Abstract

Professor Philippe Aghion is the 2016 recipient of the Global Award for Entrepreneurship Research, consisting of 100,000 Euros and a statuette designed by the internationally renowned Swedish sculptor Carl Milles. He is one of the most influential researchers worldwide in economics in the last couple of decades. His research has advanced our understanding of the relationship between firm-level innovation, entry and exit on the one hand, and productivity and growth on the other. Aghion has thus accomplished to bridge theoretical macroeconomic growth models with a more complete and consistent microeconomic setting. He is one of the founding fathers of the pioneering and original contribution referred to as Schumpeterian growth theory. Philippe Aghion has not only contributed with more sophisticated theoretical models, but also provided empirical evidence regarding the importance of entrepreneurial endeavours for societal prosperity, thereby initiating a more nuanced policy discussion concerning the interdependencies between entrepreneurship, competition, wealth and growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The 2016 Global Award for Entrepreneurship Research has been awarded to Professor Philippe Aghion, Professor of The Economics of Institutions, Innovation and Growth at Collège de France in Paris.Footnote 1 He is awarded the prize for his important contributions in several areas of entrepreneurship research. More specifically, Aghion’s theoretical work highlights (1) how higher rates of entry and exit of firms, i.e. so-called creative destruction processes, and increased competition are associated with a higher rate of innovation driven growth, (2) the relationship between growth and long-term technological waves, where such waves seem to be associated with an increase in the flows of entry and exit of firms, (3) how growth is affected differently depending on whether entry occurs close to the technology frontier or below it, (4) the relationship between growth and firm dynamics, i.e. how young and small firms exit more frequently than large but also, conditional on survival, grow faster, (5) how incomplete contracts and bankruptcy procedures affect entrepreneurial finance and (6) how institutions influence entrepreneurial activity. Although he is most renowned for his theoretical contributions, Philippe Aghion has also undertaken highly influential empirical research in which the implications of his theories are tested on real-world data. More recently, he has also addressed the issue of inequality, innovation and entrepreneurship (Aghion et al. 2015), showing that much of inequality can be attributed innovative and entrepreneurial endeavours.

The aim of this paper is to present and discuss his contributions to the entrepreneurship field. It is, however, important to start with a clear understanding of whom Philippe Aghion is. We will therefore start with a short bio of Professor Aghion followed by an overview of his scientific contributions. Thereafter, we will elaborate somewhat more in detail on the nature of the achievements that has rendered him the Global Award for Entrepreneurship Research.

1.1 Philippe Aghion: a short bio

Philippe Aghion is presently professor in The Economics of Institutions, Innovation and Growth at Collége de France in Paris. He graduated at the mathematics section of the Ecole Normale Superieure de Cachan and has a Ph.D. in Mathematical Economics from the University of Paris 1 Pantheon-Sorbonne. He also holds a Ph.D. in Economics from Harvard University in 1987.

Philippe Aghion is invited Professor at the London School of Economics and the Institute of International Economic Studies, Stockholm University. Previously, he has been Robert C. Waggoner Professor of Economics at Harvard University, Cambridge, MA, USA, Professor of Economics at the University College London, Official Fellow at Nuffield College, Member of the Executive and Supervisory Committee of CERGE, Prague and Programme Director of CEPR in Industrial Organization. He has also taught at the Massachusetts Institute of Technology (MIT). Philippe Aghion is a Fellow at the National Bureau of Economic Research (NBER), at the Institute for Fiscal Studies (IFS), of the Econometric Society and of the American Academy of Arts and Sciences. In 2001, Philippe Aghion received The Revue française d’économie prize and The Yrjö Jahnsson Award of the best European economist under age 45 from The European Economic Association. He received the Schumpeter Prize from the International Schumpeter Society in 2006 and the John von Neumann Award in 2009. In 2005, he received a Dr. Honoris Causa from the School of Economics, Stockholm, Sweden, and in 2006 he was awarded the Centre National de la Recherche Scientifique (CNRS), the largest governmental research organization in France, silver medal. In addition to his academic research, Professor Aghion has been associated with the European Bank for Reconstruction and Development (EBRD) and is currently an adviser to the president of France, François Hollande. He is also editor of Review of Economic and Statistics and the managing editor of the journal The Economics of Transition, which he launched in 1992.

1.2 Scientific contributions: an overview

Philippe Aghion is one of the most prolific and important economists of his generation in the world, and his research has been published in the most highly ranked international scientific journals, such as American Economic Review, Review of Economic Studies, Quarterly Journal of Economics and Econometrica. This puts him in a very special category as a scholar. He is very well known for his contributions to economic growth theory. In his research, he has focused much of his attention on the relationship between economic growth and economic policy and in particular on innovations as a main source of economic growth. This approach opens the door to a deeper understanding of how organizations, competition policy, education, savings, the financial system and macroeconomic policy both affect and are affected by economic growth. What differentiates his approach from other approaches to growth is that firms and entrepreneurs play a big role. It’s an ‘industrial organization’ approach to growth. Particularly, he examines competition and growth, industrial policy and growth, and how monetary and fiscal policy influence growth by affecting firms’ and entrepreneurs’ investment decisions, like R&D and other types of investment. So it’s very much firm-level growth analysis, and that’s really what he has been pushing. Not least does he try to understand how market structures and the organization of firms and government matters for growth

Professor Aghion’s approach has been to examine how various factors interact with local entrepreneurs’ incentives to either innovate or imitate frontier technologies. He has elaborated on the importance of innovation for the modern state and provided answers to some important questions: Can institutions and economic policies foster entry and innovation? What is the benefit of state innovation incentive programs?

He pioneered endogenous growth theory and developed (together with Peter Howitt) over the past two decades the so-called Schumpeterian growth theory and extended it subsequently in several directions to analyse the design of growth policies and the role of the state in the growth process.Footnote 2 To understand the contradictory effects of technological change on the economy, Aghion and Howitt (1998) delve into structural details of the innovation process to analyse how laws, institutions, customs and regulations affect peoples’ incentive and ability to create new knowledge and profit from it. To show how this can be done, they make use of Schumpeter’s concept of creative destruction, the competitive process whereby entrepreneurs constantly seek new ideas that will render their rivals’ ideas obsolete.

His contribution to growth theory is both seminal and significant as he attempts to link growth and organizations; Professor Aghion has also contributed to the field of contract theory and corporate governance. He has, for example, concentrated on the question of how to allocate authority and control rights within a firm, or between entrepreneurs and investors.

There exists a clear link between his research on economic growth and entrepreneurship and previous research. This vein in the literature dates back to the Austrian heritage, in particular Schumpeter’s work as well as to its more modern version developed by scholars such as Harvey Leibenstein and William Baumol. Leibenstein (1968) was clear of what the entrepreneur does. Microeconomics makes two assumptions that negate any role for the entrepreneur. First, the complete set of inputs is specified and known to all actual or potential firms in the industry, and second, that there is a well-defined relationship between inputs and outputs. The first assumption is implicit. The second assumption is explicit, but it is rarely challenged. The gap filing and the input-completing capacities are the unique characteristics of the entrepreneur. The role of the entrepreneur according to Leibenstein and Baumol is to complete the production function when it does not exist and complete input markets that are not yet developed. These are function that are not of management and require entrepreneurial action to complete both. The link with growth theory, one would think, is through innovation or what can be called innovative entrepreneurship. This has been developed in a set of papers by Acs et al. (2009), Acs and Sanders (2013) and others over the years. The neo-Schumpeterian growth models are still imprecise regarding the individual’s accumulation of knowledge (broadly defined), how that is interpreted and converted into entrepreneurship, innovation and societal value, even though major progress has been accomplished thanks to work by Aghion and others.

2 Main contributions to the field of entrepreneurship research

In order to demonstrate how Philippe Aghion’s work fits within the mandate of the Global Award for Entrepreneurship Research, we first classify his work into categories. Philippe Aghion has a very impressive scientific production and this survey will address a selective part of his research that we argue is of particular interest for entrepreneurship research. Still, it is not obvious what to include as relevant and what ought to instead be excluded.

The criteria for granting this Award focus on two sets of issues. First, a prize worthy contribution ought to be original and influential. Second, a prize worthy contribution ought to fall within the scope of entrepreneurship studies as discussed in the call. Three broad areas of interest are mentioned: (a) the environment and the organizations in which entrepreneurship is conducted; (b) the character of the entrepreneurs; and (c) the role of the entrepreneur or of the entrepreneurial function.

The answer to the first is that Aghion is clearly an original thinker with major contributions to economic growth and macroeconomics. It is obvious that Aghion has significantly contributed to the research on the environment and the organizations in which entrepreneurship is conducted, while he has contributed less to the last two areas of interest. Most of the works reviewed in this article are highly theoretical and abstract, and several papers use the country as a unit of analysis. So that means looking at the environment is more or less where we have to begin. There are a few that stray from this theoretical set-up, particularly in his most recent work (Aghion et al. 1994, 2007, 2010b), but the major part of Aghion’s work belongs in the realm of theoretical modelling.

Rather than focusing on any one specific stream of papers, what we do is synthesizing his research results and discuss the extent to which irrespectively of the labelling they fall within the mandate of this award. Actually, even though Aghion rarely refers to entrepreneurship—he prefers the term entry which may involve start-ups as well as innovations by incumbents—his contributions to the field of entrepreneurship are numerous. His research falls into the following six areas: growth theory (Aghion and Howitt 1992; Aghion and Bolton 1997; Acemoglu et al. 2006; Aghion and Howitt 1994; Vandenbussche et al. 2006); innovation (Aghion et al. 2001; Aghion and Tirole 1994; Aghion et al. 2005; Acemoglu et al. 2007); firm entry (Aghion and Bolton 1987; Aghion et al. 2004b, 2009); finance (Aghion and Bolton 1992; Aghion et al. 1992, 2004a); regulation (Aghion et al. 2010a; Aghion and Griffith 2006; Aghion et al. 1994); and economic policy (Aghion 2011). This categorization leads us to help understand how the work of Philippe Aghion contributes to the field of entrepreneurship.

2.1 Entrepreneurship and growth theory

While growth theory has not been a focal part of entrepreneurship research, the relationship between entrepreneurship and economic growth is critically important to understand the microdrivers of growth and to design policies conducive to societal prosperity. New growth theories, particularly the Schumpeterian approach (Aghion and Howitt 1992, 2009), emphasize the central role of entrepreneurial investments and of institutions and policies that maximize innovation incentives (Aghion 2011). They are based on three underlying main ideas: (1) the rate of technological innovations in the form of new products, new processes and new ways of organizing production is the main driver of productivity growth, (2) most innovations are the result of entrepreneurial activities or investments, e.g. R&D investments, which involves risky experimentation and learning, and (3) the incentives to engage in innovative investments are affected by the actual economic milieu.

By linking growth to innovation and entrepreneurship, and innovation incentives in turn to characteristics of the economic milieu, the Schumpeterian growth theories have made it possible to analyse the interplay between economic growth and the design of policies and institutions. Aghion has played a central role in developing the so-called Schumpeterian growth theory by operationalizing Schumpeter’s concept of creative destruction and developing growth models based on this concept, where new innovations make old innovations, technologies, skills, etc. obsolete.

These models shed light on several aspects of the economic growth process that are not properly addressed by earlier growth models: (1) the role of competition and market structure, (2) firm dynamics, (3) the role of growth institutions and (4) the emergence and impact of long-term technological waves (Aghion et al. 2013). The critical question in our review is how does entrepreneurship contribute to economic growth in a Schumpeterian growth framework? We examine two of the papers that have a bearing on entrepreneurship and organizations. Here, Aghion and Howitt (1992) is a classic. The paper does not actually single out entrepreneurship or the entrepreneur; however, it deals with the question of vertical innovation and the role of research and development in creating those innovations.

The second paper in this area, Acemoglu et al. (2006) examine where firms undertake both innovation and adoption of technologies from the world technology frontier. They argue that the closer a country or an industry is to the corresponding world technology frontier, the more growth depends on frontier innovation rather than imitation. The selection of high-skill managers and firms is more important for innovation than for adoption. As the economy approaches the frontier, selection of managers becomes more important. Early-stage firms rely on investment strategies that maximize investment but sacrifices selection. As countries get closer to the technological frontier, economies switch to an innovation-based strategy, with short-term relationships, younger firms, less investment and better selection of firms and managers. Acemoglu et al. (2009) launches the hypothesis that there exists what they refer to as ‘building on the shoulders of giants’, namely that technological progress in one industry makes future progress in that industry more effective.

2.2 Entrepreneurship and innovation

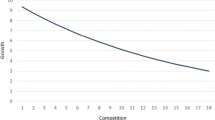

In this area, Aghion’s focus is innovation while entrepreneurship, or corporate entrepreneurship, underlies the processes generating innovation but are of a more implicit character. More precisely, Aghion et al. (2005) examine the environment and develop a model where competition discourages laggard firms from innovating but encourages neck to neck firms to innovate. The role of competition is important but is of course not really new. Aghion and Tirole (1994) analyse the organization of the R&D activity in an incomplete contract framework. It provides theoretical foundations: (a) to understand how the allocation of property rights on innovation may affect both the frequency and the magnitude of these innovations; (b) to rationalize commonly observed features in research employment contracts; (c) to discuss the robustness of the so-called Schumpeterian hypothesis to endogenizing the organization of R&D; and (d) to produce a rationale for co-financing arrangements in research activities. While much of the literature on entrepreneurship is at the organizational level, we find the paper by Acemoglu et al. (2007) in this area. The paper develops a general equilibrium model of technological adoption in an economy populated by satisfying entrepreneurs whose main objective is to minimize innovative effort while keeping the firm alive.

2.3 Entry

Aghion’s work on entry is more explicitly devoted to entrepreneurial activity. Advanced market economies are characterized by a continuous process of creative destruction. Market forces and technological change have a major role in influencing this process. However, institutional and policy frameworks also influence the decisions of entrepreneurs to enter, to expand if successful and to exit if the financial results are unsatisfactory. The papers on entry are interesting because entry in economics while not necessarily the entry of new firms may imply the entry of new establishments by existing firms in another market or industry. So it is close to strategy. Four contributions, i.e. Aghion and Bolton (1987), Aghion et al. (2004b), Aghion and Griffith (2006) and Aghion et al. (2009), point to the positive effects of liberalizing product market competition and entry on innovation and productivity growth by incumbent firms, in particular those that are more advanced in their industry and on aggregate productivity growth. Again, we find that competition and the level of technology are important players in this area. Actually, Aghion and Bolton laid out the theoretical principles for the allocation of control rights in financial arrangements, thereby providing a framework for the study of corporate governance as well as unveiling the mechanics of long-term contracting as a barrier to entry. This is today a standard reference on the topic for both economic theorists and competition policy practitioners. He and his co-authors have applied the economics of incentives on a broad array of organizational issues, for instance by introducing the distinction between formal and real authority.

2.4 Entrepreneurship and finance

Finance, financing the firm, venture capital, private equity are all topics that are central to entrepreneurship. Philippe Aghion’s focus, however, is partly in the area of incomplete contracts and inequality and how it affects economic growth (Aghion and Bolton 1992). This paper shows that wealth inequality may be good for growth, in particular when capital markets are imperfect and agents are heterogeneous, or when some agents suffer from institutional limitations in the access to investment. Another paper (Aghion et al. 1992) proposes a new bankruptcy procedure. Initially, a firm’s debts are cancelled, and cash and non-cash bids are solicited for the new (all-equity) firm. Former claimants are given shares, or options to buy shares, in the new firm on the basis of absolute priority. Options are exercised once the bids are in. Finally, a shareholder vote is taken to select one of the bids. In essence, their procedure is a variant of the US Chapter 7, in which non-cash bids are possible; this allows for reorganization.

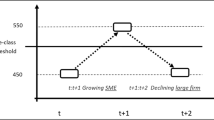

Aghion et al. (2004b) introduce a framework for analysing the role of financial factors as a source of instability in small open economies. The basic model is a dynamic open economy model with a tradeable good produced with capital and a country-specify factor. They assume that the firm faces credit constraints. A basic implication of this model is that economies at an intermediate level of financial development are more unstable than either very developed or very underdeveloped economies. This is true for both shocks and cycles. Aghion et al. (2007) showed that access to finance matters most for the entry of small firms and in industries that are more dependent upon external finance. They also found that both private capital and stock market capitalization are important for encouraging entry and post-entry growth of firms.

2.5 Entrepreneurship and regulation

Regulation is an important aspect of the entrepreneurial environment. A large literature discussed the impact of regulation on the economy and on entrepreneurial activity. This is one of the few empirical articles in this review. Aghion et al. (2010a) document in a cross section of countries that government regulation is strongly negatively correlated with measures of trust. A simple model explaining this correlating distrust creates public demand for regulation, whereas regulation in turn discourages formation of trust, leading to multiple equilibria. In contrast, people who live in a civic community and who invest in social capital will develop a civil society with low regulation and high levels of entrepreneurial activity. A key implication of the model is that individuals in low-trust countries want more government intervention even though they know the government is corrupt and that regulation will lead to lower levels of entrepreneurial activity.

One of the most interesting articles, from a regulatory perspective, is Aghion and Griffith (2006). They study whether the effects on registered manufacturing output of dismantling the Licence Raj—a system of central controls regulating entry and production activity in this sector—vary across Indian states with different labour market regulations. The effects are found to be unequal across Indian states with different labour market regulations. Aghion et al. (1994) look at Eastern European firm’s pre-privatization. This paper explores the behaviour of state firm’s pre-privatization, the incentives and the constraints facing managers and the nature and the power of the coalitions within the firm. They show that managers on low incentive payment schemes with little formal stake in privatization and who face possible redundancy have little incentive to embark on restructuring.

2.6 Entrepreneurship and economic policy

Aghion has devoted a substantial interest to the design of institutions and policies that affect long-term productivity growth not least in developing countries through their impact on the incentives of entrepreneurs and their ability to make innovative investments, such as (1) an effective education system, (2) a legal framework that allows entrepreneurs to appropriate a significant fraction of the revenues generated through their innovative investments, (3) macroeconomic stability that reduces interest rates, (4) financial development that reduces credit constraints, and (5) high competition among incumbent firms and/or high entry threats (Aghion and Armendariz de Aghion 2004). He has stressed the importance of states investing in trust, which is connected with institutions (Aghion et al. 2010b), since there exists an essential and causal relationship between trust and various economic outcomes, such as financial development, entrepreneurship and economic exchanges and that trust and a good social climate are particularly important for innovation and growth at the firm level (Aghion et al 2010a; Aghion and Cagé 2012). Aghion also claims that there are strong reasons to rethink the case for industrial policy despite that it has a bad name in terms of ‘picking winners’ and thus distorting competition, while exposing government to be captured by vested interests: (1) climate change: without government intervention to jump-start massive private investment in clean technologies, governments, by default, encourage investment in dirtier technologies, (2) a new post-crisis realism: laissez-faire complacency by many governments has led to mis-investment in the non-tradable sector at the expense of growth-rich tradable goods, and (3) China—and some other emerging economies—are big deployers of growth-enhancing sectoral policies. According to Aghion, the challenge for Europe is how it can design and govern sectoral policies that are competition-friendly and thus growth-enhancing (Aghion et al. 2011).

His most recent work on wealth and income inequality (Aghion et al. 2015), showing that the increased dispersion is associated with innovation and not speculation or returns from real estate or inheritances in the USA, has obvious policy implication and is also highly relevant to the field of entrepreneurship research. These first findings are likely to trigger a future wave of research on the sources and the increased inequalities that a number of countries have experienced.

3 Conclusions

Philippe Aghion is a highly productive scholar. It goes without saying that most of these articles appeared in the best journals in economics. It is truly an amazing record. All of the models are clearly laid out, properly developed and highly original. They have made a major contribution to the literature, and many are highly cited. The content is original and makes a major contribution to the field of economic growth and provides the first building blocks that link macroeconomics models with a more solid microeconomic foundations, emphasizing entrepreneurship—or entry using Aghion’s terminology—and innovation. Hence, many of the topics covered by Philippe Aghion are relevant to the entrepreneurship field even though they are mostly at the level of the country or the nation. Moreover, this is a trend clearly visible in the recent decade where more research centres on the nation also in entrepreneurship journals.

Philippe Aghion has made seminal contributions in several research areas related to entrepreneurship and is a worthy recipient of the Global Award for Entrepreneurship Research. He has given the entrepreneurship field a broad visibility, reaching audiences which so far might have considered themselves relatively distant from the discussion about entrepreneurship. Entrepreneurship and economic growth have something to say about the field of entrepreneurship even if growth theorists often have not explicitly said so.

Notes

The Global Award is a direct continuation of the International Award for Entrepreneurship and Small Business Research, first launched in 1996 by the Swedish Entrepreneurship Forum (then Foundation for Small Business Research, FSF) and the Swedish Agency for Economic and Regional Growth (Nutek). In 2009, the Research Institute of Industrial Economics (IFN) became a co-founder of the prize. The prize consists of 100,000 Euros and the statuette “Hand of God”, created by the internationally renowned sculptor Carl Milles. Funding is gratefully acknowledged from the Swedish Innovation Agency (Vinnova) and the Stockholms Köpmansklubb.

Much of this work is summarized in their joint books Endogenous Growth Theory (MIT Press, 1998) and The Economics of Growth (MIT Press, 2009), in his book with Rachel Griffith on Competition and Growth (MIT Press, 2006), and more recently in Repenser l’Etat (Seuil 2011).

References

Acemoglu, D., Aghion, P., Bursztyn, L., & Hemous, D. (2009). The environment and directed technical change. NBER Working Paper.

Acemoglu, D., Aghion, P., Lelarge, C., van Reenen, J., & Zilibotti, F. (2007). Technology, information and the decentralization of the firm. Quarterly Journal of Economics, 122, 1759–1799.

Acemoglu, D., Aghion, P., & Zilibotti, F. (2006). Distance to frontier, and economic growth. Journal of the European Economic Association, 4, 37–74.

Acs, Z. J., Braunerhjelm, P., Audretsch, B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32, 15–30.

Acs, Z. J., & Sanders, M. (2013). Knowledge spillover entrepreneurship in an endogenous growth model. Small Business Economics, 41, 775–796.

Aghion, P. (2011). Industrial policy, entrepreneurship and growth. In D. B. Audretsch, O. Falck, S. Heblich, & A. Lederer (Eds.), Handbook of research on innovation and entrepreneurship (pp. 45–54). Cheltenham: Edward Elgar.

Aghion, P., Akcigit, U., Bergeaud, A., Blundell, R., & Hémous, D. (2015). “Innovation and Top Income Inequality,” mimeo Harvard and National Bureau of Economic Research (NBER), Working Papers Series no 21247.

Aghion, P., Akcigit, U., & Howitt, P. (2013). What do we learn from schumpeterian growth theory? PIER Working Paper 13-026, Penn Institute of Economic Research.

Aghion, P., Algan, Y., Cahuc, P., & Schleifer, A. (2010a). Regulation and distrust. Quarterly Journal of Economics, 125, 1015–1049.

Aghion, P., & Armendariz de Aghion, B. (2004). New growth approach to poverty alleviation. In A. V. Banerjee, R. Benabou, & D. Mookherjee (Eds.), Understanding poverty (pp. 73–84). Oxford: Oxford University Press.

Aghion, P., Bacchetta, P., & Banerjee, A. (2004a). Financial development and the instability of open economies. Journal of Monetary Economics, 51, 1077–1106.

Aghion, P., Blanchard, O., & Burgess, R. (1994). The behaviour of the state in Eastern Europe, pre-privatisation. European Economic Review, 38, 1327–1349.

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: An inverted-U relationship. Quarterly Journal of Economics, 120, 701–728.

Aghion, P., Blundell, R., Griffith, R., Howitt, P., & Prantl, S. (2004b). Entry and productivity growth: Evidence from micro level panel data. Journal of the European Economic Association, 2, 265–276.

Aghion, P., Blundell, R., Griffith, R., Howitt, P., & Prantl, S. (2009). The effects of entry on incumbent innovation and productivity. Review of Economics and Statistics, 91, 20–32.

Aghion, P., & Bolton, P. (1987). Contracts as a barrier to entry. American Economic Review, 77, 388–401.

Aghion, P., & Bolton, P. (1992). An incomplete contracts approach to financial contracting. Review of Economic Studies, 59, 473–494.

Aghion, P., & Bolton, P. (1997). A theory of trickle-down growth and development. Review of Economic Studies, 64, 151–172.

Aghion, P., Boulanger, J., & Cohen, E. (2011). Rethinking industrial policy. Breugel policy brief, June 1–8.

Aghion, P., & Cagé, J. (2012). Rethinking growth and the state. In C. Ottaviano & D. M. Leipziger (Eds.), Ascent after decline: Regrowing global economies after the great recession (pp. 181–201). Washington DC: The World Bank.

Aghion, P., Dewatripont, M., Hoxby, C., Mas-Colell, A., & Sapir, A. (2010b). The governance and performance of universities: Evidence from Europe and the US. Economic Policy, 25, 7–59.

Aghion, P., Fally, T., & Scarpetta, S. (2007). Credit constraints as a barrier to the entry and post-entry growth of firms. Economic Policy, 22, 732–779.

Aghion, P., & Griffith, R. (2006). Competition and growth. Reconciling theory and evidence. Cambridge, MA: MIT Press.

Aghion, P., Harris, C., Howitt, P., & Vickers, J. (2001). Competition, imitation and growth with step-by-step innovation. Review of Economic Studies, 68, 467–492.

Aghion, P., Hart, O., & Moore, J. (1992). The economics of bankruptcy reform. Journal of Law Economics and Organization, 8, 523–546.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60, 323–351.

Aghion, P., & Howitt, P. (1994). Growth and unemployment. Review of Economic Studies, 61, 477–494.

Aghion, P., & Howitt, P. (1998). Endogenous growth theory. Cambridge, MA: MIT Press.

Aghion, P., & Howitt, P. (2009). The economics of growth. Cambridge, MA: MIT Press.

Aghion, P., & Roulet, A. (2011). Repenser l’Etat. Paris: Editions du Seuil.

Aghion, P., & Tirole, J. (1994). The management of innovation. Quarterly Journal of Economics, 109, 1185–1209.

Leibenstein, H. (1968). Entrepreneurship and development. American Economic Review, 58, 72–83.

Vandenbussche, J., Aghion, P., & Meghir, C. (2006). Growth, human capital. Journal of Economic Growth, 11, 97–127.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Acs, Z.J., Braunerhjelm, P. & Karlsson, C. Philippe Aghion: recipient of the 2016 Global Award for Entrepreneurship Research. Small Bus Econ 48, 1–8 (2017). https://doi.org/10.1007/s11187-016-9801-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-016-9801-2