Abstract

Most R&D-based growth models fail to explicitly account for the role of entrepreneurs in economic growth. By contrast, this study accounts for this factor and constructs an overlapping-generations model that includes entrepreneurial innovation and the occupational choice of becoming an entrepreneur or a worker. For the role of entrepreneurs, even a policy intended to encourage innovation can negatively affect economic growth. For the effect of such policies, I focus on the role of R&D subsidies. I show that while R&D subsidies promote entrepreneurs’ R&D activities, they increase workers’ wages by boosting labor demand. Thus, it is more attractive to be a worker, which reduces the number of entrepreneurs. Subsidies can have both a negative and positive effect on growth, which results in an inverted U-shaped relationship between R&D subsidies and growth. In addition, a growth-maximizing R&D subsidy rate exists, although this rate is too high to maximize the welfare level of any one generation. When individuals are heterogeneous in their abilities, R&D subsidies reduce intra-generational inequalities.

Similar content being viewed by others

Notes

Typically, youths in period t are called generation t because they are born in period t. In this paper, however, adults in period t who are born in period \(t-1\) are called generation t for simplicity of notation.

Stokey et al. (1989) and Glomm and Ravikumar (2003) also assume that individuals live for two periods and receive (dis)utilities from leisure/labor in the first period of their lives and consumption in the second period of their lives. The assumption that individuals consume in only the last period of their lives is also made by John and Pecchenino (1994) and Futagami and Ishiguro (2004).

Skilled individuals can also become workers instead of entrepreneurs. However, in the equilibrium, everyone chooses to become an entrepreneur.

In Sect. 4, I develop the model to include ex ante heterogeneity and show that qualitative results remain unchanged.

In addition to the labor market, there is a final goods market and several intermediate goods markets. Each intermediate goods market is cleared because the intermediate goods firms’ behavior accounts for the goods’ demand. Moreover, if the labor market is cleared, the final goods market is also cleared following Walras’ Law.

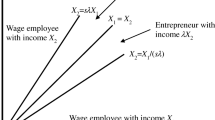

This condition can be interpreted as a Nash equilibrium where each young individual chooses his/her future occupation given others’ choice, and no one wants to change his/her choice. In García-Peñalosa and Wen (2008), Jiang et al. (2010), and Poschke (2013), there are similar conditions where agents choose their occupation to maximize their utility with an expectation or perfect foresight of future income.

Peretto (1998), Peretto and Smulders (2002), Peretto and Connolly (2007), and Grossmann (2007) note that there is no scale effect of population size on growth if the knowledge aggregator does not rise with the number of sectors/goods. In this paper, the scale effect is removed in a slightly different way in which the knowledge aggregator rises with the number of goods given the population size. The knowledge aggregator depends on the ratio of entrepreneurs to the working population. Given the population size, the ratio rises with the number of goods, which is, however, proportional to the population size. Therefore, the ratio is independent of the population size as is the knowledge aggregator and the growth rate.

If I consider alternative methods of taxation, the results vary slightly. For example, assume that the government imposes a corporate tax on firms’ profits. Then, firms do not change their behaviors, but the tax makes it less attractive to be an entrepreneur because it reduces entrepreneurial income. An increase in the R&D subsidy rate decreases the number of entrepreneurs through an increment in the tax rate, which is another negative effect. For this new effect, the growth-maximizing subsidy rate is less than \(\hat{\mu }\).

It may be more natural to assume that individuals know their ability after they have invested time in training. It can be considered that all individuals receive some primary education before they decide whether to train to become entrepreneurs or not, and they learn their own entrepreneurial abilities, \(\theta \), through primary education. The cost of a primary education is normalized to zero. Various reasons why all individuals receive primary education can be considered, such as because of the necessary for assuming a role as a worker as well as an entrepreneur, because the costs are minimal, or because of some institutional reasons.

I appreciate one of the referees noting this.

For example, as mentioned above, Kihlstrom and Laffont (1979) highlight three factors that determine occupational choice between entrepreneurs and workers; entrepreneurial ability versus labor skills, access to capital markets, and individual risk attitude. This paper only focuses on the first factor because of abstraction of capital accumulation and entrepreneurial risk.

References

Acemoglu D, Akcigit U (2012) Intellectual property rights policy, competition and innovation. J Eur Econ Assoc 10(1):1–42

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Banerjee AV, Newman AF (1993) Occupational choice and the process of development. J Polit Econ 101(2):274–298

Becker B (2015) Public R&d policies and private R&D investment: a survey of the empirical evidence. J Econ Surv 29(5):917–942

Bernard AB, Eaton J, abd Samuel Kortum JBJ (2003) Plants and productivity in international trade. Am Econ Rev 93(4):1268–1290

Bernard AB, Redding SJ, Schott PK (2007) Comparative advantage and heterogeneous firms. Rev Econ Stud 74:31–66

Cagetti M, De Nardi M (2006) Entrepreneurship, frictions, and wealth. J Polit Econ 114(5):835–870

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67(3):297–308

Futagami K, Ishiguro S (2004) Signal-extracting education in an overlapping generations model. Econ Theory 24(1):129–146

García-Peñalosa C, Wen JF (2008) Redistribution and entrepreneurship with schumpeterian growth. J Econ Growth 13:57–80

Glomm G, Ravikumar B (2003) Public education and income inequality. Eur J Polit Econ 19(2):289–300

Goolsbee A (1998) Does government R&D policy mainly benefit scientists and engineers? Am Econ Rev 88(2):298–302

Grossmann V (2007) How to promote R&D based growth? public education expenditure on scientists and engineers versus R&D subsidies. J Macroecon 29:891–911

Grossmann V (2009) Entrepreneurial innovation and economic growth. J Macroecon 31:602–613

Grossman GM, Helpman E (1991) Innovation and growth in the global economy. MIT Press, Boston

Grossmann V, Steger T, Trimborn T (2013) Dynamically optimal R&D subsidization. J. Econ Dyn Control 37(3):516–534

Grossmann V, Steger T, Trimborn T (2016) Quantifying optimal growth policy. J Public Econ Theory 18(3):451–485

Impullitti G (2010) International competition and U.S. R&D subsidies: a quantitative welfare analysis. Int Econ Rev 51(4):1127–1158

Jaimovich N, Rebelo S (2012) Non-linear effects on taxation on growth, nBER Working paper

Jiang N, Wang P, Wu H (2010) Ability-heterogeneity, entrepreneurship, and economic growth. J Econ Dyn Control 34:522–541

John A, Pecchenino R (1994) An overlapping generations model of growth and the environment. Econ J 104(427):1393–1410

Jones CI (1995) Time series tests of endogenous growth models. Q J Econ 110(2):495–525

Keuschnigg C (2004) Venture capital backed growth. J Econ Growth 9:239–261

Kihlstrom RE, Laffont JJ (1979) A general equilibrium entrepreneurial theory of firm formation based on risk aversion. J Polit Econ 87(4):719–748

Kortum S (1993) Equilibrium R&D and the patent–R&D ratio: U.S. evidence. Am Econ Rev Pap Proc 83(2):450–457

Lazear EP (2005) Entrepreneurship. J Labor Econ 23(4):649–680

Lloyd-Ellis H, Bernhardt D (2000) Enterprise, inequality and economic development. Rev Econ Stud 67:147–168

Lucas RE (1978) On the size distribution of business firms. Bell J Econ 9(2):508–523

Peretto PF (1996) Sunk costs, market structure, and growth. Int Econ Rev 37(4):895–923

Peretto PF (1998) Technological change and population growth. J Econ Growth 3:283–311

Peretto PF (1999) Firm size, rivalry and the extent of the market in endogenous technological change. Eur Econ Rev 43:1747–1773

Peretto PF (2007) Corporate taxes, growth and welfare in a schumpeterian economy. J Econ Theory 137:353–382

Peretto PF, Smulders S (2002) Technological distance, growth and scale effects. Econ J 112:603–624

Peretto PF, Connolly M (2007) The manhattan metaphor. J Econ Growth 12:329–350

Poschke M (2013) Who becomes an entrepreneur? labor market prospects and occupational choice. J Econ Dyn Control 37:693–710

Reynolds PD, Bygrave WD, Autio E, Cox LW, Hay M (2002) Global entrepreneurship monitor 2002 executive report. Kaufman Center, Kansas City

Romer PM (1990) Endogenous technological change. J Polit Econ 98(5):71–102

Schmitz JA (1989) Imitation, entrepreneurship, and long-run growth. J Polit Econ 97(3):721–739

Şener F (2008) R&d policies, endogenous growth and scale effects. J Econ Dyn Control 32(12):3895–3916

Stokey NL, Lucas RE, Prescott EC (1989) Recursive methods in economic dynamics. Harvard University Press, Cambridge

van Stel A, Carree M, Thurik R (2004) The effect of entrepreneurship on national economic growth: an analysis using the gem database. SCALES paper N200320

Wong PK, Ho YP, Autio E (2005) Entrepreneurship, innovation and economic growth: evidence from gem data. Small Bus. Econ. 24:335–350

Young A (1998) Growth without scale effects. J Polit Econ 106(1):41–63

Acknowledgements

During this study, I interacted with several individuals and their knowledge and ideas have significantly contributed to the analysis. In particular, I thank Koichi Futagami, Tatsuro Iwaisako, Kazuhiro Yamamoto, Real Arai, Keisuke Kawata, and Ken Tabata for their helpful comments and suggestions. I also thank the seminar participants at the Hiroshima University, the 2014 Spring Annual Meetings of the Japanese Economic Association at the Doshisha University, and the 15th International Meeting of the Association for Public Economic Theory University at the University of Luxembourg. I would also like to thank two anonymous referees for their valuable comments. I acknowledge financial support from the Grant-in-Aid for JSPS Fellows of the Japan Society for the Promotion of Science No. JP15J04580

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Intermediate goods firms’ problems

There are two steps in the intermediate goods firms’ problem. First, the intermediate goods firms invest in R&D activities and then produce intermediate goods. I solve the problems backward. In the second step, I maximize an intermediate goods firm’s profit from production, given its productivity and R&D outlay. Then, I go back to the first step and decide how much the intermediate goods firm should invest in R&D activities.

The jth intermediate goods firm’s problem in the second step can be written as

subject to (6) and (7) where \(\pi (A)\) is a profit function in this step of the problem given its productivity A. The first-order condition yields the optimal price and output of firm j given its productivity and price index as

Substituting (37) and (38) into (36) yields the profit function

Then, I return to the first step. The objective of this step is to maximize the intermediate goods firm’s net profits, \(\varPi _t\). Since R&D activities are subsidized, the net profit of the jth intermediate goods firm is

subject to (8) and (39). The first-order condition with respect to \(l_t^R(j)\) is

Equation (41) implies that \(l_t^R(j)\) is independent of j and so are \(A_t(j)\) and \(p_t(j)\). In addition, it is necessary to assume \(1-\gamma (\eta -1) >0\) to satisfy the second-order condition. Since all firms behave in the same way, the price index becomes

By substituting (42) into (41) and rearranging it, the optimal level of labor input for R&D activities is (13). Moreover, substituting (38) and (42) into (7) yields (12).

1.2 Proof of Proposition 2

Proof

I show that (i) \(v_t\) is maximized at \(\mu =0\) for \(t\le \bar{t}\), (ii) \(v_t\) is maximized at an internal point \(\mu ^* \in (0,1)\) for \(t>\bar{t}\), and (iii) \(\mu ^*\) is less than the growth-maximizing rate \(\hat{\mu }\).

Differentiating (26) with respect to \(\mu \) yields

where

Note that \(\frac{\beta \gamma }{(1-\mu ) [\eta (1-\mu )+\gamma (\eta -1)\mu ] [(1+Z)(1-\mu ) + \gamma Z] } >0\) for all \(\mu \in [0,1) \), that is, the sign of \(dv_t/d\mu \) is the same as that of \(\varPsi _t\). In addition, note that \(\varPsi _t \) is a continuous, quadratic, and convex function of \(\mu \). By substituting \(\mu =0,1\)—the lower and upper limits of \(\mu \)—into \(\varPsi _t(\mu )\), I obtain

\(\varPsi _t(0)\) is negative if and only if \(t < \bar{t} \equiv \frac{(1-z)^{-1/\beta } -1}{[1+(1+\gamma -\phi )Z]\eta }\), whereas \(\varPsi _t(1) \) is always negative since I assume \(\gamma < \phi \).

-

(i)

When t is less than or equal to \(\bar{t}, \varPsi _t(0)\) is non-positive and \(\varPsi _t(1) \) is negative. Since \(\varPsi _t \) is quadratic and convex, \(\varPsi _t \) is non-positive for all \(\mu \in [0,1)\) and so is \(dv_t/d\mu \). That is, \(v_t\) is a non-increasing function for the interval [0, 1) and is maximized at \(\mu =0\).

-

(ii)

When t is greater than \(\bar{t}, \varPsi _t(0)\) is positive and \(\varPsi _t(1) \) is negative. Since \(\varPsi _t \) is continuous, by the intermediate value theorem, there exists at least one \(\mu \in (0,1)\) at which \(\varPsi _t\) becomes zero. Let \(\mu _t^* \) denote such \(\mu \), that is, \(\varPsi _t(\mu _t^*)=0\). Because of the functional form of \(\varPsi _t\) (quadratic and convex), \(\mu _t^* \) is unique and \(\varPsi _t\) is downward sloping at \(\mu _t^* \), that is, \(\varPsi _t (\mu _t^*) =0\) and \(\varPsi ^\prime (\mu _t^*)<0\). Then, I show that \(\mu _t^* \) satisfies the first- and second-order conditions for maximization because

$$\begin{aligned} \frac{dv_t}{d\mu } \bigg | _{\mu =\mu _t^* }&= \frac{\beta \gamma }{(1-\mu _t^* ) [\eta (1-\mu _t^* )+\gamma (\eta -1)\mu _t^* ] [(1+Z) (1-\mu _t^*) + \gamma Z] } \varPsi _t (\mu _t^*) =0, \\ \frac{d^2 v_t}{d\mu ^2} \bigg | _{\mu =\mu _t^* }&= \frac{\beta \gamma }{(1-\mu _t^* ) [\eta (1-\mu _t^* )+\gamma (\eta -1)\mu _t^* ] [(1+Z) (1-\mu _t^*) + \gamma Z] } \varPsi ^\prime _t (\mu _t^*) <0. \end{aligned}$$ -

(iii)

Finally, I show that the welfare-maximizing rates of R&D subsidies, \(\mu _t^*\), are less than the growth-maximizing rate. By evaluating (43) at the growth-maximizing R&D subsidy rate, \(\hat{\mu } \), I obtain

$$\begin{aligned} \begin{aligned} \frac{dv_t }{d\mu } \bigg | _{\mu =\hat{\mu } }&= \frac{\beta \gamma }{1-\hat{\mu } } \biggl \{ 1 - \frac{\eta -1}{\eta (1-\hat{\mu } )+\gamma (\eta -1)\hat{\mu } } \\&\quad \quad \quad -\frac{Z}{(\eta -1) [(1+Z)(1-\hat{\mu }) + \gamma Z]} \Biggr \} +\frac{\beta t}{1+g} \frac{dg}{d\mu } \bigg | _{\mu =\hat{\mu } }. \end{aligned} \end{aligned}$$(46)

The last term of (46) is zero because \(\hat{\mu }\) satisfies the first-order condition for maximization of the growth rate. Therefore \(dv_t/d\mu |_{\mu =\hat{\mu }}\) is independent of time t and I obtain,

The last inequality holds because \(v_t\) is a decreasing function of \(\mu \) for \(t < \bar{t}\). Since \(\varPsi _t \) and \(dv_t/d\mu \) are negative only for \(\mu >\mu _t^*\), the growth-maximizing rate, \(\hat{\mu }\), is larger than the welfare-maximizing rate, \(\mu _t^*\). \(\square \)

1.3 Intermediate goods firms’ problems with heterogeneity

I solve the problems backward, as in Sect. 2. Since the final goods firm’s behavior does not change, the demand functions for the intermediate goods are the same as (6). The production functions of the intermediate goods, given the productivity, are also the same as (7). Therefore, the second step in the intermediate goods firms’ problem is (36), subject to (6) and (7). Thus, the optimal price and output and the profit function of firm j, given its productivity and price index, are (37), (38), and (39), respectively.

The first step of the problem marginally changes because R&D efficiency differs by entrepreneur. The objective of this step is to maximize the intermediate goods firms’ net profits (40) subject to (39) and

The first-order condition with respect to \(l_t^R(j)\) is

Since there is \(\theta _j \) on the left-hand side of (47), \(l_t^R(j)\) differs by the intermediate goods firms and so does \(A_t(j)\) and \(p_t(j)\). Note that it is necessary to assume \(1-\gamma (\eta -1) >0\) to satisfy the second-order condition. Substituting (37) and (47) into the definition of the price index of the intermediate goods, \(P_t\), I obtain

I define \(\varTheta _t\) as \(\int _0^{N_t} \theta _j ^{\eta -1} [l_t^R(j)]^{\gamma (\eta -1)} dj\). Then, by using (49), I obtain

Solving (48) for \(l_t^R(j)\) and rewriting it using \(\varTheta _t\), I obtain

Raising both sides of (51) to the power of \(\gamma (\eta -1)\) and multiplying these by \(\theta _j ^{\eta -1}\) yields

Integrating both sides of (52) with respect to \(j \in [0,N_t]\), I obtain

The left-hand side of (53) is \(\varTheta _j\) and, thus, I solve for \(\varTheta _t\) as follows

Substituting (54) into (51), I obtain the optimal labor input of the jth intermediate goods firm for the R&D activities as (29). Substituting (29) into (47), the productivity of the jth intermediate goods firm becomes

Using (49), (50), and (54), the price index of the intermediate goods can be computed as follows:

Using (7), (38), (A19), and (56), I obtain the optimal labor input of the jth intermediate goods firm for production as (28). Finally, substituting (29), (39), (55), and (56) into (40), I obtain the net profit of the jth intermediate goods firm as (30).

Rights and permissions

About this article

Cite this article

Morimoto, T. Occupational choice and entrepreneurship: effects of R&D subsidies on economic growth. J Econ 123, 161–185 (2018). https://doi.org/10.1007/s00712-017-0549-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-017-0549-1