Abstract

A growing body of literature studies the effects of aspiration levels on people’s choices. Researchers often assume an aspiration level at zero, which helps to explain several empirical phenomena. In two experiments, we test this assumption. Our experimental design exploits the discontinuity in the utility function at the aspiration level. The lotteries vary in complexity in terms of the number of outcomes and the use of round or non-round probabilities. We do not find support for an aspiration level at zero, neither for simple lotteries nor for complex lotteries. Overall, our aggregate results are consistent with prospect theory, but can also be explained by a population with heterogeneous aspiration levels instead of a homogeneous aspiration level at zero.

Similar content being viewed by others

Notes

See also Castagnoli and LiCalzi (2006), who formulate a theory of target-based decision making and show that this approach satisfies the Savage axioms that underlie the Expected Utility Theorem.

Under PT, risk attitude is described by the value function and probability weighting function. In this paper we address only the value function.

Wang and Johnson (2012) also use this strategy, and they find support for multiple reference points. In the experiments in which they shift lotteries, they prime subjects with reference points by instructing subjects that, e.g., an outcome less than zero is considered as a ‘failure.’

Because of the utility function’s discontinuity, certainty equivalence in the aspiration level model is not well defined everywhere. The CE in our context is defined as the minimum certain amount of money that is (weakly) preferred to the lottery.

The actual experiment had four parts. Each of the two parts presented in this section had a counterpart with large but hypothetical outcomes. For the sake of focus, we only discuss the parts with small outcomes. The results of the other parts are very similar and are reported in Appendix 2 of the Online Supplementary Materials.

We did not expect any order effects between the parts, which is the reason why we did not change the order between sessions. Within each part we randomized the questions because we did not want to make it salient to subjects that we shifted the lotteries. This also encouraged subjects to pay attention to every question.

Very few subjects made multiple switches. For these choices, we take the midpoint between the first and the last switch to determine the certainty equivalent and risk attitude. The results are robust to excluding these choices.

For instance, if the expected value of a lottery is 14, and the subject indicates to prefer the sure amount of 14 to the lottery, but prefers the lottery to a sure amount of 13, this person could be risk-neutral (and therefore indifferent between 14 for sure or the lottery) or risk-averse (and strictly prefer 14 for sure to the lottery). We classify this person as risk-neutral. Note that this may result in an overestimation of the fraction of risk-neutral people, but in any case, people classified as risk-neutral are at most very mildly risk-seeking or risk-averse.

We excluded these very few choices from the analysis.

Note that the high fraction of risk-neutral subjects is possibly due to the way in which we classify risk attitudes. See also footnote 10.

Nonparametric McNemar tests for related samples (two-tailed tests with a correction for continuity).

We cannot compare the risk attitudes between the lotteries with small shifts and the other lotteries. We gave subjects a list of sure integer amounts of money. This means that the expected value of the lotteries with small shifts (9.5 and 10.5) fell between two sure amounts. When this is the case, a risk-neutral subject has a unique switching point. For instance, when the expected value is 9.5, a risk-neutral person prefers the lottery to a sure amount of 9, and prefers a sure amount of 10 to the lottery. By contrast, for lotteries with an expected value that is equal to an integer, a risk-neutral person may switch at any one of two points. For instance, when the expected value is 9, a risk-neutral person may switch to the sure amount when the sure amount is either 9 or 10, because the person is indifferent between a sure amount of 9 and the lottery. We therefore look at the CEs instead.

At the individual level we find some violations of monotonicity. Compared with the baseline lottery, 18 of the 48 subjects report a higher CE for L − 0.5,19.5; for 5 of them, this difference is strictly greater than €2. Also, 13 subjects report a lower CE for \( {L}_{0.5,19.5} \); for 4 of these subjects, the difference is strictly greater than €2. Such violations of dominance for small changes in outcomes have been found elsewhere; see, for example, Bateman et al. (2007) and Mellers et al. (1992).

The fact that the CEs for these three lotteries are so similar is consistent with prospect theory, but also with other theories. For instance, one feature of the Priority Heuristic (Brandstätter et al. 2006) is that people stop examining differences between lotteries if the lotteries are perceived as very similar.

Using the medians instead of means gives very similar results.

Note that monotonicity is not violated for the 2-outcome lotteries, but sometimes it is violated for 3- and 5-outcome lotteries. This is not too surprising, given that the increments of the shifts are small (€0.5) and questions were randomized within each block of lotteries.

The classical study by Payne et al. (1980) shows that a uniform translation of all outcomes can lead to a dramatic reversal of choices. When subjects are asked to choose between GI′ = (55, 0.6; 25, 0.1; −35, 0.3) and GII′ = (33, 0.5; 25, 0.3; 5, 0.2), 86 % of them choose GII′. However, when all outcomes are shifted by −50 and subjects are asked to choose between GI″ = (5, 0.6; −25, 0.1; −85, 0.3) and GII″ = (−17, 0.5; −25, 0.3; −45, 0.2), the results are reversed and 86 % choose GI″ (see their Table 4, p. 1048). This is typically interpreted as evidence for an aspiration level at zero. Indeed this is one possible explanation for the observed reversal of choices. However, notice that an aspiration level anywhere in the range [−17,5] explains the results just as well. Moreover, aspiration levels may be heterogeneous across subjects within this range. A relatively large range for the aspiration level is also obtained in experiments in which subjects are allowed to add a certain amount (e.g. $10) to one of the outcomes. Venkatraman et al. (2014) find that subjects tend to choose to add the amount to the middle outcome of 0, which indicates a possible aspiration level in the range [0, 10].

The values of the CEs are based on the parameters and functional forms described in Tversky and Kahneman (1992). We do use a slightly lower value for the loss aversion parameter (λ is set at 1.75 instead of 2.25) to yield a better fit with the data.

References

Abdellaoui, M., Bleichrodt, H., & L’Haridon, O. (2008). A tractable method to measure utility and loss aversion under prospect theory. Journal of Risk and Uncertainty, 36(3), 245–266.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2006). Elicitation using multiple price list formats. Experimental Economics, 9(4), 383–405.

Bateman, I., Dent, S., Peters, E., Slovic, P., & Starmer, C. (2007). The affect heuristic and the attractiveness of simple gambles. Journal of Behavioral Decision Making, 20(4), 365–380.

Baucells, M., & Villasís, A. (2010). Stability of risk preferences and the reflection effect of prospect theory. Theory and Decision, 68(1–2), 193–211.

Binswanger, H. P. (1980). Attitudes toward risk: experimental measurement in rural India. American Journal of Agricultural Economics, 3, 395.

Binswanger, H. P. (1981). Attitudes towards risk: theoretical implications of an experiment in rural India. Economic Journal, 364, 867–890.

Birnbaum, M. H., Coffey, G., Mellers, B., & Weiss, R. (1992). Utility measurement: configural-weight theory and the judge’s point of view. Journal of Experimental Psychology: Human Perception and Performance, 18, 331–346.

Brandstätter, E., Gigerenzer, G., & Hertwig, R. (2006). The priority heuristic: making choices without trade-offs. Psychological Review, 113(2), 409–432.

Camerer, C. F. (1989). An experimental test of several generalized utility theories. Journal of Risk and Uncertainty, 2(1), 61–104.

Camerer, C. F., Babcock, L., Loewenstein, G., & Thaler, R. (1997). Labor supply of New York City cabdrivers: one day at a time. The Quarterly Journal of Economics, 112(2), 407–441.

Castagnoli, E., & LiCalzi, M. (2006). Expected utility without utility. Theory and Decision, 41, 281–301.

Diecidue, E., & van de Ven, J. (2008). Aspiration level, probability of success and failure, and expected utility. International Economic Review, 49(2), 683–700.

Ert, E., & Erev, I. (2011). On the descriptive value of loss aversion in decisions under risk. Mimeo.

Etchart-Vincent, N., & L’Haridon, O. (2011). Monetary incentives in the loss domain and behavior toward risk: an experimental comparison of three reward schemes including real losses. Journal of Risk and Uncertainty, 42(1), 61–83.

Fehr-Duda, H., Bruhin, A., Epper, T., & Schubert, R. (2010). Rationality on the rise: why relative risk aversion increases with stake size. Journal of Risk and Uncertainty, 40(2), 147–180.

Fellner, G., Werner G., & Boris M. (2009). Satisficing in financial decision making—a theoretical and experimental approach to bounded rationality. Journal of Mathematical Psychology 53(1), 26–33.

Hoffmann, A. O., Henry, S. F., & Kalogeras, N. (2013). Aspirations as reference points: an experimental investigation of risk behavior over time. Theory and Decision, 75(2), 193–210.

Levy, H., & Levy, M. (2009). The safety first expected utility model: experimental evidence and economic implications. Journal of Banking & Finance, 33(8), 1494–1506.

Lopes, L. (1987). Between hope and fear: the psychology of risk. Advances in Experimental Social Psychology, 20, 255–295.

Lopes, L., & Oden, G. (1999). The role of aspiration level in risky choice: a comparison of cumulative prospect theory and SP/A theory. Journal of Mathematical Psychology, 43(2), 286–313.

Mellers, B., Weiss, R., & Birnbaum, M. (1992). Violations of dominance in pricing judgments. Journal of Risk and Uncertainty, 5(1).

Pahlke, J., Kocher, M. G., & Trautmann, S. (2013). Tempus fugit: time pressure in risky decisions. Management Science, 59(10), 2380–2391.

Payne, J. W. (2005). It is whether you win or lose: the importance of the overall probabilities of winning or losing in risky choice. Journal of Risk and Uncertainty, 30(1), 5–19.

Payne, J. W., Laughhunn, D. J., & Crum, R. (1980). Translation of gambles and aspiration level effects in risky choice behavior. Management Science, 26(10), 1039–1060.

Payne, J. W., Laughhunn, D. J., & Crum, R. (1981). Further tests of aspiration level effects in risky choice behavior. Management Science, 27(8), 953–958.

Roy, A. D. (1952). Safety first and the holding of assets. Econometrica, 20(3), 431–449.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Venkatraman, V., Payne, J. W., Bettman, J. R., Luce, M., & Huettel, S. A. (2009). Separate neural mechanisms underlie choices and strategic preferences in risky decision making. Neuron, 62(4), 593–602.

Venkatraman, V., Payne, J. W., & Huettel, S. A. (2014). An overall probability of winning heuristic for complex risky decisions: choice and eye fixation evidence. Organizational Behavior and Human Decision Processes, 125(2), 73–87.

Wakker, P. P. (2010). Prospect Theory for Risk and Ambiguity. Cambridge: Cambridge University Press.

Wang, X. T., & Joseph, G. J. (2012). A tri-reference point theory of decision making under risk. Journal of experimental psychology: general, 141(4), 743.

Weber, M., & Camerer, C. F. (1998). The disposition effect in securities trading: an experimental analysis. Journal of Economic Behavior & Organization, 33(2), 167–184.

Weber, E. U., Anderson, C. J., & Birnbaum, M. H. (1992). A theory of perceived risk and attractiveness. Organizational Behavior and Human Decision Processes, 52(3), 492–523.

Zeisberger, S. (2014a). Do investors care explicitly about loss probabilities? Mimeo.

Zeisberger, S. (2014). Is it really whether you win or lose? To what extent is the focus on the overall gain and loss probability in risky choice? Presentation at the FUR conference, 2014, Rotterdam.

Zeisberger, S., Langer, T., & Weber, M. (2012). Why does myopia decrease the willingness to invest? Is it myopic loss aversion or myopic loss probability aversion? Theory and Decision, 72(1), 35–50.

Acknowledgments

We are very grateful to Fabiano Prestes and Elad Vardi for programming the experiment, and Alexander Schram for research assistance. We thank the Editor (Kip Viscusi), an anonymous referee, Jeeva Somasundaram, Stefan Trautmann, Peter Wakker, and Stefan Zeisberger for detailed comments that substantially improved the paper.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

ESM 1

(PDF 795 kb)

Appendix: Classification of subjects

Appendix: Classification of subjects

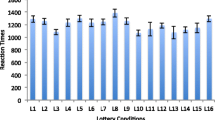

This appendix describes our procedure for classifying subjects. The individual certainty equivalent (CE) for a question is determined as described in the main text. We normalized the certainty equivalent of a subject to (CE-y)/(x-y) and interpret the probabilities of the high outcome as utilities. The first step is to eliminate subjects that show strong violations of monotonicity. A subject is classified as violating monotonicity if on five or more occasions the associated probability decreased by 0.15 or more as the CE increased, or if on three or more occasions the associated probability decreased by 0.30 or more as the CE increased. The second step identified the remaining subjects as risk-neutral if in at least 14 out of the 19 questions the probability was at most 0.10 away from the expected value. The third step identified the remaining subjects as having an aspiration level if there were four (or more) consecutive choices for which the CEs were within a bandwidth of 0.50. The fourth step identified the remaining subjects as risk-averse if in at least 14 out of the 19 questions the CE was below the expected value. All subjects that could not be classified are, together with those that showed violations of monotonicity, grouped as mixed. The resulting classification is shown in the figures below.

Rights and permissions

About this article

Cite this article

Diecidue, E., Levy, M. & van de Ven, J. No aspiration to win? An experimental test of the aspiration level model. J Risk Uncertain 51, 245–266 (2015). https://doi.org/10.1007/s11166-015-9229-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-015-9229-0