Abstract

This article shows that if an allocation rule can be implemented with unlimited information certification, then it can also be implemented with limited information certification if the designer can use ambiguous communication mechanisms, and if agents are averse to ambiguity in the sense of maxmin expected utility. The reverse implication is true if there is a single agent and a worst outcome.

Similar content being viewed by others

Notes

Section 5 discusses which of our results extend to multiple agents.

The certifiability structure defined above could be deduced from any arbitrary message correspondence \(\mathcal {M}(t)\), \(t\in T\), by letting \(\mathcal {C}(t) \equiv \{ \mathcal {M}^{-1}(m) : m\in \mathcal {M}(t)\}\). The number of messages in \(\mathcal {M}(t)\) may be larger than in \(\mathcal {C}(t)\) because several messages in \(\mathcal {M}(t)\) may certify the same event in \(\mathcal {C}(t)\), but since we consider mechanisms with arbitrary sets of additional cheap talk messages, taking the certifiability structure as a primitive of the model is without loss of generality.

We could also define the normalized certifiability structure of \(\mathcal {C}\) by the smallest set of events including \(\mathcal {C}\) which is closed under intersection without affecting any of the results below.

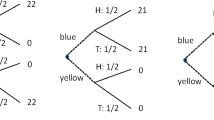

This mechanism is constructed such that the agent faces ambiguity at the first stage (report) and a decision problem under certainty at the last stage (certification). Therefore, consistent plans consist in choosing a report that maximizes the minimal expected utility given the designer’s ambiguous communication strategy and his anticipated certification decisions.

Notice that, in general, a deviation to a nondeterministic strategy for an ambiguity averse player may be beneficial while no pure strategy is; however, it is readily observed that the strategy of the agent in the mechanism considered in the proof of the proposition is still optimal if he can use non-deterministic strategies.

Equivalently, agent 2 can first reveal his type to the designer, who then sends messages \(m_1\) and \(m_2\) to agent 1 according to the previous ambiguous communication strategy. Thus, the mechanism described here is consistent with our definition of ambiguous mechanisms.

References

Ben-Porath, E., & Lipman, B. L. (2012). Implementation with partial provability. Journal of Economic Theory, 147(5), 1689–1724.

Bose, S., & Renou, L. (2014). Mechanism design with ambiguous communication devices. Econometrica, 82, 1853–1872.

Bull, J. (2008). Mechanism design with moderate evidence cost. The BE Journal of Theoretical Economics (Contributions) , 8(5)

Bull, J., & Watson, J. (2007). Hard evidence and mechanism design. Games and Economic Behavior, 58, 75–93.

Deneckere, R., & Severinov, S. (2008). Mechanism design with partial state verifiability. Games and Economic Behavior, 64(2), 487–513.

Di Tillio, A., Kos, N., & Messner, M. (2012). The Design of Ambiguous Mechanisms. mimeo.

Forges, F., & Koessler, F. (2005). Communication equilibria with partially verifiable types. Journal of Mathematical Economics, 41(7), 793–811.

Gilboa, I., & Schmeidler, D. (1989). Maxmin expected utility with non-unique prior. Journal of Mathematical Economics, 18(2), 141–153.

Glazer, J., & Rubinstein, A. (2001). Debates and decisions: on a rationale of argumentation rules. Games and Economic Behavior, 36(2), 158–173.

Glazer, J., & Rubinstein, A. (2004). On optimal rules of persuasion. Econometrica, 72(6), 1715–1736.

Green, J. R., & Laffont, J.-J. (1986). Partially verifiable information and mechanism design. Review of Economic Studies, 53(3), 447–456.

Kartik, N., & Tercieux, O. (2012). Implementation with evidence. Theoretical Economics, 7(2), 323–355.

Koessler, F., & Perez-Richet, E. (2014). Evidence Based Mechanisms. mimeo.

Lang, M., & Wambach, A. (2013). The fog of fraud—Mitigating fraud by strategic ambiguity. Games and Economic Behavior, 81, 255–275.

Lipman, B. L., & Seppi, D. (1995). Robust inference in communication games with partial provability. Journal of Economic Theory, 66, 370–405.

Lopomo, G., Rigotti, L., & Shannon, C. (2013) Uncertainty in mechanism design. mimeo.

Myerson, R. B. (1991). Game theory. Analysis of conflict. Massachusetts: Harvard University Press.

Riedel, F., & Sass, L. (2013) Ellsberg Games. Theory and Decision pp. 1–41.

Sher, I. (2011). Credibility and determinism in a game of persuasion. Games and Economic Behavior, 71(2), 409–419.

Sher, I., & Vohra, R. (2015). Price discrimination through communication. Theoretical Economics, 10, 597–648.

Singh, N., & Wittman, D. (2001). Implementation with partial verification. Review of Economic Design, 6(1), 63–84.

Siniscalchi, M. (2011). Dynamic choice under ambiguity. Theoretical Economics, 6(3), 379–421.

Strausz, R. (2016) Mechanism Design with Partially Verifiable Information. mimeo.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank Eduardo Perez-Richet, Regis Renault, Ludovic Renou, Joel Watson, two anonymous referees, and participants at the Paris Game Theory Seminar (IHP), the workshop on “Ambiguity in Games and Mechanisms” at PSE, and the conference “Mathematical Aspects of Game Theory and Applications” at Roscoff for useful comments and discussions. Mehdi Ayouni thanks the Labex MME-DII (ANR11-LBX-0023-01) and the French National Research Agency (ANR AmGames) for the financial support. Frédéric Koessler thanks the French National Research Agency (ANR AmGames and ANR-10–LABX93-01) for the financial support.

Rights and permissions

About this article

Cite this article

Ayouni, M., Koessler, F. Hard evidence and ambiguity aversion. Theory Decis 82, 327–339 (2017). https://doi.org/10.1007/s11238-016-9575-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-016-9575-7