Abstract

This article examines emerging trends in childbearing, marital status, and earnings for U.S. women over young adulthood across recent birth cohorts spanning the late baby boom and Generation X. We use a unique dataset that matches the 1990, 1996, and 2004 fertility and marital history modules of the Survey of Income and Program Participation with Social Security Administration longitudinal earnings records derived from survey respondents’ own tax records. While there have been some cohort-level changes, we find little empirical evidence of large-scale shifts in the family and earnings histories of young adult women born toward the end of Generation X, particularly college graduates, relative to their late baby-boom counterparts at the same stage of the life course. The broader implications of our findings and directions for further research are discussed.

Similar content being viewed by others

Notes

Typically, the baby-boom cohort is defined as persons born between 1946 and 1964. Generation X has been conditionally defined by the U.S. Census Bureau as persons born between the years 1968 and 1979 (Crowley 2003).

A variety of factors have contributed to the growth in women’s labor participation rate over recent decades, such as rising wages and educational attainment, increasing opportunities in the workplace, changes in the American family, and shifting socio-cultural attitudes about women’s role in work and family (see Blau et al. 2006; Thornton and Young-DeMarco 2001).

A birth cohort reflects the year or group of years in which a person was born. In essence, grouping by birth year connects persons born at the same time with the historical context shaping the life course (Elder et al. 2003).

Young adulthood is defined in diverse ways. We use the concept here to emphasize a life course stage often dense in transitions to ‘adulthood’, such as finishing education, having a child, marriage, and full-time employment. For a valuable perspective on the features of ‘emerging adulthood’, from the late teens to mid- to late 20s, see Arnett (2004).

Our two-year age groups correspond to three-year birth cohorts because persons born over three calendar years can be 27 or 28 years old at the time of the survey.

Unlike 1990 and 1996, the 2004 SIPP Marital History Public-Use File suppresses marital event dates. Through an agreement with the U.S. Census Bureau, SSA has access to a Restricted-Use File with such information. All users must be authorized by the U.S. Census Bureau.

Our method of observing earnings from ages 23 to 28 across the cohorts is as follows. For the 2004 SIPP panel, annual earnings from Social Security records are observed for N sample of women who are age 28 from 1999 through 2004; for women who are age 27, administrative earnings are observed from 2000 through 2005. For the 1996 panel, young adult earnings histories consist of annual earnings from 1991 through 1996 for women age 28, and from 1992 through 1997, for women age 27. In the 1990 panel, administrative earnings are observed from 1985 through 1990 for women aged 28 and from 1986 through 1991 for women age 27.

Cohort differences in cumulative earnings over young adulthood could be influenced by economic cycles, among other factors, not controlled for in our descriptive analysis.

References

Arnett, J. J. (2004). Emerging adulthood: The winding road from the late teens through the early twenties. Oxford: Oxford University Press.

Belkin, L. (2003). The opt-out revolution. New York Times Magazine, October 26.

Blau, F. D., Ferber, M., & Winkler, A. (2006). The economics of women, men and work (5th ed.). Englewood Cliffs, NJ: Prentice Hall.

Blau, F. D., & Kahn, L. M. (2007). Changes in the labor supply behavior of married women: 1980–2000. Journal of Labor Economics, 25(3), 393–437.

Blossfeld, H. P., & Huinink, J. (1991). Human capital investments or norms of role transition? How women’s schooling and career affect the process of family formation. American Journal of Sociology, 97, 143–168.

Boushey, H. (2008). ‘Opting out?’ The effect of children on women’s employment in the United States. Feminist Economics, 14(1), 1–36.

Bradbury, K., & Katz, J. (2005). Women’s rise: A work in progress. Regional Review, 14(3), 58–67.

Brenner, M. (2001). Not their mothers’ choices. Newsweek, 138(7), 48–49.

Bumpass, L. L., & Lu, H.-H. (2000). Trends in cohabitation and implications for children’s family contexts in the United States. Population Studies, 54(1), 29–41.

Butrica, B. A., Iams, H. M., & Smith, K. E. (2003). It’s all relative: Understanding the retirement prospects of baby boomers. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Crowley, M. (2003). Generation X Speaks Out on Civic Engagement and the Decennial Census: An Ethnographic Approach. Technical Report, Census 2000 Ethnographic Study. Statistical Research Division, U.S. Census Bureau, Washington, DC.

Czajka, J. L., Mabli, J., & Cody, S. (2008). Sample loss and survey bias in estimates of social security beneficiaries: A tale of two surveys. Final Report, contract no. 0600-01-60121. Mathematica Policy Research, Inc., Washington, DC.

Davies, P. S., & Fisher, T. L. (2009). Measurement issues associated with using survey data matched with administrative data from the Social Security Administration. Social Security Bulletin, 69(2), 1–12.

DiNatale, M., & Boraas, S. (2002). the labor force experience of women from ‘Generation X.’ Monthly Labor Review, March, 3–15.

Easterlin, R. A., Schaeffer, C. M., & Macunovich, D. J. (1993). Will the baby boomers be less well off than their parents? Income, wealth, and family circumstances over the life cycle in the United States. Population and Development Review, 19(3), 497–522.

Elder, G. H., Jr., Johnson, M. K., & Crosnoe, R. (2003). The emergence and development of life course theory. In J. T. Mortimer & M. J. Shanahan (Eds.), Handbook of the life course (pp. 3–19). New York: Kluwer.

Ginther, D. K., & Pollak, R. A. (2004). Family structures and children’s educational outcomes: Blended families, stylized facts, and descriptive regressions. Demography, 41(4), 671–696.

Goldstein, J., & Kenney, C. (2001). Marriage delayed or marriage forgone? New cohort forecasts of first marriage for U.S. women. American Sociological Review, 66, 506–519.

Gross, J. (2005). Forget the career. My parents need me at home. The New York Times, November 24, A1.

Hotchkiss, J. L. (2006). Changes in behavioral and characteristic determination of female labor force participation 1975–2005. Economic Review, 91(2), 1–20.

Kreider, R. M., & Elliott, D. B. (2009). America’s families and living arrangements: 2007. Washington, DC: Current Population Reports, US Census.

Kuperberg, A. (2009). Motherhood and graduate education: 1970–2000. Population Research and Policy Review, 28, 473–504.

Kuperberg, A., & Stone, P. (2008). The media depiction of women who ‘opt out’. Gender & Society, 22(4), 497–517.

Manning, W. D., Longmore, M. A., & Giordano, P. C. (2007). The changing institution of marriage: Adolescents’ expectations to cohabit and to marry. Journal of Marriage and Family, 69(3), 559–575.

McNabb, J., Timmons, D., Song, J., & Puckett, C. (2009). Uses of administrative data at the Social Security Administration. Social Security Bulletin, 69(1), 75–84.

Olsen, A., & Hudson, R. (2009). Social Security Administration’s master earnings file: Background information. Social Security Bulletin, 69(3), 29–45.

Pattison, D., & Waldron, H. (2008). Trends in elective deferrals of earnings from 1990–2001 in Social Security Administrative data. Research and Statistics Note No. 2008-03, Office of Retirement and Disability Policy, Social Security Administration, June.

Pedace, R., & Bates, N. (2000). Using administrative data to assess earnings reporting error in the survey of income and program participation. Journal of Economic and Social Measurement, 26, 173–192.

Percheski, C. (2008). Opting out? Cohort differences in professional women’s employment rates from 1960 to 2005. American Sociological Review, 73(3), 497–517.

Raley, R. K. (2000). Recent trends and differentials in marriage and cohabitation: The United States. In L. Waite, C. Bachrach, M. Hindin, E. Thomson, & A. Thornton (Eds.), The ties that bind. Perspectives on marriage and cohabitation (pp. 19–39). New York: Aldine de Gruyter.

Research Triangle Institute [RTI]. (2005). SUDAAN User’s Manual, Release 9.0. Research Triangle Park, NC: Research Triangle Institute.

Schoen, R. (2004). Timing effects and the interpretation of period fertility. Demography, 41(4), 801–819.

Story, L. (2005). Many women at elite colleges set career path to motherhood. New York Times, September 20.

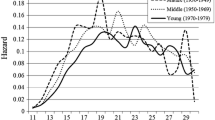

Sullivan, R. (2005). The age pattern of first-birth rates among U.S. women: The bimodal 1990s. Demography, 42(2), 259–273.

Tamborini, C. R. (2007). The never-married in old age: Projections and concerns for the near future. Social Security Bulletin, 67(2), 25–40.

Thornton, A., & Young-DeMarco, L. (2001). Four decades of trends in attitudes toward family issues in the United States: The 1960s through the 1990s. Journal of Marriage and the Family, 63(4), 1009–1037.

U.S. Census Bureau. (2008). Statistical abstract of the United States: 2009 (128th ed.). Washington, DC: US Government Printing Office.

Vere, J. P. (2007). Having it all no longer: Fertility, female labor supply, and the new life choices of generation X. Demography, 44(4), 821–828.

Waite, L. J. (1995). Does marriage matter? Demography, 32(4), 483–507.

Acknowledgements

We thank the Editor and the anonymous reviewers of Population Research and Policy Review for helpful comments and suggestions. The authors also thank Hilary Waldron, Irena Dushi, and Glenn Springstead for valuable comments. The findings and conclusions presented in this paper are those of the authors and do not represent the views of the U.S. Social Security Administration. The administrative earnings data used in this paper are restricted use; users must receive approval of the Social Security Administration and the U.S. Census Bureau.

Author information

Authors and Affiliations

Corresponding author

Appendix A: SSA Administrative Earnings Data

Appendix A: SSA Administrative Earnings Data

The Social Security Administration (SSA) collects and stores a large range of earnings data on the U.S. working population to administer the Social Security program, such as for calculating benefit amounts, and to conduct policy analysis and research on the population served by SSA’s programs. Earnings reports include information on wages, salaries, bonuses, and self-employment income, as reported on the Internal Revenue Service (IRS) Form W-2 (Wage and Tax Statement) sent by employers and Form 1040, U.S. Individual Income Tax Return, including the Schedule SE for self-employment income sent by the IRS. This information is only sent to SSA and the IRS. Form W-3 (Transmittal of Wage and Tax Statements) is also sent by employers and used by SSA to check the accuracy of W-2 earnings.

In this study, we use SIPP respondents’ matched earnings from 1985 to 2005 contained in SSA’s Detailed Earnings Record (DER) file. Earnings in this file reflect uncapped full income and wage compensation from uncovered (employment not covered by Social Security) and covered (employment covered by Social Security). Social Security taxable earnings include deferred compensation, typically in the form of 401(k)s, for covered workers whose earnings are below the taxable maximum from 1984 forward. Deferred compensation for workers with non-Social Security taxable earnings, such as earnings above the taxable maximum, only became available in administrative data as of 1990 when it could be explicitly identified (Pattison and Waldron 2008). The share of our sample above the Social Security taxable maximum (e.g. $90,000 in 2005) is very small, around 1–2% depending on the year and educational subgroup. For more information on SSA’s earnings files, see Olsen and Hudson (2009).

SSA maintains a number of data sets linking information on its administrative records with national surveys such as the Current Population Survey (CPS) and the Survey of Income and Program Participation (SIPP). Linking administrative and survey data is advantageous for a large range of research, policy, and operational purposes and improves the research potential of either data source alone. In essence, the matched datasets combine the rich demographic and socioeconomic information in surveys with the longitudinal scope and accuracy of SSA administrative records (for more information, see Davies and Fisher 2009 and McNabb et al. 2009).

SSA earning data are subject to strict disclosure rules. To protect respondent confidentiality, all potentially identifying information, such as names and Social Security Numbers, are removed after the data is linked to survey fields. The match is verified by comparing date of birth and sex information in both data sources. All users of the data must be approved by both SSA and the Census Bureau. The data must be used for approved research projects only and analyzed and stored at a secured site.

Rights and permissions

About this article

Cite this article

Tamborini, C.R., Iams, H.M. Are Generation X’ers Different than Late Boomers? Family and Earnings Trends among Recent Cohorts of Women at Young Adulthood. Popul Res Policy Rev 30, 59–79 (2011). https://doi.org/10.1007/s11113-010-9178-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11113-010-9178-x