Abstract

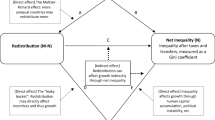

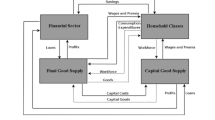

We examine the effects of redistributive taxation on growth and inequality in a Schumpeterian model with risk-averse agents. There are skilled and unskilled workers, and the growth rate is determined by the occupational choice of skilled agents between entrepreneurship and employment. We show that redistribution provides insurance to entrepreneurs and increases the growth rate. The effects on inequality are such that low tax rates increase inequality relative to laissez-faire due to changes in wages, but higher tax rates can simultaneously raise growth and reduce inequality. We contrast the optimal linear income tax with alternative policies for promoting R&D and find that it is preferable on both equity and efficiency grounds.

Similar content being viewed by others

References

Acemoglu D., Zilibotti F. (1997) Was prometheus unbound by chance? Risk, diversification, and growth. Journal of Political Economy 105: 709–751

Acs Z.J., Audretsch D.B. (1988) Innovation in large and small firms: An empirical analysis. American Economic Review 78:678–690

Aghion P., Bolton P. (1997) A trickle-down theory of growth and development with debt overhang. Review of Economic Studies 64: 151–162

Aghion P., Caroli E., García-Peñalosa C. (1999) Inequality and growth in the new growth theories. Journal of Economic Literature 37: 1615–1669

Aghion P., Howitt P. (1992) A model of growth through creative destruction. Econometrica 60: 323–351

Aghion P., Tirole J. (1994) The management of innovation. Quarterly Journal of Economics 109: 1185–1209

Alesina A., Rodrik D. (1994) Distributive politics and economic growth. Quarterly Journal of Economics 109: 465–490

Arrow K.J. (1962) Economic welfare and the allocation of resources for invention. In: Nelson R.R. (eds) The rate and direction of inventive activity: Economic and social factors. Princeton, Princeton University Press, pp. 609–625

Bertola G., Foellmi R., Zweimüller J. (2006) Income distribution in macroeconomic models. Princeton, Oxford, Princeton University Press

Bird E.J. (2001) Does the welfare state induce risk-taking? Journal of Public Economics 80: 357–383

Boadway R., Marchand M., Pestieau P. (1991) Optimal linear income taxation in models with occupational choice. Journal of Public Economics 46:133–162

Carree M.A., Thurik A.R. (1998) Small firms and economic growth in Europe. Atlantic Economic Journal 26:137–146

Caucutt E.M., Imrohoroǧlu S., Kumar K.B. (2003) Growth and welfare analysis of tax progressivity in a heterogeneous agent model. Review of Economic Dynamics 6:546–577

Caucutt E.M., Imrohoroǧlu S., Kumar K.B. (2006) Does the progressivity of taxes matter for human capital and growth? Journal of Public Economic Theory 8: 95–118

Chou C., Talmain G. (1996) Redistribution and growth: Pareto improvements. Journal of Economic Growth 1: 505–523

Cooper B., García-Peñalosa C., Funk P. (2001) Status effects and negative utility growth. Economic Journal 111:642–665

Dunne T., Roberts M.J., Samuelson L. (1988) Patterns of firm entry and exit in US manufacturing industries. RAND Journal of Economics 19: 495–515

Eaton J., Rosen H.S. (1980) Optimal redistributive taxation and uncertainty. Quarterly Journal of Economics 95: 357–364

Galor O., Zeira J. (1993) Income distribution and macroeconomics. Review of Economic Studies 60: 35–52

García-Peñalosa C., Turnovsky S.J. (2007) Growth, inequality, and fiscal policy with endogenous labor supply: What are the relevant tradeoffs? Journal of Money, Credit, and Banking 39: 369–394

García-Peñalosa, C., & Wen, J.-F. (2004). Redistribution and occupational choice in a schumpeterian growth model. CESifo Working Paper No. 1323.

Gould E., Moav O., Weinberg B.A. (2001) Precautionary demand for education, inequality, and technological progress. Journal of Economic Growth 6: 285–315

Greenwood J., Jovanovic B. (1999) The IT revolution and the stock market. American Economic Review Papers and Proceedings 89: 116–122

Hamilton, B. H. (2000). Does entrepreneurship pay? An empirical analysis of the returns to self-employment. Journal of Political Economy, 108, 604–31.

Himmelberg C.P., Petersen B.C. (1994) R&D and internal finance: A panel study of firms in high-tech industries. Review of Economics and Statistics 76: 38–51

Ilmakunnas, P., & Kanniainen, V. (2001). Entrepreneurship, economic risks, and risk insurance in the welfare state: Results with OECD data 1978–93. German Economic Review, 2, 195–218.

Kanbur S.M. (1981) Risk taking and taxation: An alternative perspective. Journal of Public Economics 15: 163–184

Katz M., Ordover J. (1990) R&D cooperation and competition. Brookings Papers, Microeconomics 1990: 137–203

Lambson V.E., Phillips K.L. (2007) Market structure and schumpeterian growth. Journal of Economic Behavior and Organization 62: 47–62

Mayshar J. (1977) Should government subsidize risky private projects? American Economic Review 67: 20–28

Moskowitz T., Vissing-Jorgensen A. (2002) The returns to entrepreneurial investment: A private equity premium puzzle. American Economic Review 92:745–778

Myers S.C., Majluf M.S. (1984) Corporate financing decisions when firms have investment information that investment do not. Journal of Financial Economics 13: 187–221

O’Donoghue T., Zweimüller J. (2004). Patents in a model of endogenous growth. Journal of Economic Growth 9: 81–123

Persson T., Tabellini G. (1994). Is inequality harmful for growth? American Economic Review 84: 600–621

Saint-Paul G. (1992) Technological choice, financial markets and economic development. European Economic Review 36: 763–781

Saint-Paul G., Verdier T. (1993) Education, democracy and growth. Journal of Development Economics 42: 399–407

Sinn H.-W. (1996). Social insurance, incentives and risk taking. International Tax and Public Finance 3: 259–280

Skeel D.A., Jr. (2001) Debt’s dominion: A history of bankruptcy in America. Princeton, Princeton University Press

U.S.B.C. Small Business Administration. (2003). Research summary. U.S. Bureau of the Census, February 2003.

Varian H.R. (1980). Redistributive taxation as social insurance. Journal of Public Economics 14: 49–68

Zeira J. (1988) Risk reducing fiscal policies and economic growth. In: Helpman E., Razin A., Sadka E. (eds) Economic effects of the government budget. MIT Press, Cambridge. MA, pp. 65–90

Zeira J. (2005). Innovations, patent races and endogenous growth. Mimeo, Hebrew University of Jerusalem

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

García-Peñalosa, C., Wen, JF. Redistribution and entrepreneurship with Schumpeterian growth. J Econ Growth 13, 57–80 (2008). https://doi.org/10.1007/s10887-008-9027-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10887-008-9027-5