Abstract

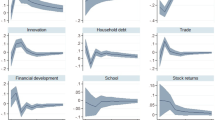

We analyzed the link between financial development and income inequality for a broad unbalanced dataset of up to 138 developed and developing countries over the years 1960–2008. Using credit to GDP as a measure of financial development, our results reject theoretical models predicting a negative impact of financial development on income inequality measured by the Gini coefficient. Controlling for country fixed effects, possible endogeneity problems, GDP per capita and other control variables, we find that financial development increases income inequality. These results are robust to different measures of financial development, econometric specifications and control variables.

Similar content being viewed by others

Notes

Demirgüç-Kunt et al. (2009) provide a brief overview of the relation between microfinance and income inequality and also cite studies that do not confirm that microfinance lowers inequality.

See, e.g., the monograph of Wilkinson and Pickett (2011) for an extensive discussion of the problems posed by high and rising inequality for modern economies and societies.

A more detailed discussion of these papers is available in an extended version of this research online.

Other datasets that claim to have a broad coverage and that are widely used in cross-country studies include different measures of the Gini, e.g., household consumption or income, household or per person levels and gross or net income. The Solt database is in that sense the most comprehensive standardized dataset on income inequality to our knowledge.

Table A.3 in the Online Appendix provides an overview of our measures for financial development and income inequality for all countries in our sample. Figure A.1 in the same Appendix provides a 3D chart of income inequality against GDP p.c. and financial development.

We have done various robustness checks using a limited dataset that excludes credit booms and financial centers. These checks confirmed our results. Please see our robustness section below.

We do acknowledge that these countries have shown excessive provision of private credit or serve as financial hubs. Excluding the 5 year term 2005–2009 does, however, not change the sign of the coefficients and has no substantial effect on the significance of our results.

See Tables A.1 and A.2 in the Online Appendix.

Detailed results are available in an extended Working Paper version of this research online at http://www.cesifo-group.de/de/ifoHome/publications/working-papers/CESifoWP/CESifoWPdetails?wp_id=17407941.

This is best shown by the French motto “liberté, egalité, fraternité” which of course includes equality. This motto shows that the origin of the legal system is not independent of inequality and that the legal system is therefore not a good instrument because it directly influences inequality. Legal origin may be a good instrument for financial development when studying growth, but it is not suitable for an investigation of the influence of financial development on inequality.

There are different approaches on how to proceed with yearly data. Yearly data may represent cyclical movements, whereas using a five-year average yields a more balanced panel, but at the same time means a loss in the number of observations. To compare the results of this larger and more suitable dataset with previous work, we focus on five-year averages. Most variables move slowly over time. Therefore, differences between five-year averages show more variation than yearly data and smooth the effect of business cycles. Yearly data and five-year averages lead to similar coefficients, and we therefore report five-year averages only.

See in particular the recent debate on long-term trends in inequality as initiated, e.g., by Piketty (2014). Please see also the discussion by Milanovic and Alvaredo in Finance and Development, IMF, Sept 2011.

We would like to thank a referee for pointing these robustness tests out to us. Results are available from the authors upon request.

This value ranges from 0.176 to 0.275 depending on the subsample and specification (see Table 3).

References

Arcand J-L, Berkes E, Panizza U (2012) Too much finance? IMF Working Paper, WP/12/161

Alvaredo F (2011) Inequality over the past century. Finance and development, IMF, vol 48

Banerjee AV, Newman AF (1993) Occupational choice and the process of development. J Polit Econ 101(2):274–298

Beck R, Georgiadis G, Straub R (2014) The finance and growth nexus revisited. Econ Lett 124(3):382–385

Beck T, Demirguc-Kunt A, Levine R (2004) Finance, inequality, and poverty: cross-country evidence. National Bureau of Economic Research Working Paper Series, No. 10979

Beck T, Demirguc-Kunt A, Levine R (2010) Financial Institutions and Markets across countries and over time: the updated financial development and structure database. World Bank Econ Rev 24(1):77–92

Beck T, Levine R, Levkov A (2010) Big bad banks? The winners and losers from bank deregulation in the United States. J Finance 65(5):1637–1667

Bordo MD, Meissner CM (2012) Does inequality lead to a financial crisis? J Int Money Finance 31(8):2147–2161

Clarke G, Xu LC, Zou H-F (2003) Finance and income inequality: test of alternative theories. World Bank Policy Research Working Paper, No. 2984

Clarke GRG, Xu LC, Zou H-F (2006) Finance and income inequality: What do the data tell us? Southern Econ J 72(3):578–596

Deininger K, Squire L (1996) A new dataset measuring income inequality. World Bank Econ Rev 10(3):565–591

Demirgüç-Kunt A, Beck T, Honohan P (2008) Finance for all? Policies and pitfalls in expanding access. The World Bank, Washington

Demirgüç-Kunt A, Levine R (2009) Finance and inequality: theory and evidence. Annu Rev Financ Econ 1(1):287–318

Galor O, Zeira J (1993) Income distribution and macroeconomics. Rev Econ Stud 60(1):35–52

Gimet C, Lagoarde-Segot T (2011) A closer look at financial development and income distribution. J Bank Finance 35:1698–1713

Giné X, Townsend R (2004) Evaluation of financial liberalization: a general equilibrium model with constrained occupation choice. J Dev Econ 74:269–307

Greenwood J, Jovanovic B (1990) Financial development, growth, and the distribution of income. J Polit Econ 98(5):1076–1107

Hamori S, Hashiguchi Y (2012) The effect of financial deepening on inequality: some international evidence. J Asian Econ 23:353–359

International Monetary Fund (2011) Financial Access Survey. http://fas.imf.org/

Jaumotte F, Lall S, Papageorgiou C (2008) Rising income inequality: technology, or trade and financial globalization? IMF Working Paper, No. 08/185

Kappel V (2010) The effects of financial development on income inequality and poverty. Center of Economic Research at ETH Zurich, Working Paper, No. 10/127. http://ssrn.com/abstract=1585148

Kumhof M, Ranciere R (2010) Inequality, leverage and crises. IMF Working Paper, No. 10/268

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

La Porta R, Lopez-de-Silanes F, Shleifer A (2008) The economic consequences of legal origins. J Econ Lit 46(2):285–332

Levine R (2005) Finance and growth: theory and evidence: 12. In: Aghion P, Durlauf S (eds) Handbook of economic growth. Elsevier, Amsterdam, pp 865–934

Li H, Squire L, Zou H-F (1998) Explaining international and intertemporal variations in income inequality. Econ J 108(446):26–43

Nikoloski Z (2012) Financial sector development and inequality: Is there a financial Kuznets curve? J Int Dev (published online May 2012)

Ortiz I, Cummins M (2011) Global inequality: beyond the bottom billion—a rapid. Review of income distribution in 141 countries. UNICEF social and economic policy working paper

Piketty T (2014) Capital in the twenty-first century. The Belknap Press of Harvard University Press, Cambridge

Rajan RG (2010) Fault lines. Princeton University Press, Princeton

Roeder PG (2001) Ethnolinguistic fractionalization (ELF) indices, 1961 and 1985. http://weber.ucsd.edu/~proeder/elf.htm

Romer CD, Romer DH (1999) Monetary policy and the well-being of the poor. Econ Rev (Q I):21–49. doi:10.3386/w6793

Solt F (2009) Standardizing the world income inequality database. Soc Sci Q 90(2):231–242

Tan HB, Law SH (2012) Nonlinear dynamics of the finance-inequality nexus in developing countries. J Econ Inequal 10(4):551–563

Wilkinson RG, Pickett K (2011) The spirit level: why greater equality makes societies stronger. Bloomsbury Press, New York

World Bank (2011) World development indicators. Washington. http://data.worldbank.org/data-catalog/world-development-indicators

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank the editor, Badi Baltagi, two anonymous referees, Gerhard Illing, Mathias Hoffmann, Frederick Solt, Carsten Sprenger, Mark Gradstein and the participants of seminars at the University of Munich, the DIW Macroeconometric Workshop 2011, the CESifo Macro Money and Finance Conference 2012, the Fiscal Policy Conference Barcelona 2012, the National Bank of Serbia Young Economists Conference 2012 and the Workshop on Inequality and Macroeconomic Performance, Paris 2012, for their helpful comments.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Jauch, S., Watzka, S. Financial development and income inequality: a panel data approach. Empir Econ 51, 291–314 (2016). https://doi.org/10.1007/s00181-015-1008-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-015-1008-x