Abstract

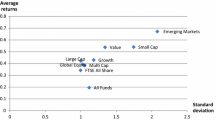

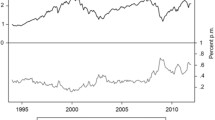

This paper examines the interaction of idiosyncratic risk, liquidity and return across time in determining fund performance, as well as across investment style portfolios of European mutual funds. This study utilizes a unique data set including returns for equity mutual funds registered in six European countries. Overall, using monthly data, we find that both liquidity and idiosyncratic risk are relevant in determining mutual fund returns. Our results are robust across different model specifications. We show that model specifications up to six factors are useful as these risk factors capture different aspects in the cross-section of mutual funds returns. The evidence regarding mutual funds subgroups is strongly in favor of the significance of liquidity, and idiosyncratic risk to a lesser extent, as risk factors. Even if liquidity and idiosyncratic risk are considered at the same time, one factor is not significantly decreasing the importance of the other factor.

Similar content being viewed by others

Notes

See European Fund and Asset Management Association (EFAMA) 2012 annual statistics. We exclude Luxemburg as it is considered an offshore centre, as a result of fiscal advantages.

Source: Lipper, a Thomson Reuters company.

Returns on low-price stocks are influenced by the minimum tick of $1/8 (see Harris 1994), which adds noise to the estimations. Prices are converted to euros before the introduction of the currency.

References

Acharya V, Pedersen LH (2005) Asset pricing with liquidity risk. J Financ Econ 77:375–410

Amihud Y (2002) Illiquidity and stock returns: cross-section and time-series effects. J Financ Mark 5:31–56

Angelidis T, Andrikopoulos A (2010) Idiosyncratic risk, returns and liquidity in the London Stock Exchange: a spillover approach. Int Rev Financ Anal 19:214–221

Avramov D, Chordia T (2006) Asset pricing models and financial market anomalies. Rev Financ Stud 19:1001–1040

Baker M, Stein J (2004) Market liquidity as a sentiment indicator. J Financ Mark 7:271–299

Bali T, Nusret C, Xuemin Y, Zhe Z (2005) Does idiosyncratic risk really matter? J Financ 60:905–929

Banz RW (1981) The relative efficiency of various portfolios: some further evidence: discussion. J Financ 32:663–682

Biktimirov E, Li B (2014) Asymmetric stock price and liquidity responses to changes in the FTSE Small Cap index. Rev Quant Financ Acc 42:95–122

Brunnermeier MK, Pedersen LH (2009) Market liquidity and funding liquidity. Rev Financ Stud 22:2201–2238

Campbell JY, Martin L, Malkiel BG, Xu Y (2001) Have individual stocks become more volatile? An empirical exploration of idiosyncratic risk. J Financ 56:1–43

Carhart M (1997) On persistence in mutual fund performance. J Financ 52:57–82

Chiu J, Chung H, Ho K (2014) Fear sentiment, liquidity, and trading behavior: evidence from the index ETF market. Rev Pac Basin Financ Mark Polic 17:1–25

Chordia T, Subrahmanyam A, Anshuman VR (2001) Trading activity and expected stock returns. J Financ Econ 59:3–32

Dong X, Feng S, Sadka R (2012) Does liquidity beta predict mutual-fund alpha? Working Paper

Dybvig PH, Stephen AR (1985) The analytics of performance measurement using a security market line. J Financ 40:401–416

Elton E, Gruber M, Blake C (1995) Fundamental economic variables, APT, and bond fund performance. J Financ 50:1229–1256

Elton EJ, Gruber MJ, Blake CR (1996) The persistence of risk-adjusted mutual fund performance. J Bus 69:133–157

Fama EF, French K (1992) The cross-section of expected stock returns. J Financ 47:427–465

Fama EF, French K (1993) Common risk factors in the return on stocks and bonds. J Financ Econ 33:3–56

Fama EF, French K (1996) Multifactor explanations of asset pricing anomalies. J Financ 51:55–84

Fama E, MacBeth J (1973) Risk, return, and equilibrium: empirical tests. J Polit Econ 81:607–636

Fu F (2009) Idiosyncratic risk and the cross-section of expected stock returns. J Financ Econ 91:24–37

Goyal A, Santa-Clara P (2003) Idiosyncratic risk matters! J Financ 58:975–1008

Grinblatt M, Titman S (1989a) Mutual fund performance: an analysis of quarterly portfolio holding. J Bus 62:393–416

Grinblatt M, Titman S (1989b) Portfolio performance evaluation: old issues and new insights. Rev Financ Stud 2:393–421

Grinblatt M, Titman S (1994) A study of mutual fund returns and performance evaluation techniques. J Financ Quant Anal 29:419–444

Gruber MJ (1996) Another puzzle: the growth in actively managed mutual funds. J Financ 51:783–810

Gruenbichler A, Pleschiutschnig U (1999) Performance persistence: evidence for the European mutual funds market. Working Paper, University of St. Gallen

Hachmeister A, Schiereck D (2010) Dancing in the dark: post-trade anonymity, liquidity and informed trading. Rev Quant Financ Acc 34:145–177

Harris LE (1994) Minimum price variation, discrete bid–ask spreads, and quotation sizes. Rev Financ Stud 7:149–178

Hasbrouck J (2005) Trading costs and returns for US equities: the evidence from daily data. J Financ 64:1445–1477

Ho T, Stoll H (1980) On dealer markets under competition. J Financ 35:259–267

Ho C, Lee C, Lin C, Wang E (2005) Liquidity, volatility and stock price adjustment: evidence from seasoned equity offerings in an emerging market. Rev Pac Basin Financ Mark Polic 8:31–51

Jensen MC (1968) The performance of mutual funds in the period 1945–1964. J Financ 23:389–416

Lee K (2011) The world price of liquidity risk. J Financ Econ 99:136–161

Lo A, Wang J (2000) Trading volume: definitions, data analysis, and implications of portfolio theory. Rev Financ Stud 13:257–300

Malkiel BG (1995) Returns from investing in equity mutual funds 1971–1991. J Financ 50:549–572

Malkiel BG, Xu Y (2006) Idiosyncratic risk and security returns. Working Paper, University of Texas at Dallas

Merton R (1987) A simple model of capital market equilibrium with incomplete information. J Financ 42:483–510

Newey W, West K (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55:703–708

Nelson DB (1991) Conditional heteroskedasticity in asset returns: new approach. Econometrica 59:347–370

O’Hara M (2003) Presidential address: liquidity and price discovery. J Financ 58:1335–1354

Otten R, Bams D (2002) European mutual fund performance. Eur Financ Manag 8:75–101

Reinganum M (1981) A misspecification of capital asset pricing: empirical anomalies based on earnings’ yields and market values. J Financ Econ 9:19–46

Pastor L, Stambaugh R (2003) Liquidity risk and expected stock returns. J Polit Econ 111:642–685

Sharpe W (1966) Mutual fund performance. J Bus 39:119–138

Spiegel MI, Avanidhar S (1995) On intraday risk premia. J Financ 50:319–339

Spiegel MI, Wang X (2005) Cross-sectional variation in stock returns: liquidity and idiosyncratic risk. Yale ICF Working Paper No. 05-13

Stoll H (2000) Presidential address: friction. J Financ 55:1479–1514

Wagner NF, Winter E (2013) A new family of equity style indices and mutual fund performance: do liquidity and idiosyncratic risk matter? J Empir Financ 21:69–85

Watanabe A, Watanabe M (2008) Time-varying liquidity risk and the cross section of stock returns. Rev Financ Stud 21:2449–2486

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Vidal-García, J., Vidal, M. & Nguyen, D.K. Do liquidity and idiosyncratic risk matter? Evidence from the European mutual fund market. Rev Quant Finan Acc 47, 213–247 (2016). https://doi.org/10.1007/s11156-014-0488-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-014-0488-7