Abstract

The financial crisis of 2008 and the introduction of the Interlocking Ban in 2011 (for financial firms) deeply influenced the Italian corporate governance system. The aim of the present study is to investigate to what extent personal ties among the directors of Italian listed companies have changed after these two events. We describe the evolution and dimension of the phenomenon of interlocking directorship (ID) for all the Italian listed companies over the period 1998–2013 using different methodologies. Social network analysis discloses the existence of clusters of companies whose links remain dense after the crisis, while connections to the peripheral units of the system decrease, reducing the overall connectedness. Results reveal that, over the period, there is a reduction in the cumulation ratio which still remains high and mainly due to a high number of directorships for multiple directors. This reduction is more severe after 2008 when both the financial crisis and the Interlocking Ban occur. In disentangling the two effects we observe ID reduction during and after the crisis, also for non-financial firms, confirming the general tendency of a decline in national board interlocking networks.

Similar content being viewed by others

Notes

The number of positions held by multiple directors can be lower than the number of seats since it consists of the number of positions covered exclusively by interlocked directors. Therefore, directors who do not sit on other boards are not considered in this computation.

All measures of centrality, of network structure and graph layout are obtained using Gephi. Gephi is an open-source program available at www.gephi.org.

This indicator consists of the number of closed triplets or triangles—three connected nodes—divided by the number of open triplets—three nodes connected by two edges. The value, which ranges from 0 to 1, expresses the probability that the neighbours of a vertex (the other vertices to which the actor is connected by an edge) are also connected to each other, revealing the presence of a small-world network. High numbers of closed triplets translate into different and multiple alternative paths which allow the flow of information even in case of failure on a node or an edge; in this sense, high levels of clustering are associated with high robustness of the network.

After the crisis, PCA coefficients turn negative. A negative sign of the PCA coefficient of ID does not imply a negative cumulation ratio; rather, it expresses a negative variation of the ID component driven by the reduction of links among directors.

We conducted the SNA excluding the main business group of the sample to ensure the reduction of interlocking is not driven exclusively by the Reform. Data revealed a decline in the number of ties among directors, even excluding the business group from the sample. These results are not reported in this paper.

References

Aganin, A., & Volpin, P. (2003). History of corporate ownership in Italy. In R. K. Morck (Ed.), History of corporate governance around the world: from family business groups to professional managers (pp. 325–361). Chicago: University of Chicago Press.

Almeida, H., & Wolfenzon, D. (2006). A theory of pyramidal ownership and family business groups. Journal of Finance, 61, 2637–2680.

Autorità garante della concorrenza e del mercato, AGCM (2009). Indagine conoscitiva: la corporate governance di banche e compagnie di assicurazioni. http://www.agcm.it/.

Baccini, A., & Marroni, L. (2016). Regulation of interlocking directorates in the financial sector: A comparative case study. European Journal of Law and Economics. doi:10.1007/s10657-014-9467-7.

Barnes, R., & Ritter, E. R. (2001). Networks of corporate interlocking: 1962–1995. Critical Sociology, 27, 192–220.

Barucci, E. (2006). Mercato dei capitali e corporate governance in Italia. Roma: Carocci.

Bazerman, M. H., & Schoorman, F. D. (1983). A limited rationality model of interlocking directorates. Academy of Management Review, 8(2), 206–217.

Bellenzier, L., & Grassi, R. (2014). Interlocking directorates in Italy: Persistent links in network dynamics. Journal of Economic Interaction and Coordination, 9(2), 183–202.

Bianchi, M., Bianco, M., & Enriques, L. (2010). Pyramidal group and the separation between ownership and control in Italy. In F. Barca & M. Becht (Eds.), The control of corporate Europe (pp. 154–186). Oxford: Oxford University Press.

Bianchi, M., Ciavarella, A., Novembre, V., & Signoretti, R. (2011). Comply or explain: Investor protection through the Italian corporate governance code. Journal of Applied Corporate Finance, 23(1), 107–121.

Bianco, M., & Pagnoni, E. (1997). Interlocking directorates across listed companies in Italy: The case of banks. BNL Quarterly Review, Special Issue on Property, Control and Corporate Governance of Banks, March.

Blondel, V. D., Guillaume, J.-L., Lambiotte, R., & Lefebvre, E. (2008). Fast unfolding of communities in large networks. Journal of Statistical Mechanics Theory and Experiment, 10, p10008.

Chiesi, A. M. (1985). Property, capital and network structure in Italy. In F. N. Stokman, R. Ziegler, & J. Scott (Eds.), Networks of corporate power: Comparative analysis of ten countries (pp. 199–213). Cambridge: Polity Press.

Chu, J. S., & Davis, G. F. (2016). Who killed the inner circle? The decline of the American Corporate Interlock Network 1. American Journal of Sociology, 122(3), 714–754.

Confindustria (General Confederation of Italian Industry). (2014). Guidelines for the construction of the Organisation, management and control model. Belluno: Confindustria (General Confederation of Italian Industry).

CONSOB Commissione Nazionale per le Società e la Borsa. (2012). Rapporto 2012 sulla corporate governance delle società quotate italiane. Roma: CONSOB Commissione Nazionale per le Società e la Borsa.

Core, J. E., Holthausen, R. W., & Larcker, D. F. (1999). Corporate governance, chief executive officer compensation, and firm performance. Journal of Financial Economics, 51, 371–406.

Croci, E., & Grassi, R. (2013). The economic effect of interlocking directorates in Italy: New evidence using centrality measures. Computational and Mathematical Organization Theory, 20, 89–112.

Cross, R., & Cummings, J. (2004). Tie and network correlates of individual performance in knowledge-intensive work. The Academy of Management Journal, 47(6), 928–937.

Di Carlo, E. (2014). Pyramids and the separation between direction and control of non-financial Italian family companies. Journal of Management and Governance, 18(3), 835–872.

Di Donato, F., & Tiscini, R. (2009). Cross ownership and interlocking directorates between banks and listed firms: an empirical analysis of the effects on debts leverage and cost of debt in the Italian case. Corporate Ownership and Control, 6, 473–481.

Drago, C., Ricciuti, R., & Santella, P. (2015). An attempt to disperse the italian interlocking directorship network: Analyzing the Effects of the 2011 Reform. Report. Fondazione Eni Enrico Mattei (FEEM).

Enriques, L., & Volpin, P. (2007). Corporate governance reforms in continental Europe. The Journal of Economic Perspectives, 21(1), 117–140.

Fama, E. (1980). Agency problems and the theory of the firm. Journal of Political Economy, 88, 288–307.

Fama, E., & Jensen, M. (1983). The separation of ownership and control. Journal of Law and Economics, 26, 301–325.

Farina, V. (2008). Banks’ centrality in corporate interlock networks: Evidences in Italy. MPRA paper 11698.

Ferri, G., & Trento, S. (1997). La dirigenza delle grandi banche e delle grandi imprese: ricambio e legami., Storia del capitalismo italiano da dopoguerra ad oggi Roma: Donzelli.

Fich, E., & Shivdasani, A. (2006). Are busy boards effective monitors? The Journal of Finance, 61(2), 689–724.

Fich, E. M., & White, L. J. (2003). Why do CEOs reciprocally sit on each other’s boards? Journal of Corporate Finance, 11, 175–195.

Fracassi, C., & Tate, G. (2012). External networking and internal firm governance. Journal of Finance, 67(1), 153–194.

Gambini, A., Sarno, E., & Zazzaro, A. (2012). Composizione e Struttura di Rete tra le Società Quotate in Italia. In A. Zazzaro (Ed.), Reti d’Imprese e Territorio. Tra Vincoli e Opportunità dopo la Crisi. Bologna: il Mulino.

Hallock, K. F. (1997). Reciprocally Interlocking boards of directors and executive compensation. Journal of Financial and Quantitative Analysis, 32, 331–344.

Haunschild, P., & Beckman, M. (1998). When do interlocks matter? Alternate sources of information and interlock influence. Administrative Science Quarterly, 43, 815–844.

Heemskerk, E. M., Fennema, M., & Carroll, W. K. (2016). The global corporate elite after the financial crisis: Evidence from the transnational network of interlocking directorates. Global Networks, 16(1), 68–88.

Hilferding, R. (1981). Finance capital: A study of the latest phase of capitalist development. London and Boston: Routledge and Kegan Paul.

Inklaar, R., & Yang, J. (2012). The impact of financial crises and tolerance for uncertainty. Journal of Development Economics, 97(2), 466–480.

Jensen, M. C., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs, and capital structure. Journal of Financial Economics, 3, 305–360.

Lambiotte, R., Delvenne, J.-C., & Barahona, M. (2015). Laplacian dynamics and multiscale modular structure in networks. IEEE Transactions on Network Science and Engineering, 1(2), 76–90.

Larcker, D., So, E., & Wang, C. (2013). Boardroom centrality and firm performance. Journal of Accounting and Economics, 55(2–3), 225–250.

Luzzatto Fegiz, P. (1928). Il consiglio di amministrazione e l’interdipendenza delle imprese (p. 68). Giornale degli Economisti e Rivista di: Statistica, vol.

Meeusen, W., & Cuyvers, L. (1985). The interaction between interlocking directorships, the economic behaviour of companies. In F. N. Stokman, R. Ziegler, & J. Scott (Eds.), Networks of corporate power: A comparative analysis of ten countries. Oxford: Polity Press.

Melis, A., & Zattoni, A. (2017). A primer on corporate governance: Italy. New York: Business Expert Press.

Mills, C. W. (1956). The Power Elite. New York: Oxford University Press.

Mitchell, J. C. (1969). Social networks in urban situations. Manchester: Manchester University Press.

Mizruchi, M. S. (1996). What do interlocks do? An analysis, critique, and assessment of research on interlocking directorates. Annual Review of Sociology, 22, 271–298.

Mizruchi, M.S. (2017). The Power Elite in historical context: a reevaluation of Mills’s thesis, then and now. Theory and Society, 46(2), 95–116.

Mizruchi, M. S., & Stearns, L. B. (1988). A longitudinal study of the formation of interlocking directorates. Administrative Science Quarterly, 33, 194–210.

Palmer, D. (1983). Broken ties: interlocking directorates and intercorporate coordination. Administrative Science Quarterly, 28, 40–55.

Palmer, D., Friedland, R., & Singh, J. V. (1986). The ties that bind: Organizational and class bases of stability in a corporate interlock network. American Sociological Review, 51, 781–796.

Pennings, J. M. (1980). Interlocking directorates. San Francisco: Jossey-Bass.

Pfeffer, J. (1972). Size and composition of corporate boards of directors. Administrative Science Quarterly, 17, 218–228.

Rinaldi, A., & Vasta, M. (2005). The structure of Italian capitalism, 1952–1972: New evidence using the interlocking directorates technique. Financial History Review, 2, 173–198.

Rinaldi, A., & Vasta, M. (2012). The Italian corporate network after the “Golden Age” (1972–1983): from centrality to marginalization of State-owned enterprises. Enterprise and Society, 13, 1378–1413.

Romano, M., & Favino, C. (2013). Board composition and interlocking directorate evolution as a consequence of the recent financial crisis: Evidence from Italian listed companies. Ownership and Control, 11(1), 175–192.

Rommens, A., Cuyvers, L., & Deloof, M. (2007). Interlocking directorates and business groups: Belgian evidence. Working paper.

Santella, P., Drago, C., Polo, A., & Gagliardi, E. (2007). The Italian Chamber of Lords sits on listed company boards: an empirical analysis of Italian listed company boards from 1998 to 2006. MPRA paper, no. 2265.

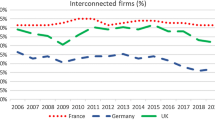

Santella, P., Drago, C., Polo, A., & Gagliardi, E. (2008). A comparison of the director networks of the main listed companies in France, Germany, Italy, the United Kingdom, and the United States. MPRA Paper, no. 16397.

Schoorman, F. D., Bazerman, M. H., & Atkin, R. S. (1981). Interlocking directorates: A strategy for reducing environmental uncertainty. Academy of Management Review, 6, 243–251.

Scott, J. (1985). Theoretical framework and research design. In F. N. Stockman, R. Ziegler, & J. Scott (Eds.), Networks of corporate power a comparative analysis of ten Countries (pp. 1–19). Cambridge, England: Polity Press.

Selznick, P. (1947). Foundations of a theory of organizations. American Sociological Review, 13, 25–35.

Selznick, P. (1949). TVA and the Grass Roots. New York: Harper & Row.

Silva, F., Majluf, N., & Paredes, R. D. (2006). Family ties, interlocking directorates, performance of business groups in emerging countries: The case of chile. Journal of Business Research, 59, 315–321.

Stokman, F. N., & Wasseur, W. (1985). National networks in 1976: a structural comparison. In F. N. Stockman, R. Ziegler, & J. Scott (Eds.), Networks of corporate power a comparative analysis of ten Countries. Cambridge, England: Polity Press.

Useem, M. (1984). The inner circle: Large corporations and the rise of business political activity. New York: Oxford University Press.

Wasserman, S., & Faust, K. (1994). Social network analysis: Methods and applications. New York: Cambridge University Press.

Yiu, D. W., Lu, Y., Bruton, G. D., & Hoskisson, R. E. (2007). Business groups: An integrated model to focus future research. Journal of Management Studies, 44, 1551–1579.

Zattoni, A. (1999). The structure of corporate groups: The Italian case. Corporate Governance An International Review, 7(1), 38–48.

Acknowledgements

The authors would like to thank Professors Alessandro Carretta, Vincenzo Farina, Claudio Porzio, GianMario Raggetti and the colleagues from University of Rome Tor Vergata for their helpful suggestions. We also thank two anonymous referees and the Editor for their comments and feedbacks which have helped us to refine and strengthen this article. In addition, we express our gratitude to Luigi Caiffa who kindly helped us in downloading the data.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fattobene, L., Caiffa, M. & Di Carlo, E. Interlocking directorship across Italian listed companies: evidence from a natural experiment. J Manag Gov 22, 393–425 (2018). https://doi.org/10.1007/s10997-017-9392-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10997-017-9392-6