Abstract

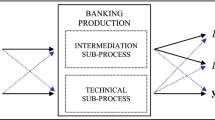

Data envelopment analysis (DEA) has become one of the most widely used instruments for measuring bank efficiency. However, its application encounters many problems, which is evidenced by continuous evolvements in the DEA method so far. Our paper addresses the pitfalls of DEA in the context of measuring bank efficiency, with focus on the specification of performance factors. We aim at examining whether the input-output specification for banks in DEA applications is in consistence with the criteria upon which banks make decisions. Four bank behaviour models which are most popularly employed to determine input and output factors in DEA studies—the intermediation approach, production approach, user cost approach and value added approach—are comprehensively discussed and reviewed. The comparative reflection on the bank behaviour models and the standard DEA models shows that the input-output related pitfalls of a DEA application are associated with its implicitly fixed preference structure, flexible weight determination and limited explanatory power. Due to the pitfalls, the conventional DEA models may fail to capture bank behaviours. In such cases, DEA results can hardly reflect the performance in its true sense, i.e. how banks perform against the goals that they decide to pursue. The findings suggest focusing on (DEA-based) performance measurement from a goal-oriented perspective, i.e. from the point of view of multi criteria decision making.

Similar content being viewed by others

Notes

The terms “input factor” and “output factor” specify types of objects from a stock-oriented view. From the view of a dynamic context, the term “input” classifies a factor which enters a production process, while the term ”output” classifies a factor which results from a production process. This distinction is relevant for the case of anti-isotonic data (see Sect. 4.1).

According to Berger and Humphrey (1992), explicit revenues of deposits are calculated as extra charges on deposits when a bank pays a deposit interest rate at the market rate; implicit revenues are defined as a bank’s earnings from paying a deposit interest rate below the market rate.

Under the user cost approach, e.g., the determination of inputs and outputs alters when data for constructing user cost changes.

It should be mentioned that it is also possible to use loans adjusted for bad loans or loan loss reserves as a variable in the DEA model in order to cover the risk factors. Such approach can even improve the discriminating power for the measurement results since the number of variables is reduced. However, the exclusion of risk factors from the variable set can cause difficulties in interpreting the results on whether and how the risks themselves affect the overall efficiency of banks.

According to Lovell (1993), an efficiency measurement model needs to address three questions which are: (1) How many and which inputs and outputs should be included? (2) How should they be weighted in the aggregation process to obtain a single index? and (3) How should the potential production units be determined? As for the first question, DEA applications must rely on exogenous information to specify inputs and outputs. For measuring bank efficiency, bank behaviour models can provide an anchor to address this question. The standard DEA models answer the two last questions as follows: optimal weights are used in the aggregation process to obtain efficiency scores; the potential production units are derived directly from the data set, referring to the best practice ones.

References

Ahn H, Dyckhoff H (2011) Methodology of DEA-based performance analysis: foundations and the example of research performance. SSRN eLibrary. http://ssrn.com/paper=1992367. Accessed 18 March 2013

Ahn H, Neumann L, Vazquez Novoa N (2012) Measuring the relative balance of DMUs. Eur J Oper Res 221(2):417–423

Allen F, Santomero AM (1997) The theory of financial intermediation. J Bank Financ 21(11–12):1461–1485

Allen F, Santomero AM (2001) What do financial intermediaries do? J Bank Financ 25(2):271–294

Allen R, Athanassopoulos A, Dyson RG, Thanassoulis E (1997) Weights restrictions and value judgement in data envelopment analysis: evolution, development, and future directions. Ann Oper Res 73:13–34

Asmild M, Paradi JC, Aggarwall V, Schaffnit C (2004) Combining DEA window analysis with the Malmquist index approach in a study of the Canadian banking industry. J Prod Anal 21(1):67–89

Asmild M, Zhu M (2012) Bank efficiency and risk during the financial crisis: evidence from weight restricted DEA models. MSAP Working Paper Series, No. 03/2012. http://www.msap.life.ku.dk/Research/Publications/Working_Paper_Series.asp1-26. Accessed 6 Aug 2013

Avkiran NK (2006) Developing foreign bank efficiency models for DEA grounded in finance theory. Soc Econ Plan Sci 40(4):275–296

Avkiran NK (2009) Removing the impact of environment with units-invariant efficient frontier analysis: an illustrative case study with intertemporal panel data. Omega 37(3):535–544

Avkiran NK, Morita H (2010) Benchmarking firm performance from a multiple-stakeholder perspective with an application to Chinese banking. Omega 38(6):501–508

Baltensperger E (1980) Alternative approaches to the theory of the banking firm. J Monetary Econ 6(1):1–37

Banker RD, Charnes A, Cooper WW (1984) Some models for estimating technical and scale efficiencies in data envelopment analysis. Manag Sci 30(9):1078–1092

Barr RS, Killgo KA, Siems TF, Zimmel S (2002) Evaluating the productive efficiency and performance of US commercial banks. Manag Financ 28(8):3–25

Bauer PW, Berger AN, Ferrier GD, Humphrey DB (1998) Consistency conditions for regulatory analysis of financial institutions: a comparison of frontier efficiency methods. J Econ Bus 50(2):85–114

Bell FW, Murphy NB (1968) Economies of scale and division of labor in commercial banking. South Econ J 35(2):131–139

Benston GJ (1965) Branch banking and economies of scale. J Financ 20(2):312–331

Benston GJ (1972) Economies of scale of financial institutions. J Money Credit Bank 4(2):312–341

Berg SA, Førsund FR, Hjalmarsson L, Suominen M (1993) Banking efficiency in the Nordic countries. J Bank Financ 17(2–3):371–388

Bergendahl G (1998) DEA and benchmarks: an application to Nordic banks. Ann Oper Res 82:233–249

Bergendahl G, Lindblom T (2008) Evaluating the performance of Swedish savings banks according to service efficiency. Eur J Oper Res 185(3):1663–1673

Berger AN, Hancock D, Humphrey DB (1993) Bank efficiency derived from the profit function. J Bank Financ 17(2–3):317–347

Berger AN, Hanweck GA, Humphrey DB (1987) Competitive viability in banking: scale, scope, and product mix economies. J Monetary Econ 20(3):501–520

Berger AN, Humphrey DB (1992) Measurement and efficiency issues in commercial banking. In: Griliches Z (ed) Output measurement in the service sectors. University of Chicago Press, Chicago, pp 245–300

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: international survey and directions for future research. Eur J Oper Res 98(2):175–212

Bessent AM, Bessent EW, Clark CT, Elam J (1988) Efficiency frontier determination by constrained facet analysis. Oper Res 36(5):785–796

Bhattacharya S, Thakor AV (1993) Contemporary banking theory. J Financ Intermed 3(1):2–50

Canhoto A, Dermine J (2003) A note on banking efficiency in Portugal: new vs. old banks. J Bank Financ 27(11):2087–2098

Casu B, Girardone C, Molyneux P (2004) Productivity change in European banking: a comparison of parametric and non-parametric approaches. J Bank Financ 28(10):2521–2540

Chan Y-S, Greenbaum SI, Thakor AV (1986) Information reusability, competition, and bank asset quality. J Bank Financ 10(2):243–253

Chang T, Chiu Y (2006) Affecting factors on risk-adjusted efficiency in Taiwan’s banking industry. Contemp Econ Policy 24(4):634–648

Charnes A, Cooper WW, Golany B, Seiford LM, Stutz J (1985) Foundations of data envelopment analysis for Pareto-Koopmans efficient empirical production functions. J Econom 30(1–2):91–107

Charnes A, Cooper WW, Huang ZM, Sun DB (1990) Polyhedral cone-ratio DEA models with an illustrative application to large commercial banks. J Econom 46(1–2):73–91

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2(6):429–444

Chen TY, Yeh TL (2000) A measurement of bank efficiency, ownership, and productivity changes in Taiwan. Serv Ind J 20(1):95–109

Christensen LR, Jorgenson DW (1970) US real product and real factor input, 1929–1967. Rev Income Wealth 16(1):19–50

Coase RH (1937) The nature of the firm. Economica 4(16):386–405

Cook WD, Hababou M, Liang L (2005) Financial liberalization and efficiency in Tunisian banking industry: DEA test. Int J Inf Technol Decis Making 4(3):455–475

Cook WD, Seiford LM (2009) Data envelopment analysis: thirty years on. Eur J Oper Res 192(1):1–17

Cooper WW, Park KS, Pastor JT (1999) RAM: a range adjusted measure of inefficiency for use with additive models, and relations to other models and measures in DEA. J Prod Anal 11(1):5–42

Das A, Ghosh S (2006) Financial deregulation and efficiency: an empirical analysis of Indian banks during the post reform period. Rev Financ Econ 15(3):193–221

Das A, Ghosh S (2009) Financial deregulation and profit efficiency: a nonparametric analysis of Indian banks. J Econ Bus 61(6):509–528

Delis MD, Papanikolaou NI (2009) Determinants of bank efficiency: evidence from a semi-parametric methodology. Manage Financ 35(3):260–275

Devaney M, Weber WL (2000) Productivity growth, market structure, and technological change: evidence from the rural banking sector. Appl Financ Econ 10(6):587–595

Diamond DW (1984) Financial intermediation and delegated monitoring. Rev Econ Stud 51(3):393–414

Diamond DW, Dybvig PH (1983) Bank runs, deposit insurance, and liquidity. J Polit Econ 91(3):401–419

Diewert WE (1980) Aggregation problems in the measurement of capital. In: Usher D (ed) The measurement of capital. University of Chicago Press, Chicago, pp 443–528

Drake L, Hall MJB (2003) Efficiency in Japanese banking: an empirical analysis. J Bank Financ 27(5):891–917

Dyckhoff H (1992) Betriebliche Produktion. Springer, Berlin

Dyckhoff H, Ahn H (2010) Verallgemeinerte DEA-Modelle zur Performanceanalyse. Z Betriebswirtschaft 80(12):1249–1276

Dyckhoff H, Allen K (2001) Measuring ecological efficiency with data envelopment analysis (DEA). Eur J Oper Res 132(2):312–325

Dyson RG, Allen R, Camanho AS, Podinovski VV, Sarrico CS, Shale EA (2001) Pitfalls and protocols in DEA. Eur J Oper Res 132(2):245–259

Dyson RG, Thanassoulis E (1988) Reducing weight flexibility in data envelopment analysis. J Oper Res Soc 39(6):563–576

Epstein MK, Henderson JC (1989) Data envelopment analysis for managerial control and diagnosis. Decis Sci 20(1):90–119

Fama EF (1980) Banking in the theory of finance. J Monet Econ 6(1):39–57

Fama EF (1985) What’s different about banks? J Monet Econ 15(1):29–39

Färe R, Grosskopf S, Weber WL (2004) The effect of risk-based capital requirements on profit efficiency in banking. Appl Econ 36(15):1731–1743

Färe R, Whittaker J (1993) An intermediate input model of dairy production using complex survey data. J Agr Econ 46(2):201–213

Farrell MJ (1957) The measurement of productive efficiency. J R Stat Soc A (Gen) 120(3):253–290

Favero C, Papi L (1995) Technical efficiency and scale efficiency in the Italian banking sector: a non-parametric approach. Appl Econ 27(4):385–395

Ferrier GD, Lovell CAK (1990) Measuring cost efficiency in banking: econometric and linear programming evidence. J Econ 46(1–2):229–245

Fethi MD, Pasiouras F (2010) Assessing bank efficiency and performance with operational research and artificial intelligence techniques: a survey. Eur J Oper Res 204(2):189–198

Fixler DJ, Zieschang KD (1992) User costs, shadow prices, and the real output of banks. In: Griliches Z (ed) Output measurement in the service sectors. University of Chicago Press, Chicago, pp 219–243

Freixas X, Rochet JC (2008) Microeconomics of banking, 2nd edn. MIT Press Cambridge

Frisch R (1965) Theory of production. Reidel, Dordrecht

Fukuyama H, Weber WL (2005) Estimating output gains by means of Luenberger efficiency measures. Eur J Oper Res 164(2):535–547

Fukuyama H, Weber WL (2010) A slacks-based inefficiency measure for a two-stage system with bad outputs: empirical research in the EU banking sector and the financial crisis. Omega 38(5):398–409

Fung MK (2006) Scale economies, X-efficiency, and convergence of productivity among bank holding companies. J Bank Financ 30(10):2857–2874

Gilbert RA, Wilson PW (1998) Effects of deregulation on the productivity of Korean banks. J Econ Bus 50(2):133–155

Golany B, Roll Y (1989) An application procedure for DEA. Omega 17(3):237–250

Grigorian DA, Manole V (2002) Determinants of commercial bank performance in transition: an application of data envelopment analysis. Policy research working paper No. 2850, World Bank

Guzmán I, Reverte C (2008) Productivity and efficiency change and shareholder value: evidence from the Spanish banking sector. Appl Econ 40(15):2037–2044

Hakenes H (2004) Banks as delegated risk managers. J Bank Financ 28(10):2399–2426

Hancock D (1985) The financial firm: production with monetary and nonmonetary goods. J Polit Econ 93(5):859–880

Hancock D (1986) A model of the financial firm with imperfect asset and deposit elasticities. J Bank Financ 10(1):37–54

Hancock D (1991) A theory of production for the financial firm. Kluwer Academic Publisher, Norwell

Hauner D (2005) Explaining efficiency differences among large German and Austrian banks. Appl Econ 37(9):969–980

Heise A (1992) Commercial banks in macroeconomic theory. J Post Keynesian Ec 14(3):285–296

Hjalmarsson L, Kumbhakar SC, Heshmati A (1996) DEA, DFA and SFA: a comparison. J Prod Anal 7(2–3):303–327

Humphrey DB (1985) Cost and scale economies in bank intermediation. In: Aspinwall RC (ed) Handbook for banking strategy. Wiley, New York, pp 745–783

Kaplan RS, Norton DP (1992) The balanced scorecard: measures that drive performance. Harvard Bus Rev 70(1):71–79

Klein MA (1971) A theory of the banking firm. J Money Credit Bank 3(2):205–218

Klimberg RK, Lawrence KD, Lawrence SM (2010) Data envelopment analysis is not multi-objective analysis. In: Lawrence KD, Kleinman G (eds) Applications on multi-criteria decision making, data envelopment analysis, and finance. Emerald, Bingley, pp 79–93

Kolari J, Zardkoohi A (1987) Bank costs, structure, and performance. Lexington books, Lexington

Kumar S, Gulati R (2008) Evaluation of technical efficiency and ranking of public sector banks in India: an analysis from cross-sectional perspective. Int J Prod Perform Manage 57(7):540–568

Kumar S, Gulati R (2009) Did efficiency of Indian public sector banks converge with banking reforms? Int Rev Econ 56(1):47–84

Leightner JE, Lovell CAK (1998) The Impact of financial liberalization on the performance of Thai banks. J Econ Bus 50(2):115–131

Leland HE, Pyle DH (1977) Informational asymmetries, financial structure, and financial intermediation. J Financ 32(2):371–387

Levine R (1992) Financial intermediary services and growth. Growth and development: new theory and evidence. J Jpn Int Econ 6(4):383–405

Lewis MK (1992) Modern banking in theory and practice. Rev Econ 43(2):203–227

Li X-B, Reeves GR (1999) A multiple criteria approach to data envelopment analysis. Eur J Oper Res 115(3):507–517

Longbrake WA (1974) Banks and bank holding companies. Financ Manag 3(4):10–24

Lovell CAK (1993) Production frontiers and productive efficiency. In: Fried HO, Lovell CAK, Schmidt SS (eds) The measurement of productive efficiency: techniques and applications. Oxford University Press, New York, pp 3–21

Löthgren M, Tambour M (1999) Productivity and customer satisfaction in Swedish pharmacies: a DEA network model. Eur J Oper Res 115(3):449–458

Maudos J, Pastor JM (2003) Cost and profit efficiency in the Spanish banking sector (1985–1996): a non-parametric approach. Appl Financ Econ 13(1):1–12

Merrick JJ Jr, Saunders A (1985) Bank regulation and monetary policy. J Money Credit Bank 17(4):691–717

Mester LJ (1996) A study of bank efficiency taking into account risk-preferences. J Bank Financ 20(6):1025–1045

Miller SM, Noulas AG (1996) The technical efficiency of large bank production. J Bank Financ 20(3):495–509

Neal P (2004) X-Efficiency and productivity change in Australian banking. Aust Econ Pap 43(2):174–191

Neely A, Gregory M, Platts K (2005) Performance measurement system design: a literature review and research agenda. Int J Oper Prod Manag 25(12):1228–1263

Noulas AG (2001) Deregulation and operating efficiency: the case of the Greek banks. Manage Financ 27(8):35–47

Paradi JC, Asmild M, Simak PC (2004) Using DEA and worst practice DEA in credit risk evaluation. J Prod Anal 21(2):153–165

Paradi JC, Zhu H (2013) A survey on bank branch efficiency and performance research with data envelopment analysis. Omega 41(1):61–79

Pasiouras F (2008) International evidence on the impact of regulations and supervision on banks’ technical efficiency: an application of two-stage data envelopment analysis. Rev Quant Financ Acc 30(2):187–223

Pastor J (2002) Credit risk and efficiency in the European banking system: a three-stage analysis. Appl Financ Econ 12(12):895–911

Piesse J, Townsend R (1995) The measurement of productive efficiency in UK building societies. Appl Financ Econ 5(6):397–407

Podinovski VV (1999) Side effects of absolute weight bounds in DEA models. Eur J Oper Res 115(1999):583–595

Porter ME (1985) Competitive advantage: creating and sustaining superior performance. Free Press, New York

Roll Y, Cook WD, Golany B (1991) Controlling factor weights in data envelopment analysis. IIE Trans 23(1):2–9

Sathye M (2001) X-efficiency in Australian banking: an empirical investigation. J Bank Financ 25(3):613–630

Schaffnit C, Rosen D, Paradi JC (1997) Best practice analysis of bank branches: an application of DEA in a large Canadian bank. Eur J Oper Res 98(2):269–289

Sealey CW, Lindley JT (1977) Inputs, outputs, and a theory of production and cost at depository financial institutions. J Financ 32(4):1251–1266

Seiford LM, Zhu J (1999) Profitability and marketability of the top 55 US commercial banks. Manag Sci 45(9):1270–1288

Seiford LM, Zhu J (2002) Modeling undesirable factors in efficiency evaluation. Eur J Oper Res 142(1):16–20

Sexton TR, Lewis HF (2003) Two-stage DEA: an application to major league baseball. J Prod Anal 19(2–3):227–249

Simons R (1995) Levers of control: how managers use innovative control systems to drive strategic renewal. Harvard Business School Press, Boston

Sturm J-E, Williams B (2004) Foreign bank entry, deregulation, and bank efficiency: lessons from the Australian experience. J Bank Financ 28(7):1775–1799

Swank J (1996) Theories of the banking firm: a review of the literature. Bull Econ Res 48(3):173–207

Thanassoulis E, Portela MC, Allen R (2004) Incorporating value judgments in DEA. In: Cooper WW, Seiford LW, Zhu J (eds) Handbook on data envelopment analysis. Kluwer Academic Publisher, Boston, pp 99–138

Thompson RG, Singleton FD Jr, Thrall RM, Smith BA (1986) Comparative site evaluations for locating a high-energy physics lab in Texas. Interfaces 16(6):35–49

Tobin J (1963) Commercial banks as creators of money. In: Carson D (ed) Banking and monetary studies, for the comptroller of the currency. Richard D Irwin, Homewood, pp 408–419

Tone K, Tsutsui M (2009) Network DEA: a slacks-based measure approach. Eur J Oper Res 197(1):243–252

Towey RE (1974) Money creation and the theory of the banking firm. J Financ 29(1):57–72

Weill L (2004) Measuring cost efficiency in European banking: a comparison of frontier techniques. J Prod Anal 21(2):133–152

Wheelock DC, Wilson PW (1995) Evaluating the efficiency of commercial banks: does our view of what banks do matter? Review (July/August), Federal Bank Reserve of St. Louis, pp 39–52

Acknowledgments

The authors would like to thank the two anonymous reviewers for their helpful and constructive comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ahn, H., Le, M.H. An insight into the specification of the input-output set for DEA-based bank efficiency measurement. Manag Rev Q 64, 3–37 (2014). https://doi.org/10.1007/s11301-013-0098-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11301-013-0098-9