Abstract

Generally, inequality indices play a basic role in the analysis of welfare economics, also appearing as technical tools applied to income data. A good deal of findings in this research field is provided by the Gini coefficient, typically used for non-negative income values. Even if negative income is often an unfamiliar concept, its presence in real surveys may lead to difficulty in applying the classical Gini-based inequality measures, as they lie outside their standard ranges. In this paper, the more general issue of negative values is considered and a reformulation of the main Gini-based inequality measures adjusted for the problem of negative values is adopted with the purpose of providing theoretical extensions for the income decomposition approach by both income sources and area components. Investigations about the related inferential issues, conducted thorough simulation studies based on resampling techniques, highlight how the traditional approach of removing negative income values may yield different results in terms of inequality estimation, proving that the proposed approach, based on preserving negative values, is the more appropriate practice to follow to avoid the loss of data that really provide a coherent picture of the inequality condition.

Similar content being viewed by others

Notes

Negative values may also arise when dealing with non-monetary attributes. For this reason, the normalisation introduced in Raffinetti et al. (2015) is relevant to both methodologists interested in index construction and applied researchers interested in using derived measures. An example of its usefulness in real-life datasets can be found in a recent contribution of Malý (2016), where the normalisation is applied to negative demographic and territorial attributes.

Note that the weights \(p_i\) and N may be non-integers.

We observe that \(T^{+}_{Y}+T^{-}_{Y}=\sum \nolimits ^{H}_{i=1}|y_i|p_i\).

This decomposition is also used by Kakwani and Lambert (1998) to assess the redistribution effects of taxes.

The distribution of Y and its average also change when the negative values of a sources are replaced by zeros.

If the total income Y is considered, it would be enough to replace the subscript Z with the subscript Y in Eq. (10).

As Dagum (1997) shows, the term \({\varDelta }^{GB}_{Z}\) could be further split into the between and transvariation components. The former depends on the averages of a and b, and the latter (e.g., Gini 1916; Dagum 1959, 1961) arises from the fact that the income differences are of opposite signs compared to the difference in their corresponding mean incomes.

In so doing, the weight represents the number of equivalent components in the family (given by the scale) and the representativeness of the sampled family with respect to the Italian population.

\(N=\sum \nolimits ^{H}_{i=1}p_i\) = 18105.25 is lower than the total number of persons in SHIW, which is 20022.

The density functions are plotted by the Gaussian smoothing kernel. Incomes are expressed in equivalent terms.

If the confidence intervals do not overlap, the null hypothesis that the two differences are equal is a fortiori rejected according to the test size of the complement at one of the confidence levels.

We stress that preliminary analyses on the \({\varDelta }\)’s of the considered indices allow us to further reject the equality hypothesis of the differences for the ratio and in most cases for the simple differences. These results are available on request.

References

Angrist, J., & Pischke, J. S. (2010). The credibility revolution in empirical economics: How better research design is taking the con out of econometrics. Journal of Economic Perspectives, 24(2), 3–30.

Banca d’Italia. (2012). Survey of household income and wealth (SHIW) of the Bank of Italy in 2012. http://www.bancaditalia.it/statistiche/tematiche/indagini-famiglie-imprese/bilanci-famiglie/index.html.

Bellú, L. G., & Liberati, P. (2006). Policy impact on inequality. Decomposition of income inequality by income sources. EASYPol for the Food and Agriculture Organization of the United Nations, FAO. http://www.fao.org/docs/up/easypol/446/decomp_inequlty_by_source_053en.

Berebbi, Z. M., & Silber, J. (1985). The Gini coefficient and negative income: A comment. Oxford Economic Papers, 37(3), 525–526.

Burkhauser, R. V., Larrimore, J., & Simon, K. (2013). Measuring the impact of health insurance on levels and trends in inequality and how the affordable care act of 2010 could affect them. Contemporary Economic Policy, 3(4), 779–794.

Cavalcanti Ferreira, P., & Pereira Gomes, D. B. (2015). Heterogeneity of initial assets and wealth inequality. Economics Working Papers, No. 768 (Ensaios Economicos da EPGE) from FGV/EPGE Escola Brasileira de Economia e Finanças, Getulio Vargas Foundation (Brazil). http://bibliotecadigital.fgv.br/dspace/bitstream/handle/10438/13886/Heterogeneity-of-Initial-Assets-and-WealthInequality;jsessionid=A378E0327C44851685C4E2E38624B853?sequence=3.

Chen, C. N., Tsaur, T. W., & Rhai, T. S. (1982). The Gini coefficient and negative income. Oxford Economic Papers, 34(3), 473–478.

Dagum, C. (1959). Transvariazione fra più di due distribuzioni. In C. Gini (Ed.), Memorie di metodologia statistica (Vol. II). Roma: Libreria Goliardica (in Italian).

Dagum, C. (1961). Transvariacion en la hipotesis de varaibles aleatorias normales multidimensionales. Proceedings of the International Statistical Institute, 38(4), 473–486 (in Spanish).

Dagum, C. (1997). A new approach to the decomposition of the Gini income inequality ratio. Empirical Economics, 22, 515–531.

Fei, J. C. H., Ranis, G., & Kuo, S. W. Y. (1978). Growth and the family distribution of income by factor components. The Quarterly Journal of Economics, 92(1), 17–53.

Fei, J. C. H., Ranis, G., & Kuo, S. W. Y. (1979). Growth with equity: The Taiwan case. London: Oxford University Press.

Feng, S., Burkhauser, R. V., & Butler, J. S. (2006). Levels and long-term trends in earnings inequality: Overcoming current population survey censoring problems using the GB2 distribution. Journal of Business & Economic Statistics, 24(1), 57–62.

Frick, J. R., Goebel, J., Schechtman, E., Wagner, G. G., & Yitzhaki, S. (2006). Using analysis of Gini (ANOGI) for detecting whether two subsamples represent the same universe. The German Socio-Economic Panel Study (SOEP) Experience. The German Socio-Economic Panel Study (SOEP) Experience. Sociological Methods Research, 34(4), 427–468.

Gini, C. (1916). Il concetto di transvariazione e le sue prime applicazioni. Giornale degli Economisti e Rivista di Statistica (pp. 21–44). Athenaeum (in Italian).

Gornick, J. C., & Milanovic, B. (2015). Income inequality in the United States in cross-national perspective: Redistribution revisited. LIS Center Research Brief, No. 1. https://www.gc.cuny.edu/CUNY_GC/media/CUNY-GraduateCenter/PDF/Centers/LIS/LIS-Center-Research-Brief-1-2015.

Kakwani, N., & Lambert, P. J. (1998). On measuring inequality in taxation: A new approach. European Journal of Political Economy, 14, 369–380.

Lambert, P. J., & Yitzhaki, S. (2013). The inconsistency between measurement and policy instruments in family income taxation. FinanzArchiv: Public Finance Analysis, 69(3), 241–255.

Malý, J. (2016). Impact of polycentric urban systems on intra-regional disparities: A micro-regional approach. European Planning Studies, 24(1), 116–138.

Mussard, S., Alperin, P. M. N., Seyte, F., & Terraza, M. (2006). Extensions of Dagum’s Gini decomposition. Statistica & Applicazioni, IV, 5–29.

Podder, N. (1993). The disaggregation of the Gini coefficient by factor components and its applications to Australia. Review of Income and Wealth, 39(1), 51–61.

Podder, N., & Chatterjee, S. (2002). Sharing the national cake in post reform New Zealand: Income inequality trends in terms of income sources. Journal of Public Economics, 86(1), 1–27.

Pyatt, G., Chen, C., & Fei, J. (1980). The distribution of income by factor components. The Quarterly Journal of Economics, 95(3), 451–473.

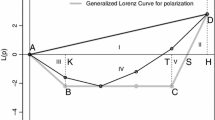

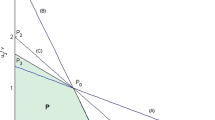

Raffinetti, E., Siletti, E., & Vernizzi, A. (2015). On the Gini coefficient normalization when incomes with negative values are considered. Statistical Methods & Applications, 24(3), 507–521.

Rao, V. M. (1969). Two decompositions of concentration ratio. Journal of the Royal Statistical Society-Series A (General), 132(3), 418–425.

Sandovall, H. H., & Urzúa, C. M. (2009). Negative net incomes and the measurement of poverty: A note. Journal of Management, Finance and Economics, 3(1), 29–36.

Silber, J. (1989). Factor components, population subgroups and the computation of the Gini index of inequality. The Review of Economics and Statistics, 71(1), 107–115.

Schutz, R. R. (1951). On the measurement of the income inequality. The American Economic Review, 41(1), 107–122.

van de Ven, J., & Creedy, J. (2005). Taxation, reranking and equivalence scales. Bulletin of Economic Research, 57(1), 13–36.

Yitzhaki, S. (2003). Gini’s mean difference: A superior measure of variability for non-normal distributions. Metron, 61(2), 285–316.

Yitzhaki, S. (2015). Gini’s mean difference offers a response to Leamer’s critique. Metron, 73(1), 31–43.

Acknowledgments

We are thankful to Maria Giovanna Monti for her support and suggestions at an early stage of the research proposed in the paper. Usual disclaimers are applied.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Raffinetti, E., Siletti, E. & Vernizzi, A. Analyzing the Effects of Negative and Non-negative Values on Income Inequality: Evidence from the Survey of Household Income and Wealth of the Bank of Italy (2012). Soc Indic Res 133, 185–207 (2017). https://doi.org/10.1007/s11205-016-1354-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-016-1354-x