Abstract

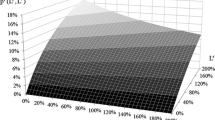

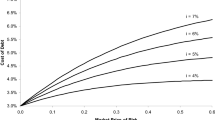

This paper considers a dynamic model of the firm in which the firm has debt financing as an additional means to provide funds for investments. It is assumed that it is more difficult for the firm to get a loan when the debt-equity ratio is large. Consequently it is imposed that the interest rate increases with this ratio. The model under consideration has been studied before by Steigum (1983, Econometrica). He obtained that the problem reduces to a strictly concave optimal control problem with a unique saddle point. In this paper we prove this result in a different way, and provide a generalization to his model by extending the objective functional such that positive utility is assigned to dividends as well as equity. Despite the fully concave setting, we show that the optimal solution of a mainly equity oriented firm has history dependent equilibria.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Barucci, E., 1998, Optimal investments with increasing returns to scale, International Economic Review, 39, 789–808.

Davidson, R., Harris, R., 1981, Non-convexities in continuous-time investment theory, Review of Economic Studies, 48, 235–253.

Dechert, D.W., 1983, Increasing returns to scale and the reverse flexible accelerator, Economic Letters, 13, 69–75.

Gould, J.P., 1968, Adjustment costs in the theory of investment of the firm, Review of Economic Studies, 35, 47–56.

Hartl, R.F., Kort, P.M., 2000, Optimal investments with increasing returns to scale: a further analysis, in E.J. Dockner, R.F. Hartl, M. Luptacik, and G. Sorger (eds.): Optimization, Dynamics and Economic Analysis: Essays in Honor of Gustav Feichtinger, Springer/Physica, 228–240.

Hilten, O. van, Kort, P.M., Loon, P.J.J.M. van, 1993, Dynamic Policies of the Firm: An Optimal Control Approach, Springer, Berlin.

Jorgensen, S., Kort, P.M., 1993, Optimal dynamic investment policies under concave-convex adjustment costs, Journal of Economic Dynamics and Control, 17, 153–180.

Jorgensen, S., Kort, P.M., 1997, Optimal investment and financing in renewable resource harvesting, Journal of Economic Dynamics and Control, 21, 603–630.

Jorgenson, D.W., 1963, Capital theory and investment behavior, American Economic Review, 52, 247–259.

Lucas, R.E. jr., 1967, Optimal investment policy and the flexible accelerator, International Economic Review, 8, 78–85.

Steigum, E. jr., 1983, A financial theory of investment behavior, Econometrica, 51, 637–645.

Wirl, F., Feichtinger, G., 1999, History dependence due to unstable steady states in concave intertemporal optimizations, Working paper.

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2002 Springer Science+Business Media New York

About this chapter

Cite this chapter

Hartl, R.F., Kort, P.M., Novak, A. (2002). A Capital Accumulation Model with Debt Financing: The Steigum Model Revisited. In: Zaccour, G. (eds) Optimal Control and Differential Games. Advances in Computational Management Science, vol 5. Springer, Boston, MA. https://doi.org/10.1007/978-1-4615-1047-5_2

Download citation

DOI: https://doi.org/10.1007/978-1-4615-1047-5_2

Publisher Name: Springer, Boston, MA

Print ISBN: 978-1-4613-5368-3

Online ISBN: 978-1-4615-1047-5

eBook Packages: Springer Book Archive