Abstract

We use the recent financial crisis to investigate financing constraints of private small and medium-sized enterprises (SMEs) in Belgium. We hypothesize that SMEs with a large proportion of long-term debt maturing at the start of the crisis had difficulties to renew their loans due to the negative credit supply shock, and hence could invest less. We find a substantial variation in the maturity structure of long-term debt. Firms which at the start of the crisis had a larger part of their long-term debt maturing within the next year experienced a significantly larger drop in investments in 2009. This effect is driven by firms which are ex ante more likely to be financially constrained. Consistent with a causal effect of a credit supply shock to corporate investments, we find no effect in “placebo” periods without a negative credit supply shock.

Similar content being viewed by others

Notes

This survey is addressed to senior loan officers of a representative sample of Euro area banks and is conducted four times a year. Detailed information on the survey and its results are available at: http://www.ecb.int/stats/money/surveys/lend/html/index.en.html.

Detailed information on the survey and its results are available at: http://www.ecb.int/stats/money/surveys/sme/html/index.en.html.

The net percentage of tightening of credit standards is the percentage of banks reporting a tightening minus the percentage of banks who reported they eased credit standards. See http://www.ecb.int/stats/money/surveys/lend/html/index.en.html for a further discussion of this issue.

Data refer to the nonfinancial business economy (NACE C–I, K) and represent estimates for 2008.

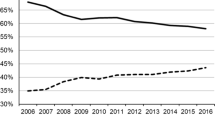

Own calculations based on the Belfirst database used for this study (see Sect. 4.1 for more information). Firms in financial and public sectors are excluded.

We thank an anonymous reviewer for this insight.

Managers of not-for-profit organizations and governmental enterprises may be influenced by government regulation and may have less discretion concerning investments (Smith 1986).

A firm has to deposit the complete format if it has more than 100 employees or if it satisfies at least two of the following criteria: number of employees (yearly average) of at least 50, turnover (value-added tax excluded) of at least 7,300,000 Euro and total assets of at least 3,650,000 Euro (article 15 from Wetboek van Vennootschappen).

Firms with negative equity which have continuous reported losses are likely to be financially distressed. While this will significantly impact their access to external finance, it is not the focus of our study.

We used the Hausman test to determine whether to use fixed-effects or random-effects model.

Percentages on gross capital formation reported in the annual reports of the National Bank of Belgium, available at http://www.nbb.be/pub/06_00_00_00_00/06_02_00_00_00/06_02_06_00_00/06_02_06_2001.htm?l=en.

See Heyman et al. (2008) for an analysis of the determinants of the debt ratio and debt maturity for a sample of Belgian SMEs.

Young firms also tend to be more financially constrained than older firms (Hadlock and Pierce 2010). However, since most of the firms in our sample are fairly mature firms, age is not a useful measure for financing constraints in this research.

References

Almeida, H., Campello, M., Laranjeira, B., & Weisbenner, S. (2012). Corporate debt maturity and the real effects of the 2007 credit crisis. Critical Finance Review, 1(1), 3–58.

Audretsch, D. B., & Elston, J. A. (1997). Financing the German Mittelstand. Small Business Economics, 9(2), 97–110.

Barclay, M. J., & Smith, C. W. J. (1995). The maturity structure of corporate debt. Journal of Finance, 50(2), 609–631.

Beck, T., Demirgüç-Kunt, A., & Maksimovic, V. (2008). Financing patterns around the world: Are small firms different? Journal of Financial Economics, 89, 467–487.

Berger, A. N., Espinosa-Vega, M. A., Frame, W. S., & Miller, N. H. (2005). Debt maturity, risk, and asymmetric information. Journal of Finance, 60, 2895–2923.

Berger, A. N., & Udell, G. F. (1998). The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance, 22, 613–673.

Campello, M., Graham, J. R., & Harvey, C. R. (2010). The real effects of financial constraints: Evidence from a financial crisis. Journal of Financial Economics, 97(3), 470–487.

Chava, S., & Purnanandam, A. (2011). The effect of banking crisis on bank-dependent borrowers. Journal of Financial Economics, 99(1), 116–135.

Dendooven, P. (2008, 24 November). Een gewoon weekend van 3,5 miljard. De Standaard.

Duchin, R., Ozbas, O., & Sensoy, B. A. (2010). Costly external finance, corporate investment, and the subprime mortgage credit crisis. Journal of Financial Economics, 97(3), 418–435.

European Commission. (2003). Commission Recommendation concerning the definition of micro, small and medium-sized enterprises. Official Journal of the European Union, 203/361/EC.

European Commission—Enterprise and Industry. (2009). Small Business Act (SBA) Fact Sheet Belgium. http://ec.europa.eu/enterprise/policies/sme/facts-figures-analysis/performance-review/pdf/final/sba_fact_sheet_belgium_en.pdf. Accessed February 2011.

Fazzari, S. M., Hubbard, R. G., & Petersen, B. C. (1988). Financing constraints and corporate investment. Brookings Papers on Economic Activity, 19(1), 141–195.

Febelfin. (2008). Statistisch vademecum van de banksector 2007. http://www.febelfin.be/export/sites/default/febelfin/pdf/nl/publicaties/vademecum/VM2007NL.pdf. Accessed July 2011.

Febelfin (2009). Statistisch vademecum van de banksector 2008. http://www.febelfin.be/export/sites/default/febelfin/pdf/nl/publicaties/vademecum/VM2008NL.pdf. Accessed July 2011.

Greenwood, R., Hanson, S., & Stein, J. C. (2010). A gap-filling theory of corporate debt maturity choice. Journal of Finance, 65(3), 993–1028.

Guedes, J., & Opler, T. (1996). The determinants of the maturity of corporate debt issues. Journal of Finance, 51(5), 1809–1833.

Hadlock, C. J., & Pierce, J. R. (2010). New evidence on measuring financial constraints: moving beyond the KZ Index. Review of Financial Studies, 23(5), 1909–1940.

Heyman, D., Deloof, M., & Ooghe, H. (2008). The financial structure of private held Belgian firms. Small Business Economics, 30, 301–313.

Holmstrom, B., & Tirole, J. (1997). Financial intermediation, loanable funds, and the real sector. Quarterly Journal of Economics, 112(3), 663–691.

Hyytinen, A., & Väänänen, L. (2006). Where do financial constraints originate from? An Empirical analysis of adverse selection and moral hazard in capital markets. Small Business Economics, 27, 323–348.

Jaffee, D., & Russell, T. (1976). Imperfect information, uncertainty, and credit rationing. Quarterly Journal of Economics, 90(4), 651–666.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Kenniscentrum voor Financiering van KMO. (2009). Rapport Kredietverlening: 4e kwartaal 2008. http://www.cefip.be/files/Documenten/NL/2008%20Q4_NL.pdf. Accessed May 2011.

Khwaja, A. I., & Mian, A. (2008). Tracing the impact of bank liquidity shocks: Evidence from an emerging market. American Economic Review, 98, 1413–1442.

Lemmon, M., & Roberts, M. R. (2010). The response of corporate financing and investment to changes in the supply of credit. Journal of Financial & Quantitative Analysis, 45(3), 555–587.

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. American Economic Review, 48, 261–297

Mooijman, R. (2008, 28 October). 31,2 miljard euro. De Standaard.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investers do not have. Journal of Financial Economics, 13(2), 187–221.

Nationale Bank van België. (2009). Verslag 2008, Economische en financiële ontwikkeling. http://www.nbb.be/doc/ts/Publications/NBBreport/2008/NL/T1/verslag2008_T1.pdf. Accessed June 2011.

Ortiz-Molina, H., & Penas, M. F. (2008). Lending to small businesses: The role of loan maturity in addressing information problems. Small Business Economics, 30, 361–383.

Peek, J., & Rosengren, E. S. (2000). Collateral damage: Effects of the Japanese bank crisis on real activity in the United States. American Economic Review, 90(1), 30–45.

Rommens, A., Cuyvers, L., & Deloof, M. (forthcoming). Dividend policies of privately held companies: Stand-alone and group companies in Belgium. European Financial Management. doi:10.1111/j.1468-036X.2010.00554.x

Smith, C. W. J. (1986). Investment banking and the capital acquisition process. Journal of Financial Economics, 15, 3–29.

Stiglitz, J. E., & Weiss, A. (1981). Credit rationing in markets with imperfect information. American Economic Review, 71, 393–410.

Sufi, A. (2009). The real effects of debt certification: Evidence from the introduction of bank loan ratings. Review of Financial Studies, 22(4), 1659–1691.

TNL/Belga. (2008, 15 April). Ratinghuis Fitch somber over Belgische banken. De Standaard.

Whited, T. M. (1992). Debt, liquidity constraints, and corporate investment: Evidence from Panel data. Journal of Finance, 47, 1425–1460.

Acknowledgments

We are grateful to Jan Annaert, Katrien Craninckx, Marc De Ceuster, Marc Jegers, Armin Schwienbacher and two anonymous reviewers for helpful comments and suggestions. The paper has also benefitted from presentations at the Belgian Entrepreneurship Research Day in Louvain-La-Neuve, the Belgian Financial Research Forum in Antwerp and the Doctoral Research Day at the University of Antwerp.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Vermoesen, V., Deloof, M. & Laveren, E. Long-term debt maturity and financing constraints of SMEs during the Global Financial Crisis. Small Bus Econ 41, 433–448 (2013). https://doi.org/10.1007/s11187-012-9435-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-012-9435-y