Abstract

We extend the dynamic Cournot duopoly framework with emission charges on output by Mamada and Perrings (Econ Anal Policy 66:370–380, 2020), which encompassed homogeneous products in its original formulation, to the more general case of differentiated goods, in order to highlight the richness in its static and dynamic outcomes. Each firm is taxed proportionally to its own emission only and charge functions are quadratic. Moreover, due to an adjustment capacity constraint, firms partially modify their output level toward the best response. Like in Mamada and Perrings (Econ Anal Policy 66:370–380, 2020), the only steady state coincides with the Nash equilibrium, and it will be considered admissible when it guarantees the positivity of the marginal emission charge. We find that the full efficacy of the environmental policy, which applies to an equilibrium that is globally asymptotically stable anytime it is admissible, is achieved in the case of independent goods, as well as with a low good interdependence degree in absolute value, independently of being substitutes or complements. When goods are substitutes and their interdependence degree is high, the considered environmental policy is still able to reduce pollution at the equilibrium, but the latter is stable just when the policy intensity degree is large enough. When instead goods are complements and their interdependence degree is high in absolute value, the considered environmental policy produces detrimental effects on the pollution level and the unique equilibrium is always unstable, when admissible. This highlights that, from the static viewpoint, even in the absence of free riding possibilities, the choice of the mechanism to implement has to be carefully pondered, according to the features of the considered economy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the past decades, environmental policies to control pollution have been considered in several works, such as Segerson (1988); Katsoulacos and Xepapadeas (1995); Suter et al. (2008). In particular, some of them are based on both charges and incentives, according to a comparison between the aggregate emission level and the ambient standard, mainly in the case of non-point source (NPS) pollution, like for instance in Ganguli and Raju (2012); Matsumoto et al. (2018a, 2018b); Matsumoto and Szidarovszky (2021), while other ones are based just on charges, as it happens, e.g., in Mamada and Perrings (2020) and in its extension in Matsumoto et al. (2022). Indeed, Mamada and Perrings (2020) propose a Cournot duopoly with homogeneous products where the environmental policy is characterized by a tax, for each firm, proportional to its own emission only and charge functions are quadratic. Moreover, due to an adjustment capacity constraint, firms partially modify their output level toward the best response.

Following the suggestion contained in the concluding remarks by Mamada and Perrings (2020), in the present contribution we investigate the static and dynamic effects produced by the introduction of differentiated goodsFootnote 1 in the framework proposed therein, finding a much richer variety of results than dealing with homogeneous products. Namely, for their setting (Mamada and Perrings 2020) showed that a unique steady state exists, coinciding with the Nash equilibrium, which is stable when the policy intensity degree is high enough, i.e., for instance when marginal emission charges are increasing in emissions, while it is unstable when the policy is too soft. According to Mamada and Perrings (2020), the latter case, characterized by the system instability, possibly allows for the transition from a duopolistic to a monopolistic framework. Furthermore, in the homogeneous good context it holds that the policy is effective, from the static viewpoint, in reducing pollution. On the other hand, a comparative statics result is economically grounded if it concerns an equilibrium which is asymptotically stable and thus orbits converge towards it after a transient period. As recalled above, this is not the case with homogeneous goods when the policy intensity degree is low.

Although also in the differentiated product framework there exists a unique steady state, which coincides with the Nash equilibrium, different scenarios may occur in regard to the efficacy of the considered environmental policy and the stability of the steady state, according to the fact that goods are complements or substitutes, as well as according to the strength of the interdependence degree between the two goods and of the environmental policy. In more detail, calling admissible the steady state when it guarantees the positivity of the marginal emission charge, we find that when goods are substitutes the considered environmental policy is effective, from the static viewpoint, in reducing pollution and the steady state may be always stable, when admissible, or the stabilizing scenario can occur, with the steady state being stable just when the policy intensity level is sufficiently high. In particular, when products are independent the former possibility arises, with a consequent full efficacy of the environmental policy, while, within the framework of substitutes, the case of homogeneous goods, analyzed in Mamada and Perrings (2020), turns out to be the less favorable to assess the efficacy of the considered environmental policy, due to the reduced equilibrium stability interval. On the other hand, with complements much worse situations can occur when the interdependence degree between goods is high in absolute value. Indeed, when goods are complements two different frameworks may take place, according to the strength of the interdependence degree between the two products. When the interdependence degree is low in absolute value, the considered environmental policy is effective, from the static viewpoint, in reducing pollution and the equilibrium is always stable, when admissible, like in the case of independent products. This means that the full efficacy of the environmental policy, which applies to an equilibrium that is globally asymptotically stable anytime it is admissible, is achieved in the case of independent goods, as well as with a low interdependence degree between goods in absolute value, independently of being substitutes or complements. When instead goods are complements and the interdependence degree between them is high in absolute value, the considered environmental policy produces a negative effect on the equilibrium pollution level, which increases, and the unique steady state is always unstable, when admissible. Such comparative statics finding highlights that, even in the absence of free riding possibilities, the choice of the mechanism to implement has to be carefully pondered, according to the features of the considered economy.

Namely, even if it would seem natural to expect that higher charges lower the emission volume, sometimes counterintuitive outcomes may be observed, especially in frameworks in which the aggregate pollution level is taken into account. A similar situation occurs for instance in Ganguli and Raju (2012), where a higher emission level may come as a consequence of increased charges in a Bertrand duopoly setting. Indeed, the framework in Ganguli and Raju (2012) encompasses strategic interactions between firms both on the demand side in the market and in regard to emissions in the environmental sphere. The latter aspect leads to a public good game setting, which may give rise to free riding possibilities. By contrast, we here prove that a similar detrimental effect occurs in the framework by Mamada and Perrings (2020), i.e., in the absence of strategic interactions, when goods are complements and the interdependence degree between them is high in absolute value. We stress that the relevance of the latter result is limited by the instability of the Nash equilibrium in the corresponding scenario, in the presence of the mechanism of gradual adjustment towards the best response considered in Mamada and Perrings (2020). In fact, the significance of the steady state should be further assessed by dealing with alternative adjustment mechanisms, such as the local monopolistic approximation introduced in Bischi et al. (2007) or the gradient rule discussed in Bischi et al. (2010). For brevity’s sake, we will limit ourselves to the consideration of the mechanism in Mamada and Perrings (2020), stressing however that the effect played by the introduction of differentiated goods and a nonlinear output adjustment rule in the framework by Mamada and Perrings (2020) has been recently analyzed in Matsumoto et al. (2022). On the other hand, in that work goods can be just substitutes, not complements, and the quadratic emission charges can only be convex, without the linear term considered in Mamada and Perrings (2020), so that the environmental policy is always effective in the setting by Matsumoto et al. (2022). Furthermore, the nonlinearity therein, being represented by output dependent factors that replace the constant adjustment coefficient in the best reply mechanism in Mamada and Perrings (2020), induces two boundary equilibria, in addition to the internal equilibrium corresponding to the one in Mamada and Perrings (2020). Moreover, Matsumoto et al. (2022) deal with the case in which marginal production costs do not coincide across firms and analyze, among other issues, the conditions for market transitions between duopoly and monopoly.

The remainder of the paper is organized as follows. In Sect. 2 we present the model with differentiated products, comparing it with the homogeneous product framework in Mamada and Perrings (2020). In Sect. 3 we analyze the model, focusing on substitutes in Subsection 3.1 and on complements in Subsection 3.2. In Sect. 4 we conclude.

2 The model

Following the duopoly formulation in Mamada and Perrings (2020), but supposing that the goods produced by the two firms are differentiated, we assume that in each time period t firm \(i\in \{1,2\}\) maximizes the profit function

where \(q_{i,t}\) and \(q_{j,t}\) are the output levels by firms i and j, respectively, with \(i\ne j\in \{1,2\}.\) For the chock price p and the production costs c we suppose that they are positive like in Mamada and Perrings (2020). In regard to \(\beta \) and \(\gamma ,\) as usual in the case of differentiated goods, we assume that the absolute value of \(\gamma \) is smaller than \(\beta :\) if \(\gamma >0\) (resp. \(\gamma <0\)) the two goods are substitutes (resp. complements), while they are independent if \(\gamma =0.\) We recall that the framework with homogeneous products is obtained as limit case with \(\gamma =\beta =k,\) where k is the price-depressing effect of oligopoly. Cf. Singh and Vives (1984); Motta (2004) for further details.

Denoting by \(\varepsilon >0\) emissions per unit output, so that \(u_{i,t}=\varepsilon q_{i,t}\) are emissions by firm \(i\in \{1,2\}\) at time t, Mamada and Perrings (2020) propose the following quadratic formulation for emission charges

with \(b>0\) and \(d\in {\mathbb {R}},\) that we will consider, too. Since the marginal emission charge is given by \(\frac{dC_{i,t}^e}{du_{i,t}}=b+du_{i,t},\) it holds that \(C_{i,t}^e\) may be increasing or decreasing according to the sign of d. In particular, if d is negative, the condition

is needed to guarantee the positivity of the marginal emission charge.

Like in Mamada and Perrings (2020), we assume that, due to an adjustment capacity constraint, firms modify the output level according to (the size and the extent of) the difference between their best response and their current output level with a reactivity parameter \(\lambda \in (0,1),\) so that

where \(R_i(q_j)\) is the best response function of firm i to the output \(q_j\) produced by firm j. Notice that there is no adjustment when \(\lambda =0,\) while adjustment is complete and instantaneous when \(\lambda =1.\) Although overadjustment, given by \(\lambda >1,\) is possible, Mamada and Perrings (2020) disregard such eventuality and in our analysis we will stick to their choice, too. Namely, following the suggestion in Mamada and Perrings (2020), we aim to compare their results with those obtainable in the more general (and realistic) case of differentiated goods. We also stress that the mechanism in (4) is just one of the possible adjustment rules. Suitable alternatives are indeed given by the nonlinear gradient rule first introduced in Bischi et al. (1999); Bischi and Naimzada (2000), as well as by the nonlinear mechanism recently proposed by Matsumoto et al. (2022). For dynamical aspects connected with oligopoly models, see Bischi et al. (2010).

From (1) it follows that

for \(i\ne j\in \{1,2\},\) and thus profits are strictly concave when

This condition is satisfied for every \(d\ge 0,\) in which case \(C_i^e\) in (2) is convex, for \(i\in \{1,2\},\) and for \(d\in \left( -\frac{2(\beta +c)}{{\varepsilon }^2},0\right] ,\) that is, when \(C_i^e\) is concave, but production variations lead to emission charge variations close to those that we would have in the linear case, corresponding to \(d=0.\) We will maintain assumption (6) along the manuscript, even when not explicitly mentioned. Moreover, setting \({\partial {\pi _{i,t}}}/{\partial q_{i,t}}=0,\) from (5) we find

as best response function for \(i\ne j\in \{1,2\},\) which is well defined under (6), so that the unique (symmetric) Nash equilibrium is given by

With homogeneous goods, the Nash equilibrium becomes

In order to ensure the positivity for (9), in Mamada and Perrings (2020) it is supposed that \(p>b\varepsilon \) and that \(3k+2c+d{\varepsilon }^2>0,\) since this is the only case compatible with (6) when goods are homogeneous. More generally, we will see in Subsection 3.1 that the unique scenario which may occur with substitutes is \(p>b\varepsilon \) and \(2(\beta +c)+d{\varepsilon }^2+\gamma >0,\) which extends the framework analyzed in Mamada and Perrings (2020). On the other hand, in Subsection 3.2 we will observe that with complements also the case \(p<b\varepsilon \) and \(2(\beta +c)+d{\varepsilon }^2+\gamma <0\) needs to be taken into account. We stress that all such conditions have to be considered jointly with (6), as well as with the constraints coming from (3) at the Nash equilibrium. For instance, notice that the Nash equilibrium in (9), for the homogeneous good setting, fulfills the right constraint in (3) if \(d\in \Bigl (-\frac{b(3k+2c)}{{\varepsilon }p},0\Bigr ).\) In Sect. 3, taking into account (3) and (6), we will derive similar conditions for the differentiated product case under the various assumptions on the parameters, analyzing also, when suitable, what happens in the limit case in which products are homogeneous.

Supposing that firms partially adjust their output level toward the best response according to (4) with \(\lambda \in (0,1),\) when inserting (7) therein we obtain the dynamical system

which coincides with the model (2) on page 373 in Mamada and Perrings (2020) for \(\gamma =\beta =k,\) and whose only steady state is given by the Nash equilibrium in (8). Indeed, with the dynamic decisional mechanisms considered in the literature (see Bischi et al. (2010) for a compendium), the Nash equilibrium is always one of the steady states of the discrete-time system generated by the introduced mechanism, but in general it is not the only one. For instance, in the case of the gradual best response rule in (4), it is immediate to check that the steady state is unique, while this is not true for its nonlinear counterpart in Matsumoto et al. (2022), with which, in addition to the internal equilibrium corresponding to (8), two boundary equilibria arise due to the presence of output dependent factors replacing the constant adjustment coefficients in (4).

3 Analysis

We split the analysis of the model described by (10) according to the sign of the parameter \(\gamma ,\) measuring the interdependence degree between goods, since the focus of the paper is on the static and dynamic effects produced by the extension of the setting in Mamada and Perrings (2020) to the case of differentiated goods. In particular, in Subsection 3.1 we consider what occurs when \(\gamma \) is non-negative and thus goods are substitutes or independent, while in Subsection 3.2 we focus on the scenario in which \(\gamma \) is negative and hence goods are complements. We stress that the homogeneous goods case is encompassed as limit case in the framework investigated in Subsection 3.1.

3.1 The case of substitutes

In the present subsection, we focus on the case \(\gamma \ge 0.\) Then, recalling (6), it holds that \(2(\beta +c)+d{\varepsilon }^2+\gamma >0,\) and thus, in order to ensure the positivity of the Nash equilibrium in (8), we need that

Under such conditions, we present our results about comparative statics (cf. Propositions 1 and 2 ) and about the model dynamics (see Proposition 3).

Proposition 1

When \(\gamma \ge 0,\) under (6) and (11), in regard to \(\left( q_{1}^{*},q_{2}^{*}\right) \) in (8) it holds that, for \(i\in \{1,2\},\) \(q_{i}^{*}\) decreases when b or d increase.

Proof

The desired conclusions immediately follow by observing that, with reference to (8), for \(i\in \{1,2\}\) it holds that

\(\square \)

A counterpart of Proposition 1, which highlights the efficacy from the static viewpoint, with substitutes and independent goods, of the environmental policy described by the emission charges in (2) under (6) and (11), holds true in the homogeneous product framework in Mamada and Perrings (2020) in regard to \(\left( \bar{q_{1}}^{*},\bar{q_{2}}^{*}\right) \) in (9).

Moreover, similar to the setting by Mamada and Perrings (2020), we have the following:

Proposition 2

When \(\gamma \ge 0,\) under (6) and (11), in regard to \(\left( q_{1}^{*},q_{2}^{*}\right) \) in (8) it holds that, for \(i\in \{1,2\},\) \(q_{i}^{*}\) decreases when \(\varepsilon \) increases.

Proof

Since for \(q_{i}^{*}\) as in (8), with \(i\in \{1,2\},\) it holds that

it is straightforward to conclude. \(\square \)

Hence, at the equilibrium we obtain, when \(\gamma \ge 0,\) under (6) and (11), a reduction in the production levels, and consequently in emissions, on raising parameter \(\varepsilon ,\) too. Noticing that an increase in the latter describes the transition for firms to more polluting technologies, the result in Proposition 2 may be seen as an indirect positive effect produced by the considered environmental policy.Footnote 2

In relation to the model dynamic behavior, the next result about the stability of the Nash equilibrium holds true:

Proposition 3

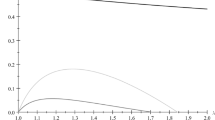

When \(\gamma \ge 0,\) under (6) and (11), \(\left( q_{1}^{*},q_{2}^{*}\right) \) is admissible according to (3) for \(d>-\frac{b(2\beta +2c+\gamma )}{{\varepsilon }p}.\) If this is the case, it is globally asymptotically stable for System (10) when \(d>-\frac{2\beta +2c-\gamma }{{\varepsilon ^2}}.\)

Proof

We investigate the system stability by using the well-known Jury conditions

where

is the Jacobian matrix for (10), and \(\det (J),\,\textrm{tr}(J)\) denote its determinant and trace, respectively.Footnote 3 Thus, we have \(\det (J)=1-2\lambda +\lambda ^2\Bigl (1-\frac{\gamma ^2}{(2(\beta +c)+d{\varepsilon }^2)^2}\Bigr )\) and \(\textrm{tr}(J)=2-2\lambda .\) Hence, (iii) reads as

Since \(\lambda \in (0,1),\) conditions (i) and (ii) are then always fulfilled. Condition (14) can be rewritten as \((2(\beta +c)+d{\varepsilon }^2-\gamma )(2(\beta +c)+d{\varepsilon }^2+\gamma )>0,\) which implies that \(2(\beta +c)+d{\varepsilon }^2-\gamma >0,\) since \(2(\beta +c)+d{\varepsilon }^2+\gamma >0\) under the maintained assumptions. Observing that in the considered case the conditions in (3) lead to \(d>-\frac{b(2\beta +2c+\gamma )}{{\varepsilon }p},\) the desired conclusion follows. \(\square \)

We stress that we have analyzed the system stability because a comparative statics result is economically grounded if it concerns an equilibrium which is asymptotically stable and thus orbits converge towards it after a transient period.

Considering the homogeneous product setting, the stability condition \(d>-\frac{2\beta +2c-\gamma }{{\varepsilon ^2}},\) found in Proposition 3, becomes \(d>-\frac{k+2c}{{\varepsilon }^2}\) in agreement with the result on page 374 in Mamada and Perrings (2020), which highlights the stabilizing role of d on \(\left( \bar{q_{1}}^{*},\bar{q_{2}}^{*}\right) \) in (9). Together with the constraints coming from (3) discussed in Sect. 2, we can conclude that \(\left( \bar{q_{1}}^{*},\bar{q_{2}}^{*}\right) \) in (9) is stable and admissible for \(d>\max \{-\frac{b(3k+2c)}{{\varepsilon }p},-\frac{k+2c}{{\varepsilon }^2}\}.\) Notice that \(-\frac{b(3k+2c)}{{\varepsilon }p}>-\frac{k+2c}{{\varepsilon }^2}\) for \(b\varepsilon <p\,\bigl (\frac{k+2c}{3k+2c}\bigr ),\) in which case the Nash equilibrium is always stable when it is admissible according to (3). More generally, in the case of differentiated products, it holds that the stability threshold \(d^{*}:=-\frac{2\beta +2c-\gamma }{{\varepsilon ^2}}\) is lower than the admissibility threshold \(\widetilde{d}:=-\frac{b(2\beta +2c+\gamma )}{{\varepsilon }p}\) coming from (3) when \(b\varepsilon <p\,\bigl (\frac{2\beta +2c-\gamma }{2\beta +2c+\gamma }\bigr ).\) Under (11), the latter condition can possibly be fulfilled when the two products are substitutes, while it is granted in the case of independent goods. In such positive eventualities, the comparative statics results reported in Proposition 1, which show that the environmental policy described by the emission charges in (2) is effective in reducing pollution under (11), are robustly grounded from an economic viewpoint, since the Nash equilibrium is a global attractor. When instead the stability threshold \(d^{*}\) is larger than the admissibility threshold \({\widetilde{d}}\) coming from (3), then Proposition 1 is robustly economically grounded for \(d>-\frac{2\beta +2c-\gamma }{{\varepsilon ^2}}.\)

Summarizing, we can say that in the case of substitutes the considered environmental policy is always effective from the static viewpoint. From a dynamic perspective, Proposition 3, which supports the comparative statics results obtained in Proposition 1, shows that when d is large enough, i.e., when the policy intensity degree is sufficiently high, orbits converge towards the steady state after a transient period. When the convergence is reached, raising d further leads to a decrease in emissions and to a full efficacy of the environmental policy. In particular, since for \(b\varepsilon <p\,\bigl (\frac{2\beta +2c-\gamma }{2\beta +2c+\gamma }\bigr )\) it holds that the Nash equilibrium is always stable anytime it is admissible according to (3), we notice that such condition is more easily verified for small non-negative values of the interdependence degree between goods,Footnote 4 as the term on the right-hand side is decreasing in \(\gamma .\) Indeed, it is granted in the case of independent goods under (11). Hence, within the framework of substitutes, the case of homogeneous goods, analyzed in Mamada and Perrings (2020), turns out to be the less favorable to assess the efficacy of the considered environmental policy, due to the reduced equilibrium stability interval. On the other hand, as we shall see in the next subsection, with complements much worse situations can occur when the interdependence degree between goods is high in absolute value (cf. Propositions 7 and 9).

3.2 The case of complements

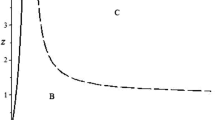

In the present subsection, we deal with the case \(\gamma <0.\) Accordingly, under (6), two different scenarios ensure the positivity of the Nash equilibrium in (8), i.e.,

and

The former scenario, in which (6) is granted, leads to findings similar to, but in regard to dynamics not coinciding with, those described in Sect. 3.1. Namely, recalling (12), the following result about comparative statics holds true.

Proposition 4

When \(\gamma <0,\) under (15), in regard to \(\left( q_{1}^{*},q_{2}^{*}\right) \) in (8) it holds that, for \(i\in \{1,2\},\) \(q_{i}^{*}\) decreases when b or d increase.

Hence, like it happened in Proposition 1 the environmental policy described by the emission charges in (2) is still effective, from the static viewpoint, in reducing pollution when dealing with complements under (15), i.e., when the interdependence degree between the two goods is low in absolute value. Moreover, under the same assumptions, from (13) we find the next result, analogous to Proposition 2, which shows that a reduction in the production levels, and consequently in emissions, is obtained when firms move toward more polluting technologies:

Proposition 5

When \(\gamma <0,\) under (15), in regard to \(\left( q_{1}^{*},q_{2}^{*}\right) \) in (8) it holds that, for \(i\in \{1,2\},\) \(q_{i}^{*}\) decreases when \(\varepsilon \) increases.

On the other hand, still dealing with complements under (15), in regard to the system dynamic behavior we have an even better situation than that described in Proposition 3, as the following result shows.

Proposition 6

When \(\gamma <0,\) under (15), \(\left( q_{1}^{*},q_{2}^{*}\right) \) is admissible according to (3) for \(d>-\frac{b(2\beta +2c+\gamma )}{{\varepsilon }p}.\) If this is the case, it is always globally asymptotically stable for System (10).

Proof

Following the same steps in the proof of Proposition 3, we find that, for \(\gamma <0,\) under (15), \(\left( q_{1}^{*},q_{2}^{*}\right) \) is globally asymptotically stable for System (10) when \(d>-\frac{2\beta +2c-\gamma }{{\varepsilon ^2}}.\) Such condition is granted under (15). \(\square \)

Thus, the equilibrium is always stable when it is admissible in the case of complements under (15), and the full efficacy of the considered environmental policy holds true, like in the case of independent goods.

Dealing instead with (16), i.e., when the interdependence degree between the two goods is high in absolute value, since the partial derivatives in (12) are now positive, the considered environmental policy produces detrimental effects. Namely, pollution increases at the Nash equilibrium when emission charges raise, as highlighted by the following:

Proposition 7

Under (6) and (16), in regard to \(\left( q_{1}^{*},q_{2}^{*}\right) \) in (8), it holds that, for \(i\in \{1,2\},\) \(q_{i}^{*}\) increases when b or d increase.

Recalling that \(\gamma \in (-\beta ,0)\) in the case of complements, it holds that (16) can be fulfilled just for negative values of d, in which case \(C_i^e\) in (2) is concave. We can then rephrase Proposition 7 by saying that we have proven the inefficacy, from the static viewpoint, of the environmental policy described by the emission charges \(C_i^e\) in (2), for suitable parameter configurations in which \(C_i^e\) is concave and emission charges increase too slowly with production. Furthermore, observing that, for the same parameter configurations, the partial derivative in (13) is positive as well, we can add that at the equilibrium pollution increases, because of a raise in the production levels, when emissions per unit output grow, as the next result illustrates:

Proposition 8

Under (6) and (16), in regard to \(\left( q_{1}^{*},q_{2}^{*}\right) \) in (8), it holds that, for \(i\in \{1,2\},\) \(q_{i}^{*}\) increases when \(\varepsilon \) increases.

Also in relation to the model dynamic outcomes, things drastically change when assuming (16). Indeed, the following result holds true.

Proposition 9

Under (6) and (16), \(\left( q_{1}^{*},q_{2}^{*}\right) \) is admissible according to (3) for \(d<-\frac{b(2\beta +2c+\gamma )}{{\varepsilon }p}.\) If this is the case, it is always unstable for System (10).

Proof

The proof is based on similar steps to those used to check Proposition 3. In particular, from (14) we would obtain the stability condition \(d<-\frac{2\beta +2c-\gamma }{{\varepsilon ^2}},\) which however contradicts (6) since we are supposing that \(\gamma \) is negative.

The admissibility condition \(d<-\frac{b(2\beta +2c+\gamma )}{{\varepsilon }p}\) follows from (3). \(\square \)

Notice that the assumptions in Proposition 9 are jointly fulfilled for \(d\in \bigl (-\frac{(2\beta +2c)}{{\varepsilon }^2},-\frac{b(2\beta +2c+\gamma )}{{\varepsilon }p}\bigr ),\) interval that may be empty for each value of \(\gamma \in (-\beta ,0),\) in which case the equilibrium is never admissible,Footnote 5 like it happens, e.g., when parameter p, that is an index of the market size, is too low.

To sum up, in the case of complements two opposite situations occur, both in regard to the static efficacy of the environmental policy and the dynamic behavior of the system, according to the interdependence degree between goods. When the latter is low in absolute value, we observe a full efficacy of the considered environmental policy, since it makes pollution decrease at the Nash equilibrium, which is stable anytime it is admissible; on the contrary, if the interdependence degree between goods is high in absolute value, when emission charges raise pollution increases at the Nash equilibrium, that is however never stable when admissible. Indeed, the relevance of the comparative statics result in Proposition 7 is limited by Proposition 9, which highlights the instability of the Nash equilibrium in the corresponding scenario, in the presence of the mechanism of gradual adjustment towards the best response considered in Mamada and Perrings (2020). On the other hand, the significance of the steady state should be further assessed by dealing with various adjustment mechanisms that would still make the model dynamic in nature, such as the local monopolistic approximation introduced in Bischi et al. (2007) or the gradient rule discussed in Bischi et al. (2010). We restricted ourselves to considering the mechanism in Mamada and Perrings (2020) since, following the suggestion therein, our aim was to compare the results contained in that paper with those obtainable in the more general and realistic case of differentiated goods.

4 Conclusions

In the present work we have shown the richness in the static and dynamic outcomes arising when replacing homogeneous goods with differentiated products in the dynamic Cournot duopoly framework with emission charges on output by Mamada and Perrings (2020), following the suggestion contained in their concluding remarks.

In more detail, we found that the full efficacy of the environmental policy considered therein, according to which each firm is taxed proportionally to its own emission only and charge functions are quadratic, is achieved in the case of independent goods, as well as with a low interdependence degree between products in absolute value, independently of being substitutes or complements. Namely, in such cases on raising emission charges pollution decreases at the only steady state, coinciding with the Nash equilibrium, which is globally asymptotically stable anytime it is admissible, i.e., anytime it guarantees the positivity of the marginal emission charge. On the other hand, when goods are substitutes and their interdependence degree is high, the considered environmental policy is still able to reduce pollution at the equilibrium, but the latter is stable just for a large enough policy intensity degree. When instead goods are complements and the interdependence degree between them is high in absolute value, the examined environmental policy produces a detrimental effect on the equilibrium pollution level, which increases.

The latter result highlights that, from the static viewpoint, even in the absence of free riding possibilities, the choice of the mechanism to implement has to be carefully pondered, according to the features of the analyzed economy. We stress that the relevance of such finding is limited by the instability, in the presence of the mechanism of gradual adjustment towards the best response considered in Mamada and Perrings (2020), of the Nash equilibrium in the corresponding scenario. However, instabilities can in some contexts give rise to chaotic dynamics, similar to those observed in the time series of good prices and exchanged quantities in real-world markets, especially in relation to agricultural commodities. In particular, a growing empirical and experimental literature [see, e.g., Arango and Moxnes (2012); Chatrath et al. (2002); Gouel (2012); Huffaker et al. (2018)] suggests that the therein identified dynamic phenomena may be explained in terms of the endogenous fluctuations generated by the presence of nonlinearities. Accordingly, in order to provide a more accurate description of real-world markets, some forms of nonlinearities should be introduced in the model, so as to guarantee that it is able to produce interesting, non-divergent dynamic outcomes. We will investigate the efficacy of the environmental policy in such more realistic settings in a future research work, also in view of testing the robustness of the here obtained results. For instance, the model would become nonlinear by introducing an evolutive approach, in the form, e.g., of the replicator rule in Taylor and Jonker (1978) or of the discrete choice model in Brock and Hommes (1997) to represent the share updating mechanism. Such a model modification would allow to describe the transition among different market structures based on relative profitability of markets and thus on the decision for firms to remain in a given market or to leave it. In this way, the kind of achieved market structure would depend not only on what occurs inside the single market, but it would rather be determined by the features of other markets, too, in a wider perspective.

We recall that Mamada and Perrings (2020) deal with the issue of the market structure endogeneity, focusing in particular on the conditions that may lead from duopoly to monopoly, investigated also in Matsumoto et al. (2022) under the assumption that marginal production costs do not coincide across firms. An alternative approach to the problem of the market structure endogeneity could be evolutive in nature, with firms deciding whether to operate or not in a given market on the basis of a profitability signal, such as the comparison between the profitability of the market with respect to the average profitability of other markets. In this manner the number of firms operating in a market would become an endogenous variable. Such solution would allow to more generally investigate the conditions which lead, possibly in a reversible manner, from a market structure to another one. We refer, e.g., to Antoci et al. (2020, 2022) for an evolutive approach to the description of the interactions between the economic and environmental sectors.

A different, natural, extension of our model, suggested by one of the Reviewers, could be obtained by assuming that emissions per unit output do not coincide across firms, as recently done, e.g., by Matsumoto and Szidarovszky (2022) in a homogeneous good framework with non-point source (NPS) pollution. Namely, considering firm-specific emissions per unit output is sensible both when firms produce differentiated goods, as it happens in the framework we analyzed along the manuscript, and when they produce the same good by means of distinct technologies, like in Matsumoto and Szidarovszky (2022). In particular, following Zeppini (2015), where a discrete choice model of sustainable transitions from dirty to clean technologies is proposed, the latter context would become evolutive when supposing that firms can choose between a dirty technology, characterized by high emissions per unit output, and a clean technology, characterized by low emissions per unit output, according to the relative profitability of the two production methods.

Notes

We recall that the consideration of homogeneous goods is just a limit case, theoretical in nature, which does not take place in real-world markets. Namely, even when goods, both from a physical and a functional viewpoint, look identical, they are always perceived as differentiated by consumers, e.g., due to advertising. See in this respect (Schmalensee 1986, 1972).

Since the focus of the paper is on the static and dynamic implications, in the presence of differentiated goods, of the environmental policy scheme introduced by Mamada and Perrings (2020), after Proposition 3 we will comment just on the comparative statics results contained in Proposition 1, without mentioning Proposition 2. The same remark applies to Subsection 3.2, where the dynamic results in Propositions 6 and 9 will be discussed together with the comparative statics results contained in Propositions 4 and 7 only, without making reference to Propositions 5 and 8.

Notice that, differently from d, parameter b plays no role on the stability of the Nash equilibrium, being not present in J.

According to Proposition 6, a similar phenomenon holds true in the case of complements with a low interdependence degree in absolute value.

References

Antoci, A., Borghesi, S., Iannucci, G., et al.: Emission permits, innovation and sanction in an evolutionary game. Econ. Polit. J. Anal. Inst. Econ. 37, 525–546 (2020)

Antoci, A., Borghesi, S., Iannucci, G., et al.: Free allocation of emission permits to reduce carbon leakage: an evolutionary approach. In: Jakob, M. (ed.) Handbook on Trade Policy and Climate Change, pp. 76–93. Edward Elgar Publishing, Cheltenham (2022)

Arango, S., Moxnes, E.: Commodity cycles, a function of market complexity? Extending the cobweb experiment. J. Econ. Behav. Organ. 84, 321–334 (2012)

Bischi, G.I., Naimzada, A.: Global analysis of a duopoly game with bounded rationality. In: Filar, J.A., Gaitsgory, V., Mizukami, K. (eds.) Advances in Dynamic Games and Applications. Annals of the International Society of Dynamic Games, vol. 5, pp. 361–385. Birkhaeuser, Boston (2000)

Bischi, G.I., Gallegati, M., Naimzada, A.: Symmetry-breaking bifurcations and representative firm in dynamic duopoly games. Ann. Oper. Res. 89, 253–272 (1999)

Bischi, G.I., Naimzada, A.K., Sbragia, L.: Oligopoly games with local monopolistic approximation. J. Econ. Behav. Organ. 62, 371–388 (2007)

Bischi, G.I., Chiarella, C., Kopel, M., et al.: Nonlinear Oligopolies. Stability and Bifurcations, Springer-Verlag, Berlin (2010)

Brock, W.A., Hommes, C.H.: A rational route to randomness. Econometrica 65, 1059–1095 (1997)

Chatrath, A., Adrangi, B., Dhanda, K.K.: Are commodity prices chaotic? Agric. Econ. 27, 123–137 (2002)

Ganguli, S., Raju, S.: Perverse environmental effects of ambient charges in a Bertrand duopoly. J. Environ. Econ. Policy 1, 1–8 (2012)

Gouel, C.: Agricultural price instability: A survey of competing explanations and remedies. J. Econ. Surv. 26, 129–156 (2012)

Huffaker, R., Canavari, M., Muñoz Carpena, R.: Distinguishing between endogenous and exogenous price volatility in food security assessment: An empirical nonlinear dynamics approach. Agric. Syst. 160, 98–109 (2018)

Katsoulacos, Y., Xepapadeas, A.: Environmental policy under oligopoly with endogenous market structure. Scand. J. Econ. 97, 411–420 (1995)

Mamada, R., Perrings, C.: The effect of emission charges on output and emissions in dynamic Cournot duopoly. Econ. Anal. Policy 66, 370–380 (2020)

Matsumoto, A., Nonaka, Y., Szidarovszky, F.: Emission charge controllability in Cournot duopoly: Static and dynamic effects. J. Differ. Equ. Appl. 28, 1282–1307 (2022)

Matsumoto, A., Szidarovszky, F.: Controlling non-point source pollution in Cournot oligopolies with hyperbolic demand. SN Bus. Econ. 2021, 1–38 (2021)

Matsumoto, A., Szidarovszky, F.: N-firm oligopolies with pollution control and random profits. Asia Pac. J. Reg. Sci. 6, 1017–1039 (2022)

Matsumoto, A., Szidarovszky, F., Takizawa, H.: Extended oligopolies with pollution penalties and rewards. Discrete Dyn. Nat. Soc. (2018). https://doi.org/10.1155/2018/7861432

Matsumoto, A., Szidarovszky, F., Yabuta, M.: Environmental effects of ambient charge in Cournot oligopoly. J. Environ. Econ. Policy 7, 41–56 (2018)

Motta, M.: Competition Policy: Theory and Practice. Cambridge University Press, Cambridge (2004)

Schmalensee, R.: The Economics of Advertising. North-Holland Publishing Company, Amsterdam (1972)

Schmalensee, R.: Advertising and market structure. In: Stiglitz, J.E., Mathewson, G.F. (eds.) New Developments in the Analysis of Market Structure. International Economic Association Series, vol. 77, pp. 373–398. Palgrave Macmillan, London (1986)

Segerson, K.: Uncertainty and incentives for nonpoint pollution control. J. Environ. Econ. Manag. 15, 87–98 (1988)

Singh, N., Vives, X.: Price and quantity competition in a differentiated duopoly. Rand J. Econ. 15, 546–554 (1984)

Suter, J.F., Vossler, C.A., Poe, G.L., et al.: Experiments on damage-based ambient taxes for nonpoint source polluters. Am. J. Agric. Econ. 90, 86–102 (2008)

Taylor, P.D., Jonker, L.B.: Evolutionarily stable strategies and game dynamics. Math. Biosci. 40, 145–156 (1978)

Zeppini, P.: A discrete choice model of transitions to sustainable technologies. J. Econ. Behav. Organ. 112, 187–203 (2015)

Funding

Open access funding provided by Università degli Studi di Milano - Bicocca within the CRUI-CARE Agreement. No funds, grants, or other support was received.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Human or Animal Rights

Not applicable.

Informed consent

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Naimzada, A., Pireddu, M. Differentiated goods in a dynamic Cournot duopoly with emission charges on output. Decisions Econ Finan 46, 305–318 (2023). https://doi.org/10.1007/s10203-023-00387-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-023-00387-0

Keywords

- Dynamic Cournot duopoly

- Differentiated products

- Emission charges

- Pollution control

- Comparative statics

- Global asymptotic stability