Abstract

This study investigates the link between female board directors and company financial performance and agency costs in Sri Lanka's publicly listed companies. In order to investigate the impact of board gender diversity on firm financial performance, a dynamic panel generalised method of moment estimation is applied. Three variables are used as proxies for gender diversity of the board of directors, namely the percentage of women on the board, a dichotomous dummy and the Blau index. A Tobit model with endogenous regressors is used to investigate the impact of female board members on agency cost, using growth opportunities as a measure of agency cost. After controlling for size, industry and other corporate governance measures, this study finds a significant negative relationship between the proportion of women on boards and firm value along with an increase in company agency cost. This evidence provides insights for governments and academic institutions in their efforts to provide resources that will help enhance women's leadership skills.

Similar content being viewed by others

Introduction

This paper investigates women in the Sri Lankan boardroom and their effect on the financial performance and agency costs of local public companies (LPCs). Over the last decade, the issue of gender diversity in boardrooms and top management has received increasing attention in the academic literature and popular press. Recent studies have investigated the ‘glass ceiling’ that stops the progress of more qualified females within the hierarchy of an organisation because of some form of discrimination. Corporate boardrooms are still not very diverse in terms of gender. According to the Boards in Turbulent Times Report (Hedrick & Struggles International, Inc. 2009), one in three European companies had no women board members (against 46 % in 2005 and 54 % in 2003). According to the New Zealand Census of Women's Participation (Human Rights Commission 2008)], 60 of top 100 companies on the New Zealand Stock Market have no women on their boards. Asian countries are even further behind their male counterparts in the board directorships. According to recent surveys in China and India, women in top companies hold a mere 5 % of board seats. Although women made up 33.7 % (Ministry of Finance and Planning 2009) of the Sri Lankan workforce in 2009 (excluding northern and eastern provinces)Footnote 1, there are only 1 % or fewer females in higher management positions in Sri Lanka's top corporations (Tudawe 2010).

However, the situation has started to change. The existing literature reveals a slow but steady rise in female presence on boards of directors in companies across the globe. The German Institute for Economic Research pointed to legislation as being the key factor for attracting women to board membership (King 2010). For example, in Norway, federal legislation requires all boards to have at least 40 % female representation on the company board. Before Norway's law in 2003, only 7 % of publicly listed Norwegian companies' board members were female, but after the enactment of the law, Norway had the highest proportion of women on corporate boards in the world with an average of 44.2 %. Similar laws have since been passed in the Netherlands and Sweden. Women occupy 23 % of the listed Swedish companies' board seats in 2011. Following the Nordic countries, most of the European countries support board gender quota. In France, a new law was adopted in early 2011, which requires a 40 % female presence in boardrooms by 2017. Quotas for public limited companies are also being discussed in Belgium, Canada and Italy, where laws are at different stages of the ratification process. The issue of women on corporate boards of directors has clearly received considerable attention in the last two decades, thus the central question is whether the presence of women on a board contributes to positive board and corporate performance.

This paper makes a number of contributions to the literature. First, it adds to the empirical evidence on the relationship of female directors and firm financial performance and agency costs. Most existing studies use data from developed countries with western cultures. Cultural differences influence individual behaviours, leadership and management activities. Also, management and leadership philosophies typically develop in synchronisation with the culture. This paper provides evidence from Sri Lanka, a developing country with a male-dominated society similar to most other Asian countries. Third, this paper undertakes the first direct study of company financial performance/agency costs and gender diversity in Sri Lankan companies' board. Fourth, the econometric analysis is more robust than prior research due to the use of generalised method of moment (GMM) dynamic panel technique to control the endogeneity effect and the panel Tobit regression.

Gender diversity in the boardroom and the Sri Lankan context

Sri Lanka is a lower-middle-income island, located in the Indian Ocean, and has made considerable progress in terms of literacy levels, life expectancy and so-called development. However, Human Development Report (UNDP 1998) indicates that though the level of gender development in Sri Lanka is higher than average for an Asian country, gender empowerment is relatively low.

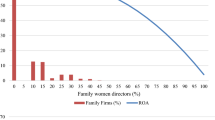

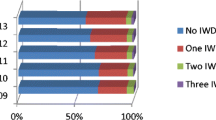

Around the world, companies are facing increasing pressure to appoint females to senior officer and management positions. Many recent proposals for governance reform explicitly stress the importance of gender diversity in the boardroom. However, gender diversity is still low in Sri Lanka compared to the USA and other developed countries. Figure 1 shows female senior officials and managers in Sri Lankan companies since 2006. In 2009, male representation was twice as high as female representation in senior managerial positions. Figure 2 shows female board directors' presence in Sri Lankan listed companies (excluding banking and finance sectors). This figure is roughly constant and has stayed less than 1 % since 2007.

Due to high existence of family businesses in Sri Lankan listed companies (Masulis et al. 2009), the founder will include all family members on the board. Most of the time, founding female family members are inactive, uninvolved in the day to day running of the business and are there only to increase board numbers. It must be noted that less than 1 % female representation includes women who are involved in family business and are silent members. Another reason for this under-performance is that most of women in Sri Lankan companies are inactive representatives. In a male-dominant society, women are silent members on the board. Female directors are chosen merely because of tokenism; their impact is likely to be minimal. Sri Lankan women are the primary caregivers for their families. The unpaid work of bringing up children, preparing food and maintaining the household are the main duties of all Sri Lankan women. The biggest barriers to women accessing leadership positions as identified by the respondents are these ‘general norms and cultural practices in the country’. According to Tudawe (2010), ‘masculine or patriarchal corporate culture’ and ‘lack of role models’ are the barriers to women accessing leadership in Sri Lanka. Therefore, if there is a female representative on a board, her main duty is still family unpaid work rather than performing on the corporate board. So, she gives priority to family tasks and becomes a silent representative on the board.

It has been suggest that although females in Sri Lanka have equal access to education at all levels, education has not adequately empowered women to be aware of and assert their rights, and that women are still unable to resist the social imposition of practices that inhibit their personal development. The University of Colombo statistics (1993–1996) indicate that postgraduate entry for female students is significantly less than their male counterparts for all subject streams. In vocational training institutes, the majority of students are male. Therefore, the probability of unspecialised female directors serving on boards is higher than for males. The non-specialisation could have a negative effect on the financial performance for a company.

The next sections review prior research, present the hypotheses and discuss data, variables, method and procedures used in the study. The results and conclusion then follow.

Literature review

Board diversity and performance

Board composition affects company performance in two ways. First, the board is highly influential in a company's strategic decision-making. Secondly, the board plays a supervisory and monitory role in the company, representing shareholders and responding to takeovers and the threats (Finkelstein and Hambrick 1996). Existing literature suggests that boards with balance of men and women where individuals have different characteristics, qualities and experience lead to be more creative, innovative and make quality decision-making. There is a normative rationalisation that greater gender diversity in the boardroom results in well-rounded decision-making, problem-solving and, hence, better results. Furthermore, Nowell and Tinkler (1994) found that women are more cooperative than men and they increase firm value. The fact that women drive more than 80 % of consumer decisions in households indicates the depth of customer understanding that women can bring commercial needs (Hudson 2007). Women are more altruistic than male, and their altruistic behaviour may enhance firm financial performance. Moreover, a firm with more female board directors may increase firm competitive advantages because gender diversity improves the image of the firm. Further, Women on Board (2008) shows that having women on boards leads to improve firm financial performance because women tend to consider a wide range of issues and options that are more in touch with stakeholders' need. However, evidence suggests that women typically face an invisible obstacle, the glass ceiling, which prevents their climb up leadership ladders, and conversely, men are more likely to rise up into management positions (Kanter 1977; Williams 1992).

In recent years, board gender diversity has become the subject of number of empirical studies, though the results are mixed. In an investigation into Spain's listed firms, Campbell and Minguez-Vera (2007) found a positive significant relationship with female proportion on the board and the company's Tobin's Q value. Erhardt et al. (2003) found that the percentage of female directors' is positively related to the larger US firms' two accounting measures: return on assets and return on investments. In addition to this, recent research in the UK has found that the presence of at least one female board director reduces company bankruptcy costs (Wilson and Altanlar 2009). Jurkus et al. (2008) provide evidence that the proportion of female directors on boards is related to a firm's financial performance as measured by Tobin's Q and agency cost measured as free cash flow. Their findings suggest that the positive effects of gender diversity exist only in women-exclusive work environments, suggesting that the benefit of gender diversity would be more effective in environments where this resource is relatively scarce. However, Carter et al. (2003) found that gender diversity on a board of directors has a positive effect only when firms have a weak governance structure. While bringing benefits, board diversification might have high communication costs to a company. Earley and Mosakowski (2000) argue that members of a homogeneous group face fewer emotional conflicts and tend to communicate more frequently than heterogeneous groups. A study by Jude (2003) suggests that companies with female directors tend to perform less well than companies with all male boards. Using an index compiled by the Cranfield School of Management, she reports that after female board directors were recruited, of the top ten companies in the index, six under-performed. But rather than the female board directors being responsible for the drop in company financial performance, it is equally possible that the company's poor performance was the reason for appointing women to the board. Therefore, it is important to consider circumstances surrounding female directors' appointments and not to focus solely on female board directors' company performance. Testable hypothesis regarding the board gender diversification and financial performance in Sri Lankan companies is: (H1) The gender diversifications of board have a positive impact on the firms' financial performance.

From the agency perspective, Adams et al. (2009) find that female board directors reduce agency conflicts in their study of US data because they are always monitored on board top compared to their male counterparts. Jurkus et al. (2008) find similar results and explain an inverse relationship between female board directors' percentage and agency costs proxy as free cash flow. This greater gender diversification among board members may tend to increase board monitoring and reduce misalignments. Carter et al. (2003) examined board diversity and firm value in the context of agency theory and found a significant negative relationship between the fraction of women on a board and company agency costs for Fortune 100 firms. They posited that gender diversity can enhance the monitoring and controlling of managers while increasing the independence of board directors. This may be because of women are more inclined to ask questions that would not be ask by male board members. Testable hypothesis regarding the board gender diversification and agency costs in Sri Lankan companies is: (H2) The gender diversification of board will negatively impact on the firms' agency costs.

Data

The sample for the panel data analysis embraces non-financial firms listed on the Colombo Stock Exchange (CSE) during the period from 2006 to 2010. The data are gathered from CSE publications and individual companies' audited annual reports. On 2010, the CSE had 151 listed non-financial companies representing 18 business sectors. From that 151, only 88 companies were statutory domiciled in Sri Lanka and categorised as LPC; this study sample consists of 88 LPCs.

Dependent variables

Firm financial performance is measured by the approximation of Tobin's Q (Q). Brav et al. (2008) defined Tobin's Q as the market value of equity plus book value of debt, all divided by book value of debt plus book value of equity.

The agency cost proxy is represented as a measure of free cash flow into Q dummy (QFCF) of the company. Free cash flow represents the cash that the company is able to generate after laying out the all positive net percent value projects when discounted at the relevant cost of capital. Jensen (1986) explains that when the company generates a considerable amount of free cash flow, it increases the conflict between managers and shareholders because managers tend to invest money, not maximise shareholder value.

Following the methods adopted by McKnight and Weir (2009) and McConnell and Servaes (1990), growth opportunities are measured by Tobin's Q dummy. Growth dummy takes 1 if the firm's Tobin's Q is less than 1 (indicating poorly managed firms) and 0 otherwise. Creating dummy variables for growth prospect is consistent with Doukas et al. (2000).

Explanatory variables

Three variables were used as proxies for the gender diversity of the board of directors. The first variable is the percentage of women (PWOMEN) on the board. This is calculated as the number of female directors divided by the total number of board directors. The dummy variable (DWOMEN) takes a value of 1 when at least one woman is present on the board and 0 otherwise. The third variable measures board diversity (DIVERSITYT), which is Blau index,Footnote 2 a measure widely used in ecology, genetics, linguistics and economics. The Blau index is calculated by 1 − Σn i = 1 p 2 i , where p is the proportion of board members in each category and n is the total number of board members. The Blau index value range for diversity is 0 from 0.5, which can be achieved only when a board has equal numbers of female and male directors. The following corporate governance variables are included in this study. Board size (BOARD), defined as logarithm of the total number of directors. Ownership type (OWNER) is dummy variable 1 if the ownership type is institutional, 0 otherwise. Moreover, following control variables were also included: Leverage is calculated as the ratio of total debts to total assets (DEBT); firm size (LNSALES), defined as logarithm of the total sales of the company. As a performance measure, the return on assets (ROA) and firm maturity (AGE) are measured by the number of years operating in the industry. Descriptive statistics for all variables are presented in Table 1.

The approximation of mean value of Tobin's Q (Q) figures is greater than 1. This is consistent with values obtained by Campbell and Minguez-Vera (2007) for the Spanish market, Demsetz and Villalonga (2002) for the US market and Hillier and McColgan (2001) for the UK market are all greater than 1. Furthermore, Table 1 indicates that only 37.8 % of Sri Lankan listed companies have one or more female directors on their boards. The incorporation of women into the workplace has been higher in Sri Lanka than some developed countries like France, USA and Australia (Hausmann et al. 2009), a fact reflected in the descriptive statistics. The mean percentage of female directors (PWOMEN) is 7.5. This is lower than the numbers reported from the European average (10 %) in 2009 (Hedrick & Struggles International, Inc. 2009). In Sri Lanka, the highest percentage of women on a board is 50 % in LPCs and the lowest female representation is 0 %. Therefore, total female boards do not exist in Sri Lanka. The mean value of board size is 7. This is smaller than the average European board size of 11.8 as recorded in 2009 (Hedrick & Struggles International, Inc. 2009). But the average board size of Sri Lankan companies is consistent with the recommendations of the European and US codes for ideal board size between 5 and 15 members.

The correlation matrix shown as Table 2 indicates that board diversification variables are significantly correlated with the level of Tobin's Q and QFCF, which offers tentative support for the claim that board diversity interacts with firm financial performance and agency costs.

Method

T test

The t test is used to investigate whether highly diversified boards' company performance and less diversified boards' company performance are the same over time. The testable hypothesis for the proposed t test is: H0 = There are no differences in the mean performance of less diversified companies and highly diversified companies.

A relatively straightforward two-tailed t test is required to test this hypothesis. Based on the Blau index, the highly diversified firms' index values are greater than 0 and low diversified firms' index values are equal to 0. In Table 3, the t test result is reported. Table 3 reports that for two sets of companies P(T ≤ t) two-tailed value (2.3E-51) is less than the alpha (0.05) value. Therefore, null hypothesis is not accepted, suggesting that there are differences in the performance of less diversified companies and high diversified companies. This suggests that there may be a link between financial performance and diversification, which will want further investigations.

Panel data analysis is the most efficient statistical method, widely used in econometrics and social science Maddala (2001). The panel data structure allows for taking into account the unobservable and consistent heterogeneity. However, Hermalin et al. (2003), Carter et al. (2003), Campbell and Minguez-Vera (2007) and Marinova et al. (2010) show that problems arise with OLS regression if two or more variables are jointly endogenous. To control the effect of inverse causality, most previous studies use a two-stage least squares (2SLS) regression technique. However, 2SLS requires the identification of instruments that are correlated with the endogenous variables and are uncorrelated with the error term of the model. Researchers sometimes resist identifying possible instruments that are uncorrelated with the error term and correlated with an endogenous variable. This weak instrument can lead to misinterpretation of coefficients.

Dynamic panel GMM estimator

To obtain robust estimates, a GMM panel estimator is used to estimate the relationship between board diversity and financial performance. Using the GMM method can build up instrumental variables for potential endogenous variables. First-differencing removes potential unobservable heterogeneity bias. After, first-differencing estimates are obtained via GMM using lagged values of the explanatory variables as instruments for the explanatory variables. An important aspect of the dynamic panel estimator is its use the company's history as instruments for explanatory variables.

Arellano and Bover (1995) and Blundell and Bond (1998) further develop the GMM estimator using first differenced variables as instruments for the equations in a stacked system of equations that include the equations in both levels and differences. However, the equations in the stacks may include unobservable heterogeneity. To deal with this problem, it is assumed that the diversity and other control variables exhibit a constant correlation over time. This assumption leads to additional set of orthogonality condition. A Hansan/Sargan overidentification test for serial correlation indicates the validity of this model specification.

Panel Tobit model

Following Cameron and Trivedi (2009), this study uses Tobit regression model because the sample of observation is a mixture of zero and positive values. The random effect panel Tobit model specifies the latent variable y* it to depend on regressors, an idiosyncratic error and an individual specific error, so

where \( {\alpha_i} \sim N\left( {0,\sigma_{\text{a}}^2} \right) \) and \( { \in_{{it}}} \sim N\left( {0,\sigma_{\text{a}}^2} \right) \) and the regressor vectors X it includes an intercept.

For left censoring at L, we observe the y it variable, where

The random effects Tobit estimator has following advantages. First, time-invariant, time-varying and time-dummies variables can be incorporated in the model and they can be estimated constantly using a simulation estimator. Secondly, this method allows for complicated dynamic panels, possibly with more than one lag variable. Thirdly, it is straightforward and easy to accommodate serial correlation errors (Chang 2002a, b).

Results

Female board directors effect on financial performance

The regression analysis is undertaken in three steps using the panel data. The results of LPC financial performance and PWOMEN are presented in Table 4 column 2. Table 4 columns 3 and 4 presented the results of LPC financial performance and presence of women (DWOMEN) and board gender diversity (DIVERSITY), respectively.

The results indicate that the coefficient of PWOMEN variable is negative and statistically significant at the 1 % level for Tobin's Q. This finding is consistent with Adams et al. (2009) who posit a strong negative relationship between female representation on the board and stock return. Moreover, Table 4 column 3 indicates that the presence of women on board (DWOMEN) variable is negatively and statistically significant at 1 % level for LPCs' Tobin's Q. According to Andreoni and Vesterlund (2001), this may be because female board directors are less altruistic than male board directors. Therefore, boardroom conflicts may increase at the female directors' presence. This leads to low financial performance. The DIVERSITY variable is negatively and statistically significant at 1 % level for LPC Tobin's Q value and indicates that highly gender diversified company boards destroys LPCs' financial performance. This is consistent with Hambrick et al. (1996) and Knight et al. (1999) who find a significant negative impact on board diversity and company financial performance. The one possible explanation is that greater time and effort are required for different gender group decision-making. Hence, companies may lose their competitive edge. This is in line with Cox et al. (1991) who explain gender diversity within top management brings potential costs to an organisation due to interpersonal conflicts and communication problems. Hence, the above findings reject this study hypothesis 1 and suggest that more gender diversification leads to reduced financial performance of Sri Lankan companies.

Concerning the corporate governance variables, this study reports institutional ownership (OWNER) has a positive impact on firm value. This finding is consistent with Allen et al. (2000) who explain with better information gathering, higher dividend payouts and better monitoring, which reduces the agency conflicts. Institutional ownership is predominant in the Sri Lankan stock market. Manawaduge et al. (2009) suggest that a very high percentage of shares on the Sri Lankan stock market are owned by institutional investors. Lee (2010) explains that due to the undeveloped equity market and weak investor protection, domestic investors are reluctant to invest in emerging markets with low levels of corporate governance reform. This may be one reason why institutional ownership is dominant in Sri Lanka. Next, it is noted that firm size and firm age have a negatively effect on firm financial performance, at 5 % significance level, suggesting large older firms are less efficient than smaller younger firms. Moreover, the leverage ratio is positively related to Tobin's Q ratio, at the 1 % significance level, indicating that with more debt, there is a greater increase in company financial performance.

Female board directors effect on agency performance

Female board directors and their effect on Q dummy free cash flow measure of agency costs are reported in Table 5. Within this measure, a positive coefficient means high agency costs and a negative one implies low agency costs. Table 5 column 2 reports that the percentage for female directors (PWOMEN) does not have a significant impact on agency cost. However, column 3 and column 4 reported that the presence of women on a board (DWOMEN) and board gender diversity (DIVERSITY) have a 5 % significant positive impact on agency cost proxy (QFCF). This may be the group in whihc heterogeneity increases communication, managerial and coordination costs and misalignment with owners' interests. Further, greater gender diversity among board members generates more critical questions and, thus, more conflicts; decision-making will be more time-consuming and less effective. This result coincides with several previous studies that demonstrate the gender diversity increases firm agency cost (Jurkus et al. 2008, 2011). This result leads to reject hypothesis 2 and indicates that board gender diversity increases agency problem of Sri Lankan firms.

Consideration of the corporate governance variables in Table 5 reveals institute ownership is negatively related with Tobin's Q at the 1 % significance level, indicating institutional ownership decreases LPCs' agency conflicts. Moreover, this finding is in line with Shleifer and Vishny (1997). Based on the efficient monitoring hypothesis, when the percentage of institutional owners increases, there is a decrease in LPC agency conflicts. Furthermore, the coefficient of BOARD variable is positively and statistically significant at 5 % level for LPCs' agency costs, which indicates large boards increase LPCs' agency conflicts. The sign on debt in the result indicates that an increase in debt is associated with an increase in agency costs for LPCs. This finding is in line with Singh and Davidson (2003) who find a significant positive relationship for leverage in their study of larger companies. A negative relationship is evident between firm size (LNSALES) and firm age (AGE) and firm free cash flow growth dummy agency cost proxy. This result suggests that larger and mature LPCs may be subject to fewer agency costs.

Conclusion and discussion

This study indicates that gender board diversity has an effect on Sri Lankan listed companies' financial performance and agency costs. While most studies of board gender diversification are based on data from developed economies, it is widely accepted that because of individual, cultural and institutional characteristics, caution should be exercised in the generalisation of results. This study indicates that board gender diversity increases firm agency conflict while decreasing firm financial performance. This may be due to the environment of Sri Lanka where there is a preference for homogeneous board. Though there has recently been an increase in female representation in the workforce, Sri Lanka still has very few female representatives on its company boards or in higher managerial positions. There is potential merit in introducing more opportunities for female education, management and leadership training to enhance their skills.

Furthermore, flexible working arrangements along with training would give more opportunities for increasing female board representation and their contribution to the company. Upskilling of women in governance through education initiatives is likely to be beneficial. A scheme along these lines has recently been introduced in Australia. However, for a country with a male-dominant society, like Sri Lanka, it would be necessary implement social programmes in place to reduce the effect of being ‘female’ in a social group. Such programmes could decrease boundary heightening and exaggeration by dominant male of the difference between male (dominant group) and female (minority group) in the workplace. This would reduce negative workplace experiences for female groups, to reduce the ‘token’ experience of them and hence improve monitoring and reduce agency costs. Strengthening country institutional structure would also be needed. This would reduce the high uncertainty of country, information asymmetry problem, political influence and government expropriation. This raises female board member performance.

Finally, this study has addressed the endogeneity of gender diversity in performance regression and agency costs regression. Although a positive relationship between gender diversity in the boardroom and firm financial performance is often cited in the previous literature and popular press, some of early studies are not robust in addressing the endogeneity of gender diversity. Therefore, the actual relationship between gender diversity and firm financial performance is still unsolved.

Limitations

Notwithstanding the findings, the current study does have limitations, which point to potentially fruitful further research opportunities. First, the current study used only few aspects of gender diversity (female percentage, diversity or not and female presence or not). Further studies could consider other aspects of female board directors, such as their education level, years of experience, age and more demographic factors. Second, the findings are based on research in a single country and may not be generalisable.

Notes

Sri Lankan Labour Force Survey statistics excluding northern and eastern provinces.

This index quantifies the diversity of a group with regard to nominal features, such as ethnicity, gender, or education; they usually employ the Blau Index (Blau, 1977).

References

Hedrick & Struggles International, Inc. (2009a) Boards in turbulent times.

UNDP. (1998). Human development report. London: Oxford University Press.

Human Rights Commission. (2008). New Zealand census of women’s participation.

Ministry of Finance and Planning. (2009b). In: Department of Census and Statistics (ed) Sri Lankan labour force survey

Women on Board. (2008). Department of Business Innovation & Skills, UK.

Adams, R. B., & Daniel, F. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94, 291–309.

Allen, F., Bernardo, A. E., & Welch, I. (2000). A theory of dividends based on tax clienteles. Journal of Finance, 55, 2499–2536.

Andreoni, J., & Vesterlund, L. (2001). Which is the fair sex? Gender differences in altruism. Quarterly Journal of Economics, 116, 293–312.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68, 29–52.

Blau, P. M. (1977). Inequality and heterogeneity. New York: Free Press.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143.

Brav, A., Jiang, W., Partnoy, F., & Thomas, R. (2008). Hedge fund activism, corporate governance, and firm performance. Journal of Finance, 63(4), 1729–1775.

Cameron, C., & Trivedi, P. K. (2009). Microeconometrics using stata. Texas: Stata.

Campbell, K., & Minguez-Vera, A. (2007). Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics, 83, 435–451.

Carter, D. A., Simkins, B. J., & Simpson, W. G. (2003). Corporate governance, board diversity, and firm value. Financial Review, 38, 33–53.

Chang, S. (2002a). Simulation estimation of dynamic panel Tobit models. Detroit: Wayne State University.

Chang, S. (2002b). Simulation estimation of dynamic panel Tobit models. Detroit: Wayne State University.

Cox, T. H., Lobel, S. A., & McLeod, P. L. (1991). Effects of ethnic group cultural differences on cooperative and competitive behaviour on a group task. Academy of Management Journal, 34, 827–847.

Demsetz, H., & Villalonga, B. (2002). Ownership structure and corporate performance. Journal of Corporate Finance, 7, 209–233.

Doukas, J., Kim, C., & Pantzalis, C. (2000). Security analysts, agency costs, and company characteristics. Financial Analysts of Journal, 56(6), 344–361.

Earley, P. C., & Mosakowski, E. (2000). Creating hybrid team cultures: an empirical tests of transitional team functioning. Academy of Management Journal, 43, 26–49.

Erhardt, N. L., Werbel, J. D., & Shrader, C. B. (2003). Board of director diversity and firms financial performance. Corporate Governance: An International Review, 11(2).

Finkelstein, S., & Hambrick, D. (1996). Strategic leadership: top executives and their effects on organisations. St. Paul: West.

Hambrick, D., Cho, T., & Chen, M. (1996). The influence of top management team heterogeneity on firms' competitive moves. Administrative Science Quarterly, 41, 659–685.

Hausmann, R., Tyson, L. D., Saadia Z. (2009). The global gender gap report

Hermalin, B. E., Weisbach, M. S. (2003). Boards of directors as an endogenously determined institution: a survey of the economic literature.

Hillier, D., McColgan, P. (2001). Inside ownership and corporate value: an empirical test from the United Kingdom corporate sector. In Financial management Association (FMA) Meeting. Paris.

Hudson, A. (2007) "Women flunk finance" in New Zealand Herald, 18 November.

Jensen, M. C. (1986). Agency cost of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2).

Jude, E. (2003). Women on board: help or hindrance?" The Times.

Jurkus, A. F., Park, J. C., & Woodard, L. S. (2008). Gender diversity, firm performance, and environment. Working Paper. http://ssrn.com/abstract=1085109.

Jurkus, A. F., Park, J. C., & Woodard, L. S. (2011). Women in top management and agency costs. Journal of Business Research, 64(2), 180–186.

Kanter, R. M. (1977). Men and women of the corporation. New York: Basic Books.

King, N. (2010). Getting women on board(s). The Casual truth. Retrieved from http://www.thecasualtruth.com/story/getting-women-boards.

Knight, D., Pearce, C. L., Smith, K. G., Olian, J. D., Sims, H. P., Smith, K. A., et al. (1999). Top management team diversity, group process, and strategic consensus. Strategic Management Journal, 20, 445–465.

Lee, J. (2010). Institutional change: Asian corporate governance and finance.

Maddala, G. S. (2001). Introduction to econometrics. New York: Wiley.

Manawaduge, A., De Zoysa, A., & Rudkin, K. (2009). Performance implication of ownership structure and ownership concentration: evidence from Sri Lankan firms. Dunedin: Otago University.

Marinova, J., Plantenga, J., & Remery, C. (2010). Gender diversity and firm performance: evidence from Dutch and Danish boardrooms. Tjalling C. Koopman Research Institute, discussion paper series nr: 10-03.

Masulis, R. W., Pham, P. K., & Zein, J. (2009). Family business groups around the world: costs and benefits of pyramids. Retrieved from http://www.ccfr.org.cn/cicf2010/papers/20091215164310.pdf.

McConnell, J. J., & Servaes, H. (1990). Additional evidence on equity ownership and corporate value. Journal of Financial Economics, 27, 595–612.

McKnight, P. J., & Weir, C. (2009). Agency costs, corporate governance mechanisms and ownership structure in large UK publicly quoted companies: a panel data analysis. The Quarterly Review of Economics and Finance, 49, 139–158.

Nowell, C., & Tinkler, S. (1994). The influence of gender on the provision of a public good. Journal of Economic Behaviour and Organisation, 25, 25–36.

Rose, C. (2007). Does female board representation influence firm performance? The Danish evidence. Corporate Governance: An International Review, 15(2), 404–413.

Shleifer, A., & Vishny, R. (1997). A survey of corporate governance. Journal of Finance, 52, 737–783.

Singh, M., & Davidson, W. N. (2003). Agency costs, ownership structure and corporate governance mechanisms. Journal of Banking and Finance, 27, 793–816.

Tudawe, S. (2010). No women on top… is that news? Examining the 2010 corporate gender gap report. In Daily Mirror. Colombo.

Williams, C. L. (1992). The glass escalator: hidden advantages for men in the ‘female professions’. Social Problems, 39, 253–267.

Wilson, N., & Altanlar, A. (2009). Director characteristics, gender balance and insolvency risk: an empirical study. Retrieved from http://ssrn.com/abstract=1414224.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wellalage, N.H., Locke, S. Women on board, firm financial performance and agency costs. Asian J Bus Ethics 2, 113–127 (2013). https://doi.org/10.1007/s13520-012-0020-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13520-012-0020-x