Abstract

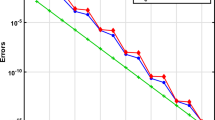

In this paper, we propose the application of third-order semi-discrete central-upwind conservative schemes to option pricing partial differential equations (PDEs). Our method is a high-order extension of the recent efficient second-order “Black-Box” schemes that successfully priced several option pricing problems. We consider the Kurganov–Levy scheme and its extensions, namely the Kurganov–Noelle–Petrova and the Kolb schemes. These “Black-Box” solvers ensure non-oscillatory property and achieve desired accuracy using a third-order central weighted essentially non-oscillatory (CWENO) reconstruction. We compare the schemes using a European test case and observe that the Kolb scheme performs better. We apply the Kolb scheme to one-dimensional butterfly, barrier, American and non-linear options under the Black–Scholes model. Further, we extend the Kurganov–Levy scheme to solve two-dimensional convection-dominated Asian PDE. We also price American options under the constant elasticity of variance (CEV) model, which treats volatility as a stochastic instead of a constant as in Black–Scholes model. Numerical experiments achieve third-order, non-oscillatory and high-resolution solutions.

Similar content being viewed by others

References

Andersen, L., Andreasen, J.: Jump-diffusion processes: volatility smile fitting and numerical methods for option pricing. Rev. Deriv. Res. 4, 231–262 (2000)

Balbas, J., Tadmor, E.: Centpack: a package of high-resolution central schemes for nonlinear conservation laws and related problems. http://www.cscamm.umd.edu/centpack/

Barraquand, J., Pudet, T.: Pricing of American path-dependent contingent claims. Math. Financ. 6, 17–51 (1996)

Bhatoo, O., Peer, A.A.I., Tadmor, E., Tangman, D.Y., Saib, A.A.E.F.: Efficient conservative second-order central-upwind schemes for option-pricing problems. J. Comput. Financ. 22, 71–101 (2019)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Politi. Econ. 81, 637–654 (1973)

Cox, J.C.: Notes on option pricing I: constant elasticity of variance diffusions. Unpublished note, Stanford University Graduate School of Business (1975)

Hajipour, M., Malek, A.: Efficient high-order numerical methods for pricing of options. Comput. Econ. 45, 31–47 (2015)

Hajipour, M., Malek, A.: High accurate modified WENO method for the solution of Black–Scholes equation. Comput. Appl. Math. 34, 125–140 (2015)

Jiang, G.S., Levy, D., Lin, C.T., Osher, S., Tadmor, E.: High-resolution nonoscillatory central schemes with nonstaggered grids for hyperbolic conservation laws. SIAM J. Numer. Anal. 35, 2147–2168 (1998)

Jiang, G.S., Shu, C.W.: Efficient implementation of weighted ENO schemes. J. Comput. Phys. 126, 202–228 (1996)

Kolb, O.: On the full and global accuracy of a compact third order WENO scheme. SIAM J. Numer. Anal. 52, 2335–2355 (2014)

Kurganov, A., Levy, D.: A third-order semidiscrete central scheme for conservation laws and convection-diffusion equations. SIAM J. Sci. Comput. 22, 1461–1488 (2000)

Kurganov, A., Noelle, S., Petrova, G.: Semi-discrete central-upwind schemes for hyperbolic conservation laws and Hamilton–Jacobi equations. SIAM J. Sci. Comput. 23, 707–740 (2001)

Kurganov, A., Tadmor, E.: New high-resolution central schemes for nonlinear conservation laws and convection-diffusion equations. J. Comput. Phys. 160, 241–282 (2000)

Leisen, D., Reimer, M.: Binomial models for option valuation - examining and improving convergence. Appl. Math. Financ. 3, 319–346 (1996)

Levy, D., Puppo, G., Russo, G.: Central WENO schemes for hyperbolic systems of conservation laws. Math. Model. Numer. Anal. 33, 547–571 (1999)

Levy, D., Puppo, G., Russo, G.: Compact central WENO schemes for multidimensional conservation laws. SIAM J. Sci. Comput. 22, 656–672 (2000)

Liu, X.D., Tadmor, E.: Third order nonoscillatory central scheme for hyperbolic conservation laws. Numer. Math. 79, 397–425 (1998)

Lu, R., Hsu, Y.H.: Valuation of standard options under the constant elasticity of variance model. Int. J. Bus. Econ. 4, 157–165 (2005)

Medovikov, A.A.: High order explicit methods for parabolic equations. BIT Numer Math. 38, 372–390 (1998)

Merton, R.C.: Theory of rational option pricing. Bell. J. Econ. Manag. Sci. 4, 141–183 (1973)

Oosterlee, C.W., Frisch, J.C., Gaspar, F.J.: TVD, WENO and blended BDF discretizations for Asian options. Comput. Visual. Sci. 6, 131–138 (2004)

Ramírez-Espinoza, G.I., Ehrhardt, M.: Conservative and finite volume methods for the convection-dominated pricing problem. Adv. Appl. Math. Mech. 5, 759–790 (2013)

Shampine, L.F., Reichelt, M.W.: The MATLAB ODE suite. SIAM J. Sci. Comput. 18, 1–22 (1997)

Shu, C.W., Osher, S.: Efficient implementation of essentially non-oscillatory shock-capturing schemes. J. Comput. Phys. 77, 439–471 (1988)

von Sydow, L., Höök, L.J., Larsson, E., Lindström, E., Milovanović, S., Persson, J., Shcherbakov, V., Shpolyanskiy, Y., Sirén, S., Toivanen, J., Waldén, J., Wiktorsson, M., Levesley, J., Li, J., Oosterlee, C.W., Ruijter, M.J., Toropov, A., Zhao, Y.: BENCHOP – the BENCH marking project in option pricing. Int. J. Comput. Math. 92, 2361–2379 (2015)

Tangman, D.Y., Gopaul, A., Bhuruth, M.: A fast high-order finite difference algorithm for pricing American options. J. Comput. Appl. Math. 222, 17–29 (2008)

Windcliff, H., Wang, J., Forsyth, P.A., Vetzal, K.R.: Hedging with a correlated asset: solution of a nonlinear pricing PDE. J. Comput. Appl. Math. 200, 86–115 (2007)

Wong, H.Y., Zhao, J.: An artificial boundary method for American option pricing under the CEV model. SIAM J. Numer. Anal. 46, 2183–2209 (2008)

Zvan, R., Forsyth, P.A., Vetzal, K.R.: Robust numerical methods for PDE models of Asian options. J. Comput. Financ. 1, 39–78 (1997)

Acknowledgements

The research of O. Bhatoo was supported by a postgraduate research scholarship from the Tertiary Education Commission. The work of E. Tadmor was supported in part by ONR grant N00014-1812465 and NSF grants RNMS11-07444 (Ki-Net) and DMS-1613911.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Bhatoo, O., Peer, A.A.I., Tadmor, E. et al. Conservative Third-Order Central-Upwind Schemes for Option Pricing Problems. Vietnam J. Math. 47, 813–833 (2019). https://doi.org/10.1007/s10013-019-00360-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10013-019-00360-8

Keywords

- Conservative central-upwind schemes

- CWENO reconstruction

- Black–Scholes PDEs

- Non-linear PDE

- Two-dimensional PDE

- CEV model