Abstract

This paper proposes a new motivation for information sharing in a decentralized channel consisting of a single manufacturer and two competing retailers. The manufacturer provides a common product to the retailers at the same wholesale price. Both retailers add their own values to the product and distribute it to consumers. Factors such as retail prices, values added to the product, and local advertising of the retailers simultaneously have effect on market demand. Each retailer has full information about the own added value which is unknown to the manufacturer and other retailer. The manufacturer uses a cooperative advertising program for motivating the retailers to disclose their private information. A numerical study is presented to compare different scenarios of information sharing. Computational results show that there is a condition in which full information sharing is beneficial for all members of the supply chain through cooperative advertising program and, therefore, retailers have enough incentive to disclose their cost information to the manufacturer.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

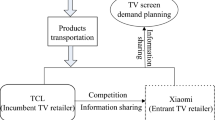

Supply chain efficiency significantly depends on how its members coordinate with each other (Choi 2010). Hence, coordination between decisions of different supply chain stages is an important issue in supply chain management (Agnetis et al. 2006). Supply chain coordination can be defined as any condition where upstream and downstream members are engaged in any form of long-term cooperation or agreement (Bahinipati et al. 2009). Information sharing is one of the important aspects of coordination among firms in a supply chain (Kumar and Pugazhendhi 2012). Indeed, it is difficult to consider coordination without some forms of information sharing (Chen 2003). Information sharing can enhance the whole supply chain performance and allow enterprises to refine their strategies of supply chain to maximize their profits (Chen et al. 2007). It is clear that different enterprises obtain different benefits of information sharing. In addition, it is apparent that the unbalanced benefits of information sharing decreases incentives for information sharing. Therefore, the members that gain most benefits should give their partners the incentive to participate in the information sharing (Baihaqi and Beaumont 2006). Literature review indicates that a substantial part of supply chain management research examined the role of information in achieving supply chain coordination and the importance of the information sharing. In contrast, there are few studies on how to align benefits between members and create motivation for information sharing. This paper proposes a new motivation for information sharing in a decentralized supply chain consisting of one manufacturer and two retailers who compete on both added value and retail price.

Ability to improve a primary product or service with additional and distinctive values that differentiate it from the competition is an important element in creating successful brands. In the current industry in which so many products and services are considered as a commodity, their capability to add value to a product or service is an absolute necessity (Brooks 2003). Value is described as anything added to a product to improve its usefulness to the consumer, which can be either a physical value or a value-added service (Mukhopadhyay et al. 2008). Value can be added to a product in many ways. A retailer can add value to the product with desirable bundling or packaging. In IT industry, the retailers can add value through services, free software, technical training, or maintenance. In the electronics industry, the distributors can add value through simple components labeling and kitting to complex supply chain management service (Yao et al. 2008).

This paper considers a two-echelon supply chain where a manufacturer sells its product through two retailers. Both retailers add their own values to the product and sell it to customers. Factors such as retail prices, values added to the product, and local advertising efforts simultaneously have effect on market demand. In addition, the manufacturer has no complete knowledge of the retailers’ value-added cost information. Each retailer has to decide if he is willing to disclose his cost information to the manufacturer. The manufacturer shares a certain fraction of retailers’ advertising expenditures for motivating the retailers to participate in information sharing. Therefore, we are interested in analysing the following issues:

-

How the cooperative advertising program motivates the retailers to share their private information with the manufacturer?

-

If one of the retailers is not willing to disclose his private information to the manufacturer, can the manufacturer motivate the other retailer to reveal his information through cooperative advertising program?

-

If only one retailer is willing to share his private information with the manufacturer, can the manufacturer induce the other retailer to reveal his information through cooperative advertising program?

Our work is the extension of work done by Yao et al. in 2008, where it is studied retailers’ incentives for value-added cost information sharing and indicated that the retailers are not always better off with information sharing. Here, we add cooperative advertising contract to the model and demonstrate that the manufacturer with cooperative advertising program can encourage the retailers to share their information.

Our main contribution to the information sharing literature is that we use the cooperative advertising program as a new incentive mechanism for information sharing in a decentralized supply chain. To the best our knowledge, there is no paper which simultaneously considers information sharing and cooperative advertising decisions of a one-manufacturer and two-retailer distribution channel.

This paper is organized as follows. The literature review is presented in Sect. “Literature review”. Section “Model formulation” describes the distribution channel structure, notations, demand functions, value-added functions, and the players’ objective functions. In Sect. “Solution”, the solution of the model is presented. Section “Illustrative example” presents an illustrative example and the corresponding sensitivity analysis for some parameters. Finally, the main results of the research are summarized in the Section “Conclusion”.

Literature review

There are three categories of research related to our study which we will review briefly. The first category is about information sharing in a competitive environment. The second category concentrates on supply chain coordination with contracts and the third category is on cooperative advertising.

Some researchers have studied information sharing in a supply chain and in a competitive environment. For example, Zhang (2002) studied demand information sharing in a supply chain with duopoly retailers and investigated the effects of horizontal information leakage on vertical information sharing. Li (2002) considered a two-level supply chain with a manufacturer and many retailers, and studied the incentives for vertical demand and cost information sharing in an environment with horizontal competition. He also investigated the effects of horizontal information leakage on vertical information sharing. Huang and Iravani (2007) studied sharing of inventory information for a two-echelon capacitated supply chain with one manufacturer and two non-identical retailers in a competitive market. They characterized the optimal inventory policies and the optimal rationing policy in their model. Li and Zhang (2008) investigated incentives for demand information sharing in a decentralized supply chain with one manufacturer and multiple competing retailers. They demonstrated that with confidentiality and intense competition, all parties have an incentive to share their information. Yao et al. (2008) examined incentives for value-added cost information sharing in a supply chain consisting of one supplier and two value-adding heterogeneous retailers who compete on both added value and retail price. Wu et al. (2012) considered a two-echelon supply chain with a single manufacturer and two retailers, and investigated the retailers’ incentives for demand information sharing. Setak et al. (2017) studied the cost information sharing between the manufacturer and traditional retailer in a dual channel supply chain and uses the cooperative advertising program as an incentive mechanism for information sharing under free riding behaviour.

So far, many coordinative contracts have been proposed for supply chain coordination, such as, revenue sharing (Alaei and Setak 2015; Qin and Yang 2008), cost sharing (Tsao and Sheen 2012), revenue and cost sharing (Panda 2013), buyback (Heydari et al. 2017; Pasternack 2008), combined buyback and quantity discount (Heydari and Norouzinasab 2015; Parthasarathi et al. 2011), quantity flexibility (Tsay 1999), lead time induced contract (Heydari 2014a; Heydari et al. 2016), delay in payments contract (Heydari 2015), and pricing schemes and discount contracts (Chaharsooghi et al. 2011; Heydari 2014b). Instead, there are few works which studied how to design a coordinative contract to motivate the supply chain members to share their information. For example, Xiao and Yang (2009) considered a supply chain comprising a manufacturer and a retailer who compete with an outside integrated manufacturer in retail price and service level. They investigated how the manufacturer designs a wholesale price-order quantity contract to induce the retailer to reveal his risk sensitivity information truthfully. Liu and Özer (2010) investigated demand forecast information sharing in a distribution channel with a manufacturer and a retailer and compared widely used price-only, quantity flexibility, and buyback contracts. They indicated that the quantity flexibility contract is not robust, but the buyback contract is robust and it always motivates the manufacturer to share his information. Chen (2011) analysed the effect of the customer returns information on decisions and profits of both manufacturer and retailer with and without a buyback policy in a supply chain consisting of a manufacturer and a retailer. He also studied the incentives and the value of sharing customer returns information. Zhang and Chen (2013) studied demand information sharing in a supply chain that consists of one supplier and one retailer. They indicated that revenue sharing contract is coordinative and ensures that the members in a supply chain reveal their information completely.

Cooperative advertising acting as a kind of marketing instrument usually occurs in a vertical supply chain (Zhang et al. 2015). Vertical cooperative advertising is a financial agreement between manufacturer and his retailers, whereby advertising mostly is prepared by the retailers and a certain percentage of local advertising cost is shared by the manufacturer (Aust and Buscher 2014a). Among the existing studies on cooperative advertising, very few researchers investigated a channel with a single manufacturer and two or more competing retailers. For example, He et al. (2011) developed a dynamic model for a distribution channel with a manufacturer and two competing retailers, and obtained the retailers’ optimal advertising decisions as well as the manufacturer’s optimal subsidy rate. Alaei et al. (2014) studied four non-cooperative models in a supply chain with a manufacturer and two identical retailers. They also investigated the cooperative game and used a cost sharing contract to coordinate the channel. Giri and Sharma (2014) developed two models in a two-echelon supply chain that includes a manufacturer and two competing retailers. In the first model, a certain percentage of each retailer’s advertising cost is shared by the manufacturer, while in the second model, no retailer’s advertising cost has been shared. Aust and Buscher (2014c) analysed the effects of retailer competition on cooperative advertising and pricing in a supply chain comprising a manufacturer and two competing retailers, who act either non-cooperatively or cooperatively.

Model formulation

Here, a two-echelon supply chain consisting of one manufacturer and two competing retailers has been considered. The manufacturer has a fixed production cost (\(c \ge 0\)) per unit product. We assume that the manufacturer does not apply price discrimination, and sells a common generic product to retailers at the same wholesale price (\(w > c\)). Afterwards, each retailer \(i\) adds his own value \(v_{i}\) to the product and decides on the retail price (\(p_{i} > w\)). Here, each retailer has private information about the cost of the added value which is unknown to the manufacturer and the other retailer. In addition, we assume that there are no horizontal information sharing and no horizontal information leakage between retailers. Besides the retail price and values added to the product, the advertising expenditures of two retailers have effect on the customer demand as well. We consider the local advertising expenditures \(a_{i}\) for the retailer \(i\). The manufacturer decides to offer a vertical cooperative advertising program to encourage the retailers to share their value-added cost information, whereby he can bear a fraction (\(0 \le \theta_{i} < 1\)) of retailers’ local advertising expenditures. However, if the retailers are unwilling to reveal their information, the manufacturer is not interested in offering a cooperative advertising program. The quantity demanded \(d_{i}\) of a product is sold by each retailer, while the total demand of \(d_{1} + d_{2}\) is served by the manufacturer as a single supplier for both retailers. All the model variables and parameters are summarized in Table 1.

Demand functions

The market demand of the retailer \(i\) is determined by a demand function which depends on retail prices, added values, and local advertising expenditures, as follows:

where \(g\left( {p_{i} ,p_{3 - i} ,v_{i} ,v_{3 - i} } \right)\) reflects the effect of retail prices and added values on demand, and \(h\left( {a_{1} ,a_{3 - i} } \right)\) reflects the effect of advertising costs on demand that are connected via multiplication (Aust and Buscher 2014b, c).

We utilize a linear demand function \(g\left( {p_{i} ,p_{3 - i} ,v_{i} ,v_{3 - i} } \right)\) that is widely used in supply chain and marketing literature and tested by many researchers (Amrouche and Yan 2013; Giri and Sarker 2015; Raju et al. 1995; Tsay and Agrawal 2000; Xiao and Yang 2009; Yao et al. 2008):

where \(\alpha_{i}\) is market base for retailer \(i\); \(\beta_{1}\) is the demand sensitivity to the price; \(\beta_{2}\) is the demand sensitivity to the value-added service; and \(\gamma_{1}\) and \(\gamma_{2}\) are the substitutability coefficient of the two products for the perceived price difference and the perceived service difference, respectively. In other words, if customers realize that there is a price difference (value-added service) between two retailers, they substitute the other retailer at the rate of \(\gamma_{1}\) (\(\gamma_{2}\)). Hence, two retailers are competing horizontally. We also assume that the effect of direct price (value) changes to be higher than that of the price (value) difference between two retailers (\(\beta_{i} > \gamma_{i} ,\;\quad i = 1,\;2\)) (Yao et al. 2008).

Since the additional advertising generates continuously diminishing returns, we use a sales’ response function based on square roots \(h\left( {a_{i} ,a_{3 - i} } \right)\) which reflects “advertising saturation effect” (Aust and Buscher 2014b, c; SeyedEsfahani et al. 2011; Xie and Wei 2009). Furthermore, we assume that each retailer’s local advertising has effect on the demand of his competitor (Aust and Buscher 2014c; Karray and Zaccour 2007):

where the two positive parameters \(k_{1}\) and \(k_{2}\) can be, respectively, interpreted as the effectiveness of retailer \(i\)’s and his rival’s local advertising investment.

Therefore, the resulting total demand function for retailer \(i\) is as follows:

Value-added cost functions

Each retailer \(i\) adds value to his product to increase its utility to the consumers. This value-added can differentiate retailer \(i\)’s product and increase his market demand. One interesting form of service function in the previous literature (Amrouche and Yan 2013; Giri and Sarker 2015; Iyer 1998; Tsay and Agrawal 2000; Yao et al. 2008) is given in the following equation:

where \(\eta_{i}\) is an efficiency parameter for the retailer \(i\)’s value-added cost. The smaller the \(\eta_{i}\), the more efficient retailer \(i\). According to Yao et al. (2008), we assume that \(\eta_{i}\) is uniformly distributed, i.e., \(\eta_{i} \sim U\left[ {\bar{\eta } - \varepsilon ,\bar{\eta } + \varepsilon } \right]\). \(\bar{\eta }\) and \(\varepsilon\) are the average and deviation value-added cost efficiency, respectively. In addition, each retailer knows his own \(\eta_{i}\) but does not know the other retailer’s efficiency parameter. However, each retailer knows the probability distribution function of the other retailer’s cost information and can estimate \(\eta_{i}\) and \(\varepsilon\). In this model, \(\eta_{1}\) is known only to retailer 1, \(\eta_{2}\) is known only to retailer 2, and neither \(\eta_{1}\) nor \(\eta_{2}\) is known to the manufacturer.

Profit functions

Here, the unit production cost assumed for the manufacturer is \(c\). Thus, the profit function of manufacturer is as follows:

In addition, retailer \(i\)’s profit function is formulated in the following equation:

where \(\theta_{i} \left( {i = 1,\;2} \right)\) is the fraction of the total local advertising expenditure that the manufacturer agrees to share with the retailer \(i\)(\(0 \le \theta_{i} < 1\)).

Sequence of events

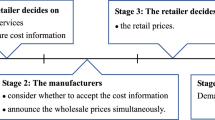

The paper studies a three-stage game in which the sequence of events is as follows:

In the first stage of the game, each retailer decides if he is willing to share his private cost information about value-added service with the manufacturer vertically. Therefore, we have four different scenarios for information sharing in this stage, as follows:

-

1.

Both retailers reveal their information to the manufacturer.

-

2.

None of the retailers reveal their information to the manufacturer.

-

3.

Only retailer 1 reveals his private information to the manufacturer.

-

4.

Only retailer 2 reveals his private information to the manufacturer.

In addition, we assume that the cases 3 and 4 are identical due to symmetric characteristics.

At the second stage of the game, the manufacturer optimizes his profit and sets the wholesale price using the information available to him from the information exchange stage of the game. Therefore, in this stage, three different cases exist for the wholesale price.

At the final stage of the game, based on the wholesale price set by the manufacturer in the previous stage, the retailers decide on the added values, the retail prices, and the local advertising expenditures simultaneously to maximize their own expected profits.

Solution

As previously mentioned, this is a three-stage game. This dynamic game is analysed with the backward induction approach. The manufacturer who acts as the Stackelberg leader sets his wholesale price with respect to the reactions of his following retailers. Therefore, first, we assume that the wholesale price is given and solve the decision problem of the retailers to find the retail prices, added values, and advertising expenditures. Since two retailers choose their decisions simultaneously, we can describe this situation by a horizontal Nash game. Then, we use these retailers’ reaction functions as constraints in the decision problem of the Stackelberg leader and find the optimal wholesale price for the manufacturer. Therefore, we first solve the following general decision problem of retailers:

Proposition 1

Optimal response functions for the retailers:

where A, B i ,C, and E i are defined by the following:

Proof

See “Appendix A”.

Now, we use the retailers’ response functions as constraints in the decision problem of the manufacturer and solve the manufacturer’s decision problem to find the optimal wholesale price. The manufacturer’s objective function is as follows:

As previously mentioned, we have three different scenarios for information sharing and wholesale price. In the following subsections, we, respectively, will discuss each of these scenarios.

Full information sharing (FIS)

Here, we assume that both retailers decide to disclose their information to the manufacturer in the first stage. Therefore, the retailers’ value-added cost information (\(\eta_{1}\) and \(\eta_{2}\)) is known to the manufacturer, and the manufacturer’s objective function is as follows:

To identify the optimal wholesale price, the retailers’ decisions are substituted into Eq. (10). Then, the partial first-order derivative \(\partial \pi_{\text{M}} /\partial w\) is set to zero and the resulting system of equations is solved (entire mathematical calculations are presented in “Appendix B”). However, because of complexity of the problem, the first-order condition \(\partial \pi_{\text{M}} /\partial w = 0\) cannot lead to a closed-form formula for \(w\). Hence, we will obtain the optimal wholesale price by means of illustrative example.

No information sharing (NIS)

Considering that there is no information exchange between the manufacturer and any of the retailers. Therefore, \(\eta_{1}\) nor \(\eta_{2}\) is known to the manufacturer, and the manufacturer’s objective function is:

To recognize the optimal wholesale price, the retailers’ decisions are substituted into Eq. (11) and the first-order condition is set equal to zero.

Partial information sharing (PIS)

Now, we assume that retailer 1 decides to share information with the manufacturer and the manufacturer has full knowledge of the retailer 1’s cost structure \(\eta_{1}\). Therefore, \(\eta_{2}\) is unknown to the manufacturer and manufacturer’s objective function is as follows:

Similar to the previous cases, the optimal wholesale price can be obtained by substituting the retailer’s reaction functions into Eq. (12) and setting the first-order condition to zero.

Illustrative example

In this section, we present an example to investigate how the cooperative advertising program motivates the retailers to share their private information with the manufacturer. Therefore, we compare different scenarios of information sharing and find the equilibrium in the first stage of the game. In addition, as retailers are supposed homogeneous, the following assumptions are presented.

-

1.

Under partial information sharing, retailer 1 discloses his information to the manufacturer, while retailer 2 does not. Thus, \(\theta_{2} = 0\) and \(\theta_{1} = \theta\). Since retailers are homogeneous, this case is equivalent to the case in which retailer 2 discloses his information to the manufacturer and \(\theta_{1} = 0\).

-

2.

Under no information sharing, since neither of the retailers reveals their information, the manufacturer is not interested in offering a cooperative advertising program. Therefore, \(\theta_{1} = \theta_{2} = 0\).

-

3.

Under full information sharing, \(\theta_{1} = \theta_{2} = \theta\).

To ease the consideration of the parameters \(k_{1}\) and \(k_{2}\), which describe the effectiveness of retailer \(i\)’s and his rival’s local advertising expenditures, we introduce the ratio \(k = k_{2} /k_{1}\). We perform our analysis for different values of \(k\) and \(\eta\), and determine the feasible ranges of participation rate \(\theta\). Similar to Xiao and Yang (2009) and Aust and Buscher (2014c), we consider the following default values of parameters:

Similar to (Yao et al. 2008) and (Zhang 2002), we define the following notations for the manufacturer and retailers’ profits:

-

\(\pi_{\text{M}} \left( {1_{s} ,2_{s} } \right)\): The manufacturer’s profit when both retailers share their information with the manufacturer.

-

\(\pi_{\text{M}} \left( {1_{n} ,2_{n} } \right)\): The manufacturer’s profit when neither retailer shares their information with the manufacturer.

-

\(\pi_{\text{M}} \left( {1_{s} ,2_{n} } \right)\): The manufacturer’s profit when retailer 1 shares his information with the manufacturer.

-

\(\pi_{\text{M}} \left( {1_{n} ,2_{s} } \right)\): The manufacturer’s profit when retailer 2 shares his information with the manufacturer.

-

\(\pi_{{R_{i} }} \left( {1_{s} ,2_{s} } \right)\): The retailer \(i\)’s profit when both retailers reveal their information to the manufacturer.

-

\(\pi_{{R_{i} }} \left( {1_{n} ,2_{n} } \right)\): The retailer \(i\)’s profit when neither retailer reveals their information to the manufacturer.

-

\(\pi_{{R_{i} }} \left( {1_{s} ,2_{n} } \right)\): The retailer \(i\)’s profit when retailer 1 reveals his information to the manufacturer, while retailer 2 does not.

-

\(\pi_{{R_{i} }} \left( {1_{n} ,2_{s} } \right)\): The retailer \(i\)’s profit when retailer 2 reveals his information to the manufacturer, while retailer 1 does not.

Comparison between FIS and NIS scenarios

This section provides a comparison of all members’ profit under full information sharing and no information sharing scenarios. Then, the condition in which full information sharing is beneficial for all the supply chain members is determined. The results are shown in Fig. 1 and Table 2. For specific values of \(k\) and \(\eta\) in Table 2, \(\pi_{M} \left( {1_{s} ,2_{s} } \right) > \pi_{M} \left( {1_{n} ,2_{n} } \right)\) and \(\pi_{{R_{i} }} \left( {1_{s} ,2_{s} } \right) > \pi_{{R_{i} }} \left( {1_{n} ,2_{n} } \right) , i = 1,2\), as long as the manufacturer’s participation rate is in the specified range. Note that “dashes (–)” for some values of \(k\) and \(\eta\) in Table 2 imply that there is no feasible range of participation rate in cooperative advertising program.

For example, for \(k = 0.5\) and \(\eta = 0.6\) as shown in Fig. 1b and Table 2, information sharing is beneficial for all the supply chain members, if \(\theta \in \left( {0.4, 0.74} \right)\). In other words, all the supply chain members are always better off with full information sharing (FIS) than with no information sharing (NIS), if the manufacturer’s participation rate is between 0.4 and 0.74. From Fig. 1b and Table 2, it can be concluded that, if \(k = 0.5\) and \(\theta \in \left( {0.58, \;0.65} \right)\), for \(0.1 \le \eta \le 0.8\), information sharing is beneficial for all the supply chain members. In addition, as shown in Fig. 1, the manufacturer’s participation interval increases with any increasing in the value of \(k\), and also, for any fixed \(k\), the manufacturer’s participation interval decreases by increasing in \(\eta\).

Furthermore, Fig. 2 specifies the region in which cooperative advertising program makes full information sharing better than no information sharing for all the supply chain members. In other words, for any values of \(k\) and \(\eta\) in the highlighted region, there exists a feasible range of participation rate in the cooperative advertising program. From Fig. 2, it can be observed that for all values of \(\eta\), information sharing is beneficial for all the supply chain members, if \(k \ge 0.55\). In other words, if \(k \ge 0.55\), cooperative advertising program can lead to a win–win situation for all channel members, and therefore, full information sharing is the unique equilibrium in the first stage of the game.

Comparison between PIS and NIS scenarios

Here, we investigate that if one of the retailers is not willing to disclose his information, if it is feasible for the manufacturer to use cooperative advertising program to motivate the other one to share his information. Therefore, we assume that retailer 2 is not willing to share his private information and compare profits of the manufacturer and retailer 1 under partial information sharing and no information sharing scenarios. The comparison results are shown in Fig. 3 and Table 3. For specific values of \(k\) and \(\eta\) in Table 3, \(\pi_{M} \left( {1_{s} ,2_{n} } \right) > \pi_{M} \left( {1_{n} ,2_{n} } \right)\) and \(\pi_{{R_{1} }} \left( {1_{s} ,2_{n} } \right) > \pi_{{R_{1} }} \left( {1_{n} ,2_{n} } \right)\), as long as the manufacturer’s participation rate is in the specified range. For example, Fig. 3 and Table 3 indicate that, if \(k = 0.5\) and \(\theta \in \left( {0.34, \;0.6} \right)\), for \(0.1 \le \eta \le 0.4\), partial information sharing is beneficial for the manufacturer and retailer 1. In other words, for \(0.1 \le \eta \le 0.4\), the manufacturer and retailer 1 are always better off with PIS than with NIS, if the manufacturer’s participation rate is between 0.34 and 0.6. In addition, Fig. 4 illustrates that for any fixed \(k\), the manufacturer’s participation interval decreases by increasing in \(\eta\).

Furthermore, Fig. 4 specifies the region in which cooperative advertising program makes partial information sharing better than no information sharing for the manufacturer and retailer 1. In other words, for any values of \(k\) and \(\eta\) in the highlighted region, there exists a feasible range of participation rate in the cooperative advertising program. From Fig. 4, it can be concluded that, for all values of \(k\) and \(0.1 \le \eta \le 0.3\), the manufacturer with cooperative advertising program can motivate the retailer 1 to share his information. In other words, the manufacturer can acquire information from the retailer 1, if retailer 1 is efficient enough.

Comparison between FIS and PIS scenarios

In this section, we investigate that if only one of the retailers discloses his private information, if it is feasible for the manufacturer to use cooperative advertising program to motivate the other one to share his information. Therefore, we first assume that retailer 1 decides to share his private information with the manufacturer. Then, we investigate that under what conditions retailer 2 has an incentive to reveal his private information to the manufacturer. Therefore, we compare all members’ profit under FIS and PIS scenarios. The comparison results are shown in Fig. 5 and Table 4. For specific values of \(k\) and \(\eta\) in Table 4, \(\pi_{M} \left( {1_{s} ,2_{s} } \right) > \pi_{M} \left( {1_{n} ,2_{s} } \right)\) and \(\pi_{{R_{i} }} \left( {1_{s} ,2_{s} } \right) > \pi_{{R_{i} }} \left( {1_{n} ,2_{s} } \right),i = 1,\;2\), as long as the manufacturer’s participation rate is in the specified range. For example, Fig. 5 and Table 4 indicate that, if \(k = 0.5\) and \(\theta \in \left( {0.76, \;0.88} \right)\), for \(0.1 \le \eta \le 0.6\), FIS is better than NIS for all channel members. In other words, for \(0.1 \le \eta \le 0.6\), retailer 1 has an incentive to share his private information with the manufacturer, if the manufacturer’s participation rate is between 0.76 and 0.88.

Furthermore, Fig. 6 specifies the region in which cooperative advertising program makes full information sharing better than partial information sharing for all channel members. In other words, for any values of \(k\) and \(\eta\) in the highlighted region, there exists a feasible range of participation rate in the cooperative advertising program. From Fig. 6, it can be concluded that, if only retailer 1 is willing to share his information, for any values of \(k\) and \(\eta\) in the highlighted region, the manufacturer with cooperative advertising program can induce the retailer 2 to disclose his information.

Effect of competition

In this subsection, we examine the effect of competition on the manufacturer’s wholesale price and retailers’ retail prices, added values, and advertising expenditures and their profits under different scenarios of information sharing, where the default values of parameters are as follows:

We introduce the ratio \(\gamma = \gamma_{2} /\gamma_{1}\) to ease the analyses, where competition is increased through increasing \(\gamma\). The effect of competition under no information sharing is illustrated in Fig. 7 and Fig. 8. As shown in Fig. 7a, the retailers’ added values are increased by increasing competition. In addition, Fig. 7b indicates that the retailers’ retail prices are decreased by increasing competition, while and manufacturer’s wholesale price are increased. Figure 8a shows that the manufacturer’s profit is increased by increasing competition. In addition, Fig. 8b demonstrates that the retailers’ advertising expenditures and profits are decreased by increasing competition. Thus, under no information sharing, increase in competition between retailers is detrimental for the retailers and beneficial for the manufacturer. Furthermore, under information sharing, retailers’ retail prices and the manufacturer’s wholesale price are decreased by increasing competition, while retailers’ added values and the manufacturer’s profit are increased. In addition, for small values of \(\theta\), retailers’ advertising expenditures and profits are decreased by increasing competition, while for large values of \(\theta\), retailers’ advertising expenditures and profits are increased by increasing competition. Therefore, if the manufacturer offers a higher cooperative advertising participation rate, increasing competition will be beneficial for the manufacturer and retailers. For instance, the effect of competition on the manufacturer’s and retailers’ profits under information sharing is illustrated in Fig. 9.

Conclusion

Although information sharing can increase efficiency, independent firms with private information often do not have an incentive to disclose their private information. This paper proposes a new motivation for information sharing in a decentralized distribution channel. We present a supply chain model with one manufacturer and two competing retailers who face a customer demand sensitive to retail price, added value, and advertising. Both retailers add their own values to the product and distribute it to the customers. Each retailer has full information about his own cost structure which is unknown to the manufacturer and the other retailer. The manufacturer uses a cooperative advertising program to motivate the retailers to share their information. We determined the optimal decision for pricing, value-adding, and advertising of the retailers analytically. In addition, we determined the manufacturer’s optimal wholesale price numerically.

We compared different scenarios of information sharing through illustrative example. The results indicate that: (1) If the manufacturer offers a cooperative advertising program and \(k \ge 0.55\), each retailer has an incentive to share his private information with the manufacturer, so, a win–win situation for the whole supply chain is obtained. (2) If one of the retailers is not willing to share his information with the manufacturer, through the cooperative advertising program, the other retailer has an incentive to disclose his information under certain conditions. (3) If only one retailer is willing to disclose his information to the manufacturer, there is a condition in which the manufacturer with the cooperative advertising program can induce the other retailer to share his information. (4) If the manufacturer offers a higher cooperative advertising participation rate, increasing the competition will be beneficial for all the supply chain members.

Our research has some limitations and can be extended in several ways. First, as we determine the certain condition (\(k \ge 0.55\)) in which information sharing is beneficial for all the supply chain members, if the value of \(k\) is small (\(k < 0.55\)), we can study its feasibility to use another coordinative contract in addition to cooperative advertising program. Second, we consider homogeneous retailers in our analyses; we can relax this limitation and consider heterogeneous retailers. Another limitation of this research is the issue in which we consider a distribution channel with one manufacturer and two retailers. One can generalize the model considering more retailers or more manufacturers.

References

Agnetis A, Hall NG, Pacciarelli D (2006) Supply chain scheduling: Sequence coordination. Discret Appl Math 154:2044–2063

Alaei S, Setak M (2015) Multi objective coordination of a supply chain with routing and service level consideration. Int J Prod Econ 167:271–281

Alaei S, Alaei R, Salimi P (2014) A game theoretical study of cooperative advertising in a single-manufacturer-two-retailers supply chain. Int J Adv Manuf Technol 74:101–111

Amrouche N, Yan R (2013) Can a weak retailer benefit from manufacturer-dominant retailer alliance? J Retail Cons Serv 20:34–42

Aust G, Buscher U (2014a) Cooperative advertising models in supply chain management: a review. Eur J Oper Res 234:1–14

Aust G, Buscher U (2014b) Game theoretic analysis of pricing and vertical cooperative advertising of a retailer-duopoly with a common manufacturer. Cent Eur J Oper Res 24:1–21

Aust G, Buscher U (2014c) Vertical cooperative advertising in a retailer duopoly. Comput Ind Eng 72:247–254

Bahinipati BK, Kanda A, Deshmukh S (2009) Coordinated supply management: review, insights, and limitations. Int J Logist Res Appl 12:407–422

Baihaqi I, Beaumont N (2006) Information sharing in supply chains: a literature review and research agenda. Department of Management, Monash University, Clayton

Brooks B (2003) Ten ways to add value and defeat price objections. Am Salesm 48:3–6

Chaharsooghi SK, Heydari J, Kamalabadi IN (2011) Simultaneous coordination of order quantity and reorder point in a two-stage supply chain. Comput Oper Res 38:1667–1677

Chen F (2003) Information sharing and supply chain coordination. Handb Oper Res Manag Sci 11:341–421

Chen J (2011) The impact of sharing customer returns information in a supply chain with and without a buyback policy. Eur J Oper Res 213:478–488

Chen M-C, Yang T, Yen C-T (2007) Investigating the value of information sharing in multi-echelon supply chains. Qual Quant 41:497–511

Choi HCP (2010) Information sharing in supply chain management: a literature review on analytical research. Calif J 8:110–116

Giri B, Sarker B (2015) Coordinating a two-echelon supply chain under production disruption when retailers compete with price and service level. Oper Res 16(1):71–88

Giri B, Sharma S (2014) Manufacturer’s pricing strategy in a two-level supply chain with competing retailers and advertising cost dependent demand. Econ Model 38:102–111

He X, Krishnamoorthy A, Prasad A, Sethi SP (2011) Retail competition and cooperative advertising. Oper Res Lett 39:11–16

Heydari J (2014a) Coordinating supplier's reorder point: a coordination mechanism for supply chains with long supplier lead time. Comput Oper Res 48:89–101

Heydari J (2014b) Supply chain coordination using time-based temporary price discounts. Comput Ind Eng 75:96–101

Heydari J (2015) Coordinating replenishment decisions in a two-stage supply chain by considering truckload limitation based on delay in payments. Int J Syst Sci 46:1897–1908

Heydari J, Norouzinasab Y (2015) A two-level discount model for coordinating a decentralized supply chain considering stochastic price-sensitive demand. J Ind Eng Int 11:531–542

Heydari J, Zaabi-Ahmadi P, Choi T-M (2016) Coordinating supply chains with stochastic demand by crashing lead times. Comput Oper Res. doi:10.1016/j.cor.2016.10.009

Heydari J, Choi T-M, Radkhah S (2017) Pareto improving supply chain coordination under a money-back guarantee service program. Serv Sci 9:91–105

Huang B, Iravani SM (2007) Optimal production and rationing decisions in supply chains with information sharing. Oper Res Lett 35:669–676

Iyer G (1998) Coordinating channels under price and nonprice competition. Mark Sci 17:338–355

Karray S, Zaccour G (2007) Effectiveness of coop advertising programs in competitive distribution channels. Int Game Theory Rev 9:151–167

Kumar RS, Pugazhendhi S (2012) Information sharing in supply chains: an overview. Proc Eng 38:2147–2154

Li L (2002) Information sharing in a supply chain with horizontal competition. Manag Sci 48:1196–1212

Li L, Zhang H (2008) Confidentiality and information sharing in supply chain coordination. Manag Sci 54:1467–1481

Liu H, Özer Ö (2010) Channel incentives in sharing new product demand information and robust contracts. Eur J Oper Res 207:1341–1349

Mukhopadhyay SK, Yao D-Q, Yue X (2008) Information sharing of value-adding retailer in a mixed channel hi-tech supply chain. J Bus Res 61:950–958

Panda S (2013) Coordinating two-echelon supply chains under stock and price dependent demand rate. Asia Pac J Oper Res 30:1–20

Parthasarathi G, Sarmah SP, Jenamani M (2011) Supply chain coordination under retail competition using stock dependent price-setting newsvendor framework. Oper Res 11:259–279

Pasternack BA (2008) Optimal pricing and return policies for perishable commodities. Mark Sci 27:133–140

Qin Z, Yang J (2008) Analysis of a revenue-sharing contract in supply chain management. Int J Logist Res Appl 11:17–29

Raju JS, Sethuraman R, Dhar SK (1995) The introduction and performance of store brands. Manag Sci 41:957–978

Setak M, Kafshian Ahar H, Alaei S (2017) Coordination of information sharing and cooperative advertising in a decentralized supply chain with competing retailers considering free riding behavior. J Ind Syst Eng 10:151–168

SeyedEsfahani MM, Biazaran M, Gharakhani M (2011) A game theoretic approach to coordinate pricing and vertical co-op advertising in manufacturer–retailer supply chains. Eur J Oper Res 211:263–273

Tsao Y-C, Sheen G-J (2012) Effects of promotion cost sharing policy with the sales learning curve on supply chain coordination. Comput Oper Res 39:1872–1878

Tsay AA (1999) The quantity flexibility contract and supplier-customer incentives. Manag Sci 45:1339–1358

Tsay AA, Agrawal N (2000) Channel dynamics under price and service competition. Manuf Serv Oper Manag 2:372–391

Wu J, Iyer A, Preckel PV, Zhai X (2012) Information sharing across multiple buyers in a supply chain. Oper Res Lett 44:74–79

Xiao T, Yang D (2009) Risk sharing and information revelation mechanism of a one-manufacturer and one-retailer supply chain facing an integrated competitor. Eur J Oper Res 196:1076–1085

Xie J, Wei JC (2009) Coordinating advertising and pricing in a manufacturer–retailer channel. Eur J Oper Res 197:785–791

Yao D-Q, Yue X, Liu J (2008) Vertical cost information sharing in a supply chain with value-adding retailers. Omega 36:838–851

Zhang H (2002) Vertical information exchange in a supply chain with duopoly retailers. Prod Oper Manag 11:531–546

Zhang J, Chen J (2013) Coordination of information sharing in a supply chain. Int J Prod Econ 143:178–187

Zhang J, Gou Q, Li S, Huang Z (2015) Cooperative advertising with accrual rate in a dynamic supply chain. Dyn Games Appl 7:1–19

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

Proof of proposition 1

The profit function of retailer 1 is as follows:

The first-order partial derivatives are as follows:

Setting the derivatives to zero and solving the resulting system of equations, we obtain the optimal response function for retailer 1:

The profit function of retailer 2 is as follows:

The first-order partial derivatives are as follows:

Setting the derivatives to zero and solving the resulting system of equations, we obtain the optimal response function for retailer 2:

Since retailer 1 does not know the retailer 2’s efficiency parameter, he has no complete information about retailer 2’s added value \(v_{2}\) and price \(p_{2}\). Therefore, similar to (Yao et al. (2008)), we assume that retailer 1 finds the expected added value and retail price for retailer 2.

Similarly, the retailer 2 finds the expected added value and retail price for retailer 1:

Substituting Eqs. (27) and (28) into Eqs. (18) and (19), and Eqs. (29) and (30) into Eqs. (25) and (26), and solving Eqs. (18), (19), (25), and (26) simultaneously, we obtain the equilibriums for the retailers:

and

where A, B i ,C, and E i are defined as follows:

Appendix B

The profit function of the manufacturer is as follows:

The first-order partial derivative is as follows:

where

where

We obtain the optimal wholesale price for the manufacturer by setting Eq. (34) to zero. However, as previously mentioned, because of complexity of the problem, the first-order condition \(\partial \pi_{M} /\partial w = 0\) cannot lead to a closed-form formula for \(w\). Hence, we obtain the optimal wholesale price by means of illustrative example.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Setak, M., Kafshian Ahar, H. & Alaei, S. Incentive mechanism based on cooperative advertising for cost information sharing in a supply chain with competing retailers. J Ind Eng Int 14, 265–280 (2018). https://doi.org/10.1007/s40092-017-0225-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40092-017-0225-7