Abstract

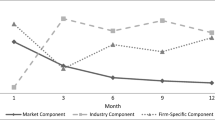

This study uses logistic regression for the development of prediction models that distinguish between share-repurchasing and non-share repurchasing firms. The estimated models form the basis for an investment strategy, according to which one invests on the stock of the firms that are predicted as repurchasing ones. Using a sample of firms from the UK, France, and Germany, the results show that this strategy generates positive and statistically significant abnormal returns over different investment periods that range between 1 and 18 months.

Similar content being viewed by others

Notes

Our study is not the first to investigate whether abnormal returns can be earned from the prediction of important corporate events. Katz et al. (1985) examine the usefulness of bankruptcy prediction models in investment strategies, while other recent studies focus on the prediction of takeovers (e.g. Powell 2001; Ouzounis et al. 2009). However, a model specifically designed for open market share repurchases is necessary for at least two reasons. First, the results of the bankruptcy and takeover studies are mixed. Second, there are important differences between those corporate events, leading to differences in the models’ predictive ability and the market reaction to such announcements and events.

Another drawback of the study by Andriosopoulos et al. (2012) is that cross-validation resampling technique that they use, does not allow them to examine the out-of-time performance of their model. However, testing the model simultaneously out of sample and out of time is crucial when one aims to use it in the context of an investment strategy.

Stephens and Weisbach (1998) investigate the implementation of open market share repurchase programs in the US market and find that firms repurchase either a substantial fraction of the announced shares or almost none at all. Bhattacharya and Dittmar (2003) argue that firms make the announcement but not repurchase because the firm has already attracted the wanted scrutiny from the market. This is supported by Chan et al. 2007, who find that firms repurchasing their shares during the first year of the year of the repurchase announcement, experience lower abnormal returns compared to firms that do not repurchase their shares. Hence arguing that firms do not repurchase their shares because the market has reacted quickly to the signal and therefore the firm cannot take advantage of an undervalued price.

The study focuses on this period because it was not until 1998 that share repurchasing was allowed to take place more freely in both Germany and France. The Perfect Analysis and Factiva databases report any news announcements that were available in the press made by UK and European firms. Only firms that announced their intention to repurchase ordinary shares were included in the sample. The list of repurchasing firms that formed our starting basis was initially used in the study of Andriosopoulos and Hoque (2013).

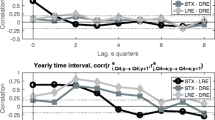

We replicate our estimations by using alternatively the market-adjusted returns during the 1-year period prior to the announcement (days −261 to −2) and the smaller timeframes −42 to −2 days (2 months), and −22 to −2 days (20 days) prior to the announcement of intention to repurchase. In all cases, the results remain the same.

We do not employ longer time-horizons as longer horizons clash with the 2007–2009 financial crisis which would contaminate and distort our results.

We would like to thank an anonymous reviewer for recommending the estimation of the second specification. Due to missing data, the estimation sample for this specification includes 124 UK firms, 84 French firms, and 54 German firms. The corresponding figures for the holdout sample are: 719 (UK), 384 (France), and 349 (Germany).

For brevity we only present the results obtained from Specification 1. As expected, the results of Specification 2 have very poor performance due to the low specification accuracies in the holdout sample. Both the BAHAR and the Fama and MacBeth results for Specification 2 are available from the authors upon request.

This portfolio actually includes 213 firms due to missing values in four cases.

The standard errors are adjusted for heteroskedasticity and autocorrelation based on Newey and West (1987).

References

Alzahrani M, Lasfer M (2012) Investor protection, taxes and dividends. J Corp Financ 18(4):745–762

Andriosopoulos D, Hoque H (2013) The determinants of share repurchases in Europe. Int Rev Financ Anal 27:65–76

Andriosopoulos D, Lasfer M (2014) The market valuation of share repurchases in Europe. J Bank Financ (forthcoming)

Andriosopoulos D, Gaganis C, Pasiouras F, Zopounidis C (2012) An application of multicriteria decision aid models in the prediction of open market share repurchases. Omega 40(6):882–890

Bagwell LS, Shoven JB (1988) Share repurchases and acquisitions: an analysis of which firms participate. In: Auerbach A (ed) Corporate takeovers: causes and consequences. University of Chicago Press, Chicago, pp 191–220

Bagwell LS, Shoven JB (1989) Cash distributions to shareholders. J Econ Perspect 3(3):129–140

Baker HK, Powell GE, Veit TE (2003) Why companies use open-market repurchases: a managerial perspective. Q Rev Econ Financ 43(3):483–504

Barber BM, Lyon JD (1997) Detecting long-run abnormal stock returns: the empirical power and specification of test statistics. J Financ Econ 43(3):341–372

Barber BM, Lyon JD, Tsai CL (1999) Improved methods for tests of long-run abnormal stock returns. J Financ 54(1):165–201

Barth ME, Kasznik R (1999) Share repurchases and intangible assets. J Account Econ 28(2):211–241

Bartram SM, Brown PR, How JCY, Verhoeven P (2009) Agency conflicts and corporate payout policies: a global study. SSRN: http://ssrn.com/abstract=1068281

Bhattacharya U, Dittmar A (2003) Costless versus costly signaling: theory and evidence from share repurchasing. SSRN: http://ssrn.com/abstract=250049

Brounen D, De Jong A, Koedjik K (2004) Corporate finance in Europe: confronting theory with practice. Financ Manag 33(4):71–101

Chan K, Ikenberry D, Lee I (2004) Economic sources of gain in stock repurchases. J Financ Quant Anal 39(3):461–479

Chan K, Ikenberry D, Lee I (2007) Do managers time the market? Evidence from open-market share repurchases. J Bank Financ 31(9):2673–2694

Chen SS, Wang Y (2012) Financial constraints and share repurchases. J Financ Econ 105(2):311–331

Chen M, Chen C-L, Cheng W-H (2004) The announcement effects of restricted open market share repurchases: experience from Taiwan. Rev Pac Basin Financ Mark Policies 7(3):335–354

Comment R, Jarrell GA (1991) The relative signaling power of Dutch-auction and fixed-price self-tender offers and open-market share repurchases. J Financ 46(4):1243–1271

Dittmar AK (2000) Why do firms repurchase stock? J Bus 73(3):331–355

Fama E, MacBeth J (1973) Risk, return, and equilibrium: empirical tests. J Polit Econ 81(3):607–636

Gong G, Louis H, Sun AX (2008) Earnings management and firm performance following open-market repurchases. J Financ 63(2):947–986

Grullon G, Michaely R (2002) Dividends, share repurchases, and the substitution hypothesis. J Financ 57(4):1649–1684

Grullon G, Michaely R (2004) The information content of share repurchase programs. J Financ 59(2):651–680

Gu AY, Schinski M (2003) Patriotic stock repurchases: the two weeks following the 9–11 attack. Rev Quant Finan Account 20(3):267–276

Gunthorpe DL (1993) Stock repurchases: a further test of the free cash flow hypothesis. Rev Quant Finan Account 3(3):353–365

Hovakimian A, Opler T, Titman S (2001) The debt-equity choice. J Financ Quant Anal 36(1):1–24

Ikenberry D, Vermaelen T (1996) The option to repurchase stock. Financ Manag 25(4):9–24

Ikenberry D, Lakonishok J, Vermaelen T (1995) Market underreaction to open market share repurchases. J Financ Econ 39(2–3):181–208

Ikenberry D, Lakonishok J, Vermaelen T (2000) Stock repurchases in Canada: performance and strategic trading. J Financ 55(5):2373–2397

Jagannathan M, Stephens C (2003) Motives for multiple open-market repurchase programs. Financ Manag 32(2):71–91

Kaplan S, Zingales L (1997) Do investment–cash flow sensitivities provide useful measures of financing constraints? Q J Econ 112(1):169–215

Katz S, Lilien S, Nelson B (1985) Stock market behavior around bankruptcy model distress and recovery predictions. Financ Anal J 41(1):70–74

Kim HJ, Jo H, Yoon SS (2013) Controlling shareholders’ opportunistic use of share repurchases. Rev Quant Finan Account 41(2):203–224

Kothari SP, Warner JB (1997) Measuring long-horizon security performance. J Financ Econ 43(3):301–339

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (1997) Legal determinants of external finance. J Financ 52(3):1131–1150

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (1998) Law and finance. J Polit Econ 106(6):1113–1155

La Porta R, Lopez-de-Silanes F, Shleifer A (1999) Corporate ownership around the world. J Financ 54(2):471–517

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (2000) Agency problems and dividend policies around the world. J Financ 55(1):1–33

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (2002) Investor protection and corporate valuation. J Financ 57(3):1147–1170

Lakonishok J, Vermaelen T (1990) Anomalous price behavior around repurchase tender offers. J Financ 45(2):455–477

Lasfer MA (2005) The market valuation of share repurchases in Europe. Unpublished working paper, Cass Business School, London

Lee C-H, Alam P (2004) Stock option measures and the stock repurchase decision. Rev Quant Finan Account 23(4):329–352

Manconi A, Peyer U, Vermaelen T (2012) Buybacks around the world. INSEAD working paper

Masulis RW (1980) Stock repurchase by tender offer: an analysis of the causes of common stock price changes. J Financ 35(2):305–319

McNally WJ (1999) Open market stock repurchase signaling. Financ Manag 28(2):55–67

McNally WJ, Smith BF (2007) Long-run returns following open market share repurchases. J Bank Financ 31(3):703–717

Mitchell JD, Dharmawan GV (2007) Incentives for on-market buy-backs: evidence from a transparent buy-back regime. J Corp Financ 13(1):146–169

Morck R, Wolfenzon D, Yeung B (2005) Corporate governance, economic entrenchment and growth. J Econ Lit 43:655–720

Newey W, West K (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55(3):703–708

Opler T, Titman S (1993) The determinants of leveraged buyout activity: free cash flow vs. financial distress. J Financ 48(5):1985–1999

Oswald D, Young S (2004) What role taxes and regulation? A second look at open market share buyback activity in the UK. J Bus Financ Account 31(1–2):257–292

Ouzounis G, Gaganis C, Zopounidis C (2009) Prediction of acquisitions and portfolio returns. Int J Bank Account Financ 1(4):381–406

Palepu KG (1986) Predicting takeover targets: a methodological and empirical analysis. J Account Econ 8:3–35

Park Y, Jung K (2005) Stock repurchase in Korea: market reactions and operating performance. Rev Pac Basin Financ Mark Policies 8(1):81–112

Pettit RR, Ma Y, He J (1996) Do corporate insiders circumvent insider trading regulations? The case of stock repurchases. Rev Quant Financ Account 7(1):81–96

Peyer UC, Vermaelen T (2005) The many facets of privately negotiated stock repurchases. J Financ Econ 75(2):361–395

Peyer U, Vermaelen T (2009) The nature and persistence of buyback anomalies. Rev Financ Stud 22(4):1693–1745

Powell RG (2001) Takeover prediction and portfolio performance: a note. J Bus Financ Account 28(7 & 8):993–1011

Powell RG (2004) Takeover prediction models: a multinomial approach. Multinatl Financ J 8(1 & 2):35–74

Rau PR, Vermaelen T (2002) Regulation, taxes, and share repurchases in the U.K. J Bus 75(2):245–282

Stephens CP, Weisbach MS (1998) Actual share reacquisitions in open-market repurchase programs. J Financ 53(1):313–333

von Eije H, Megginson WL (2008) Dividends and share repurchases in the European Union. J Financ Econ 89(2):347–374

Vermaelen T (1981) Common stock repurchases and market signaling. J Financ Econ 9(2):139–183

Yook KC, Gangopadhyay P (2011) A comprehensive examination of the wealth effects of recent stock repurchase announcements. Rev Quant Finan Account 37(4):509–529

Acknowledgments

We would like to thank an anonymous reviewer for valuable comments that helped improve earlier versions of the manuscript.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

See Table 6.

Rights and permissions

About this article

Cite this article

Andriosopoulos, D., Gaganis, C. & Pasiouras, F. Prediction of open market share repurchases and portfolio returns: evidence from France, Germany and the UK. Rev Quant Finan Acc 46, 387–416 (2016). https://doi.org/10.1007/s11156-014-0473-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-014-0473-1