Abstract

We exhibit a mechanism by which two parties leverage their social relationship to ratchet up the rents they collect from a third party residual claimant. Specifically, in a laboratory environment, we study a novel three-person insider game in which ‘insiders’ decide how to distribute profits among themselves and an ‘outsider’ who is the residual claimant. We find that the distribution of payments is largely determined by an informal quid pro quo among the two decision makers at the expense of the outsider. We then manipulate pay transparency and the competition to keep interaction partners, thereby improving the strategic position of one insider. Pay transparency increases the profit share that goes to rent seekers. In addition, rent extraction from the third party persists when competition for interaction partners is introduced. As a result, we find that payments both affect and reflect the influence of social relationships.

Similar content being viewed by others

1 Introduction

This paper investigates the effect of pay transparency in a novel three-person insider game in which reciprocity leads to negative externalities. Two players (the “insiders”) mutually decide on the payments of their counterparts, whereas the third player (the “outsider”) acts as the residual claimant of profits. Hence, social relationships between insiders may be leveraged to enhance their well-being, but only at a cost to the outsider. We examine how the transparency of payments and competition for interaction partners affect rent extraction. First, we find that pay transparency increases rent extraction, because information about payments to other parties enables insiders to coordinate on a jointly accepted payment level as the basis for stable reciprocal relationships. Second, we observe that introducing competition for transaction partners does not diminish rent extraction. Importantly, insiders who are given the possibility of ending the relationship reciprocate higher payments and rarely change transaction partners once a reciprocal relationship is established.

Reciprocity is an important prerequisite for the establishment of interactions that benefit some agents, but only at the costs of others, such as the case of corruption (Lambsdorff 2012): Once a corrupt act is initiated by one party, for instance, by providing a payment, a favorable response cannot be enforced, and the initiator has to rely on the other party’s willingness to reward the friendly action. Therefore, such interactions are often restricted to a network of insiders in which stable relationships can be formed (Lambsdorff 2007). Such relationships can be established in governmental institutions through “the misuse of public office for private gain”, including, for example, “the sale of government property by government officials, kickbacks in public procurement, bribery and embezzlement of government funds” (Svensson 2005, p. 20). In the private realm, such interactions may involve cases, where managers or workers in companies act in opposition to their duties to benefit themselves or others (Argandoña 2003). For instance, social relations between executives and board members may contribute to inefficiencies, such as higher CEO compensation and lower reactivity of CEO pay to poor company performance (Bertrand and Mullainathan 2001; Hwang and Kim 2009; Fracassi and Tate 2012; Kramarz and Thesmar 2013). Similarly, owners and management of a firm can sometimes reciprocally exchange favors and payments at a cost to consumers (Anton et al. 2016).

The goal of our controlled laboratory setting is to isolate mechanisms through which reciprocity might influence the allocation of resources between rent seeking parties and residual claimants, and the role transparency (that is, observability of reciprocal payments) might play in the effectiveness of these mechanisms when explicit sanctions of resource extraction are absent. In this sense, our experimental setting isolates the direct behavioral responses of insiders to transparency irrespective of the threat of material punishment. There can be different roles for transparency in our setting: for one, the observability of actions might induce less resource extraction by the rent seeking parties, for example, due to concerns for social image (Andreoni and Bernheim 2009). At the same time, transparent information about exploitative acts might help to establish a common behavioral norm, leading to even more resource extraction among the observing parties. In this sense, a social norm for resource extraction from the outsiders may emerge endogenously in the course of our game. Concerning the role of competition, there is the argument that the existence of competing (potentially) corrupt transaction partners may lead to a decline in the level of corruption; yet, as we will see, there are various mechanisms at work that mute any competition effect.

Our study is related to a burgeoning literature on the downside of reciprocity. In a seminal study in the context of lobbying and bribing, Abbink et al. (2002) find positive reciprocal patterns between subjects in the roles of “bribers” and “officials” that are unaffected if small negative externalities on other subjects are introduced.Footnote 1 Moreover, the results of the experimental corruption game by Azfar and Nelson (2007) indicate the importance of social relations for monitoring: stronger monitoring can be achieved if the person who monitors an “executive” is elected rather than being directly selected by the executive. Malmendier and Schmidt (2016, forthcoming) conduct an experiment in which decision makers have to choose a product on behalf of their clients. Here, small gifts by experimental producers strongly bias choices in favor of this firm; yet, the disclosure of the gift by the producer and the product choice by the decision maker to the client do not affect reciprocity towards the producer.Footnote 2 Ellman and Pezanis-Christou (2010) focus on decision procedures in firms, where production is associated with negative externalities and find that the organization structure (vertical or horizontal) has a significant impact on the harm caused by the firm.Footnote 3 In a recent study, Serra and Salmon (2015) find evidence for an important impact of norms on corrupt behavior. Here, subjects participate in different games that involve rule breaking and subsequent harm to third parties. Among other things, the authors conduct a bribery game that involves mutual cooperation at the expense of an outsider and find that the effect of social observability depends on the cultural background of the decision maker.

A different line of experimental studies finds that bilateral reciprocal exchange can be sustained even in the face of competition for partners in a variety of game settings (e.g., Brandts and Charness 2004; Bolton et al. 2008; Brown et al. 2012; Huck et al. 2012). Other studies find that relative wage comparisons may lead to punitive behaviors (e.g., Gächter and Thöni 2010; Greiner et al. 2011; Cohn et al. 2014). Our game differs from these studies in two central respects: in our game, the decision to reciprocate is not efficiency enhancing, and there is a third party potentially harmed by the exchange. Finally, in the study by Ryvkin and Serra (2015), participants in the role of public officials can request bribes and compete for customers who can switch between public officials. Here, the effect of competition depends on the size of the switching costs and the search behavior of customers.

Section 2 presents our game, the experimental design, and hypotheses. Our results are described in Sect. 3. Section 4 discusses the findings and concludes.

2 Game, experiment, and hypotheses

2.1 The insider game

There are two insiders, Alpha and Beta, and an outsider, Gamma. A total amount of 400 experimental points is to be distributed among them. First, Beta decides the payment for Alpha p A that is subtracted from the total amount. Then, Alpha chooses compensation for Beta p B with p A ≤ 400 − p B. The residual 400 − p A − p B is then distributed among the three parties, so that the insiders receive 10% each with 80% transferred to the outsider Gamma who does not make a decision. Therefore, any reciprocal interaction between insiders extracts resources away from the outsider.

In subgame perfect Nash equilibrium, there is no reciprocal exchange: irrespective of the payment, it is optimal for Alpha to pay p B* = 0 to Beta, since every point transferred decreases the share of the residual paid out to her at the end of the period. Foreseeing this, Beta will also choose a payment of p A * = 0. The resulting period payoffs are (40; 40; 320) for Alpha, Beta, and Gamma, respectively. Hence, the subgame perfect Nash equilibrium profit shares for the three subjects are π* A = 0.1, π* B = 0.1, and π* G = 0.8.

2.2 The experiment

Subjects played 20 rounds of the insider game. At the beginning of the session, roles were randomly determined, and these roles stayed fix for the entire session.

We conducted a 2 × 2 design, where the manipulated factors are pay transparency and competition to keep an Alpha partner. In the RM-NoInfo condition, subjects were randomly matched into three-party groups (RM). The matching was implemented in the following way: in a session with 30 participants, Alpha players were sequentially matched to a new Beta player from the session, so that after the first ten rounds, an Alpha player had interacted with every Beta player in the session. In rounds 11–20, the same sequence was repeated. As such, each Alpha player interacts with a given Beta player twice but never in two consecutive rounds.Footnote 4 Gamma players were always linked to the same Beta player.Footnote 5 At the end of the round, members of a three-person group were informed about payments to the players in their group, but were not informed about payments realized in the other groups (NoInfo).

In RM-Info, we implemented full transparency about payments to Alpha. Specifically, at the end of each round, after players were informed about the payments within their own group, every player was shown a list with the payments made to all Alpha players in this particular round. The displayed payments were Alpha’s share prior to the 10% residual was added. The addition of transparency does not change the incentives in the game.

Two competition treatments (CM) introduce excess demand for Alphas to the setting. In every session, there were twice as many subjects acting in the role of Beta and Gamma than in Alpha, so that their probability of being matched in the first round was 50%. Hence, in a session with 30 participants, there were 6 Alpha players and 24 participants acting in the roles of Beta and Gamma (12 in each role). Beta and Gamma players who were not matched to an Alpha player and thus inactive received a round payoff of 20 points. After each round, participants in the role of Alphas could decide to stay or to leave the current group. If they decided to stay, they would interact with the same Beta and Gamma in the next round. If they chose to leave, they would be matched with a randomly chosen new Beta–Gamma pair. In the CM-Info treatments with random matching, participants were informed about all Alphas’ payments in the same way as in RM-Info before Alpha players could decide about staying or leaving, whereas no such information was given in CM-NoInfo treatment. Observe that the introduction of competition does not change the subgame perfect Nash equilibrium of the game, making the competition treatments directly comparable to our treatments with random matching.Footnote 6

We conducted ten sessions of our experimental design (two for the treatments with random matching and three for the treatments with competition for Alpha players) with altogether 297 subjects in the Cologne Laboratory for Economic Research from June to August 2012. Table 1 gives an overview of the sessions, the number of experimental participants and the number of active groups in each experimental round.

Subjects were recruited online with ORSEE (Greiner 2015); the computerized experiment was implemented with z-tree (Fischbacher 2007). When subjects arrived at the laboratory, they were randomly seated and received written instructions (sample instructions in the Online Appendix). After the experiment was over, payoffs from the experiments were converted into Euros at the rate of 250 points = 1 Euro. Subjects privately received their payoffs, including a show-up fee of 2.50 Euros (mean: 10.97 Euros; standard deviation: 4.78 Euros) and left the laboratory. Each session lasted approximately 60 min.

2.3 Hypotheses

The insider game shares some important features of gift exchange experiments (Fehr et al. 1993) in the sense that the insiders can gain from mutual cooperation. In light of the abundant evidence for reciprocity, we can hypothesize, for the baseline RM-NoInfo treatment, that Beta players choose on average more than the minimum payment and Alpha players reciprocate by choosing higher than minimum payments. This would lead to higher than subgame perfect Nash equilibrium payoffs for Alpha and Beta, and subsequently lower payoffs for Gamma (below, we will point out that there is a potentially key difference with gift exchange games that might lead to lower or little reciprocity, providing the null hypothesis).

If the insider game does facilitate reciprocal payments between Alpha and Beta, how might these payments be affected by the introduction of transparency or competition?

We would expect the introduction of transparency of payments to Alphas to result in an overall compression of their profit shares, i.e., the dispersion of payments to Alpha players should become smaller. As Beta players should be inclined to care more about the perceived fairness of payments in both Info treatments relative to the NoInfo treatments (see Frank 1984 for a seminal study; Card et al. 2012; Cohn et al. 2014; Ockenfels et al. 2015, for recent evidence), they should be less likely to make extreme offers to Alpha players. However, the issue of where the compression happens—a lower or higher level—is harder to say. On the one hand, if Beta players focus on the highest payments achieved, compression should occur on high levels. At the same time, as outsiders’ payments decrease with higher Alpha payments, this also could have a moderating effect.

The standard market arguments suggest that competition too should compress payments. Competition gives the Alpha player the option of unilaterally ending an interaction. We would expect this increase in bargaining leverage to increase any insider payment Alpha receives; how this would change Beta’s payment is less clear.

Finally, the interaction of reciprocity with transparency and competition is not easily predicted. Transparency plausibly plays a more important role when interaction partners are scarce and can move between companies or switch suppliers, as the observation of higher payments for other insiders may influence one’s decision to end the relationship.

All this said, there are reasons to believe that behavior in the insider game might instead better approximate subgame perfect Nash equilibrium behavior than it does in gift exchange games. In the latter, mutual cooperation is efficiency enhancing, whereas in the former, any reciprocity just redistributes money away from outsiders. This is potentially a critical difference as theories of inequality aversion imply that increases to efficiency are critical to observing reciprocal exchange (e.g., Fehr and Schmidt 1999; Bolton and Ockenfels 2000). As pointed out above, neither the introduction of transparency or competition changes the equilibrium. In light of these considerations, we take as our null hypothesis that the subgame perfect equilibrium prediction approximates behavior in all treatments.

3 Results

We first present results on the aggregate level and, in the next step, take a closer look at the determinants of the payments for each player type. We then focus on the role of relative payments on the profits of Beta players and Alpha players’ decisions to continue or to end a particular relationship in the treatments with competition and, subsequently, on the dispersion of payments.

Our experiment aims to investigate the possibly reciprocal relationship between the inside players in a large market (large matching group) environment. As explained in Sect. 2, we do random (re)matching over the larger session group rather than dividing the session into small matching groups.Footnote 7 In our regression analyses reported below, we control for the most obvious session effect dependency—the repeated sample of the same individual decision maker—using random effects regression models.

3.1 Profit distribution

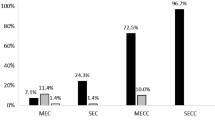

Figure 1 plots average profit shares for each role and treatment. Observe that average profit shares (i.e., the percentage of the total profit of 400 points allocated to a particular player) differ strongly from equilibrium shares, with Alpha and Beta players receiving substantially more (43.2 and 34.1% on average across all treatments) and Gamma players receiving substantially less (22.7%). Moreover, introducing information about payments to Alpha players in the random-matching (RM) treatments leads to a rise of 17.7% in their profit shares (44.5% in RM-Info compared to 37.8% in RM-NoInfo). The corresponding increase in the competition treatments (CM) accounts for 9.4% (the corresponding profit shares are 47.5% in CM-Info and 43.4% in CM-NoInfo).

Percentage share of profits per role and treatment. The figure displays average percentage shares of total profits (400 points) calculated over all 20 rounds of the game, separately for experimental treatments and player types. The dashed lines indicate the equilibrium profit shares π* A, π* B (10% respectively) and π* G (80%) of the stage game

Although their bargaining position tends to become weaker in the treatment variations, Beta players clearly gain in all treatments relative to their share in the baseline condition (27.2%): their profit shares account for 32.3, 37.3, and 40.1% in treatments RM-Info, CM-NoInfo, and CM-Info, respectively. As a result, only outsiders carry the financial burden arising from transparency and competition. Compared to RM-NoInfo, their profit shares decline from 35.0 to 23.2, 19.3, and 12.5% (RM-Info, CM-NoInfo, and CM-Info). Thus, outsiders experience a loss of up to 64.3% of their profit shares compared to the baseline condition.Footnote 8

In the next step, we investigate the influence factors on payments to Alpha and Beta players in regression analyses. To account for individual heterogeneity of the decision makers, we calculate the model with random effects on the level of Beta players. Models 1 and 2 in Table 2 use the payment to the Alpha player in points as the dependent variable. Model 1 includes only dummy variables for treatments (RM-NoInfo is the reference condition). Here, we observe a weakly significant positive effect of introducing competition for Alpha players in the CM-NoInfo treatment compared to the baseline condition (RM-NoInfo). Moreover, Model 1 suggests that payments to Alpha are significantly higher when payments are transparent, as indicated by the significant coefficients of CM-Info and RM-Info.Footnote 9 Next, in Model 2, we additionally control for the experience of Beta players. In this specification, we introduce the variable “Active Round” that captures the number of rounds the Beta player has interacted with an Alpha player at the particular point in time. For the treatments with random matching, this variable corresponds to the actual number of experimental rounds. For the competition treatments, however, the number of active rounds can be substantially smaller. The reason is that in the competition treatments, half of the Beta players are inactive in a particular round, and, due to the formation of stable reciprocal relationships between Alphas and Betas, there is substantial heterogeneity among Beta players concerning their experience. We scale “Active Round” in a way, so that the respective treatment dummy measures the treatment effect in the first active round of a Beta player. Moreover, to allow for different dynamics across treatments, we include also the interaction term of this variable with the treatment dummies.

The model suggests that transparency has a significant positive initial effect on the payments to Alpha, as the significant coefficients of CM-Info and RM-Info show. These coefficients are not significantly different from each other, as a two-sided Wald test indicates (p = 0.70). The coefficient of CM-NoInfo is positive, but insignificant. Moreover, we observe no effect of experience in the baseline condition RM-NoInfo, as the coefficient for the number of active rounds is insignificant. Yet, the coefficients of the interaction terms with treatments are all positive and significant, in line with a positive effect of growing experience over time on Alpha payments.Footnote 10 Summing up, we can state the following result concerning Alphas’ payments:

Result 1: Average payments for Alphas are higher under transparency and competition. Experience of Beta players is associated with higher Alpha payments.

The remaining models of Table 2 analyze influence factors on Beta players’ profits (incorporating random effects on the level of Alphas who decide about their payments). Model 3 regresses the set of treatment dummies on Beta payments as the dependent variable. Here, we find a significant effect in all three treatments relative to RM-Info. Moreover, the coefficients CM-NoInfo and CM-Info are (weakly) significantly larger than the coefficient RM-Info (p = 0.055 and p = 0.001, two-sided Wald tests), suggesting that the Beta players gain through the introduction of competition.Footnote 11 Next, in Model 4, we additionally include the experience variables that coincide with the number of rounds in these specifications, since Alpha players are active in every round of the experiment. Again, we find a significant positive initial effect of the treatments, as the coefficients of all respective dummy variables are significant. This confirms the observation from Model 3 that active Beta players also benefit from the competition for Alpha players. Concerning time trends, we observe that Beta payments decline in both treatments with random matchings. At the same time, this effect seems to be somewhat counterbalanced for the competition treatments, as the positive (and in case of CM-NoInfo significant) coefficient of the respective interaction effects indicate.

Model 5 additionally includes the payment to the Alpha player in points (divided by 100) as an additional control. The results remain roughly similar to the previous model (however, the coefficient for the interaction effect of CM-NoInfo now is insignificant), and we observe a robust positive correlation to Beta payments, in line with positive reciprocity. This result is similar to typical findings from gift exchange games, in which subjects respond positively to favorable actions by other players. Finally, to test whether the sizes of the positive correlations between Alpha and Beta payments differ across treatments, we calculate Model 6, where we integrate interaction terms between Alphas’ payments and the treatment variables. While these interaction terms are all positive and at least marginally significant, suggesting a stronger positive relation compared to the baseline condition RM-NoInfo, they are not significantly different from each other (pairwise Wald tests comparing the coefficients of the interaction terms are all insignificant with p-values > 0.1). Importantly, this result provides an indication that Alpha players do not exploit their higher bargaining power in the treatments with competition.

Nevertheless, our models capture only correlations, and, as it is typical for the analysis of dynamic decision situations, they cannot isolate a causal effect of Alphas’ payments on Betas’ profits. For example, in the competition treatments, where subjects are able to form stable relationships, the decision of Beta to offer a higher payment to Alpha in the first step can result from a high payment to herself in the previous period. Likewise, the decision to increase Beta’s profit can partly be an attempt of the Alpha player to trigger higher Beta offers in the next round. However, our analysis establishes that in the repeated game, higher payments to Alpha and Beta players seem to reinforce each other, in line with positive reciprocity. Hence, we arrive at our next result:

Result 2: Payments for Beta players are significantly higher under transparency and competition. Moreover, they are significantly positively correlated with Alpha payments, in line with positive reciprocity.

3.2 Transparency, fluctuation, and payment dynamics

Next, we consider the determinants of changes of transaction partners in the treatments with competition. The first observation is that insider matchings are rather stable: calculated over rounds 1–19, Alpha players chose to exit the relationship in only 17.8% (18.7%) of all cases in CM-Info (CM-NoInfo). In the first five rounds of the game, the share of partner changes peaks in both treatments (23.3 and 30.0% in CM-Info and CM-NoInfo). In subsequent five-round time intervals, these shares drop first and remain roughly constant in CM-NoInfo while slightly increasing towards their original level in the last time interval in CM-Info. Figure 2 displays the dynamics of decisions of Alpha players over time. The figure indicates that introducing the possibility of ending the relationship does not lead to a significant fluctuation of Alpha players between different interaction partners.

Share of changes in the interaction partner per time interval. Figure 2 displays the percentage shares of rounds after which Alpha players decided to leave their current interaction partner, calculated over time intervals (the last time interval refers to rounds 16–19)

To investigate the determinants of the decision to leave the interaction partner, we calculate Probit models with a binary-dependent variable that takes the value of one if the Alpha player chooses to leave after a particular round and include random effects to account for individual-specific heterogeneity (see Table 3). In Model 1, we include the number of rounds, a treatment dummy for CM-Info and the strong insider’s payment as dependent variables. Not surprisingly, the payment to the Alpha player has a significant impact on decisions to leave, with higher payments reducing the probability of quits. On the contrary, the coefficients for the number of rounds and for the treatment dummy are insignificant.

Model 2 concentrates on the subsample of Alpha players in CM-Info. Again, higher payments for Alpha players decrease the probability that the relationship is terminated. Moreover, the coefficient for the number of rounds is positive and significant in this specification, suggesting an increasing trend of partner changes over time. In Model 3, we replace the absolute payment by the positive and negative deviations from the median payment in a particular round and session (measured in percent) to account for relative concerns among Alpha players. It turns out that relative positions seem to affect the decision to leave: an Alpha player is significantly more likely to end the relationship if she earns less than the median payment. At the same time, we do not observe a significant drop in the probability to quit among those who earn more than the median payment, although the coefficient has the correct negative sign.Footnote 12

Result 3: Alpha and Beta players form relatively stable relationships in both competition treatments, with higher payments to Alpha players significantly reducing the probability of quitting.

In the final step, we consider the implications of transparency for the dispersion of Alpha payments. To do so, we calculate simple OLS models (Table 4 lists the results), using period level data from each of our four experimental treatments.

In Model 1, we regress the treatment dummies and a control for the experimental round on the standard deviation of Alpha payments in this round. We find that the coefficients for both treatments in which pay information is provided are significant and negative. Moreover, the coefficients for CM-Info and CM-NoInfo are significantly different from each other in this model (p < 0.001, two-sided Wald test). Hence, the provision of pay information seems to lead to stronger compression of Alpha payments. This conclusion remains similar if we instead use the difference between the maximum and the median payment to Alpha players as an alternative dependent variable (Model 2). Again, we observe a negative effect on the measure of pay dispersion for RM-Info and CM-Info; also here, the latter coefficient is significantly different from the coefficient of CM-NoInfo (p = 0.016, two-sided Wald test). All in all, these models seem to indicate that transparency about payments to the Alpha players leads to less dispersed payments compared to a situation in which each Alpha player only knows her own payment. Combined with the observations from the models reported in Table 2, this seems to suggest that subjects infer a norm for the appropriate payment of Alpha players which eventually leads to the emergence of generally higher payments. This implies that the reactions of Alpha players to relative pay information lead to additional pressure on Beta players to increase payments, in line with previous research on the impact of relative payments and, importantly, irrespective of the existence of competition. We, therefore, arrive at our final result:

Result 4: Transparent pay information leads to less dispersion of payments to Alpha players.

4 Discussion and conclusion

We conducted a three-person profit sharing game in which Alpha and Beta players (the “insiders”) mutually decide on the payoffs of their interaction partners. The remaining profits are transferred to a third party (“the outsider”) who cannot influence decisions. With respect to the impact of pay transparency, we find that Alpha players’ profits increase substantially compared to the case when Alphas know only their own payments. Importantly, this effect is found irrespective of the degree of competition. Even if relative pay information is non-instrumental for Alpha players (as in our treatment RM-Info, where interaction partners randomly change in every round), it gives rise to substantial increases in payments compared to the baseline condition. This suggests that transparency of payments triggers comparison processes that in turn put Beta players under pressure to increase payments.Footnote 13 Due to reciprocal patterns in the relationships between Alpha and Beta players, the latter gain relative to the baseline setting, even in the competition treatments when Alpha players can end the relationship if they are dissatisfied with their profits. The reason for this pay increase is that Alpha players do not fully exploit their increased bargaining position but instead reward higher shares allocated by Beta players. As a result, the possibility for the Alpha player to end the relationship does not lead to strong fluctuations between transaction partners. Instead, stable reciprocal relationships evolve between Alpha and Beta players in which earnings are mutually increased. In turn, this robust gift exchange leads to third party exploitation.

In the experiment, the reciprocal purpose of player payoffs, while not actually visible, is nevertheless rather apparent. If payoffs of this sort take place in the field and if they are similarly apparent in purpose, we would, given their corrupt nature, expect institutional prohibitions to arise to tamp them down. However, attribution is harder in the field. For example, there are vigorous debates in both public and academic arenas about whether corporate manager salaries are driven by firm performance or other, insider kinds of concerns (e.g., Anton et al. 2016). Our studies provide some insight into the kinds of patterns one might look for in the field to uncover any insider reciprocal relationship.

As our study is only a reduced form model of exploitative relationships, it does not take into account a number of important other factors in this context. Indeed, as the aim of our design is to model the particular channel through which reciprocal relations between insiders can affect mutual profit sharing, we abstract away from the possibility that the third party can influence the allocation of payoffs. In our design, insiders are free to implement their desired allocation. It follows that our design does not imply that pay transparency is bad per se. Yet, at the same time, our study suggests that transparency comes at a potential cost. Thus, a possible implication of our experimental study for deterring corrupt practices is that changes in the environment that hinder the evolution of stable reciprocal relationships will likely be beneficial from a third party perspective. One example for such a practice would be staff rotation which is found to reduce bribing and inefficient choices in experimental one-to-one interactions (Abbink 2004). However, our results suggest that exploitative patterns may persist even if partners change in the course of the game, in particular, when subjects receive information about what constitutes an adequate payment to trigger positive responses. Further research should thus aim at understanding better the interaction between the nature of the corrupt relationship and the information flows between the involved players and third parties.

Notes

Abbink and Serra (2012) review the literature on experiments that test mechanisms for the deterrence of corruption inside the laboratory.

In the context of cooperation, Engel and Rockenbach (2011) provide evidence on how the interaction of payoff externalities and relative endowment positions of bystanders affects contributions in public goods games. Bland and Nikiforakis (2015) introduce externalities on third parties into coordination games and find that behavioral responses depend on the sign of these externalities.

In a session that had 27 subjects due to a lower show-up rate, each Alpha player interacted twice with 7 of the Beta players and three times with 2 of the Beta players, but never with the same Beta in two consecutive rounds.

In order to keep the focus of Beta players on the interaction with Alpha players and to avoid that the behavior of Beta players might be influenced by the fact that they were matched to new Gamma players in a particular round, we did not change the assignment of Beta and Gamma players in the course of the experiment. This is true also for our treatments with competition. Given that the procedure of matching Alpha players to Beta players was one of our main treatment variations, it was not explicitly mentioned in the instructions that Beta and Gamma players would remain assigned to each other for the entire experiment, in order to avoid confusion among the subjects.

A stronger form of competition, one in which Alpha players can accept binding offers of companies, would have changed the equilibrium to one with very high payments to Alphas.

Both small and large matching group protocols are vulnerable to session-effects that can confound statistical tests (Frechette 2012), so one must choose on which side to err. Important to our choice, there is evidence that small matching groups can induce greater reciprocity than would be observed in large groups even when available theory suggests they should be equivalent (Bolton et al. 2004). So while small matching groups can eliminate session-effects having to do with sample dependencies, they can exaggerate the reciprocity actually present in the larger matching group phenomenon we wished to capture. Frechette (2012) also shows that when subject responses to feedback are an issue, as it will be here, smaller matching groups are more likely to lead to misleading results with regard to how feedback adjustment affects behavior in large groups.

To check whether the implementation of equal allocations between the players is relevant in our setting, we calculate the percentage share of “fair shares” for Gamma players which we define as profit shares between 32 and 34% of the total amount of 400 points. The probability for the Gamma players of receiving a fair share across treatments is rather low: In the treatments without competition, it accounts for 13.7% (9.5%) of the cases in RM-NoInfo (RM-Info); in the treatments with competition, the corresponding values are 8.3% and 9.4% in CM-NoInfo and CM-Info.

Comparing the coefficients of the treatment dummies pairwise yields a weakly significant difference between CM-Info and CM-NoInfo (p = 0.063, two-sided Wald test), whereas the other two comparisons are not significant (p-values of two-sided Wald tests exceed p = 0.1).

The coefficient of the interaction term is largest for CM-Info; however, this difference is significant only compared to the interaction term of RM-Info (p = 0.024, two-sided Wald test).

Coefficients of the treatment dummies CM-NoInfo and CM-Info do not differ from each other (p = 0.208, two-sided Wald test).

Note that we can measure the direct effect of relative pay only on the decision of Alpha players to leave but not on the decision how to remunerate the Beta player, because at the time of deciding about the payment, the Alpha player does not know her relative standing in the particular round and therefore cannot punish the Beta player for an “unfair” payment.

References

Abbink, K. (2004). Staff rotation as an anti-corruption policy: an experimental study. European Journal of Political Economy, 20(4), 887–906.

Abbink, K., Irlenbusch, B., & Renner, E. (2002). An experimental bribery game. Journal of Law Economics and Organization, 18, 428–454.

Abbink, K., & Serra, D. (2012). Anticorruption policies: Lessons from the lab. In D. Serra & L. Wantchekon (Eds.), New Advances in Experimental Research on Corruption (Research in Experimental Economics, Volume 15) (pp. 77–115). Bingley: Emerald Group Publishing Limited.

Andreoni, J., & Bernheim, B. D. (2009). Social image and the 50-50 norm: a theoretical and experimental analysis of audience effects. Econometrica, 77(5), 1607–1636.

Anton, M., Ederer, F., Gine, M., Schmalz, M. (2016). Common ownership, competition, and top management incentives. Ross School of Business Working Paper No. 1328.

Argandoña, A. (2003). Private-to-private corruption. Journal of Business Ethics, 47, 253–267.

Azfar, O., & Nelson, W. R., Jr. (2007). Transparency, wages, and the separation of powers: an experimental analysis of corruption. Public Choice, 130(3), 471–493.

Bertrand, M., & Mullainathan, S. (2001). Are CEOs rewarded for luck? The ones without principals are. Quarterly Journal of Economics, 116, 901–932.

Bland, J., & Nikiforakis, N. (2015). Tacit coordination in games with externalities on third parties. European Economic Review, 80, 1–15.

Bolton, G., Katok, E., & Ockenfels, A. (2004). How effective are electronic reputation mechanisms? An experimental investigation. Management Science, 50(11), 1587–1602.

Bolton, G., Loebbecke, C., & Ockenfels, A. (2008). Does competition promote trust and trustworthiness in online trading? An experimental study. Journal of Management Information Systems, 25, 145–170.

Bolton, G., & Ockenfels, A. (2000). ERC: a theory of equity, reciprocity, and competition. American Economic Review, 90, 166–193.

Brandts, J., & Charness, G. (2004). Do labour market conditions affect gift exchange? Some experimental evidence. Economic Journal, 114, 684–708.

Brown, M., Falk, A., & Fehr, E. (2012). Competition and relational contracts: the role of unemployment as a disciplinary device. Journal of the European Economic Association, 10, 887–907.

Card, D., Mas, A., Moretti, E., & Saez, E. (2012). Inequality at work: the effect of peer salaries on job satisfaction. American Economic Review, 102, 2981–3003.

Cohn, A., Fehr, E., Herrmann, B., & Schneider, F. (2014). Social comparison in the workplace: evidence from a field experiment. Journal of the European Economic Association, 12, 877–898.

Ellman, M., & Pezanis-Christou, P. (2010). Organizational structure, communication, and group ethics. American Economic Review, 100, 2478–2491.

Engel, C., & Rockenbach, B. (2011). We are not alone: the impact of externalities on public good provision. Working Paper, MPI Collective Goods Preprint, No. 2009/29.

Fehr, E., Kirchsteiger, G., & Riedl, A. (1993). Does fairness prevent market clearing? An experimental investigation. Quarterly Journal of Economics, 108, 437–459.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. Quarterly Journal of Economics, 114, 817–868.

Fischbacher, U. (2007). z-Tree: zurich toolbox for ready-made economic experiments. Experimental Economics, 10, 171–178.

Fracassi, C., & Tate, G. (2012). External networking and internal firm governance. Journal of Finance, 67, 153–194.

Frank, R. H. (1984). Are workers paid their marginal products? American Economic Review, 74, 549–571.

Frechette, G. R. (2012). Session-effects in the laboratory. Experimental Economics, 15, 485–498.

Gächter, S., & Thöni, C. (2010). Social comparison and performance: experimental evidence on the fair wage–effort hypothesis. Journal of Economic Behavior & Organization, 76, 531–543.

Gneezy, U., Saccardo, S., & Van Veldhuizen, R. (2016). Bribery: greed versus reciprocity, WZB Discussion Paper, No. SP II 2016-203.

Greiner, B. (2015). Subject pool recruitment procedures: organizing experiments with ORSEE. Journal of the Economic Science Association, 1, 114–125.

Greiner, B., Ockenfels, A., & Werner, P. (2011). Wage transparency and performance: a real-effort experiment. Economics Letters, 111, 236–238.

Huck, S., Lünser, G. K., & Tyran, J.-R. (2012). Competition fosters trust. Games and Economic Behavior, 76, 195–209.

Hwang, B.-H., & Kim, S. (2009). It pays to have friends. Journal of Financial Economics, 93, 138–158.

Kramarz, F., & Thesmar, D. (2013). Social networks in the boardroom. Journal of the European Economic Association, 11, 780–807.

Lambsdorff, J. G. (2007). The institutional economics of corruption and reform. Cambridge: Cambridge University Press.

Lambsdorff, J. G. (2012). Behavioral and experimental economics as a guidance to anticorruption. In D. Serra & L. Wantchekon (Eds.), New advances in experimental research on corruption (research in experimental economics, volume 15) (pp. 279–300). Bingley: Emerald Group Publishing Limited.

Malmendier, U. M., & Schmidt, K. M. (2016). You owe me. American Economic Review (forthcoming).

Ockenfels, A., Sliwka, D., & Werner, P. (2015). Bonus payments and reference point violations. Management Science, 61(7), 1496–1513.

Pan, X., & Xiao, E. (2016). It’s not just the thought that counts: an experimental study on hidden cost of giving. Journal of Public Economics, 138, 22–31.

Ryvkin, D., & Serra, D. (2015). Is more competition always better? An experimental study of extortionary corruption. Working Paper.

Serra, D., & Salmon, T. (2015). Does social judgment diminish rule breaking? An experiment. Working Paper.

Svensson, J. (2005). Eight questions about corruption. Journal of Economic Perspectives, 19(3), 19–42.

Acknowledgements

Financial support of the German Research Foundation through the Leibniz-program and through the research unit “Design and Behavior” (FOR 1371) is gratefully acknowledged. We thank the Editor Robert Slonim, two anonymous referees, Karim Sadrieh, Nick Zubanov and conference and seminar audiences in Düsseldorf and Cologne for valuable comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper replaces an older version with the title “How managerial wage transparency may reduce shareholder returns—Evidence from an experiment”.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Bolton, G., Ockenfels, A. & Werner, P. Leveraging social relationships and transparency in the insider game. J Econ Sci Assoc 2, 127–143 (2016). https://doi.org/10.1007/s40881-016-0030-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40881-016-0030-x