminars in Heidelberg, the ifo Institute for helpful comments, and Lucas Rohleder for excellent research assistance.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Alternative lag assumptions

Appendix: Alternative lag assumptions

An important issue is the timing of when changes in partisan control are likely to predict annual GDP growth. Our main results follow BW by assuming that a new president or governor starts to take effect during his or her first full quarter in office. Kane (2017) maintains that it takes longer than one quarter for a new government to affect GDP growth, because it takes quite some time for new legislation and fiscal policies to be implemented. Consumer behavior and firm investment decisions have, however, been shown to respond immediately to electoral outcomes because of shifts in expectations (Snowberg et al., 2007a, b; Falk & Shelton, 2018; Gerber & Huber, 2009; Jens, 2017; Julio & Yook, 2012). In Table

10, we enter different lags and leads of state government partisanship as explanatory variables. The correlation between Democrat state government control and GDP growth is strong for lags 0 to 3. For governors and legislatures, the correlation is less pronounced and no longer statistically significant when we consider lags of more than three quarters, while for unified governments, it remains positive and statistically significant at the 10% level up to the 10th lag. The first and second leads of Democrat state government control (governors and unified governments) also are positively and significantly correlated with GDP growth, suggesting that high national GDP growth may have preceded Democrat victories in state elections (Pastor & Veronesi, 2020).Footnote 12

In Table

11, we investigate the sensitivity of our results that follow the BW methodology (Table 10) to different assumptions about when a newly elected politician can begin to affect the economy. The explained portions of the D-R presidential growth gap for the state politics variables are negative, large in magnitude, and statistically significant when we instead assume that a new politician starts to have an effect in the quarter of the election, or in the quarter of the inauguration. For lags longer than one quarter, the explained portions of the D-R presidential growth gap become somewhat smaller in magnitude and attain lower levels of statistical significance, although they remain large and negative in all specifications and statistically significant in some of them. In any event, the share of Democrat governors does not explain the D-R presidential growth gap, providing additional evidence that the Democrat performance advantage with respect to the partisan balance of the state governments is a separate effect from the D-R presidential growth gap. One final consideration (for future research) is whether GDP growth would be modeled better as a moving average process exhibiting persistence, in line with Higgs’s Crisis and Leviathan (1987).

Source: Klarner (2013b), own calculations

The share of state legislatures that were controlled by the incumbent president’s party also decreased in the course of the presidential term (though not as consistently and not as drastically as in the case of control of governorships).

Rights and permissions

About this article

Cite this article

Cahan, D., Potrafke, N. The Democrat-Republican presidential growth gap and the partisan balance of the state governments. Public Choice 189, 577–601 (2021). https://doi.org/10.1007/s11127-021-00912-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-021-00912-y

Keywords

- Democrat-Republican GDP growth gap

- Federalism

- Partisan politics

- Government ideology

- Democrats

- Republicans