Abstract

Legislative requirements are motivating vehicle manufacturers to produce innovative electric vehicle (EV), hybrid electric vehicle (HEV) and plug-in hybrid electric vehicle (PHEV) concepts. End-of-Life (EOL) for the vehicle’s battery is often taken to be the battery having 80% retained capacity. Even at this lower threshold, there is still considerable inherent value embedded within the battery system. The extraction of raw materials through recycling and the use of the battery in second life applications are widely documented. In contrast, there has been relatively little research published that investigates the options and requirements for remanufacturing the vehicle’s battery system as one means of improving the efficiency of the overall production process. This paper addresses two of the barriers, often cited, that inhibit organizations from adopting a remanufacturing strategy—ambiguity regarding the meaning of remanufacturing and uncertainty in how to manage intellectual property (IP). Based on a critical review of UK law and legal decisions pertaining to remanufacturing, the authors propose a revised set of definitions for circular economy activities, exploiting the terms: warranty and design-life to provide a clear differentiation for remanufacturing. The authors also propose a new framework for managing IP uncertainty. The model may be employed by both original equipment manufacturers (OEMs) to protect their innovations and remanufacturing activities and by independent organizations seeking to remanufacture OEM products.

Similar content being viewed by others

Introduction

One of the main drivers for technological development and innovation within the global automotive market is the need to reduce fuel consumption and the emissions of carbon dioxide (CO2). Legislative requirements are motivating manufacturers to produce innovative electric vehicle (EV), hybrid electric vehicle (HEV) and plug-in hybrid electric vehicle (PHEV) concepts. In recent years, there has been considerable research published into the different designs and technology options that underpin the vehicle’s energy storage system (ESS). This includes the use of different battery chemistries [3], the design of the energy management control software [32, 58, 61] and the mechanical integration of the battery system within the vehicle [27]. The primary motivation is often to overcome the systems engineering challenge and to design an ESS with an energy density and power density that will facilitate new vehicle concepts with a driving range and dynamic performance commensurate with consumer expectations. End-of-Life (EOL) for the vehicle’s ESS has been defined as the battery having 80% retained capacity (Ahmadi et al., 2014; [1, 11, 17, 46, 50]) and a doubling of a cell impedance from when it was new [58]. Many national bodies such as the Department for Energy (DOE) within the US and the Office for Low Emissions Vehicles (OLEV) within the UK employ such metrics to guide the automotive industry as to the length of product warranty and to incentivize consumer demand through the availability of vehicle purchase grants. However, a number of studies highlight the apparent arbitrary nature of these thresholds. It is often argued that even at 80% retained capacity, there is still considerable inherent value embedded within the ESS [35, 37, 46].

In addition to improving on-vehicle metrics of energy density, power density and component cost, there has been an increasing desire to better understand the sustainability of producing vehicles that contain embedded electrochemical energy storage. Much of this research has been guided by circular economy principles. In recent years, the term circular economy has come to embody any framework that advocates an alternative to the traditional linear economic model (make, use, dispose); retaining key resources within the supply chain for longer, extracting the maximum value from them whilst in use before embarking on a process of regenerating products and materials at the end of their service life [13].

Two of the primary concerns regarding the sustainability of electrified vehicles are the financial cost of the ESS and the associated environmental impact of the ESS during production, usage and recycling. The financial cost of the battery system is often cited as the primary barrier to EV production (Ahmadi et al., 2014; [17, 35, 37]). Research by [17], states that a 50% reduction in battery cost is required to equalize the economics of owning a PHEV as compared to a conventionally-fuelled vehicle. Conversely, [37] show that the EV powertrain cost must reduce from circa: $600–700 kWh-1 to $200 kWh-1 to achieve parity with comparable internal combustion engine (ICE) technology. Different mitigation strategies for lowering life-cycle cost through recycling and remanufacturing have been discussed. This includes the potential to save up to 20% of new battery cost through materials recycling and the use of remanufacturing techniques to offset up to 40% of new production costs [35]. The financial incentives associated with recycling different lithium-ion (Li-ion) battery chemistries is, however, not clear and is highly dependent on the chemistry employed [17, 37]. The Life-Cycle Assessment (LCA) of electrified vehicles has been widely reported [25, 35, 37, 45, 50, 62]. Common scenarios include the use of vehicle-to-grid (V2G) or the use of the vehicle’s battery in 2nd-life applications in which different EOL batteries are aggregated together to form larger grid-storage solutions for meeting peak-power demand. One of the primary outputs from LCA is a better understanding of the greenhouse gas emissions associated with ESS production as§compared to in-vehicle use.

A common view reported within the literature is that the sustainability of integrating resource intensive battery packs into vehicles is not clear. Embedding circular economy principles of reuse, remanufacturing and recycling is seen as one method to minimize production cost and environmental impact. Materials reprocessing through recycling and the use of the battery in 2nd—life applications is widely documented. In contrast, there has been relatively little research published that investigates the options and requirements for remanufacturing the vehicle’s battery system as one means of improving the efficiency of the overall production process. ‘Remanufacturing’ is generally seen as the process of returning a used product to at least its original performance with a warranty that is equivalent to or better than that of the newly manufactured product. However, as discussed further within Remanufacturing of vehicle battery systems section, subtle differences exist with the interpretation of remanufacturing that potentially may have significant implications for the adoption of a remanufacturing strategy and the ability of the intellectual property (IP) system to effectively support such adoption. A recent UK government report [52] highlights the strategic opportunities offered to industry through remanufacturing but cites the primary barriers as the lack of a global legal definition, engrained linear business models, negative regulatory frameworks, a shortage of skills and design IP conflicts.

The authors support this assertion and propose that a lack of understanding of how to manage the particular uncertainties associated with IP in remanufacturing represents a significant challenge for industry wishing to adopt a remanufacturing approach. The aim of this paper is to extend the discussion surrounding the application of circular economy principles to vehicle battery systems. This paper critically reviews the role of IP and the associated legislative framework within the context of remanufacturing a vehicle ESS as one means of improving the sustainability of introducing electrified vehicles to the market. A review of key legal decisions applied to remanufacturing in related fields of engineering and production underpins this research and the subsequent creation of a decision-making support model that can be employed by different stakeholders to manage IP uncertainty, reduce the risk of IP conflict and thereby lower the barriers to the successful adoption of circular business models.

This paper is structured as follows; Market and technology overview section provides an overview of the automotive market and ESS technology solutions currently employed. Remanufacturing of vehicle battery systems section discusses, in greater detail, the strategic challenge for remanufacturing within the low-carbon vehicle sector. The role of intellectual property in remanufacturing section considers the role of IP in remanufacturing and identifies the IP-related uncertainties particular to remanufacturing. Management of IP-related uncertainties in remanufacturing section proposes two tools for managing these particular uncertainties and tests them on three possible EV/HEV battery remanufacturing scenarios. Issues and scope for further work section considers issues and scope for further work. Conclusions from this research are presented in Conclusions section.

Market and technology overview

Market overview for electrified vehicles

A recent 2015 report by KPMG [30] highlights the potential for electrified vehicles to be between 11–15% of new vehicle sales within the EU and China by 2025. Within the US, the market may comprise 16–20% of vehicles over the next 10 years. These predictions are comparable to those cited in [37]. The article collates a number of studies and concludes that, by 2025, there will be in excess of 11 million EV sales worldwide, with approximately 6 million in North America (20% of new vehicle sales). Research presented in [17] predicts that in 2035 the number of available EOL batteries will range from 1.4 million in their pessimistic forecast to 6.8 million in the optimistic forecast with a middle forecast of 3.8 million. Their analysis concludes that this volume is sufficient to justify the capital investment required to enable remanufacturing, repurposing and recycling. Further, their study highlights that the number of available EOL batteries will be between 55% and 60% of the number of batteries needed for new EV and PHEV production; further supporting the opportunity for remanufacturing.

The potential volume of EVs that exists within the market is a key measure when considering different EOL strategies for the ESS. Within the context of remanufacturing, the potential volume of electrified vehicles underpins the security of the supply of the core. As discussed further in [3, 16, 20], the concept of the remanufacturing core relates to the fundamental component or subsystem that undergoes the remanufacturing process. This includes the reverse logistics and business models that define how the remanufacturer retains access to a sufficient volume of cores to create a sustainable production process. As discussed further in [52], in many regards the ESS does not exemplify the traditional core that is often associated with a successful remanufacturing activity. While there is considerable value embedded within the battery system and the raw materials employed with its production, the underpinning cell technologies, ESS production process and business models (e.g. vehicle purchase vs. vehicle lease) are far from mature with many different manufacturers and suppliers are implementing different strategies.

Vehicle energy storage systems

A consensus does not exist as to the optimal design of battery cell, in terms of both chemistry and form-factor, for use within automotive applications. There is significant research characterizing the different chemistries, including: Lithium Cobalt Oxide (LiCoO2), Lithium Iron Phosphate Oxide (LiFePO4), Lithium Nickel Cobalt Manganese (NCM—LiNixCoyMnxOZ) and Lithium Titanate Oxide (LTO—LI4Ti5O12). The integration challenge associated with designing a complete ESS using either pouch cells or cylindrical 18650 cells is reported within [32, 44, 58, 59].

It is beyond the scope of this paper to discuss, in detail, the engineering challenges associated with the ESS; further information can be found within [6, 24, 58]. To illustrate the complexity within a real-world system, Table 1 presents an overview of the contents of the battery pack within the commercially available Nissan Leaf EV. The complete battery assembly weighs 293 kg and contains 48 battery modules, each containing 4 li-ion pouch cells. An active cooling system is not included within the battery, but it does contain an electrical heating element to warm the li-ion cells. The 48 modules within the battery are grouped together into 3 primary sub-assembles called module stacks, each containing a number of electrical interfaces and mechanical fasteners. The module stacks are accessible once the pack lid has been removed, potentially making it easier to identify and replace faulty components during a repair or remanufacturing activity. The battery pack is held together and attached to the vehicle chassis using 20 mechanical bolts. Within the battery, at the module stack and module levels, a variety of different joining methods are employed, including mechanical screws and bolts, totaling 376 fasteners. It is noteworthy that adhesives or mechanical welds are not employed within the assembly which, as discussed within (Ahmadi et al., 2014; [7, 16]), can significantly inhibit system remanufacturability.

Of particular relevance to the remanufacturability of the ESS is a clear understanding of the ageing mechanisms and those factors that degrade cell capacity towards the 80% lower threshold. A number of studies highlight the relative importance of cell operating temperature, energy-throughput and depth-of-discharge on capacity degradation and increasing impedance [4, 38, 58]. Based on an improved understanding of battery degradation, a number of studies highlight different EOL options. Within [50] a decision making model is formulated for different scenarios. The model defines the optimum production strategy as remanufacturing for a cell with retained capacity between 100–80%; followed by reuse within a grid storage application for a retained capacity between 80–45%. Below this threshold the economics of the production process precludes further ESS repurposing and greatest economic benefit is recovered from material recycling.

Remanufacturing of vehicle battery systems

The importance of remanufacturing is demonstrated by the size of the remanufacturing market that is estimated to be between £6.3–£7.7 billion within Europe [13] and £70 billion globally [19]. Within the existing UK automotive sector, [41] estimates that the value of remanufacturing is approximately £250 million. As discussed within [37, 42, 50, 64], remanufacturing is a process that can often be confused with other EOL options such as repair, refurbishment, reconditioning and recycling. This is further complicated by the aforementioned problem of the lack of globally accepted legal definitions of the various options.

A number of possible definitions for ‘remanufacturing’ exist within the literature. Table 2 presents the definitions employed within [52]. A common view is that a remanufactured product should be of the same quality as the remanufactured article [5]. Within [12, 16, 34, 39, 52, 64] the definition of remanufacturing includes the requirement that the product must be offered with a warranty that is the same as the original product. Within [33] the definition of remanufacturing is further refined through the use of additional terms such as upward and downward remanufacturing to define the nature of the modifications made to the core. The generic remanufacturing process is defined within a number of publications, including [20] and includes inspection, disassembly, part replacement/refurbishment, cleaning, reassembly and testing [48]. Examples of remanufacturing processes and tools have been published that assess a product’s suitability for remanufacturing and assist with the implementation of a remanufacturing strategy [18, 49, 60].

The above discussion of EV/HEV battery remanufacturability notwithstanding, there is currently little evidence within the academic literature for a sustainable process for EV/HEV battery systems remanufacturing in the sense of Table 2. In recent years, independent commercial organizations have arisen that claim to offer a battery ‘remanufacturing’ service for the Nissan Leaf and the Toyota Prius. However, in all cases, the organizations only offer a limited warranty (circa: 12 months) and do not claim the vehicle will have a comparable performance to a newly purchased vehicle. Although there is little information within the public domain that defines the process steps employed and whether they comply with the remanufacturing stages introduced above, it is questionable if these services meet the requirements for remanufacturing defined in Table 2. One reason being that the primary contributor to capacity fade within li-ion cells is the formation of the solid electrode interface (SEI) layer between the graphite cathode and the electrolyte, which is known to be largely irreversible [36, 38, 43, 63]. Admittedly, research published within [42] discusses the possibility of removing the SEI from LiFePO4 cells as part of a cell-level remanufacturing process. However, the results presented are constrained to low capacity variants that are not transferable to the automotive domain. It follows that the services offered by independent commercial organizations are unlikely to be able to provide the ‘as new or better’ capacity required by the definition of 'remanufacturing' in Table 2.

OEM led initiatives that claim to remanufacture the vehicle‘s battery system through the identification and swap-out (replacement) of degraded modules similarly do not appear to meet the strict definition of ‘remanufacturing’ within Table 2. The vehicle’s battery is therefore not returned to its ‘as new’ condition and is not offered to the market with a comparable product warranty for the consumer. The ‘remanufacturing’ definition of Table 2 is therefore not met. Irrespective of the exact definition of the process employed and in keeping with key circular economy principles, the underpinning objective remains the same—to extend the in-vehicle service life of the vehicle’s battery and to delay, for as long as possible, the ultimate requirement for recycling. Moreover, if the technology to achieve this objective is not to be paid for solely by the state, then it must also be implemented in a way that is commercially viable.

The role of intellectual property in remanufacturing

General principles

As is generally known and set out e.g. in [10], [21] and [29], intellectual property laws support the commercial viability of technological ideas (‘inventions’) by granting a monopoly to their owners. Such a monopoly can allow the owner to sell the invention at a higher price than would be the case if there were no monopoly and competitors were also able to offer the invention. These higher prices result in higher profits that reward the earlier investment in development of the invention. For the protection of technological ideas, two main categories of intellectual property law are available: trade secret law, which involves keeping an idea out of the public domain, and patent law, which involves public registration of an idea.

As regards trade secret law, [47] proposes that this could have a positive impact on an OEM’s decision to remanufacture products in the automotive aftermarket, citing the suggestion by [40] that in-house disassembly of a used product reduces the risk of design secrets being lost, as might otherwise be the case were disassembly to be performed by a third party. Specifically, [40] suggests that an OEM may be obliged to provide such a third party with trade secrets in the form of designs, product material manifests and prototypes in order that the third party might be able to build an efficient disassembly system, but that such trade secrets could then become public—or at least available to competitors—particularly if the third party is not ‘captive’ but rather free to service more than one firm. The US company GreenDisk is cited as a positive example of a recycling supplier that promises to provide secured and audited disposal of IP, albeit in the sense of data stored on collected electronic media (e.g. CDs and DVDs) rather than designs, product material manifests and prototypes. Hewlett Packard’s investment in US company Micro Metalics is also cited, apparently as a way of creating a ‘captive’ recycler of cathode ray tubes, albeit one that uses a ‘grind and sort’ approach rather than a disassembly approach. [40] also cites automotive OEM BMW as an example of recycling with disassembly, but with no indication of whether such recycling is carried out in-house or externally or the extent to which this is influenced by a desire to protect trade secrets. As regards patent law, [47] suggests that the expansion of automotive electronics has forced many automotive suppliers to apply for patents, inter alia to defend against brand erosion by counterfeit products. A survey by [22] suggests that, in the UK and German automotive sectors, valid patent rights are generally respected and rarely require enforcement through court action.

Whilst the literature above is generally positive as regards the impact of IP on remanufacturing, the aforementioned observations of [52] suggest that remanufacturing may give rise to additional uncertainties that increase the likelihood of IP conflict and act as an additional barrier to organizations wishing to adopt a remanufacturing strategy. Certainly, with regard to US law, [28] refers to ‘mischief that ensues when courts must solve the riddle’ of the right to repair.

It is therefore with a view to addressing such potential shortcomings in the literature, and in particular with regard to the situation in the UK, that the most recent UK Supreme Court decision in the area of remanufacturing has been analysed with a view to identifying remanufacturing-specific uncertainties. Unlike the sciences, where more data gives a more definitive picture, UK law is built on precedent, with the conclusions of current court decisions taking account of, and sometimes overruling, the conclusions of earlier court decisions. With a view to obtaining a robust picture, four UK court cases relating to remanufacturing have been reviewed together with a case that was settled before being decided. One [54] relates to the automotive field of interest. However, this decision together with another [31] from the high-profile field of printer toner cartridges has been superseded, both with respect to conclusions and to IP rights. Hence only the three remaining cases are considered in detail below.

Schütz (UK) limited v Werit (UK) limited

The present position of UK patent law in respect of remanufacturing was set out by the UK Supreme Court (2013) in Schütz (UK) Ltd v Werit (UK) Ltd. According to the published decision, claimant Schütz was the leading manufacturer of rigid composite intermediate bulk containers (‘IBC’) in the UK. Such containers are ubiquitous and comprise a metal cage that may be attached to a wooden pallet into which a large plastic container is fitted. New IBCs are normally sold to a “filler”—such as a manufacturer of food additives—who then uses the IBC to send its product to an end-user such as a drinks manufacturer. Used IBCs are then collected, the large plastic container removed and replaced by a new container (a process described in the published decision as ‘reconditioning’) before being offered back to fillers as an alternative to new IBCs. Thus, in the terminology used above, the cage of the used IBC is the ‘core’ while the manufacturer of new IBCs is the ‘OEM’. The published decision explains that the OEMs also ‘recondition’ their own original IBCs (around 25% of Schütz’s output being ‘reconditioned’) but that there are many competing suppliers of IBCs who are solely ‘reconditioners’ of used OEM cores.

In accordance with the role of intellectual property set out above, Schütz asserted its patent monopoly against the ‘reconditioner’ Delta Ltd and the manufacturer of new replacement bottles, Werit Ltd. Specifically, Schütz asserted its patent covering its particular IBC having a particular construction of cage, arguing that, in placing new bottles in discarded Schütz cages, Delta was performing the prohibited act of ‘making’ the IBC covered by the patent. When Delta and Werit disagreed with this assertion, Schütz launched legal proceedings in the Patents Court with a view to obtaining a binding decision in its favour. This decision was subsequently appealed to the Court of Appeal and hence to the UK Supreme Court, which decided that Delta and Werit should be allowed to continue to sell their ‘reconditioned’ IBCs using Schütz cages.

The UK Supreme Court decided that in placing new bottles in discarded Schütz cages, Delta was not performing the act of ‘making’ of the IBC covered by the patent and which would otherwise be prohibited by the patent statutes, noting that: “In the present case, given that (a) the bottle (i) is a freestanding, replaceable component of the patented article, (ii) has no connection with the claimed inventive concept, (iii) has a much shorter life expectancy than the other, inventive, component, (iv) cannot be described as the main component of the article, and (b) apart from replacing it, Delta does no additional work to the article beyond routine repairs, … Delta does not “make” the patented article.”

United Wire Limited v. Screen Repair Services (Scotland) Limited

Prior to the Schütz decision of 2013, the definitive case in the area of remanufacturing had been set out by the UK House of Lords [54], the predecessor of the UK Supreme Court, in United Wire Limited v. Screen Repair Services (Scotland) Limited. According to the published decision, United Wire Limited were “the market leaders in selling … complete vibratory sifting machines” for sifting drilling fluids used in offshore oil extraction. These machines employ special mesh sifting screens “consisting of a frame or “support member” to which two meshes of different mesh sizes are “bonded” or adhesively secured at the periphery so as to be at different tensions.” However, the screens “quickly become torn in use. To some extent they can be patched but this reduces their efficiency because the patches are impermeable or “blind.” … [United Wire] therefore also enjoy a captive and profitable aftermarket in selling replacement screens made in accordance with their inventions.” Scottish company Screen Repair Services Limited (SRS) sold replacement mesh sifting screens for United Wire’s sifting machines, removing the damaged mesh from original United Wire screens and stripping the remaining frame down to the bare metal before attaching a new mesh.

In accordance with the role of IP set out above, United Wire asserted its patent monopoly against SRS. Specifically, United Wire asserted its patent covering the special mesh sifting screens, arguing that, in placing a new mesh on the original United Wire frames, SRS was performing the prohibited act of ‘making’ the screen covered by the patent. When SRS disagreed with this assertion, United Wire launched legal proceedings in the Patents Court with a view to obtaining a binding decision in its favour. This decision was subsequently appealed to the Court of Appeal and hence to the UK Supreme Court. As noted in the published decision, SRS argued that “although the product which they sell is a screen in accordance with the [patented] invention, they do not infringe because they do no more than repair screens which have been marketed with the consent of [United Wire]”.

In response, the Court noted that acts prohibited by the patent statutes “are infringing acts whether or not they can be categorized as repairs. It is therefore better to consider whether the acts of a defendant amount to manufacture of the product rather than whether they can be called repair, particularly as what could be said to be repair can depend upon the perception of the person answering the question” (emphasis added). The decision went on to note that “in this case the defendants had made the product. They had repaired or reconditioned the frame and then used that frame to make a screen in exactly the same way as if they had bought the frames as components from a third party.” In other words, the Court simply focused on whether SRS’ activity constituted the act of ‘making’ the screen covered by the patent and thus prohibited under the patent statutes.

Canon KK v. Badger Office Supplies Ltd

A press release from Canon [8] announced that it had launched UK legal proceedings against Badger Office Supplies Limited and two other companies for infringement of their European patent “by, inter alia, the importation, manufacture and sale of certain toner cartridges for use in various models of Canon and Hewlett-Packard laser beam printers” (emphasis added). A subsequent response from Badger, reported in The Recycler [51], clarifies that “Badger sells remanufactured … toner cartridges, but Canon believes that any remanufactured toner reusing OEM components infringes the … patent”. The Canon press release further indicates that “In the action, Canon is seeking various remedies including an injunction and damages”, Herbert Smith [26] reporting Canon’s argument that the patent in suit “protected sales of products worth €70 million each year”.

Unlike the cases discussed in Schütz (UK) Limited v Werit (UK) Limited and United Wire Limited v. Screen Repair Services (Scotland) Limited sections, this case was never the subject of a final court decision, having been settled beforehand—see [2]. It was, however, the subject of a preliminary decision by the England and Wales Patents Court [14] that the complexity of the case rendered it unsuitable for consideration by the (cheaper) Intellectual Property Enterprise Court. Moreover, according to The Recycler [51], Badger took the unusual step of putting its points of disagreement with Canon into the public domain, asking Canon for clarification of “the level of permitted repair to an OEM empty cartridge before it infringes … [Canon’s] patent” and listing several possible remanufacturing scenarios (in addition to the essential step of refilling the cartridge with toner). These were:

-

1.

No replacement of any parts,

-

2.

Replacement of a minor part e.g. magnetic roller or wiper blade,

-

3.

Replacement of toner drum fitted with a new gear/coupling which avoids infringing the patent and

-

4.

Fit OEM gear/coupling from that empty (not another empty) onto a new toner drum and the new combined part then assembled into the empty.

Of relevance to scenarios 3 and 4 was a further report by [26] that Badger “also challenged infringement on the basis that it purchased ‘remanufactured’ drums from a third party located in China, and the remanufacturing process carried out by that party was a legitimate ‘repair’ of the product rather than infringement by ‘making’ the patented product.”

For its part, Canon [9] stated on its website that “Recycling means that toner cartridges are neither refilled nor remanufactured. Toner cartridges that are refilled or remanufactured reuse critical toner cartridge parts that could be damaged or close to the end of their lifespan. They are more likely to malfunction, generate fewer prints, and do not guarantee print quality. By recycling toner cartridges, Canon safeguards toner cartridge quality and protects the environment.”

IP-Related Uncertainties Particular to Remanufacturing

The authors suggest that there are two IP-related uncertainties that are particular to remanufacturing and that increase the likelihood of IP conflict. The first is that alluded to in [52], namely a lack of legally recognized definitions. The second uncertainty is whether circular activities regardless of how the perpetrator chooses to describe them are covered by IP rights.

IP-related uncertainties

The Supreme Court uses terms ‘repair’ and ‘reconditioning’ interchangeably in both the Schütz and United Wire decisions. For their part, defendants describe their activities as ‘repair’ and ‘remanufacture’ to stave off allegations of patent infringement while OEM patent owners try to distinguish their own circular activities from the ‘remanufacturing’ of aftermarket suppliers by the term ‘recycling’. In its Schütz decision, the UK Supreme Court summarizes the current state of the law as “deciding whether a particular activity involves “making” the patented article involves … an exercise in judgment, or … it is a matter of fact and degree. In some such cases, one can say that the answer is clear; in other cases, one can identify a single clinching factor. However, in this [Schütz] case, it appears to me that it is a classic example of identifying the various factors which apply on the particular facts, and, after weighing them all up, concluding, as a matter of judgment, whether the alleged infringer does or does not “make” the patented article”. Together, these two uncertainties increase the likelihood of disagreement and IP conflict, thereby decreasing the willingness of companies to invest in circular activities.

The potential impact on circular economy activities

To understand how these uncertainties might impact on circular economy activities in the field of EV/HEV batteries, the authors consider three example scenarios for the OEM-led initiatives mentioned above:

-

1.

A battery pack has a warranty for 8 years, but after 5 years the pack fails in some way; subsystems within the battery pack are replaced (e.g. a new battery module, some power electronics etc.) and the battery pack is reused within a vehicle with a 3-year warranty (corresponding to the balance of the original 8-year warranty).

-

2.

As 1, but the battery pack is returned to the market with the original 8-year warranty.

-

3.

Ten battery packs fail in the fifth year; a first battery pack is designated as the “host” and the other nine battery packs are disassembled with parts from each being used to bring the first battery pack back to working order.

Firstly, there is the basic uncertainty, mentioned above, as to whether such activities can properly be considered to be ‘remanufacturing’, particularly where, as in scenario 1, an ‘as new’ warranty is not issued. This will make it more difficult for an OEM to distinguish their activities from the activities of non-approved independent organizations and vice versa. Secondly, there is uncertainty whether an OEM will be able to maintain the patent monopoly over these activities that is necessary to support the commercial viability of the activities, in particular to repay the investment in designing battery packs for remanufacture.

Management of IP-related uncertainties in remanufacturing

Structured approach

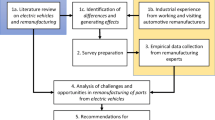

Drawing on the legal decisions presented in The role of intellectual property in remanufacturing sections, the authors propose the IP decision support model shown in Fig. 1 as one means of mitigating any potential IP uncertainty associated with the remanufacturing process. There is established precedent for managing IP-related uncertainties in the automotive industry. Moreover, the scenarios above suggest a basis on which the two circular-specific uncertainties might be managed. Fundamental would seem to be the act of ‘replacement’: not only is this key to the EV/HEV battery scenarios above, it is also a key determinant of infringement in the three legal cases discussed: a bottle is replaced in the Schütz decision, mesh is replaced in the United Wire decision and a toner drum is replaced in at least two of the scenarios proposed by Badger Office Supplies in its dispute with Canon. Thus the identification of the act of replacement provides a first step in the process of managing uncertainty as indicated in decision diamond 1 of Fig. 1. The absence of an act of replacement would seem to be indicative of the absence of a ‘permission issue’, the latter term being used in preference to the term ‘infringement’ of third-party IP rights, which has negative, fear-engendering connotations. It is the authors’ submission that, in a busy technological field such as EV battery systems, third-party IP rights may well be unavoidable and must consequently be managed rather than feared.

A second inherent issue, indicated by diamond 2 of Fig. 1, is whether a third-party IP right covers the remanufactured article. If answered in the affirmative, this leads to a third decision (diamond 3 of Fig. 1) regarding the presence/absence of the ‘Schütz factors’ (i)-(iv) cited in support of the UK Supreme Court’s finding in the Schütz decision that the activity of replacing the bottle of an IBC should not being considered as infringing a third-party patent to the IBC as a whole. Violation of these factors is indicative of a permission issue with respect to a third-party patent.

The final issue, indicated by diamond 4 of Fig. 1, is whether the replaced aspect is itself covered by a third-party IP right. This, arguably more conventional situation, does not arise in the Schütz and United Wire cases: if it had, then there may not have been the uncertainty and disagreement that led to the matter being taken to the courts. It does arise in the yet-to-be-decided Canon case, however, where Badger lists one possible scenario as ‘replacement of toner drum fitted with a new gear/coupling which avoids infringing the patent’. The latter underlined wording serving as an acknowledgement that, in addition to having claims that protect a complete toner cartridge, the patent asserted by Canon also has a second set of claims that protect the toner drum unit on its own. To the extent that the replaced aspect is covered by an IP right and is newly manufactured, there is a strong likelihood of a permission issue.

There is a further possibility—highlighted by Badger’s assertion in the Canon case that it “purchased ‘remanufactured’ drums from a third party located in China, and the remanufacturing process carried out by that party was a legitimate ‘repair’ of the product rather than infringement by ‘making’ the patented product”—namely that the replaced aspect is itself remanufactured. In such circumstances, to determine whether there is a permission issue, that aspect must itself be subjected to the above process—as indicated by the box ‘repeat from START’ at the bottom right-hand corner of Fig. 1.

Complementary terminology

Complementary to the decision-making tool of Fig. 1, the authors also propose a revised set of definitions that arise from another issue fundamental to EV/HEV batteries, namely that of warranty. As discussed in Introduction section, an adequate warranty on battery life is a prerequisite for financial support from UK government agencies. Indeed, warranty is by definition related to the design life of an article, which is in turn is a concept that arises in two of the legal cases discussed above. In the case of Schütz, the European patent in suit protected an IBC in which the metal cage was constructed—by a particular configuration of the connections between the vertical and horizontal lattice bars of the cage—for the explicit purpose of improving the durability (i.e. design life) of the cage. Such durability is a prerequisite for the reuse of a cage in a remanufactured IBC. In the case of Canon, the Canon [9] notes that ‘toner cartridges that are refilled or remanufactured reuse critical toner cartridge parts that could be damaged or close to the end of their lifespan’ while also indicating that the charging roller, sleeve and magnetic roller components of the cartridge are in fact re-used. Table 3 compares the current definitions with the proposed definitions, expressed both in terms of warranty (a legally-recognized concept) and in terms of design life (a technically-recognized concept).

Management of IP-related uncertainties in EV/HEV battery remanufacturing

Applying Fig. 1 to the 3 battery remanufacturing scenarios, all will meet the condition of decision (1) that there is replacement of articles, namely of subsystems of the battery pack. However, the outcome of decision (2) (‘is the remanufactured article covered by an IP right’) will depend on the knowledge of third-party IP rights, which may necessitate conventional searches in patent databases of the kind discussed in [22]. Moreover, to the extent that a third-party IP right does cover the remanufactured article, the outcome of decision (3) will require the input of a legal professional, again a conventional IP risk management measure of the kind discussed in [22]. Finally, conventional searches in patent databases will again be required to determine the outcome of decision 4 (‘is the replaced aspect covered by an IP right’). It follows that whilst the tool of Fig. 1 cannot remove uncertainty, it nevertheless provides a framework within which uncertainty can be managed using conventional IP risk management techniques (searches, legal assessment). It can also be used both ways—by OEMs looking to protect their remanufacturing activity (in the manner of Schütz, United Wire and Canon) and by independent commercial organizations looking to remanufacture OEM products (in the manner of Delta, SRS and Badger Office Supplies).

Applying the ‘Proposed Definition based on Warranty’ column of Table 3 allows the three scenarios to be clearly distinguished. Scenario 1, where remedial work takes place within the initial warranty period of the battery pack without that warranty being renewed, falls within the definition of ‘repair’. However, should the same work be considered as justifying a new warranty, as in scenario 2, then it will fall within the definition of ‘remanufacture’. Scenario 3, where remedial work again takes place within the initial warranty period of the battery pack, will again fall within the definition of ‘repair’ unless a new warranty is issued, in which case it will be considered as ‘remanufacture’. Should remedial work on the battery take place after expiry of the warranty (perhaps in a second life scenario) such work will fall within the proposed definition of ‘reconditioning’ except where the work is aesthetic where ‘refurbishment’ will apply. Application of the ‘Proposed Definition based on Design Life’ column of Table 3 is less straightforward given that, as previously noted, the ageing process and design life of EV/HEV batteries continues to be a subject of research.

The above categorization is not a matter of mere semantics: as evidenced by the case studies above, disagreement over how to describe a particular activity is a key source of uncertainty leading to IP conflict. The warranty-based definitions of Table 3 address this by providing a clear unambiguous framework on which to base discussions aimed at resolving disagreement without resort to the courts. Moreover, within an organization such as a large OEM, the proposed definitions can facilitate communication between technologists responsible for product design, management responsible for business models and the legal department responsible for managing IP risk. As noted by [23] with reference to [15], differing understanding between business and legal personnel of the meaning of apparently straightforward terms can have far-reaching consequences for a business.

Issues and scope for further work

In its own words, UK law is still changing and evolving to meet the needs of society (UK Courts and [53]), which includes the needs of society regarding circular manufacturing activities. It follows that the structured approach set out in Fig. 1 may also evolve, not least to reflect any final court decision in the Canon litigation. There is also scope for the law to evolve in response to the approaches set out above with a view to encouraging circular manufacturing. Similar refinements to other aspects of UK legislation have already been proposed in [52]. In IP law there is precedent in the Supplementary Protection Certificates introduced in the 1990s to encourage the development of new pharmaceuticals. For example, the ‘Schütz factors’ in favour of a given activity not being considered as ‘making’ a patented article could be waived in cases where a core was still under warranty by the OEM. Alternatively, the factors could be waived where, as in the Schütz case, the patent in suit relates to an invention that enhances remanufacturability. Such measures could incentivize OEMs to make their products more remanufacturable and remove the significant source of uncertainty represented by the proposed decision support model in Fig. 1, thereby reducing the aforementioned barrier of IP conflict.

UK law alone is of limited relevance to the automotive industry, which operates on a global basis, although it should be noted that UK Supreme Court decisions often reference jurisprudence from other countries around the world. Accordingly, there is scope for considering how the structured approach set out in Management of IP-related uncertainties in remanufacturing section might be modified to allow IP uncertainty to be managed across key markets or indeed globally, referring to analyses of the kind carried out by [28], as well as more recent conflicts such as those instigated in US automotive remanufacturing by Remy [56, 57]. Similarly useful would be the extension of the study to IP rights other than patents, such as the assertion of US trade secret rights by Faiveley [55] in support of a remanufacturing business model in the field of railway braking systems. While this research has focused on the IP considerations pertaining to remanufacturing, research should be undertaken to review the potential impact of IP uncertainty within related areas of the circular economy. This will further refine the robustness of the conclusions made here and highlight the transferability of the proposed decision support model to other technologies and circular economy activities.

Finally, in the particular area of EV and HEV battery systems, there is scope for testing the structured approach against real-life IP rights rather than just theoretical scenarios. This may be complicated by commercial confidentiality considerations; however, the likely future importance of this technology and of circular manufacturing suggests that such real life IP conflicts will end up in the Courts and will therefore be available for analysis sooner rather than later.

Conclusions

The need to meet stringent environmental legislation aimed at decarbonizing road transport is motivating manufacturers to produce innovative vehicles with increasing levels of powertrain electrification and embedded electrochemical energy storage. EOL for the vehicle’s battery is often taken to be when the energy capacity has reduced by 20%. However, even at this lower threshold, a number of publications highlight the inherent value that remains embedded within the battery. The authors show that there has been little published research that investigates the requirements for remanufacturing the battery system as one means of improving the sustainability of introducing EVs into the market. The authors propose that a lack of understanding of how to manage the uncertainties associated with IP in remanufacturing represents a significant challenge for industry wishing to adopt a remanufacturing strategy. Furthermore, the ambiguity surrounding the exact meaning of a number of related circular economy activities such as: repair, reconditioning, refurbishment and remanufacturing drives further uncertainty into how to best adopt remanufacturing. Based on a critical review of UK law and legal decisions pertaining to remanufacturing, the primary contribution of this research is a revised set of definitions for circular economy activities, exploiting both the terms warranty and design-life to provide a clear differentiation for remanufacturing. Based on this work, the authors derive a new framework for managing IP uncertainty. The authors demonstrate how the proposed decision support model may be employed by both OEMs to protect their innovations and remanufacturing activities and by independent organizations seeking to remanufacture OEM products.

Abbreviations

- DOE:

-

Department of Energy

- EOL:

-

End of life

- ESS:

-

Energy storage system

- EV:

-

Electric vehicle

- HEV:

-

Hybrid electric vehicle

- HV:

-

High voltage

- ICE:

-

Internal combustion engine

- IP:

-

Intellectual Property

- LCA:

-

Life cycle assessment

- NREL:

-

National Renewable Energy Laboratory

- OLEV:

-

Office for Low Emissions Vehicles

- PHEV:

-

Plug-in hybrid electric vehicle

- UK:

-

United Kingdom

- US:

-

United States

- V2G:

-

Vehicle-to-grid

References

Antaloae C, Marco J, Assadian F. A novel method for the parameterization of a Li-Ion Cell Model for EV/HEV control applications. IEEE Trans Veh Technol. 2012;61:3881–92. doi:10.1109/TVT.2012.2212474.

Badger Office Co. Press release dated Tuesday 16th February 2016 [online] http://www.badgeroffice.co.uk/. 2016. (Accessed 21 June 2016).

Boston Consulting Group. Focus: Batteries for Electric Cars, Challenges, Opportunities and the Outlook to 2020. 2010.

Brand MJ, Schuster SF, Bach T, Fleder E, Stelz M, Gläser S, Müller J, Sextl G, Jossen A. Effects of vibrations and shocks on lithium-ion cells. J Power Sources. 2015;288:62–9. doi:10.1016/j.jpowsour.2015.04.107.

Bras B, Hammond R. Towards Design for Remanufacturing – Metrics for Assessing Remanufacturability. In: Proceedings of the 1st International Workshop on Reuse. Eindhoven, The Netherlands: 1996. pp. 5–22.

Bruen T, Marco J. Modelling and Experimental Evaluation of Parallel Connected Lithium Ion Cells for an Electric Vehicle Battery System. J Power Sources. 2016;310:99–101.

BS8877-1:2006. BSI: Design for manufacture, assembly, disassembly and end-of-life processing (MADE) - Part 1: General Concepts, Processes and Requirements. 2006.

Canon. Canon announces patent infringement action in England and Wales [online] http://www.canon.com/news/2014/aug28e.html. 2014. (Accessed 2 June 2015).

Canon. Recycled, not refilled [online] http://www.canoneurope.com/for_home/product_finder/multifunctionals/laser/features/environment/cartridge_recycling/recycled.aspx. 2015. (Accessed 2 June 2015).

Cantrell RL. Outpacing the competition: patent-based business strategy. New Jersey: Wiley; 2009.

Dubarry M, Truchot C, Liaw BY, Gering K, Sazhin S, Jamison D, Michelbacher C. Evaluation of commercial lithium-ion cells based on composite positive electrode for plug-in hybrid electric vehicle applications. Part II. Degradation mechanism under 2C cycle aging. J Power Sources. 2011;196:10336–43. doi:10.1016/j.jpowsour.2011.08.078.

El Saadany AM a, Jaber MY, Bonney M. How many times to remanufacture? Int J Prod Econ. 2013;143:598–604. doi:10.1016/j.ijpe.2011.11.017.

Ellen Macarthur Foundation, McKinsey & Company. Towards the Circular Economy : Accelerating the scale-up across global supply chains, world Economic Forum Reports. 2014.

England and Wales Patents Court. Canon Kabushiki Kaisha v Badger Office Supplies Ltd & Ors [2015] Ch. D, 6 February 2015. 2015.

England and Wales Patents Court. Baillie & Ors v Bromhead & Co [2014] EWHC 2149 (Ch) 2nd July 2014.

Fang HC, Ong SK, Nee a YC. Product remanufacturability assessment based on design information. Procedia CIRP. 2014;15:195–200. doi:10.1016/j.procir.2014.06.050.

Foster M, Isely P, Standridge CR, Hasan M. Feasibility assessment of remanufacturing, repurposing, and recycling of end of vehicle application lithium-ion batteries. J Ind Eng Manage. 2014;7:698–715.

Gehin A, Zwolinski P, Brissaud D. A tool to implement sustainable end-of-life strategies in the product development phase. J Clean Prod. 2008;16:566–76. doi:10.1016/j.jclepro.2007.02.012.

Global industry analysts. Automotive Remanufacturing, A Global Strategic Business Report. 2010.

Goodall P, Rosamond E, Harding J. A review of the state of the art in tools and techniques used to evaluate remanufacturing feasibility. J Clean Prod. 2014. doi:10.1016/j.jclepro.2014.06.014.

Granstrand O. The economics and management of intellectual property: towards intellectual capitalism. Cheltenham: Edward Elgar Publishing; 1999.

Hartwell IP. Patent infringement clearance practice in UK and German automotive companies. Int J Intellect Property Manag. 2012;5:1.

Hartwell IP. Using shape, position and colour to explain and embed the distinction between patent invalidity and patent infringement. Riga: European Intellectual Property Teachers’ Network Annual Conference; 2015.

Hannan M a, Azidin F a, Mohamed a. Hybrid electric vehicles and their challenges: A review. Renew Sustain Energy Rev. 2014;29:135–50. doi:10.1016/j.rser.2013.08.097.

Hendrickson TP, Kavvada O, Shah N, Sathre R, Scown CD. Life-cycle implications and supply chain logistics of electric vehicle battery recycling in California. Environ. Res Lett. n.d.;10, 14011. doi:10.1088/1748-9326/10/1/014011.

Herbert Smith Freehills. Canon’s printer cartridge patent infringement claim too complex for transfer to IPEC. Patent and Pharma Update, March 2015. London: 2015.

Hooper JM, Marco J. Experimental modal analysis of lithium-ion pouch cells. J Power Sources. 2015;285:247–59. doi:10.1016/j.jpowsour.2015.03.098.

Janis, M.D. A Tale of the Apocryphal Axe: Repair, Reconstruction, and the Implied License in Intellectual Property Law, 58 Md. L. Rev. 1999;423.

Knight HJ. Patent strategy for researchers and research managers. Chichester: Wiley; 1996.

KPMG’s Global Automotive Executive Survey. 2015.

Lords of the Judicial Committee of the Privy Council. Canon Kabushiki Kaisha v. Green Cartridge Company (Hong Kong) Limited [1997] UKPC 19. 1997.

Lu L, Han X, Li J, Hua J, Ouyang M. A review on the key issues for lithium-ion battery management in electric vehicles. J Power Sources. 2013;226:272–88. http://dx.doi.org/10.1016/j.jpowsour.2012.10.060.

Marshall SE, Archibald TW. Substitution in a hybrid remanufacturing system. Procedia CIRP. 2015;26:583–8. doi:10.1016/j.procir.2014.07.073.

Nasr N, Thurston M. Remanufacturing : A Key Enabler to Sustainable Product Systems. 2006. p. 15–8.

Neubauer J, Pesaran A. The ability of battery second use strategies to impact plug-in electric vehicle prices and serve utility energy storage applications. J Power Sources. 2011;196:10351–8. doi:10.1016/j.jpowsour.2011.06.053.

Ning G, Haran B, Popov BN. Capacity fade study of lithium-ion batteries cycled at high discharge rates. J Power Sources. 2003;117:160–9. doi:10.1016/S0378-7753(03)00029-6.

Olalekan M, Zhang RH. End-of-life (EOL) issues and options for electric vehicle batteries. Clean Technol. Environ Policy.2013;881–891. doi:10.1007/s10098-013-0588-4.

Omar N, Monem MA, Firouz Y, Salminen J, Smekens J, Hegazy O, Gaulous H, Mulder G, Van den Bossche P, Coosemans T, Van Mierlo J. Lithium iron phosphate based battery – Assessment of the aging parameters and development of cycle life model. Appl Energy. 2014;113:1575–85. doi:10.1016/j.apenergy.2013.09.003.

Opresnik D, Taisch M. The manufacturer’s value chain as a service - the case of remanufacturing. J Remanufacturing.2015;5. doi:10.1186/s13243-015-0011-x.

Pagell M, Zhaohui W, Murthy N. The supply chain implications of recycling. Bus Horiz. 2007;50:133–43.

Parker D. A study on behalf of DTI and SMMT into automotive aftermarket remanufacturing. 2009.

Monsuru R, Zhang HC. "Remanufacturing processes of electric vehicle battery." 2012 IEEE international symposium on sustainable systems and technology (ISSST). Boston: IEEE; 2012. p. 1-11.

Ramoni MO, Zhang H-C. End-of-life (EOL) issues and options for electric vehicle batteries. Clean Technol Environ Policy. 2013;15:881–91. doi:10.1007/s10098-013-0588-4.

Santhanagopalan S, White RE. Quantifying cell-to-cell variations in lithium ion batteries. Int J Electrochem. 2012;2012:1–10. doi:10.1155/2012/395838.

Schau EM, Traverso M, Lehmann A, Finkbeiner M. Life cycle costing in sustainability assessment—a case study of remanufactured alternators. Sustainability. 2011;3:2268–88. doi:10.3390/su3112268.

Schneider EL, Jr, WK, Souza S, Malfatti CF. Assessment and reuse of secondary batteries cells. 2009;189:1264–9. doi:10.1016/j.jpowsour.2008.12.154.

Subramoniam R, Huisingh D, Chinnam R. Remanufacturing for the automotive aftermarket – strategic factors: literature review and future research needs. J Cleaner Prod. 2009;17:1168–74.

Sundin E. Product and Process Design for Successful Remanufacturing (PhD), Department of Mechanical Engineering Linköpings Universitet, SE-581 83 Linköping, Sweden.

Sundin E, Lindahl M. Rethinking Product Design for Remanufacturing to Facilitate Integrated Product Service Offerings In: IEEE International Symposium on Electronics and the Environment; 2008.

Thein S, Chang YS. Decision making model for lifecycle assessment of lithium-ion battery for electric vehicle – A case study for smart electric bus project in Korea. J Power Sources. 2014;249:142–7. http://dx.doi.org/10.1016/j.jpowsour.2013.10.078.

The Recycler. Badger Office Supplies comments on Canon case [online] http://www.therecycler.com/posts/badger-office-supplies-comments-on-canon-case/. 2014. (Accessed 2 June 2015).

Triple Win: The Social, Economic and Environmental Case for Remanufacturing. A Report by the All Party Sustainable Resource Group and the All Party Parliamentary Manufacturing Group. 2014. http://www.policyconnect.org.uk/apsrg/research/report-triple-win-social-economic-and-environmental-case-remanufacturing.

UK Courts and Tribunals Judiciary. History of the Judiciary [online] https://www.judiciary.gov.uk/about-the-judiciary/history-of-the-judiciary. 2015. (Accessed 2 June 2015).

UK House of Lords. British Leyland Motor Corporation and Others v Armstrong Patents Company Limited [1986] R.P.C. 103. 1986.

United States District Court Southern District of New York. Faiveley Transport USA Inc. et al v Wabtec Corporation 10-cv-04062. 2010.

United States District Court for the Southern District of Indiana. Remy International, Inc. v Evensen Enterprises, Inc.; Machinery Components, Inc.; and United Starters & Alternators Industries, Inc. 1:04-cv-01895. 2004.

United States District Court for Nevada. Remy International, Inc. v. Dixie Electric Limited 2:06-cv-01374. 2006.

Waag W, Fleischer C, Sauer DU. Critical review of the methods for monitoring of lithium-ion batteries in electric and hybrid vehicles. J Power Sources. 2014a;258, 321–339. doi:10.1016/j.jpowsour.2014.02.064.

Waag W, Fleischer C, Sauer DU. Critical review of the methods for monitoring of lithium-ion batteries in electric and hybrid vehicles. J Power Sources. 2014b 258, 321–339. doi:10.1016/j.jpowsour.2014.02.064.

Willems D, D. A method to assess the lifetime prolongation capabilities of products.pdf. Int J Sustain Manuf. 2008;1:122–44.

Xu J, Mi CC, Cao B, Cao J. A new method to estimate the state of charge of lithium-ion batteries based on the battery impedance model. J Power Sources. 2013;233:277–84. doi:10.1016/j.jpowsour.2013.01.094.

Zackrisson M, Avellán L, Orlenius J. Life cycle assessment of lithium-ion batteries for plug-in hybrid electric vehicles – Critical issues. J Clean Prod. 2010;18:1519–29. doi:10.1016/j.jclepro.2010.06.004.

Zhang Y, Wang C-Y. Cycle-life characterization of automotive Lithium-Ion Batteries with LiNiO[sub 2] Cathode. J Electrochem Soc. 2009;156:A527. doi:10.1149/1.3126385.

Zwolinski P, Brissaud D. Remanufacturing strategies to support product design and redesign. J Eng Des. 2008;19:321–35. doi:10.1080/095448207014357.

Acknowledgements

This research is supported by Innovate UK through the ABACUS Project (Project Number: 38846-283215) in collaboration with the WMG Centre High Value Manufacturing (HVM) Catapult, Jaguar Land Rover, Potenza Technology and G + P Batteries.

Competing interests

The authors declare that they have no competing interests.

Authors’ contributions

JM—Academic Principal Investigator and Co-Author (automotive remanufacturing and energy storage). IH—Researcher and Co-author (Intellectual Property). Both authors read and approved the final manuscript.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Hartwell, I., Marco, J. Management of intellectual property uncertainty in a remanufacturing strategy for automotive energy storage systems. Jnl Remanufactur 6, 3 (2016). https://doi.org/10.1186/s13243-016-0025-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s13243-016-0025-z