Abstract

In this paper, we analyze the optimal consumption and investment problem of an agent by incorporating the stochastic hyperbolic preferences with constant relative risk aversion utility. Using the dynamic programming method, we deal with the optimization problem in a continuous-time model. And we provide the closed-form solutions of the optimization problem.

Similar content being viewed by others

1 Introduction

After the seminal research of Strotz [11], the exponential discount function with a constant discount rate has been widely used in finance/economics. He explained the phenomenon of the different preferences between current and future reward with the discount function. And much research on dynamically inconsistent preferences has been undertaken [1, 3, 4, 10, 12]. Especially the hyperbolic discounting model is the most widely used in the study of inconsistent preferences.

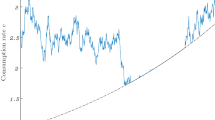

Harris and Laibson [4] introduced the instantaneous-gratification (IG) model of time preferences. This model is based on a quasi-hyperbolic stochastic discount function. Palacios-Huerta and Pérez-Kakabadse [9] extended the classical problem of [7, 8] to the time-inconsistent agent problem. They used stochastic hyperbolic preferences model (IG model) which is introduced in Harris and Laibson [4]. Zou et al. [13] extended the work of Palacios-Huerta and Pérez-Kakabadse [9] to an agent who has finite life time. They also found that stochastic hyperbolic discounting increases the optimal consumption rate.

Caillaud and Jullien [1] introduced the theoretical explanations of the model of time-inconsistent preferences. They also derived aspects of time-inconsistency from basic psychological phenomena. Gong et al. [2] described that the marginal effect of risk on consumption is always greater under hyperbolic discounting than under exponential discounting.

In this paper, we suggest a technical approach which is different from Palacios-Huerta and Pérez-Kakabadse [9] and Zou et al. [13] for solving an optimal consumption and investment problem with a stochastic hyperbolic discounting function. A stochastic hyperbolic discounting means that there is a jump on a subjective discounting factor. When a jump occurs in a subjective discounting factor, there is a change of an agent’s preference. It means that a preference of an agent is time-inconsistency. And it signifies that it is more sensitive to change the rewards that occur in the near future than those in the distant future. For example, the investor is willing to wait a day to receive a one more dollar in a year later. But she is not waiting to receive a one more dollar in today. We apply the dynamic programming method suggested by Karatzas et al. [6] to an optimal consumption and portfolio selection problem with a stochastic hyperbolic discounting function. This approach has many merits to handle the optimal consumption and portfolio selection problem under infinite horizon. First, after we introduce the inverse function of the optimal consumption \(X(c)= C^{-1}(x)\), we can turn the nonlinear ordinary differential equation (Bellman equation) into the linear ordinary differential equation (ODE). From this linear ODE, we easily obtain the general solution and particular solution to Cauchy equation. So it is possible to tackle the portfolio selection problem with the various economic constraints. The lack of this approach is that it is not proper in a finite horizon problem. Jeon and Shin [5] suggested the Mellin transform techniques to convert the Hamilton–Jacobi–Bellman partial differential equation (PDE) into a non-homogeneous PDE. Using the Mellin transform method which was used in Jeon and Shin [5], it is possible to extend our result to the finite horizon.

The rest of this paper is organized as follows. In Sect. 2, we introduce the financial market setup. We use the dynamic programming approach to derive the marginal propensity to consume corresponding to a stochastic hyperbolic discounting function in Sect. 3, and Sect. 4 concludes.

2 The financial market model

We assume that there are two assets which can be invested in the financial market. One is a riskless asset which pays a constant interest rate \(r>0\) and the other is a risky asset \(S_{t}\) which follows the geometric Brownian motion,

where \(\mu >r\) and \(\sigma >0\) are constants and \(B_{t}\) is a standard Brownian motion defined on a complete probability space \((\varOmega , \mathcal{F}, \mathbb{P})\) and \(\{\mathcal{F}_{t} \}_{t \geq 0}\) is the \(\mathbb{P}\)-augmentation of the filtration generated by the Brownian motion \(\{ B_{t} \}_{t\geq 0}\).

Let \(\pi _{t}\) be the amount invested in the risky asset at time t and \(c_{t}\) be consumption at time t. A portfolio process \(\{ \pi _{t} \}_{t\geq 0}\) is an adapted process with respect to \(\{\mathcal{F}_{t} \}_{t\geq 0}\), and a consumption process \(\{ c_{t} \}_{t\geq 0}\) is a non-negative adapted process with respect to \(\{\mathcal{F}_{t} \}_{t\geq 0}\). They satisfy the following mathematical conditions:

\(X_{t}\) is the agent’s wealth process at time t, which evolves according to the following stochastic differential equation (SDE):

with an initial endowment \(X_{0}=x>0\).

In this paper, we take into account the optimal consumption and portfolio selection problem of an agent with time-inconsistent preferences (for details, see Sect. 2.2 of Zou et al. [13]). Following Palacios-Huerta and Pérez-Kakabadse [9] and Zou et al. [13], we assume that the agent’s discount factor function \(D(t,s)\) is given by

where \(\rho >0\) and \(0<\beta \leq 1\). The discount factor function \(D(t,s)\) decays exponentially at a constant discount rate ρ in the present interval \([t,t+\tau )\), drops at time \(t+\tau \) to a fraction β of its level just prior to \(t+\tau \), and then decays exponentially at a rate ρ in the future interval \([t+\tau , \infty )\). The arrival of future is determined by τ which is stochastic and exponentially distributed with a constant intensity \(\lambda \geq 0\).

3 The optimization problem with a stochastic hyperbolic discounting

Now we consider the following optimization problem. In this problem, the infinite-lived agent wants to maximize her/his expected discounted lifetime utility:

subject to the budget constraint (2.2). Here, \(\mathcal{A}(x)\) is the class of all admissible controls \((c,\pi )\) at x, and \(u(\cdot )\) is a constant relative risk aversion (CRRA) utility function given by

where \(\gamma >0\) (\(\gamma \ne 1\)) is the agent’s coefficient of relative risk aversion.

Definition 1

A control pair \((c,\pi )\) is said to be admissible for initial wealth \(X_{t}=x\) if the following are satisfied:

-

(1)

equation (2.1) is satisfied,

-

(2)

\({\mathbb{E} [\int _{t}^{\infty }D(t,s) u^{-}(c_{s})\,ds \vert X_{t}=x ]<\infty }\), where \(\zeta ^{-}:=\max (-\zeta ,0)\).

We define Merton’s constant K such that

where \(\theta :=(\mu -r)/\sigma \) is the market price of risk. To guarantee the existence of the optimal solution, we assume that Merton’s constant K is positive.

Remark 1

For later use, we define a quadratic equation:

with two roots \(m_{+}>0\) and \(m_{-}<-1\). Also we have the following identities:

Remark 2

Note that

since \(g(-1/\gamma )=-K<0\).

By the dynamic programming principle, the value function \(V(x)\) in (3.1) satisfies the following Bellman equation (for details, refer to equation (20) in Sect. 4.2 of Zou et al. [13]):

where \(c^{*}_{t}\) is the optimal consumption of the optimization problem (3.1). In order to obtain the closed-form of \(V(x)\), we conjecture that

where \(K_{H}\) is constant and determined in the next theorem.

Theorem 1

Under the assumption

the marginal propensity to consume \(K_{H}\) is determined implicitly by the equation

Proof

Based on Karatzas et al. [6], we assume that the optimal consumption \(c^{*}=c=C(x)\) is a function of wealth and \(X(\cdot )=C^{-1}(\cdot )\), that is, \(X(c)=X(C(x))=x\). Then, from the first-order conditions (FOCs) of Bellman equation (3.3), we have

Plugging the FOCs and equations (3.7) into equation (3.3) implies

where \({f(c):=\int _{0}^{\infty }e^{-(\rho +\lambda )t} \mathbb{E}[u(c^{*} _{t})]\,dt}\) with optimal consumption c. Differentiating equation (3.8) with respect to c, we obtain the following non-homogeneous second-order ODE:

Using the method of variation of parameters to equation (3.9), we can derive the solution as follows:

Substituting \(X(c)\) into (3.8) with using the identities in (3.2) implies

From equation (3.4), we obtain the following relations with the optimal consumption and portfolio:

By using the above relations and Itô’s formula, we obtain the following equation:

So we can calculate \(f(c)\) as follows:

under assumption (3.5).

Plugging equation (3.12) into equation (3.10) with using Remark 2 implies

□

This result is exactly the same as the works of Palacios-Huerta and Pérez-Kakabadse [9] and Zou et al. [13]. So we omit the detailed analysis of the marginal propensity to consumption \(K_{H}\).

Remark 3

If there is no hyperbolic discounting (\(\beta =1\)), then the marginal propensity to consume is equal to Merton’s constant, that is, \(K_{H}=K\).

Remark 4

Under assumption (3.5), equation (3.6) implies

This coincides with the result of Palacios-Huerta and Pérez-Kakabadse [9].

If we are able to conjecture the value function or optimal consumption policy, then we can obtain the analytic value function as equation (3.11). It is different from the results of [9, 13]. It reveals that our method is useful to the portfolio selection problem with the various constraints.

4 Concluding remarks

In this paper we take into account a continuous-time optimal consumption and investment problem with stochastic hyperbolic discounting. We suggest another mathematical approach based on Karatzas et al. [6] which is different from the research works of Palacios-Huerta and Pérez-Kakabadse [9] and Zou et al. [13]. We believe that this approach is more useful to derive the closed-form solution of the consumption and portfolio optimization problem with various constraints. We will consider the optimal consumption and portfolio selection problem of an agent who receives constant labor income and will extend this problem with negative wealth constraints in the future work.

References

Caillaud, B., Jullien, B.: Modelling time-inconsistent preferences. Eur. Econ. Rev. 44, 1116–1124 (2000)

Gong, L., Smith, W., Zou, H.: Consumption and risk with hyperbolic discounting. Econ. Lett. 96, 153–160 (2007)

Grenadier, S.R., Wang, N.: Investment under uncertainty and time-inconsistent preferences. J. Financ. Econ. 84, 2–39 (2007)

Harris, C., Laibson, D.: Instantaneous gratification. Q. J. Econ. 123(1), 205–248 (2013)

Jeon, J., Shin, Y.H.: Finite horizon portfolio selection with a negative wealth constraint. J. Comput. Appl. Math. 356, 329–338 (2019)

Karatzas, I., Lehoczky, J.P., Sethi, S.P., Shreve, S.E.: Explicit solution of a general consumption/investment problem. Math. Oper. Res. 11, 261–294 (1986)

Merton, R.C.: Optimum consumption and portfolio rules in a continuous-time model. J. Econ. Theory 3, 373–413 (1971)

Merton, R.C.: Lifetime portfolio selection under uncertainty: the continuous-time case. Rev. Econ. Stat. 51, 247–257 (1969)

Palacios-Huerta, I., Pérez-Kakabadse, A.: Consumption and portfolio rules with stochastic hyperbolic discounting, 2011. Working paper

Rabin, M., Psychology and economics. J. Econ. Lit. 36(1), 11–46 (1998)

Strotz, R.H.: Myopia and inconsistency in dynamic utility maximization. Rev. Econ. Stud. 23(3), 165–180 (1956)

Wang, H.: Robust asset pricing with stochastic hyperbolic discounting. Finance Res. Lett. 21, 178–185 (2007)

Zou, Z., Chen, S., Wedge, L.: Finite horizon consumption and portfolio decisions with stochastic hyperbolic discounting. J. Math. Econ. 52, 70–80 (2014)

Acknowledgements

We are indebted to an anonymous referee for valuable advices and useful comments, which have improved our paper essentially.

Funding

Yong Hyun Shin gratefully acknowledges the support of the National Research Foundation of Korea (NRF) grant funded by the Korea government (MSIP) [Grant No. NRF-2016R1A2B4008240] and Kum-Hwan Roh gratefully acknowledges the support of Basic Science Research Program through the National Research Foundation of Korea (NRF) grant funded by the Korea government [Grant No. NRF-2017R1D1A3B03036548].

Author information

Authors and Affiliations

Contributions

All authors contributed equally to the writing of this paper. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Shin, Y.H., Roh, KH. An optimal consumption and investment problem with stochastic hyperbolic discounting. Adv Differ Equ 2019, 211 (2019). https://doi.org/10.1186/s13662-019-2144-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s13662-019-2144-y