Abstract

Financial institutions use credit rating models to make lending, investing, and risk management decisions. Credit rating models have been developed using a variety of statistical and machine learning methods. These methods, however, are data-intensive and dependent on assumptions about data distribution. This research offers an integrated fuzzy credit rating model to address such issues. This study proposes an integrated fuzzy credit rating model to reduce such problems. The study applies the fuzzy best–worst method (fuzzy-BWM) to obtain the weight of criteria that affect creditworthiness and fuzzy technique for order of preference by similarity to ideal solution (fuzzy-TOPSIS)-Sort-C to evaluate the borrowers. The BWM was found consistent amongst existing multi-criteria decision-making (MCDM) methods, and consistency further improves when BWM is extended to a fuzzy version. The study applies TOPSIS-Sorting along with fuzzy theory to overcome human uncertainty while making a decision. TOPSIS-sorting has been found capable of handling rank reversal problems that persist in the TOPSIS method. The fuzzy-TOPSIS-Sort-C method is applied to evaluate borrowers based on the characteristic profile of the identified criteria. The proposed model's efficacy has been illustrated with a case study to rate fifty firms with real-life data. The proposed model results are compared with previous studies and commercially available ratings. The model results show better accuracy in terms of accuracy and true-positive rates to predict default. It can help financial institutions to find potential borrowers for granting credit.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Credit risk evaluation is a fundamental responsibility of financial institutions before granting credit. First and foremost, it aids in determining a borrower's ability to repay an advance on time [1]. It not only aids in the identification of prospective borrowers but also serves as a risk management tool. Lenders use credit ratings to assess risk, the capacity of borrowers to repay loans, and determine loan pricing [2]. However, assessing credit rating is a complex task that involves identifying various risks which can instigate a repayment default [3]. The whole process requires rigorous scrutiny, and the consequence of a small error is significant. The financial institutions often choose to play on a safer side and deny credits to risky firms to avoid any pitfall [3]. A credit rating model provides a structured framework to appraise and approve loans [4]. A well-assessed process guides the lender to check the repayment capacity and identify potential borrowers [5]. Hence, a slight improvement in the process can bring significant profits to financial institutions. Over the period, financial institutions have dedicated many efforts to quantify and mitigate these risks.

With the recommendations of BCBS,Footnote 1 the financial institutions have established many credit risk assessment models [6]. The credit assessment methodology includes statistical, artificial intelligence, and hybrid multi-criteria approaches [7]. The statistical methods, such as regression analysis [8] and discriminate analysis [9], use stochastic probability approaches to estimate the default and found efficient. Researchers [10] have used statistical methods in forecasting bankruptcy. However, statistical techniques have been criticised for violating assumptions such as linearity and multiple interactions [2]. The main limitation of such techniques is difficulties in modelling the multifaceted financial information [2, 11]. In many cases, applying such a technique makes the process unsound [12].

Recently, various artificial intelligence (AI) techniques, such as neural network (NN), support vector machine (SVM), decision tree, and Bayesian hyper-parameter optimisation, have received significant attention from academia and industry. The AI-based methods have shown better accuracy compared to statistical techniques [7, 13]. However, its complex algorithms do not take into account the multicollinearity indicator [7]. Although the sophisticated AI methods have received considerable performance efficiency, understanding of its results is minimal. The main limitation of the machine learning technique is the complicated configuration and simulations. Apart from the above, both statistical and machine learning approaches require a more extensive data set consisting of a significant number of default data, time-consuming, costly, and relatively scarce [14]. The more comprehensive data set causes the time intricacy for computation and affects the applicants' final credit rating [7]. Furthermore, where a firm is not competent in preserving finances, it becomes more difficult to apply statistical and machine learnings to predict the default [15]. To overcome such situations, financial institutions often rely on non-financial information [16]. Lenders take into consideration the track record, management, and size of firms into consideration [17].

The problem can be handled using multi-criteria decision-making (MCDM) techniques. Many choice issues, such as selection, ranking, and sorting alternatives, have been solved using MCDMs [18]. The transparency and flexibility to handle qualitative and fuzzy inputs make MCDM an excellent choice in credit risk assessment. It can assess economic and financial information without assumptions in statistical and machine learning techniques [14, 19]. MCDM techniques add precision to the decision-making process by engaging experts throughout the model build-up and execution [20]. MCDM model does not necessarily require segregating the data into two groups (default and not default), but can continuously estimate the extent of solvency [11].

This study presents a credit rating model using newly developed MCDM techniques, fuzzy-BWM, and proposed fuzzy-TOPSIS-Sort-C. The proposed model incorporates important non-financial factors besides financial information to decide the credit ratings. To the best of the author's knowledge, very few studies have been reported addressing these two factors. The current research aims to answer the following research questions.

-

What are the various financial and non-financial factors that affect the creditworthiness of borrowers?

-

How to assign weight to these factors in a consistent manner?

-

How to classify the borrowers based on their relative creditworthiness?

-

What are the advantages of the proposed method over existing methods?

In the study, fuzzy-BWM is applied to evaluate the weight of the criteria, and fuzzy-TOPSIS-Sort-C is used to sort borrowers into classes. The study combines fuzzy sets theory with MCDM techniques to address human judgment uncertainty [21,22,23]. The main reason for applying BWM is its better consistency than other existing MCDM techniques [24]. Guo and Zhao [25] mentioned that the consistency of comparisons further improves when BWM is combined with fuzzy-set theory [25]. Whereas the TOPSIS-Sort-C fulfils the main objective of credit rating in finance to sort applicants into classes, the traditional TOPSIS applies in the ranking. With TOPSIS-Sort-C, a decision-maker can make profiles to define performance expectations into predefined classes and help solve the sorting problem [26, 27].

This study is a pioneer in extending the BWM for credit scoring along with fuzzy-set theory. It requires less time and data than existing MCDMs. Furthermore, this study extends the previous TOPSIS sort method to fuzzy-TOPSIS sort discussed in this study's methodology section. Second, this study makes a significant effort to improve the credit rating system by incorporating sufficient non-financial information along with financial data. The study considers all the relevant managerial, industrial, and ethical aspects. Third, the proposed method handles the uncertainty of experts' opinions with fuzzy-set theory. The proposed model can conquer the limitations of existing processes and help decision-makers in financial institutions reach an improved decision while granting credit.

The rest of the paper is arranged as follows. The next section deals with the related literature and research gap. The next section describes the methodology using BWM, TOPSIS-Sort-C, along with fuzzy-set theory. The model is demonstrated through a real-life case study in the following section. The next section presents the comparative results of the proposed method with previous studies based on BWM and commercial ratings. Finally, the last section presents conclusions and future research direction.

Literature review

This section presents the literature review on credit rating in three parts. The first part presents credit rating and its evaluation. The second part discusses the importance of non-financial criteria affecting creditworthiness, and the third part presents the applications of MCDA in credit rating.

Credit rating and its evaluation

Financial institutions need to apply a proper credit rating model to identify potential borrowers for granting credits. It helps to make faster credit decisions, collateral, and capital requirement [28]. It also facilitates deciding the pricing of loans as incorrect pricing might cause significant loss to the business [29]. Thus, financial institutions determine whether or not to grant credit based on an accurate credit risk assessment. Relying only on external credit assessments caused serious imprecations to the financial system witnessed during the 2008 financial crisis. Therefore, utilising an internal rating system with an improved credit risk assessment model can help financial institutions make more appropriate decisions and reduce the financial loss associated with loans. Basel II guidelines provide a standard framework for assessing credit risk associated with lending and measuring capital adequacy [30]. It suggests different approaches to measure credit risks and capital requirements; the standardised approach (TSA) and the internal rating-based (IRB) approaches. Under TSA, financial institutions can take the help of external credit ratings to measure the credit risks. In IRB approaches, financial institutions may deploy their internal rating model to assess credit risk [31]. As a result, financial institutions started applying internal credit scoring as a capable tool to assess credit risk and select potential borrowers. Implementation of the IRB approach allowed financial institutions to assess credit risk more precisely than TSA [32, 33].

Credit risk assessment is a complex task that is exemplified with requirements, extensive data set, and lesser known relationships amongst criteria that affect credit standing [7]. The engagement of various techniques has resulted in remarkable improvements in the credit scoring process in recent years [34]. The credit assessment methodologies include statistical, machine learning, and MCDM techniques. Statistical techniques mainly apply discriminant, regression, and probit analysis need large volumes and data varieties to predict default probability [35]. Missing and redundant information makes the dynamic decision system uncertain to predict default correctly. Machine learning techniques also use the classification and clustering techniques [36,37,38], which depend on the problems and data structure's details and are yet to be tested in all aspects [11]. Furthermore, it is not easy to understand the importance of the machine learning model's criteria. Such limitations have received criticism about machine learning [39]. These techniques suffer violations of assumptions such as the normality of distribution for independent variables and data structure [11]. Although researchers have frequently applied statistical and machine learning techniques, it does not ensure the right decision with limited and redundant financial information [11]. As per the Basel II guidelines, the credit assessment should combine qualitative and quantitative approaches [20]. An MCDM-based system can be considered adequate to combine qualitative methods by taking expert opinions to determine the weights of criteria, with quantifiable information, to determine credit score [14].

Non-financial factors to the creditworthiness

The possibility of getting finance from a financial institution depends on financials and various non-financial information. In the process, financial institutions analyse the length of the relationship and the firm's age. It also helps to decide the collateral requirements, if any [40]. Regarding relationship lending, Bhimani et al. [41] observed an interesting behavioural change of firms to default in loans after the lapse of an initial 2–3 years. The size and geographic presence also impact the vulnerability to repay the loans [42]. Angilella and Mazzù [16] pointed out the credit assessment process's quality of management, market, and social position. The repayment performance often depends on industry performance, as different industries have different levels of competition and profitability [43]. Castrén et al. [44] observed that firms' default rates also change with changes in macroeconomic scenarios, like the gross domestic product, interest, and exchange rate. In the process, trust plays a significant role in reducing agency costs to obtain a loan [45]. Yurdakul and Iç [46] reported that due to the instability of the economic-financial condition, it is tough to rely on a credit rating model based on financial ratios only [47]. They developed an AHP-based credit evaluation method combining non-financial with financial information to judge firms' creditworthiness. Tang et al. [48] observed that the default behaviour could prompt others to default intention on account of defective disciplinary procedures in the system.

Application of MCDM techniques in credit rating models

MCDM techniques to credit risk assessments have been used as a predictive and constructive framework [49] and outranking technique [20] to the decision-making process. These techniques have received significant credit rating attention due to their ease of use and operational flexibility [50]. The great thing about MCDM is its transparency and flexibility, which make it appropriate. Moreover, MCDM techniques do not suffer problems of violating assumptions or requiring a large set of default data. With the help of expert collaboration, MCDM techniques can also handle the financial and non-financial aspects imperative for credit rating. Researchers have applied various MCDM-based techniques to help the credit decision process. For example, Babic and Plazibat [51] applied the combined preference ranking organisation method for enrichment of evaluations (PROMETHEE) and analytic hierarchy process (AHP) to rank firms based on financial parameters. Iç and Yurdakul [52] applied AHP in the fuzzy environment to measure the creditworthiness of SMEs. Chi and Zhang [53] proposed an entropy-based method to assess the creditworthiness of firms. Gastelum Chavira et al. [5] proposed a credit ranking model based on ELimination Et Choix Traduisant la REalité –III (ELECTRE-III). The author argued that the MCDM model provides a relative ranking of borrowers instead of two categories in discriminant analysis or logistic regression. Mousavi and Lin [54] applied PROMETHE-II to find out the best corporate credit distress prediction in a recent study. The study pointed out that an MCDM framework is more practical and proper than any single criteria-based evaluation framework. Roy and Shaw [55] applied AHP-TOPSIS to develop a low-cost SME’s credit scoring model. The study found that the model can commensurate the external rating model to score SMEs and replace external credit rating by financial institutions. Syau et al. [56] pointed out the importance of non-financial factors, which are more challenging to capture in the credit rating process due to their subjective nature. Therefore, decision-makers often applied fuzzy-set theory and MCDMs to deal with human judgment uncertainty [57, 58].

Sorting methods have recently gained much interest for ranking the alternatives. Doumpos and Figueira [20], for example, proposed a credit rating model based on the ELECTRE Tri-NC sorting technique, which aids in the establishment of specified performance categories. In a similar vein, de Lima Silva et al. [26] used TOPSIS-Sort to rank Brazilian debentures according to ten financial parameters. Compared to conventional ranking or scoring systems, sorting approaches provide decision-makers with more leeway. With recent advances in TOPSIS-sorting for decision-making in multi-criteria classification issues in mind, this research employs TOPSIS-Sort-C for judgemental credit risk assessment. The fuzzy-TOPSIS-Sort-C method is proposed in this research for classifying borrowers into specified risk groups. The research methodology is discussed in depth in the next section.

Methodology

The present study proposes a three-phase methodology to classify borrowers into different risk classes. To accomplish the objective, first, the criteria that affect the creditworthiness of borrowers are identified through literature review and expert opinions. In the study, 12 respondents were selected from financial institutions and industries. Out of the 12 experts, seven were from banks with vast experience in lending. Furthermore, five experts from the industries were experienced obtaining credit from financial institutions. The reasons for taking a panel of experts were to reach a better decision than a single expert [59]. In this study, initially varying responses were received from experts while comparing the criteria. However, after a detailed discussion, a consensus was reached.

In the second phase, the criteria weights are determined using the fuzzy-BWM. This study employs Guo and Zhao's [25] suggestion of fuzzy-BWM, which uses fuzzy triangular numbers to determine the weight of factors that impact borrowers' creditworthiness. The study employs fuzzy-BWM to overcome the disadvantage of crisp values while making decisions.

After determining the weight of criteria, in the final stage, the borrowers have been evaluated using the proposed fuzzy-TOPSIS-Sort-C. With an objective to classify applicants into different risk profiles, credit rating is considered sorting against a set of criteria. MCDM technique, especially TOPSIS-Sorting, is appropriate to overcome such complex problems due to their flexibility [60]. To sort the borrowers into classes, de Lima Silva and de Almeida Filho [27] proposed TOPSIS-Sort-C. Recently, de Lima Silva et al. [26] applied the TOPSIS-Sort to classify the Brazilian debentures. The study found that sorting techniques can handle the rank reversal problems of original TOPSIS when an alternative is included or excluded. However, the existing TOPSIS-Sort was based on a threshold value and could not handle human uncertainty.

Given these recent developments and handling human uncertainty while deciding, this study proposes TOPSIS-Sort-C to classify alternatives in a fuzzy environment by extending into the fuzzy-TOPSIS-Sort-C. The applicability of the suggested model is illustrated by a case study taking a large sample. The pictorial view of the methodology flowchart is shown in Fig. 1.

Preliminary

This section provides a short overview of the current methods used in the research. The section explains briefly the fuzzy-set theory, BWM, the fuzzy-BWM, the TOPSIS, and the suggested fuzzy-TOPSIS-Sorting used in this research.

Fuzzy set theory

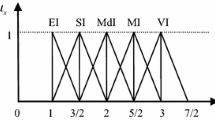

The fuzzy-set theory defines classes and groups of data with non-sharply defined boundaries, i.e., fuzzy. In 1965, Zadeh proposed the fuzzy-set theory and successfully applied it to uncertain situations [61]. The authors proposed several membership functions, including Flat, Triangular, and Trapezoidal. However, fuzzy triangular numbers (TFN) have been widely used. TFNs are used in this study to describe the relative importance of two linguistic variables (shown in Fig. 2) [62]. A TFN can be represented by three parameters \((l,m,n)\) left, middle, and right.

Hence, a TFN can be expressed as \(\mu \tilde{A}(x) = \tilde{A}(a,b,c)\) where the parameters “a” and “c” represent the lower and upper bounds of membership function \(\tilde{A}(x)\), i.e., \(\tilde{A}(c) = 1\). A narrower interval portrays the lower fuzziness of the data. The membership function \(\mu \tilde{A}(x)\) is defined as follows:

The linguistic variable absolutely important (AI) can be represented by (7/2, 4, 9/2), whereas equally significant (ES) can be defined by (1, 1, 1). Table 1 represents the TFN scale of the linguistic variables. The basic algebraic operational laws of two fuzzy numbers \(M_{1} = (a_{1} ,b_{1} ,c_{1} )\) and \(M_{2} = (a_{2} ,b_{2} ,c_{2} )\) can be traced in Chang [63]. Furthermore, the fuzzy number \(\tilde{k}_{i} = (a_{i} ,b_{i} ,c_{i} )\) can be converted into a crisp value \(R(\tilde{k})\) by applying the following graded mean integration representation (GMIR) formula:

BWM

BWM is a relatively new MCDM method developed by Rezaei in 2015 [24]. It outperforms current methods owing to its flexibility and fewer inputs to make a quick conclusion. BWM produces more consistent and reliable results than AHP and may be readily integrated with other MCDM methods. BWM has been applied to solve various MCDM problems such as selection of supplier, m-banking [64, 65] and credit scoring [66, 67]. In the BWM process, the experts are asked to identify the best (most important) and the worst (least important) criteria. Further experts to carry out pairwise comparisons amongst the criteria using a number between 1 and 9. From the pairwise comparisons, the optimal weight of the criteria is calculated by solving linear programming [24].

However, decision-makers face difficulties while making judgments using absolute crisp numbers in real-life problems due to the lack of information and the associated uncertainty [68]. Therefore, generally, a decision-maker prefers to use interval judgment to compare subjective elements [56]. The authors applied the fuzzy-BWM in real-life case studies to remove the uncertainty and found the fuzzy-BWM as more consistent than the existing BWM. Looking at the subjective character of non-financial information in credit rating, this research employs Guo and Zhao's [25] proposed fuzzy-BWM with triangular fuzzy numbers to calculate the weight of criteria.

Fuzzy-BMW

To obtain the weight of criteria using fuzzy-BWM, the experts' panel performed the pairwise comparison using linguistic terms given in Table 1. The consensus of decisions is converted into fuzzy numbers [25]. The steps of Guo and Zhao’s proposed fuzzy-BWM are presented as follows.

-

(a)

The experts are asked to identify the best \(C_{B}\) (most important) and worst \(C_{W}\) (least important) criteria determined from each set of criteria and sub-criteria.

-

(b)

The experts are then asked to perform the best criterion's fuzzy preference rating over other criteria. The resultant best-to-others weights vector is expressed as

$$\tilde{A}_{{_{B} }} = (\tilde{a}_{B1} ,\tilde{a}_{B2} , \ldots ,\tilde{a}_{Bn} ).$$(3)

Here, the fuzzy preference of the best criterion “\(B\)” over criterion “\(j\)” is represented by \(\tilde{a}_{Bj}\) indicating the importance best criterion over other criteria \(j = 1,2, \ldots ,n\). Therefore, it is observed that

-

iii.

Similarly, the fuzzy preference of all other criteria “\(j\)” over Worst “\(W\)” criterion represented by \(\tilde{a}_{iW}\) is expressed as

$$\tilde{A}_{w} = (\tilde{a}_{1W} ,\tilde{a}_{2W} , \ldots ,\tilde{a}_{nW} ),$$(5)

where \(a_{jW}\) indicates the importance of criterion “\(j\)” over the worst criterion “W”. Therefore, it is observed that

-

iv.

The optimum weights (\(\tilde{w}_{1}^{*} ,\tilde{w}_{2}^{*} ,\tilde{w}_{3}^{*} , \ldots ,\tilde{w}_{n}^{*}\)) of the criteria are obtained by minimising the absolute differences, i.e., \(\left| {\frac{{\tilde{w}_{B} }}{{\tilde{w}_{j} }} - \tilde{a}_{Bj} } \right|\) and \(\left| {\frac{{\tilde{w}_{j} }}{{\tilde{w}_{w} }} - \tilde{a}_{jw} } \right|\) for all j. The weights are obtained by solving the following mini-max model:

$$\min \, \max_{j} \left\{ {\left| {\frac{{\tilde{w}_{B} }}{{\tilde{w}_{j} }} - \tilde{a}_{Bj} } \right|,\left| {\frac{{\tilde{w}_{j} }}{{\tilde{w}_{w} }} - \tilde{a}_{jw} } \right|} \right\}$$(7)$${\text{s.t.}}\; \left\{ \begin{gathered} \sum\limits_{j} {R(\tilde{w}_{j} )} = 1, \hfill \\ l_{j}^{w} \le m_{j}^{w} \le u_{j}^{w} , \hfill \\ l_{j}^{w} \ge 0 \hfill \\ j - 1,2,, \ldots ,n \hfill \\ \end{gathered} \right.$$where, \(\tilde{w}_{B} = (l_{B}^{w} ,m_{B}^{w} ,u_{B}^{w} ),\)\(\tilde{w}_{j} = (l_{j}^{w} ,m_{j}^{w} ,u_{j}^{w} )\)\(\tilde{w}_{w} = (l_{w}^{w} ,m_{w}^{w} ,u_{w}^{w} )\)\(\tilde{a}_{Bj} = (l_{Bj}^{{}} ,m_{Bj}^{{}} ,u_{Bj}^{{}} ),\)\(\tilde{a}_{jW} = (l_{jW}^{{}} ,m_{jW}^{{}} ,u_{jW}^{{}} ).\)

Fuzzy-BWM can be represented as follows [24, 25]:

\({\text{where }}\upxi = (l^{\upxi } ,m^{\upxi } ,u^{\upxi } ).\)

-

e.

Considering \(l^{\upxi } \le m^{\upxi } \le u^{\upxi } , \,\) \(\tilde{\xi }^{*} = (k^{*} ,k^{*} ,k^{*} ),k^{*} \le l^{\xi }\) the above equation can be transformed as below

$$s.t \, \left\{ \begin{gathered} \left| {\frac{{l_{B}^{w} ,m_{B}^{w} ,u_{B}^{w} }}{{l_{j}^{w} ,m_{j}^{w} ,u_{j}^{w} }}} \right. - (l_{Bj}^{{}} ,m_{Bj}^{{}} ,\left. {u_{Bj}^{{}} )} \right| \le (k^{*} ,k^{*} ,k^{*} ) \hfill \\ \left| {\frac{{l_{j}^{w} ,m_{j}^{w} ,u_{j}^{w} }}{{l_{W}^{w} ,m_{W}^{w} ,u_{W}^{w} }}} \right. - (l_{jW}^{{}} ,m_{jW}^{{}} ,\left. {u_{jW}^{{}} )} \right| \le (k^{*} ,k^{*} ,k^{*} ) \hfill \\ \sum\limits_{J = 1}^{N} {R(\mathop {W_{J} }\limits^{\sim } } ) = 1 \hfill \\ l_{j}^{w} \le m_{j}^{w} \le u_{j}^{w} \hfill \\ l_{j}^{w} \ge 0 \hfill \\ j = 1,2,....,n \hfill \\ \end{gathered} \right.$$(9)

\(\tilde{\xi }*\) denotes the consistency of decision-making.

Finally, the optimal weights \(\left( {\tilde{w}_{1}^{*} } \right.,\tilde{w}_{2}^{*} ,\tilde{w}_{3}^{*} ,........\left. {\tilde{w}_{n}^{*} } \right)\) and consistency \(\tilde{\xi }*\) of the pairwise comparison are obtained by solving the above model. Consistency Index (CI), i.e., maximum possible values \(\upxi\), can be obtained from Guo and Zhao [25]. The authors provided a different consistency index for fuzzy-BWM (shown in Table 2). A low consistency ratio signifies the accuracy of the comparison. The evaluation's consistency ratio (CR) can be obtained as follows:

Proposed fuzzy-TOPSIS-Sort-C method

The TOPSIS-Sort-C technique is a novel way to alternative sorting. Hwang and Yoon proposed the original TOPSIS in 1981 [69]. Because of its simplicity in solving decision-making issues, the technique has piqued the attention of academics. TOPSIS, on the other hand, has proven unable to resolve rank reversal issues and sorting inconsistencies when an alternative is added or deleted [70]. Sabokbar et al. [73] modified TOPSIS to TOPSIS-Sort to address ranking reversal and sort alternatives into classes.

Furthermore, de Lima Silva and de Almeida Filho [27] presented improved versions named TOPSIS-Sort-B and TOPSIS-Sort-C to classify alternatives based on the boundary and characteristic profiles. The researchers pointed out that for a problem like classifying borrowers into risky or safe categories based on the characteristics of the defined classes, TOPSIS-Sort-C should be applied rather than boundary profiles where limits are determined between two classes. However, academicians [71] have criticised TOPSIS for its inability to handle ambiguous circumstances involving expert judgment, since it utilises crisp values. When experts are unable to explain their choice with a single value, they prefer to utilise linguistics values interval judgment to describe such a situation.

This study amalgamates fuzzy logic with TOPSIS-Sort-C introduced by de Lima Silva and de Almeida Filho [27] to rate borrowers using the linguistic scale to remove human decision-making ambiguity. The steps of the proposed fuzzy-TOPSIS-Sort-C are discussed below.

Step 1: When a set of alternatives \(A_{j} (i = 1, \, 2, \ldots ,m)\) is rated against criteria \(C_{j} (j = 1, \, 2, \ldots ,n)\), a fuzzy-decision matrix is formed

Step 2: Set the characteristic profile \(P = \left\{ {P_{1} , \ldots ,P_{q} } \right\}\) where \(p = q\) profiles for every criterion \(j\), and each characteristic profile \(\tilde{P}_{k}\) represents the class \(C_{k}\) defined by fuzzy linguistic terms as per Fig. 3. Where the value \(\tilde{P}_{k,j}\) represents the typical evaluation of an alternative for a class \(C_{k}\) for criterion \(j\). Furthermore for any pair of consecutive profiles, the profile \(\tilde{P}_{k}\) dominates the profile

Step 3: Define each criterion’s domain that can be reached by an alternative using linguistic terms to represent the fuzzy positive ideal solution (FPIS) and fuzzy negative ideal solution (FNIS). The domain FPIS and FNIS can be represented by the following matrix [27]:

where \(\tilde{a}_{n}^{*}\) and \(\tilde{a}_{n}^{ - }\) are fuzzy domain solutions for criteria.

Step 4: Form a complete fuzzy-decision matrix incorporating each criterion's characteristic profile and domain set [27]

Step 5: The fuzzy-TOPSIS-Sort-C was utilised to evaluate the alternatives concerning criteria using linguistic variables \(\left\{ {\tilde{X}_{ij} , \, i = 1, \, 2, \ldots ,m, \, j = 1, \, 2, \ldots ,} \right.\left. {\mathop n\limits^{{}} } \right\}\). A triangular fuzzy number (TFN) represented by [0, 1] need not require further normalisation.

Step 6: The normalised decision matrix is multiplied with criteria weights \(w_{i}\) to determine the weighted normalised fuzzy-decision matrix

Step 7: From \(\tilde{V}\), the FPIS \(\left( {A^{*} } \right)\) and FNIS \(\left( {A^{ - } } \right)\) are determined as follows:

Here, \(J\) and \(J^{^{\prime}}\) represent positive and negative attributes, respectively.

Step 8: Calculate the Euclidian distances of the alternatives \(S_{ai}^{*}\) and profiles \(S_{pk}^{*}\) from the FPIS and FNIS as follows:

Step 9: Calculate the closeness index of alternatives \(C_{ai}^{*}\) and profiles \(C_{pk}^{*}\) relative to the ideal solution as below

Step 10: Finally, the alternatives are classified based on their closeness indexes \(C_{ai}^{*}\) by comparing closeness indexes of profiles \(C_{pi}^{*}\)

Rating using the proposed fuzzy-TOPSIS-Sort-C

The suggested fuzzy-TOPSIS-Sort-C is used to evaluate the borrowers after determining the criterion's weight using the fuzzy-BWM. In the study, borrowers are rated by classifying them according to the characteristic profile depicted in Fig. 3 [27]. Seven distinctive profiles (\(C_{k}\)) are created utilising the fuzzy linguistic scale in the order VG > MLG > G > M > MLP > P > VP. The application borrowers' eventual rating is determined using the specified rating classes. The alternatives are assessed according to their Closeness Index (CI) in comparison to fuzzy-TOPSIS-Sort-C profiles.

The FPIS and FNIS can be defined by the decision-maker using linguistic variables “VG” and “VP", as mentioned in Table 3. The linguistic variables are kept in the range of 0 to 1 to remove the need for further normalisation. In the case of positive attributes, values in descending order are represented from "VG" to "VP" by linguistic scale, while negative attributes are in the opposite direction. The CI is denoted by its Euclidean distance from FPIS and farthest from FNIS. An alternative with a higher CI or near the FPIS may be regarded as excellent.

Case study

Following the implementation of the BASEL-II framework in 2006, financial institutions are no longer restricted to relying on external credit rating models due to lack of dependability, instead opting for the internal rating model [32]. As a result, the suggested model may be used as an internal credit rating model to evaluate potential borrowers' credit ratings. The proposed approach is both affordable and adaptable. This method may readily integrate the decision-expertise. This research aims to classify applicants to identify prospective borrowers for financing. The efficacy of the suggested approach is shown with a case study by evaluating 51 enterprises. The sample included 43 non-defaulted (ND) and eight defaulted (DT) firms. Financial and non-financial data were gathered from Capitaline, an Indian database. Although the case study is an example, it focuses on two key points. First, it completes the necessary criteria, including financial and non-financial data and the weighting procedure. Second, the research provides a rating profile that rates and categorises the options using fuzzy linguistic scales.

Phase I: identification of criteria that affect the credit rating of borrowers

When dealing with the MCDM issue, it is necessary to identify the criteria that affect borrowers' credit ratings. A comprehensive set of criteria and sub-criteria was initially identified through a comprehensive literature study. Finally, 15 non-financial criteria, in addition to 15 financial criteria, are divided into two major groups based on the views of the previously chosen panel of experts. Financial parameters are further subdivided into five main ratio categories: leverage, coverage, liquidity, efficiency, and profitability. Non-financial factors are further subdivided into three categories: business, management, and account behaviour. To the best of the author's knowledge, only a few research have considered such a broad range of factors. Finally, a decision hierarchy is constructed based on the criteria, objectives, and alternatives to be evaluated. The sub-criteria are put underneath the primary criterion to evaluate the alternatives while maintaining the objective at the forefront. Figure 4 depicts the suggested model's hierarchical structure.

Phase II: calculation of criteria weight using the fuzzy best–worst method

After identifying the criteria, it is imperative to evaluate the weights of the criteria to evaluate borrowers. In this particular study, the weights of criteria are calculated using fuzzy-BWM [25]. The optimum weight of criteria is obtained by pairwise comparison, as the decision-makers may not be precise in every judgment. The detailed procedure to calculate the weight of the criteria and sub-criteria using fuzzy-BWM is demonstrated below.

In the first step, the bank experts were requested to choose the best (most important) and the worst (least important) criteria from each set of main criteria and sub-criteria. The experts were then further asked to carry out pairwise comparisons using fuzzy linguistic values from the fuzzy best-to-others, and fuzzy others-to-worst vector for FBWM are shown in Tables 4 and 5.

After obtaining the fuzzy best-to-others and others-to-worst vectors for the main criteria, the non-linear constrained optimisation model is built as mentioned below, using Eq. 9, as suggested by Guo and Zhao [25]. Finally, the optimal fuzzy weights \((l^{\upxi } ,m^{\upxi } ,u^{\upxi } )\) of the main criteria are obtained by solving the optimisation model at equation no 26 in Lingo 12.0 solver and their crisp weights based on GMIR of fuzzy weight as per Eq. 2. The fuzzy weights, crisp weights, consistency index \(\tilde{\xi }* = (k^{*} ,k^{*} ,k^{*} )\), and consistency ratio are shown in Table 6.

The consistency ratio was obtained at 0.098, which is close to zero, and pairwise comparisons are considered consistent as per the fuzzy-BWM norms [25]. After getting the different main criteria' weights, a similar fuzzy linguistic pairwise comparison of every sub-criterion is calculated using Eq. 9. The final local and global weights of each criterion and sub-criterion are listed in Table 7. These weights are used to get the importance of each criterion and sub-criterion used in rating.

From Table 7, it can be seen that the global weight of conduct of accounts and industry/business parameters in the main criteria, which got 0.25 and 0.14. The applicants' credit history got the highest weight, followed by ROCE, cash ratio, repayment period, integrity and commitment, financial flexibility, and group support. In this study, a borrower's previous track record has emerged as one of the most critical factors for loan sanctioning. Besides, the lenders also consider a quality return from the investment. In lending, financial institutions often give significant importance to financial flexibility and group support before granting loans. The criteria and sub-criteria's global weights were computed by the fuzzy-BWM method in the study. Furthermore, the derived weight is used in fuzzy-TOPSISsortC to compute borrowers' final rating.

Phase III: rating of applicants against each criterion using proposed fuzzy-BWM-TOPSIS-Sort-C

After calculating the weight of criteria using fuzzy-BWM discussed in the section “Proposed fuzzy-TOPSIS-Sort-C method”, all applicants are evaluated. In this study, the applicants' performance is rated against the criteria and their corresponding weight, as depicted in Table 7 using the linguistic variable shown in Table 3 [72]. A firm was rated as "VG" if it was found to be at the lowest level of credit risk when it was evaluated as best in performance parameters. On the other hand, a firm was rated as "VP" or the highest level of credit risk when it was found to be least in performance level. The risk level of applicants can be decided based on the above benchmark levels.

In this study, the above-mentioned 30 financial and non-financial data types were gathered to determine selected borrowers' creditworthiness. The financial statements were taken from the Capitaline database, a firm based in India. Finally, the requisite financial ratios were calculated using the financial data obtained. Financial measures like efficiency, profitability, and liquidity are considered positive attributions in this case study, implying that greater is better. Whereas coverage and leverage are considered negative attributes, implying that smaller is better. Table 8 contains financial information.

The values depicted in Table 8 have been mapped in Table 9 using the fuzzy linguistic scale given in Table 3. The rating class profile has been mapped fuzzy characteristic profiles mentioned in Fig. 3. An applicant has been assigned "VG" if the firm was found above the benchmarked performance level or lowest credit risk level. On the other hand, a score of "VP" can be assigned if its performance was found below the threshold level or highest level of credit risk. The riskiness of applicants can be decided based on the above benchmark levels. However, the proposed benchmarking criteria can be changed depending on the type of loan and riskiness.

After financial evaluation, the corresponding non-financial information was collected from the market, audit reports, corporate websites, and archived information. Similarly, the non-financial evaluation of the applicants was rated using the linguistic terms in Table 3, depicted in Table 10.

This study assumes the best and worst alternatives with a defined characteristic profile for making the decision support model ideal for industrial application. In this case, FFPI_B and FFNI_B represent the fuzzy positive ideal borrower and the fuzzy negative ideal borrower. Table 11 illustrates the fuzzy linguistic values used for FFPI, FFNI, and characteristic profiles set for ratings of prospective borrowers.

After evaluating the financial and non-financial criteria using fuzzy linguistic terms, the same was converted to fuzzy numbers using the linguistic scale shown in Table 3. In the next step, the fuzzy evaluation matrix was multiplied with the corresponding criteria weights in Table 7. Subsequently, based on the type of the variable, the corresponding FPIS and FNIS were calculated. In this study, the best and worst solutions are represented as very good (VG) and very poor (VP), respectively. VG and VP signify the FPIS and FNIS, respectively. The FPIS and FNIS values for all the variables were calculated from the weighted matrix. Furthermore, the Euclidean distances from the FPIS and FNIS were calculated using Eqs. 25 and 26 mentioned in fuzzy-TOPSIS-Sort-C. The complete evaluation of all borrowers can be traced in supplementary.

Results and validation

The final rating class of borrowers was derived based on its closeness index \(C_{ai}^{*}\) and \(S_{ai}^{*}\),\(S_{ai}^{ - }\) using Eq. 25. The borrowers are rated into predefined classes using fuzzy-TOPSIS-Sort-C based on their closeness indexes \(C_{ai}^{*}\) compared to the closeness indexes of profiles \(C_{pi}^{*}\) discussed in the methodology. Accordingly, the borrower, whose closeness coefficient ranges in the profile \(C_{p1}^{*}\), is allocated to the class \(C_{1}^{{}}\). If the borrower’s closeness coefficient ranges profile \(C_{p2}^{*}\) and \(C_{p1}^{*}\), it will be allocated to the class \(C_{2}^{{}}\). Similarly, the borrowers are rated between profiles \(C_{p1}^{*}\) to \(C_{p7}^{*}\) based on characteristic profiles shown in Table 12.

This study applied fuzzy-BWM to obtain the weight of criteria identified in the credit rating system. The proposed model's main advantage is that it is simple to use in a real-life scenario; it considers human judgment's subjectivity and rank reversal issues. However, it is essential to compare the results with previous studies and validate the available ratings. Comparing previous studies and commercially available ratings with the proposed model helps set up the model validity. Hence, the proposed fuzzy-BWM-TOPSIS-Sort-C rating model results have been compared with a BWM-based credit rating model [73] and commercial avail ratings of these firms. The results of the BWM-based model were obtained by changing the criteria weight obtained by BWM. All borrowers' ratings were taken from a single rating agency (CRISIL) to make comparisons logical. Finally, the weighted \(S_{ai}^{*}\) \(S_{ai}^{ - }\) and \(C_{ai}^{*}\) score and corresponding rating class using class interval for all the borrowers based on characteristic profile \(C_{i}^{*}\) range are shown in Table 13.

The results shown in Table 14 represented a relative position of ratings of the selected borrowers from the perspective of BWM, rating from the commercial rating agency, and rating obtained using the proposed fuzzy-TOPSIS-Sort-C model. The accuracy of the proposed model was also calculated using equation no 27. The Type-I error, i.e., probability of predicting a non-defaulted firm as default, and Type-II error, i.e., likelihood of predicting a defaulted firm as non-defaulted one, also been evaluated using Eqs. 28 and 29 from the information based on the definitive matrix shown in Table 14 [74].

The proposed model's reliability has been tested using AUC (area under receiving operating characteristics) [75]. Table 15 summarises the Type-I and Type-II error and accuracy rates, whereas Table 16 summarises the true-positive rate, false positive, and reliability rate (AUC) of the proposed model compared to a commercial model.

From Table 15, it is observed that the proposed fuzzy-BWM-TOPSIS model shows an accuracy rate is 94.00%, indicating better predictability than only BWM-based model and the commercial rating model’s accuracy rate of 90.00% and 88.24%, respectively. Furthermore, the Type-I error of the proposed fuzzy-BWM-TOPSIS model is lower than the BWM-based model and commercial model. The Type-II error, which is more severe, i.e., predicting a defaulted firm as a non-defaulted one, is also better, i.e., 4.65% for the fuzzy-BWM-TOPSIS model compared to 6.98% for the BWM-based model and commercial model. Reduced Type-II error signifies the fuzzy-BWM model's better capacity to test the applicant borrowers' eligibility and not include a probably defaulted firm to an eligible one. Furthermore, AUC is shown in Table 16, which indicates the reliability of the proposed model in credit risk assessment endorse the accuracy and less Type-I and Type-II error. Therefore, it can be observed that the proposed fuzzy-BWM-TOPSIS-Sort-C model can perform well to predict the possibility of default.

Following the study of the outcomes, it is critical to compare the present with comparable research. Although a few scholars, such as Ignatius et al. [76], Froelich and Hajek [77], and Roy and Shaw [55], have researched credit ratings using MCDM, no identical study incorporating financial and non-financial information has been discovered. Furthermore, none of them thoroughly addressed the ambiguity in human decision-making. The suggested fuzzy approach to identifying creditworthy firms is unique in that it considers human uncertainty. The current study identified 30 sub-criteria, 15 of which were financial and 15 of which were non-financial. None of the existing literature included all of these variables in a single case. This study's outcomes differ substantially from those of studies. For example, Ignatius et al. [76] and Roy and Shaw [55] suggested an AHP-based framework to get criterion weight and TOPSIS to assess the companies. Recently, Roy and Shaw [73] suggested a BWM-based sustainable credit scoring model. The study applied BWM to obtain the weight of criteria that affect credit rating. As a result, none of these studies has considered human ambiguity while evaluating firms.

Furthermore, Froelich and Hajek [77] included just six parameters, solvency, liquidity elements under financial and country risk, company, and corporate behaviour under subjective analysis, neglecting crucial factors such as profitability, leverage, and account conduct. In terms of approach, the current study employs BWM and TOPSIS-Sort in a fuzzy environment, thoroughly addressing human uncertainty. Table 17 compares the present research to similar studies.

Conclusion

Credit rating is a complex and perilous process. The existing literature research using statistical and AI approaches to assess borrowers primarily focused on financial data. However, depending just on financial data may be insufficient. As a result, it is critical to include both financial and non-financial information when risk profiling debtors. The current study proposed an integrated fuzzy MCDM credit rating model that included financial and non-financial aspects to answer better. The suggested fuzzy-integrated multi-criteria credit rating model employs fuzzy-BWM in combination with the novel fuzzy-TOPSIS-Sort-C. The fuzzy environment makes it easier to deal with the ambiguity of the decision-making process. A real-life case study was used to demonstrate the model's effectiveness.

The suggested approach does not require any distribution assumptions for data structure, as do statistical and machine learning techniques. Compared to the BWM-based and commercial rating model, the findings show higher accuracy and a higher true-positive rate in predicting default in advance. The suggested model's relevance is demonstrated by its lower Type-II error and greater AUC to forecast default effectively. Furthermore, financial institutions may use it as an internal credit rating model under the BASEL rules' IRB method because of its simplicity and low cost. The suggested model is also capable of being coded into DSS software.

The current study has addressed Guo and Zhao's [44] future research direction by combining the fuzzy-BWM with other MCDM in a real-world problem. This study has successfully extended TOPSIS-sort-C into fuzzy-TOPSIS-sort-C, which has not been reported in the existing literature. The fuzzy-TOPSIS-sort-C can handle inconsistency of human judgment better as compared to normal TOPSIS-sort-C. The proposed model is unique in terms of the factors adopted. This study helps financial institutions identify the set of financial and non-financial criteria for credit rating. Like other studies, this study also suffers from a few limitations. There may be a bias of the experts for assigning the ratings to the factors. There may be other factors that can be considered for the credit rating. Future research can be conducted by applying Bayesian-BWM, and the results may be compared.

Availability of data and materials

Data used in this study are available with the author on request with reasonable time.

Code availability

Code used in this study is available with the author on request at a reasonable time.

Notes

The Basel Committee on Banking Supervision (BCBS) is a group of central bank governors that created a committee of bank regulatory authority in 1975. It is comprised of senior executives from bank regulatory organisations and central banks. On July 4, 2006, the Committee issued the final version of the Basel II Framework.

References

Moon TH, Kim Y, Sohn SY (2011) Technology credit rating system for funding SMEs. J Oper Res Soc 62:608–615. https://doi.org/10.1057/jors.2010.15

Wang M, Ku H (2021) Utilising historical data for corporate credit rating assessment. Expert Syst Appl 165:113925. https://doi.org/10.1016/j.eswa.2020.113925

Zhang F, Tadikamalla PR, Shang J (2016) Corporate credit-risk evaluation system: Integrating explicit and implicit financial performances. Int J Prod Econ 177:77–100. https://doi.org/10.1016/j.ijpe.2016.04.012

Ala’raj M, Abbod MF (2016) A new hybrid ensemble credit scoring model based on classifiers consensus system approach. Expert Syst Appl 64:36–55. https://doi.org/10.1016/j.eswa.2016.07.017

Gastelum Chavira DA, Leyva Lopez JC, Solano Noriega JJ, Ahumada Valenzuela O, Alvarez Carrillo PA (2017) A credit ranking model for a parafinancial company based on the ELECTRE-III method and a multiobjective evolutionary algorithm. Appl Soft Comput J 60:190–201. https://doi.org/10.1016/j.asoc.2017.06.021

Basel Committee on Banking Supervision (2006) International convergence of capital measurement and capital standards: a revised framework & comprehensive version. http://www.bis.org/publ/bcbs128.pdf

Bai C, Shi B, Liu F, Sarkis J (2019) Banking credit worthiness: evaluating the complex relationships. Omega (United Kingdom) 83:26–38. https://doi.org/10.1016/j.omega.2018.02.001

Ju YH, Sohn SY (2014) Updating a credit-scoring model based on new attributes without realisation of actual data. Eur J Oper Res 234:119–126. https://doi.org/10.1016/j.ejor.2013.02.030

Shi B, Wang J, Qi J, Cheng Y (2015) A novel imbalanced data classification approach based on logistic regression and fisher discriminant. Math Probl Eng. https://doi.org/10.1155/2015/945359

Hwang RC, Chung H, Chu CK (2010) Predicting issuer credit ratings using a semiparametric method. J Empir Financ 17:120–137. https://doi.org/10.1016/j.jempfin.2009.07.007

Wang G, Hao J, Ma J, Jiang H (2011) A comparative assessment of ensemble learning for credit scoring. Expert Syst Appl 38:223–230. https://doi.org/10.1016/j.eswa.2010.06.048

Huang Z, Chen H, Hsu CJ, Chen WH, Wu S (2004) Credit rating analysis with support vector machines and neural networks: a market comparative study. Decis Support Syst 37:543–558. https://doi.org/10.1016/S0167-9236(03)00086-1

Guotai C, Abedin MZ, Moula FE (2017) Modeling credit approval data with neural networks: an experimental investigation and optimisation. J Bus Econ Manag 18:224–240. https://doi.org/10.3846/16111699.2017.1280844

García F, Giménez V, Guijarro F (2013) Credit risk management: a multicriteria approach to assess creditworthiness. Math Comput Model 57:2009–2015. https://doi.org/10.1016/j.mcm.2012.03.005

Hasumi R, Hirata H (2014) Small business credit scoring and its pitfalls: evidence from Japan. J Small Bus Manag 52:555–568. https://doi.org/10.1111/jsbm.12049

Angilella S, Mazzù S (2015) The financing of innovative SMEs: a multicriteria credit rating model. Eur J Oper Res 244:540–554. https://doi.org/10.1016/j.ejor.2015.01.033

Dietsch M, Petey J (2004) Should SME exposures be treated as retail or corporate exposures? A comparative analysis of default probabilities and asset correlations in French and German SMEs. J Bank Financ 28:773–788. https://doi.org/10.1016/S0378-4266(03)00199-7

Roy B (1981) The optimisation problem formulation: Criticism and overstepping. J Oper Res Soc 32:427–436. https://doi.org/10.1057/jors.1981.93

Roy PK, Shaw K (2021) A credit scoring model for SMEs using AHP and TOPSIS. Int J Finan Econ. https://doi.org/10.1002/ijfe.2425

Doumpos M, Figueira JR (2019) A multi-criteria outranking approach for modeling corporate credit ratings: an application of the ELECTRE TRI-NC method. Omega (United Kingdom) 82:166–180. https://doi.org/10.1016/j.omega.2018.01.003

Samanlioglu F, Taskaya YE, Gulen UC, Cokcan O (2018) A fuzzy AHP–TOPSIS-based group decision-making approach to IT personnel selection. Int J Fuzzy Syst 20:1576–1591. https://doi.org/10.1007/s40815-018-0474-7

Zhi-Luo S, Ning-Xing L (2019) A hybrid decision making framework for personnel selection using BWM, MABAC and PROMETHEE. Int J Fuzzy Syst 21:2421–2434. https://doi.org/10.1007/s40815-019-00745-4

Sofuoğlu MA (2020) Fuzzy applications of best-worst method in manufacturing environment. Soft Comput 24:647–659. https://doi.org/10.1007/s00500-019-04491-5

Rezaei J (2015) Best-worst multi-criteria decision-making method. Omega 53:49–57. https://doi.org/10.1016/j.omega.2014.11.009

Guo S, Zhao H (2017) Fuzzy best-worst multi-criteria decision-making method and its applications. Knowl Based Syst 121:23–31. https://doi.org/10.1016/j.knosys.2017.01.010

de Lima Silva DF, Ferreira L, de Almeida-Filho AT (2020) A new preference disaggregation TOPSIS approach applied to sort corporate bonds based on financial statements and expert’s assessment. Expert Syst Appl 152:113369. https://doi.org/10.1016/j.eswa.2020.113369

de Lima Silva DF, de Almeida Filho AT (2020) Sorting with TOPSIS through boundary and characteristic profiles. Comput Ind Eng 141:1–15. https://doi.org/10.1016/j.cie.2020.106328

Grunert J, Norden L, Weber M (2005) The role of non-financial factors in internal credit ratings. J Bank Financ 29:509–531. https://doi.org/10.1016/j.jbankfin.2004.05.017

Liu C, Shi H, Cai Y, Shen S, Lin D (2019) A new pricing approach for SME loans issued by commercial banks based on credit score mapping and Archimedean copula simulation. J Bus Econ Manag 20:618–632. https://doi.org/10.3846/jbem.2019.9854

Van Gool J, Verbeke W, Sercu P, Baesens B (2012) Credit scoring for microfinance: is it worth it? Int J Financ Econ 17:103–123. https://doi.org/10.1002/ijfe.444

Merikas A, Merika A, Penikas HI, Surkov MA (2020) The journal of economic asymmetries the basel II internal ratings based (IRB) model and the transition impact on the listed Greek banks. J Econ Asymmetries 22:e00183. https://doi.org/10.1016/j.jeca.2020.e00183

Cucinelli D, Di Battista ML, Marchese M, Nieri L (2018) Credit risk in European banks: the bright side of the internal ratings based approach. J Bank Financ 93:213–229. https://doi.org/10.1016/j.jbankfin.2018.06.014

Cummings JR, Durrani KJ (2016) Effect of the Basel Accord capital requirements on the loan-loss provisioning practices of Australian banks. J Bank Financ 67:23–36. https://doi.org/10.1016/j.jbankfin.2016.02.009

Gupta J, Wilson N, Gregoriou A, Healy J (2014) The effect of internationalisation on modelling credit risk for SMEs: evidence from UK market. J Int Financ Mark Inst Money 31:397–413. https://doi.org/10.1016/j.intfin.2014.05.001

Bedin A, Billio M, Costola M, Pelizzon L (2019) Credit scoring in SME asset-backed securities: an Italian case study. J Risk Financ Manag 12:89. https://doi.org/10.3390/jrfm12020089

Tripathi D, Edla DR, Kuppili V, Bablani A, Dharavath R (2018) Credit scoring model based on weighted voting and cluster based feature selection. Proc Comput Sci 132:22–31. https://doi.org/10.1016/j.procs.2018.05.055

Barboza F, Kimura H, Altman E (2017) Machine learning models and bankruptcy prediction. Expert Syst Appl 83:405–417. https://doi.org/10.1016/j.eswa.2017.04.006

Butaru F, Chen Q, Clark B, Das S, Lo AW, Siddique A (2016) Risk and risk management in the credit card industry. J Bank Financ 72:218–239. https://doi.org/10.1016/j.jbankfin.2016.07.015

Tam KY, Kiang MY (1992) Managerial applications of neural networks: the case of bank failure predictions. Manage Sci 38:926–947. http://www.jstor.org/stable/2632376

Steijvers T, Voordeckers W, Vanhoof K (2010) Collateral, relationship lending and family firms. Small Bus Econ. https://doi.org/10.1007/s11187-008-9124-z

Bhimani A, Gulamhussen MA, Lopes SR (2013) The role of financial, macroeconomic, and non-financial information in bank loan default timing prediction. Eur Account Rev 22:739–763. https://doi.org/10.1080/09638180.2013.770967

Gupta J, Gregoriou A (2018) Impact of market-based finance on SMEs failure. Econ Model 69:13–25. https://doi.org/10.1016/j.econmod.2017.09.004

Chava S, Jarrow RA (2008) Bankruptcy prediction with industry effects. Financ Deriv Pricing. https://doi.org/10.1142/9789812819222_0021

Castrén O, Dées S, Zaher F (2010) Stress-testing euro area corporate default probabilities using a global macroeconomic model. J Financ Stab 6:64–78. https://doi.org/10.1016/j.jfs.2009.10.001

Hirsch B, Nitzl C, Schoen M (2018) Interorganizational trust and agency costs in credit relationships between savings banks and SMEs. J Bank Financ 97:37–50. https://doi.org/10.1016/j.jbankfin.2018.09.017

Yurdakul M, Iç YT (2004) AHP approach in the credit evaluation of the manufacturing firms in Turkey. Int J Prod Econ 88:269–289. https://doi.org/10.1016/S0925-5273(03)00189-0

Tang M, Mei M, Li C, Lv X, Li X, Wang L (2020) How does an individual’s default behavior on an online peer-to-peer lending platform influence an observer’s default intention? Financ Innov. https://doi.org/10.1186/s40854-020-00197-y

Tang Y, Moro A (2020) Trade credit in China: exploring the link between short term debt and payables. Pac Basin Financ J 59:101240. https://doi.org/10.1016/j.pacfin.2019.101240

Doumpos M, Niklis D, Zopounidis C, Andriosopoulos K (2015) Combining accounting data and a structural model for predicting credit ratings: empirical evidence from European listed firms. J Bank Financ 50:599–607. https://doi.org/10.1016/j.jbankfin.2014.01.010

Gül S, Kabak Ö, Topcu I (2018) A multiple criteria credit rating approach utilising social media data. Data Knowl Eng 116:80–99. https://doi.org/10.1016/j.datak.2018.05.005

Babic Z, Plazibat N (1998) Ranking of enterprises based on multicriterial analysis. Int J Prod Econ 56–57:29–35. https://doi.org/10.1016/S0925-5273(97)00133-3

Iç YT, Yurdakul M (2010) Development of a quick credibility scoring decision support system using fuzzy TOPSIS. Expert Syst Appl 37:567–574. https://doi.org/10.1016/j.eswa.2009.05.038

Chi G, Zhang Z (2017) Multi criteria credit rating model for small enterprise using a nonparametric method. Sustainability. https://doi.org/10.3390/su9101834

Mousavi MM, Lin J (2020) The application of PROMETHEE multi-criteria decision aid in financial decision making: case of distress prediction models evaluation. Expert Syst Appl. https://doi.org/10.1016/j.eswa.2020.113438

Roy PK, Shaw K (2021) A credit scoring model for SMEs using AHP and TOPSIS. Int J Financ Econ. https://doi.org/10.1002/ijfe.2425

Syau Y-R, Hsieh HT, Stanley-Lee E (2001) Fuzzy numbers in the credit rating of enterprise financial condition. Rev Quant Financ Account 17:351–360. https://doi.org/10.1023/A:1012783613875

Parameshwaran R, Praveen Kumar S, Saravanakumar K (2015) An integrated fuzzy MCDM based approach for robot selection considering objective and subjective criteria. Appl Soft Comput J 26:31–41. https://doi.org/10.1016/j.asoc.2014.09.025

Şengül Ü, Eren M, Eslamian Shiraz S, Gezder V, Sengül AB (2015) Fuzzy TOPSIS method for ranking renewable energy supply systems in Turkey. Renew Energy 75:617–625. https://doi.org/10.1016/j.renene.2014.10.045

Hirschey M (1979) Fundamentals of managerial economics, 1st edn. The Macmillan Press Ltd, South-Western. https://doi.org/10.1007/978-1-349-16225-3

Ishizaka A, Senior PN (2013) Multi-criteria decision analysis multi-criteria decision analysis. In: Alessio Ishizaka PN (ed) Multi-criteria decis. anal. multi-criteria decis. anal., 1st edn. Wiley, West Sussex, pp 1–82. https://doi.org/10.1002/9781118644898

Zadeh LA (1965) Canopy temperature depression as an indication of correlative measure of spot blotch resistance and heat stress tolerance in spring wheat. Inf Control 8:338–353. https://doi.org/10.1016/S0019-9958(65)90241-X

Lootsma FA (1980) Saaty’s priority theory and the nomination of a senior professor in operations research. Eur J Oper Res 4:380–388. https://doi.org/10.1016/0377-2217(80)90189-7

Chang D-Y (1996) Applications of the extent analysis method on fuzzy AHP. Eur J Oper Res 95:649–655. https://doi.org/10.1016/0377-2217(95)00300-2

Roy PK, Shaw K (2021) An integrated fuzzy model for evaluation and selection of mobile banking (m-banking) applications using new fuzzy-BWM and fuzzy-TOPSIS. Complex Intell Syst. https://doi.org/10.1007/s40747-021-00502-x

Roy P, Shaw K (2022) A fuzzy MCDM decision-making model for m-banking evaluations: comparing several m-banking applications. J Ambient Intell Humaniz Comput. https://doi.org/10.1007/s12652-022-03743-x

Roy PK, Shaw K (2021) A multi-criteria credit scoring model for SMEs using hybrid BWM and TOPSIS. Financ Innov 7:1–27. https://doi.org/10.1002/ijfe.2425

Roy PK, Shaw K (2021) Developing a multi-criteria sustainable credit score system using fuzzy BWM and fuzzy TOPSIS. Environ Dev Sustain. https://doi.org/10.1007/s10668-021-01662-z

Bellman RE, Zadeh LA (1970) Decision-making in a fuzzy environment. Manag Sci 17:B-141-B-164. https://doi.org/10.1287/mnsc.17.4.B141Full

Chen TY, Tsao CY (2008) The interval-valued fuzzy TOPSIS method and experimental analysis. Fuzzy Sets Syst 159:1410–1428. https://doi.org/10.1016/j.fss.2007.11.004

Aires RFF, Ferreira L (2019) A new approach to avoid rank reversal cases in the TOPSIS method. Comput Ind Eng 132:84–97. https://doi.org/10.1016/j.cie.2019.04.023

Afshar A, Mariño MA, Saadatpour M, Afshar A (2011) Fuzzy TOPSIS multi-criteria decision analysis applied to Karun reservoirs system. Water Resour Manag 25:545–563. https://doi.org/10.1007/s11269-010-9713-x

Aboutorab H, Saberi M, Asadabadi MR, Hussain O, Chang E (2018) ZBWM: the Z-number extension of best worst method and its application for supplier development. Expert Syst Appl 107:115–125. https://doi.org/10.1016/j.eswa.2018.04.015

Roy PK, Shaw K (2021) Modelling a sustainable credit score system (SCSS) using BWM and fuzzy TOPSIS. Int J Sustain Dev World Ecol 00:1–14. https://doi.org/10.1080/13504509.2021.1935360

Wang G, Ma J, Huang L, Xu K (2012) Two credit scoring models based on dual strategy ensemble trees. Knowl Based Syst 26:61–68. https://doi.org/10.1016/j.knosys.2011.06.020

Dželihodžić A, Donko D, Kevrić J (2018) Improved credit scoring model based on bagging neural network. Int J Inf Technol Decis Mak 17:1725–1741. https://doi.org/10.1142/S0219622018500293

Ignatius J, Hatami-Marbini A, Rahman A, Dhamotharan L, Khoshnevis P (2018) A fuzzy decision support system for credit scoring. Neural Comput Appl 29:921–937. https://doi.org/10.1007/s00521-016-2592-1

Froelich W, Hajek P (2020) IVIFCM-TOPSIS for bank credit risk assessment. In: Czarnowski IJL, Howlett R (eds) Intell. decis. technol. 2019. Smart innov. syst. technol. Springer Singapore, Singapore. https://doi.org/10.1007/978-981-13-8311-3_9

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

All authors have contributed equally to the study.

Corresponding author

Ethics declarations

Conflict of interest

There are no competing/conflicts of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Roy, P.K., Shaw, K. An integrated fuzzy credit rating model using fuzzy-BWM and new fuzzy-TOPSIS-Sort-C. Complex Intell. Syst. 9, 3581–3600 (2023). https://doi.org/10.1007/s40747-022-00823-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40747-022-00823-5