Abstract

Before the formation of the Federal Reserve, banking panics were routine events in the United States. During the most severe episodes, banks in cities across the country would often suspend or restrict the par convertibility of their demand deposit liabilities. In diagnosing the causes of the Great Depression, Friedman and Schwartz famously regard these local initiatives as a second best solution, which in the absence of an effective lender of last resort would have prevented the rash of bank failures during the early 1930s and their dire monetary and real impacts. Recent research in macroeconomics though has raised the possibility that banks’ suspension of payments might also have negative real effects albeit through changes in aggregate supply such as the financing of working capital. We would expect to observe these negative shocks during the pre-Fed era, because the decentralized, private interbank payments network was especially vulnerable to systemic disruptions such as suspensions by New York and other money center banks. Reports in national trade periodicals and local newspapers during suspension periods offer many accounts of factories closing because of the inability to obtain currency for weekly payrolls and “domestic exchange” to finance internal trade. We corroborate these observations with more systematic econometric evidence at the national and regional levels. Our results show that controlling for the overall contraction and bank failures, suspension periods were associated with a statistically significant and quantitatively large decline in real activity, on the order of 10–20 %.

Similar content being viewed by others

Notes

Friedman and Schwartz (1963) preferred the terminology of restrictions of cash payments instead of the more common contemporary term of suspension to distinguish it from the temporary closure of particular beleaguered banks. But since both terms are used interchangeably in the literature, we shall do so here as well. Only remember that by “suspension” we always mean a temporary restriction on par cash payments, not a complete deferral of bank operations.

This applied to intercity remittances. Within cities, interbank payments were generally accomplished by net settlement at the end of the day at the clearinghouse. Recent theoretical work also suggests that delayed settlement in the payment system can exacerbate the resolution of uncertainty and credit risks which regular settlement is designed to achieve (Koeppl et al. 2005). These disruptions caused by the banking crises we study delayed settlements for both financial and real transactions. If the counterparties could not costlessly resort to alternative means of settlement, which we assert they could not do, then real risks and uncertainty in the economy persisted longer than anticipated, reducing the ability of counterparties to take on new transactions or to extend additional credit.

Yet, another channel in modern monetary theory is based on the idea that credit instruments act as a social memory device for economic transactions (Kocherlakota 2000). If there is a disruption in the system by which agents in the economy make long-distance monetary transfers, as occurred during the panics under review, they must turn to less well-suited instruments (such as cash transfers) to accomplish the information-tracking task that the drafts and checks performed during normal times. This adjustment constitutes a supply shock as well, because it increases producers’ information costs.

Loan certificates were issued in 1860 through 1864 in New York; in 1873 in New York, Boston, Philadelphia, Baltimore, Cincinnati, St. Louis, and New Orleans; in 1879 in New Orleans; in 1884 in New York; in 1890 in New York, Boston, and Philadelphia; and in 1893 in New York, Boston, Philadelphia, New Orleans, Buffalo, Pittsburgh, Detroit, Atlanta, and Birmingham (Cannon 1910, 75–116). In 1907, according to Andrew (1908b), clearinghouses in 41 of the 145 cities surveyed issued these large-denomination clearinghouse loan certificates.

The decision to issue loan certificates involved significant conflicts of interest within the clearinghouse, among other things between considerations of avoiding the effects of panics and resultant decreases in profits on the one hand and giving aid to commercial rivals on the other (Goodhart 1988, 38–39; Roberds 1995, 19; James and Weiman 2005). In July 1893, for example, 78 % of interbank settlements in the New York Clearing House were accomplished with loan certificates; in August, it was 95 % (Sprague 1910, 182).

Hanes and Rhode (2011) argue, however, that the fundamental roots of financial crises in the United States under the gold standard lay in fluctuations in the cotton harvest.

There are some exceptions, of course. In 1907, for example, the governors of Oklahoma, Nevada, Washington, Oregon, and California declared legal holidays, allowing individual banks to choose whether to restrict payments. In several mid-western states, bank commissioners and superintendents made it known that they would not look askance if banks decided to restrict payments; some even suggested it as an option (Andrew 1908b, 498–500).

In Andrew’s “roll of honor,” those with populations greater than 100,000 included Rochester (NY), Toledo (OH), Worcester (MA), Patterson (NJ), and Scranton (PA). He found only six states (Maine, Vermont, South Dakota, Montana, Idaho, and Wyoming) in which there was no record of restrictions of payments, but in several of those, there was no city of greater than 25,000 population and hence no information on doings there (p. 446).

Refusals by New York banks to pay out cash for their interior correspondents in 1907 are described in Senate Document No. 435 (U.S. Senate 1908). As for 1893, “the majority of New York institutions continued to pay cash on demand to all depositors, and those which did refuse cash payments not only offered to such depositors checks on other banks, but cashed small checks without inquiry,” but “the banks which did shut down on cash payments to depositors included several of the soundest institutions in the city” (Noyes 1894, 26–27).

Kroszner (2000, 162), au contraire, argued “the temporary suspension of cash payments in late 1907, while causing some inconveniences, allowed the banks to continue to provide payments functions….”

Although the Chicago Tribune (November 23, 1907) noted that “some plants are idle because of the difficulty experienced in obtaining cash with which to pay employees…” Sprague (1910, 71) also suggested that payroll difficulties in 1873 were less pronounced than in later suspensions because wages were typically paid monthly rather than weekly. Nevertheless, he cited a number of reports of plant closures in 1873 as a consequence. In any case, they were relatively short-lived, however (as in 1893), having essentially disappeared within a month, after mid-October. “Their place was taken by far more serious causes of trouble, which were not, however, of a banking nature” (pp. 72–74).

These instruments were employed in 1893 as well, although not to the extent as in 1907. Warner claimed, for example, that clearinghouse certificates were frequently issued, particularly in the Southeast, in towns where no clearinghouse existed—“a travesty on the paper after which they were named” (1896, 71). He estimated “vaguely” around $80 million of emergency currency put in circulation (p. 73), or about 8 % of the stock of high-powered money (Friedman and Schwartz 1970, 6).

The largest component of this total, however, remained the traditional large-value clearinghouse loan certificates ($238 million as compared with an issue of $69.1 million in 1893) (see Table 1).

The currency premium apparently applied to all forms of currency, not just gold. The Commercial and Financial Chronicle (5 August 1893, 196) noted the premium on small note currency, while a week later it observed that “all kinds of currency” were in demand “even standard silver dollars” (12 August 1893, 232).

In 1893, the early large purchasers were interior banks. “Then the premium declined, owing to a smaller demand which was confined largely to those requiring money for pay-roll purposes,” with the peak on August 19 resulting from the renewal of purchases by banks (Sprague 1910, 188). Andrew (1908a, 291) similarly attributed the initial currency premium in New York at the end of October 1907 to Western banks that paid “a bonus for large blocks of money.” These demands were supplemented by “orders from large mill-owners and manufacturers who were supplied with sufficient money to meet pay-roll demands.”

Hoarding was stimulated by the incipient and actual currency premium. During the panic week in October 1907 culminating in the declaration of suspension on Saturday, about six times the normal rate of safe deposit boxes were rented. Similar surges in demand also occurred in Boston, Chicago, St. Louis, and San Francisco. Interior country banks as well as individuals were enthusiastic hoarders. Their gain in cash reserves was almost equal to the loss of cash by central reserve city banks over the same period. As Andrew (1908a, 298) observed, “The most extraordinary aspect of the matter is that the hoarding of reserves occurred for the greater part in places where cash payments were suspended by the banks and at a time when the banks were inundating their respective communities with illegal money substitutes.”

Possibly, the reported low and high figures in 1873 and 1907 might have been prices paid by brokers and retail prices paid by customers, respectively (as in 1893), so the daily bands measure the spread rather than the range of intraday fluctuations (Sprague 1910, 57).

However, Andrew (1908a, 290–291) noted that “even in the dire vicissitudes” in France in its war with Prussia “the premium paid for coin rose only once to the level of 4 %, a surplus price which was frequently paid for currency in New York during November, 1907.” On the other hand, Noyes (1894, 28) attributed the fact that the premium never rose “exorbitantly high” to the expectation that early resumption of cash payments by banks was “universally expected.”

Indeed during the month of suspension, August 1893, over $40 million in gold was imported from Europe to New York, a sum greater than the cash sent from New York to the interior. At the same time, European gold was also shipped directly to some other cities, such as Chicago (Sprague 1910, 190–195).

A resolution of the Merchants’ Association of New York passed on November 21, 1907, read in part: “Checks payable ‘through clearing-house only’ are useful for local settlements, but do not pay non-local debts. The business of all large manufacturing and mercantile concerns is chiefly non-local, and cannot go on if local funds are everywhere tied up. Interstate exchange is essential to the conduct of interstate business, and this constitutes the greater part of our domestic exchanges. Provision for the settlement of local indebtedness is helpful, but provision for the settlement of non-local indebtedness is essential, and, therefore, still more helpful” (Bankers’ Magazine, December 1907, 970).

Similarly, in 1893, Louisville banks were reported to have declined to receive country checks “even for collection” and preferred not to “handle” New York exchange (Bradstreet’s, August 12, 1893, 511). Or else, it became very expensive to use such payments instruments. In 1893, Sprague (1910, 206) claimed that “drafts were often of little or no utility to the holder because the banks refused to take them except at a ruinous discount or for collection.”

Just as was suggested with regard to payroll difficulties, Sprague (1910, 75–77) argued that the “dislocation” of the domestic exchanges had less serious consequences in 1873 than later because markets had been less integrated geographically. Moreover, the exchanges then while “deranged for a time… were never completely blocked [except in Chicago].”

The large relative premia of local funds relative to those in New York were not simply the result of the interior origins of the Panic of 1893. In the Panic of 1873, which did originate in New York rather than in the interior, domestic exchange rates in Chicago also fell dramatically, reaching levels of −$35.

As striking evidence of this trend, the Independent Treasury withdrew from the Boston clearinghouse on 30 October, precisely because it could not accept bank liabilities in the form of loan certificates in settling its accounts (Boston Globe, 31 October 1907, 7).

According to Sprague (1910, 297–298), banks also refused to grant customers immediate credit for the deposit of “foreign,” that is non-local, checks and instead made them wait for the funds until the items were cleared and settled.

An agent reported to Bradstreet’s from Philadelphia: “The scarcity and high rate of exchange on New York has no doubt militated against the customary prompt settlements with that city, the banks for the reason named being unwilling to part with their currency” (29 July 1893, 480). Similarly, Noyes (1894, 26) observed that in 1893 even before formal cash restrictions “country banks were charged with refusing to remit their cash collections… The express companies did a very large business, during the panic, in presenting out-of-town checks at the banks on which they were drawn, and bringing the money to the city bank whence the check was remitted. The out-of-town banks frequently resisted this by paying in silver dollars or fractional coin. Domestic exchange between two great Eastern cities was at one time fixed by the express charges for transporting silver dollars.” And as well “banks in some larger cities were next accused of withholding similar remittances.”

Disruptions in the foreign exchange market had similar effects. In 1873, the Chicago Tribune reported that “the shipping movement was partially paralyzed by the news from New York that sterling exchange was unnegotiable.” Shipments of wheat to Atlantic ports were interrupted and grain elevators became “crowded to their utmost capacity” (September 20 and September 25, 1873).

Between the May 4 and October 4 call dates in 1893, loans of national banks fell by almost 15 % (Sprague 1910, 208).

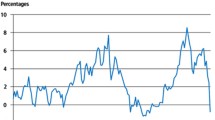

Freight ton-miles fell by 10.8 % between July and September 1893 and by 10.4 % between October 1907 and January 1908. The declines in pig iron production were 42.2 and 52.8 %, respectively, while in the Babson index, they were 12 and 18 %.

All cited NBER series were retrieved from the MacroHistory database at http://data.nber.org/databases/macrohistory/contents.

Wicker (2000, 3) distinguished between bank suspensions, a closure that might have been temporary or permanent, and failure that was permanent. Here we focus on the latter.

The series is constructed from data on monthly gross real earnings. From 1879 to 1890, it is based on 24–27 railroads accounting for about 50 % of total traffic drawn from Poor’s Manual of Railroads. After 1890, similar techniques were applied to ICC data for all railroads. The data are seasonally adjusted. A detailed description may be found in U.S. Bureau of the Census (1949, 323–324).

These data are daily averages in gross tons constructed by dividing figures based on the weekly capacity of furnaces in blast by the number of calendar days in the month. They are not seasonally adjusted (U.S. Bureau of the Census 1949, 323). The original data are found in Macaulay (1938, A252–A270).

Also using pig iron production as the output measure over this period, Grossman (1993) found au contraire a strong and statistically significant influence of bank failures. Perhaps this might have been due to the fact that result is based on quarterly data that might conflate the effects of bank failures and suspensions (suspensions do not appear explicitly in his specification).

In any case, the message in these results accord with Wicker (2000, 2) who argued that bank failures in the interior (although qualified by excepting 1893) “were generally few in number, region-specific, and too localized geographically to have exerted economy-wide effects… It was the suspension of cash payments and not bank runs nor bank failures through which the public in the rest of the country experienced the effects of banking panics.”

And this notwithstanding the real effects of suspension in 1873 may have been weaker than in 1893 and 1907. Indeed, Sprague (1910, 77) argued that it “had relatively little influence on the course of trade.”

These are the main factors that differentiate bank clearings from the more economically pertinent variable, debits to deposit accounts (Garvy 1959, 46–55). Still, as Garvy (pp. 69–70) showed, during the postbellum period, annual “outside” bank clearings and GNP were highly correlated.

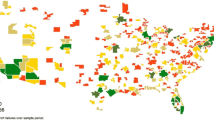

The figures for 1892 and 1893 come from the local money-securities markets reports in the Chicago Daily Tribune. For the later years, the data are taken from the “Bank Clearings” section of the Wall Street Journal and exclude New Orleans.

The panels for each year cover the same time period, but are unbalanced because of inconsistencies in data reporting and collection. For this reason, we applied the panel-corrected standard error and not generalized least squares estimation procedure.

We also tested for but found no evidence of serial correlation in the error terms for each city.

Regression estimates based on the quadratic specification yield an inverted-U trend line and imply a much larger suspension impact of 15.7 %. Strikingly, the range parallels the results from the aggregate analysis in the preceding section.

The results are available from the authors upon request.

References

Andrew AP (1908a) Hoarding in the panic of 1907. Q J Econ 22:290–299

Andrew AP (1908b) Substitutes for cash in the panic of 1907. Q J Econ 22:497–516

Bank for International Settlements, Committee on Payment and Settlement Systems (2012) Statistics on payment and settlement systems in the CPSS countries—figures for 2010. CPSS Publications No. 99

Bankers’ Magazine (1907) various issues

Barth M, Ramey V (2002) The cost channel of monetary transmission. In: NBER macroeconomics annual, 2001, pp 199–239

Bernanke B (1983) Nonmonetary effects of the financial crisis in the propagation of the great depression. Am Econ Rev 73:257–276

Bodenhorn H (2000) A history of banking in antebellum America. Cambridge University Press, New York

Bordo MD, Kydland FE (1995) The gold standard as a rule: an essay in exploration. Explor Econ Hist 32:423–464

Bradstreet’s (1893, 1907) various issues

Burns AF, Mitchell WC (1946) Measuring business cycles. National Bureau of Economic Research, New York

Calomiris C, Gorton G (1991) The origins of bank panics: models, facts, and bank regulation. In: Hubbard RG (ed) Financial markets and financial crises. University of Chicago Press, Chicago, pp 109–173

Calomiris C, Hubbard RG (1989) Price flexibility, credit availability, and economic fluctuations: evidence from the United States, 1894–1909. Q J Econ 104:429–452

Cannon JG (1910) Clearing houses. National Monetary Commission. Government Printing Office, Washington, DC

Chandler AD (1977) The visible hand. Belknap Press, Cambridge

Chari VV (1989) Banking without deposit insurance or bank panics: lessons from a model of the U.S. national banking system. Fed Reserve Bank Minneap Q Rev 13:3–19

Chicago Daily Tribune (1893, 1907) various issues

Chordia T, Sarkar A, Subrahmanyan A (2004) An empirical analysis of stock and bond market liquidity. Rev Financ Stud 18:85–129

Christiano LJ, Eichenbaum M (1992) Liquidity effects and the monetary transmission mechanism. Am Econ Rev 82:346–353

Christiano LJ, Eichenbaum M, Evans C (1997) Sticky price and limited participation models of money. Eur Econ Rev 41:1201–1249

Colwell S (1859) The ways and means of payment. J. B. Lippincott, Philadelphia

Commercial and Financial Chronicle (1893, 1907–1908) various issues

Craighead WD (2010) Across time and regimes: 212 years of the US–UK real exchange rate. Econ Inquiry 48:951–964

Dewald, WG (1972) The national monetary commission: a look back. J Money Credit Banking 4:930-956

Diamond DW, Dybvig PH (1983) Bank runs, deposit insurance, and liquidity. J Polit Econ 91:401–419

Dunbar CF (1906) Chapters on the theory and history of banking, 2nd edn. G. P. Putnam’s Sons, New York

Dwyer GP Jr, Hassan I (2007) Suspension of payments, bank failures, and the nonbank public’s losses. J Monet Econ 54:565–580

Frickey E (1925) Bank clearings outside New York City, 1875–1914. Rev Econ Stat 7:252–262

Frickey E (1930) A statistical study of bank clearings, 1875–1914. Rev Econ Stat 12:112–138

Friedman M, Schwartz A (1963) A monetary history of the United States, 1867–1960. Princeton University Press, Princeton

Friedman M, Schwartz A (1970) Monetary statistics of the United States. National Bureau of Economic Research, New York

Garvy G (1959) Debits and clearing statistics and their use. Board of Governors of the Federal Reserve System, Washington, DC

Gilbert RA (2000) The advent of the Federal Reserve and the efficiency of the payments system: the collection of checks, 1915–1930. Explor Econ Hist 37:121–148

Gorton G (1985a) Bank suspension of convertibility. J Monet Econ 15:177–193

Gorton G (1985b) Clearinghouses and the origin of central banking in the United States. J Econ Hist 45:277–283

Gorton G, Mullineaux D (1987) The joint production of confidence: endogenous regulation and nineteenth century commercial-bank clearinghouses. J Money Credit Banking 19:457–468

Grossman RS (1993) The macroeconomic consequences of bank failures under the national banking system. Explor Econ Hist 30:294–320

Hanes CL (1999) Degrees of processing and changes in the cyclical behavior of prices in the United States, 1869–1900. J Money Credit Banking 31:35–53

Hanes CL, Rhode P (2011) Harvests and financial crises in gold-standard America. Unpublished manuscript

James JA, Weiman DF (2005) Financial clearing systems. In: Nelson RR (ed) The limits of market organization. Russell Sage Foundation, New York, pp 114–155

James JA, Weiman DF (2010) From drafts to checks: the evolution of correspondent banking networks and the formation of the modern U.S. payments system, 1850–1914. J Money Credit Banking 42:237–265

James JA, McAndrews J, Weiman DF (2011) Panics and the disruption of private payments networks: the United States in 1893 and 1907. Unpublished manuscript

Johnson JF (1905) Money and currency. Ginn and Co., Boston

Kemmerer EW (1911) American banks in times of crisis under the national banking system. Proc Acad Polit Sci City N Y 1:233–253

Kinley D (1895) Credit instruments in retail trade. J Polit Econ 3:203–217

Kinley D (1897) Credit instruments in business transactions. J Polit Econ 5:157–174

Kinley D (1910) The use of credit instruments in payments in the United States. National Monetary Commission. Government Printing Office, Washington, DC

Klovland JT (1993) Zooming in on Sauerbeck: monthly wholesale prices in Britain, 1845–1890. Explor Econ Hist 30:195–228

Knodell J (1998) The demise of central banking and the domestic exchanges: evidence from antebellum Ohio. J Econ Hist 58:714–730

Kocherlakota N (2000) Money is memory. J Econ Theory 81:232–251

Koeppl T, Monnet C, Temzelides T (2005) Mechanism design and payments. 2005 meeting papers 11, Society for Economic Dynamics

Kroszner RL (2000) Lessons from financial crises: the role of clearinghouses. J Financ Serv Res 18:157–171

Lacker JM, Walker JD, Weinberg JA (1999) The Fed’s entry into check clearing reconsidered. Fed Reserve Bank Richmond Econ Q 85:1–32

Macaulay FR (1938) The movements of interest rates, bond yields and stock prices in the United States since 1856. National Bureau of Economic Research, New York

McAndrews J, Potter SM (2002) Liquidity effects and the events of September 11, 2001. Fed Reserve Bank N Y Econ Rev 8:59–79

McAndrews J, Rajan S (2000) The timing and funding of Fedwire funds transfers. Fed Reserve Bank N Y Econ Rev 6:17–32

McAndrews J, Roberds W (1999) Payment intermediation and the origins of banking. FRB of New York Staff Report No. 85

Miron JA, Romer CD (1990) A new monthly index of industrial production, 1884–1940. J Econ Hist 50:321–337

Mishkin FS (1996) The channels of monetary transmission: lessons for monetary policy. NBER Working Paper 5464

Moore GH (ed) (1961) Business cycle indicators, vol II. Princeton University Press, Princeton

Myers MG (1931) The New York money market, volume 1: origins and development. Columbia University Press, New York

Noyes AD (1894) The banks and the panic of 1893. Polit Sci Q 9:12–30

Persons WM (1919) An index of general business conditions: I. the index: a statement of results. Rev Econ Stat 1:111–117

Roberds W (1995) Financial crises and the payments system: lessons from the national banking era. Fed Reserve Bank Atlanta Econ Rev 80:15–31

Rockoff H (1993) The meaning of money in the great depression. NBER Historical Paper No. 52

Selgin G (1993) In defense of bank suspension. J Financ Serv Res 7:347–364

Sprague OMW (1910) A history of crises under the national banking system. National Monetary Commission. Government Printing Office, Washington, DC

Stevens AC (1894) Analysis of the phenomena of the panic in the U.S. in 1893. Q J Econ 9:117–145

Stevens EJ (1996) The founders’ intentions: sources of the payments services franchise of the Federal Reserve Banks. Federal Reserve Bank of Cleveland Working Paper Series, 03-96

Summers BJ, Gilbert RA (1996) Clearing and settlement of U.S. dollar payments: back to the future? Fed Reserve Bank St. Louis Rev 78:3–27

Timberlake RH Jr (1984) The central banking role of clearinghouse associations. J Money Credit Banking 16:1–15

U.S. Bureau of the Census (1949) Historical statistics of the United States, 1789–1945. Government Printing Office, Washington, DC

U.S. Comptroller of the Currency (1894, 1896, 1907, 1908, 1931) Annual report. Government Printing Office, Washington, DC

U.S. Senate (1908) Refusal of national banks in New York City to furnish currency for needs of interior banks. Senate document No. 435, 60th Congress, 1st Session

Wall Street Journal (1893, 1907) various issues

Wallace N (1990) A banking model in which partial suspension is best. Fed Reserve Bank Minneap Q Rev 14:11–23

Warner JD (1896) The currency famine of 1893. Sound Curr 2:339–356

Weber WE (2003) Interbank payments relationships in antebellum Pennsylvania. J Monet Econ 50:455–474

Wicker E (2000) Banking panics of the gilded age. Cambridge University Press, Cambridge

Acknowledgments

The views expressed in the paper are those of the authors and do not necessarily represent the views of the Federal Reserve Bank of New York or of the Federal Reserve System. Earlier versions of this paper were presented at the Institute for Monetary and Economic Studies, Bank of Japan, London School of Economics, Rutgers University, 7th BETA Workshop in Historical Economics. We thank the participants and Richard Grossman and Christopher Hanes for comments and suggestions but alas must still accept responsibility for any errors. Weiman acknowledges the financial support of Barnard College, and research assistance from Keren Baruch, Olivia Benjamin, and Nancy Greenewalt.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

James, J.A., McAndrews, J. & Weiman, D.F. Wall Street and Main Street: the macroeconomic consequences of New York bank suspensions, 1866–1914. Cliometrica 7, 99–130 (2013). https://doi.org/10.1007/s11698-012-0083-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11698-012-0083-x