Abstract

This paper analyzes the R&D profile of Indian drug and pharmaceutical industry during the period 2000–2013, and the factors that influence a pharmaceutical firm’s decision to undertake R&D activities. The study period from 2000 to 2013 has been characterized by a rapid growth in industry’s R&D expenditures, as part of the strategic shift, induced by the Patents (Amendment) Act, 2005. Using the real financial data for the top 91 publicly listed Indian domestic pharmaceutical companies, the study provides new evidence on drivers of R&D intensity in Indian Drugs and Pharmaceutical industry. A panel data random effects Tobit model along with OLS model using firm fixed effects are applied to identify the factors affecting the R&D intensity of the sample firms. Furthermore, McDonald and Moffitt in Rev Econ Stat 62(2):318–321, (1980) procedure is used to decompose Tobit estimates. The empirical findings of the study reveal that firm’s size, past year profitability, past innovative output, leverage ratio; past cash flow; export and import intensities of the firm tend to significantly impact the R&D intensity. While firm size exhibits a non-linear relationship, cash flow, past innovative output shows a positive and significant relationship with R&D intensity. Further, patent count and firm’s overseas presence, considered as additional important determinants of firm-level R&D intensity, influences R&D positively. Lastly, global orientation of Indian pharmaceutical firms has been found to impact R&D activities considerably.

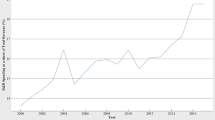

Source CMIE Prowess Database, 2014

Similar content being viewed by others

Notes

It aims to provide a therapeutic amount of drug to the appropriate site in the body to accomplish promptly and then maintain the desired drug concentration. This drug delivery system improves drug potency, control drug release to give a sustained therapeutic effect, provide greater safety.

DRF-2725 (NN622) was a peroxisome proliferator-activated receptor alpha and gamma agonist which, according to Dr Reddy's, has shown potential to regulate these parameters and thereby blood glucose and diabetic dysplasia. This molecule failed after it has been out-licensed.

DRF- 4148 was a anti-diabetic compound, which was out-licensed to Novartis in 2001. It also failed during further development.

RBX 2258 (pamirosin) was being developed for the treatment of benign prostate hyperplasia by Ranbaxy. Ranbaxy later out-licensed it to the German firm Schwarz Pharma which stopped Phase II trials of RBX 2258.

ANDA is an application for a U.S. generic drug approval for an existing licensed medication or approved drug.

DMF is a submission to the Food and Drug Administration, that may be used to provide confidential detailed information about facilities, processes, or articles used in the manufacturing, processing, packaging, and storing of one or more human drugs.

It is a molecule developed by the innovator company in the early drug discovery stage, which after undergoing clinical trials could translate into a drug that could be a cure for some disease.

References

Abbott TA, Vernon JA (2007) The cost of US pharmaceutical price regulation: a financial simulation model of R&D decisions. Manag Decis Econ 28:293–330

Abdelmoula M, Etienne JM (2010) Determination of R&D investment in French firms: a two-part hierarchical model with correlated random effects. Econ Innov New Technol 19(1):53–70

Abrol D, Prajapati P, Singh N (2011) Globalization of the Indian pharmaceutical industry: implications for innovation. Int J Inst Econ 3(2):327–365

Acs ZJ, Audretsch DB (1987) Innovation, market structure, and firm size. Rev Econ Stat 69(4):567–574

Amiti M, Konings J (2005) Trade liberalization, intermediate inputs, and productivity: evidence from Indonesia. Am Econ Rev 97(5):1611–1616

Arora A, Ceccagnoli M (2006) Patent protection, complementary assets, and firms' incentives for technology licensing. Manag Science 52(2):293–308

Arrow K (1962) Economic welfare and the allocation of resources for invention. In: The rate and direction of inventive activity: economic and social factors. Princeton University Press, New Jersy, USA, pp 609–626

Asheim BT, Coenen L (2005) Knowledge bases and regional innovation systems: comparing nordic clusters. Res Policy 34(8):1173–1190

Austin DH (2006) Research and development in the pharmaceutical industry. Congressional Budget Office, USA

Barge-Gil A, López A (2011) R versus D: estimating the differentiated effect of research and development on innovation results. MPRA Paper: 29083, Munich Personal RePEc Archive, Germany. RePEc:pra:mprapa:41270. Accessed Aug 2013

Basant R, Fikkert B (1996) The effects of R&D, foreign technology purchase, and domestic and international spillovers on productivity in Indian firms. Rev Econ Stat 78(2):187–199

Baum CF, Caglayan M, Talavera O (2013) R&D expenditures and geographical sales diversification. Rev Int Econ 8(1):459–474

Baysinger B, Hoskisson RE (1989) Diversification strategy and R&D intensity in multiproduct firms. Acad Manag J 32(2):310–332

Bhagwat Y, DeBruine M (2011) R&D and advertising efficiencies in the pharmaceutical industry. Int J Appl Econ 8(1):55–65

Bhat S, Narayanan K (2006) Technological Strategies and Exports: A study of Indian Basic Chemical Industry. http://hdl.handle.net/1853/35996. Accessed July 2014

Bhat S, Narayanan K (2011) Technology sourcing and outward FDI: comparison of chemicals and IT industries in India. Trans Corp Rev 3(2):50–64

Bloch C (2005) R&D investment and internal finance: the cash flow effect. Econ Innov New Technol 14:213–223

Bloom PN, Kotler P (1975) Strategies for high market-share firms. Harv Bus Rev 53(6):63–72

Blundell R, Griffith R, Reenen JV (1999) Market share, market value and innovation in a panel of british manufacturing firms. Rev Econ Stud 66(3):529–554

Bougheas S, Görg H, Strobl E (2003) Is R&D financially constrained? Theory and evidence from Irish manufacturing. Rev Ind Organ 22:159–174

Bradley M, Gregg AJ, Kim E (1984) On the existence of an optimal capital structure: theory and evidence. J Finance 39(3):857–878

Brekke KR, Straume OR (2009) Pharmaceutical patents: incentives for research and development or marketing? South Econ J 76:351–374

Brown JR, Fazzari SM, Petersen BC (2009) Financing innovation and growth: cash flow, external equity, and the 1990s R&D boom. J Finance 64(1):151–185

Chan LKC, Lakonishok J, Sougiannis T (2001) The stock market valuation of research and development expenditures. J Finance 56(6):2431–2457

Chang H, Song FM (2014) R&D investment and capital structure. http://www.efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEETINGS/2014Rome/papers/EFMA2014_0145_fullpaper.pdf

Chaturvedi K, Chataway J (2006) Strategic integration of knowledge in Indian pharmaceutical firms: creating competencies for innovation. Int J Bus Innvov Res 1(1):27–50

Chaudhuri S, Park C, Gopakumar KM (2010) Five years into the product patent regime: India’s response. United Nations Development Program, New York

Cohen WM (2010) Fifty years of empirical studies of innovative activity and performance, In: Hall B, Rosenberg N (ed) Handbook of the economics of innovation, 1st edn. Elsevier, North-Holland, pp 129–213

Congressional Budget Office (2006) Research and development in the pharmaceutical industry. USA. https://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/76xx/doc7615/10-02-drugr-d.pdf. Accessed July 2011

Correa CM (2004) Ownership of knowledge: the role of patents in pharmaceutical R&D. World Health Organ 8(10):784–787

Davies SW, Rondi L (1996) Intra-EU multinationality of industries. In: Davies SW, Lyons BR (eds) European union structure, strategy and the competitive mechanism. Oxford University Press, Oxford

Department of Pharmaceuticals (2010) Annual report-2009–10. Ministry of Chemistry and Fertilizers, Government of India

Eberhart AC, Maxwell WF, Sidique AR (2004) An examination of long-term abnormal stock returns and operating performance following R&D increases. J Finance 59(2):623–650

Ettlie JE (1998) R&D and global manufacturing performance. Manag Sci 44(1):1–11

European Commission (2014) The 2014 EU industrial R&D investment scoreboard: 60–62. http://iri.jrc. ec.europa.eu/scoreboard14.html

European Federation of Pharmaceutical Industries and Associations (EFPIA) (2013) The pharmaceutical industry in figures. Brussels, Belgium. http://www.efpia.eu/uploads/Figures_Key_Data_2013.pdf. Accessed July 2013

Feng L, Li Z, Swenson DL (2012) The connection between imported intermediate inputs and exports: evidence from Chinese firms. IAW Discussion Papers 86. Tübingen Germany. ftp://ftp.repec.org/opt/ReDIF/RePEc/iaw/pdf/iaw_dp_86.pdf, Accessed 18 May 2015

Food and Drug Administration (2004) Innovation or stagnation: challenge and opportunity on the critical path to new medical products. Government of USA

Greene W (2004) The behaviour of the maximum likelihood estimator of limited dependent variable models in the presence of fixed effects. Econ J 7(1):98–119

Goldar B (2013) R&D intensity and exports: a study of Indian pharmaceutical firms. Innov Dev 3(2):151–167

Grabowski H, Vernon JA (2000) The determinants of pharmaceutical research and development expenditures. J Evol Econ 10:201–205

Griliches Z, Pakes A, Hall BH (1987) The value of patents as indicators of inventive activity. In: Dasgupta P, Stoneman P (eds) Economic Policy and Technological Performance. Cambridge University Press, Cambridge, pp 97–124

BH Hall, Lerner J (2009) The financing of R&D and innovation, Working Paper 15325 http://www.nber.org/papers/w15325, National Bureau of Economic Research 1050, Cambridge, MA 02138

Hsiao C (2003) Analysis of panel data. Cambridge University Press, Cambridge

Hsieh PH, Mishra CS, Gobeli DH (2003) The return on R&D versus capital expenditures in pharmaceutical and chemical industries. Eng Manag 50(2):141–150

Hussinger K (2008) R&D and subsidies at the firm level: an application of parametric and semiparametric two-step selection models. J Appl Econom 23(6):729–747

Jensen MC (1986) Agency cost of free cash flow, corporate finance, and takeovers. Corporate finance, and takeovers. Am Econ Rev 76(2):323–329

Jordan J, Lowe J, Taylor P (1998) Strategy and financial policy in UK small firms. J Bus Finance Account 25(1–2):1–27

Joseph RK (2011) The R&D scenario in Indian pharmaceutical industry. Research and information system for developing countries, New Delhi. http://ris.org.in/images/RIS_images/pdf/dp176_pap.pdf. Accessed May 2011

Kallumal M, Bugalya K (2012) Trends in India’s trade in pharmaceutical sector: some insights. Centre for WTO Studies, Indian Institute of Foreign Trade, New Delhi. http://wtocentre.iift.ac.in/workingpaper/Working%20Paper2.pdf, Accessed June 2013

Kumar N, Budhwaar V (2015) Dynamics of drug master filings at United States Food and Drug Administration. World J Pharm Pharm Sci 4(4):424–435

Kumar N, Pradhan JP (2003) Export competitiveness in the knowledge-based Industries: a firm-level analysis of Indian manufacturing. RIS discussion paper no. 43, Research and Information System for Developing Countries, New Delhi

Kumar N, Saqib M (1996) Firm size, opportunities for adaptation and in-house R&D activity in developing countries: the case of Indian manufacturing. Res Policy 25(5):713–722

Kumar N, Siddharthan NS (1994) Technology, firm size and export behavior in developing countries: the case of Indian enterprises. J Dev Stud 31(2):289–309

Kwon HU, Inui T (2013) What determines R&D intensity? Evidence from Japanese manufacturing firms. http://home.sogang.ac.kr/sites/sgrime/journal/Lists/b6/Attachments/671/JOME_V42_1_2.pdf. Accessed Jan 2014

Lall S (1986) Technological development and export performance in LDCs: leading engineering and chemical firms in India. Rev World Econ 122(1):80–92

Lee M, Choi M (2015) The determinants of research and development investment in the pharmaceutical industry: focus on financial structures. Osong Public Health Res Perspect 6(5):302–309

Lee MH, Hwang IJ (2003) Determinants of corporate R&D investment: an empirical study comparing Korea’s IT industry with its non-IT industry. ETRI J 25(4):258–265

Lev B, Sougiannis T (1996) The capitalization, amortization and value-relevance of R&D. J Account Econ 21:107–138

Mahajan V, Nauriyal DK, Singh SP (2015) Trade performance and revealed comparative advantage of Indian pharmaceutical industry in new IPR regime. Int J Pharm Healthc Mark 9(1):56–73

Mahlich JC, Roediger-Schluga T (2006) The determinants of pharmaceutical R&D expenditures: evidence from Japan. Rev Ind Organ 28(2):145–164

Mairesse J, Robin S (2008) Innovation and productivity: a firm-level analysis for French manufacturing and services using CIS3 and CIS4 data (1998–2000 and 2002–2004). Paper presented at the DRUID conference, in Copenhagen, Denmark. http://www2.druid.dk/conferences/viewpaper.php?id=3604&cf=29. Accessed Aug 2012

Majumdar SK (1998) Assessing comparative efficiency of the state-owned mixed and private sectors in Indian industry. Public Choice 96(1–2):1–24

Malmberg C (2008) R&D and financial systems: the determinants of R&D expenditures in the Swedish pharmaceutical industry. CIRCLE Electronic Working Paper Series. http://www2.druid.dk/conferences/viewabstract.php?id=2999&cf=29. Accessed Aug 2011

Matraves C (1999) Market structure, R&D and advertising in the pharmaceutical industry. J Ind Econ 47(2):169- 194

Mazumdar M (2012) Performance of pharmaceutical companies in India: a critical analysis of industrial structure, firm specific resources, and emerging strategies. Springer, Berlin

McDonald JF, Moffitt RA (1980) The uses of Tobit analysis. Rev Econ Stat 62(2):318–321

Mitchell W, Shaver JM, Yeung B (1993) Performance following changes of international presence in domestic and transition industries. J Int Bus Stud 24(4):647–669

Mulkay B, Hall BH, Mairesse J (2001) Investment and R&D in France and in the United States. In: Herrmann H, Strauch R (eds) Investing today for the world tomorrow. Springer, New York

Myers S (1997) Determinants of corporate borrowing. J Fin Econ 5:147–175

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Fin Econ 13(2):187–221

Nath P (1993) Firm size and in-house R & D: the Indian experience revisited. Dev Econ 31(3):329–344

Nauriyal DK, Sahoo D (2008) The new IPR regime and Indian drug and pharmaceutical industry: an empirical analysis. Paper Presented in EPIP Conference, Berne, Switzerland. http://www.epip.eu/conferences/epip03/papers/Nauriyal_EPIP%20Conference%202008.pdf. Accessed July 2011

Nord LJ (2011) R&D investment link to profitability: a pharmaceutical industry evaluation. Undergrad Econ Rev 8(1):Article 6. http://digitalcommons.iwu.edu/uer/vol8/iss1/6

O’brien JP (2003) The capital structure implications of pursuing a strategy of innovation. Strateg Manag J 24(5):415–431

Office of Technology Assessment (1993) Pharmaceutical R&D: costs, risks and rewards. Government printing office, Washington DC, USA. http://govinfo.library.unt.edu/ota/Ota_1/DATA/1993/9336.PDF. Accessed Aug 2011

Pakes A (1986) Patents as options: some estimates of the value of holding European patent stocks. Econometrica 54(4):755–784

Pakes A, Schankerman M (1984) The Rate of obsolescence of patents, research gestation lags, and the private rate of return to research resources. In: Griliches Z (ed) R&D, patents, and productivity. University of Chicago Press, Chicago, pp 73–88

Pindado J, De Queiroz V, De La Torre C (2010) How do firm characteristics influence the relationship between R&D and firm value? Financ Manag 39(2):757–782

Pradhan JP (2003) Liberalization, firm size and R&D performance: a firm level study of Indian pharmaceutical industry. Munich Personal RePEc Archive, Germany. http://mpra.ub.uni-muenchen.de/17079/1/MPRA_paper_17079.pdf. Accessed August 2012

Pradhan JP (2007) Trends and patterns of overseas acquisitions by Indian multinationals. Munich Personal RePEc Archive, Germany. http://mpra.ub.uni-muenchen.de/id/eprint/12404.pdf. Accessed Aug 2012

Pradhan JP (2010) R&D strategy of small and medium enterprises in India: trends and determinants. Munich Personal RePEc Archive, Germany. http://mpra.ub.uni-muenchen.de/id/eprint/20951.pdf. Accessed July 2012

Raymond W, Mohnen P, Palm F, der Loeff SS (2010) Persistence of innovation in Dutch manufacturing: is it spurious? Rev Econ Stat 92(3):495–504

Salmon RM, Shaver JM (2005) Learning by exporting: new insights from examining firm innovation. J Econ Manag Strategy 14(2):431–460

Sanguinetti P (2005) Innovation and R&D expenditures in Argentina: evidence from a firm level survey. Universidad Torcuato Di Tella, Department of Economics, Buenas Aires. http://www.crei.cat/activities/sc_conferences/23/papers/sanguinetti.pdf. Accessed July 2012

Sanyal S, Vancauteren M (2014) R&D and its determinants: a study of the pharmaceutical firms in the Netherlands. http://cit2014.sciencesconf.org/conference/cit2014/pages/Full_Paper_Shreosi_Sanyal.pdf

Scherer FM (2001) The link between gross profitability and pharmaceutical R&D spending. Health Aff 20(5):216–220

Scherer FM (2007) Pharmaceutical innovation. KSG working paper RWP07-004. Harvard University. http://ssrn.com/abstract=902395 or http://dx.doi.org/10.2139/ssrn.902395. Accessed July 2012

Scherer, FM (2011) R&D costs and productivity in biopharmaceuticals. Working Paper RWP11-046. John F. Kennedy School of Government, Harvard University. http://dash.harvard.edu/bitstream/handle/1/5688848/RWP11-046_Scherer.pdf?sequence=1. Accessed June 2013

Schumpeter JA (1942) Capitalism, socialism, and democracy. Harper and Brothers Publishers, New York

Scott J (1984) Firm versus industry variability in R&D intensity. In: Griliches Z (ed) R & D, patents, and productivity. University of Chicago Press, Chicago, pp 233–248

Sharma C, Mishra RK (2011) Does export and productivity growth linkage exist? Evidence from the Indian manufacturing industry. Int Rev Appl Econ 25(6):633–652

Siddharthan NS (1988) In-house R&D, imported technology, and firm size: lessons from Indian experience. Dev Econ 26(3):212–221

Silva A, Afonso O, Africano A (2013) Economic performance and international trade engagement: the case of Portuguese manufacturing firms. Int Econ Econ Policy 10(4):521–547

Simanjuntak DG, Raymond RT (2005) M&A of generic pharmaceutical companies increases productivity. http://ssrn.com/abstract=1946761. doi:10.2139/ssrn.194676

Simanjuntak DG, Tjandrawinata RR (2011) Impact of Profitability, R&D Intensity, and Cash Flow on R&D Expenditure in Pharmaceutical Companies. http://ssrn.com/abstract=1824267. doi:10.2139/ssrn.1824267

Sun Y (2010) What matters for industrial innovation in China: R&D, technology transfer or spillover impacts from foreign investment? Int J Bus Syst Res 4(5/6):621–647

Titman S, Wessels R (1988) The determinants of capital structure choice. J Finance 43(1):1–19

Tsai SC (2001) Valuation of R&D and advertising expenditures. J Contemp Account 2(1):41–76

Tyagi S, Mahajan V, Nauriyal DK (2014) Innovations in Indian drug and pharmaceutical industry: have they impacted exports? J Intellect Prop Rights 19:243–252

Vernon R (1966) International investments and international trade in the product life cycle. Q J Econ 80(2):190–207

Vernon JA (2005) Examining the link between price regulation and pharmaceutical R&D investment. Health Econ 14(1):1–16

Zimmerman KF (1987) Trade and dynamic efficiency. Kyklos 40(1):73–87

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tyagi, S., Nauriyal, D.K. & Gulati, R. Firm level R&D intensity: evidence from Indian drugs and pharmaceutical industry. Rev Manag Sci 12, 167–202 (2018). https://doi.org/10.1007/s11846-016-0218-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-016-0218-8

Keywords

- Patent rights

- Indian pharmaceutical industry

- R&D intensity

- TRIPS

- Innovation and invention

- Processes and incentives

- Management of technological innovation and R&D

- Chemicals

- Drugs

- Biotechnology