Abstract

The main objective of this study is to analyze the performance of non-life insurance companies operating in the Turkish insurance industry with a hybrid model including Pythagorean Fuzzy Analytic Hierarchy Process (PFAHP) and Multi-Attributive Ideal-Real Comparative Analysis (MAIRCA) methods. For this purpose, the performance assessment indicators, consisting of fourteen sub-criteria in three dimensions are taken into account for comparing five insurance companies traded on the Borsa Istanbul (BIST) over five consecutive years (2015 to 2019). Subsequently, year-wise rankings are aggregated using the Borda count (BC) procedure. The results of PFAHP indicate that service network is the most important main criterion (dimension) for performance assessment of non-life insurance companies, followed by stock market performance and financial ratios that come in the second and third ranks, respectively. Furthermore, the results of MAIRCA based on BC procedure reveal that Halk Sigorta, a state-owned insurance company, is the most successful company in terms of selected performance indicators in the period examined. A comprehensive sensitivity analysis is performed in order to test stability and the robustness of the results from the proposed framework, and the results of sensitivity analysis confirms the rationality and robustness of the suggested integrated MCDM framework. As a result, the suggested assessment framework can be applied by different decision-making groups in the industry as a valuable and practical decision-making tool for monitoring and improving the performance of insurance companies. Finally, some of managerial implications are also discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Companies operating in the fields of life and non-life insurance generally undertake to cover the loss of the insured against a predetermined event in return for a certain premium or fee under an insurance policy.

Wars, infectious diseases, natural disasters, economic or financial crises that have emerged in recent years have deeply affected social and economic life around the world. Therefore, in line with these developments, there has been a significant increase in the uncertainty and risks that individuals and companies are exposed to, which has triggered the need for insurance companies (Ćurak et al., 2009; Magee et al., 2019; Shen et al., 2017; Xiazi & Shabir, 2022).

Although banks are more dominant financial institutions in financial service intermediation compared to other financial intermediaries, it is possible to say that insurance companies play an increasingly vital role in the process of financial intermediation. Indeed, insurance companies, one of the most dynamic financial intermediaries of the financial system, play a very important role in the effective functioning of financial markets and make significant contributions to the growth and development of every economy through the products and services they offer to their customers (Biener et al., 2016; Ćurak et al., 2009; Oscar Akotey et al., 2013; Suvvari et al., 2019; Yang, 2006).

Insurance companies that collect funds from individuals and other companies by issuing insurance policies mediate the transformation of the collected funds into real investments. Additionally, insurance companies, which act as a risk management mechanism for economic units such as individuals and real sector companies, also contribute to the establishment of financial stability in financial markets (Chen & Lu, 2015; Khan & Noreen, 2014; Torbati & Sayadi, 2018).

The performance assessment of insurance companies has attracted the attention of many researchers due to its significant impact on economic activities and human life. Analysing the performance of insurance companies is critical to the stability of the economies of both developed and developing countries.

While some insurance companies achieve higher performance and profitability, others face structural problems. Since any problem that may arise in financial service intermediation within a financial system has adverse effects on individuals, shareholders, real sector companies, and the overall economy, the performance of financial institutions such as insurance companies and other intermediaries (banks, mutual funds, etc.) in the financial service network should be measured and evaluated systematically (Asadi & Moghri, 2016; Aytekin & Karamaşa, 2017; Seçme et al., 2009; Suvvari et al., 2019). Indeed, the efficiency of insurance companies’ financial intermediation role and the sustainability of their activities can be associated with the regular analysis of the performance of these companies in terms of various indicators and the detailed examination of the analysis results obtained.

1.1 Objectives and Contributions

Overall performance assessment, which has an impact on all operational activities of insurance companies, is a key tool for achieving sustainable competitive advantage and improving performance in the insurance market, which has a competitive and dynamic structure.

Given that the ranking issue in the insurance industry is one of the most critical optimization problems in the MCDM literature, our paper aims to address the performance evaluation issue for insurance companies. To this end, five listed insurers whose shares are traded on BIST in the 2015–2019 period are determined. Following a detailed literature review, fourteen evaluation criteria are defined in three different dimensions such as financial ratios, service network and stock market performance. The evaluation criteria selected for performance assessment offer a practical framework for all stakeholders involved in the insurance industry (managers, policyholders, agents, banks, authorities, etc.) to make more effective, robust, and reliable decisions.

The present study also proposes the use of a new integrated approach that comprises PFAHP and MAIRCA procedures that will allow decision-makers to solve the problem with many conflicting criteria and express their ambiguous views in the decision-making environment. The main reason for combining these two methods is to integrate the advantages of both approaches into the performance assessment process, as outlined below. The presented MCDM approach is a novel performance analysis procedure and can also provide a very comprehensive assessment methodology that can be utilized as a mathematical tool to assess insurers’ overall performance. Consequently, the suggested PFSHP-MAIRCA tool can serve as decision support to various decision-makers in the insurance industry in identifying a reliable, realistic, and applicable methodological framework.

The main contributions of this study to the insurance literature are as follows:

-

The current article is the first study to address the overall performance assessment of publicly quoted companies in the insurance market in terms of financial ratios, service network and stock market performance. Thus, it proposes a novel set of criteria for performance analysis and assessment in the insurance sector and the suggested criteria set can meet the DMs’ requirements related to identifying a reliable, realistic, and practical methodological framework.

-

A novel integrated MCDM approach encompassing PFAHP and MAIRCA procedures is proposed.

-

A real-time case study is performed for assessment of listed non-life insurers’ overall performance in Turkish insurance market.

-

Unlike other studies in the literature, the present paper merges the 5-year ranking results of listed non-life insurance companies according to the BC principle, which makes an important scientific contribution to the literature.

1.2 Motivation for Using PFSs and PFAHP

The concept of fuzzy sets (FSs) was introduced by Zadeh (1965) as a valuable tool for taking the vagueness and impreciseness of subjective evaluations into account. According to classical fuzzy set theory, an element is either a member of a set or not. Thus, while FSs are capable of expressing the degree of membership \((\mu )\) of an element, they are insufficient to express its degree of non-membership (\(\upnu \)) (Buyukozkan & Gocer, 2019). To overcome the shortcoming regarding the \(\upnu \) in classical FSs, Atanassov (1986) extended the classical FSs and developed Intuitionistic Fuzzy Sets (IFSs), which take into account both the \(\mu \) and the \(\upnu \) of an element. The total value for the parameters \(\mu \) and \(\upnu \) in IFSs should be between 0 and 1 or equal to these values (Shen et al., 2018). However, in some problems, the total value of these parameters obtained through the experts may be greater than 1. This situation is not appropriately addressed in the IFSs (Garg & Chen, 2020). To address this limitation, Yager (2013) developed the Pythagorean Fuzzy Sets (PFSs), which are an extension of the IFSs, by stretching the condition of \(\mu \) + \(\upnu \) ≤ 1 to \({\mu }^{2}\) + \({v}^{2}\)≤1 (Kutlu Gündoğdu & Kahraman, 2020). Consequently, the main difference between IFSs and PFSs is that the latter can deal with more information in the fuzzy environment (Garg, 2016; Garg & Chen, 2020; Lin et al., 2021). In other words, PFSs provide decision-makers with greater flexibility in expressing their opinions concerning the vagueness and impreciseness of the considered decision-making problem (Ilbahar et al., 2018; Lahane & Kant, 2023).

In the present paper, the PFAHP approach, obtained by integrating PFSs into the AHP method, is utilized to prioritize the evaluation criteria. Compared with traditional Analytic Hierarchy Process (AHP) and FAHP, this approach has a variety of advantages. It can better handle the uncertainty of decision-making environment (Ayyildiz et al., 2021; Buyukozkan & Gocer, 2019). Additionally, as the decision problem gets more complicated, it provides more consistent, reliable and robust outcomes (Başaran et al., 2023; Karasan et al., 2019). Besides, it can easily reduce uncertainty in the decision-making process by providing more flexibility to decision-makers. This feature makes it easier for decision-makers to achieve clearer solutions (Ayyildiz & Taskin Gumus, 2021).

1.3 Motivation for Using MAIRCA

The MAIRCA approach is responsible for the ranking of decision alternatives. The advantages of employing the MAIRCA algorithm based on the comparison of theoretical and empirical alternative ratings (Pamučar et al., 2014) are: (1) this algorithm is not influenced by the rank reversal problem (Pamucar et al., 2018); (2) since its mathematical frame remains the same irrespective of the number of decision alternatives and evaluation criteria, it is considered to be a feasible choice for MCDM problems involving a large number of alternatives and criteria (Boral et al., 2020; Gülin Feryal & Muzaffer Bertan, 2019); (3) it provides a convenient and practical approach for the decision maker, as it does not require advanced mathematical knowledge and has high solution stability in response to changes in the character and structure of the criteria (Pamucar et al., 2022; Pamučar et al., 2017); (4) The MAIRCA algorithm, which has a more straightforward and more flexible normalization technique, helps decision makers obtain faster, reliable and robust results (Ecer, 2022); (5) this technique can be very successfully combined with a variety of MCDM approaches (Kaya, 2020); and (6) it provides a more objective rankings based on the predefined dominance threshold, which makes it easier for decision-makers to make a final decision (Zolfani et al., 2021).

1.4 Organization of the Study

The present paper is structured as follows: A brief review of recent literature on both the performance evaluation of insurance companies and the applications of PFAHP and MAIRCA methods in MCDM problems is presented in Sect. 2. The suggested hybrid methodology for overall performance assessment is described in detail in Sect. 3. Section 4 provides the findings of the suggested hybrid methodology and sensitivity analyses. The managerial implications of current paper are also discussed in this section. Finally, Sect. 5 presents the conclusion, limitations, and suggestions for future research.

2 Literature Review

The literature review is organized into four sections. Past studies that assess performance and efficiency by applying MCDM techniques in the insurance market are overviewed in the first subsection. In the second and third subsections, the literature on the MCDM techniques that constitute the suggested performance evaluation approach has been examined. In the last subsection, research gaps regarding previous studies in the literature are identified.

2.1 MCDM Techniques in Insurance Market

Recently, researchers from different disciplines have integrated MCDM tools into the solution process of many multi-criteria decision-making problems. In addition to this, various dynamics such as significant changes and transformations in the markets, advances in science and technology, increasing competition, trade wars have made it important to measure and evaluate the performance of companies concerning the conflicting criteria, which has increased the interest in the use of MCDM tools in this field. Although most of the studies in the performance evaluation literature focus on manufacturing companies and banks, it is noteworthy that the number of studies conducted to evaluate the performance of insurance companies have tended to increase in recent years. Thus, some of the studies related to the performance assessment of the insurance companies are summarized as follows.

The Data Envelopment Analysis (DEA) method is one of the methods frequently used to evaluate the performance of insurance companies in the literature (Akhtar, 2018; Al‐Amri et al. 2012; Barros et al., 2005; Ilyas & Rajasekaran, 2019). For example, Hong and Kim (2001) suggested a hybrid methodology combining DEA with a self-organizing map approaches for assessing the performance of twenty-nine life insurance companies operating in South Korea. Yang (2006) used a two-stage DEA model for the production and investment performances of seventy-two insurance companies operating in Canada during 1998. Davutyan and Klumpes (2008) utilized the DEA methodology for efficiency comparison of 188 life and 284 non-life insurers from seven European countries (France, Germany, Italy, Netherlands, Spain, Switzerland, and the UK) over the period 1996–2002. Eling and Luhnen (2010) compared the efficiency performance of 6462 insurers from 36 countries by using the DEA approach from 2002 to 2006. Khan and Noreen (2014) analyzed the performance of seventeen insurance companies operating in Pakistan between 2006 and 2010 by using the DEA technique. Zimková (2015) utilized the DEA approach for assessing and ranking thirteen Slovak insurance companies by considering their efficiency scores in the year 2013. Eling and Jia (2019) investigated the efficiency and profitability relationship in the life and nonlife insurance industries using Stochastic Frontier Analysis, the DEA and regression analyses. Wanke and Barros (2016) applied the DEA and data mining techniques of insurance companies in Brazil over 19-years for efficiency measurement. Tone et al. (2019) examined the effect of investment assets on the performance of insurance companies in Malaysia from 2008 to 2016 by a dynamic two-stage network DEA model. Almulhim (2019) employed a two-stage DEA to assess the efficiency scores of thirty-three listed insurance companies in Saudi Arabia during 2014–2017. In another study focusing on the Saudi Arabian insurance industry, Benyoussef and Hemrit (2019) used the DEA method for comparing the efficiency of twenty-three insurance companies. Gharizadeh Beiragh et al. (2020) proposed an integrated MCDM model comprising AHP, principal component analysis and DEA methods to evaluate and rank the sustainability performance of fourteen Iranian insurance companies for the year 2019. In the study, the sustainability performance of insurance companies is assessed by considering three dimensions, which are economic, social and environmental indicators.

Chen and Lu (2015) employed FAHP and fuzzy modified TOPSIS methods to evaluate and compare the performance of four leading insurance companies in Taiwan. Ksenija et al. (2017) evaluated the performance of twenty-eight insurance companies in Serbia based on five financial criteria by employing the FAHP and TOPSIS methods over the period 2007–2014. Torbati and Sayadi (2018) utilized the BWM and fuzzy inference system for the assessment and ranking of fifty-two insurance branches’ performance according to thirteen criteria in Iran. Suvvari et al. (2019) analyzed twenty-four Indian life insurance companies’ financial performance by taking into account four dimensions such as liquidity, capital adequacy, profitability and activity rates. The study applying the GRA method covers a four-year period between 2013 and 2016. Shen et al. (2017) proposed a hybrid approach to financial performance evaluation of life insurance companies using the DANP and fuzzy integral methods.

2.2 Studies Using the PFAHP Technique

The first component of the proposed two-stage hybrid MCDM model we suggest is the PFAHP approach. Some of the studies employing the PFAHP technique are summarized below. Ilbahar et al. (2018) utilized PFAHP to determine probability and severity parameters in terms of occupational health and safety. Gul (2018) developed an approach for risk assessment via PFAHP and fuzzy VIKOR methods. Gul and Ak (2018) proposed a hybrid approach using the \(5\times 5\) risk matrix and the PFAHP and FTOPSIS to assess risk ratings. Ozdemir and Gul (2019) measured the development level of 26 NUTS-2 regions of Turkey by PFAHP and TODIM methods. Büyüközkan and Göçer (2019) assessed digital supply chain partners with AHP and COPRAS methods under Pythagorean fuzzy sets. Karasan et al. (2019) applied PFAHP to the landfill location selection problem. Mete (2019) integrated failure mode and effect analysis, PFAHP and PFMOORA to evaluate occupational risks of a natural gas pipeline construction project. Yucesan and Kahraman (2019) defined risks in hydroelectric power plants and evaluated risk factors by PFAHP. Shete et al. (2020) identified the supply chain innovation enablers factors for the Indian manufacturing industry by PFAHP. Tepe and Kaya (2020) applied PFAHP and neutrosophic analytic hierarchy process for risk assessment for asphalt production. Çalık (2020) proposed a framework for green supplier selection considering Industry 4.0 components. Öztayşi et al. (2019) prioritized the expectations of different stakeholders to design a social open innovation platform by PFAHP. Wang et al. (2020) conducted a case study in the tropical rainforest of China for ecological landslide prevention with PFAHP. Yucesan and Gul (2020) analyzed hospital service quality by using PFAHP and PFTOPSIS methods. Nguyen et al. (2022) proposed a PFAHP-PFCoCoSo model for benefit expectations in artificial intelligence adoption. Singer and Özşahin (2022) explored the crucial factors influencing wooden outdoor furniture selection by interval-valued PFAHP. Demir et al. (2022) used PFAHP and VIKOR methods in the area of transportation. Lahane and Kant (2023) investigated and specified the importance level of the key challenges of circular supply chain adoption.

2.3 Studies Utilising the MAIRCA Technique

Another component of the hybrid model used in this study is the MAIRCA procedure. Some of the studies using the MAIRCA and its extensions can be summarized as follow. Pamučar et al. (2014) combined fuzzy DEMATEL and MAIRCA for railway level crossing selection. Gigović et al. (2016) utilised a hybrid model based on the combination of geographic information systems and MAIRCA in identifying the best site among nine alternatives for ammunition depots in Serbia. Pamučar et al. (2017) presented a hybrid MCDM model based on interval rough numbers consisting of ANP, DEMATEL, and MAIRCA to determine the most favorable bidder among ten alternatives. Chatterjee et al. (2018) used the R’AMATEL (combining the DEMATEL and ANP methods)-MAIRCA model in evaluating the environmental performance of suppliers for a Taiwanese electronics company Badi and Ballem (2018) proposed a Rough BWM-MAIRCA model for selecting the best medical supplier among three alternatives in Libya. Pamučar et al. (2018) proposed a two-step hybrid MCDM model incorporating fuzzy DEMATEL and MAIRCA to select the location of a multimodal logistics center. Pamučar et al. (2019) suggested a framework by combining the FUCOM and MAIRCA methodologies for the evaluation of level crossings. Zolfani et al. (2020) employed an integrated BWM-MAIRCA methodology for neighborhood selection for a newcomer in Chile. Bakır et al. (2020) combined the PIPRECIA and MAIRCA for the performance evaluation of the airline industry. Boral et al. (2020) suggested a hybrid MCDM model based on the integration of the FAHP and fuzzy MAIRCA for comparison of rankings of eight failure models. Božanić et al. (2020) integrated LBWA and Z-MAIRCA methods for choosing the best location for a camp space among ten alternatives. Gul and Ak (2020) developed a new model combining fuzzy BWM and fuzzy MAIRCA for occupational risk assessment. Ecer and Aycin (2022) applied various ranking strategies, including the MAIRCA method, to assess the innovation performance of the G-7 countries. Ecer (2022) used an extended MAIRCA procedure based on intuitionistic fuzzy sets to determine the best among five alternative coronavirus vaccines. Narayanamoorthy et al. (2023) developed the linear diophantine hesitant fuzzy sets based MAIRCA procedure to assess sustainable energy storage systems.

3 Research Gaps

In today’s competitive environment, insurance companies have to conduct systematic performance measurement to both optimize their business processes and improve their operations. Competitiveness in the insurance market cannot be attributed solely to the efficiency of insurers, as it also depends on insurers’ ability to maximize financial and market performance and improve the quality of their services. Although efficiency is often associated with profit performance, it alone is insufficient to provide satisfactory information about firms’ profitability, financial strength, and market performance (Bilbao-Terol et al., 2022).

The results of detailed literature review indicate that past studies have mostly focused on analyzing the efficiency or financial performance of unlisted insurers, which suggests that the number of existing studies evaluating listed insurers via decision-making approaches is excessively scarce. This reveals that many earlier studies have neglected the criteria related to market performance while analyzing the overall performance of insurers. Hence, this result reveals that more comprehensive and practical assessment criteria are needed to meet the requirements of decision-makers in the insurance industry.

It has subsequently been found that DEA methodology or its variations are generally applied as a mathematical tool to evaluate the efficiency of insurance companies in terms of selected indicators (inputs and outputs) in most of the studies in the existing literature. However, the DEA has several weaknesses and structural problems. DEA is sensitive to the choice of criteria. If the indicators utilized as inputs and outputs are not carefully chosen, serious deviations in the ranks are likely to occur. Additionally, the number of variables employed can influence the results of analyses of companies’ performance and each additional variable can lead to dramatic changes in the ranking results (Forouzandeh et al., 2022; Görçün et al., 2022; Johns et al., 1997). As for techniques such as ANP, AHP, FAHP, BWM, TOPSIS and GRA utilized in the evaluation of the insurance industry, they have some limitations and structural problems like DEA. Due to the rank reversal problem, these methods can be insufficient to produce reliable and consistent results. In other words, adding or deleting an alternative or criterion causes dramatic changes in ranking performance. Besides, ANP, AHP, FAHP and BWM approaches cannot adequately take into account the uncertainties that arise during the evaluation process. These limitations are still debated and criticized in the existing literature (Ak et al., 2022; Görçün et al., 2022; Sánchez-Garrido et al., 2022; Zolfani et al., 2021).

To fill the first important gap mentioned above, the present study introduces a new set of criteria for more effective and realistic analysis of overall performance by incorporating financial variables, factors affecting service quality and critical market performance indicator into the decision-making process.

To fill the second critical gap, the current paper develops an integrated MCDM approach based on PFAHP and MAIRCA methods to systematically analyze overall performance of listed insurers. Combining the advantages of PFAHP and MAIRCA techniques, this integrated hybrid tool offers a new performance analysis approach as an effective, powerful and applicable mathematical tool in performance analysis of publicly traded insurance companies.

The originality of this study comes from the evaluation of the overall performance of publicly quoted insurers in the Turkish insurance market for the first time. Additionally, this study provides a new and practical set of criteria for performance analysis and evaluation for publicly traded companies in the insurance industry. Finally, there have been no studies utilizing the combination of FPAHP and MAIRCA for the same case in the past.

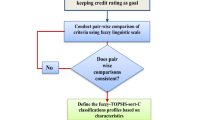

4 Suggested Hybrid Methodology

In our study an integrated MCDM model including PFAHP and MAIRCA methods is proposed to assess the performance of non-life insurance companies. The first stage involves designing the hierarchy of problems. For this aim, firstly main criteria, sub-criteria, and criteria are determined through reviewing the literature and interviewing three experts in the field. Then, financial indicators of the companies are obtained from the FINNET database and reports of the companies. As a result of the first evaluation, we realized that the indicators determined are not available for every company. For this reason, some companies were excluded. Consequently, five listed companies are included in the structure. The second stage involves a linguistic evaluation of indicators and acquiring of the weights of indicators based on the PFAHP method (usage of Eqs. 7–13). The last stage involves the ranking of the companies by using the MAIRCA method (usage of Eqs. 14–24). Hence, this section explains the application steps of the two methods mentioned above. Next, a merged ranking for alternatives is provided by employing the five-year performance rankings through the BC rank aggregation technique. Finally, a comprehensive sensitivity analysis is conducted to test the validity of the findings obtained from the integrated PFAHP-MAIRCA framework. Figure 1 outlines the research framework adopted in this study.

4.1 Preliminaries of Pythagorean Fuzzy Sets

In this section, basic concepts and definitions of PFSs are presented. In PFSs, the sum of membership and non-membership degrees can exceed 1, but the sum of squares cannot (Karasan et al., 2018; Zeng et al., 2016; Zhang & Xu, 2014). This situation is shown below in Definition 1.

Definition 1

Let a set \(X\) be a universe of discourse. A PFS \(P\) is an object having the form (Zhang & Xu, 2014):

where \({\mu }_{P}\left(x\right):X\mapsto \left[\mathrm{0,1}\right]\) defines the degree of membership and \({v}_{P}\left(x\right):X\mapsto \left[\mathrm{0,1}\right]\) defines the degree of non-membership of the element \(x\in X\) to \(P\), respectively, and, for every \(x\in X\), it holds:

For any PFS \(P\) and \(x\in X\), \({\pi }_{P}\left(x\right)=\sqrt{1-{\mu }_{P}^{2}\left(x\right)-{v}_{P}^{2}\left(x\right)}\) is called the degree of indeterminacy of \(x\) to \(P\).

Definition 2

Let \({\beta }_{1}=P({\mu }_{{\beta }_{1}},{v}_{{\beta }_{1}})\) and \({\beta }_{2}=P({\mu }_{{\beta }_{2}},{v}_{{\beta }_{2}})\) be two Pythagorean fuzzy numbers, and \(\lambda >0\), then the operations on these two Pythagorean fuzzy numbers are defined as follows (Zeng et al., 2016; Zhang & Xu, 2014):

4.2 Calculation Procedure of the PFAHP Method

The steps of PFAHP are presented as follows.

Step 1: The compromised pairwise comparison matrix \(A={\left({a}_{ik}\right)}_{m\times m}\) is structured based on the linguistic evaluation of experts using the scale proposed by Ilbahar et al. (2018) in Table 1.

Step 2 The difference matrices \(D={\left({d}_{ik}\right)}_{m\times m}\) between the lower and upper values of the membership and non-membership functions are calculated using Eqs. (7) and (8):

Step 3 Interval multiplicative matrix \(S={\left({s}_{ik}\right)}_{m\times m}\) is computed using Eqs. (9) and (10):

Step 4 The determinacy value \(\tau ={\left({\tau }_{ik}\right)}_{m\times m}\) is calculated using Eq. (11):

Step 5 The determinacy degrees are multiplied with \(S={\left({s}_{ik}\right)}_{m\times m}\) matrix for obtaining the matrix of weights, \(T={\left({t}_{ik}\right)}_{m\times m}\) before normalization using Eq. (12).

Step 6 The priority weights \({w}_{i}\) of criteria are normalized by using Eq. (13):

4.3 Calculation Procedure of the MAIRCA Method

The MAIRCA method, which is developed in 2014 by the Center for Logistics Research at the University of Defence in Belgrade, is based on the calculation of the gap between theoretical and real ratings in the assessment of alternatives (Pamučar et al., 2014). The following calculation procedure is followed to identify the ranking of the non-life insurance companies (Božanić et al., 2020; Gigović et al., 2016; Zolfani et al., 2020).

Step 1 Forming the decision matrix (A) as shown in the Eq. (14):

where, \({{\text{a}}}_{{\text{ij}}}\) represents the performance value of i-th alternative according to j-th criterion.

Step 2 Identifying preferences \(({{\text{P}}}_{{\text{Ai}}})\) according to the selection of alternatives. A decision-maker is neutral in terms of the alternatives during alternative selection and does not have any preferences. All the alternatives are taken into consideration and chosen with equal probability. In other words, the selection possibility for each alternative is equal to each other. For this reason, the process of choosing an alternative from among m alternatives is as follows:

Here, m is the number of alternatives.

Step 3 Computing the theoretical evaluation matrix elements (\({{\text{T}}}_{{\text{p}}}\)). This matrix in a format of mxn is established by multiplying the criteria weights (\({{\text{w}}}_{{\text{i}}}\)) obtained from PFAHP method with the preferences \({{\text{P}}}_{{\text{Ai}}}\) for each alternative as shown in the following equation:

Step 4 Calculating the real assessment matrix elements (\({{\text{T}}}_{{\text{r}}}\)). The real evaluation matrix elements as shown in Eq. (17) are computed as the multiplication of the elements of theoretical evaluation matrix and the normalized elements of the normalized decision matrix.

The elements in the initial-decision matrix are normalised using Eq. (18) for beneficial criteria, and Eq. (19) for non-beneficial criteria.

where \({{\text{a}}}_{{\text{ij}}}\), \({{\text{a}}}_{{\text{i}}}^{{\text{max}}}\) and \({{\text{a}}}_{{\text{i}}}^{{\text{min}}}\) represent the elements of the initial-decision matrix (A) and \({{\text{a}}}_{{\text{i}}}^{{\text{max}}}\) and \({{\text{a}}}_{{\text{i}}}^{{\text{min}}}\) are maximum and minimum values of the considered criterion, respectively.

Step 5 Forming the total difference matrix (TD). The total difference matrix elements are calculated by subtracting the theoretical assessment matrix elements from the real assessment matrix elements as shown in the following equation:

The difference \({{\text{g}}}_{{\text{ij}}}\) takes values from the interval \({{\text{g}}}_{{\text{ij}}}\) ∈ [0,∞] by employing Eq. (21):

Step 6 Obtaining the value of the criteria function (\({{\text{Q}}}_{{\text{i}}}\)) and initial ranking of alternatives.

The initial evaluation of alternatives is performed based on the obtained values of \({{\text{Q}}}_{{\text{i}}}\) and it is decided that the alternative with the lowest \({{\text{Q}}}_{{\text{i}}}\) value is the best alternative.

Step 7 Determining the dominance index \({({\text{A}}}_{{\text{D}}, 1-{\text{j}}})\) of the best-ranked alternative and the final ranking of the alternatives. The dominance index of the best-ranked alternative is computed by employing Eq. (23), and indicates the advantage of the best-ranked alternative in relation to the other alternatives.

Where \({{\text{Q}}}_{{\text{j}}}\) indicates the value of the criterion function of the alternative in comparison to the best-ranked alternative, \({{\text{Q}}}_{1}\) indicates the criterion function value of the best-ranked alternative, and \({{\text{Q}}}_{{\text{n}}}\) indicates the criterion function value of the last-ranked alternative.

After the values of the dominance index are identified, the dominance threshold \({({\text{I}}}_{{\text{D}}})\) is computed by using Eq. (24)

Here, m is the number of alternatives.

If the dominance index is greater than or equal to the dominance threshold, the initial ranking will remain unchanged. However, if the dominance index is smaller than the dominance threshold, then it is not possible to say with certainty that the first-ranked alternative has an advantage over the compared alternative and the initial ranking will no longer be valid and the ranking will need to be corrected. For example, if the criterion \({{\text{A}}}_{{\text{D}}, 1-2}\)<\({{\text{I}}}_{{\text{D}}}\) is satisfied for the second-ranked alternative, it will be assigned a value of 1* in the ranking. In this case, the best-ranked or second-ranked alternative can be chosen as the first-ranked alternative.

4.4 Borda Count (BC) Procedure

The BC rank aggregation procedure, developed by Jean-Charles de Borda (1781), is a widely applied MCDM aggregation algorithm for obtaining an optimal alternative priority orders with minimum deviations from the originally achieved ranking results of alternatives. The steps of BC are as follows.

Step 1 Identifying the final ranks of options for each different year in a decision problem having m options.

Step 2 Assigning points to each option based on the BC method. Considering the Borda rule, the options are assigned scores of (m-1), (m-2), (m-3), etc. starting from the best to the worst. This process is repeated for each year.

Step 3 Obtaining the BC scores for each option. In this step, the sum of the BC scores for each option in each year gives their total BC score.

Step 4 Ranking the options based on their total BC points. The decision options are ranked from highest to lowest, taking into account their total Borda scores. Consequently, the option having the highest BC score is determined as the best option.

5 Application of the Proposed Hybrid Methodology for Non-Life Insurance Companies

The data set used in this study, the hierarchical structure of the problem, and the results of the suggested hybrid model are explained in this section.

5.1 Problem Definition

The performance measurement and assessment to address the challenges to the successful management of insurance corporations is a common problem encountered by various decision-makers in the insurance market (Işık, 2022). To select the best insurer among competitors, it is crucial to consider multiple but often conflicting evaluation criteria. For example, an insurer may perform well when a particular criterion is taken into account, while it may perform poorly in terms of another criterion. The aggregation of these contrasting performances can be provided by employing multi-criteria approaches (Bilbao-Terol et al., 2022).

In this study, a multi-criteria problem concerning the performance measurement and assessment of insurers is given and solved by utilizing a hybrid framework based on PFAHP and MAIRCA methodologies. The determined performance evaluation problem is addressed for five listed non-life insurers and fourteen sub-criteria in three different dimensions.

Given the asset size of financial institutions in the Turkish financial system as of December 2019, insurance companies are the third most important actor in the financial system because they have a 4.71% share in total assets. Moreover, there are a total of 63 companies operating in the Turkish insurance sector. 38 of them are non-life insurance companies. Of the non-life insurance companies, the number of companies whose shares are publicly traded in BIST is 5. These companies are Aksigorta (A1) Anadolu Anonim Türk (A2), Güneş Sigorta (A3) and Halk Sigorta (A4) and Ray Sigorta (A5), respectively. These companies’ share in premium production of the non-life insurance market in 2019 is 28,85%.

As seen in Fig. 2, the performance assessment indicators employed in the study consist of fourteen sub-criteria in three dimensions.

-

The financial ratios making up the first performance dimension are as follows: (i) the ratio of gross written premiums to equity capital, (ii) the ratio of equity to total assets, (iii) the ratio of current assets to current liabilities, (iv) the ratio of cash plus marketable securities to current liabilities, (v) the ratio of net premiums to gross premiums, (vi) the ratio of incurred losses to earned premiums, (vii) the ratio of realized claims plus operating expenses to earned premiums, (viii) the ratio of technical profit to gross premiums, (ix) the ratio of net income before taxes to total assets, and (x) the ratio of net income before taxes to stockholder’s equity.

-

The second performance dimension is related to the service network. This dimension consists of the number of employees and the number of agencies.

-

The final performance dimension of the study is based on stock market performance. In this dimension, there are two indicators namely stock return and volatility of stock return (i.e., risk). Stock return (SR) is computed by employing Eq. (25):

where \({CP}_{t}\) and \({CP}_{t-1}\) are the closing price in year \(t\) and \(t-1\), respectively.

Stock return volatility is measured as the standard deviation of monthly stock returns for the previous 60 months. The data regarding the financial ratios and service network employed in the study are taken from the annual reports of listed non-life insurers. Whereas, stock market performance data are obtained from the FINNET database. All of the data utilized in this paper are given in Appendix.

Within the framework of the proposed performance evaluation, firstly, assessment criteria are identified through a comprehensive literature review and expert interviews. Secondly, the data about the insurance companies employed in the analysis are collected. Later, the importance level of the criteria is found using the PFAHP technique in line with the subjective opinions of three experts. Following the calculation of the weight coefficients, the ranking of the companies is provided by the MAIRCA method. Lastly, the ranking results from different years are combined implementing the BC approach to obtain the compromise ranking solution. Figure 2 contains the hierarchical structure of the problem, which consists of five levels: aim, main criteria, criteria, sub-criteria and companies.

5.2 Application of the PFAHP Method

Asking for the opinions of experts having different experiences and knowledge is one of the most crucial steps of the assessment process in structuring and analyzing the decision-making problem. The literature does not provide any information on how many experts should be consulted when applying subjective weighting approaches. However, the number of experts can vary between 2 and 7 in order to achieve reasonable and logical results at the end of the evaluation process (Ecer et al., 2023). For this reason, 5 highly qualified and well-informed experts in the insurance industry were consulted for the purpose of defining and evaluating the performance criteria for listed insurers. However, 3 of them agreed to take part in the evaluation process. Consequently, an expert committee composed of three professionals having more than 21 years of industry experience was established. The detailed information concerning these 3 highly experienced professionals is presented in Table 2.

Next, the criteria of the decision problem are evaluated by these experts. In the first stage, the members of the expert committee constituted pairwise comparisons to identify the level of importance of the criteria. The obtained comparison matrices by expert committee are given in Tables 3 and 4 according to the linguistic scale (Table 1) for the main and sub-criteria, respectively. The aggregated pairwise comparison matrix for the main criteria is stated in Table 5. The linguistic evaluations were transformed into the corresponding interval-valued Pythagorean fuzzy numbers and they were combined since the evaluations of the decision makers are different. Finally, the weights of the criteria were obtained by solving the Eq. (7)–(13) steps. The local and global weights of the criteria are presented in Table 6.

From the analytical results shown in Table 6, The service network (C2) is the most important dimension (main criterion) with a weight of 0.5213. Whereas, stock market performance (C3) is the second most important dimension with a weight of 0.3075. Table 5 also states that financial ratios (C1) are the lowest important dimension with a weight of 0.1711.

Table 6 also provides information about the priority weights calculated for the sub criteria. Accordingly, the number of agents (C22) with a weight of 0.3481 is the most important sub-criterion. In addition, stock returns (C31), number of personnel (C21) and return volatility (C32) are other important sub-criteria. On the other hand, the premium retention ratio (C131) is the least important sub-criterion as it has the lowest weight (0.030).

5.3 Application of the MAIRCA Method

As mentioned before, the data set covers a 5-years between 2015 and 2019. Therefore, firstly the MAIRCA method is applied to the 2015 data of non-life insurance companies and then the same application procedure is repeated for the remaining four years. The decision matrix formed for the year 2015 by using Eq. (14) is indicated in Table 7.

Following the forming of initial-decision matrix, the preferences are identified as \({{\text{P}}}_{{\text{Ai}}}\)= 1/5 = 0.20, i.e. \({{\text{P}}}_{{\text{A}}1}\)=\({{\text{P}}}_{{\text{A}}2}\)=… = \({{\text{P}}}_{{\text{A}}5}\)=0.20. In the next step, the elements of the \({{\text{T}}}_{{\text{p}}}\) matrix as shown in Table 8 are calculated based on Eq. (19). The elements of the \({{\text{T}}}_{{\text{r}}}\) are obtained from Eq. (17), and presented in Table 8. Once both the \({{\text{T}}}_{{\text{p}}}\) matrix and the \({{\text{T}}}_{{\text{r}}}\) matrix are constructed, the TD matrix is calculated through Eq. (20), and given in Table 9. After identifying the total difference (Table 10) between theoretical and actual assessments, to make the first evaluation of the alternatives, the values of \({{\text{Q}}}_{{\text{i}}}\) for each alternative is obtained with the help of Eq. (22), and the results are given in Table 11. According to the results, the initially best-ranked alternative is A5.

However, as mentioned above, the value of the dominance index of the best-ranked alternative is computed by applying Eq. (23) to make the final decision as to whether the alternative that ranks first in the performance ranking has enough advantage over other alternatives. Also, the value of the dominance threshold is calculated as 0.16 for our sample with the help of Eq. (24).

Because the dominance index of the best-ranked alternative (A5) in relation to the second-ranked alternative (A4) is smaller than the computed dominance threshold, we can say that A4 does not have enough advantage in relation to A5, thus the ranking for A4 is corrected and A4 takes the value of 1* in the ranking. The other values calculated for the dominance index are greater than the dominance threshold, so the initial ranking remains unchanged for the other alternatives. As a consequence, the order of alternatives for the year 2015 as shown in Table 11 is as follows: A5≈A4 > A1 > A3 > A2.

The results of the proposed performance evaluation model for the remaining four years as well as the year 2015 are indicated in Table 11. As shown in Table 11, the order of A3 and A4 in 2016, the order of A5 in 2018 and the order of A3 in 2019 are corrected due to the reasons mentioned above. Both initial and final ranking results for the year 2017 in Table 11 indicate that alternative A4 is the best-ranked alternative because its advantage is significant enough, compared to the other alternative. As a consequence, the analysis results covering a period of five years reveal that A4 is more dominant than other alternatives, although there is significant competition between A4 and A5.

5.4 Final Ranking of Companies Using BC Method

As mentioned before, our study covers a period of 5 years. Therefore, the rankings of the companies on a yearly basis are determined within the framework of the proposed methodology. However, it reveals that the final decision regarding the evaluation of companies is not clear. In such cases, the literature suggests various integration methods in order to aggregate the year-wise ranking results and reduce the problem to a single result (Biswas et al., 2022; Ecer, 2021). One of them is the BC method. BC scores calculated for each alternative also provide a consensus ranking between the performance rankings obtained by using five different data. The rankings obtained based on the performance indicators of five different years covering the 2015–2019 period are merged with the Borda rule and the findings are given in Table 12. The final order of alternatives is as follows: A4 > A5 > A3 > A1 > A2.

5.5 Sensitivity Analysis

Verifying the suitability of applying the proposed framework to compare companies with a comprehensive sensitivity analysis is of paramount importance for the stability and reliability of the results obtained. At this point, the stability of the proposed framework is validated through sensitivity analysis in three phases: (i) investigation of the impact of changes in criteria weights on ranking results, (ii) examination of ranking results in a dynamic environment, and (iii) comparison of the proposed hybrid model with the various MCDM approaches. The ranking results found by the application of other MCDM methods are integrated with the BC method.

5.5.1 Analysis of the Influence of Changes in the Weights of the Criteria on the Ranking of Alternatives

Although there are many sensitivity analyses in the MCDM literature regarding weight coefficients, the approach applied by (Božanić et al., 2021; Pamucar et al., 2021) is preferred for this study. By applying this method of conducting sensitivity analysis, the weight of the most important criterion (C22) is reduced by 2% in each scenario. Then, the weights of the remaining 13 criteria are proportionally corrected to meet the sum of weights, which should be equal to 1. In this way, 30 scenarios are formed, as in Table 13. By transferring the new weights found with each scenario to the MAIRCA model, a new ranking of alternatives is obtained. As can be seen in Fig. 3, it is concluded that there is no change in the order of the alternatives obtained by applying the 30 scenarios, which means that the results from sensitivity analysis are substantially stable. Thus, it is verified that the initial rank of the alternatives is not violated.

5.5.2 Examination of the Ranking Results in a Dynamic Environment

In this sub-section, the effects of adding or eliminating a new alternative to the decision matrix on the ranking results are investigated in order to test the robustness and stability of the proposed model for performance assessment (Dwivedi et al., 2023; Nedeljković et al., 2021). In this way, the resistance of the proposed methodology to the rank reversal problem can be tested. In the framework of this study, the performance of the proposed methodology is tested by eliminating the worst alternative from a set of alternatives (Yu et al., 2022; Zolfani et al., 2021). In line with this objective, we generate four scenarios (S1-S4) by removing the worst alternative and observe the changes in the results of ranking. The initial ranking results suggest that the worst alternative is A2. Therefore, in the first scenario, alternative A2 is excluded from the initial decision matrix, while the remaining alternatives are reordered. As can be seen from Table 14, the new ranking result obtained from the first scenario is A4 > A5 > A3 > A1. Similarly, in the next three scenarios, the worst alternatives are removed from the decision matrix and new rankings of alternatives are obtained. The results for all scenarios are reported in Table 14. According to the results reported in Table 14, A4 is ranked first in all scenarios, suggesting that the introduced methodology is considerably consistent and stable and is not influenced by the rank reversal problem.

5.5.3 Comparison of the Proposed Model with the Various MCDM Models

Before drawing any conclusions. it is necessary to perform a validation check to see if the results of the introduced methodology are reliable. Validation refers to comparing the results of several different MCDM methods. In the present study we compare our results with other MCDM approaches such as compromise ranking of alternatives from distance to ideal solution (CRADIS), complex proportional assessment (COPRAS), proximity indexed value (PIV), TOPSIS, and operational competitiveness ratings (OCRA). These procedures are chosen for their various advantages, ease of use, simplicity, wide applications, and potential to efficiently rank alternatives in real-world problems. The methods such as CRADIS (Puška et al., 2022), COPRAS (Kaklauskas & Zavadskas, 1996), PIV (Mufazzal & Muzakkir, 2018), TOPSIS (Hwang & Yoon, 1981), and OCRA (Parkan, 1994) have been proposed for the solution process of various MCDM problems. Among them, the CRADIS and PIV methods are relatively newer compared to the other three methods. The rank of companies obtained by the MAIRCA procedure is compared to the ranks of other MCDM procedures mentioned above. The results for the comparison of the various MADM procedures is demonstrated in Fig. 4. When we examine the comparison results, it has been confirmed that A4 is the best alternative while A2 ranks last in all applied ranking methodologies. The ranking performance of alternatives A5, A3, and A1 is almost identical except for one ranking method. Employing Spearman’s rank correlation test, we also check for statistical significance of results from all models applied in this study. The results of the rank correlation test for all implemented models are indicated in Table 15. Based on Table 15, it is noticed that correlation values are significantly above 0.92, suggesting a highly significant correlation between the ranks from the tested MCDM procedures and the initial rank from the employed MAIRCA approach. Consequently, validation test results imply that the suggested ranking is validated and can be considered credible.

5.6 Theoretical and Managerial Implications

Insurance firms, which act as a risk transfer mechanism in every economy, take an intermediary role in transferring the funds they collect as premiums for assuming risk from individuals and institutions to financial markets. On the other hand, insurance companies also play an important role in compensating for damages such as natural disasters, fires, and accidents. Thus, it can be stated that insurance services are of great importance not only economically but also socially. Determining the performance of insurance companies facing various challenges and recommending an evaluation system can be considered a critical issue for practitioners and researchers.

The theoretical implications of our paper can be summarized as follows.

-

The introduced PFSHP-MAIRCA framework provides decision support for various DMs, such as managers, policyholders, agents, banks, and supervisory authorities, to make more realistic assessments and analyses by identifying crucial factors influencing the overall performance.

-

First, the PFAHP is applied to compute the subjective weight coefficients of the criteria. The PFAHP technique, which is a combination of PFSs with AHP, gives DMs more flexibility in dealing with the complexity of the decision-making environment and enables them to achieve more reliable, consistent, and robust outputs. Second, the MAIRCA approach is responsible for comparing and ranking the performance of non-life insurers. The calculation of a predefined dominance threshold within this algorithm helps DMs to objectively make their final decision on performance evaluation. Additionally, compared to other CRM approaches, it provides DMs with high solution stability even if new alternatives and criteria are added to the decision problem. Hence, more realistic evaluations can be easily made in the insurance market.

-

The reliability and applicability of the introduced PFSHP-MAIRCA framework are checked through a three-stage sensitivity analysis. The obtained results demonstrate that the introduced decision framework is an efficient and robust procedure that DMs related to the insurance market can implement without an advanced mathematical background.

-

The proposed mathematical tool could be applied by researchers and authorities to analyze the overall performance of financial and non-financial companies in detail and to manage the decision-making process effectively.

The current study has several managerial implications in terms of the results achieved, which can be summarized as follows:

-

The proposed methodology can help identify the most important indicator and sub-indicators in the insurance industry.

-

Based on the decision-making group judgments and the application of the PFAHP technique, it is deduced from Table 6 that ‘service network performance’ is preferred as the highest priority among performance categories. For this reason, companies need to pay more attention to the elements that make up their service networks in order to produce better customer-orientated solutions and improve overall performance. Giving the highest priority by decision-makers to factors such as the number of employees and agencies that make up the service network in performance evaluation reveals how important the employees and agencies, whose number has increased rapidly in recent years are in the premium production.

-

The average of those with a degree in insurance among university and master’s graduates in Turkey is only 5%. Given the findings regarding the service network dimension, increasing this ratio will both solve the problem of qualified personnel in the industry and accelerate the growth of the industry which has a dynamic structure.

-

In addition to the above determinations, the increase in digitalization investments for the work of agencies, especially during epidemic periods, may contribute to the development of the service network.

-

Considering the stock market performance dimension, it can be stated that the investors in the Turkish insurance industry are more interested in the rate of return rather than the risk.

-

The fact that the importance level of the capital adequacy dimension is higher than that of other financial ratios reveals the importance of these ratios for the efficient management of unforeseen risks in insurance, which is built on the concept of risk.

-

Considering the performance ranking of the insurers for the five-years, Halk Sigorta is the most successful company. This result reveals the trust of individuals and institutions towards a state-owned insurance company in risk management.

-

Top executives associated with insurance firms, including board members can adopt the proposed approach to see their position in the industry in which they operate with a view to achieving and maintaining a sustainable competitive advantage.

-

Since monitoring the operating results of insurance companies is of great importance for the national economy and the development of the financial sector, regulatory and supervisory authorities can improve novel and specific strategies for the industry.

-

The proposed decision framework can assist potential customers, as well as current policyholders who have already utilized insurance services, to identify the best insurer by comparing insurers in terms of overall performance. It can also contribute to the long-term strategic decision-making of key business partners of the insurance industry, such as agents and banks.

-

The paper’s findings could provide vital information to other actors in financial markets to effectively manage and improve their financial relationships with insurance companies.

-

Finally, our results reveal that the usage of multi-criteria evaluation methods is an important tool in measuring and evaluating the performance achieved by companies from various perspectives in a certain period.

6 Conclusions

Insurance companies are one of the most crucial institutions of the financial system, not only in developed economies but also in developing economies. Due to the risk absorption role of the insurance industry, it is necessary to analyze the performance of companies operating in this industry objectively at regular intervals. Any problem that can occur in the insurance industry directly affects the intermediation function of insurance companies as well as the overall economy, which can lead to both increased insecurity and unrest in the society and crises in the financial market. Therefore, in this study, it is aimed to introduce a new MCDM framework for performance evaluation of non-life insurance companies based on a multidimensional dataset. In accordance with this purpose, to rank and assess the insurance companies, a combined PFAHP-MAIRCA tool has been employed wherein the BC principle has been applied for gaining an aggregated ranking order considering 5 years covering the period 2015–2019.

In the first stage of the implementation of the proposed methodology, The PFAHP method is applied to data of non-life insurance companies to compute the weight coefficients of the selected performance dimensions and sub-criteria. Findings show that the service network is the most important performance dimension. Moreover, number of agencies and premium retention ratios are found to be the most and least important sub-criteria, respectively.

Once the priority weights of the main-criteria and sub-criteria are determined, non-life insurance companies (alternatives) are ranked employing the MAIRCA method in the second stage of the proposed hybrid model. The findings of MAIRCA approach reveal that, except for 2017, there is no dominant alternative in terms of performance ranking for the other four years, in other words, the performance scores of the alternatives are close to each other. We then applied a ranking strategy based on the BC procedure to gain a better understanding of the performance results and achieve a more meaningful performance ranking. In this framework, year-wise rankings are aggregated by applying the BC procedure. The results of MAIRCA based on BC procedure clearly indicate that Halk Sigorta is the best alternative while Anadolu Anonim Türk ranks last.

The most important limitation of this study is that only the data of five non-life insurance companies whose shares are registered in BIST are used. This limitation is also a shortcoming related to evaluations of other insurance companies operating in the same industry. Another limitation of the study can be related to the period chosen for analysis. But, there was no loss of data for these companies in the period of 2015–2019. Performance evaluation studies to be carried out for the insurance sector can be a guide for managers, shareholders, and regulatory and supervisory authorities. Therefore, more insurance companies can be examined within the scope of analysis in future studies. Additionally, nonlinear modeling approaches which proved to be successful in modeling systems in various fields can be used in performance assessment. Finally, it should be noted that including different types of performance dimensions in the analysis process is important for a more effective performance evaluation.

Abbreviations

- AHP:

-

Analytic hierarchy process

- BWM:

-

Best worst method

- BC:

-

Borda count

- CoCoSo:

-

Combined compromise solution

- COPRAS:

-

Complex proportional assessment

- CRADIS:

-

Compromise ranking of alternatives from distance to ideal solution

- DEA:

-

Data envelopment analysis

- DEMATEL:

-

Decision making trial and evaluation laboratory

- DANP:

-

DEMATEL-based analytic network process

- FUCOM:

-

Full consistency method

- FAHP:

-

Fuzzy analytic hierarchy process

- FSs:

-

Fuzzy sets

- GRA:

-

Grey relational analysis

- IFSs:

-

Intuitionistic fuzzy sets

- LBWA:

-

Level based weight assessment

- MOORA:

-

Multi objective optimization on the basis of ration analysis

- MAIRCA:

-

Multi-attributive ideal-real comparative analysis

- OCRA:

-

Operational competitiveness ratings

- PIPRECIA:

-

PIvot pairwise relative criteria importance assessment

- PIV:

-

Proximity indexed value

- PFAHP:

-

Pythagorean fuzzy analytic hierarchy process

- PFSs:

-

Pythagorean fuzzy sets

- TOPSIS:

-

Technique for order performance by similarity to ideal solution

- VIKOR:

-

VlseKriterijuska Optimizacija I Komoromisno Resenje

References

Ak, M. F., Yucesan, M., & Gul, M. (2022). Occupational health, safety and environmental risk assessment in textile production industry through a Bayesian BWM-VIKOR approach. Stochastic Environmental Research and Risk Assessment, 1–14.

Akhtar, M. H. (2018). Performance analysis of Takaful and conventional insurance companies in Saudi Arabia. Benchmarking: An International Journal, 25(2), 677–695. https://doi.org/10.1108/BIJ-01-2017-0018

Al-Amri, K., Gattoufi, S., & Al-Muharrami, S. (2012). Analyzing the technical efficiency of insurance companies in GCC. The Journal of Risk Finance, 13(4), 362–380. https://doi.org/10.1108/15265941211254471

Almulhim, T. (2019). Analysis of Takaful vs. Conventional insurance firms’ efficiency: Two-stage DEA of Saudi Arabia’s insurance market. Cogent Business & Management, 6(1), 1633807. https://doi.org/10.1080/23311975.2019.1633807

Asadi, L., & Moghri, A. (2016). Review and ranking the private insurance companies in Iran based on TOPSIS model. International Journal of Accounting and Economics Studies, 4, 120. https://doi.org/10.14419/ijaes.v4i2.6327

Atanassov, K. T. (1986). Intuitionistic fuzzy sets. Fuzzy Sets and Systems, 20(1), 87–96. https://doi.org/10.1016/S0165-0114(86)80034-3

Aytekin, A., & Karamaşa, Ç. (2017). Analyzing financial performance of insurance companies traded in BIST via Fuzzy Shannon’s entropy based fuzzy topsis methodology. Alphanumeric Journal, 5(1), 551–84.

Ayyildiz, E., Erdogan, M., & Taskin Gumus, A. (2021). A Pythagorean fuzzy number-based integration of AHP and WASPAS methods for refugee camp location selection problem: A real case study for Istanbul, Turkey. Neural Computing and Applications, 33(22), 15751–15768.

Ayyildiz, E., & Taskin Gumus, A. (2021). Pythagorean fuzzy AHP based risk assessment methodology for hazardous material transportation: An application in Istanbul. Environmental Science and Pollution Research, 28, 35798–35810. https://doi.org/10.1007/s11356-021-13223-y

Badi, I., & Ballem, M. (2018). Supplier selection using rough BWM-MAIRCA model: A case study in pharmaceutical supplying in Libya. Decision Making: Applications in Management and Engineering, 1(2), 2560–6018.

Bakır, M., Akan, Ş, Kiracı, K., Karabasevic, D., Stanujkic, D., & Popovic, G. (2020). Multiple-criteria approach of the operational performance evaluation in the airline industry: Evidence from the emerging markets. Romanian Journal of Economic Forecasting, 23(2), 149–172.

Barros, C. P., Barroso, N., & Borges, M. R. (2005). Evaluating the efficiency and productivity of insurance companies with a malmquist index: A case study for Portugal. The Geneva Papers on Risk and Insurance—Issues and Practice, 30(2), 244–267. https://doi.org/10.1057/palgrave.gpp.2510029

Başaran, Y., Aladağ, H., & Işık, Z. (2023). Pythagorean Fuzzy AHP based dynamic subcontractor management framework. Buildings, 13(5), 1351.

Benyoussef, S., & Hemrit, W. (2019). Measuring the relative efficiency of insurance companies in Saudi Arabia: The case study of Takaful vs. cooperative industries. Cogent Economics & Finance, 7(1), 1590818. https://doi.org/10.1080/23322039.2019.1590818

Biener, C., Eling, M., & Wirfs, J. H. (2016). The determinants of efficiency and productivity in the Swiss insurance industry. European Journal of Operational Research, 248(2), 703–714. https://doi.org/10.1016/j.ejor.2015.07.055

Bilbao-Terol, A., Arenas-Parra, M., Quiroga-García, R., & Bilbao-Terol, C. (2022). An extended best–worst multiple reference point method: Application in the assessment of non-life insurance companies. Operational Research, 22(5), 5323–5362.

Biswas, S., Bandyopadhyay, G., & Mukhopadhyaya, J. N. (2022). A multi-criteria based analytic framework for exploring the impact of Covid-19 on firm performance in emerging market. Decision Analytics Journal, 5, 100143.

Boral, S., Howard, I., Chaturvedi, S. K., McKee, K., & Naikan, V. N. A. (2020). An integrated approach for fuzzy failure modes and effects analysis using fuzzy AHP and fuzzy MAIRCA. Engineering Failure Analysis, 108, 104195. https://doi.org/10.1016/j.engfailanal.2019.104195

Božanić, D., Jurišić, D., & Erkić, D. (2020). LBWA–Z-MAIRCA model supporting decision making in the army. Operational Research in Engineering Sciences: Theory and Applications, 3(2), 87–110.

Božanić, D., Milić, A., Tešić, D., Salabun, W., & Pamučar, D. (2021). D numbers–FUCOM–fuzzy RAFSI model for selecting the group of construction machines for enabling mobility. Facta Universitatis, Series: Mechanical Engineering, 19(3), 447–471.

Buyukozkan, G., & Gocer, F. (2019). A novel approach integrating AHP and COPRAS under Pythagorean fuzzy sets for digital supply chain partner selection. IEEE Transactions on Engineering Management, 68(5), 1486–1503.

Büyüközkan, G., & Göçer, F. (2019). A novel approach integrating AHP and COPRAS under pythagorean fuzzy sets for digital supply chain partner selection. IEEE Transactions on Engineering Management. https://doi.org/10.1109/TEM.2019.2907673

Çalık, A. (2020). A novel Pythagorean fuzzy AHP and fuzzy TOPSIS methodology for green supplier selection in the Industry 40 era. Soft Computing. https://doi.org/10.1007/s00500-020-05294-9

Chatterjee, K., Pamučar, D., & Zavadskas, E. K. (2018). Evaluating the performance of suppliers based on using the R’AMATEL-MAIRCA method for green supply chain implementation in electronics industry. Journal of Cleaner Production, 184, 101–129. https://doi.org/10.1016/j.jclepro.2018.02.186

Chen, S. Y., & Lu, C. C. (2015). Assessing the competitiveness of insurance corporations using fuzzy correlation analysis and improved fuzzy modified TOPSIS. Expert Systems, 32(3), 392–404. https://doi.org/10.1111/exsy.12099

Ćurak, M., Lončar, S., & Poposki, K. (2009). Insurance Sector Development and Economic Growth in Transition Countries. International Research Journal of Finance and Economics, 34(3), 29–41.

Davutyan, N., & Klumpes, P. J. M. (2008). Consolidation and Efficiency in the Major European Insurance Markets: A Non Discretionary Inputs Approach.

de Borda, J. C. (1781). M’emoire sur les’ elections au scrutin. Histoire de l’Acad’emie Royale des Sciences.

Demir, E., Ak, M. F., & Sarı, K. (2022). Pythagorean Fuzzy based AHP-VIKOR integration to assess rail transportation systems in Turkey. International Journal of Fuzzy Systems. https://doi.org/10.1007/s40815-022-01404-x

Dwivedi, A., Kumar, A., & Goel, V. (2023). A consolidated decision-making framework for nano-additives selection in battery thermal management applications. Journal of Energy Storage, 59, 106565.

Ecer, F. (2021). A consolidated MCDM framework for performance assessment of battery electric vehicles based on ranking strategies. Renewable and Sustainable Energy Reviews, 143, 110916.

Ecer, F. (2022). An extended MAIRCA method using intuitionistic fuzzy sets for coronavirus vaccine selection in the age of COVID-19. Neural Computing and Applications, 34(7), 5603–5623.

Ecer, F., Küçükönder, H., Kaya, S. K., & Görçün, Ö. F. (2023). Sustainability performance analysis of micro-mobility solutions in urban transportation with a novel IVFNN-Delphi-LOPCOW-CoCoSo framework. Transportation Research Part A: Policy and Practice, 172, 103667.

Eling, M., & Jia, R. (2019). Efficiency and profitability in the global insurance industry. Pacific Basin Finance Journal, 57, 101190. https://doi.org/10.1016/j.pacfin.2019.101190

Eling, M., & Luhnen, M. (2010). Efficiency in the international insurance industry: A cross-country comparison. Journal of Banking & Finance, 34(7), 1497–1509. https://doi.org/10.1016/j.jbankfin.2009.08.026

Forouzandeh, F., Arman, H., Hadi-Vencheh, A., & Rahimi, A. M. (2022). A combination of DEA and AIMSUN to manage big data when evaluating the performance of bus lines. Information Sciences, 618, 72–86.

Garg, H. (2016). A novel correlation coefficients between Pythagorean fuzzy sets and its applications to decision-making processes. International Journal of Intelligent Systems, 31(12), 1234–1252.

Garg, H., & Chen, S.-M. (2020). Multiattribute group decision making based on neutrality aggregation operators of q-rung orthopair fuzzy sets. Information Sciences, 517, 427–447.

Gharizadeh Beiragh, R., Alizadeh, R., Shafiei Kaleibari, S., Cavallaro, F., Zolfani, S., Bausys, R., & Mardani, A. (2020). An integrated multi-criteria decision making model for sustainability performance assessment for insurance companies. Sustainability, 12(3), 789. https://doi.org/10.3390/su12030789

Gigović, L., Pamučar, D., Bajić, Z., & Milićević, M. (2016). The combination of expert judgment and GIS-MAIRCA analysis for the selection of sites for ammunition depots. Sustainability, 8(4), 372. https://doi.org/10.3390/su8040372

Görçün, Ö. F., Zolfani, S. H., & Çanakçıoğlu, M. (2022). Analysis of efficiency and performance of global retail supply chains using integrated fuzzy SWARA and fuzzy EATWOS methods. Operations Management Research, 15(3–4), 1445–1469.

Gul, M. (2018). Application of Pythagorean fuzzy AHP and VIKOR methods in occupational health and safety risk assessment: the case of a gun and rifle barrel external surface oxidation and colouring unit. International Journal of Occupational Safety and Ergonomics. https://doi.org/10.1080/10803548.2018.1492251

Gul, M., & Ak, M. F. (2018). A comparative outline for quantifying risk ratings in occupational health and safety risk assessment. Journal of Cleaner Production, 196, 653–664. https://doi.org/10.1016/J.JCLEPRO.2018.06.106

Gul, M., & Ak, M. F. (2020). Assessment of occupational risks from human health and environmental perspectives: A new integrated approach and its application using fuzzy BWM and fuzzy MAIRCA. Stochastic Environmental Research and Risk Assessment, 34(8), 1231–1262. https://doi.org/10.1007/s00477-020-01816-x

Gülin Feryal, C., & Muzaffer Bertan, K. (2019). Occupational health and safety performance evaluation of countries based on MAIRCA. International Journal of Intelligent Computing and Cybernetics, 13(1), 1–24. https://doi.org/10.1108/IJICC-07-2019-0077

Hong, H.-K., & Kim, J.-K. (2001). Evaluating efficiency of life insurance companies utilizing DEA and machine learning. Journal of Intelligence and Information Systems, 7(1), 63–79.

Hwang, C. L., & Yoon, K. (1981). Multiple attribute decision making: methods and applications. Springer-Verlag. https://books.google.com.tr/books?id=X-wYAQAAIAAJ

Ilbahar, E., Karaşan, A., Cebi, S., & Kahraman, C. (2018). A novel approach to risk assessment for occupational health and safety using Pythagorean fuzzy AHP & fuzzy inference system. Safety Science, 103, 124–136. https://doi.org/10.1016/J.SSCI.2017.10.025

Ilyas, A. M., & Rajasekaran, S. (2019). Productivity of the Indian non-life insurance sector: New evidence employing Färe-Primont index approach. International Journal of Productivity and Performance Management, 69(4), 633–650. https://doi.org/10.1108/IJPPM-04-2019-0147

Işık, Ö. (2022). AHP, CRITIC ve WEDBA Yöntemlerini İçeren Entegre Bir Çkkv Modeli İle Axa Sigorta Şirketinin Finansal Performansinin Analizi. Uluslararası İşletme, Ekonomi Ve Yönetim Perspektifleri Dergisi, 5(2), 892–908. In Turkish.

Johns, N., Howcroft, B., & Drake, L. (1997). The use of data envelopment analysis to monitor hotel productivity. Progress in Tourism and Hospitality Research, 3(2), 119–127.

Kaklauskas, A., & Zavadskas, E. K. (1996). Multicriteria Evaluation Of Building (Pastatų Sistemotechninis Įvertinimas). Vilnius: Technika.

Karasan, A., Ilbahar, E., Cebi, S., & Kahraman, C. (2018). A new risk assessment approach: Safety and critical effect analysis (SCEA) and its extension with Pythagorean fuzzy sets. Safety Science, 108, 173–187. https://doi.org/10.1016/J.SSCI.2018.04.031

Karasan, A., Ilbahar, E., & Kahraman, C. (2019). A novel pythagorean fuzzy AHP and its application to landfill site selection problem. Soft Computing, 23(21), 10953–10968. https://doi.org/10.1007/s00500-018-3649-0

Kaya, S. K. (2020). Evaluation of the effect of COVID-19 on countries’ sustainable development level: A comparative MCDM framework. Operational Research in Engineering Sciences: Theory and Applications, 3(3), 101–122.

Khan, A., & Noreen, U. (2014). Efficiency measure of insurance v/s Takaful firms using DEA approach: A case of Pakistan. Islamic Economic Studies, 22(1), 139–158. https://doi.org/10.12816/0004133

Ksenija, M., Boris, D., Snežana, K., & Sladjana, B. (2017). Analysis of the efficiency of insurance companies in Serbia using the fuzzy AHP and TOPSIS methods. Economic Research-Ekonomska Istraživanja, 30(1), 550–565. https://doi.org/10.1080/1331677X.2017.1305786

Kutlu Gündoğdu, F., & Kahraman, C. (2020). A novel spherical fuzzy analytic hierarchy process and its renewable energy application. Soft Computing, 24, 4607–4621.

Lahane, S., & Kant, R. (2023). Investigating the circular supply chain implementation challenges using Pythagorean Fuzzy AHP approach. Materials Today: Proceedings, 72, 1158–1163. https://doi.org/10.1016/J.MATPR.2022.09.189

Lin, M., Chen, Y., & Chen, R. (2021). Bibliometric analysis on Pythagorean fuzzy sets during 2013–2020. International Journal of Intelligent Computing and Cybernetics, 14(2), 104–121.

Magee, S., Schilling, C., & Sheedy, E. (2019). Risk governance in the insurance sector—determinants and consequences in an international sample. Journal of Risk and Insurance, 86(2), 381–413. https://doi.org/10.1111/jori.12218

Mete, S. (2019). Assessing occupational risks in pipeline construction using FMEA-based AHP-MOORA integrated approach under Pythagorean fuzzy environment. Human and Ecological Risk Assessment: An International Journal, 25(7), 1645–1660. https://doi.org/10.1080/10807039.2018.1546115

Mufazzal, S., & Muzakkir, S. M. (2018). A new multi-criterion decision making (MCDM) method based on proximity indexed value for minimizing rank reversals. Computers & Industrial Engineering, 119, 427–438. https://doi.org/10.1016/j.cie.2018.03.045

Narayanamoorthy, S., Brainy, J. V., Shalwala, R. A., Alsenani, T. R., Ahmadian, A., & Kang, D. (2023). An enhanced fuzzy decision making approach for the assessment of sustainable energy storage systems. Sustainable Energy, Grids and Networks, 33, 100962.

Nedeljković, M., Puška, A., Doljanica, S., Virijević Jovanović, S., Brzaković, P., Stević, Ž, & Marinkovic, D. (2021). Evaluation of rapeseed varieties using novel integrated fuzzy PIPRECIA–Fuzzy MABAC model. PLoS ONE, 16(2), e0246857.

Nguyen, T. M. H., Nguyen, V. P., & Nguyen, D. T. (2022). A new hybrid Pythagorean fuzzy AHP and COCOSO MCDM based approach by adopting artificial intelligence technologies. Journal of Experimental & Theoretical Artificial Intelligence. https://doi.org/10.1080/0952813X.2022.2143908

Oscar Akotey, J., Sackey, F. G., Amoah, L., & Frimpong Manso, R. (2013). The financial performance of life insurance companies in Ghana. The Journal of Risk Finance, 14(3), 286–302. https://doi.org/10.1108/JRF-11-2012-0081

Ozdemir, Y., & Gul, M. (2019). Measuring development levels of NUTS-2 regions in Turkey based on capabilities approach and multi-criteria decision-making. Computers & Industrial Engineering, 128, 150–169. https://doi.org/10.1016/J.CIE.2018.12.035

Öztayşi, B., Çevik, S., & Kahraman, C. (2019). Social open innovation platform design for science teaching by using Pythagorean fuzzy analytic hierarchy process. Journal of Intelligent & Fuzzy Systems, 38, 1–11. https://doi.org/10.3233/JIFS-179450

Pamučar, D., Vasin, L., & Lukovac, V. (2014). Selection of railway level crossings for investing in security equipment using hybrid DEMATEL-MARIC model. In XVI International Scientific-expert Conference on Railways, Railcon, Niš (pp. 89–92). https://doi.org/10.13140/2.1.2707.6807.

Pamučar, D., Lukovac, V., Božanić, D., & Komazec, N. (2019). Multi-criteria FUCOM-MAIRCA model for the evaluation of level crossings: case study in the Republic of Serbia. Operational Research in Engineering Sciences: Theory and Applications, 1(1), 108–129. https://doi.org/10.31181/oresta190120101108p