Abstract

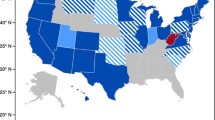

This article examines the future role of energy efficiency as a resource in the Western US and Canada, as envisioned in the most recent resource plans issued by 16 utilities, representing about 60% of the region’s load. Utility and third-party-administered energy-efficiency programs proposed by 15 utilities over a 10-year horizon would save almost 19,000 GWh annually, about 5.2% of forecast load. There are clear regional trends in the aggressiveness of proposed energy savings. California’s investor-owned utilities (IOUs) had the most aggressive savings targets, followed by IOUs in the Pacific Northwest, and the lowest savings were proposed by utilities in Inland West states and by two public utilities on the West Coast. The adoption of multiple, aggressive policies targeting energy efficiency and climate change appears to produce sizeable energy-efficiency commitments. Certain specific policies, such as mandated energy savings goals for California’s IOUs and energy-efficiency provisions in Nevada’s Renewable Portfolio Standard, had a direct impact on the level of energy savings included in the resource plans. Other policies, such as revenue decoupling and shareholder incentives and voluntary or legislatively mandated greenhouse gas emission reduction policies, may have also impacted utilities’ energy-efficiency commitments, though the effects of these policies are not easily measured. Despite progress among the utilities in our sample, more aggressive energy-efficiency strategies that include high-efficiency standards for additional appliances and equipment, tighter building codes for new construction and renovation, as well as more comprehensive ratepayer-funded energy-efficiency programs are likely to be necessary to achieve a region-wide goal of meeting 20% of electricity demand with efficiency in 2020.

Similar content being viewed by others

Notes

Most Western states had adopted integrated resource planning rules during the 1980s to encourage, and in some cases require, utilities to include demand-side as well as supply-side resources in their resource planning and to ensure that the least-cost resources were chosen. With the electric industry restructuring in the 1990s, a number of states and utilities in the West (e.g., Nevada, Arizona, Montana, Colorado, California) consciously de-emphasized long-term resource planning.

Utilities also file energy-efficiency program plans in which they seek regulatory approval to implement specific programs over periods of typically 1 to 3 years.

The WECC control area roughly includes the states of Arizona, California, Colorado, Idaho, Montana, New Mexico, Nevada, Oregon, Utah, Washington, and Wyoming and the Canadian provinces of British Columbia and Alberta, although it is not precisely bounded by state lines, and it also extends into Mexico.

These projections reflect savings only from programs implemented over each utility’s planning period and exclude savings that persist from programs implemented in prior years.

Only about half of the resource plans forecast farther than 10 years into the future, limiting our ability to report data across utilities over longer planning horizons (e.g., 20 years), which would be more useful for fully assessing the impact of carbon policies and various mitigation strategies.

In practice, most of the utilities in our sample did not elaborate on their treatment of efficiency in their load forecasts, and it is unclear to what degree past and future energy savings from naturally occurring efficiency, standards, and codes are accounted for in the reported load forecasts. In the absence of such clarification, we made the assumption that the forecasts as given represent TER, but we acknowledge that this may introduce bias to the results in Table 2.

For example, in Nevada, utilities effectively stopped offering energy-efficiency programs during the mid-1990s and many of their energy-efficiency staff were reassigned or moved on. These utilities are in the process of ramping up new programs and have to rebuild their portfolios and train new energy-efficiency program staff.

Washington’s mandate applies to both investor-owned and public utilities with more than 25,000 customers.

While BC Hydro is technically subject to the limits set by the Kyoto protocol, which was ratified by the Canadian government in 2002, inaction on the part of the federal government has led the country to fall far short of fulfilling its obligations and has prompted several provinces (e.g., British Columbia, Manitoba, Quebec) to adopt climate action policies of their own. As a result, it is the provincial policies described here, and not the federal Kyoto obligation, that drive climate-change mitigation activities in British Columbia.

The levels of efficiency in the Oregon utilities’ resources plans are restricted by the SB1149 legislation which was in effect when they were completed. SB1149 fixed energy-efficiency funding at the level implemented by the Oregon Energy Trust and did not permit utilities to spend more. The Oregon Energy Trust was responsible for forecasting savings and reporting them to the utilities for inclusion in their resource plans. As a result, it is doubtful that the state’s carbon emission reduction goals had much bearing on the levels of energy efficiency included in the resource plans in our study. In 2007, a new legislation (SB838) was passed, allowing the utilities to increase funding, so this restriction will not be binding in future resource plans.

Moreover, the methods used to account for standards, codes, and naturally occurring energy efficiency in utilities’ load forecasts are typically not documented in the resource plans, so it is unclear whether the published load forecasts include energy savings from these sources.

Energy-efficiency measures implemented prior to 2006 may not be counted toward the CDEi goal; however, energy-efficiency policies and programs authorized prior to 2006 but whose measures were implemented in 2006 or later are acceptable.

The new law introduces energy-efficiency standards for 12 types of appliances and equipment and also mandates significant improvements in incandescent lighting (common light bulbs are to use 20% less energy than current incandescent bulbs by 2012 and 30% less by 2014).

Savings of 12% from energy-efficiency programs should be sufficient to meet the WGA goal where there is strong support for codes and standards. In areas (such as the Inland West) with less contribution from these other sources, utility energy-efficiency programs may need to make up a larger portion of savings to meet the WGA goal.

Utilities typically account for the effects of standards and codes in their load forecasts through some combination of end-use and econometric analysis techniques. Reporting these assumed savings levels in their resource plan documents would represent relatively little incremental effort on the utilities’ part while providing useful information to state agencies and regulators and the public.

References

Anonymous. (2005a) California Senate Bill 1037 (SB 1037). September 29. http://www.leginfo.ca.gov/pub/05-06/bill/sen/sb_1001-1050/sb_1037_bill_20050929_chaptered.pdf. Accessed 7 March 2008.

Anonymous. (2005b) Nevada Assembly Bill No.3 (AB 3). June 7. http://www.pewclimate.org/what_s_being_done/in_the_states/rps.cfm. Accessed 10 March 2008.

Anonymous. (2006). Washington Voter Initiative (VI) 937. http://www.secstate.wa.gov/elections/initiatives/text/i937.pdf. Accessed 10 March 2008.

Anonymous. (2007) Colorado House Bill 07-1037 (HB 07-1037). April. http://www.state.co.us/gov_dir/leg_dir/olls/sl2007a/sl_253.pdf. Accessed 12 March 2008.

California Public Utilities Commission (CPUC). (2004). Interim opinion: Energy savings goals for program year 2006 and beyond. CPUC Decision 04-09-060. September 23. http://docs.cpuc.ca.gov/PUBLISHED/FINAL_DECISION/40212.htm. Accessed 13 March 2008.

California Public Utilities Commission (CPUC). (2007). Interim opinion on phase 1 issues: Energy efficiency shareholder mechanism, CPUC Decision 07-09-043. September 20.

Hopper, N., Goldman, C., & Schlegel, J. (2006). Energy efficiency in western utility resource plans: Impacts on regional resource assessment and support for WGA policies. LBNL-58271 (August).

Hydro, B. C. (2006). BC Hydro 2005 annual report. http://www.bchydro.com/info/reports/2005annualreport/report39515.html Accessed 14 March 2008.

Jensen, V. R. (2007). Aligning utility incentives with investment in energy efficiency. Prepared for the national action plan for energy efficiency. www.epa.gov/eeactionplan. Accessed 27 March 2008.

Pacific Gas and Electric Company (PG&E). (2007). PG&E energy efficiency shareholder incentive mechanism: prepared testimony. CPUC OIR 06-04-010, May 3.

Rufo, M., Coito, F. (2002). California’s secret energy surplus: The potential for energy efficiency. Prepared for the energy and Hewlett foundations. September 23.

Sierra Pacific Power. (2007). Reply comments of Sierra Pacific Power. Nevada PSC Docket No 07-06046, September 18.

Southern California Edison (SCE). (2007). Direct testimony supporting SCE’s proposal for an appropriate shared savings percentage. CPUC OIR 06-04-010, May 3.

United States Energy Information Administration (EIA). (2006). Form-861: annual electric power industry report. http://www.eia.doe.gov/cneaf/electricity/page/eia861.html. Accessed 14 March 2008.

Western Electricity Coordinating Council (WECC). (2005). Hourly demands 1998–2004. http://www.wecc.biz/modules.php?op=modload&name=Downloads&file=index&req=viewsdownload&sid=149. Accessed 13 March 2008.

Western Governor’s Association (WGA). (2004). WGA policy resolution 04-14: Clean and diversified energy initiative for the West. June 22. http://www.westgov.org/wga/initiatives/cdeac/index.htm. Accessed 8 March 2008.

Western Governors’ Association Clean and Diversified Energy Advisory Committee (WGA CDEAC). (2006). Energy Efficiency Task Force report. January. http://www.westgov.org/wga/initiatives/cdeac/Energy%20Efficiency.htm. Accessed 8 March 2008.

Western Governors’ Association Clean and Diversified Energy Advisory Committee (WGA CDEAC). (2007). Clean energy, a strong economy and a healthy environment: Western Governors’ Association Clean and Diversified Energy Initiative 2005–2007 progress report. June 10. http://www.westgov.org/wga/initiatives/cdeac/index.htm. Accessed 7 March 2008.

Acknowledgements

The work described in this report was funded by the Permitting, Siting, and Analysis Division of the Office of Electricity Delivery and Energy Reliability of the US Department of Energy under contract no. DE-AC02-05CH11231.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hopper, N., Barbose, G., Goldman, C. et al. Energy efficiency as a preferred resource: evidence from utility resource plans in the Western US and Canada. Energy Efficiency 2, 1–16 (2009). https://doi.org/10.1007/s12053-008-9030-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-008-9030-x