Abstract

As a cleaner, high-efficiency, and low-carbon fuel, natural gas has been an important fuel resource for China. To achieve a substantial increase in natural gas demand, China has sought to reform its natural gas pricing mechanism. Employing a set of unbalanced panel data for China’s 30 provinces covering 1999–2015, this study aims to estimate the evolving price and income elasticities of natural gas demand and explore the effect of natural gas price reform in China. For this purpose, a series of econometric techniques allowing for cross-sectional dependence and slope homogeneity is utilized. The results suggest that although natural gas demand in China still lacks negative price elasticity, the phenomenon is improving. Moreover, the estimates suggest that natural gas demand in China is indeed becoming increasingly sensitive to income changes. Our estimates also provide strong evidence in favor of the effect of natural gas price reform on the change in price elasticity as the price elasticity decreases in five of the seven regions. In addition, the results indicate large variations in the change in price and income elasticities of natural gas demand across China’s regions. Natural gas demand is becoming more price inelastic in Southwest China and Northwest China, while such demand in North China and East China responds less sensitively to income changes. These findings offer several policy suggestions for the reform of China’s natural gas market at the national and regional levels.

Similar content being viewed by others

1 Introduction

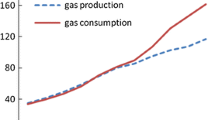

As a cleaner, high-efficiency, and low-carbon fuel, natural gas has been an important fuel resource for China and it is expected to remain important in the next few decades (Dilaver et al. 2014; Dong et al. 2017a) due to increasing energy needs, environmental concerns (e.g., carbon emissions; see Ma and Cai 2018, 2019; Shuai et al. 2017a, b), and the need to adjust the energy structure (Dong et al. 2017b). According to statistics from BP (formerly British Petroleum) (BP 2017), consumption of natural gas in China rises from about 1.1 billion cubic meters (bcm) in 1965–197.3 bcm in 2015 (see Fig. 1), an almost 180 times increase. Furthermore, in 2015, natural gas contributed approximately 5.9% of the total energy consumption in China, and its share in China’s primary energy supply is expected to be 10% by 2020, according to the Energy Development Strategy Action Plan (2014–2020) from the National Energy Administration of China (NEAC 2014). However, China’s natural gas market at its current stage is not a complete market; instead, it is highly regulated and nontransparent prices have seriously limited the development of China’s natural gas industry (Paltsev and Zhang 2015). Therefore, to achieve a substantial increase in natural gas demand, China has sought to reform its natural gas pricing mechanism since the 1960s (Dong et al. 2018a, b). From 1965 to 2015, China’s pricing reform has generally experienced three periods (Dong et al. 2017c): sole government pricing period (1965–1993), mix of government pricing and government guidance pricing period (1994–2005), and government guidance pricing period (2006–present) (Fig. 1). In particular, given the issues that emerged in the natural gas market, the National Development and Reform Commission of China (NDRC) launched a national market-oriented pricing reform program in the early 2010s (NDRC 2010, 2011). Therefore, exploring the effects of natural gas market-oriented pricing reform by estimating the evolving price and income elasticities of demand for natural gas is of theoretical and practical significance and, thus, has attracted the attention of researchers in different countries and areas in recent years.

Over the past several decades, a large number of studies have estimated the price and income elasticities of natural gas demand in different countries and areas for different time periods employing different econometric approaches, and conflicting and diverse findings are not uncommon. Table 1 summarizes some of the major studies published between 2007 and 2017. As the table shows, the existing studies typically use time-series data to estimate the price and income elasticities of natural gas demand. For example, for the state of Illinois in the United States (USA), Payne et al. (2011) use the autoregressive distributed lag (ARDL) approach and a time-series data span from 1970 through 2007 to investigate price elasticity of natural gas demand. Wadud et al. (2011) use time-series data for 1981–2008 to estimate the price and income elasticities of natural gas demand in Bangladesh and, similarly, the case of China using the ARDL method and time-series data covering 1992–2012 (Zhang et al. 2018). Only a few studies have used cross-sectional data. For instance, employing nationwide household-level data, Alberini et al. (2011) study the price elasticity of residential demand for natural gas in the USA. Sun and Ouyang (2016) estimate the price and expenditure elasticities of residential natural gas demand in China using household-level data from China’s Residential Energy Consumption Survey (CRECS). Likewise, using cross-sectional data covering 44 countries, Burke and Yang (2016) obtain estimates of price and income elasticities of natural gas demand. In addition, panel data are used to estimate the price and income elasticities of natural gas demand in other studies, such as Asche et al. (2008) for 12 European countries, Andersen et al. (2011) for 13 Organization for Economic Cooperation and Development (OECD) countries, Bilgili (2014) for 8 OECD countries, and Dilaver et al. (2014) for European countries.

To date, very few studies have explored the effect of price reform on China’s natural gas demand by estimating the evolving price and income elasticities of natural gas demand. Furthermore, studies of price and income elasticities of natural gas demand in China are still relatively sparse. Also, most have overlooked the spatial differentiation of the price and income elasticities of natural gas demand across China’s regions, which could miss important information that would provide a theoretical basis for the reform of China’s natural gas market at the national and regional levels. Moreover, the cross-sectional dependence and slope homogeneity that may exist within provinces are frequently ignored in the related studies, which can create inconsistent estimates or even result in misleading conclusions (Breitung 2005; Grossman and Krueger 1995). Against the above background, this study aims to explore the effect of price reform on China’s natural gas demand by estimating the evolving price and income elasticities of natural gas demand in China considering different regions and using an unbalanced panel dataset of 30 China’s provinces for 1999–2015. Based on the cross-sectional dependence and slope homogeneity observed in the sample, a series of econometric techniques allowing for cross-sectional dependence and slope homogeneity is utilized in this analysis.

The main contributions of this study are as follows: (1) Although a few studies have investigated price and income elasticities in China’s natural gas demand, this study is a fresh attempt to explore the effect of China’s natural gas price reform by estimating the evolving price and income elasticities of natural gas demand, which can provide a reference for the reform of China’s natural gas market, (2) considering the differences in geographic locations of various regions in China, the sample in this study is classified into seven regions, and the seven subpanels are separately analyzed; this is particularly useful for national and regional governments in devising effective and targeted policies to promote the reform and development of the natural gas market, and (3) different from the widely employed first-generation estimators, the estimation approaches in this study, which are robust to cross-sectional dependence and slope homogeneity, can provide more robust estimates.

The rest of this paper is structured as follows: Section 2 presents the methodology. Section 3 reports the results. Section 4 discusses the empirical results. Section 5 summarizes the major findings and offers several policy suggestions.

2 Methodology

2.1 Econometric model

To estimate the evolving price and income elasticities of demand for natural gas in China, we start with a basic demand model expressed in linear logarithmic form linking per capita natural gas demand to the price of natural gas and per capita income:

where \(i = 1,2, \ldots ,30\) indicates each panel country; \(t\) indicates a linear time trend ranging from 0 in 1999 to 16 in 2015; \(Q_{p,t}\) represents per capita demand for natural gas of province \(i\) in year \(t\); \(P_{i,t}\) represents the average end-user price of natural gas of province \(i\) in year \(t\), calculated as the weighted mean of the end-user prices for four sectors (i.e., household, industry, commerce, and transport); \(G_{i,t}\) represents per capita gross domestic product (GDP) of province \(i\) in year \(t\); \(\beta_{0}\) and \(\varepsilon_{i,t}\) are the intercept and the error term, respectively; and \(\beta_{1}\) and \(\beta_{2}\), respectively, denote the estimators of the price and income elasticities of demand for natural gas.

To further explore whether the price elasticity of natural gas demand has changed over time, we follow the work of Burke and Liao (2015) and extend Eq. (1) by interacting the natural gas price term with the time trend as follows:

where the static price elasticity of demand for natural gas in 2015 is equal to \(\beta_{1} + 16\beta_{3}\).

Equations (1) and (2) are static models, which do not fully reflect the fact that natural gas demand cannot immediately respond to a change in natural gas price or income (Burke and Liao 2015; Erdogdu 2010). Therefore, we further extend Eqs. (1) and (2) by adding lagged natural gas price terms (i.e., the lags for years \(t - 1\) and \(t - 2\)). Equations (1) and (2) can be updated as follows:

where the 2-year price elasticity of demand for natural gas in 2015 in Eq. (3) is equal to \(\beta_{3} + \beta_{4}\), and in Eq. (4), it is equal to \(\beta_{4} + \beta_{6} + 16\left( {\beta_{5} + \beta_{7} } \right)\).

In addition to interacting the natural gas price term with the time trend in Eqs. (2) and (4), we can use another approach to examine whether the price elasticity has changed over time in Eqs. (1) and (3). Specifically, as China launched a national natural gas pricing reform program in the early 2010s (NDRC 2010, 2011), we split the sample in this study into an early period (1999–2009) and a late period (2010–2015) and then conduct a comparison of the price and income elasticities between the two periods.

2.2 Estimation methods

2.2.1 Cross-sectional dependence test

In panel data econometrics, cross-sectional dependence is an important issue and ignoring it would likely create inconsistent estimates and lead to misleading conclusions (Grossman and Krueger 1995; Dong et al. 2017d). Therefore, before analyzing the stationarity properties of all variables, three tests, the Breusch–Pagan Lagrange multiplier (LM) test developed by Breusch and Pagan (1980) and the Pesaran scaled LM test and Pesaran cross-sectional dependence (CD) test proposed by Pesaran (2004), are first utilized to test for cross-sectional dependence.

The Breusch–Pagan LM test is valid for small \(N\) and \(T\) (Breusch and Pagan 1980) and can be calculated as follows:

The Pesaran scaled LM test is appropriate for large \(N\) and \(T\) and can be calculated as follows:

The Pesaran CD test is valid for large \(N\) and fixed \(T\) and can be expressed as follows:

In these statistics, \(\hat{\rho }_{\text{ij}}\) denotes the correlation coefficients obtained from the residuals of the models as described above. In addition, the models are asymptotically distributed as standard normal if the null hypothesis considers \(T_{ij} \to \infty\) and \(N \to \infty\).

2.2.2 Slope homogeneity test

According to Breitung (2005), cross-sectional heterogeneity should be controlled as otherwise it will result in misleading estimates when investigating the empirical results. Thus, to test the slope homogeneity assumption, we use the slope homogeneity test developed by Pesaran and Yamagata (2008) since it is valid in panels with large \(N\) and \(T\). The test statistics are as follows:

where \(\tilde{S}\) and \(\tilde{\Delta }\) are the test statistics, \(\hat{\beta }_{i}\) is the pooled ordinary least squares (OLS) coefficient, \(\tilde{\beta }_{\text{WFE}}\) is the weighted fixed effect pooled estimator, \(x_{i}\) is the matrix containing explanatory variables in deviations from the mean, \(M_{\tau }\) is the identity matrix, \(\tilde{\sigma }_{i}^{2}\) is the estimate of \(\sigma_{i}^{2}\), and \(k\) is the number of regressors. The biased-adjusted version of the \(\tilde{\Delta }\) test is denoted below:

2.2.3 Panel unit root test

First-generation conventional panel unit root tests are not valid due to the existence of cross-sectional dependence across countries in the panel. To address this shortcoming, the Pesaran cross-sectionally augmented Im, Pesaran, and Shin (Pesaran CIPS) panel unit root test proposed by Pesaran (2007), which is robust to cross-sectional dependence and slope homogeneity, is utilized to test the stationarity of each variable. As Pesaran (2007) reports, to asymptotically eliminate the cross-sectional dependence, we first run the cross-sectionally augmented Dickey–Fuller (CADF) statistics, which can be estimated as follows:

where \(\bar{y}_{t - j}\) and \(\Delta \bar{y}_{t - j}\) indicate the cross-sectional averages of lagged levels and first differences of individual series, respectively. Based on the CADF statistics, the CIPS statistic can be calculated as follows:

where \({\text{CADF}}_{i}\) is the t-statistics in the CADF regression defined by Eq. (11).

2.2.4 Panel cointegration test

To examine the cointegrating relationship between all the selected variables, the Westerlund panel cointegration test advanced by Westerlund (2005) is conducted as the test is robust to cross-sectional dependence and slope homogeneity. This test can be estimated as follows:

where \(\theta_{i}\) is the adjustment term which determines the speed by which the system adjusts back to the equilibrium relationship. Accordingly, based on least squares estimates of \(\theta_{i}\), the statistics of Westerlund error correction-based panel cointegration tests can be calculated as follows:

where \(G_{\tau }\) and \(G_{\alpha }\) are group mean statistics, and rejection of the null hypothesis implies the presence of cointegration for at least one cross-sectional unit in the panel (Shahbaz et al. 2018).

where \(P_{\tau }\) and \(P_{\alpha }\) are panel statistics, and rejection of the null hypothesis indicates rejection of no cointegration for the panel as a whole.

2.2.5 CCEMG panel cointegration estimates

The long-run parameters of independent variables are estimated by employing a recent panel estimator which takes cross-sectional dependence and slope homogeneity into account, that is, the panel common correlated effects mean group (CCEMG) estimator introduced by Pesaran (2006) and advanced by Kapetanios et al. (2011). This estimator can be estimated as follows:

where \(y_{it}\) and \(x_{it}\) are observables; \({\text{b}}_{i}\) is the country-specific estimates of coefficients; \(f_{t}\) is the unobserved common factor with the heterogeneous factor; \(a_{1i}\) and \(e_{it}\) are the intercept and error term, respectively.

2.3 Data

To estimate the evolving price and income elasticities of demand for natural gas in China, a yearly provincial panel dataset for a panel of 30 provinces (Tibet, Hong Kong, Macao, and Taiwan are not considered due to data unavailability; see Dong et al. 2018c) covering 1999–2015 is used in this analysis. Our sample is unbalanced as some data for provincial natural gas consumption or price are missing, particularly in the early period, yielding a total of 474 observations. In addition, to fully address the concern about whether the price and income elasticities of demand for natural gas differ across regions, the 30 provinces in China are classified into seven groups in accordance with the standard of regional division introduced by the NBSC: North China, Northeast China, East China, Central China, South China, Southwest China, and Northwest China. The North China subpanel in this study consists of data for five provinces (i.e., Beijing, Tianjin, Hebei, Shanxi, and Inner Mongolia), while the Northeast China, East China, Central China, South China, Southwest China, and Northwest China subpanels comprise data for three provinces (i.e., Liaoning, Jilin, and Heilongjiang), seven provinces (i.e., Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, and Shandong), three provinces (i.e., Henan, Hubei, and Hunan), three provinces (i.e., Guangdong, Guangxi, and Hainan), four provinces (i.e., Chongqing, Sichuan, Guizhou, and Yunnan), and five provinces (i.e., Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang), respectively (see Fig. 2).

The variables in this analysis consist of per capita natural gas consumption [\(Q\), measured in cubic meters (m3)], per capita GDP (\(G\), measured in Chinese yuan (CNY) normalized to 2000 prices), and natural gas price (\(P\), measured in CNY/m3). The data on per capita natural gas consumption are obtained from the China Energy Statistical Yearbook (CESY) published by the National Bureau of Statistics of China (NBSC) (CESY 2016), while the data on per capita GDP are derived from the China Statistical Yearbook published by the NBSC (2016). The natural gas price can be calculated as \(P = \sum\nolimits_{s = 1}^{4} {P_{s} \times \omega_{s} }\), where \(s = 1,2,3,4\) indicates each natural gas end-use sector (i.e., household, industry, commerce, and transport), \(P_{s}\) indicates the end-user price of natural gas for sector \(s\), and \(\omega_{s}\) indicates the share of natural gas consumption in sector \(s\) in total natural gas consumption. The data on \(\omega_{s}\) are also collected from the China Energy Statistical Yearbook published by the NBSC (CESY 2016), while the data on \(P_{s}\) are sourced from the NDRC (2017).

Before proceeding to the results, the summary statistics of all three variables for the seven subpanels and for the whole sample are listed in Table 2. The results set out in Table 2 reveal that the mean value of \(\ln Q\) in 30 China’s provinces (full sample) is 3.7547, while the mean values of \(\ln P\) and \(\ln G\) are 0.8822 and 9.9119, respectively. Table 2 also illustrates the spatial characteristics of all three variables for the seven regions in China. According to the mean value of \(\ln Q\), Northwest China maintains the highest natural gas consumption (4.7798), while Central China has the lowest at only 2.8126. With regard to the mean value of \(\ln P\), the region with the highest natural gas price level is South China (1.2830), while Northwest China maintains the lowest natural gas price level (0.4555). According to the mean value of \(\ln G\), East China is the richest region (10.3864), while Southwest China is the poorest (9.3584).

3 Results

3.1 Results of cross-sectional dependence and slope homogeneity tests

Table 3 presents the results of cross-sectional dependence and slope homogeneity tests, indicating that the null hypothesis of no cross-sectional independence is rejected for both the full sample and the seven subpanels. This implies that approaches which are robust to cross-sectional dependence are more appropriate in this analysis. In addition, the results from the two slope homogeneity tests (i.e., \(\tilde{\Delta }\) and \(\tilde{\Delta }_{adj}\)) set out in Table 3 reveal that the null hypothesis of the slope homogeneity hypothesis is rejected at the 1% level of significance, indicating the existence of heterogeneity. Thus, in addition to cross-sectional dependence, the methods employed in this analysis should also allow for slope homogeneity.

3.2 Results of panel unit root test

The results of the Pesaran CIPS panel unit root test are listed in Table 4. We find that not all the variables for the full sample or seven subpanels have stationarity at the level, while all the variables are stationary after taking the first difference. This suggests that, for both the full sample and the seven subpanels, all the variables are integrated at an order of one, that is, I (1). The unique order of integration of all the variables allows us to further test the cointegrating relationship among natural gas consumption, natural gas price, and GDP by employing a panel cointegration test.

3.2.1 Results of panel cointegration test

The results of the Westerlund panel cointegration test are provided in Table 5. As the table shows, all four Westerlund test statistics for the full sample and seven subpanels are significant, thereby rejecting the null hypothesis of no cointegration. This implies that natural gas price and GDP maintain a cointegrating relationship with respect to natural gas consumption in both the full sample and the seven subpanels. The existence of a panel cointegration relationship among the variables enables us to further estimate the evolving price and income elasticities of demand for natural gas.

3.3 Aggregate and region-wise estimates

3.3.1 Aggregate estimates

The results of the aggregate estimates by CCEMG estimator are presented in Table 6, with columns 1–4 providing static estimates and columns 5–8 including lagged natural gas price terms. Column 1 of Table 6 estimates Eq. (1) for the full sample, indicating that natural gas consumption is price inelastic and income elastic. Columns 2 and 3 estimate Eq. (1) and show a statistically insignificant natural gas price elasticity of 1.11 for 1999–2009 and a statistically significant natural gas price elasticity of 0.35 for 2010–2015. Estimates of the income elasticity of natural gas demand for columns 2 and 3 are 1.23 and 1.27, respectively, with both different from 0 at the 1% level of significance. These findings imply that the lack of negative price elasticity in natural gas demand is being improved effectively, while natural gas demand is becoming more income elastic.

Column 4 of Table 6 estimates Eq. (2) for the full sample, indicating a negative and strongly significant relationship between the natural gas price variable and the time trend (i.e., \(\beta_{3}\)). This suggests that the estimated price elasticity of natural gas demand (i.e., \(\beta_{1} + 16\beta_{3}\)) has decreased, reaching 0.04 in 2015 (statistically significant at the 1% level).

Column 5 of Table 6 estimates Eq. (3) for the full sample, including the price term for years \(t - 1\) and \(t - 2\). Both the \(t - 1\) term and \(t - 2\) term are statistically significant; thus, the estimated 2-year price elasticity in 2015 (i.e., \(\beta_{3} + \beta_{4}\)) is 0.18 and statistically significant at the 1% level.

Columns 6 and 7 estimate Eq. (3), finding that the estimates of 2-year price elasticity (i.e., \(\beta_{3} + \beta_{4}\)) for 1999–2009 and 2010–2015 are 0.59 and 0.11, respectively, with the latter different from 0 at the 1% level of significance. In addition, the estimate of income elasticity of natural gas demand has increased from 1.02 to 1.25. These estimates again confirm that the lack of negative price elasticity has been effectively improved, while natural gas demand is more responsive to income changes.

Column 8 of Table 6 estimates Eq. (4) for the full sample, showing that the links between the natural gas price variable and the time trend (i.e., \(\beta_{3}\), \(\beta_{5}\), and \(\beta_{7}\)) are negative and strongly significant. This implies that the estimated 2-year price elasticity has indeed become smaller, reaching 0.02 in 2015. Above all, although the estimated price elasticity of natural gas demand is greater than 0 (i.e., price rigidity), it has indeed become smaller in recent years due to the natural gas price reform.

3.3.2 Estimates for different regions

To examine whether the changes in price and income elasticities are affected by different localities, we split the full sample into early (1999–2009) and late (2010–2015) periods and estimate Eq. (1) for the seven regions. The CCEMG estimation results for the seven regions are reported in Table 7. Focusing first on the estimates of price elasticity across regions, these estimates are greater than 0, indicating the presence of price rigidity. As the table shows, the price elasticity displays a downward trend in five regions (i.e., North China, Northeast China, East China, Central China, and South China), especially in North China, East China, and South China. Specifically, the estimates of price elasticity in North China, East China, and South China decrease from 1.02 to 0.31, from 1.09 to 0.08, and from 1.27 to 0.09, respectively. This implies that the natural gas price reform had a significant effect on price elasticity of natural gas demand, especially in North China, East China, and South China. In contrast, the price elasticity displays an upward trend in Southwest China and Northwest China, increasing from 1.43 to 1.49 and from 1.61 to 1.83, respectively.

The bottom part of Table 7 shows the results of income elasticity across regions, suggesting that the estimates of income elasticity in most of the seven regions are significantly greater than 1 (i.e., income elastic). As the table shows, GDP heavily drives the demand for natural gas in five regions (i.e., Northeast China, Central China, South China, Southwest China, and Northwest China), especially in Southwest China and Northwest China. Specifically, the estimates of income elasticity in Southwest China and Northwest China dramatically increase from 1.20 to 2.00 and from 1.09 to 1.47, respectively. Conversely, the income elasticity displays a downward trend in North China and East China, decreasing from 1.68 to 1.33 and from 1.49 to 0.70, respectively. Reasons for the difference in the price and income elasticities across the seven regions will be presented and discussed in Sects. 4.1 and 4.2.

4 Discussion

Based on results in this paper, we find another problem that is worthy of further study: What leads to the spatial differentiation of the changes in price and income elasticities in demand for natural gas across regions? After identifying this problem, we further discuss this paper in relation to the aspects discussed below.

4.1 Spatial differentiation in the change in price elasticity of demand for natural gas

Figure 3 illustrates the spatial distributions of the change in price elasticity of demand for natural gas for China’s seven regions, providing strong evidence in favor of the effect of natural gas price reform on the change in price elasticity as the price elasticity decreases in five of the seven regions. In 2010, the Chinese government began to implement a national natural gas pricing reform program for the natural gas industry (NDRC 2010, 2011). The effect of price reform on the price elasticity has appeared gradually in recent years, implying that the lack of a negative price elasticity in natural gas demand in China is improving. This finding coincides with the existing studies, such as Dong et al. (2017c). The regions in which the price elasticity decreases are predominantly concentrated in Central and Eastern China; conversely, natural gas demand is becoming more price inelastic in Western China (i.e., Southwest China and Northwest China). Interestingly, in the two regions in which natural gas demand is becoming more price inelastic, the annual production of natural gas (3.0 × 1010 m3 for Southwest China and 7.7 × 1010 m3 for Northwest China in 2015; see Fig. 3) is considerably higher than the levels seen in other regions. This implies that the effect of price reform on the price elasticity might be obscured by an adequate supply of natural gas in Southwest China and Northwest China because the natural gas demand in these two regions responds less sensitively to price changes. In other words, the effect of price reform on the price elasticity may be affected by natural gas production.

4.2 Spatial differentiation in the change in income elasticity of demand for natural gas

Although natural gas demand in China is responding more sensitively to income changes (see Table 6), according to Fig. 4, large variations exist in the change of income elasticity in demand for natural gas across China’s regions. Specifically, natural gas demand is becoming more responsive to income changes in five of the seven regions (i.e., Northeast China, Central China, South China, Southwest China, and Northwest China), especially in Southwest China and Northwest China; conversely, natural gas demand is becoming less income elastic in North China and East China. It is worth mentioning that the poorest region in China is Southwest China (annual per capita GDP is 35,988 CNY in 2015), followed by Northwest China (39,632 CNY in 2015), while the richest region in China is East China (66,067 CNY in 2015), followed by North China (57,951 CNY in 2015). This means that the income level may affect the change in income elasticity of demand for natural gas in China. In other words, in terms of the demand for natural gas, relatively low-income regions respond more sensitively to income changes, whereas relatively high-income regions are becoming less income elastic. This finding is consistent with Yu et al. (2014), who conclude that the estimated income elasticity of demand for natural gas in Northern China and Southern China (the former is considerably richer) is − 0.19 and 0.23, respectively.

4.3 Reconciling the estimates with prior studies

A comparison of the price and income elasticities of demand for natural gas between selected prior studies and our study is shown in Fig. 5. As Fig. 5 and Table 1 show, differences in study areas, time periods, and econometric approaches contribute to differences in findings. Most prior estimates of the price elasticity of natural gas demand suggest that natural gas demand is price elastic. Payne et al. (2011), for example, obtain a short-run price elasticity of natural gas demand in the USA of − 0.19 and a long-run price elasticity of − 0.26, similar to the short-run estimate of − 0.20 and long-run estimate of − 0.28 for natural gas demand in the United Kingdom’s (UK’s) manufacturing sector obtained by Steinbuks (2012). Burke and Yang (2016) report estimates of the long-run price elasticity of natural gas demand for 44 countries, which vary from − 0.50 to − 0.68. As of 2015, we estimate that the price elasticity of natural gas demand in China is in the range of 0.02–0.04, showing an average of 0.03. This finding is contrary to the theory of price elasticity of demand but consistent with the status quo of China’s natural gas market and fully explains why natural gas price reform in China must be accelerated. In addition, a similar conclusion (i.e., natural gas demand is price inelastic) is obtained in some existing works, such as Dagher (2012) for Colorado, Bilgili (2014) for eight OECD countries, and Zhang et al. (2018) for China.

With regard to the income elasticity of natural gas demand, many studies estimate that the income elasticity is not greater than 1 even in the long run; in other words, natural gas demand is income inelastic (see Asche et al. (2008) for 12 European countries, Yoo et al. (2009) for South Korea, Bernstein and Madlener (2011) for 12 OECD countries, Yu et al. (2014) for China, and Burke and Yang (2016) for 44 countries). However, as shown in Fig. 5, as of 2015, the estimate of income elasticity of natural gas demand in China ranges from 1.37 to 1.38. Our finding is in line with the rapid expansion of natural gas consumption in China and coincides with the existing studies, such as Dagher (2012) for Colorado and Zhang et al. (2018) for China, which indicate that GDP heavily drives the demand for natural gas; in other words, natural gas demand is income elastic.

5 Conclusions and policy implications

Unlike previous related studies, this study estimates the evolving price and income elasticities of China’s demand for natural gas and examines effects of the natural gas price reform implemented in 2010 with consideration of different regions using an unbalanced panel dataset of 30 provinces covering 1999–2015. Considering the cross-sectional dependence and slope homogeneity observed in the panel, a series of econometric techniques allowing for cross-sectional dependence and slope homogeneity is utilized. The main findings of this study are provided accordingly.

(1) Although natural gas demand in China still lacks a negative price elasticity, the phenomenon is improving. This implies that the effect of price reform on price elasticity has appeared gradually in recent years. The estimates indicate that, as of 2015, the price elasticity of natural gas demand in China is in the range of 0.02–0.04. The price elasticity in this study is greater than 0, which is contrary to the theory of price elasticity of demand but consistent with the status quo of China’s natural gas market; that is, the natural gas market will be in disequilibrium if the price of natural gas is relatively low due to price regulation.

(2) The estimates suggest that natural gas demand in China is indeed becoming increasingly sensitive to income changes. As of 2015, the estimate of income elasticity of natural gas demand in China ranges from 1.37 to 1.38, which is significantly greater than 1 and also rich in elasticity. Our finding is dissimilar to many prior studies which insist that natural gas demand is income inelastic, but it coincides with the reality that natural gas consumption in China has rapidly increased with the rising economic level.

(3) Our estimates provide strong evidence in favor of the effect of natural gas price reform on the change in price elasticity as the price elasticity decreases in five of the seven regions. The regions in which price elasticity decreases are predominantly concentrated in Central and Eastern China; conversely, natural gas demand is becoming more price inelastic in Western China (i.e., Southwest China and Northwest China). Our estimates also suggest that the effect of price reform on price elasticity may be affected by natural gas production.

(4) The estimates in this study indicate that large variations exist in the change in income elasticity of demand for natural gas across China’s regions. The change in income elasticity of demand for natural gas in China might be affected by the income level. In other words, with regard to the demand for natural gas, relatively low-income regions respond more sensitively to income changes, whereas relatively high-income regions are becoming less income elastic.

Based on the above findings, important policy implications are provided below:

(1) The reform of natural gas prices must be further accelerated. Although the natural gas pricing mechanism in China is moving closer to a market system after the national natural gas pricing reform program launched by the Chinese government in 2010, the current price reform has failed to establish a true market pricing system. Accordingly, it would be wise for the Chinese government to accelerate the reform of natural gas prices and explore the pathways for moving to a complete market-based natural gas pricing mechanism driven by the interaction of supply and demand for natural gas.

(2) Several complementary measures should be introduced and strengthened. To alleviate the negative impacts of reform of natural gas prices for the end users of natural gas, it is particularly important for the Chinese government to introduce and strengthen several complementary measures, such as a more reasonable subsidy design.

(3) More focus should be put on the potential impacts of the forthcoming reform of the natural gas transportation system (NDRC 2016) on the different regions in China. Given that the effect of price reform on price elasticity may be affected by natural gas production, in regions in which the level of natural gas production is relatively low (i.e., Central and Eastern China), the forthcoming transportation system reform for natural gas will further influence the price elasticity of demand for natural gas.

(4) Sufficient differentiation in economic and energy policies should be developed considering the remarkable difference in the change in income elasticity of demand for natural gas across China’s regions. Given that GDP heavily drives the demand for natural gas in five of the seven regions, especially in Southwest China and Northwest China, the implementation of various effective economic laws and regulations by the local government in particular will play a crucial role in promoting the development of the natural gas industry.

However, this study only provides preliminary empirical evidence, and some limitations still exist. First, considering the lack of availability of data, the data in this study are not from a unique database. Second, given the significant relationship between natural gas and carbon emissions (Dong et al. 2018d, e; Ma et al. 2018, 2019; Shuai et al. 2018, 2019), it would be interesting to estimate the evolving price and income elasticities of natural gas demand in China with consideration of the effect of CO2 emissions in future research.

References

Alberini A, Gans W, Velez-Lopez D. Residential consumption of gas and electricity in the US: the role of prices and income. Energy Econ. 2011;33:870–81. https://doi.org/10.1016/j.eneco.2011.01.015.

Andersen TB, Nilsen OB, Tveteras R. How is demand for natural gas determined across European industrial sectors? Energy Policy. 2011;39:5499–508. https://doi.org/10.1016/j.enpol.2011.05.012.

Asche F, Nilsen OB, Tveterås R. Natural gas demand in the European household sector. Energy J. 2008;29: 27–46. https://doi.org/10.5547/issn0195-6574-ej-vol29-no3-2.

Bernstein R, Madlener R. Residential natural gas demand elasticities in OECD countries: an ARDL bounds testing approach. FCN working paper no. 15. 2011. https://doi.org/10.2139/ssrn.2078036.

Bilgili F. Long run elasticities of demand for natural gas: OECD panel data evidence. Energy Source Part B. 2014;9:334–41. https://doi.org/10.1080/15567249.2010.497793.

BP. BP Statistical Review of World Energy 2017. 2017. http://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/downloads.html. Accessed 23 Aug 2017.

Breitung J. A parametric approach to the estimation of cointegration vectors in panel data. Econom Rev. 2005;24:151–73. https://doi.org/10.1081/etc-200067895.

Breusch TS, Pagan AR. The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud. 1980;47:239–53. https://doi.org/10.2307/2297111.

Burke PJ, Liao H. Is the price elasticity of demand for coal in China increasing? China Econ Rev. 2015;36:309–22. https://doi.org/10.1016/j.chieco.2015.10.004.

Burke PJ, Yang H. The price and income elasticities of natural gas demand: international evidence. Energy Econ. 2016;59:466–74. https://doi.org/10.1016/j.eneco.2016.08.025.

CESY. China Energy Statistical Yearbook 2016. 2016. http://www.stats.gov.cn/tjsj/tjcbw/201706/t20170621_1505833.html. Accessed 23 Aug 2017.

Dagher L. Natural gas demand at the utility level: an application of dynamic elasticities. Energy Econ. 2012;34:961–9. https://doi.org/10.1016/j.eneco.2011.05.010.

Dilaver Ö, Dilaver Z, Hunt LC. What drives natural gas consumption in Europe? Analysis and projections. J Nat Gas Sci Eng. 2014;19:125–36. https://doi.org/10.1016/j.jngse.2014.04.002.

Dong KY, Sun RJ, Li H, Jiang HD. A review of China’s energy consumption structure and outlook based on a long-range energy alternatives modeling tool. Pet Sci. 2017a;14:214–27. https://doi.org/10.1007/s12182-016-0136-z.

Dong KY, Sun RJ, Hochman G, Zeng XG, Li H, Jiang HD. Impact of natural gas consumption on CO2 emissions: panel data evidence from China’s provinces. J Clean Prod. 2017b;162:400–10. https://doi.org/10.1016/j.jclepro.2017.06.100.

Dong X, Pi G, Ma Z, Dong C. The reform of the natural gas industry in the PR of China. Renew Sustain Energy Rev. 2017c;73:582–93. https://doi.org/10.1016/j.rser.2017.01.157.

Dong KY, Sun RJ, Hochman G. Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy. 2017d;141:1466–78. https://doi.org/10.1016/j.energy.2017.11.092.

Dong K, Sun R, Dong C, Li H, Zeng X, Ni G. Environmental Kuznets curve for PM2.5 emissions in Beijing, China: What role can natural gas consumption play? Ecol Indic. 2018a;93:591–601. https://doi.org/10.1016/j.ecolind.2018.05.045.

Dong K, Sun R, Wu J, Hochman G. The growth and development of natural gas supply chains: the case of China and the US. Energy Policy. 2018b;123:64–71. https://doi.org/10.1016/j.enpol.2018.08.034.

Dong K, Sun R, Hochman G, Li H. Energy intensity and energy conservation potential in China: a regional comparison perspective. Energy. 2018c;155:782–95. https://doi.org/10.1016/j.energy.2018.05.053.

Dong K, Sun R, Li H, Liao H. Does natural gas consumption mitigate CO2 emissions: testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renew Sustain Energy Rev. 2018d;94:419–29. https://doi.org/10.1016/j.rser.2018.06.026.

Dong K, Sun R, Dong X. CO2 emissions, natural gas and renewables, economic growth: assessing the evidence from China. Sci Total Environ. 2018e;640:293–302. https://doi.org/10.1016/j.scitotenv.2018.05.322.

Erdogdu E. Natural gas demand in Turkey. Appl Energy. 2010;87:211–9. https://doi.org/10.1016/j.apenergy.2009.07.006.

Grossman GM, Krueger AB. Economic growth and the environment. Q J Econ. 1995;110:353–77. https://doi.org/10.2307/2118443.

Joutz F, Shin D, McDowell B, Trost RP. Estimating regional short-run and long-run price elasticities of residential natural gas demand in the US. USAEE working paper. No. WP 09-021. 2009. https://doi.org/10.2139/ssrn.1444927.

Kapetanios G, Pesaran MH, Yamagata T. Panels with non-stationary multifactor error structures. J Econom. 2011;160:326–48. https://doi.org/10.1016/j.jeconom.2010.10.001.

Ma M, Cai W. What drives the carbon mitigation in Chinese commercial building sector? Evidence from decomposing an extended Kaya identity. Sci Total Environ. 2018;634:884–99. https://doi.org/10.1016/j.scitotenv.2018.04.043.

Ma M, Cai W. Do commercial building sector-derived carbon emissions decouple from the economic growth in tertiary industry? A case study of four municipalities in China. Sci Total Environ. 2019;650:822–34. https://doi.org/10.1016/j.scitotenv.2018.08.078.

Ma M, Cai W, Cai W. Carbon abatement in China’s commercial building sector: a bottom-up measurement model based on Kaya-LMDI methods. Energy. 2018;165:350–68. https://doi.org/10.1016/j.energy.2018.09.070.

Ma M, Cai W, Wu Y. China act on the energy efficiency of civil buildings (2008): a decade review. Sci Total Environ. 2019;651:42–60. https://doi.org/10.1016/j.scitotenv.2018.09.118.

NBSC. China Statistical Yearbook 2016. 2016. http://www.stats.gov.cn/tjsj/ndsj/2016/indexch.htm. Accessed 23 Aug 2017.

NDRC. National Development and Reform Commission of China, notice of the National Development and Reform Commission on increasing the ex-plant prices for domestic natural gas production. 2010. http://www.sdpc.gov.cn/zwfwzx/zfdj/jggg/tyq/201005/t20100531_350435.html. Accessed 23 Aug 2017.

NDRC. National Development and Reform Commission of China, notice of the National Development and Reform Commission on adjusting the natural gas prices in Guangdong and Guangxi provinces. 2011. http://www.sdpc.gov.cn/zwfwzx/zfdj/jggg/tyq/201112/t20111227_452950.html. Accessed 23 Aug 2017.

NDRC. National Development and Reform Commission of China, notice of the National Development and Reform Commission on management measures for transportation price of natural gas pipeline. 2016. http://www.ndrc.gov.cn/xwzx/xwfb/201610/t20161012_822393.html. Accessed 23 Aug 2017.

NDRC. National Development and Reform Commission of China, a series of notices of the National Development and Reform Commission on adjusting the natural gas prices. 2017. http://www.ndrc.gov.cn/fzgggz/jggl/zcfg/. Accessed 23 Aug 2017.

NEAC. National Energy Administration of China, Energy Development Strategy Action Plan (2014–2020). 2014. http://www.nea.gov.cn/2014-12/03/c_133830458.htm. Accessed 23 Aug 2017.

Paltsev S, Zhang D. Natural gas pricing reform in China: getting closer to a market system? Energy Policy. 2015;86:43–56. https://doi.org/10.1016/j.enpol.2015.06.027.

Payne JE, Loomis D, Wilson R. Residential natural gas demand in Illinois: evidence from the ARDL bounds testing approach. J Reg Anal Policy. 2011;41:138–47. https://doi.org/10.2139/ssrn.2078036.

Pesaran MH. General diagnostic tests for cross section dependence in panels. CESifo working paper series. No. 1229. 2004. https://ssrn.com/abstract=572504. Accessed 23 Aug 2017.

Pesaran MH. Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica. 2006;74:967–1012. https://doi.org/10.1111/j.1468-0262.2006.00692.x.

Pesaran MH. A simple panel unit root test in the presence of cross-section dependence. J Appl Econom. 2007;22:265–312. https://doi.org/10.1002/jae.951.

Pesaran MH, Yamagata T. Testing slope homogeneity in large panels. J Econom. 2008;142:50–93. https://doi.org/10.1016/j.jeconom.2007.05.010.

Serletis A, Timilsina GR, Vasetsky O. Interfuel substitution in the United States. Energy Econ. 2010;32:737–45. https://doi.org/10.1016/j.eneco.2010.01.013.

Serletis A, Timilsina G, Vasetsky O. International evidence on aggregate short-run and long-run interfuel substitution. Energy Econ. 2011;33:209–16. https://doi.org/10.1016/j.eneco.2010.05.013.

Shahbaz M, Shahzad S, Mahalik M, Sadorsky P. How strong is causal relationship between globalization and energy consumption in developed economies? A country-specific time-series and panel analysis. Appl Econ. 2018;50:1479–94. https://doi.org/10.1080/00036846.2017.1366640.

Shuai C, Chen X, Shen L, Jiao L, Wu Y, Tan Y. The turning points of carbon Kuznets curve: evidences from panel and time-series data of 164 countries. J Clean Prod. 2017a;162:1031–47. https://doi.org/10.1016/j.jclepro.2017.06.049.

Shuai C, Shen L, Jiao L, Wu Y, Tan Y. Identifying key impact factors on carbon emission: evidences from panel and time-series data of 125 countries from 1990 to 2011. Appl Energy. 2017b;187:310–25. https://doi.org/10.1016/j.apenergy.2016.11.029.

Shuai C, Chen X, Wu Y, Tan Y, Zhang Y, Shen L. Identifying the key impact factors of carbon emission in China: results from a largely expanded pool of potential impact factors. J Clean Prod. 2018;175:612–23. https://doi.org/10.1016/j.jclepro.2017.12.097.

Shuai C, Chen X, Wu Y, Zhan Y, Tan Y. A three-step strategy for decoupling economic growth from carbon emission: empirical evidences from 133 countries. Sci Total Environ. 2019;646:524–43. https://doi.org/10.1016/j.scitotenv.2018.07.045.

Steinbuks J. Interfuel substitution and energy use in the UK manufacturing sector. Energy J. 2012;33:1–29. https://doi.org/10.5547/issn0195-6574-ej-vol33-no1-1.

Sun C, Ouyang X. Price and expenditure elasticities of residential energy demand during urbanization: an empirical analysis based on the household-level survey data in China. Energy Policy. 2016;88:56–63. https://doi.org/10.1016/j.enpol.2015.10.012.

Wadud Z, Dey HS, Kabir MA, Khan SI. Modeling and forecasting natural gas demand in Bangladesh. Energy Policy. 2011;39:7372–80. https://doi.org/10.1016/j.enpol.2011.08.066.

Westerlund J. New simple tests for panel cointegration. Econom Rev. 2005;24:297–316. https://doi.org/10.1080/07474930500243019.

Yoo SH, Lim HJ, Kwak SJ. Estimating the residential demand function for natural gas in Seoul with correction for sample selection bias. Appl Energy. 2009;86:460–5. https://doi.org/10.1016/j.apenergy.2008.08.023.

Yu Y, Zheng X, Han Y. On the demand for natural gas in urban China. Energy Policy. 2014;70:57–63. https://doi.org/10.1016/j.enpol.2014.03.032.

Zhang Y, Ji Q, Fan Y. The price and income elasticity of China’s natural gas demand: a multi-sectoral perspective. Energy Policy. 2018;113:332–41. https://doi.org/10.1016/j.enpol.201.

Acknowledgements

Financial support from the National Social Science Foundation of China (Grant Nos. 17BGL014 and 18VDL017) is acknowledged. We also gratefully acknowledge the helpful comments from the editors and anonymous reviewers, which greatly improved this manuscript.

Author information

Authors and Affiliations

Corresponding author

Additional information

Edited by Xiu-Qin Zhu

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Dong, K., Dong, X. & Sun, R. How did the price and income elasticities of natural gas demand in China evolve from 1999 to 2015? The role of natural gas price reform. Pet. Sci. 16, 685–700 (2019). https://doi.org/10.1007/s12182-019-0320-z

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12182-019-0320-z