Abstract

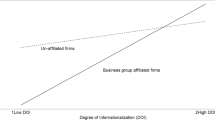

We conceptualize business group affiliation as institutional linkages by integrating the resource-based view and institutional perspective to examine its direct and moderating effects on firm value in emerging economies. In a sample of 1233 Chinese listed companies, we find that while business group affiliation has mixed direct effects, it moderates the effects of organizational traits and institutional conditions on firm value. Specifically, group affiliation aggravates old firms’ “liability of oldness,” but helps mitigate large firms’ “liability of bigness.” Besides, business group affiliation can reduce the liabilities that institutional voids bring about, as evidenced in its moderating effects on the relationship between regional under-development/industrial restriction and firm value. Our findings point to the moderating effects of business group affiliation in emerging economies.

Similar content being viewed by others

References

Agarwal, R., & Gort, M. 2002. Firm and product life cycles and firm survival. American Economic Review, 92(2): 184–190.

Aiken, L. S., & West, S. G. 1991. Multiple regression: Testing and interpreting interactions. Newbury Park: Sage.

Aldrich, H. E., & Auster, E. 1986. Even dwarfs started small: Liabilities of age and size and their strategic implications. Research in Organizational Behavior, 8: 165–198.

Amabile, T. M. 1988. A model of creativity and innovation in organizations. Research in Organizational Behavior, 10(1): 123–167.

Amsden, A. H. 1989. Asia’s next giant: South Korea and late industrialization. New York: Oxford University Press.

Bamiatzi, V., Cavusgil, S. T., Jabbour, L., & Sinkovics, R. R. 2013. Does business group affiliation help firms achieve superior performance during industrial downturns? An empirical examination. International Business Review, 23(1): 195–211.

Banz, R. 1981. The relationship between return and market value of common stocks. Journal of Financial Economics, 9(1): 3–18.

Barney, J. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17(1): 99–120.

Barney, J. B., Ketchen, D. J., & Wright, M. 2011. The future of resource-based theory revitalization or decline?. Journal of Management, 37(5): 1299–1315.

Baum, J. A. C., & Oliver, C. 1991. Institutional linkages and organizational mortality. Administrative Science Quarterly, 36: 187–218.

Belenzon, S., & Berkovitz, T. 2010. Innovation in business groups. Management Science, 56(3): 519–535.

Bertrand, M., Mehta, P., & Mullainathan, S. 2002. Ferreting out tunneling: An application to Indian business groups. Quarterly Journal of Economics, 117(1): 121–148.

Boisot, M., & Child, J. 1996. From fiefs to clans and network capitalism: Explaining China’s emerging economic order. Administrative Science Quarterly, 41: 600–628.

Carney, M. 2008. The many faces of Asian business groups. Asia Pacific Journal of Management, 25(4): 595–613.

Carney, M., Gedajlovic, E. R., Heugens, P. P. M. A. R., van Essen, M. A., & van Oosterhout, J. 2011. Business group affiliation, performance, context, and strategy: A meta-analysis. Academy of Management Journal, 54(3): 437–460.

Chang, S. 2003. Ownership structure, expropriation, and performance of group-affiliated companies in Korea. Academy of Management Journal, 46(2): 238–253.

Chang, S. J., & Choi, U. 1988. Strategy, structure and performance of Korean business groups: A transactions cost approach. Journal of Industrial Economics, 37(2): 141–158.

Chang, S., & Hong, J. 2000. Economic performance of group-affiliated companies in Korea: Intra-group resource sharing and internal business transactions. Academy of Management Journal, 43(3): 429–448.

Chen, Y., & Jaw, Y. 2014. How do business groups’ small world networks effect diversification, innovation, and internationalization?. Asia Pacific Journal of Management, 31(4): 1019–1044.

Child, J. 1993. Society and enterprise between hierarchy and market. In J. Child, M. Crozier, & R. Mayntz (Eds.). Societal change between market and organization: 203–226. Aldershot: Averbury.

Davis, L., & North, D. 1971. Institutional change and American economic growth. Cambridge: Cambridge University Press.

Dubin, R. 1978. Theory building. New York: Free Press.

Ebben, J. J., & Johnson, A. C. 2005. Efficiency, flexibility, or both? Evidence linking strategy to performance in small firms. Strategic Management Journal, 26(13): 1249–1259.

Evans, P. 1979. Dependent development. Princeton: Princeton University Press.

Fisman, R., & Khanna, T. 2004. Facilitating development: The role of business groups. World Development, 32: 609–628.

Gaur, A., & Delios, A. 2015. International diversification of emerging market firms: The role of ownership structure and group affiliation. Management International Review, 55(2): 235.

Gomes-Casseres, B. 1990. Firm ownership preferences and host government restrictions: An integrated approach. Journal of International Business Studies, 21(1): 1–22.

Gopalan, R., Nanda, V., & Seru, A. 2007. Affiliated firms and financial support: Evidence from Indian business groups. Journal of Financial Economics, 86(3): 759–795.

Granovetter, M. 1995. Coase revisited: Business groups in the modern economy. Industrial and Corporate Change, 4: 93–130.

Graubner, M. 2006. Task, firm size, and organizational structure in management consulting: An empirical analysis from a contingency perspective. Wiesbaden: DUV.

Guillén, M. 2000. Business groups in emerging economies: A resource-based view. Academy of Management Journal, 43(3): 362–380.

Hannan, M., & Freeman, J. 1984. Structural inertia and organizational change. American Sociological Review, 49(5): 149.

He, J., Mao, X., Rui, O., & Zha, X. 2013. Business groups in China. Journal of Corporate Finance, 22: 166.

Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. 2000. Strategy in emerging economies. Academy of Management Journal, 43(3): 249–267.

Huang, Y. 2003. Selling China: Foreign direct investment during the reform era. New York: Cambridge University Press.

Jia, N., Shi, J., & Wang, Y. 2013. Coinsurance within business groups: Evidence from related party transactions in an emerging market. Management Science, 59(10): 2295–2313.

Jian, M., & Wong, T. J. 2010. Propping through related party transactions. Review of Accounting Studies, 15(1): 70–105.

Jiang, G., Lee, C. M., & Yue, H. 2010. Tunneling through intercorporate loans: The China experience. Journal of Financial Economics, 98(1): 1–20.

Keister, L. 2000. Chinese business groups: The structure and impact of interfirm relations during economic development. Oxford: Oxford University Press.

Keister, L. 2001. Exchange structures in transition: Lending and trade relations in Chinese business groups. American Sociological Review, 336–360.

Khanna, T., & Palepu, K. 1997. Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4): 41–51.

Khanna, T., & Palepu, K. 2000. Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups. Journal of Finance, 55: 867–891.

Khanna, T., & Rivikin, J. 2001. Estimating the performance of business groups in emerging markets. Strategic Management Journal, 22: 45–74.

Khanna, T., & Yafeh, Y. 2005. Business groups and risk sharing around the world. Journal of Business, 78(1): 301–340.

Khanna, T., & Yafeh, Y. 2007. Business groups in emerging markets: Paragons or parasites?. Journal of Economic Literature, 45(2): 331–372.

Kock, C., & Guillén, M. F. 2001. Strategy and structure in developing countries: Business groups as an evolutionary response to opportunities for unrelated diversification. Industrial and Corporate Change, 10(1): 77–113.

Lamin, A. 2013. Business groups as information resource: An investigation of business group affiliation in the Indian software services industry. Academy of Management Journal, 56(5): 1487.

Lee, K., Peng, M. W., & Lee, K. 2008. From diversification premium to diversification discount during institutional transitions. Journal of World Business, 43(1): 47–65.

Leonard-Barton, D., Schendel, D., & Channon, D. 1992. Core capabilities and core rigidities: A paradox in managing new product development. Strategic Management Journal, 13(S1): 111–125.

Liao, L., Liu, B., & Wang, H. 2011. Information discovery in share lockups: Evidence from the split-share structure reform in China: 1001–1027. Winter: Financial Management.

Lincoln, J., Gerlach, M., & Ahmadjian, C. 1996. Keiretsu networks and corporate performance in Japan. American Sociological Review, 1996: 67–88.

Loderer, C., & Waelchli, U. 2010. Firm age and performance. IDEAS working paper series from RePEc, MPRA paper no. 26450, University Library of Munich, Germany.

Lu, J. W., & Ma, X. 2008. The contingent value of local partners’ business group affiliations. Academy of Management Journal, 51(2): 295–314.

Luo, Y. 2002. Product diversification in international joint ventures: Performance implications in an emerging market. Strategic Management Journal, 23: 1–20.

Ma, X., Tong, T. W., & Fitza, M. 2013. How much does subnational region matter to foreign subsidiary performance? Evidence from Fortune Global 500 Corporations’ investment in China. Journal of International Business Studies, 44(1): 66–87.

Ma, X., Yao, X., & Xi, Y. 2006. Business group affiliation and firm performance in a transition economy: A focus on ownership voids. Asia Pacific Journal of Management, 23(4): 467–483.

Ma, X., Yiu, D. W., & Zhou, N. 2014. Facing global economic crisis: Foreign sales, ownership groups, and corporate value. Journal of World Business, 49(1): 87–100.

Mahmood, I., & Rufin, C. 2005. Government’s dilemma: The institutional framework for imitation and innovation. Academy of Management Review, 30(2): 338–360.

Mahmood, I., Zajac, E. J., & Zhu, H. 2011. Where can capabilities come from? Network ties and capability acquisition in business groups. Strategic Management Journal, 32(8): 820–848.

Majumdar, S. 1997. The impact of size and age on firm-level performance: Some evidence from India. Review of Industrial Organization, 12(2): 231–241.

Manikandan, K. S., & Ramachandran, J. 2015. Beyond institutional voids: Business groups, incomplete markets, and organizational form. Strategic Management Journal, 36(4): 598–617.

Meyer, K., Estrin, S., Bhaumik, S., & Peng, M. 2009. Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal, 30(1): 61–80.

Naughton, B. 1995. Growing out of the plan: Chinese Economic Reform 1878–1993. New York: Cambridge University Press.

Newman, K. 2000. Organizational transformation during institutional upheaval. Academy of Management Review, 25: 602–619.

North, D. 1990. Institutions, institutional change, and economic performance. New York: Norton.

Oliver, C. 1997. Sustainable competitive advantage: Combining institutional and resource-based views. Strategic Management Journal, 18(9): 697–713.

Peng, M. W. 2003. Institutional transitions and strategic choices. Academy of Management Review, 28: 275–296.

Peng, M. W. 2004. Outside directors and firm performance during institutional transitions. Strategic Management Journal, 25(5): 453–471.

Peng, M. W., & Heath, P. 1996. The growth of the firm in planned economies in transition: Institutions, organizations, and strategic choices. Academy of Management Review, 21(2): 492–528.

Peng, M. W., & Luo, Y. 2000. Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Academy of Management Journal, 43(3): 486–501.

Peng, M. W., Lee, S., & Wang, D. 2005. What determines the scope of the firm over time? A focus on institutional relatedness. Academy of Management Review, 30(3): 622–633.

Powell, W. 1996. Commentary on the nature of institutional embeddedness. Advances in Strategic Management, 13: 293–300.

Priem, R., & Butler, J. 2001. Is the resource-based “view” a useful perspective for strategic management research. Academy of Management Review, 26(1): 22–41.

Ramaswamy, K., Li, M., & Petitt, B. 2012. Why do business groups continue to matter? A study of market failure and performance among Indian manufacturers. Asia Pacific Journal of Management, 29(3): 643–658.

Rouwenhorst, K. 1999. Local return factors and turnover in emerging stock markets. Journal of Finance, 54(4): 1439–1464.

Schmalansee, R. 1985. Do markets differ much?. American Economic Review, 75: 341–351.

Scott, W. R. 1995. Institutions and organizations. Thousand Oaks: Sage.

Sirmon, D. G., Hitt, M. A., & Ireland, R. D. 2007. Managing firm resources in dynamic environments to create value: Looking inside the black box. Academy of Management Review, 32(1): 273.

Staw, B. M., Sandelands, L. E., & Dutton, J. E. 1981. Threat rigidity effects in organizational behavior: A multilevel analysis. Administrative Science Quarterly: 501–524.

Stinchcombe, A. L. 1965. Social structure and organizations. In J. G. March (Ed.). Handbook of organizations: 142–193. Chicago: Rand McNally.

Vissa, B., Greve, H. R., & Chen, W. R. 2010. Business group affiliation and firm search behavior in India: Responsiveness and focus of attention. Organization Science, 21(3): 696–712.

Walder, A. G. 1995. Local governments as industrial firms: An organizational analysis of China’s transition economy. American Journal of Sociology, 101: 263–301.

Wan, W. P., & Hoskisson, R. E. 2003. Home country environments, corporate diversification strategies, and firm performance. Academy of Management Journal, 46(1): 27–45.

Wernerfelt, B., & Montgomery, C. 1988. Tobin’s q and the importance of focus in firm performance. American Economic Review, 78(1): 246–250.

Wright, M., Filatotchev, I., Hoskisson, R., & Peng, M. 2005. Strategy research in emerging economies: Challenging the conventional wisdom*. Journal of Management Studies, 42(1): 1–33.

Xia, J., Ma, X., Lu, J. W., & Yiu, D. W. 2014. Outward foreign direct investment by emerging market firms: A resource dependence logic. Strategic Management Journal, 35(9): 1343–1363.

Xin, K., & Pearce, J. 1996. Guanxi: Connections as substitutes for formal institutional support. Academy of Management Journal, 39(6): 1641–1658.

Xu, D. E., & Meyer, K. 2013. Linking theory and context: ‘Strategy research in emerging economies’after Wright et al. (2005). Journal of Management Studies, 50(7): 1322–1346.

Xu, X., & Wang, Y. 1999. Ownership structure and corporate governance in Chinese stock companies. China Economic Review, 10(1): 75–98.

Yabushita, N., & Sehiro, A. 2014. Family business groups in Thailand: Coping with management critical points. Asia Pacific Journal of Management, 31(4): 997–1018.

Yiu, D., Bruton, G., & Lu, Y. 2005. Understanding business group performance in an emerging economy: Acquiring resources and capabilities in order to prosper. Journal of Management Studies, 42(1): 183–296.

Young, M., Peng, M., Ahlstrom, D., Bruton, G., & Jiang, Y. 2008. Corporate governance in emerging economies: a review of the principal–principal perspective. Journal of Management Studies, 45(1): 196–220.

Yu, H., Van Ees, H., & Lensink, R. 2009. Does group affiliation improve firm performance? The case of Chinese state-owned firms. Journal of Development Studies, 45(10): 1615–1632.

Zeger, S. L., & Liang, K. 1986. Longitudinal data analysis for discrete and continuous outcomes. Biometrics, 42: 121–130.

Acknowledgements

We would like to thank APJM Senior Editor, Professor Michael Carney, and an anonymous reviewer for valuable comments in the review process. The authors acknowledge the support of grants from the Research Grants Council of the Hong Kong Special Administrative Region (No. 14501714 and No. 14504715) and the National Natural Science Foundation of China (No. 71402097).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ma, X., Lu, J.W. Business group affiliation as institutional linkages in China’s emerging economy: A focus on organizational traits and institutional conditions. Asia Pac J Manag 34, 675–697 (2017). https://doi.org/10.1007/s10490-017-9517-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-017-9517-0